Opening Comments

Reader Survey-This was in the last piece, but wanted to give all the readers one last chance at filling out the survey to help me improve the report. I want to ask all my readers to take a 2-minute survey regarding the Rosen Report. I am trying to improve the output and need some feedback. I would truly appreciate you taking a couple minutes answer some questions about how you consume the report and likes/dislikes in an effort to make it better. The link to the survey is here. I will pick two readers at random who complete the survey and send them a gift of a solid new Cabernet wine I uncovered. If you are not a wine drinker, I will come up with something else for you. If you completed the survey, thank you. I do not see comments attributed to anyone. I just know who completed it.

For those who missed my last piece, “NBA, Here I Come.” Remember, anchor links in the Table of Contents take you to the section if you click on the underlined titles.

Reminder, on 2/9/23 at 11am EST, I will be moderating a panel hosted by Prometheus Alts with some impressive fund managers Kyle Bass, Robert Mullin and Jordi Visser. My readers are invited to the event. You can register here for the live panel.

I thought this chart was interesting about SaaS (Software as a Service) multiples. Think Salesforce, Adobe, Shopify… Enterprise Value/Next 12 Month Revenue peaked at 16 times in 2021, and is now 6.1x after being as low as approximately 4 times in late 2022. I saw this on the “All In Podcast.” I don’t see 16 times sales again in my lifetime. SaaS was yet another beneficiary of the Zero Interest Rate Policy.

Markets

Payrolls Crushed Expectations

Return to the Office

More Non-Farm Workers in FL vs NY

China Spy Balloon

Real Estate-Expanded NYC Commercial Market Section-Great Charts

Picture of the Day-The Superbowl is a Kelce Family Affair

For the first time in Superbowl history, a pair of siblings will play each other. Mother, Donna, will surely be wearing the custom jersey to show support for both sons (2nd pic). The joy for the Kelce family is in start contrast to the pain of the Purdy family who learned that Brock needs major UCL surgery for his elbow. He is likely out all of next season after a fantastic start to his career where he won 8 straight games, despite being the last person taken in the 2022 draft. I hope he recoveries quickly. It was a shame to get injured at the start of the game which ended horrifically for the 49ers. In a related note, someone went to Tom Brady’s retirement announcement spot in Miami Beach and grabbed a bottle of sand. The current highest bid on ebay is $99.9k. What is wrong with people? I will drive down tomorrow and get every reader who pays me $1k the same sand. It is a 99% savings. The Rosen Report is for value investors.

The Cornucopia of the Situation

JPMorgan put on a High Yield Conference in Miami for the last 20 years. When I worked at JPM, I would go every year to see our clients. My sister, Debbie, lived (still does) in Hollywood, Florida, some 25 miles north of Miami. One year, I am guessing a dozen or years ago, she and her daughter, Rachel, met me for lunch around the time of the conference. We went for a walk on the boardwalk in South Beach and were people watching. Rachel was in high school at the time. She is very bright (PhD in geomorphology) and a professor today.

While walking on the boardwalk, we heard a coconut vendor speaking loudly on his cell phone.

During the call he said in a frustrated voice, “You are using the word in the wrong context. You cannot say it is the ‘cornucopia of the situation.’ I can’t remember what a cornucopia is, but you are using the word improperly.” Debbie, Rachel and I started laughing at the strange exchange, and the man looked at us while throwing his hands in the air. He said, “Hey, can you confirm something for me? My friend keeps saying ‘cornucopia of the situation.’ Can you tell him that is not the right use of the word.”

My niece said, “A cornucopia is used on a Thanksgiving table and is a symbol of a goat horn filled with fruit and flowers. I think your friend meant to say crux of the situation.” We all were cracking up, including the guy selling coconuts.

The man was screaming into the phone, “I was right! Please don’t say cornucopia of the situation any more. It drives me crazy.”

Any time I hear the word cornucopia, I laugh. Also, when someone uses a word or phrase improperly, I say, “It is the cornucopia of the situation” and they look at me like I am crazy until I explain the story. It reminds me of my former colleague who was from Lebanon who mixed sayings all the time given English was not his first language. He said, “He is the right-hand arm,” when he meant to say, “right-hand man.” It is funny how little things stay with you.

Quick Bites

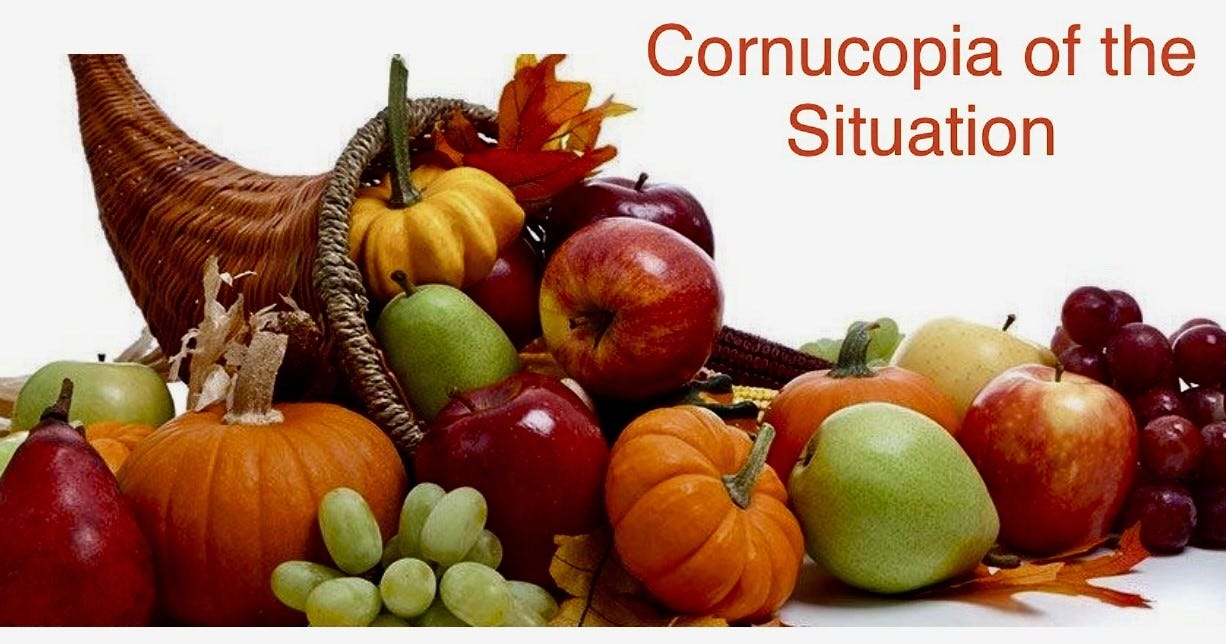

Stocks fell Friday as a strong jobs report worried some investors that the Federal Reserve would keep hiking rates. Still, the S&P 500 notched its fourth weekly gain in five weeks as investors bet falling inflation is ahead. The S&P 500 declined 1.04% to 4,136. The Nasdaq shed 1.59% to 12,007. Meanwhile, the Dow slipped 128 points, or 0.38%, to 33,926.T he S&P 500 closed the week higher by 1.62%. The Nasdaq gained 3.31%, posting its fifth-straight winning week as it rode a tech-fueled rally to outperform the other major indexes. Meanwhile, the Dow was the outlier, down 0.15%. Based on the jobs report (discussed below), I thought the market would have sold off more, given it suggests the Fed has more to go on raising rates to tame employment/inflation. Amazon stock was hit the hardest after tech earnings despite misses by Apple and Alphabet. AMZN -8% on Friday after soft growth in retail and cloud computing and gave downbeat guidance. Meta was +23% on the week after strong numbers and announcing a $40bn stock buyback. The 3rd chart shows how many of the worst performing stocks of 2022 are massively outperforming YTD 2023. Natural gas has been killed and is -41.6% YTD. It was $9.3 in August of 2022 and now at $2.4. A mild winter in US and Europe played a major role.

Payrolls increased by 517,000 in January, crushing estimates, as unemployment rate hit 53-year low. The strong payroll data is likely to help the Fed keep the Hawkish stance, as the unemployment rate fell to 3.4%. The Treasury market sold off sharply on the better than expected payroll data. Another positive development was the ISM services index which rebounded to 55.2 from 49.2 and it was far better than 50.5 expectations. However, the Small Business Optimism Index declined 2.1 points to 89.8, the 12th consecutive month below the 49 year average of 98. The 10-year yield rose almost 12 bps to 3.52% and the 2-year yield rose 20bps to 4.29%. 2s/10s is back to -77bps, near this cycle low of of -84bps in December. Anytime, we have seen 2/10s negative we have had a recession since 1976. The Terminal Rate has moved to 5.08% from 4.9% and the market is now only pricing 36bps of cuts in 2023 vs 46bps on Thursday. Who is wrong on the implied future rates? The Fed or the market?

Average office use last week was 50.4% of early 2020 levels in 10 major U.S. cities, according to Kastle Systems, which tracks security swipes into buildings every business day. It is the first time office occupancy has topped 50%, according to Kastle, since March 2020, when Covid-19 forced most workplaces to temporarily shut down. According to Kastle, two cities in Texas—Austin and Houston—had the highest return-to-office rates at above 60%. San Jose, Calif., had the lowest return-to-office rate last week, at 41.1%. In New York on average 48% are back in the office, but the day of the week plays a big part; occupancy rates dropped to 26.5% on Friday from 59.8% on Tuesday. Increasing layoffs have helped to turn the power back to the companies in many cases. I thought this cartoon was spot on and sent by a reader.

Florida isn’t just for retirees anymore. For the first time in at least 40 years, there are more jobs in the Sunshine State than there are in New York, part of the trend of Americans fleeing south to lower-cost states. Florida ended 2022 with 9,578,500 nonfarm jobs, while New York had 9,576,100, according to the Bureau of Labor Statistics. It was the first time in data going back to 1982 that Florida had more workers than New York. Yes, Florida has an older population 42.2 years vs 36.0 years (as of 2020) for NY, but the trends have changed sharply over the past decade. More are moving here for work from states like NY, NJ, CT, IL, CA… and I have noticed a sharply younger crowd, especially in Miami. Even Boca is getting younger, and I am tripping over less canes and oxygen tanks at restaurants. The takeaway for me is policies matter, and many states continue to charge a lot in taxes and have high cost of living, crime, homelessness…People and companies are voting with their feet and moving to FL, TX, NV, TN…I just don’t see that trend ending near term. New wealth taxes proposed won’t help keep those who are most mobile and pay a majority of the tax bills.

A Chinese spy balloon flew over the US, but China tells suggested “stay calm.” The spy balloon, which is the size of three buses, was spotted over Billings, Montana, on Wednesday. It entered the US after flying in over the Aleutian Islands and made its way through Canada. The Secretary of State, Blinken, postponed his trip to China next week as a result of the balloon issue. The Chinese government claimed the “civilian airship used for research” was blown off course and not intentional. The Pentagon suggested another Chinese spy balloon was over Latin America. Well, it is official. The Chinese government has never lied, cheat, stole or maimed. If they say it was not intentional and civilian, I believe them. Yeah right! Remember, COVID started in the wet market. It cannot be spread person to person, almost no one died of Covid in China….The lies are endless. A 4-star Air Force general predicted war with China in 2025 and this was prior to the spy balloon incident. Saturday, the U.S. military shot down the suspected Chinese surveillance balloon off the Carolina coast. China claims the right to “respond further.” This report suggests the balloon also crossed into the US three times during the Trump Administration.

Other Headlines

Amazon’s advertising business grew 19%, while Google and Meta both deal with slowdowns

Nordstrom stock surges after activist investor Ryan Cohen buys stake in retailer

Although Cohen is a successful business person who founded pet retail site, Chewy, his foray into public investing has included meme stocks such as GameStop and Bed Bath & Beyond. You will excuse my concern post the 25% rally on Friday in Nordstrom. Remember, GME went from $4.5 to $81 to $10 in 60 days.

Hedge fund manager Dan Niles explains why he’s so bearish — and when he sees markets falling

It boils down to his view of higher rates for longer. Interest rate swaps suggest the market believes in rate cuts in 2023, but Niles believes that is not on the table. His tech fund defied logic and was positive in 2022 despite the rout in stocks. The strong January jobs report would help support Niles’ thesis.

U.S. credit card debt jumps 18.5% and hits a record $930.6 billion

Please pay attention to the US consumer even though employment is outperforming.

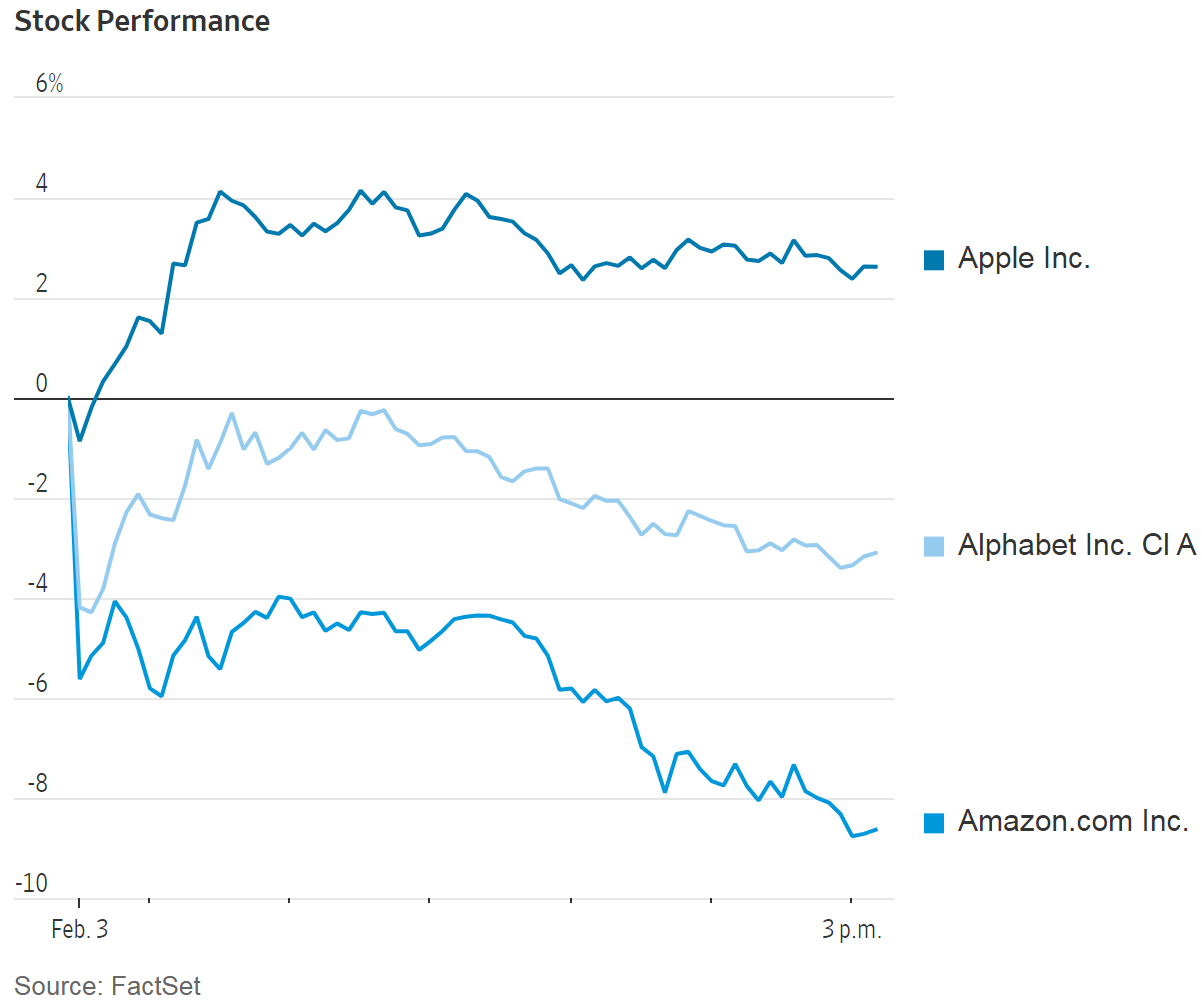

Dealers and Buyers Are Both Worried Cars Are Too Expensive

Rising interest rates and weaker used-car values are keeping people on the sidelines for new vehicles.

Chinese Tesla rival Xpeng launches P7 and G9 electric cars in Europe

Article gives pricing details. Range for cars are approximately 570 kilometers or 342 miles. I will not purchase a car from China, but I do feel TSLA will finally be facing a lot more low-priced competition in the next few years.

Tesla, General Motors get boost from EV SUV tax credit change

House Republicans vote to remove Omar from Foreign Affairs panel

Vote was 218-211 to vote her out after McCarthy vowed to remove her due to anti-Semitic comments. The House had stripped Republicans, Greene (GA) and Gosar (AZ) of committee assignments under Pelosi.

Princeton Ban On Cheating 'Unfairly Targets' Minorities, According To Student

Hotel debacle shows how US can't afford to absorb this many illegal immigrants

Nothing like government efficiency. In 2001, estimates were $1bn each mile to build and ended up being almost $3.5bn/mile or 7 times the average cost in the rest of the world.

An 81-year-old brain doctor's 7 'hard rules' for keeping your memory 'sharp as a whip'

Cancer is striking more people in their 30s and 40s. Here’s what you need to know

'Smart diaper' sends phone alerts when babies need changing

Maybe technology is not so bad for babies?

Mount Washington as cold as Mars as polar vortex brings record-breaking windchills of -110

It is almost 200 degrees warmer with a short, 3-hour flight to South Florida.

Alex Ovechkin's son steals the show with his dad and Sidney Crosby. 50 second video.

Crime Headlines

14-year-old gangbanger arrested in shooting of teen boy on NYC bus

Owner of famed Ray’s Candy Store brutally assaulted outside NYC shop

Nothing to see here. Assaulting 90 year old shop-owners is the new NYC. If I were the DA, I would clean things up in a hurry.

NJ Councilwoman Eunice Dwumfour fatally shot outside her home

One witness suggests her car was hit with approximately 12 shots. The victim was a Conservative Councilwoman.

Video shows 9-year-old Florida girl savagely beaten by two boys in school bus attack

This video is DISGUSTING. The boys look decently older than 9. At least one media outlet showed the picture on the left for the story, but the picture on the right was of the incident. The woke media strikes again.

Driver mows down biking doctor before stabbing him to death on PCH

Crazy story. ER doc hit by a car and then the driver gets out and stabs him to death.

Real Estate

Today, I will focus on the NYC office market. I have written extensively about office and retail space and shared my concerns. I had a conference call last week with senior executives from Newmark who are involved in the NYC commercial R/E market. They are loyal readers who are generous with their time to help educate me on market updates. It is clearly a tale of three markets. Manhattan has approximately 460mm square feet of office space. Approximately 100mm Class A which remains in high demand. There is approximately 200mm of middle market space and 150mm which is largely obsolete. Work from home, especially in tech, has added a major challenge to the market.

The clear winner is shiny new, Class A office buildings with amenities and good locations. Think Hudson Yards GM Building or One Vanderbilt. These buildings are largely occupied and getting significant premiums for rent. They are attracting top-tier tenants in financial services, law firms, corporations.

The 4th Q of 2022 saw 70% of transactions in Class A. Only three relocations in 4th q of 50,000 ft or greater. Already 6 deals of 50,000 ft or greater in Jan 2023. Some Class A buildings are able to get $175+/Foot for move in space today. Some examples:

550 Madison-signed a 33rd floor announced 25k ft floor $175/ft starting rent. Not much move in space in Class A buildings available.

One Vanderbilt-New turnkey $175ft high floor available.

1 Madison Avenue (23rd) old CSFB. SL Green is redoing. $180 ft to start Brand new tower.

However, if it is not Class A, the office market is struggling. My hedge fund was at 747 3rd Avenue on 47th Street. It is an older building and was paying approximately 60/ft in rent. I am told the headline rent is unchanged in the 5 years since we left, but they are offering far more concessions (additional free rent, build outs, shorter lease terms…). This is an example of the middle bucket of 200mm square feet. It tends to be older buildings, Lexington, 3rd Avenue which are fine, but hardly amazing in terms of new, fancy lobbies, amenities... This market will continue to struggle to attract tenants and have higher vacancy rates.

The lowest bucket of approximately 150mm square feet is struggling mightily. There will need to be changes to laws to convert them to lower end residential units and the fire department will need to approve it as well. Others will be torn down. The vacancy rates are very high, and as leases come due, few are re-signing. These buildings struggle to attract tenants and will be violating covenants on loans.

The carnage in NYC office markets has hit the big owners hard as can be seen below. In the past year, Vornado is -37% and SL Green -41%, while the S&P is -7%.

The ramifications of the dislocation in office markets are impacting REITS. Vornado just took a $600mm write-down of which $480mm relates to its equity investent4 in a 5th Avenue and Times Square joint venture. The ~$480M impairment charge recognized in Q4 together with the $409M impairment charge recognized in 2020 effectively reverse a portion of the ~$2.56B gain attributable to the 2019 required write-up.

Scott Rechler (CEO of RXR Realty) is big office building owner, developer and manager in and around NYC and could be handing over the keys to multiple buildings. “We need [the banks] to cooperate to enable us to do that in a way that makes sense,” Rechler said. “Some buildings aren’t going to come back to be competitive as office buildings, so you need to think of what the alternative is. Those two are in that camp. “We’re looking at converting to residential and mixed use,” Rechler added. Rechler has suggested 10% of his office buildings are being considered in his strategy to give them back to banks according to the article.

SLG: “The commercial REIT has been battered by the declining demand for office space over the past two years. For the nine months ended Sept. 30, SL Green Realty reported a net loss of $28.7 million, or 47 cents per share. This compares with the $486.1 million net income generated over the same period of 2021. The REIT slashed its dividend per share by 12.9% to $0.3108 last month. It pays $3.25 in dividends annually, translating to a 9.64% yield.”

Although, I do not know the location of Google’s office downsizing, this headline went with this section: though it is not clear which markets are impacted, this headline went with this section: Google To Incur $500M In Costs Related To Office Space Downsizing. Media firms have downsized in NYC too: Warner Media, Buzzfied, Vox Media, Dotdash Meridith. An article from November of 2022 says, “Big tech firms are looking to sublet a crushing 30 million square feet across the country, up from 9.5 million square feet in the fourth quarter of 2019, according to CBRE.”

Other R/E Headlines

Manhattan apartment sales fall by 50%

January year over year driven by a supply shortage according to the article.

US housing market seeing ‘meaningful’ damage that’s ‘not normal,’ CEO of investment firm warns

Virus/Vaccine

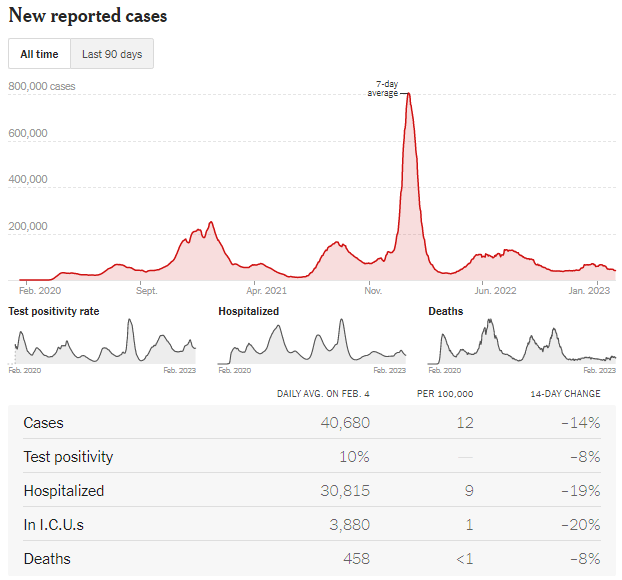

Although data continues to improve, the rate of improvements have slowed.