Today’s Podcast-26 minutes and I go into some details that are not covered in the newsletter.

Opening Comments

I hope everyone has a good holiday. Depending on news and my schedule, I may cut my pieces back or shorten depending on how it goes.

My last piece entitled “Mr. Irrelevant” was about Brock Purdy, the new starting QB for the San Francisco 49ers who was the last person picked in the 2022 NFL draft. He had another start on Thursday and led the team to his 3rd straight victory and a conference title.

I do want to acknowledge the greatest World Cup soccer game ever today and congratulate Argentina and Messi on the big win.

I packed it in while visiting NYC for a few days. Unfortunately, the weather was cold and rainy, but got to see some great people and had some fantastic meals. I do go to the new, chic Monterey American Brasserie for lunch in Midtown with a friend. Room is very well done, and menu was solid. Same owners as Dagon on Upper West Side. I had dinner at one of my favorites, Union Square Cafe, by Danny Meyer. You cannot go wrong there, and the combination of food, wine, service and ambiance are top notch. The place was JAM PACKED. I had breakfast at the Loews Regency which is a power lunch place and saw some heavy hitters, most notably, David Rubenstein from Carlyle. On Friday, I ate lunch at Marea, an amazing Italian seafood restaurant at Columbus Circle. The bone marrow fusilli with octopus is the best item on the menu.

My quick take on NYC. I took the subway 8 times all over the city and was very careful to have my back against a wall and not stand near the tracks. My only issue was a horrific smell from a homeless person in my subway car which required every single person to cover their noses. However, I never felt unsafe during the rides.

I was walking at 8:30am on Madison in the 60s (high rent district) and a homeless man was screaming vulgarities at people walking by him. I saw this happen and decided to cross the street mid-block to get away from him. He started yelling at me at the top of his lungs. I saw a police car on the block, so there was no real danger, but just a sad statement on the decay of the quality of life in NYC.

Pictures of the Day-Weed for Sale on the Streets of NYC

The Night I Ate Myself To Death At Bouley

Quick Bites

Markets

PMI Crashing

My Views on Oil

End of Title 42 for Immigration

12-Year-Old Football Star. He looks like 18.

Other Headlines

Crime Headlines

Real Estate-Big Section Today

Housing Market-Its Different This time

My Concerns on Office/Retail

NYC Rent Stabilized Disaster

San Antonio, TX R/E Decline in Charts

Other R/E Headlines

Virus/Vaccine-Data Deterioration Continues and Deaths Climbing

Pictures of the Day-Weed for Sale on the Streets of NYC

There are a lot of weed stores around NYC where you can purchase marijuana, and many are selling despite having no license yet, but authorities seem to look the other way. On Wednesday night, in the 20s on Park Avenue, I saw this truck which was selling pot on the street. Note the name, Starbuds Flowers and looks a heck of a lot like Starbucks.

The Night I Ate Myself to Death At Bouley

My wife was doing a consulting project in the fashion industry in 2008, and I spoke with the founder of the company she was assisting. Let’s call him Andy. I was incredibly impressed him and gave some advice he felt was helpful. He was thankful for the time and knew I was a foodie. As a result, he offered to take me to dinner at Bouley, which coincidentally was my favorite restaurant in NYC. I went on special occasions, for example, anniversaries, bonus day, birthday… and was never disappointed. It was given two stars by Michelin and for me, the combination of ambiance, food, service and wine was about as good as it gets.

It turns out that Andy and David Bouley were close friends, and I was in for a once in a life-time dinner. I loved walking into the restaurant, and you were hit by an aroma of a wall of apples which set the tone. I always wore a suit and tie and think a blazer was required.

Andy and I met at the restaurant, and we were given an amazing table in the center of the room. It was a four-top, even though we were only two. I thought it was strange, given how challenging reservations were at the time, but soon realized why the larger table was required. Bouley himself came out to speak with us and made it clear he would decide what we were eating. I was so excited. The waiter brought out freshly baked bread which I recall being some of the best I had ever tasted.

The food started coming and basically did not stop. Andy had serious wine game and between the two of us, we went through three bottles of wine. I recall him starting with a Montrachet and then a Chateuuneuf-du-Pape. I am generally not a fan of the earthy red, but whatever he got was special. All the food pictures were taken from the web, as I did not have any photos from that crazy meal.

Just when I thought I could not eat another bite, more food was delivered to the table. I am not a lover of most French restaurants, but this was different. It was lighter in nature than many others. The presentation was amazing, and the flavors were out of this world.

Finally the food stopped, and I had to unbutton my pants. Just when I thought there was no way I could eat more bite, every dessert was sent out to the table, and Andy had ordered the third bottle, a dessert wine. I felt a bit queasy given the amount of food I consumed and the bottle of wine I had downed but soldiered on.

The desserts came, and they were so delicious, we destroyed them and the wine. My head was spinning. I felt nauseous, as in my life, I had never consumed this much food and drink simultaneously. Andy asked if I wanted to go somewhere and grab a drink. I remember telling him, I am not sure I can make it through the evening, and if I die, I will have done it after the best meal ever. I told him I had to go home, as I could barely function.

I walked outside to get a cab (pre-Uber) and was sure I was going to puke on the ride back to my Greenwich Village apartment on 9th street. I walked into the apartment and ran to my bed, laying down on my back in my suit and overcoat. My wife, Jill, came over and asked me if I was ok. I said, “No. I think I am going to die.” My head was spinning. My stomach was so expanded, I looked pregnant. I felt like death, and just could not get comfortable. I was incredibly nauseous, and actually threw up due to over-eating for the first and only time in my life. History suggests that ancient Romans would vomit during feasts to make more room for food. I can only tell you that I felt as though I was on death’s door, and had no other choice. I am not sure my body could take another meal like the one I had, but if I was given another chance at a meal and wine by David Bouley, I would have to give it my best attempt to eat myself to death.

Bouley was a great experience and out of the fantastic restaurant many other notable chefs were launched. Chefs from the Bouley kitchen have gone on to open Blue Hill at Stone Barns (Dan Barber), Le Bernardin (Eric Ripert), Annisa (Anita Lo), Milk Bar (Christina Tosi), and more.

Quick Bites

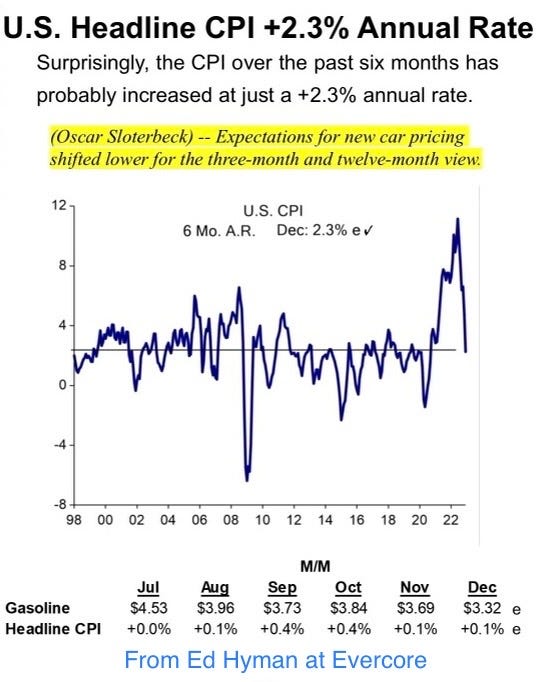

Stocks fell sharply Thursday after new data showed retail sales declined more than expected in November, raising fears that the Federal Reserve’s relentless interest rate hikes are tipping the economy into a recession. November retail sales fell 0.6% from the prior month for the biggest decline this year, the Commerce Department said Thursday. Budget-conscious shoppers pulled back sharply on holiday-related purchases, home projects and autos. Manufacturing output declined 0.6%, the first drop since June. Friday, the Dow lost 282 points, or 0.85%, to 32,920. The S&P 500 fell 1.11% to 3,852. Meanwhile, the Nasdaq declined 0.97% to 10,705. The indexes notched a second consecutive week of losses. The S&P 500 fell 2.08% for the week, and putting its December losses at 5.58%. The Dow and Nasdaq slid 1.7% and 2.7%, respectively. YTD, the Dow is -9%, S&P-19% and Nasdaq-32%. I have written extensively about the consumer, record credit card debt, declining savings rates and how they are getting squeezed by inflation. 63% of Americans are living paycheck to paycheck (1% from an all-time high from March). We are also seeing some auto loan default rates increase and the crash in used car prices may create more issues. Also of note, after starting the year on a tear, the US $ is losing serious ground. It was +18%+ against the basket (DXY-major currencies) at the end of September and now only up 9% YTD (2nd chart). The fact that inflation is coming down more quickly and the US is closer to the end of rate increases, while places like Europe are struggling to tame inflation is one big driver. Check out the 3rd chart on inflation by Ed Hyman (Ranked #1 by Institutional Investor for Economics for 42 years). I called peak inflation in June and it has proven true. Look at where the last 6 month inflation data is according to Hyman (+2.3% annualized). I continue to believe the Fed is close to done with rate hikes and will be forced to cut in 2023.

The Purchasing Managers Index (PMI) continues to collapse. The US economy deteriorated further in December according to the S&P Global manufacturing and services PMI. The index fell to 44.6 from 46.4, that matches the weakest since April 2020 and is the 6th month in a row below 50. The US economy is contracting and S&P Global said today’s numbers equate to a 1.5% annualized GDP decline in Q4. "Manufacturers registered one of the sharpest declines in new orders since the 2008-9 financial crisis during December, as customer spending waned," S&P Global said in its publication. "The further acceleration in the pace of contraction in new business led to a steeper decrease in production levels."

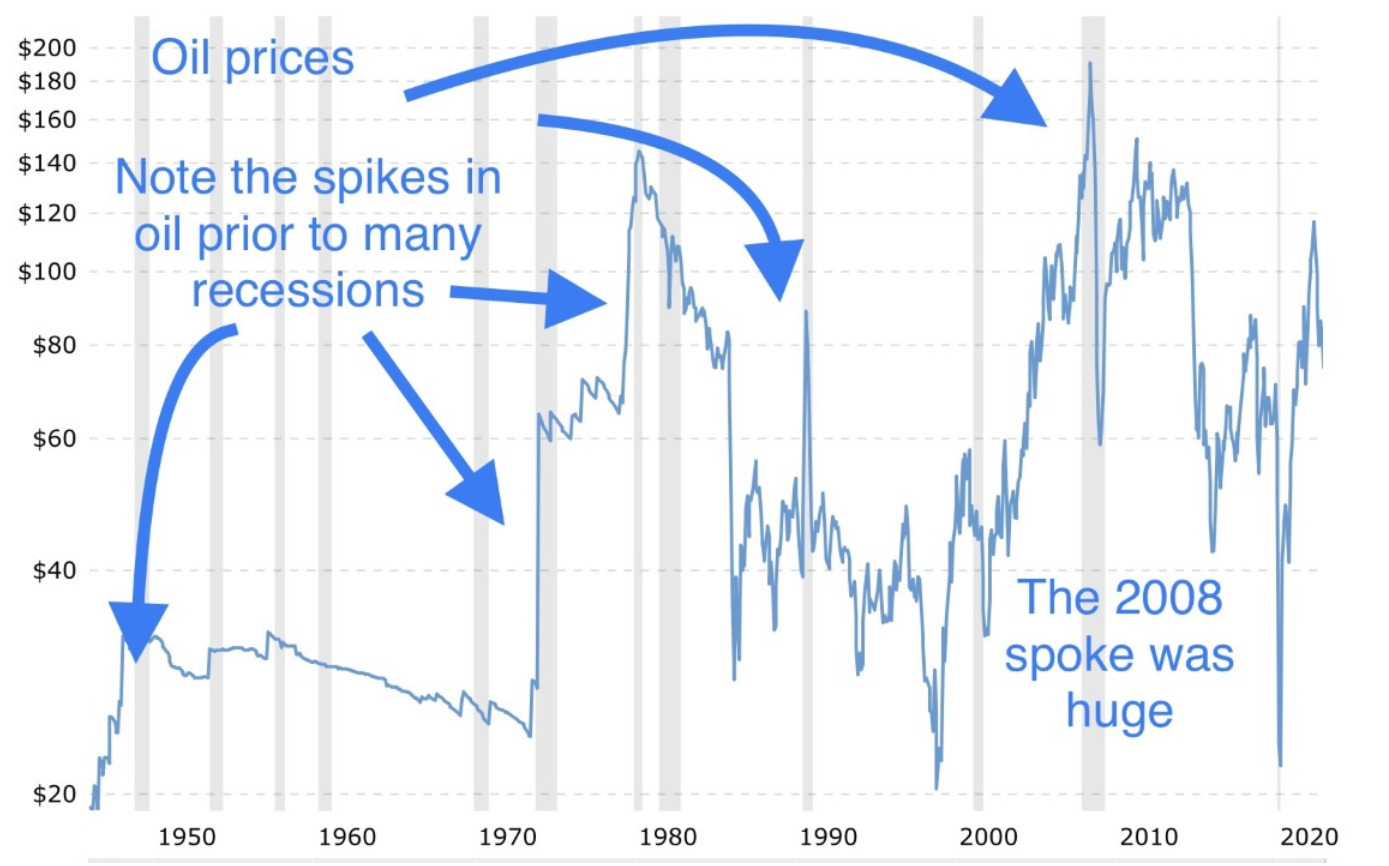

In the past few weeks, I wrote about my medium-term oil views and have become quite bullish. We have a combination of factors contributing to my stance. Oil inventories are crashing for both the oil companies and the Strategic Petroleum Reserve (SPR). China is coming back on-line which will drive demand higher. There is a continued vilification of the oil industry which is preventing companies from drilling. Just this week, the biggest producer in the North Sea refused to drill new wells due to the “Windfall Tax” imposed by idiotic politician’s new tax during a time of crisis. In the US, Biden recently vilified the oil and gas industry threatening higher taxes on excess profits. This does not help get to the desired outcome of more production. Global demand is at or near all-time highs for oil (approximately 100mm barrels/day), with the EIA estimating another 2mm+ in demand in 2023. Also of note, the weaker dollar can drive up oil prices as well. To me, all these factors spell what could be sharply higher oil prices in 2023. A couple weeks ago, Goldman estimated 2023 oil would hit $110/barrel. Currently, oil is at $75 or +5% on the week.

As federal immigration authorities continue to release migrants by the thousands, El Paso officials and local charities are near a breaking point in the sprawling border city. CA Governor Newsom said the state is overwhelmed.

"We're already at capacity and nine of our sites," "We can't continue to fund all of these sites because of the budgetary pressures now being placed on this state and the offsetting issues that I have to address." He said with Title 42 being lifted in one week, the state will not be able to handle the influx. Title 42 is a rarely used law that gives the federal government the ability to take emergency action to keep communicable diseases out of the country and expel illegal immigrants. It was used by President Trump in 2020 and the law will no longer be used after Dec 21st. Well over 5mm illegal immigrants have crossed into the US since Biden took office less than two years ago. Newsom and others including NY Mayor Adams are suggesting the systems cannot handle to flows. I keep repeating my view that the stress and costs on the system are too great and we need to slow down the flows. Homeland Security believes as many as 15k crossing will happen each day once title 42 expires.

I read this article about Jeremiah Johnson, a “12-year-old” football player with a mustache, tattoo (mom claims it is fake) who also is 5’11” and 198 lbs. He plays in the 12 and under division and was shockingly crowned MVP. There is a video in the bottom of the link of him hitting a kid, and it is a bit scary. You will excuse me if I don’t believe the kid is 12, and it reminded me of the time my son, Jack, asked if he could play tackle football when he was in 5th grade. Jack weighed 60lbs, and I brought him to my friend who coaches a team in NYC. Jack got on the pads and literally could not hold his head up with a helmet on. He did some drills which were hysterical, and then another boy came up to the practice. He was at least twice Jack’s size, and he asked, “Dad, will I have to tackle the big kid?” I let him know that he would, and he asked if we could go home. Jack’s tackle football career lasted exactly 22 minutes and the ironic part is Jeremiah Johnson would have been in Jack’s division! I believe Jack could have been a Hall of Fame NFL receiver had he not quit the game due to fear of being run over at 11 years old (yeah right). I do remember one big kid in my 6th grade class named Chris Beaton who had a full beard and looked like a man, so anything is possible. Tyreek Hill (NFL All-Pro Receiver) Tweeted, “If that 12-year-old really 12 my son not playing football, these kids built different.” In my opinion, they need weight limits, which was the case in my short tackle football career. I took one hit in practice as a receiver at the 105lb division and felt this was probably not my sport. I got the wind knocked out of me and that was all she wrote.

Other Headlines

The Philadelphia Fed Just Revised Jobs Lower by 1.2 Million for Q2

Not sure the driver here. Some suggesting conspiracy theory around the election and others believe it is seasonal adjustments, erroneous birth-death rate assumptions, PPP related fraud on fake business openings to get money. However, if jobs are indeed lower by 1.2mm, it is something to watch. In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states.

Elon Musk starts banning critical journalists from Twitter

Musk seems to be losing his mind, as TSLA crashes and TWTR seems to be imploding. I suggested he overpaid by $29bn some months ago and I was low. Musk is banning journalists and quickly restating them, while he suggested he is for free speech. You cannot make this implosion story up. TSLA is -15% on the week, -18% on the month and -62%YTD.

Goldman Sachs is planning to cut up to 8% of its employees in January

Many banks are laying people off. Bonuses are down. People have lost real money in markets and interest rates are up. I believe we will see higher end R/E in NYC and surrounding areas come down as a result.

Sam Bankman-Fried will now surrender himself for extradition before Bahamian court Monday

Jill Biden makes a tidal shift from her thoughts on another run at the White House

I am going to be irate if it comes down to Biden and Trump in 2024.

Trump lashes out at polls showing Ron DeSantis with a big lead in the 2024 GOP primary

Donald Trump’s ‘major announcement’ is a cringey line of $99 NFTs — of himself

Who will buy this crap? I was wrong. SOLD OUT for over $1mm.

It's all in jeopardy': Kevin McCarthy sounds increasingly alarmed as GOP opponents refuse to budge

A handful of Republicans won’t support McCarthy

Experimental Shock-Absorbing Material Can Stop Projectiles Traveling Over 3,000 MPH

California and the Midwest face ‘high risk’ of electricity shortages in next five years

Pushing EV mandates when you don’t have the power grid is probably not a great idea.

This proposal is crazy which limits boats over 35ft to 11mph within 100 miles from shore from Florida to Massachusetts.

School board member resigns after saying she was against voting for a 'cis, white male.'

National Archives releases thousands of JFK assassination documents

Stroke, myocardial infarction, aortic aneurysm/dissection, spinal cord compression/injury, venous thromboembolism

More than 107,000 people died in the United States last year by overdosing on illegal drugs

2/3rds of the deaths are due to Fentanyl

11 for a head of California lettuce? Here's what's behind the shortage causing 'outrageous' prices

Let me get this right. CA has high taxes, high cost of living, high gas price, weak power grids, heavy traffic, woke policies, high homelessness, high crime, mudslides, fires, droughts, floods, earthquakes, illegal immigration, and now $11 lettuce? Why are so many of the wealthy leaving paradise?

TSA recovers record number of firearms at checkpoints in 2022

TSA recovered 6,301 firearms from airport security checkpoints this year, and more than 88% were loaded.

Russia Can Finally See That Putin’s ‘Days Are Numbered’

Interesting article with quotes from Russians.

Crime

Gangbanger tied to high-end NYC heists gets sweetheart deal from DA Alvin Bragg

Man assaulted in antisemitic attack in New York's Central Park; Attacker yells 'Kanye 2024'

‘Monster’ With Sharpened Teeth Held 20-Year-Old Captive for Weeks, Cops Say

Elderly woman kicked in stomach on SF Muni bus: 'As an Asian American, I don’t feel safe'

Teen dead, three others injured after shooting outside Chicago high school

Real Estate

This WSJ article is entitled, “Why This Housing Downturn Isn’t Like the Last One,” and I agree. Yes, I believe home prices will come down, but there is far more equity (valuation over the mortgage) today than in 2008. The 2nd chart shows home prices having peaked, and coming down but prices lag decently as can be seen with a Jan 2012 bottom after the 2008/9 crash.

My bigger concern is around office and retail space. We have already seen some large R/E investors hand back the keys to the banks given the state of that market and expect a lot more to come in next two years as loans come due. Also of note some REITS (Real Estate Investment Trusts) are limiting redemptions (Blackstone and Starwood). This article, “Office-property woes are driving REIT carnage as 2022 shapes up to be second-worst year on record,” is telling and the 3rd chart shows the carnage. Like all other major sell-offs, there will be a time to buy and make real money.

New York City owners of rent-stabilized apartment buildings are facing a perfect storm as a tidal wave of mortgage maturities and resets is fast approaching for properties purchased before the passage of the Housing Stability and Tenant. Sharply higher interest rates combined with the impact of the regulation have resulted in a decline in valuations. Most vulnerable are the approximately 795 rent stabilized buildings with 41,000 units acquired between 2016 to 2019 before HSTPA was passed, according to an Ariel Property Advisors analysis of sales of New York City buildings with over 10 units. Until owners have a better way to recapture their investments to properly maintain and renovate their buildings, both tenants and investors will continue to suffer as building conditions and values deteriorate further. The new rules are so bad and damaging to both tenants and landlords that they must be changed. The people who vote for these idiotic rules don’t understand basic finance or economics.

Other R/E Headlines

Home flipping profits drop at the fastest pace in over a decade

In the third quarter, gross flipping profit fell 18.4% from the previous quarter. Roughly 7.5% of third quarter home sales were flips, still historically high, but down from 8.2% in the second quarter.

Housing market predictions: Six experts weigh in on the real estate outlook in 2023

Not as negative as I would have thought.

Canadian Home Prices Grind Lower as Winter Freeze Grips Market

Ninth straight monthly dip brings prices down 11.5% from peak. The benchmark price for a home fell 1.4% to C$744,000 ($546,880) in November.

Virus/Vaccine

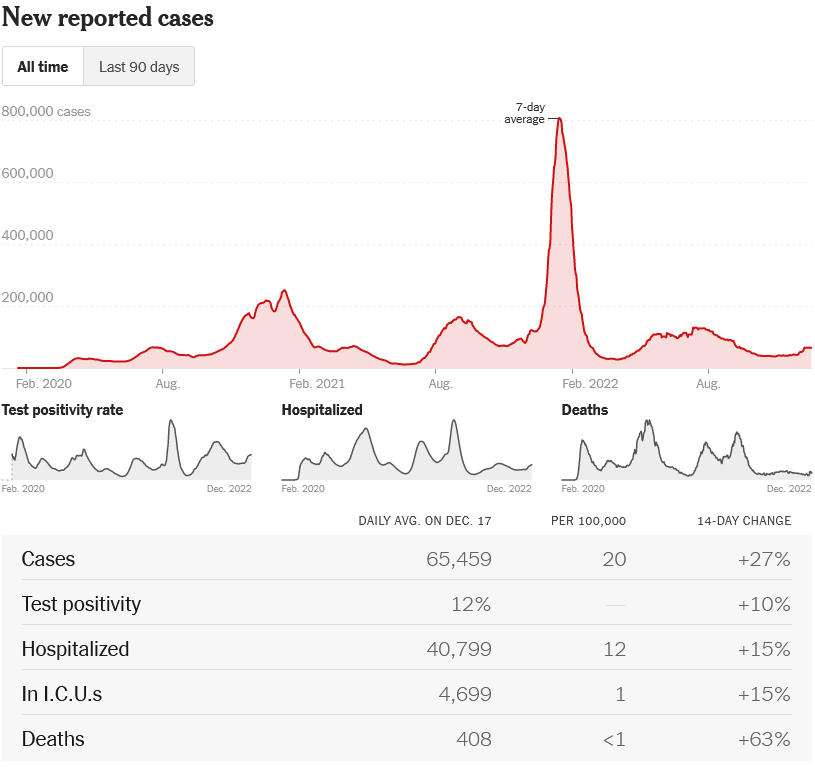

Data continues to climb and now deaths have really exploded at +63% over two weeks, but case growth is slowing at +27%.