In light of the market volatility and news, I felt the need to send a short note specifically on what has transpired around the unwind of the Yen carry trade. I will have a regular report on Wednesday.

The Road to Hell is Paved with Positive Carry

I have readers that manage $20bn hedge funds and those who don’t know a lot about financial markets. I am going to try to explain what is driving the vicious sell off in recent days. Most people know about mixed earnings with some major companies disappointing (Amazon, Snap, MSFT, Intel, MicroStrategy…). Also, market participants started to question if and when the massive AI expenditures would start showing through revenues. We have seen more CEO commentary about the consumer facing pressure and changing buying habits as cumulative inflation has crushed the consumer. We had economic data with weaker than expected payrolls data and a poor ISM Manufacturing survey. We also saw that famed investor, Warren Buffett, sold 50% of his Apple stake and raised his cash levels to $277bn. Growing geo-political risks are clearly a factor as well, especially in the Middle East. I feel the rise of Kamala in the polls played a factor, but a lesser one than the others mentioned. All of these things combined helped to change sentiment, but the biggest factor that has created havoc is the unwind of the Yen carry trade.

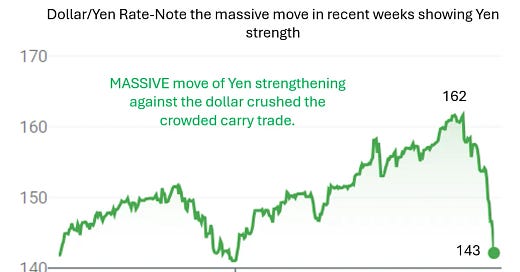

What is a carry trade? It is when an investor borrows money from a country with low rates and a weak currency and then invests in assets with a higher rate of return. The Japanese Yen had been very weak due to years of zero interest rates making the Japanese currency the ideal place to borrow from (low rates). The Yen was at such depressed rates against the dollar (levels not seen since 1986) that aggressive investors could not stop themselves.

So why did the Yen rally so hard? The Bank of Japan (BOJ) raised rates over fears of a weak Yen and inflation. The BOJ raised rates by 25bps July 31st, a move that many did not see coming. The BOJ also suggested they could hike again and will slowly cut Quantitative Tightening in half. The BOJ does not have a great track record of implementing wise policies. The BOJ waited 2-years to raise after the Fed and other central banks. The rate differential for such an extended time only added to the carry trade.

As the unwind of the carry trade progressed, investors needed to buy back Yen and sell the long assets (stocks, commodities, corporate bonds, crypto…) pushing markets sharply lower.

Some examples of carnage (the 10-year JGB yield slid the most in 20 years. The Topix and Nikkei 225 both closed down more than 12% on Monday alone and the 3 day Topix move was the worst ever. At one point, Japan’s largest bank, MUFG was -22% on the day before closing -12%. Taiwan’s benchmark index fell over 8% on Monday and South Korea’s Kospi fell nearly 9% on the day.

As investors covered their carry trades, they sold assets in the US pushing many popular stocks down sharply. Crypto was hammered with Bitcoin falling below $50k until it rebounded to $55k. Volatility EXPLODED with the VIX hitting 56 on Monday am (+190% on the day) before settling at 34. Any time VIX goes meaningfully above 40, you need to sell volatility or go long risk based on history as outlined below.

We have seen a near perfect storm due to the combination of the Yen carry trade unwinding coupled with weaker economic data, spotty earnings, Buffett’s massive cash position, escalations in the Middle East and growing geo-political tensions in general. Another factor that is being discussed was the triggering of the Sahm Rule that I wrote about recently. The so-called “Sahm rule” has observed without fail that the initial phase of a recession has started when the three-month moving average of the U.S. unemployment rate is at least a half a percentage point higher than the 12-month low. A weaker-than-expected July jobs report on Friday officially triggered the Sahm rule. The data led investors to worry that the Federal Reserve may be behind the curve in cutting interest rates to fend off a recession.

Adding to the panic Monday was outages at various brokerage firms that prevented investors from accessing accounts. DownDector reports that users of Charles Schwab, Fidelity, Ameritrade, Vanguard, and E-Trade are all reporting website outages, which have been surging around the start of the US cash session.

I am a conservative investor. I grew up with limited means and do not do crazy things with my money. I do not borrow aggressively to make investments and do not implement carry trades. There is a saying, “The road to hell is paved with positive carry.” It looks good for a while, but rarely do you exit the trade in time and get crushed in the process.

There are calls for an emergency Fed meeting to make a 50-75bps cut in Fed Funds. I think this would be a mistake and do not see it happening. I would take this as a very negative sign and fade any rally on the news. The positive news is markets are decently off the lows and cooler heads are prevailing. The futures market is now pricing in four and a half 25bps rate cuts by the end of 2024. Interestingly, 2-year Treasuries were +4bps and the 10-Year was unchanged on the day as of Monday afternoon. With such a sharp sell off in risk assets, you would have expected the Treasury market to perform better.

As of 2:15pm Monday:

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #706 ©Copyright 2024 Written By Eric Rosen.

After such a vicious sell off, I would expect a bounce. This smelled of liquidations on carry trade. I would be surprised if we don’t trend lower based on slowing economy. Thanks.

Thanks