The State of the US Consumer

5/29/24

Opening Comments

My last note was about my need for a lobotomy given I cannot get the song, “If I Could Turn Back Time” from Cher out of my head. Countless readers, called, texted or emailed me that the song is in their head and sadly it has not left mine. The most opened links were father and son terrorists casually describing raping and executing an Israeli woman and the Private Credit guide.

I received some nice notes from my last piece. One from a reporter who appreciated my correction on the Hims report about GLP-1. The other was a nice note: Thank you for consistently rewarding your readers, myself included, with your wonderful, and insightful reporting. Given I get a lot of cancellations and nasty notes too, I appreciate words of encouragement.

I had reported that Graceland was heading to auction and it turns out it was hoax by a Nigerian scam artist. The auction was called off last minute.

I am in NYC the 29th (today) for meetings and dinners and leaving Friday morning. Dinner tonight at Crown Shy (Michelin Star). I am back starting June 4th for a lot of the summer. I will be between NYC, the Hamptons, Marion, MA and Bethlehem, PA. Those readers who want to grab a meal, drink, golf, tennis…contact me @ Rosenreport@gmail.com.

AI Assistance Please

If anyone has AI game, I could use a little help. I would like to upload a few hundred of my Rosen Reports to allow me to search them with the help of AI. I am also looking to do something with all my restaurant reviews to allow my readers to search them quickly by location. If anyone has any ideas, let me know: Rosenreport@gmail.com. I will review a few dozen restaurants in NYC this summer. If you have any new NYC area restaurant recommendations, send them over and I will do my best to try them this summer. Casual or fancy. Let’s mix it up.

Giannis: The Marvelous Journey-AMAZING

A long-time friend, Bryan, suggested I watch the movie, “Giannis: The Marvelous Journey” on Amazon Prime. It is a documentary based on pro basketball player Giannis Anteokoumpo’s life growing up in Greece in poverty. He went from selling items on the street to signing a pro basketball deal in Spain 6 months later. He has since won two NBA MVP awards and an NBA Title. He signed a $228mm five-year contract lasting through 2025 in addition to earning over $25mm/year in sponsorships. He is a thoughtful young man who puts family first and the story is remarkable. He overcame countless challenges and works hard. I loved his response to the question about failure. He is also loyal to Milwaukee for drafting him. I am a big fan of this kid for his actions on and off the court. I highly recommend watching this film.

Markets

JPM’s Marko is a Bear

X-AI Fundraise

Golden Goose IPO/High-End Sneaker Market

Fewer Men Going to College-Good Map

New School in Delray, FL-Much Needed

Another New CA Tax Proposed in South Lake Tahoe

Biggest Price Increases in 1-Bed Apartments in U.S.

Picture of the Day-Fees Kill/Power of Compounding

The most powerful point I will make today is in this section about compounding and fees. A Tweet by Dividend Growth Investor showcases my point. “If you invested $1,000 in Berkshire Hathaway in 1965, by 2009 your investment would have been worth $4.3 million. If Buffett had set up Berkshire as a hedge fund, and charged a 2% annual fee plus 20% of any gains, the investor would have been left with only $300,000.” The power of compounding is real and fees can eat you alive as seen in the chart below. Very few hedge funds beat their respective benchmarks over a 20-year period after fees and expenses.

State of the US Consumer

I wrote extensively about my concerns for the U.S. consumer in 2023 and I was proven to be too early. The resiliency and stupidity of U.S. consumers never cease to amaze me. The instant gratification society where you click a button to buy something you cannot afford is maddening. The frustrating growth of Buy Now Pay Later (BNPL) programs has been covered in recent Rosen Reports. Globally, BNPL hit $316bn in sales in 2023 (doubled in two years). In the U.S. BNPL hit $85bn on e-commerce purchases (5% of all e-commerce). However, more cracks are starting to show in the consumer as the impacts of inflation, higher borrowing costs, ballooning debt levels, crashing savings rates, housing affordability issues, and skyrocketing insurance, and healthcare costs are taking a toll.

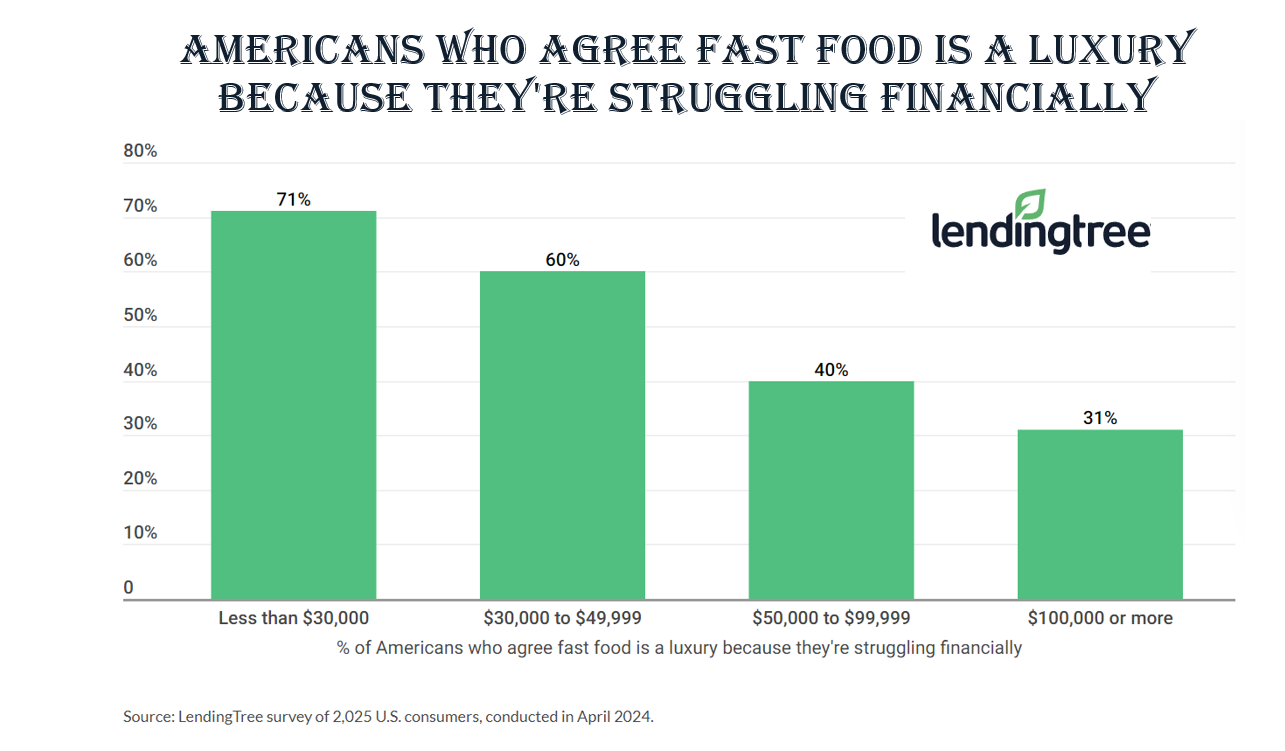

This Bloomberg article is entitled, “Cash-Strapped Shoppers Are Sending Budget Chains Into Bankruptcy,” and lists quite a few lower-end retailers feeling the pressure including Rue 21 (filed bankruptcy), 99 Cents Only Stores (liquidating), Big Lots, Dollar General, Dollar Tree. A new Lending Tree survey shows 78% of US consumers view fast food as a luxury due to high prices and 50% suggested fast food is a luxury as they are struggling financially. Walgreens announced price cuts on 1,300 items due to consumer spending fatigue.

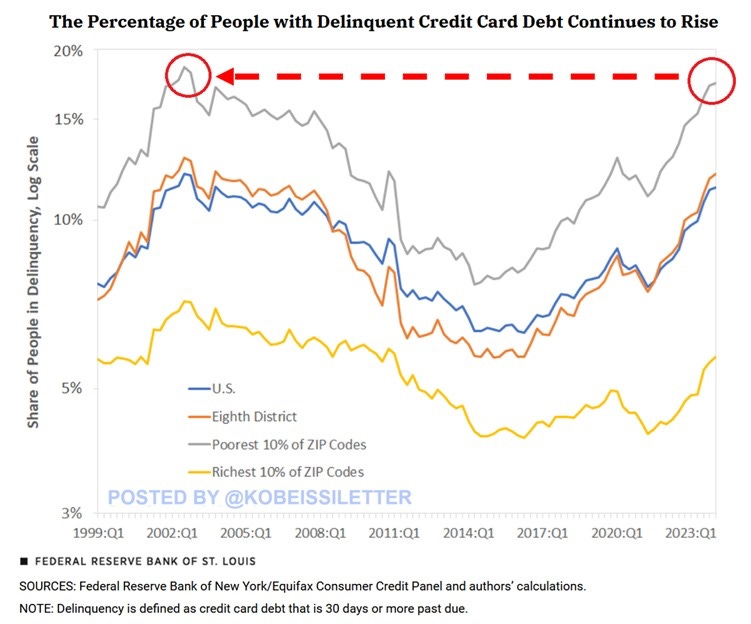

1 in 6 Americans from the poorest 10% of ZIP codes are in credit card debt delinquency, according to the Fed.

The share of people in delinquency in these areas has increased from 11% in Q2 2021 to 17% in 1Q 2024, the highest in 21 years.

In just 10 years, this percentage has more than DOUBLED.

Meanwhile, the share of people with delinquent credit card debt nationally is at ~12%, the largest since 2003.

For 90% of Americans, delinquency rates on credit card debt are now above levels seen in the 2008 Financial Crisis.

New Fed data highlights consumer weakness:

52% of US adults could not handle a surprise bill of at least $2,000 using savings in 2023, the highest share since 2020.

42% of these people could not even cover a $1,000 surprise expense, according to a Fed survey.

Shockingly, almost 1 in 5 respondents could only afford an expense of below $100.

17% of surveyed Americans also said they did not pay all their bills in full in the month prior to the survey.

Meanwhile, 28% of adults financially struggled last year, the largest share in 7 years.

The chart below is slightly concerning, showing that 52% of Americans cannot afford of a surprise bill of under $2k.

CBS news reported that more parents support their adult children amid economic hardship. In fact, according to data from Savings.com, of 1,000 parents, 47% reported providing ongoing financial assistance to their adult children. Many cited economic hardships faced by their children such as student loan debt or stagnant wages. On average, parents are shelling out around $1400 a month to help support their kids, covering everything from grocery and cell phone bills to rent to keeping them on health insurance plans until they're 26. However, this support doesn't come without its challenges -- nearly 58% of parents say they're sacrificing their own financial security.

In recent weeks, we have seen more reports of U.S. consumers slowing. Americans are showing signs of strain under a higher cost of living and a cooling job market.

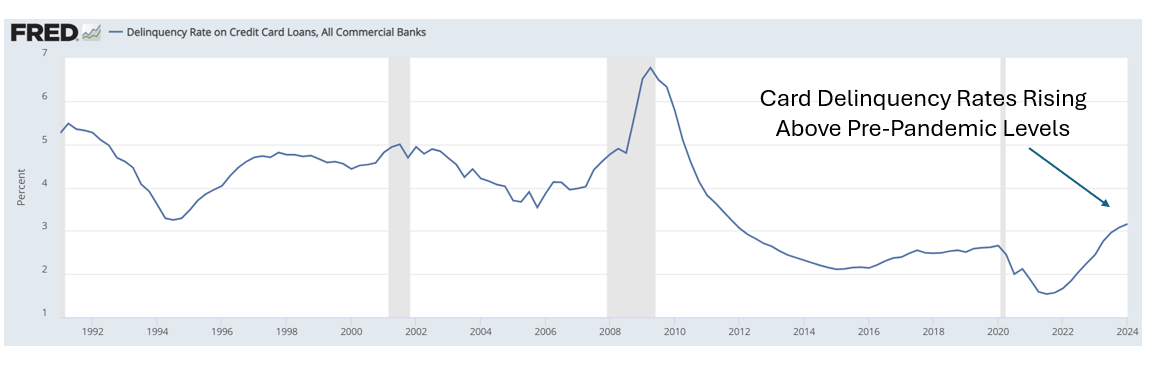

We have seen consumer savings rates crash to 50% of pre-pandemic levels. while excess savings is gone and debt levels explode while delinquencies rise. Credit card delinquency is rising. In the first quarter of 2024, 6.9% of credit card balances fell into “serious delinquency,” 90 or more days late, according to Fed data, up from 4.6% in early 2023. The overall credit card delinquency rate was 3.1% at the end of 2023, the highest level since 2011. For borrowers who can’t keep up, there has probably never been a worse time to own a credit card. The average interest rate has risen by seven full points since early 2022, from 14.6% to 21.6%, according to federal data.

Recently, we have seen numerous companies cite a weakening consumer including Target, Lowe’s, Ross Stores, Monro, Macy’s, Dillards, Walmart, Aldi, Cracker Barrel, Jack in the Box, Home Depot, Casey’s General Stores, McDonald’s, Starbucks, JB Hunt and many others. Check out this Fortune headline, “The resilient US consumer is slowing down and analysts are worried they could be ‘hitting a breaking point.’” This WaPo story is telling, “Grocers are finally lowering prices as consumers pull back.” I spoke with an owner of hundreds of restaurants across the country who also confirmed the consumers are slowing, and he has access to a lot of data.

Am I calling for Armageddon? Absolutely Not. I am merely pointing out that high inflation, consumers that needs instant gratification to buy things they cannot afford, higher rates and housing affordability issues are taking a toll on many consumers. However, it is just starting to play out and, as we have seen, consumers seem to find ways to spend money they don’t have for longer than they should. Live within your means. Be a saver. Invest when possible. Buying depreciating crap assets with 20%+ cost debt is idiocy and cannot last forever.

Quick Bites

At the rate we are going, NVIDIA is going to be worth $5 trillion by the end of 2024. It is on a non-stop tear. Check out the 1st chart showing Nvidia’s share of the data center compute market growing from 15% to 80% over five years. On Tuesday, consumer confidence came in higher than expected at 102 vs 96 estimate. Treasuries sold off on the better-than-expected consumer data with the 2-year approaching 5% again and the 10-year at 4.61%. On 12/27/23, the 10- year was at 3.78% and the yield is +83bps since. No one thought rates would be at these high levels in June of 2024. Wednesday, stocks sold off with all 11 sectors in the S&P in the red, but Nvidia was up slightly as of just prior to the close.

Interesting Barron’s article entitled, “In a Crowd of Bulls, Marko Kolanovic Is a Lonely Bear.” Wall Street pessimists have had a tough run this year as stocks chase one high after another. But one bear is holding firm. JPMorgan Chase’s Marko Kolanovic doubled down on his negative stance this past Monday, right after Morgan Stanley’s Mike Wilson abandoned his bearish outlook by upping his 12-month S&P 500 target from 4500 to 5400. Kolanovic says he doesn’t see stocks as “attractive investments,” expecting the S&P 500 to drop to 4200 by December from the current 5300, citing restrictive rates, inflation, and stress on lower-income consumers. The strategist was too bullish in 2022 and too bearish in 2023. Now Kolanovic sees the market falling at least 20%, making him the most prominent big-bank bear. Since October 2022, the S&P 500 has hit more than 20 new highs. As you can see below, Marko is an outlier.

Elon Musk's AI startup xAI raised $6 billion in series B funding, reaching a post-money valuation of $24 billion as investors bet big on challengers to companies like OpenAI in the intensifying AI race. The funding round was backed by investors including Andreessen Horowitz and Sequoia Capital, the company said in a blog post on Sunday. There are a lot of players in the space and there is likely to be more than one winner. Some articles suggested that a lot of the money raised with go straight to Nvidia for chips. Ultimately, corporations will be much better off due to massive gains in efficiency with less need for office staff and factory/warehouse personnel. But I wonder how much one person can have on his plate (TSLA, X, Boring, SpaceX, X-AI, Starlink, Neuralink, Solar City)

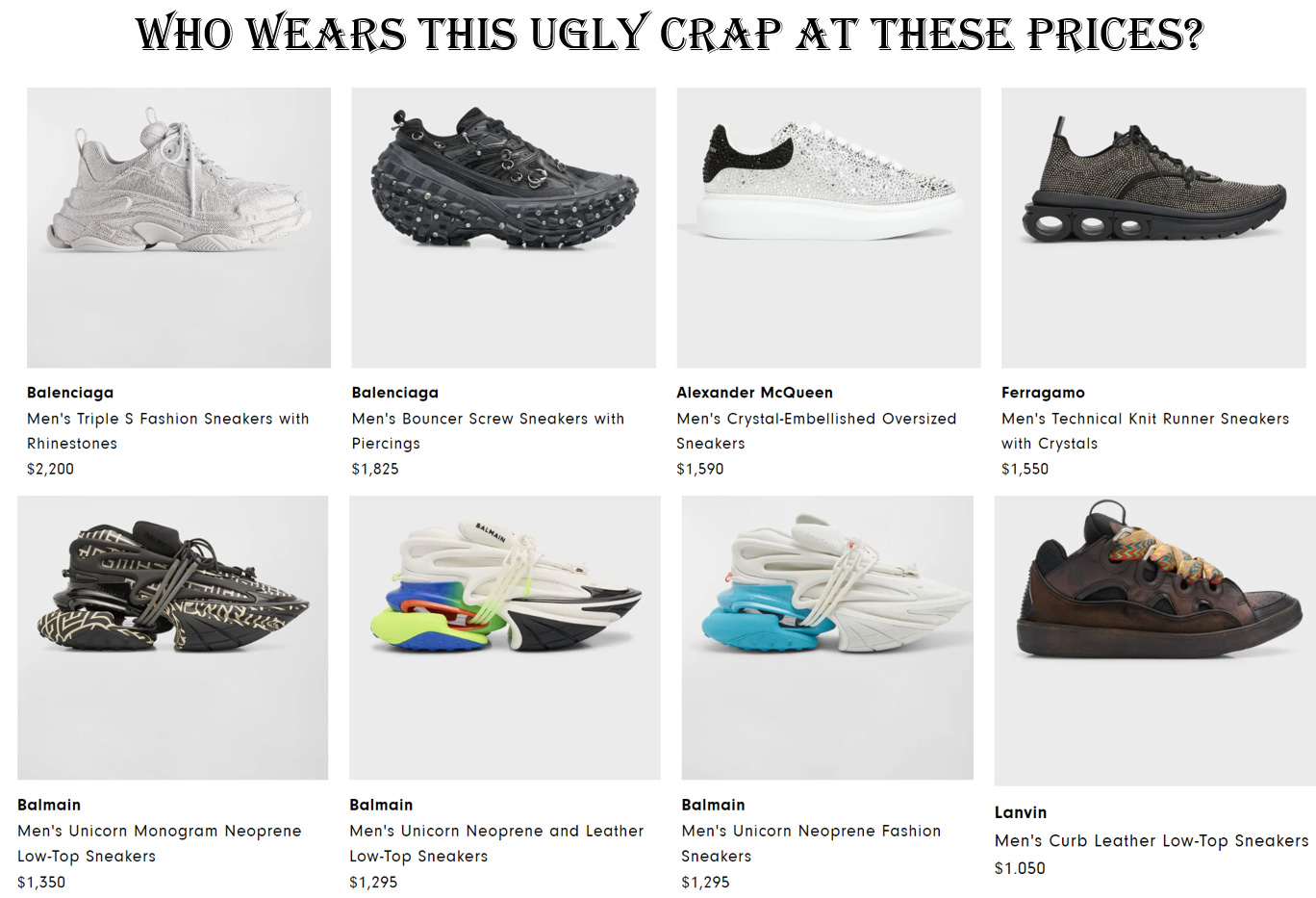

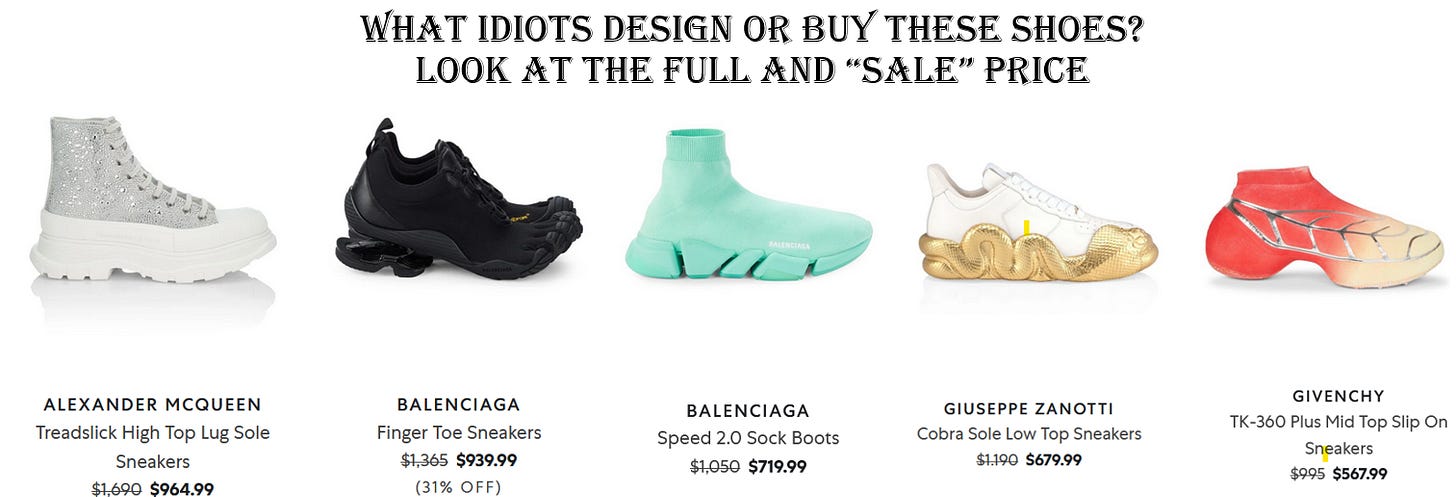

The shoemaker, Golden Goose, is set to kick off a Milan IPO this week valuing the the company at 11 times earnings or approximately $3.3bn. I do not own any Golden Goose sneakers but some are nice, albeit too expensive to justify. I love shoes and when I worked on Wall Street only wore the Italian brand, Sutor Mantellassi, after I discovered them on a massive sale. Now, I rarely bring out my fancy kicks and they collect dust in my closet. I started learning more about “dress sneakers” and things to wear to meetings. I am in shock at the prices of shoes that can cost more than $1,000 today, plus many of them are insanely ugly. Below are some of the ridiculous high-end sneakers for sale with prices today. Who would wear these ugly and expensive shoes?

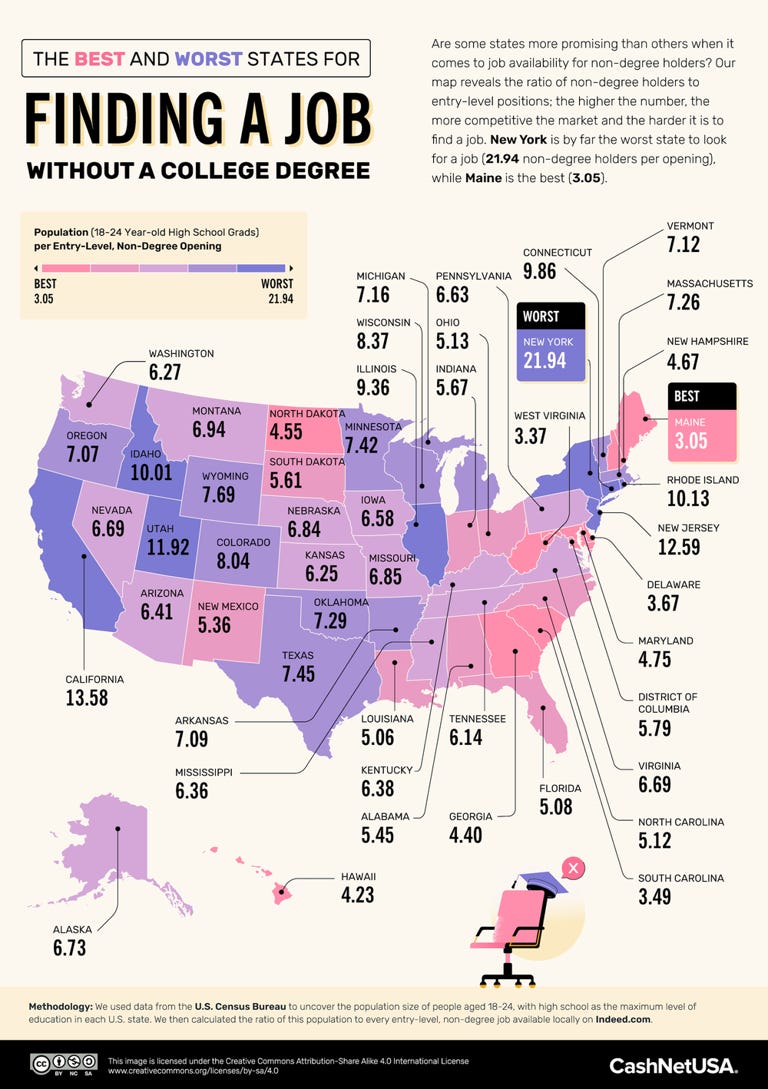

I have written regularly about college and the growing realization that many who attend four-year schools should not. Instead, go to trade school. The rapidly rising costs of college, overly woke teachings, and compensation post-graduation are all contributing. Let’s not forget about the anti-Israel/Pro-Hamas sentiment at many colleges and universities across America. I thought this article, “Fewer Young Men Are Going to College — Here's a State-By-State Breakdown of Where They'll Have the Best and Worst Job Prospects,’ was a good one with a great chart. Fifty-six percent of Americans think earning a four-year college degree isn't worth it, according to a poll from The Wall Street Journal and NORC at the University of Chicago. That belief has translated to lower college enrollment among young Americans over the past decade, mostly due to fewer young men opting for higher education: about one million of them, per Pew Research Center. Although you don't necessarily need to graduate from college to land a great entry-level job — and some top companies, including Accenture, IBM and Dell Technologies, have done away with degree requirements altogether — it could put you at a disadvantage depending on who's hiring for the position. Check out the chart below. The higher the #, the harder it is to get a job without a degree, as the # signifies the amount of non-degreed applicants for each entry-level role. NY is the worst state with a score of 21.94 and Maine is the best with a score of 3.05.

Israel/Middle East

Israeli PM Netanyahu acknowledges ‘tragic mistake’ after Rafah camp strike

The U.S. Built a $320 Million Pier to Get Aid to Gazans. Little of It Has Reached Them.

Nazi salute and racial chants seen at German event: 'Foreigners out'

Data Analysis Confirms That Anti-Israel Protests “are overwhelmingly an elite college phenomenon”

Biden Administration Presses Allies Not to Confront Iran on Nuclear Program

Other Headlines

The Fed probably won’t be delivering any interest rate cuts this summer

Just months ago, the market thought there would be 6+ cuts in 2024 and today, the market is pricing a little more than 1 cut in 2024.

Fed’s Kashkari wants to see ‘many more months’ of positive inflation data before a rate cut

The ‘absolute worst’ of times for car buying are over

I have had multiple readers tell me of SIGNIFICANT discounts buying new cars in the past month. One person received a $45k discount on a new EV.

I have spoken with Uber/Lyft drivers who work up to 80 hours a week and make about $10 an hour after the cost of car, gas, parking, insurance…

Japanese carmaker Toyota set to end massive Olympic sponsorship deal

The $835mm deal was for 4 Olympic games and according to reports, Toyota was unhappy with the way sponsorship money was used by the IOC. WOW.

SpaceX mulling tender offer at $200 bln valuation, Bloomberg News reports

GameStop shares jump more than 30% after $933 million stock sale

Market cap is back up to almost $8bn or 300 times EBITDA. The stock was +35% mid day Tuesday. I would not touch this stock. Remember, it was $65/share two weeks ago.

American shares tumble 15% after sales strategy backfires; carrier cuts growth

Abercrombie & Fitch shares surge 25% as retailer’s torrid growth shows no signs of slowing

‘We found the missing link’: Energy storage breakthrough could charge electronics in 60 seconds!

Amazing claims in the article about charging times for EVs or laptops if the technology is proven effective. Wow.

Jury in Donald Trump’s hush money case asks to rehear testimony as deliberations get underway

Crazy times as the former President could be sentenced to jail.

Just what Congress needs, another criminal.

Sunak’s plan to make 18-year-olds do national service grabs attention on U.K. election trail

Lawmakers’ horrific plan to turn NYC into ‘Sin City East’ by OK’ing prostitution

I thought this was a joke. Check out the two competing plans on legalizing prostitution. Just what NYC needs, less laws. Legalizing casinos, drugs, prostitution and decriminalizing everything else. What could go wrong?

Multiple factors here. Many hotels closed due to Covid. Inflation is taking a toll and more hotels are housing migrants, taking key availability out of the market during the summer tourist season. According to the NYT, about 135 of the nearly 700 hotels in New York City are now sheltering asylum seekers.

Maniac who set NYC straphanger on fire was behind earlier similar incident

Not his first arrest. All soft-on-crime policies do is hurt law-abiding citizens.

Suspects not caught. What are the chances this is their first crime? What are the chances they have been let out of jail by idiotic DAs who don’t believe in consequences for crime? The suspects shot an unarmed man who did not try to fight them. Nothing could get me to live in LA. I just had lunch with a lovely young woman from L.A. who told me her family could not take it anymore and moved to Miami. I asked how she liked South Florida. She said, “It is so much better than L.A., I don’t want to go back.” I wonder why? Wealthy people have options. Stop charging people $700 for Taco Bell. That is what NY, IL, CA, DC…continue to do. High taxes, high cost of living, high crime, woke policies….push out those you need to keep.

California teenager arrested after violent swarm pounded and kicked a deputy's car

Throw these kids in jail. Watch the video.

Please open the link and check out the pictures. Due to zero consequences for crime idiotic policies, law-abiding consumers pay the price.

Illegal Alien Convicted of Killing 2 Children Released Despite ICE Detainer

Deport him immediately.

South Carolina family of boy, 13, who died by suicide sues Snapchat over sextortion scheme

These stories make me sick. Predators caused a 13-year-old to kill himself through a sextortion scheme. It is so scary. Social media is the devil. The psychological impact of social media is the most devastating thing to happen to children in my lifetime, especially young girls. Parents, be all over this crap. I want the death penalty for the people involved.

Arizona official uses deepfake version of himself to warn voters not to be fooled by AI

I’m a doctor — here’s how to lower your risk for top cause of death

Possible link between tattoos and lymphoma revealed in new study

A new study out of Sweden finds that people with tattoos have a 21% higher risk of developing lymphoma, a type of blood cancer.

The Plastic Chemicals Hiding in Your Food

A very concerning article from Consumer Reports. Plastic is everywhere in your food. One example of many below:

Charges dropped for Scottie Scheffler, who shares 'no ill will'

Meet America’s newest nuclear stealth bomber - with a cost of $700m per plane

North Korean trash balloons are dumping ‘filth’ on South Korea

Fauci actively hid his communications from the public on Lab Leak

I was critical of Fauci early and called for his dismissal in numerous newsletters. The email from the top Fauci NIH advisor is troubling. In an April 21, 2021, email to Daszak, Morens sought to conduct business either via personal email or with no electronic record. He wrote: "PS, I forgot to say there is no worry about FOIAs. I can either send stuff to Tony [Fauci] on his private gmail, or hand it to him at work or at his house. He is too smart to let colleagues send him stuff that could cause trouble."

Real Estate

South Florida does not have a lot of school choices. Many families cannot relocate down here as is it is virtually impossible to get three kids into the same school. A reader just sent me this new school opening (Inspire) in August 2026 that looks BEAUTIFUL and it is in Delray. They are looking for a head of school for what eventually will be a 1,500-2,000 student campus. The campus is 35 acres with 380,000 feet of building space. As you can see from the brochure, it is impressive and much needed. Unless the place is run by idiots, it should fill up in no time.

I have repeatedly written why California is no longer inhabitable from my perspective. Highest taxes in the country, highest gas, highest natural gas, anti-business policies, worst traffic, worst natural disasters (fires, floods, droughts, mudslides, earthquakes), worst COVID policies, worst lockdowns, bad crime, no consequences for crime, worst homeless population, illegal immigration, sanctuary cities, massive deficits, anti-business policies, woke school teaching... L.A. County came up with another wealth tax on any R/E over $5mm called ULA as outlined here one year ago. Now, South Lake Tahoe, one of my favorite places in the country, wants to impose a new tax on property owners who leave their homes vacant for 6 months or more. The measure dubbed the “South Lake Tahoe Vacancy Tax,” aims to penalize homeowners who leave thousands of homes empty in the mountain resort town; the tax penalties would go toward affordable housing, road repair and public transportation. The measure is an attempt to incentivize homeowners to rent properties out rather than leaving them vacant. I wanted to buy in Lake Tahoe. NO CHANCE I CONSIDER BUYING IN CA. The state is trying to pass wealth taxes, exit taxes, slave reparation taxes, and higher taxes on the wealthy….

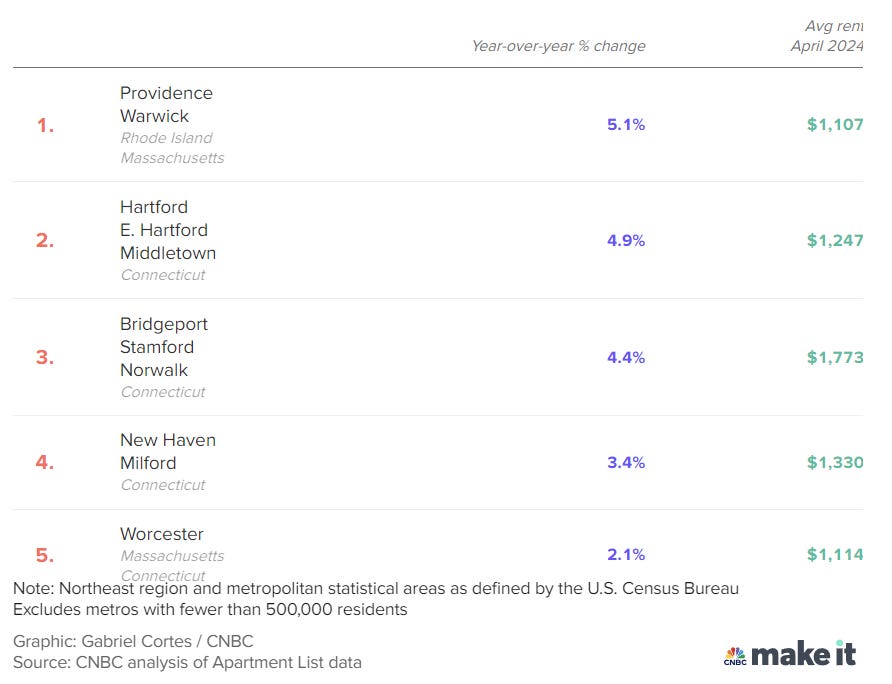

CNBC article outlines the 5 Northeast metro areas where rent for a 1-bedroom increased the most over the past year. Rent prices are up all across the United States. According to a May Zumper report, the national median rent for a one-bedroom apartment is $1,487. In New York and Los Angeles, the figure jumps to $4,280 and $2,300, respectively.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #686 ©Copyright 2024 Written By Eric Rosen.