Opening Comments

Early send today as I am on the road. I had a truly remarkable response from my last piece, Perspective, which was a departure from my generally light-hearted themes. I felt the message was important and worried my readers would not like it. I could not have been more wrong. I had more emails of encouragement than any other piece I can recall. The most opened link was, “A Harvard genetics professor who only sleeps 6 hours a night and doesn’t exercise every day swears 3 habits helped reverse his biological age by a decade.”

I get so many lovely emails from readers who appreciate what I do in the Rosen Report. Interactions with readers and intellectual curiosity keep me going. Again, a reader asked me how many people are on the Rosen Report team. I do it solo. The research, writing, pictures, and editing are done by me. My readers contribute with story ideas, links, and thoughts, and my sister, Debbie, gives my report a read before I hit send to save me from any catastrophic errors, and trust me, she has caught some doozies which would have been embarrassing. Regardless of how many times I re-read my report, I never catch all the mistakes.

I have received lovely notes of encouragement from a highly respected investor and business builder. I told readers I was in the Hamptons and he sent me this note: If you are in Southampton and have time for coffee or more, give me a shout. Devoted reader. I called him up and went to his amazing beach front home and had a fantastic time, and his stories were legendary. The readership of the Rosen Report is far more impressive than I could have imagined. So many incredibly bright, successful, interesting readers. Thank you.

A reader sent me Howard Marks latest diatribe entitled, “Taking the Temperature,” which is yet another informative view from the investing legend from Oaktree Capital.

Jack and I are back in Marion, Mass for a few days and returning to the Hamptons Sunday.

Markets

Corporate Earnings Implications

South Florida Inflation Runs High for A Reason

Longevity Doctors Don’t Come Cheap

South Florida Homeowners Insurance is a BIG Issue

Surf Club Miami Condo sells for $5,700/ft

NYC Luxury Market Heats Up

LA Office Vacancy

19 Hotels will be Turned Back Over to Lenders

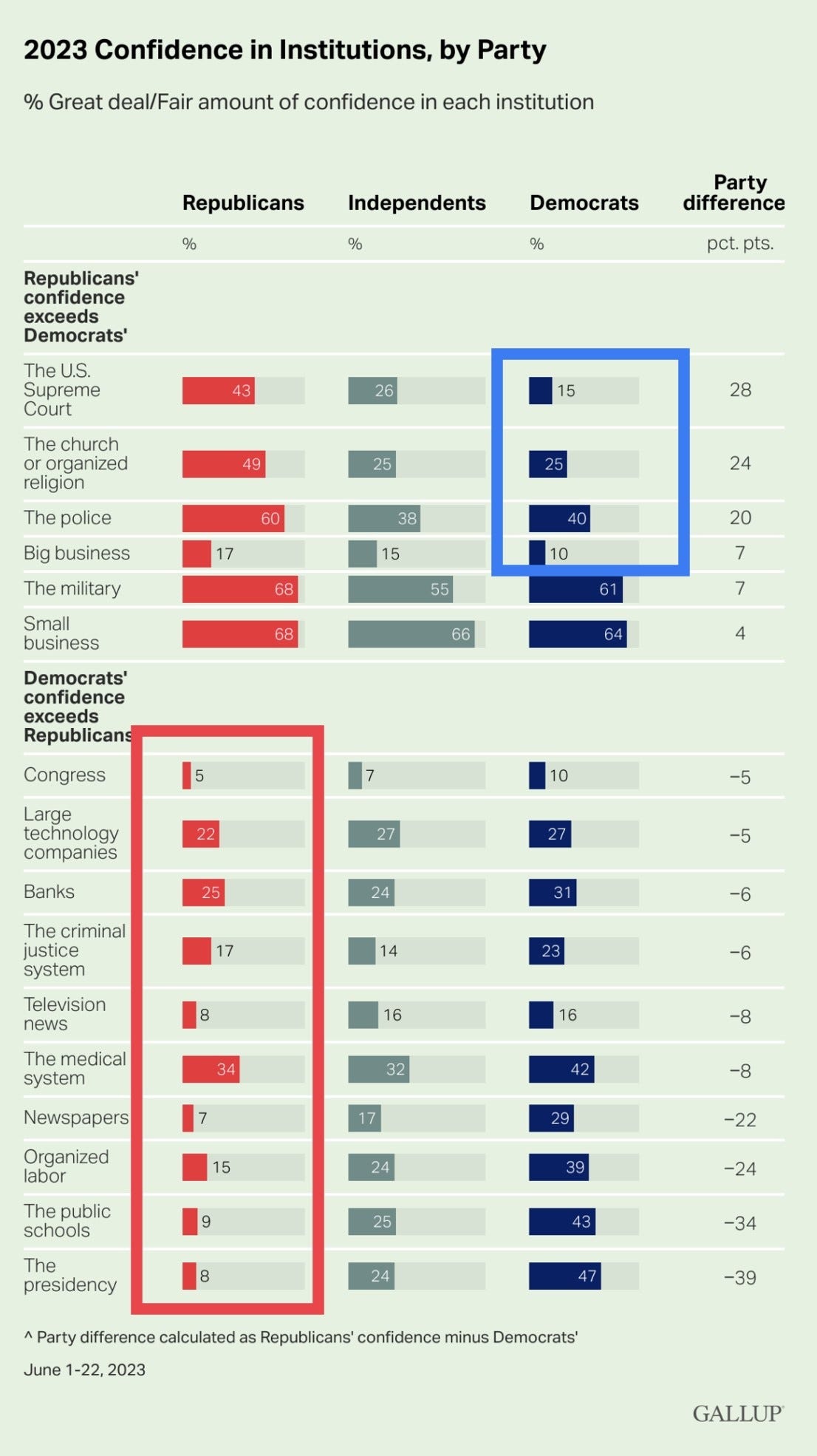

Picture of the Day-Trust In Institutions is Falling

I think we should be able to do better than these polls suggest in the USA. Check out how little confidence Americans have in many institutions. Look at how low Congress, Big Business, TV News, Criminal Justice System is on the confidence list. Great story on the most trusted man in news, Walter Cronkite. America needs to gain trust in institutions, but to do that, we need more honesty, transparency and acknowledgement of mistakes From members on the list below. I sure would watch someone like Cronkite.

There is Fishing. There is Catching & Then There is Crushing

In my last piece, I talked about how I lost my perspective. I am one lucky person who has been fortunate despite growing up with limited means and no father. I have a lot of hobbies and passions, and since I moved to Florida, I have been doing a lot more fishing on my boat. This time of year, Yellowfin Tuna migrate south and tend to go as low as the area 124 miles Northeast of Boca. Sure, you can catch random ones further south, but it is far less common. I had never taken my boat farther than Bimini (60 miles) and decided to give it a go.

I went with a great fisherman named Dustin (26 years old) and he brought his girlfriend, Maddie. I must admit I had high expectations and was very excited about the trip, as the fishing reports were solid. We left Monday morning at 8 am and stopped at West End to clear customs. I made a rookie move by not topping off the gas tanks there as I burned about 70 gallons on the trip at that point. Gas availability is spotty in the Bahamas.

We left West End and drove straight to fishing. The Yellowfin tuna bite in the am or pm and turn off during the day. It was about noon and we started with some “Deep Dropping” which is fishing in very deep water for snapper and grouper. We were fishing in 1200-1400 feet of water and doing fine catching fish, but it was not epic. You need a huge electric reel. I have two electric LP’s which are about $6,000 each and with the rod and line it is almost $10,000. We caught some beautiful fish, but not as many as I would have liked.

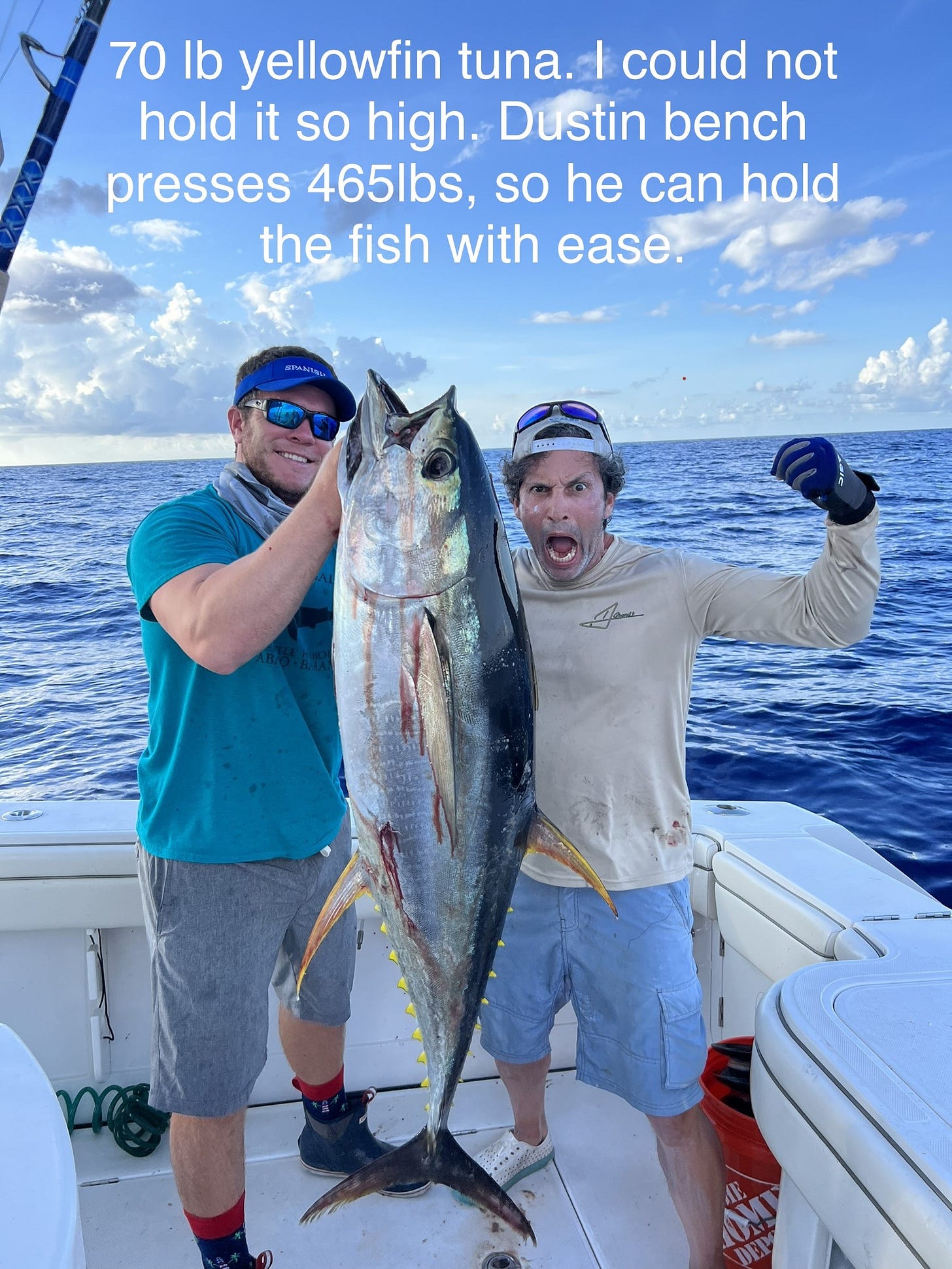

From there we went to the tuna grounds to troll for Yellowfin Tuna. We look for birds on my radar and by sight. Birds fly together and when they find bait, they circle and dive. The small bait fish are being eaten by bigger fish which are eaten by the tuna. When you find birds, you tend to find some fish on them. In short order, the radar picked up the birds and we started trolling with our lures. In no time, we got our 1st tuna and then another. We also caught some Blackfin Tuna-up to 12lbs as well. This Video is 4 minutes and shows me fighting tuna and Dustin helping me bring them in. Shockingly challenging. Video from an iPhone and a head mounted GoPro.

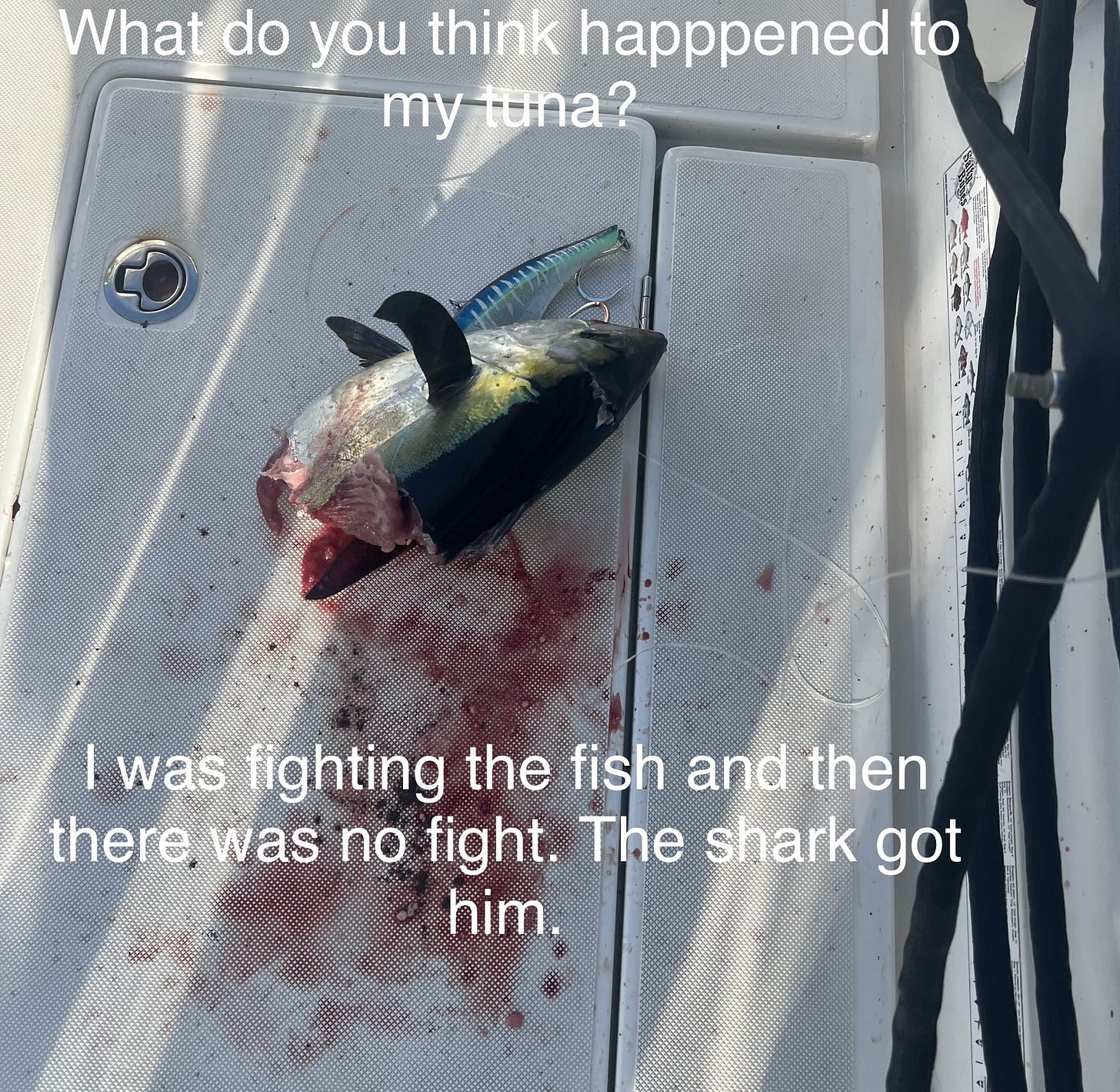

We got sharked a bit as the toothy creatures love to eat tuna. Here is one Blackfin that I was reeling in and then felt very little fight. I wonder what happened to it. We started fishing around noon on Monday and fished until 7pm and had a good first day.

We then went to check into the hotel, I mean hell hole called, Jolleeka’s Motel. I have stayed at countless 5-Star hotels and plenty of dumps, especially with Jack for his golf tournaments. Long-time readers will recall my piece entitled “Zachary, Louisiana, Why?” which showed a bullet hole in the window of my room which smelled like dirty gym socks. To be clear, that room was 10 times nicer than Jolleeka’s Despite being covered in blood and fish from fishing all day, I REFUSED to take a shower with the sulfur-smelling well-water. The ONLY positive about the place was the AC was cold. Apart from that it was awful. I was scared to sleep on the bed and was concerned about communicable diseases. Did I mention the smell was rancid? It was hard not to puke, but I made Yelloweye Snapper tacos which were delicious after being in the heat and sun for 12 hours.

We started fishing at 7 am on Tuesday and got another nice Yellowfin and more Blackfin Tuna. We did more deep dropping and caught some additional fish, but given the accommodations and the gas challenges, decided to head back home. The island was low on gasoline which happens in the Bahamas all the time.

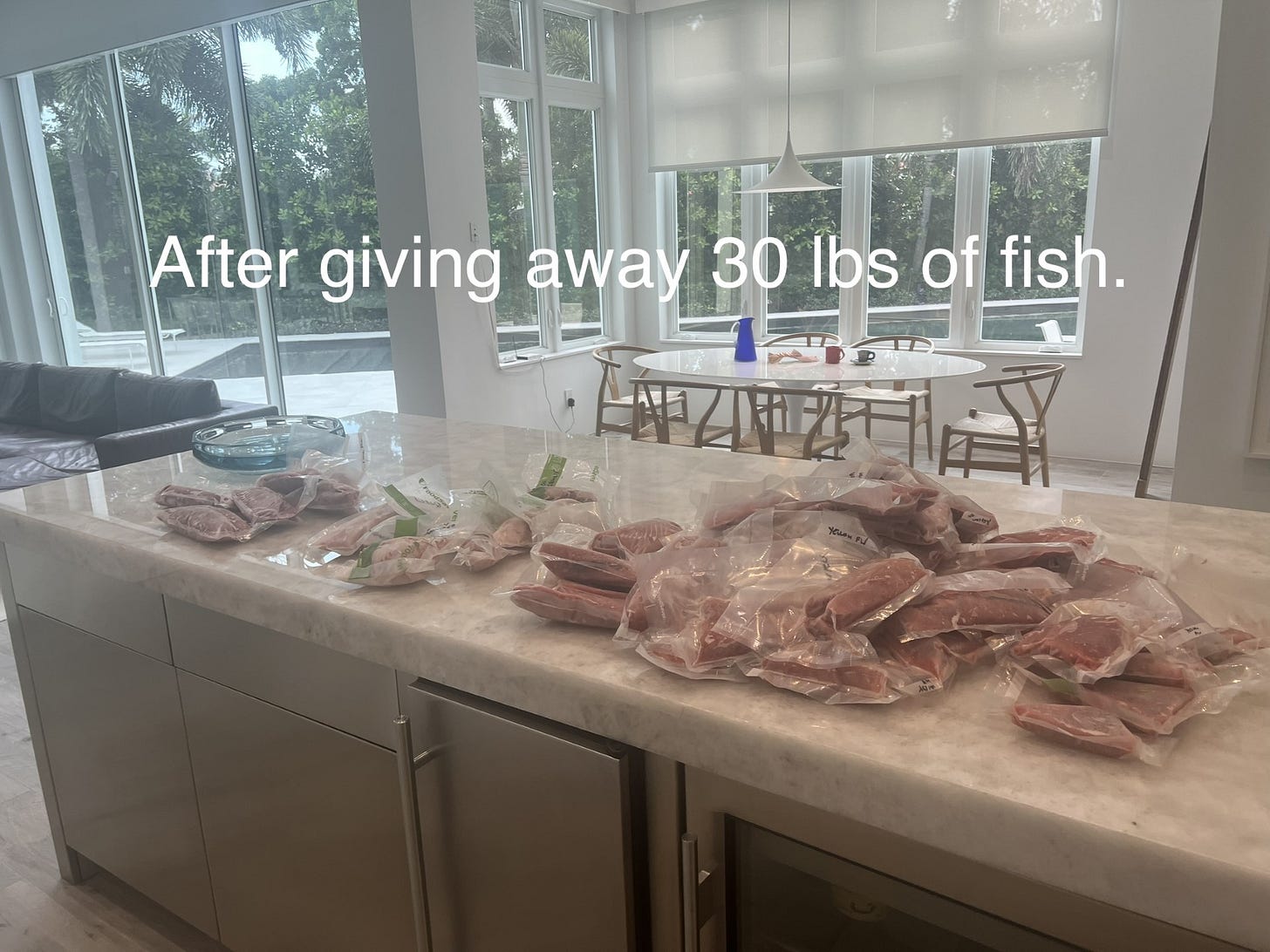

We got back to the doc at 8 pm Tuesday. In 36 hours, I drove a total of over 320 miles on the boat and caught some nice fish. We had to filet the fish that night until 10 pm on July 4th with the fireworks exploding. The next day, I had to vacuum seal 75 pounds of meat after giving a bunch away. It took me 3 hours to vacuum seal, but we have fish for months.

I had my sisters and brother-in-law for dinner on Wednesday and here are some photos of food. I also made sauteed Queen Snapper but somehow have no picture of it. Despite the accommodations, it was an amazing 36 hours. Yes, I cleaned the boat on Wednesday am for 3 hours, as there was blood everywhere. It was a great trip with a lot of memories. These Yellowfin are extremely strong creatures and I was glad to have Dustin’s muscle on the boat. There is no chance I could have done it solo.

Quick Bites

Inflation rose just .2% in June and was up 3% from a year ago. Excluding food and energy core CPI increased .2% and 4.8% respectively. Stocks and bonds rallied on the news. As of 2:35pm, the Dow traded 147 points higher, or 0.4%. The S&P 500 gained 0.9%, and the Nasdaq popped 1.3%. The S&P 500 reached a new high for 2023 and its highest level since April 2022. Year-to-date, the S&P is +16.5%, Nasdaq+32.8% and the Russell 2000 +10%. The VIX was -8% to 13.7. Bonds rallied sharply with the 2-year Treasury yield -15bps and the 10-year -12bps. Futures suggest an 86% chance of a 25bps hike at the next meeting one more by the end of the year is down to 20% from 40% pre inflation data. Oil rallied 1% to almost $76/barrel on the news and crypto was largely unchanged. I felt inflation would come down a little faster in prior months, but this is quite a positive development, and it seems as though the impact of higher rates, tighter lending standards, the consumer stretched… are starting to impact prices more sharply. This WSJ article is entitled, “Credit Scores Went Up in Pandemic. Now, More Borrowers Are Slipping.” The cumulative impact of rates, inflation, borrowing levels, crashing savings…will really start impacting the consumers now.

Good WSJ article entitled, “A Soft Corporate-Earnings Season Poses Next Test for Stock Market Rally-Analysts expect S&P 500 companies to report third consecutive quarter of declining profits.” The market faces its next test this week when the quarterly earnings season kicks off and investors begin to assess whether U.S. stocks can defend their rally against a backdrop of depressed corporate profits. Companies have been battling persistent inflation, strained consumer demand and the Federal Reserve’s interest-rate increases for more than a year. Investors are looking to this next round of reports for insights into how corporate profits are holding up and whether that makes stocks look expensive relative to their value. U.S. stocks have defied expectations to rally in 2023, with the S&P 500 up 15% and the Nasdaq Composite up 31%, logging its best start to a year in four decades. Analysts expect companies in the S&P 500 to report a third consecutive decline in quarterly earnings. Second-quarter profits are projected to have dropped 7.2% from the same period a year earlier, according to FactSet. That would mark the steepest pullback since the second quarter of 2020, when the onset of the Covid-19 pandemic resulted in a 32% profit decline.

Florida is America’s inflation hotspot because of a persistent problem with sky-high housing costs. The Miami-Fort Lauderdale-West Palm Beach area has the highest inflation rate of metro areas with more than 2.5 million residents, with a 9% inflation rate for the 12 months ended in April. That’s more than double the national average of 4%, according to data from the Consumer Price Index. The Tampa-St. Petersburg-Clearwater metro had the third-highest inflation rate in the country, at 7.3% for the year ended in May. Don’t get me wrong, housing costs have sky rocketed in South Florida as the great migration saw hundreds of thousands relocate. However, I want to be crystal clear, the cost of living in South Florida is fractional to NYC. I lived in NYC for over 20 years. When you factor in housing, education, parking, regular expenses such as food, travel (you take a lot more vacations from NYC), tutors, cabs/Ubers, clothes… it is not close. Florida is far cheaper. I paid $1,200/month to park my car 6 years ago and in FL I have a 4 car garage. High School tuition in FL is $40k and it is $62k in NYC before donations, and the expectations for donations are far higher than in FL. A guitar instructor in NYC was $150/hr (6 years ago) and in Florida, I have a world class guitarist for $70/hr (far better than the NYC instructor). Tutors in NYC for 4th grade math were $200/hr 6 years ago. In Florida, it is less than half the price. I would say the inflation is higher in FL because the world is figuring out the quality of life and cost of living is better than the alternative-despite the far higher recent inflation. Oh yeah, those pesky income taxes are ZERO in Florida and total 14% in NYC after you consider city and state. The one pricey thing in FL is R/E tax on your home which is about 1.75% of assessed value of the house. But at least here we have Homestead Exemption, putting a 3% cap on annual tax increases. However, my total living expenses are sharply lower than NYC. Great article on the entrepreneurial migration to South Florida with some solid data behind it. My has South Florida changed dramatically in a short time.

Interesting WSJ article entitled, “The Longevity Clinic Will See You Now—for $100,000 The clinics cater to a growing number of people obsessed with fighting aging.” Medical clinics are popping up across the country promising to help clients live longer and better—so long as they can pay. Longevity clinics aim to do everything from preventing chronic disease to healing tennis elbow, all with the goal of optimizing patients’ health for more years. Clients pay as much as $100,000 a year for sometimes-unproven treatments, including biological-age testing, early cancer screenings, stem-cell therapies and hair rejuvenation.

The centers capitalize on Americans’ obsession with living longer and desire for personalized medical care, even if it comes from outside the mainstream, say industry investors and analysts. Many doctors and scientists caution that some clinics’ treatments lack robust scientific evidence or introduce health risks.

“It’s not a regulated market. Anybody who is treating your toenails can say they’re contributing to longevity,” says aging researcher Dr. Andrea Maier, who heads a nonprofit group working to establish medical standards around longevity medicine. Maier also runs a longevity clinic in Singapore focused on treatments backed by human trials. I am all for being healthier and living a longer life if it is a quality one. Advances in medicine and protocols have improved drastically over the past 50 years. I believe that there are advancements and treatments to help you live longer/healthier but also believe some of this is unproven and not worth the money.

Other Headlines

Tom Lee is generally bullish. He was right as he made the call prior to the CPI report.

There’s More Pain Ahead for S&P 500 as Profit Warnings Loom, Investors Say

AI boost to tech earnings is overblown, while financial tightening hurts company earnings, survey respondents say.

The American banking landscape is on the cusp of a seismic shift. Expect more pain to come

Rising interest rates, losses on commercial real estate and heightened regulatory scrutiny will pressure regional and midsized banks, leading to a wave of mergers, sources told CNBC.

Bank of America accused of opening fake accounts and charging illegal junk fees

Goldman Sachs says India will overtake the U.S. to become the world’s second-largest economy by 2075

Apple just released a preview of its big iPhone update, here’s what’s new

Twitter traffic is ‘tanking’ as Meta’s Threads hits 100 million users

US Air Force suspends personnel moves and bonuses due to funding shortfall

With the growing deficits, rising debt levels ($32 trillion), higher interest rates, aging population and mounting entitlement holes, how do you think this plays out over the next 20 years? Do you think it gets better if politicians refuse to make tough decisions on entitlements? I don’t. We need means testing and must raise the minimum age dramatically over the next 20 years. The only politician discussing this I can find is Chris Christie. I am not a huge fan, but am of his view on this topic.

Mark Zuckerberg Spends $43 Million on One Service for the Super-Rich

$14mm/year on security seems like a big # to me but when you are worth $100bn, what does it matter?

Here’s what Americans say they need to earn to feel rich, or even just financially secure

More than 2,500 US adults said they would need to earn, on average, $233,000 a year to feel financially secure and $483,000 annually to feel rich or to attain financial freedom, according to a new survey from Bankrate. Just for comparison’s sake, the median earnings for a full-time, year-round worker in 2021 was $56,473, according to the US Census Bureau.

Tranq invades NYC drug mills, expert calls city’s drugs ‘most dangerous’ ever

Disturbing pictures in the article.

50 Cent warns Los Angeles is ‘finished’ after city reinstates no-bail policy

Georgia mayor held at gunpoint after being accused of breaking into lake house

Crazy story where the mayor loved a home he thought was vacant and broke in only to find someone living there.

Chicago residents outraged over molestation in public beach bathroom: 'Worse than jail washrooms'

A man assaulted a 4-year-old and has not been caught. The DA refuses to prosecute people and criminals run free and constituents don’t understand why. Maybe consider your vote and elect people who share your concerns on crime. What does NYC, Philly, Chicago, DC, St. Louis, LA, SF, Portland and Seattle have in common with respect to crime policy?

Missing girl found at Camp Pendleton Marine barracks after family claimed she was sold for sex

Not sure what is fact vs fiction, but a 14-year-old girl with learning disabilities was found at Marine barracks and a man was arrested, but subsequently released.

Almost Forty percent of Brown University students say they are LGBT

How is this even remotely humanly possible? The latest data show that between 2010 and 2023, identification as LGBTQ+ has almost tripled among the student body at Brown (from 14% in 2010 saying they were not heterosexual to 38% now). "The Herald’s Spring 2023 poll found that 38% of students do not identify as straight — over five times the national rate," The Brown Daily Herald reported . "Over the past decade, LGBTQ+ identification has increased across the nation, with especially sharp growth at Brown."

Fight or flight: Florida losing some LGBTQ residents to blue states, but not all

YMCA Bans Swimmer for Protesting Against Biological Men in Women’s Locker Room

Girls protested that biological males were changing in the women’s locker room and the YMCA banned the girls as a result.

Dating Apps are destroying young men and should be banned

I am a firm believer that social media, dating apps and video games have made in person interactions less consistent. With two teenage kids, I see the way they interact through DMs and hate it. What happened to going up to someone and having a conversation? I would not do very well in the new world if I were 30 years younger.

In China, Ozempic jabs cost 478 Chinese yuan, or $67, per China's National Reimbursement Drugs List (NRDL). That price stands in stark contrast to the US, where an Ozempic injection costs $995, per the pharmaceutical website Drugs.com. We just can’t get it right on prescription drugs and the Big Pharma lobby is too strong. We can do better. Obesity rate in the US is 42% and in China 14%, yet they have much easier access to the drugs to help people in need. More than two-thirds of Americans are overweight or obese.

Weight loss drugs: EU expands Ozempic probe over suicide risks

The No. 1 way to grow your wealth, according to a self-made millionaire: It’s ‘deceptively simple’

Some good tips here.

Phoenix heat wave may be the longest ever and temperatures will likely increase

Real Estate

If you are moving to Florida, you better get your homeowner’s insurance squared away. Many Rosen Report readers are telling me horror stories about home insurance. My neighbor, not on the water, told me about this crazy insurance nightmare. His home was built in 1997 and redone in 2007. He was paying $17k/year for insurance. His carrier canceled him, and he reached out to four insurance companies. Two would not give him a quote. One said $150k/year and the other $85k/year despite materially HIGHER deductibles relative to his $17k insurance. You need to do your homework, as the cost of insurance is SKYROCKETING, and many carriers are refusing coverage. I would think hard about water lots as a result. Get an insurance quote prior to making an offer on a house. You can self-insure if you don’t have a mortgage. In a commercial R/E example, one reader was given a quote of $2mm for $10mm of coverage for a waterfront mixed use property. At that rate, I would self-insure.

I have often cited residences at the Surf Club in Miami as exceptional places which trade at a high per square foot price. One just sold at $5,700/ft, I believe it is a new record for the building. The 4,000/ft unit had all the original finishes from 2017 but the buyer only wanted that line and was willing to pay the full price. After renovations, the unit will end up costing $6,500/ft. A Florida entity linked to a real estate agent sold a Four Seasons Residences at the Surf Club condo for $22.8 million — marking a $13.5 million, or 145 percent price gain in six years. The same unit sold pre-pandemic for $13mm for perspective. I know a lower PH at the Perigon on 53rd and Collins (Barry Sternlihct Development) sold for $7,700/ft.

Good WSJ article entitled, “Manhattan Luxury Real Estate Market Heats Up.” New York City’s luxury residential market is gaining momentum after stumbling early in the year, another sign that pockets of the U.S. housing market are stirring to life despite high mortgage rates. Manhattan’s most expensive homes posted their second-best June for contracts signed since at least 2006. Signs of a potential turnaround have defied expectations that rising interest rates and a weakening economy would keep even the most affluent buyers on the sidelines for much of 2023. Instead, a rebounding stock market and fading recession fears boosted activity among well-heeled New Yorkers. “People went out and they’re still spending money on good digs,” said Donna Olshan, president of Olshan Realty, a brokerage firm that tracks Manhattan luxury sales of $4 million or higher. While still slower than the “boom years” of 2021 and 2022, luxury transactions in the first half of this year outpaced pre-pandemic levels, according to Olshan. A penthouse in the Soho neighborhood that traded off-market for $50 million last month ranked among the most expensive home sales ever to close in downtown Manhattan. 151 Wooster PH (combination of multiple units) totaling about 10,000Sq Ft just sold off market for $50MM. Also, a PH at 150 Charles just sold for $52mm in the West Village.

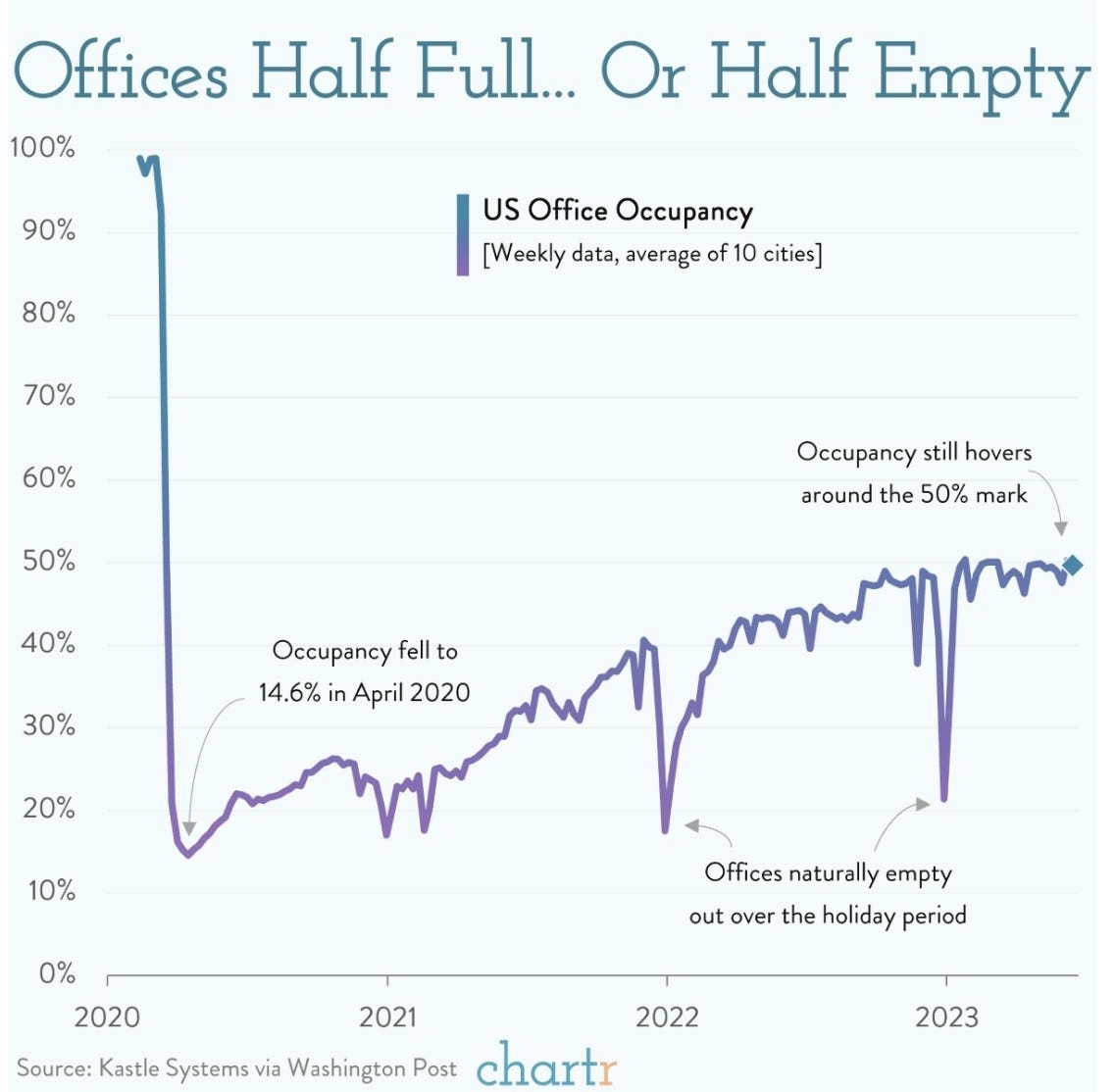

LA office availability grew 40 basis points to 26.6% at the halfway point in 2023, according to a new report from Savills. That’s the highest availability rate ever reported in the Greater L.A. market. Helping to raise that availability rate, the L.A. area’s sublease market increased yet again, to 10.8 million square feet, up 400,000 square feet from last quarter, and up 20 percent from the 9 million square feet reported this time last year. That’s still not even 5 percent of the 221 million square feet in the overall office market, but big-name tenants are putting unused space up for grabs. Chart below is interesting for 10 US cities.

Another example of the troubled commercial R/E market but this is on the hotel front. Ashford Hospitality Trust Inc. expects to return 19 hotels to lenders in cities including Las Vegas and Atlanta, declining to pour more cash into the properties, which are part of a $982 million mortgage pool that missed a repayment deadline in June. Keeping the hotels would have required a paydown of about $255 million to extend the financing and $80 million in capital expenditures through 2025, Dallas-based Ashford Trust said in a statement Friday. The equity in the properties is already negative, based on comparable sales and brokers opinion of value, according to the statement. “At this time, it appears that the most likely outcome will be a consensual transfer of these hotels to the respective lenders,” the company said in the statement. Most of the hotels Ashford Trust expects to return to lenders “are located in markets that have experienced significant headwinds throughout their post-pandemic recoveries, and a number of these markets are not forecasted to reach pre-pandemic topline levels until 2025 or 2026,” Ashford Trust said in the statement. Great charts from Green Street Advisors show how much transaction volumes have declined in the commercial R/E market in 2023. Amazing declines in volumes given the market disarray, high cap rates, higher US Treasury yields, challenges in getting loans and the wide disparity between buyer and seller with respect to bid/offer prices. Sellers are unrealistic as to the clearing prices today.

In short, I don’t think it has a huge impact. Miami and Palm beach have limited high end home inventory and lots of demand. Boca is weaker on the high end for sure. Yes, on the margin it will impact things, but I presume new insurance companies come into the market in the next year given the ridiculous prices.

How about a deep dive on all the home insurance companies pulling out in Florida and expected home prices after they do.