Opening Comments

We are in Ashland, Kentucky on the border of Southern Ohio and West Virginia. Although it has a bit more going on that Zachary, Louisiana, it is hardly a bastion of good food or things to do. We are staying at the remodeled Delta (Marriott Bonvoy) Hotel. Rooms are good enough. Note to self, DON’T stay on the even side rooms as a freight train comes in the middle of the night constantly and the local law is 6 horn toots. We switched to an odd room to try to get some sleep and did not hear the train. The restaurant in the hotel was highly recommended and called the Winchester. Trust me when I tell you it is a 1 out of 10 and basically inedible. The town has a few fast food choices, and some chains. High end dining is Applebee’s or Texas Roadhouse.

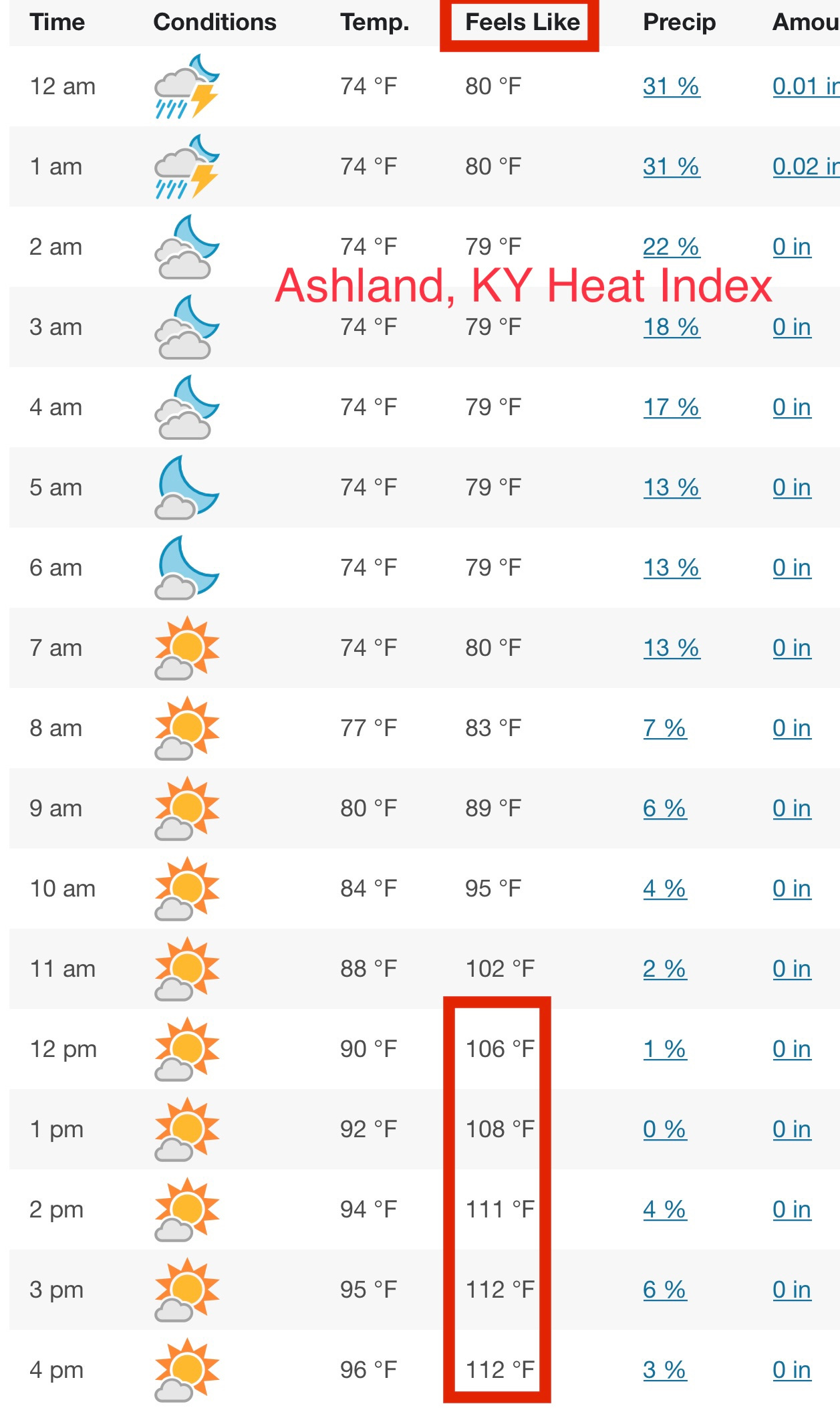

The weather is awful. On Monday, the high was 91 and the heat index was 112 degrees. On Wednesday, the high was 98 without the heat index. The early am is not offensive, but by the late am/early pm, it is oppressive heat as can be seen below. Jack is eating fried food for breakfast, lunch and dinner and cannot keep on weight. He fell to 125lbs at 5’11.5.” He has lost 6 lbs given the extreme heat and the fact that he needs to walk for all the tournaments and practice rounds. Walking 7 miles pushing a trolly cart with clubs in 100+ degree heat up hills is burning serious calories. He is the anthesis in weight of the local community and I fear the local Department of Family Services thinks I am starving him. He needs to change his shirt 2 or 3 times during the round as it is soaking wet. This never happened once in Florida. It looks like I am hitting the laundromat tomorrow am. You cannot make up my life. Eric Rosen doing laundry in an Ashland, KY laundromat. This may be the subject of my next piece. It is amazing just how far I have fallen. I never thought I would say this, but South Florida is cooler than Louisiana and Kentucky… by 10-15 degrees on the heat index.

I look at 12-15 deals every month. They range from hard asset lending, fund, private equity and venture deals as well as real estate. Two months ago, I saw a deal in which the founder was looking to raise $150mm at a $150mm pre-money valuation or $300mm post money. I felt it was fully valued and passed. He ended up raising $30mm at $60mm pre-money or $90mm post. Yes, raising money is challenging and valuations are crashing. I received a call today for two lending deals against private equity and a SPAC. The demand for such lending has shot up sharply in the past 60 days and the rates I am quoting are far higher with far more bells and whistles in the documents. People are looking for liquidity.

Picture of the Day-Kentucky Photos

There Is No Such Thing As A Free Lunch-Part II

Quick Bites

Markets

Fed +75bps

US $ Rallying

Market Volatility in Charts

Inflation Peaking/Demand Destruction

Biden Energy Policy Failure

Crypto Winter

Policies Matter/Migration Patterns

Other Headlines

Virus/Vaccine

Data

Real Estate

My General Comments-Peak is In/Mortgage Rates

Homebuilder Sentiment vs Homebuyer Sentiment

Price Declines in Miami

US and European Price Declines

Picture of the Day-Kentucky Photos

I found the sponsors of the golf event interesting and something you don’t generally see in most places. Coal Miners galore with explanations below were the major sponsors. Could you imagine what would happen if these companies sponsored a jr. golf tournament in New York or California? Clearly, Kentucky and West Virginia are a bit different.

Inmet Mining-Coal

4 Gen Fuels

Friends of Coal

Mark Energy

Blackhawk Mining-Metallurgical coal

Alpha Metallurgical

Bumper stickers you don’t see in liberal states, but you do in Kentucky. I had run to get Jack some food at Chick-Fil-A and this SUV pulled in front of me.

I got caught in this biblical looking storm (unedited) on Monday night while buying dozens of Gatorades to prepare for the heat fest. I took this with my iPhone. We will have gone through 48 Gatorades in 10 days. Yes, I got drenched.

There Is No Such Thing As A Free Lunch (TINSTAAFL)-Part II

In July of 2021, I wrote a critical piece entitled, “There is no such thing as a free lunch,” on the Fed being behind the inflation curve and suggested there would be a heavy price to pay for free money, low rates, continued Quantitative Easing and stimulus. I feel as though the academics need some business people to become Fed Presidents to help give a better dose of reality to situations. I believe Bernanke, Yellen, Powell have gotten too many things incredibly wrong and the cost is too high. Bernanke suggested subprime was contained in 2007 and we were not heading to a recession in 2008 among many other blunders. Yellen and Powell were convinced this bought of inflation was transitory as can be seen in the links above. They are all well-educated with fancy degrees, but lack real world business experience, although Powell had a short stint as a banker.

I am reminded of my horrible time at the University of Chicago Business School. I learned zero despite it being ranked at the top of the list. It was the single biggest waste of time and money I can recall. The teachers were all “award winners” who have largely never worked outside academia. Shockingly, I learned more from my state school for undergrad than I did at the U of C. My undergrad was hardly academically rigorous, but the teachers were not all academics. My real estate professor actually owned a portfolio of real estate and taught us how to buy, manage, finance… a portfolio of real estate assets using real life examples. My meteorology professor was the local TV star on the subject.

On Monday afternoon, the WSJ broke a story entitled, “Fed Likely to Consider 0.75-Percentage-Point Rate Rise This Week. It turned out to be the case Wednesday, as the Fed raised by 75bps, the largest increase since 1994. The Fed could have easily taken their foot off the gas a long time ago. The article suggesting the larger rate hike helped to exacerbate the sell off in stocks and Treasuries got smashed with yields flying higher. Equities finished -3 to 5% and the 10-year Treasury was +20bps and the 2-year Treasury was +30bps on the day driving the 2s/10s spread to 3bps on Monday. As of Monday’s close, FANG stock valuations has plunged over $2 trillion since mid-November 2021. Personally, I believe the Fed lacks credibility and needed a 75bps hike to let the markets know they mean business.

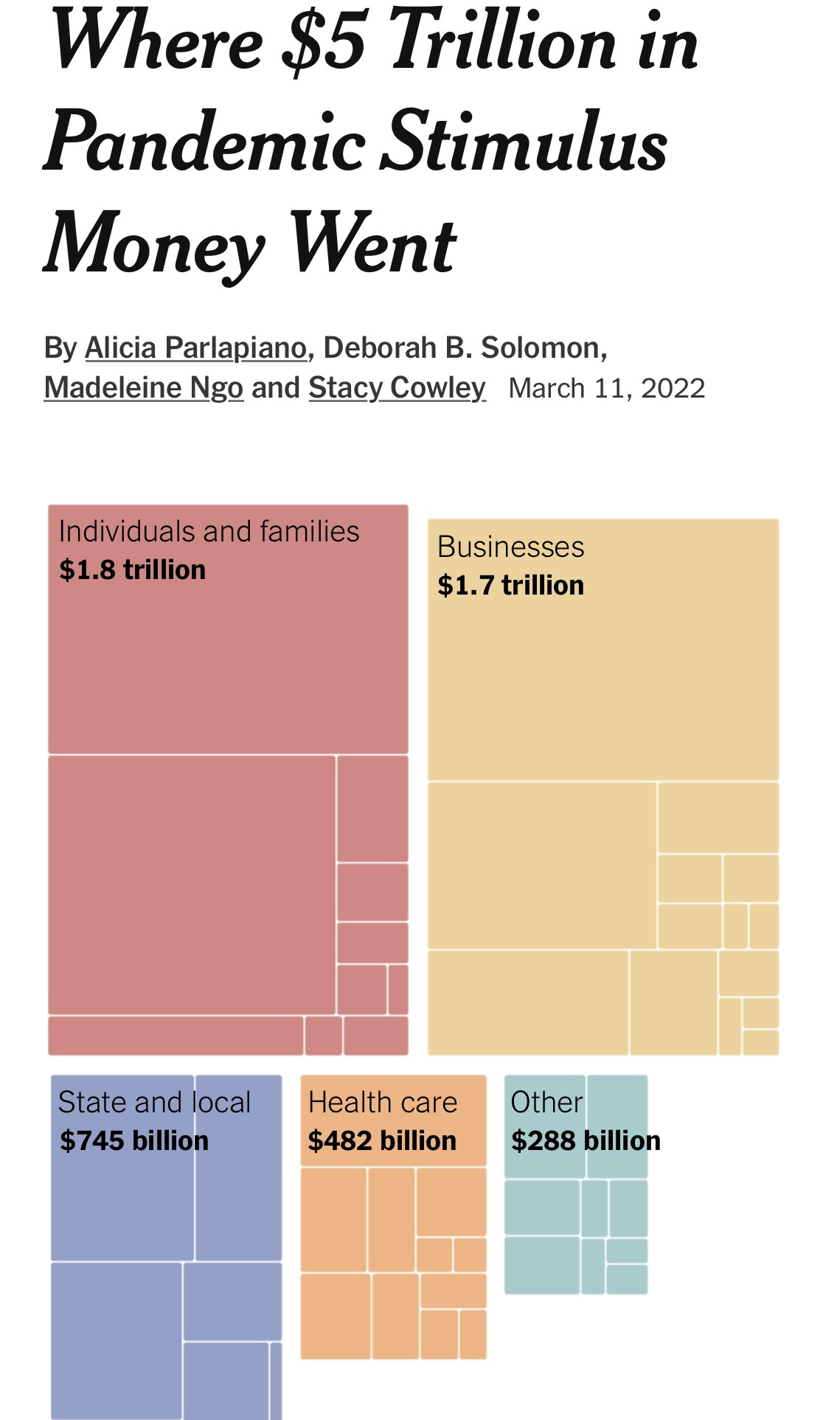

I feel the big takeaway here is THERE IS NO SUCH THING AS A FREE LUNCH. There is an ultimate cost of zero interest rates in perpetuity and a dovish Fed using every means possible to pump liquidity into a system which no longer needed it. Add to the Fed actions the trillions of pandemic stimulus with $3.5 trillion going to individuals and businesses and you help to create serious inflation. What would have happened if Senator Manchin did not block the Build Back Better stimulus?

I applaud the Fed officials who did heroic things during the Global Financial Crisis and early in the pandemic to stave off disaster. I just wish when housing, car, commodities, consumer products, food, gas…. prices were going gangbusters, they eased off accommodative policies. Huge stimulus may have been needed early into the pandemic, but not late.

These brainiac Fed officials with fancy PhD’s were buying mortgage and Treasury bonds until March 2022 despite the market no longer requiring it for some time. I called for it to end over a year ago as can be seen in numerous Rosen Reports. One report was from May of 2021 entitled “Druckenmiller vs the Basket Regarding Inflation-I Take Druck,” and there are many more Rosen Reports discussing the topic and can be found on Substack. I was crystal clear regarding my inflation concerns in May of last year in this report. Another person I respect, Mohamed El-Erian (Former PIMCO CIO) said, “Most inflation could have been avoided” if Fed acted earlier.

Now we are paying a price for the sloppy behavior that some thought the accommodative policies were without risk. Now, we have a real economic slowdown and the growing likelihood of a recession while the Fed is forced to aggressively alter policy and raise rates. Just remember TANSTAAFL.

As an aside, There Ain’t No Such Thing As A Free Lunch originated in the 1930s where bars offered “free” lunch to entice drinkers to come into their establishment.

Quick Bites

Stocks rallied on Wednesday after the Federal Reserve hiked rates by 75 basis points giving investors confidence the central bank was committed to tamping down inflation. The Dow snapped a five-day losing streak, jumping 304 points, or 1%, to settle at 30,669. The S&P 500 rose 1.46% to 3,790. while the Nasdaq gained 2.5% to settle at 11,099. Stocks were volatile after the rate hike decision but jumped to session highs as Fed Chairman Jerome Powell said during his afternoon press conference that, “either a 50 basis point or a 75 basis point increase seems most likely at our next meeting.” The 10-year treasury rallied almost 19bps to 3.3%, while the 2-year Treasury rallied 23bps to 3.21%. Oil fell 2.5%, while natural gas rebounded 5% after the substantial sell off yesterday. Crypto continued to slide approximately 3% for BTC and ETH. The VIX fell almost 10% to sub 30 on the day.

The Federal Reserve on Wednesday launched its biggest broadside yet against inflation, raising benchmark interest rates three-quarters of a percentage point in a move that equates to the most aggressive hike since 1994. Ending weeks of speculation, the rate-setting Federal Open Market Committee took the level of its benchmark funds rate to a range of 1.5%-1.75%. Additionally, members indicated a much stronger path of rate increases ahead to arrest inflation moving at its fastest pace going back to December 1981, according to one commonly cited measure. The Fed’s benchmark rate will end the year at 3.4%, according to the midpoint of the target range of individual members’ expectations. That compares with an upward revision of 1.5 percentage points from the March estimate. The committee then sees the rate rising to 3.8% in 2023, a full percentage point ramp higher. Officials also significantly cut their outlook for 2022 economic growth, now anticipating just a 1.7% gain in GDP, down from 2.8% from March. I agree with 75bps and would have been disappointed with 50bps. Finally, the Fed understands they are behind the curve due to their overly accommodative policies for too long. I am less bearish post the Fed than I was prior to the announcement Wednesday. I just did not have faith they would get to the right answer.

The US Dollar is flying against the basket given the likelihood of more substantial rate hikes coming to a theater near you soon. The US$ hit a 19 year high against the DXY (basket of foreign currencies). The moves since last October is pretty substantial. The Japanese Yen is getting clobbered (lowest level since 1998) and the Bank of Japan (BOJ) is struggling. The BOJ bought 1.5 trillion yen of government bonds to defend its yield curve control target. If the current pace of buying persists, the bank will have bought approximately 10 trillion yen in June. For perspective, it is the equivalent of the Fed doing $300bn of QE in a month when adjusting for GDP. The Japanese Government Bond (JGB) yield is being held artificially low by the BOJ. Not sure how much longer they can keep it there.

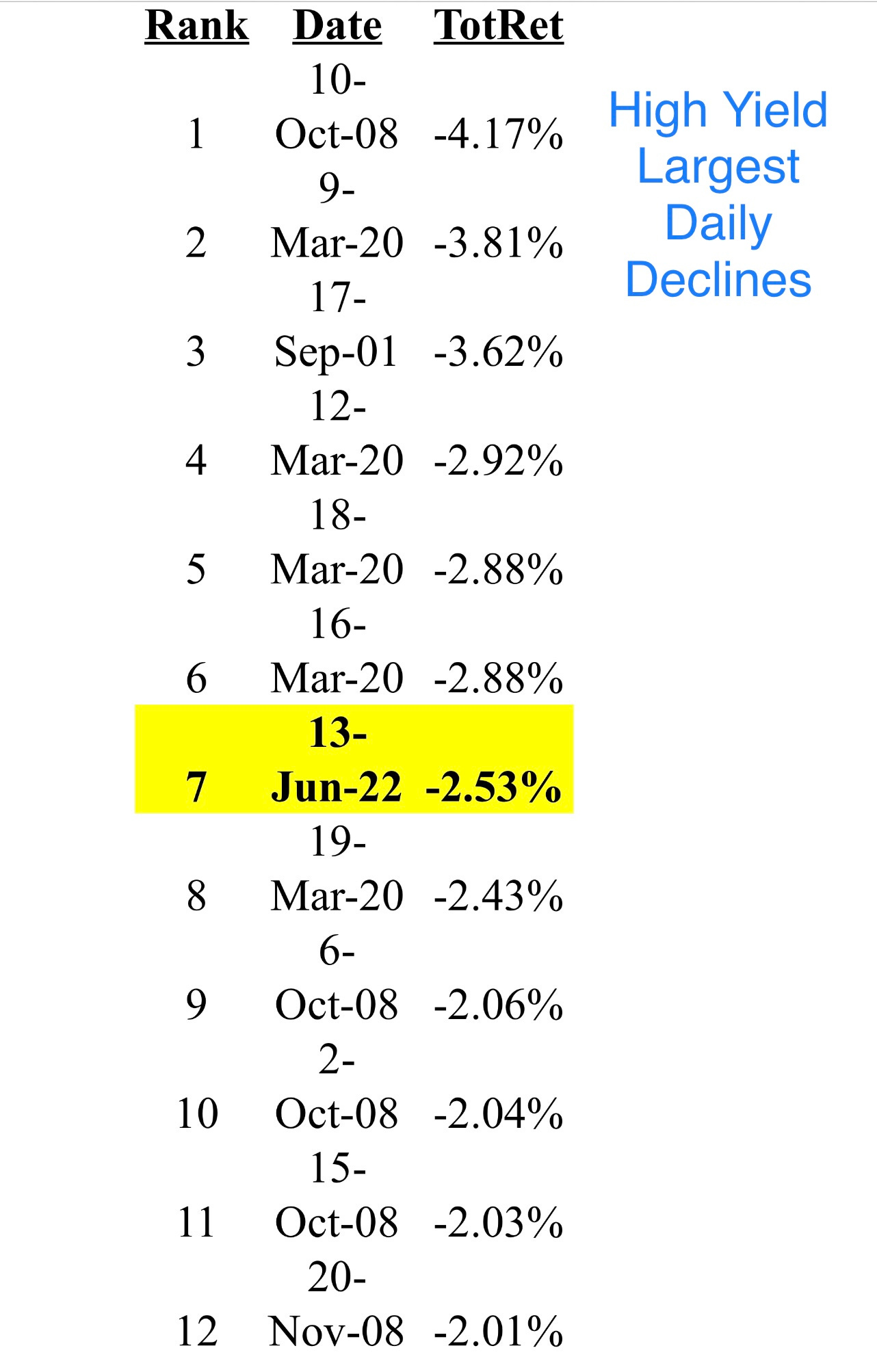

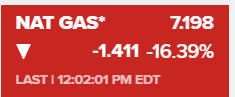

I want to make a comment on market volatility. When you look at the massive swings in Stocks, Treasury Bonds, High Yield Bonds, Crypto, Commodities, Foreign Currency… it is stunning and concerning. Moves of 3% in equity markets are nothing today. The HY bond market was off 2.5% on little volume on Monday. It is the 7th largest single day move in history as seen below. The 2-year treasury moved 30bps in a day! Crypto prices fell 15-20% in some cases on Monday. Tuesday, Natural Gas fell 15% on the news that a Liquid Natural Gas (LNG) facility would not come back on line as quickly as thought. LNG facilities convert Natural Gas to LNG for shipment (largely to Europe) given the huge price differential. The fact that the gas wont be shipped abroad sank the price dramatically. On the currency front, the moves are huge with the dollar appreciating sharply against the basket (Euro Below). This volatility is painful, but will more quickly take out the weak hands and help us find the right levels across asset classes. Below are a bunch of examples of substantial moves/volatility in various assets.

I have recently written that I feel inflation is peaking and I continue to believe that to be the case, but worry it stays at elevated levels. Retails sales just posted an unexpected .3% decline in May as inflation hammers consumers. Excluding autos, sales were +.5% vs +.8% expectations. Despite a 4% increase in gas station spending, auto sales and parts were -3.5%. Miscellaneous store retailers saw -1.1% sales and on line posted -1%. Large retailers are sitting on $45bn of excess inventory because the consumer does not have the money. The large rate increases and inflation will created more demand destruction in my mind. People will drive less, dine out less, spend less on clothes and entertainment because the need to feed their family. Home, car and extravagant purchases will be pushed off as well. My one concern is oil and natural gas and I will write more about that below.

This is a fairly critical bullet, as the state we are requires direct language. I was not and am not a fan of Trump as a person. I felt his behavior was beneath the office of the President and his actions and inactions made and make him unfit for office. However, for the most part, I felt that his administration’s policies such as lower regulations, lower taxes, criminal justice reform, pushing back on China and Iran, unwavering support of Israel… were solid. Also important was the push to be energy independent as a country, something I believe we should strive to do. I cannot suggest Biden’s policies have been impressive. Despite claiming scholarships, three degrees, sponsors at the Naval Academy and graduating at the top of his class (all lies), Biden really does not understand basic economics and Supply/Demand. It appears he went to the AOC school of economics. This is not a flattering comment as she singlehandedly blocked Amazon from coming to her district in NYC which would have created a massive positive multiplier effect for her community. Biden has been critical of the oil industry and called industry profit margins “unacceptable” in a letter to oil companies which Jim Cramer suggested reminded him of Jimmy Carter (interesting read).

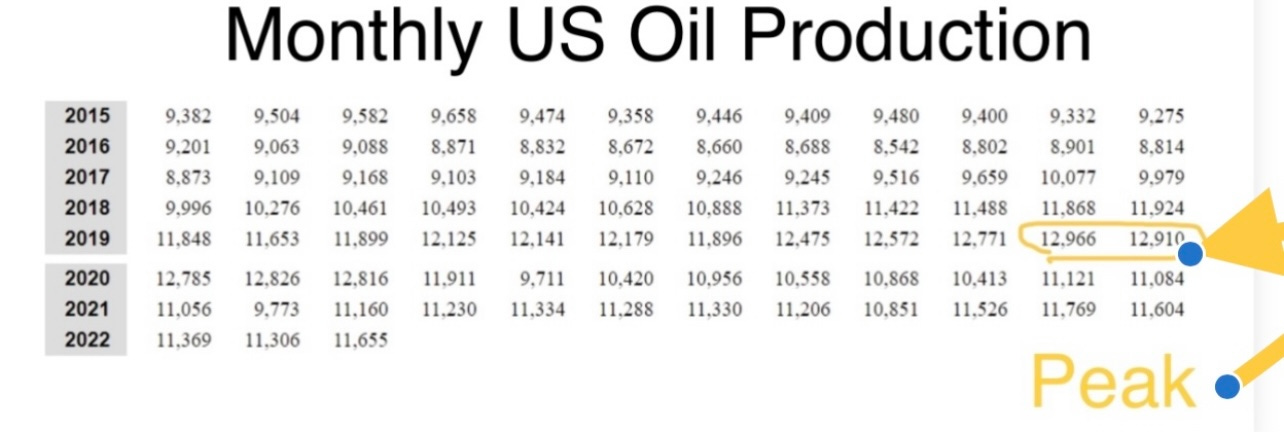

Biden ally, Senator Ron Wyden wants to charge a 21% surtax on oil company profits. Let’s explain a simple concept of Supply/Demand. Right now, we have too much oil demand and not enough supply. Do you think imposing extra taxes and telling them profits are “unacceptable” will make them produce more or less? Will it encourage new entrants? When you wanted EV production to increase, what did the government do? Tax incentives and look what happened - it worked. My first TSLA was $7,500 cheaper due to a tax incentive. I would not have bought it otherwise. The same is true of solar and incentives. If you want to increase production, then give incentives, not increased taxes and admonish profits. A good deal of the price increase in oil is due to the Biden’s actions and inaction on the space. I spoke with multiple senior people in the energy space. The common theme was the Biden administration has been slow walking important administrative issues with the Department of Energy (DOE) and Federal Energy Regulation Commission (FERC) slowing down the growth of oil and gas production in the US. The vilification of the oil industry is well documented, resulting in reduced availability of capital and increasing road blocks to domestic production. Yes, Russia/Putin can share some of the blame, but not all. Approximately 1% of autos on the road in the US are EVs and zero of the trucks and planes are EV. We are DECADES away from not relying on oil. Look at the chart below. To keep it simple, I am only discussing oil as natural gas and biofuels will complicate the story. When did production peak? Under Trump at 13mm barrels/day. Why are we down so much while demand is up under Biden? He needs to take some responsibility for his actions, words and the left’s vilification of the oil industry. You do not tax and vilify your way to prosperity. That is not how it works. A 33% Biden approval rating suggests I am not alone in my concerns. Just being “not Trump” is not enough for most Americans. I sure hope the next election gives me someone to vote FOR, not against someone else.

I bought a diversified basket of crypto last year and got smoked over 80%. I was wrong, but have held my positions despite Jeff Gundlach’s call of potentially $10k Bitcoin. The asset class is too correlated with the broader equity markets and proved to be a horrific inflation hedge. The moves this week have been brutal as crypto lender, Celsius paused withdrawals due to “extreme market conditions.” Celsius operated as a money market fund, with the aim of taking advantage of the high yields available in DeFi and passing them onto clients. Also, Binance, the world’s largest crypto exchange, suspended withdrawals on its Bitcoin network for a few hours on Monday. The moves sent many crypto currencies down 15-20% with the average -14% on the day. Bitcoin peaked at $68k and fell to sub $21k on Wednesday for perspective. That is down 69% since November 2021 and ETH is down 76% during the same period. Layoffs were announced at Blockfi, Crypto.com and Gemini and will let go 20%, 5% and 10% of employees respectively. Coinbase announced the layoff of 18% of the staff in preparation for crypto winter. Global crypto valuations have crashed over $2 trillion since peaking in November 2021 at just under $3 trillion. I touted the Defi space last year when I learned more about it. I continue to believe there are many applications which will eventually come to fruition in the space, but the pain is great, and much faith has been lost. This article is entitled, “Binance.US Accused of Misleading Investors in Class-Action Lawsuit Over Terra.“ This Bloomberg article outlines the devastation to billionaires net worth due to the Crypto crash.

Policies matter. How your constituents perceive quality of life, cost of living, crime, taxes and general conditions matter. We are seeing more people and companies, “vote with their feet.” It is a saying my old boss, Pete Vaky, taught me. We are seeing wealth leave CA, IL, NY, NJ, CT… and head to places like FL, TX, NV, TN, WY… Tesla left CA for TX. Caterpillar is moving its global headquarters to Texas from Chicago as well. Wait. High taxes, high crime, poor quality of life, high costs and horrific weather are not selling points? Inept mayors and governors too? Other recent moves include Oracle, Palantir, Hewlett Packard, Boeing, Raytheon, CBRE, Charles Schwab and many others. Billionaires such as Drew Houston, Joe Lonsdale, Elon Musk and Larry Ellison have also left CA for greener pastures. Carl Icahn moved from NYC to Miami and brought is $25bn net worth with him as well as a bunch of wealthy employees. Hedge funds and finance companies are moving to Florida in droves. Alliance Bernstein moved thousands to Nashville from NYC. Citadel (largest financial employer in Chicago) is considering leaving Chicago given high crime and quality of life. What are the budget ramifications to CA, IL, NY… with both companies and wealthy individuals leaving which will create substantial deficits? Raise taxes more for those who stay? Cut services? I have written 100 times that the big long-term change with COVID is work flexibility and many are realizing you don’t need to live in NYC, SFO, LA, Chicago…

Other Headlines

Wholesale prices rose 10.8% in May, near a record annual pace

Ned Davis Research downgrades equities, goes to 20% cash as global stocks break down

World's Richest Have Lost $1.4 Trillion In 2022 After Rapid Gains

Luxury brands say China’s latest Covid wave has whacked consumer demand

Inside the explosive Oval Office confrontation three days before Jan 6.

Trump issues 12-page statement amid Jan. 6 hearings alleging he plotted a 'coup'

No record of Biden Naval Academy appointment he boasted about

At least 10 dead, 42 injured as wave of weekend mass shootings in US continues

'Shoot a Jew in the head' graffitied near Toronto university

A good story for a change.

Virus/Vaccine

Now the Memorial Day data has left the picture and you can see that things are trending higher across the board, but at lower rates than in May. Positivity rates for the country have been approximately 11.5% (elevated), but there is some noise around yesterday showing 3.3%. I am not convinced that is correct.

Real Estate

I am a firm believer that in general, R/E prices are heading south and this bullet explains the rate impact on housing. There is a link to 30 year mortgage rates here. There are different options on the link in terms of tenors and fixed vs floating. The one year chart below is fairly telling. The rate goes from 3.12% to 6.28% in a year. I calculated the incremental cost on various size mortgages for perspective using my HP 12 C calculator. Yes, I travel with my 12 C. On a $500k mortgage at 3.12%, your monthly payment is $2,141/month and at 6.28% it is $3,088/month. The borrower is paying $947/month in additional payments for the same size mortgage. That is the equivalent of $11,364/year. Yes, the incremental interest is $15,800/year, but the amortization schedule changes so the payments do not go up by the full amount of the interest change. Said in another way, the buyer who could afford a $500k home at 3.12% can now afford a $350k home at 6.28% to have the same monthly payment. If you want a $2mm mortgage, your monthly payment goes from $8,562 to $12,353 or an increase of $3,791/month.

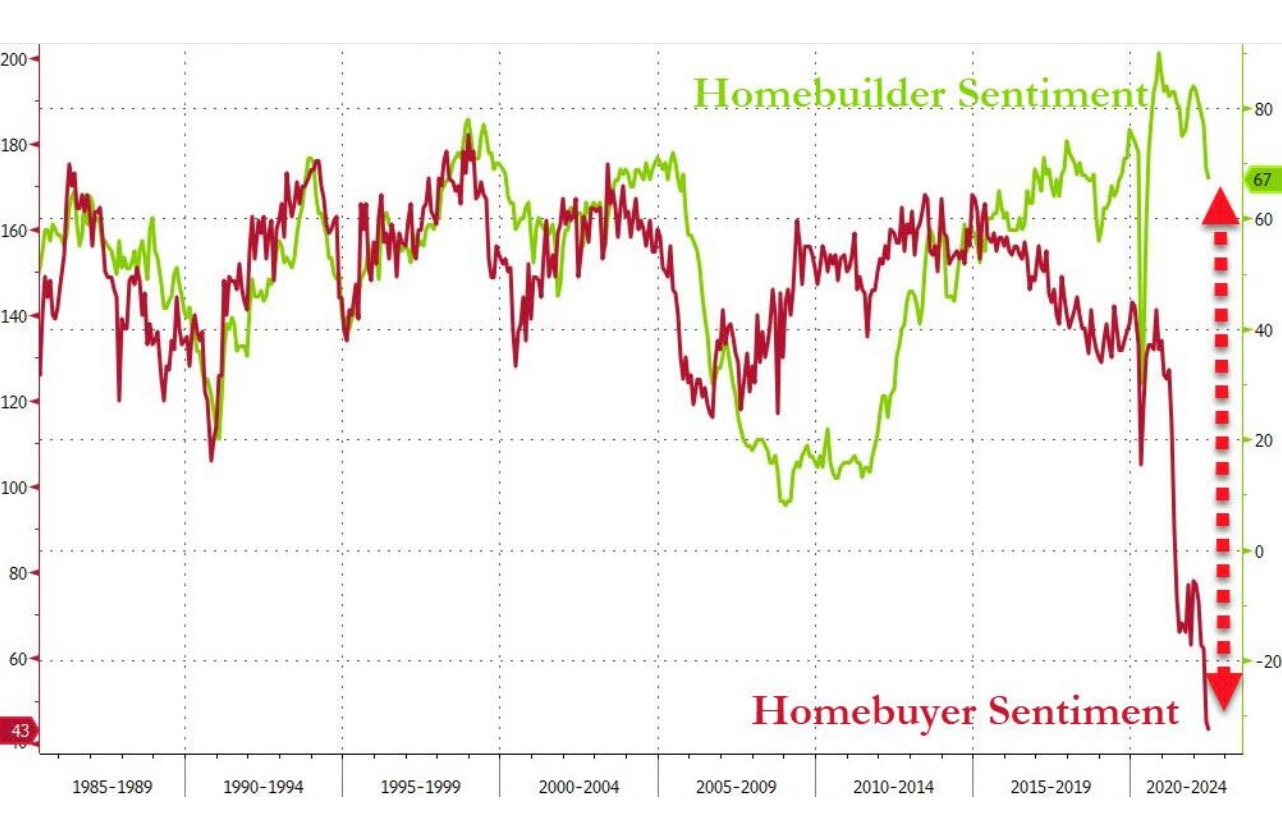

Real estate prices will be going down. No refinance opportunities now which has been a big drive with homeowners taking out equity to fund lifestyles. Mortgage demand plummeted to the lowest level in 22 years last week as can be seen in this CNBC article and rates have only increased since. Also of note, real estate firms Compass and Redfin announce layoffs as housing market slows. The chart below comparing homebuilder and homebuyer sentiment are telling.

On a related note, I am seeing more price decreases in homes. I spoke with Devin Kay (South Florida Realtor) and he told me about less traffic, price declines and homes staying on the market longer. Here was an email from Devin today on yet another price reduction example (picture below). This is in stark contrast to the market for the past couple years where places sold in hours or days above ask with countless bidders with no contingencies. He had a conversation with someone from Beverly Hills who told him the market has frozen in recent months with limited activity taking place.

The US and European real estate markets are experiencing a downwards shift in prices as buyers fall away, according to the global chief investment officer of Hines, one of the largest closely held real estate investors in the world. Prices have fallen by about 5% to 10% compared to a year earlier in some areas, according to David L. Steinbach, with Europe following a trajectory set in the US. “I think we’re in for a rough few months,” he said. “This year is going to be choppy water.” “Higher inflation is without a doubt making its way into private real estate,” Steinbach said. “The bidding pools are becoming thinner.”