Opening Comments

Another great NFL game for the Super Bowl. This was the best playoff season I can recall. The Rosen family went to a fun party with 50 or so people to watch the game and over indulge on food. It was good to see Stafford and Donald win as well as Cupp, the best offensive player in the league. 112mm people watched the game which is the best in 7 years.

I did not catch all the ads, but like the one with Jost and Johansson with Alexa. I thought it was incredibly funny and cost $20mm to air it not including production costs. This is a link to the best Super Bowl commercials from the Athletic. Given my love of Dr. Evil, I also liked the GM commercial with him. The Larry David FTX commercial was hysterical. That guy kills me.

My last note from Super Bowl Sunday had was brief and had some very good info in it for those who missed it. It was called, “Disconnected At Sea-Fishing Up a Storm.”

Today’s piece has a lot of interesting information which is only possible due to my expansive network in part because of the networking given the Rosen Report. Thank you for all the contributions, story ideas, and help.

Picture of the Day-Wildlife Photos Of the Year

Mike Cembalest-Risk unwind, supply chains and the Ukraine

Thick Skin

Quick Bites

Markets, High Yield

Inflation Report, Bullard Comments

Currency Market, HY Market,

SPACs, Cannabis Market

Media Bias

Prince Andrew, NFT Craziness

Other Headlines

Virus/Vaccine

Data-Improvements Across the Board

Japan Data on Mask Efficacy

Pregnant Mother Vaccination Protection to Baby

Real Estate

Miami and Palm Beach Homes

Miami and Tampa Rents-On Fire

Tampa Mansion Sale

Elevated Rents Across the Market

Lumber Prices Impact on Housing Costs

Picture of the Day

I enjoy seeing beautiful photos and this link is to the Wildlife Photos of the year. A picture by Cristiano Vendramin of a frozen lake in northern Italy won the award for 2021, but others in the link are amazing too. I just don’t picture Italy like this for some reason. Rome could be my favorite city in the world.

I enjoyed this photo by Qiang Guo taken in China of two male golden pheasants.

Mike Cembalest-Risk unwind, supply chains and the Ukraine

Whenever I put one of these in my report, it is the most opened link of the day. Good discussion on markets, Ukraine, and vaccination issues. The chart below is relevant for what is happening in the Ukraine now.

Thick Skin

A good friend of mine, Danny Kanell, was a star QB at Florida State and was drafted by the Giants in the 4th round in the 1996 draft. He is an incredible athlete who played baseball, football and basketball at very high levels and happens to be one hell of a nice person and a great family man. Today, Danny does a sports radio show and some TV work as well. He is always using Twitter, and he is one of the 5 people I follow. I see some awful Tweets sent his way with people using vulgar language and calling him all kinds of names with a threatening tone. Every now and then I will text him and ask what he did to deserve such venom. He brushes it off and does not seem to be bothered by the haters. Danny has thick skin, something which comes with being a pro athlete playing pro football in NY and his activity on social media.

With respect to the Rosen Report, I receive a ton of very kind and thoughtful emails, letters, texts and calls. I write because I enjoy interacting with my readers and have met so many great people along the way. I learn from interactions and now feel my network is stronger than ever.

The other day, I heard from a well-connected and successful fund manager this week: “Thank you for the Rosen Report. I’m an avid reader. You do a great job-informative, entertaining-very much enjoy it.” It put a smile on my face that a well-educated, successful person enjoys what I am doing and took the time to send a short note of support. I have received thousands of such emails, texts or calls and they make me want to keep writing despite the fact that this is an unpaid position. A couple days after the email, another person I respect a great deal called to tell me he believes the Rosen Report “has legs” and really should be turned into something bigger. He is another very successful man who does not need to read my newsletter or call me to show support, but he does. I receive bottles of liquor, wine, candy, clothes, deep dish pizza and other assorted gifts as “thank-yous” for the newsletter and I am always appreciative.

Due to writing a couple times a week, I am in front of people and my dialogue with business leaders has been fantastic. It has led to interesting interactions with a wide array of people from uber successful billionaires to college students and everything in between including teachers, nurses, doctors, lawyers, and housewives. I have turned these relationships into consulting agreements and board seats as well. I have taken on mentees with various students and young professionals looking for guidance and do it with pleasure. I believe I have helped to generate improved outcomes due to the fact that I am willing to give advice from a perspective of someone who has been in similar situations.

However, not every interaction is so positive. During Trump’s reign, if I did not write that Trump should be in a gulag for Russia collusion or his ineptitude, I heard from some Progressives that I was an idiot and Trump belongs in jail. Not many, but a few long and testy emails were sent my way. When I have written that career criminals should be in jail and not out to cause more damage in the community, some have let me know I am very wrong and these people need to be given another chance. When I typed that the best days of the once great mayor, Rudy Guilani, were behind him due to his election craziness, I received a very nasty note which let me know I will never be as great of an American as Rudy. I don’t think he liked the picture included in my piece (seen below) from my 11-19-20 letter. He had invited me and Jack golfing at one point and then was sending me hate mail and unsubscribed.

In recent months, I felt I found my stride and I believed the quality of the Rosen Report was improving and the feedback was overwhelmingly positive. Readership is growing and I am getting many interesting new followers. I revered a lovely hand written note from a reader who has the best handwriting ever, and it was a touching and very appreciative which made me feel the Rosen Report was being well received.

This all changed a couple weeks ago when I received a nasty email with multiple F-Bombs telling me no one cares about my report.

Yes, he included the emoji, actually two of them, but cant seem to get the same side by side going. One minute after I received the email, I received a notice that I have a new subscriber to the Rosen Report with the address: i.hate.eric.rosen@xxxx.com. Now, for a kid who was probably the last person picked on the kickball team in 3rd grade and and currently lives with his mom’s basement, I thought this was quite a creative way to attempt to get under my thick skin. "Bro," I worked on Wall Street for 30 years and ran a hedge fund. I have been called every name in the book by people who matter. I have built up quite thick skin with 30 years of abuse. If you don’t like what you are reading, click unsubscribe.

I suppose a ratio of 1,000 positive responses to few negative ones is a pretty good hit rate. If it were a touchdown to interception ratio, a batting average, or a stock picking ratio, I would be a billionaire. Keep the comments coming even if you don’t agree, but I am not sure you need to curse to get your point across. Explain like an adult as to why you think I am wrong or what you disagree with and let’s have a dialogue around it. Who knows, I could be misinformed and you could teach me something.

I appreciate the support and new friendships that my writing has given me. I have learned in life that you can’t please everyone all the time. As Danny said, “not everyone is going to love you, but you gotta have thick skin if you want to be in the game.” This is my new look with all the years of verbal abuse.

Quick Bites

Markets have been volatile largely around the Ukraine headlines and fears of an “imminent” attack by Russia. However, headlines on Tuesday had markets rally sharply as Putin pulled back troops. Some credit to Biden if this goes away, and he sure could use a win (discussed in last piece). Personally, I do not believe Putin respects Biden and am not convinced Biden threats made a huge impact, but must have played some role. If Putin does not invade, Biden should get some credit for it. The S&P 500 closed flat after volatile trading Wednesday as investors surveyed the latest update from the Federal Reserve and the status of Russia’s military build-up near Ukraine. The benchmark index inched up less than 0.1%. The Dow Jones Industrial Average closed about 50 points lower. The blue-chip index was down more than 300 points at its lows. The Nasdaq Composite ticked down 0.1%. The major averages cut some losses following the release of the minutes from the Federal Reserve’s January meeting. Traders were perhaps a bit relieved the release did not indicate the Fed would move any faster than already expected in hiking interest rates. The 10-Year Treasury closed at 2.02% and the 2-Year at 1.51% meaning the 2s/10s is back up to 51bps. Remember, it was down to 40bps the other day. Crypto is back up with BTC at $44k (recent low was $35k) and ETH is at $3.2k (recent low was $2.3k).

Oil sold off 4% on the troop movements on Tuesday and another 1% Wednesday, but Natural Gas was up more than 7% today. This CNBC story suggests oil could hit $150. No, the price of oil being elevated is not 100% on Biden policies, but he can take a decent amount of the blame with the administration’s policies. Yes, they are better for the environment, but not all make sense economically. Clearly, a substantial growth in demand relative to the pandemic period is not helping matters. Reports suggests that global oil demand will exceed pre-pandemic levels in 2022.

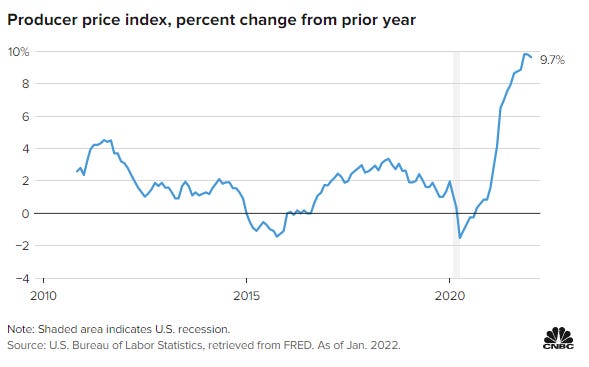

Prices at the wholesale level jumped twice the expected level in January as inflation pressures were unabated to start the year, the Labor Department said Tuesday. The producer price index, which measures final-demand goods and services, increased 1% for the month, against the Dow Jones estimate for 0.5%. Over the past 12 months the gauge rose an unadjusted 9.7%, close to a record in data going back to 2010. Final demand energy prices jumped 2.5% in January, while food rose 1.6%. Retail sales rose 3.8% in January, well ahead of the 2.1% estimate. Online shopping and furniture sales boosted the number, while sporting goods and gasoline sales totals declined. The Big Mac’s price is up 40%, and it isn’t a good sign. The link is interesting and compares price increases of various goods over 10 years.

Federal Reserve Bank of St. Louis President James Bullard said the U.S. central bank needs to move forward its plans to raise interest rates to underline the Fed’s inflation-fighting credibility. “I do think we need to front-load more of our planned removal of accommodation than we would have previously,” Bullard, who votes on monetary policy this year, said in an interview on CNBC on Monday. “These are numbers Alan Greenspan never saw,” Bullard said, referring to the former Fed chairman. “Our credibility is on the line here and we do have to react to data.” Bullard repeated his view that the Fed should raise interest rates by 100 basis points by July 1, and start shrinking its balance sheet in the second quarter, in response to the strongest inflation in 40 years. This was before yet another hot inflation reports above.

An avid reader, Alon, sent me an article written by Craig Shapiro who also has a Substack account which you can sign up for here. I found it an interesting read and he is clearly more of a macro thinker than I am. Italics is Craig’s writing: I found this chart below to be a fascinating reflection of this current reality and it fits well within the dynamic I think is at play between Russia and China and their desire to work toward the end of $ as the world’s exclusive reserve currency. We can see the white line reflects the difference between US and China’s CPI since the beginning of 2018, which is when China started to trade some oil for RMB and listed oil contracts on the Shanghai International Energy Exchange. The orange line is the $/CNH rate (inverted) which means the rising line is the $ weakening against the CNH. The US, running a massive current account deficit with its enormously growing government debt as % of GDP, is experiencing inflation at an accelerated speed and is doing very little about it. This is the type of behavior we normally would see out of countries like Argentina, Turkey, Brazil, etc. Classic emerging markets who behave this way see their currency weaken and their sovereign bonds sell off (higher interest rates) as capital begins to flow out of the country due to fears of investor loss stemming from this inflation. In order to keep the capital in country, the central bank needs to tighten policy, raise interest rates and make it more attractive for capital to stay. The $ continues to weaken against the CNH as inflation differentials between the two countries grow further and further apart. Until the Fed starts to get serious about arresting the inflationary pressures in the US, we suspect the $ is going to continue to weaken against hard assets, gold, the RMB, etc. And as we have discussed, if the Fed chooses to defend the US$ with higher interest rates, we are likely to experience a recession and market correction that possibly could kick off a debt crisis anyway as tax receipts would fall and exacerbate the government’s borrowing needs. Bad choices all around for the Fed and the Biden administration.

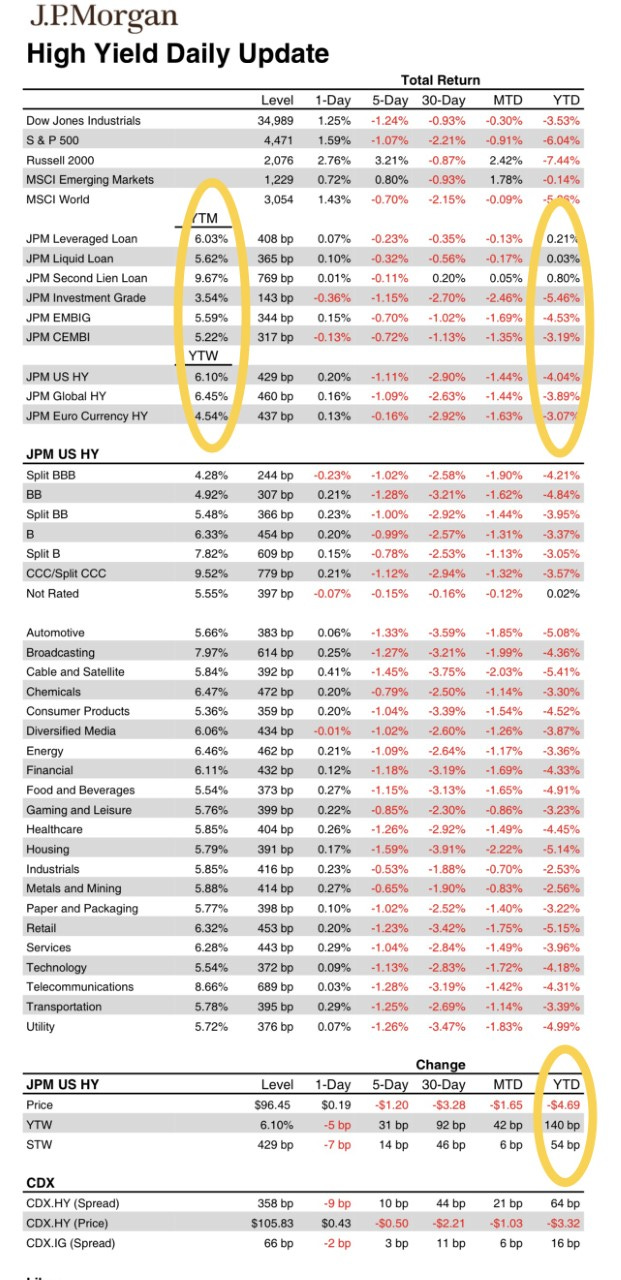

I have not included anything about the High Yield market recently and am throwing in a chart of levels to show that it has come under pressure, but is out performing the High Grade market which is more sensitive to rates. I used my new editing functions to highlight some numbers. The HY market is now yielding over 6% and at one point last year it was mid 4% range. The HY market is now down 4% and the HG market is down almost 5.5%. The loan market is outperforming given the floating rate nature of the product and is a little better than break even year to date. Thank you to the JPM team for putting out great research. The Yield to Worst on the HY market is +140 bps Year to Date. Note CCC rated bonds are approaching 10%.

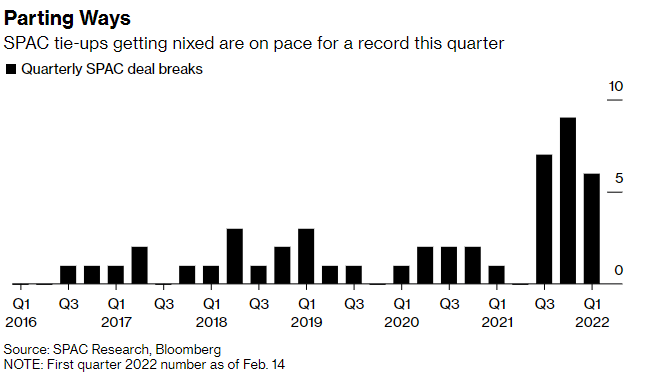

The pace of blank-check mergers failing to cross the finish line is accelerating as the industry grapples with waning investor interest. At least six mergers with special-purpose acquisition companies have been canceled this year, on pace for a record number of nixed deals in a single quarter. At least 22 have been spiked since the middle of 2021, according to data compiled by Chicago-based SPAC Research, which tracks the industry. That compares with 26 tie-ups that were called off in the more than five years prior, the data show. Deals between Carlyle-backed Syniverse Technologies LLC and M3-Brigade Acquisition II Corp. and between Acorns Grow Inc. and Pioneer Merger Corp. were among those canceled so far this year. That may signal that technology-stock volatility and investors’ desire to return their shares for cash are hitting high-profile mergers.

I do not smoke weed, have never tried a gummy and do not know a great deal about the industry having never invested one dollar in it. I wrote a bullet about a week ago on the subject, but wanted input from those more informed, and I am glad I waited. I saw that cannabis stocks are down 55-60% in the past year. I decided to reach out to some of the Rosen Report readers who are experts (Brian and Justin) to help me write a summary about what is happening given the incredible moves and low valuations. The weakness appears to be a combination of the lack of regulatory relief, high tax rates on legal weed relative to the “black market,” decriminalization of cannabis related offenses, and maturing markets. The CA market has been hit harder due to the high taxes and decriminalization angle. People don’t want to pay the large extra costs for legal weed when they can buy it illegally and face no consequences when caught.

U.S. Cannabis stocks have posted two consecutive positive weeks of share price gains, disrupting the downward momentum that has plagued them to start the year. Investors have been encouraged with the potential progress in Washington D.C. with respect to federal legislation change and the potential for either the SAFE Act to be taken up by the Senate (after passing in the House 6 times with strong bi-partisan support) or, alternatively, for Senators Schumer and Booker to get more serious about compromising on a more comprehensive bill (Schumer has stated that he wants to propose something by early April).

Valuations in the sector remain severely depressed, notwithstanding the most current rally, as shown by the chart of the major Multi-State Operators (MSO’s) as shown by the MSOS chart and the valuation grid below for the largest US operators.

Valuations have rebounded from roughly 8x 2022 Ebitda to an average multiple of 10.7x currently, which is still quite low for an industry that is growing at 30-35% per annum at roughly 30% Ebitda margins. See below:

So how does all this play out? Right now, these stocks only trade on the Canadian Stock Exchange (CSE) with dual listings on the NASDAQ OTC market. Note that you cannot even buy a US OTC stock on a Robin Hood account and no self-respecting institutional fund can either. Therefore, the market is dominated by retail investors and a few cannabis specific hedge funds. Liquidity is awful as a result. If/when the SAFE Act or other legislative relief passes, look for these stocks to go parabolic, given both private equity and institutional money will be able to play. The analogy is sports betting – it is not Federally legal, but individual states are allowed to have legal programs if they wish, and the stocks are allowed to be listed on NYSE and NASDAQ. BINGO – that is all that the US operators want. And by the way, when that happens, Visa and Mastercard will be able to take payments at dispensaries and volumes should also increase. That will also open the door for big alcohol, big pharma and big tobacco to come running in, all of which trade at much higher multiples with low growth profiles. My view is I believe these stocks look cheap on virtually every metric. I do not love taking a “stroke of the pen” risk, but given how badly the sector has been hit, I am dipping my toe into uncharted waters and taking a hit, yes pun intended. I believe that IF SAFE legislation passes, these stocks fly. These stocks are volatile with limited liquidity given the industry issues preventing institutional investors. I am sizing my positions accordingly. Other headlines to watch are New Jersey implementation (expected in months), quarterly earnings could miss due to delayed legislation, price compression in maturing markets (MA, PA, FL). I expect 1st Quarter volatility in March and will be buying MSOS on downdrafts.

I have written numerous reports about my frustration with media bias. It comes from both sides and requires you to look at multiple media sources, as no single one will really give you a 360 degree view. The latest big scandal is the Durham probe (outlined in last report) which claims Hillary’s campaign lawyers worked with tech company to access Trump servers. I have no idea if these claims are true or off the mark. I went on CNN to find the story and it was hidden in the recesses of the website only to be found with a search function. However, Trump’s troubles with his accounting firm firing him are at the top of the page. Both items are newsworthy, but to me, the news that a special counsel is suggesting Hillary did something which would be akin to Watergate warrants coverage. I lack the infrastructure to do such research. For perspective, Durham has already indicted three people as part of the investigation : Igor Danchenko, Kevin Clinesith and Michael Sussman. I believe the Hillary scandal is newsworthy and if it turns out to be false, that is also newsworthy. I checked MSNBC and all I could find through searching was something discrediting the investigation by the Morning Joe host. A growing number of Democrats are now calling for Clinton to be investigated on this matter. On the other hand, the Trump Organization being fired by its accounting firm, Mazars, is also newsworthy and hard to find on Fox News. The result is you need to follow various news outlets to get information. To write the Rosen Report, I look at WSJ, Bloomberg, CNBC, Drudge, CNN, Fox, Yahoo, MSN, NY Post, NY Times, WaPo and all the articles sent to me by my readers. I do my best to call out hypocrisy on both sides.

A lawsuit accusing Britain’s Prince Andrew of sexually assaulting an underage girl while she was under the control of sex criminal Jeffrey Epstein and his procurer Ghislaine Maxwell has been settled out of court, a court filing revealed Tuesday. The sum of the money that Andrew has agreed to pay his accuser Virginia Giuffre was not disclosed in the filing, which also said the prince also will make “a substantial donation to Ms. Giuffre’s charity in support of victims’ rights.” Another report suggests it was a $16mm payment at the insistence of the Queen. The bombshell development came in Manhattan federal court, where Andrew had failed in attempts to get Giuffre’s suit tossed out, and after he had been stripped of military titles and other honorifics and associations related to being a member of Britain’s royal family. In my opinion, Prince Andrew was 100% guilty as are dozens of other high powered men affiliated with Epstein as far as I am concerned. Andrew, smart idea for you to settle. Clearly, the Queen knows best. You were TOAST.

I am doing my best to not sound like an old, resentful person, but it is getting harder when I see the picture below. A reader sent me this and I am struggling to comprehend what idiot spent $24mm on this NFT. Making 15,000 times your money in a few years on something which to me seems worthless is insanity. This is not something I would have said at $1,600 was a screaming buy. Yes, I there is some envy in my writing, but no, I will never understand why someone thinks at $24mm, this is a MUST BUY. In a separate, but related story, famed DN, Steve Aoki said he made more money from his NFT drop last year tha a decade of music making. My following is growing. Who wants to pay me $24mm for NFTs of my fishing pictures, Jack’s golf swing, Julia playing guitar, my wife yelling at me or anything related to the Rosens. Other than obscene pictures, the Rosen Family will comply with $24mm orders. Yes, we are negotiable. I will even NFT my first Rosen Report which may one day be in some Hall of Fame or be used as toilet paper.

Other Headline

Google plans privacy change similar to Apple’s, which wiped $230 billion off Facebook’s market cap

Accounting Firm Drops Trump Organization Over Dubious Financial Docs

If it is indeed true, it is concerning. You never want to be fired by your accountant. The attached story is quite aggressive and the firm, Mazars suggested that 2011-2020 financial statements “should no longer be relied upon.”

Biden allows Jan. 6 panel access to Trump's White House visitor logs

Money That Won Melania Trump NFT Came From Melania Trump Wallet

Feinstein's approval ratings hit an all-time low; Harris underwater, poll says

Vote on Biden Fed picks delayed as GOP presses for answers on Raskin’s ties to firm

The story is absolutely crazy and scary. The BLM activist, Quintez Brown, 21, shot at the candidate multiple times and only grazed his sweater.

California teachers union leader under fire for maskless picture at Rams game

Politicians, teachers union representative and other people who mandate masks don’t wear them, but want you and your kids to wear them. No hypocrisy here.

Canadian government invokes Emergencies Act due to blockades and protests over Covid-19 measures

NYC private school tuition to top $60K next year

Despite rising R/E prices in South Florida, you cannot compare the cost of living in NYC to South Florida even without the tax benefits. Good private schools in South Florida are $35k and I have found that despite living a much bigger life here, my costs are down 40% (before tax benefits). Also of note, my kids are much older and much more expensive today than in NYC when they were in elementary school.

Regulators Probe Block Trading at Morgan Stanley, Goldman, Other Wall Street Firms

I had always heard stories, but never having run equities businesses, I never knew first hand. The results of this investigation should be interesting. I personally am of the belief there is something here.

US suspends avocado imports from Mexico after threat to US inspector

I love avocados. However, about 30% of the ones I buy end up being spoiled and given they are pricey, it infuriates me.

British authorities just seized NFTs for the first time, in a £1.4 million fraud probe

AOC blames crime surge on child tax credit ending

I blame the crime surge on de-criminalizing various crimes and not prosecuting repeat offenders. Sorry AOC, robbing Gucci, Louis Vuitton, Apple, high end watch stores and others is not being done to feed their children. Hundreds of NYC looters had charges dropped. Do you think this helps quell the problem?

Serial thief with 167 busts nabbed for shoplifting at UES Rite Aid

Sorry, AOC, the child tax credit does not explain these crimes. Lack of consequences is the explanation. Read the article for details of his criminal activity. The cops joke about his “frequent flier” miles from being arrested so many times. Bail Reform strikes again.

Interesting stats in the link to show that the current system in NYC is not working to protect the citizens.

13 police officers shot nationwide in 24 hours, 6 killed in the line of duty in 2022

Nigeria hero 'supercop' arrested in cocaine smuggling case

According to the story, he was lauded as Nigeria’s most decorated cop until his suspension.

Alec Baldwin, ‘Rust’ movie sued for wrongful death by Halyna Hutchins’ family

Homebuilders’ confidence falls as they wait months for cabinets, garage doors and appliances

The aircraft, which features a dance floor and bar, costs $1,350 per hour to rent, or $16,000 for 24 hours.

Virus/Vaccine

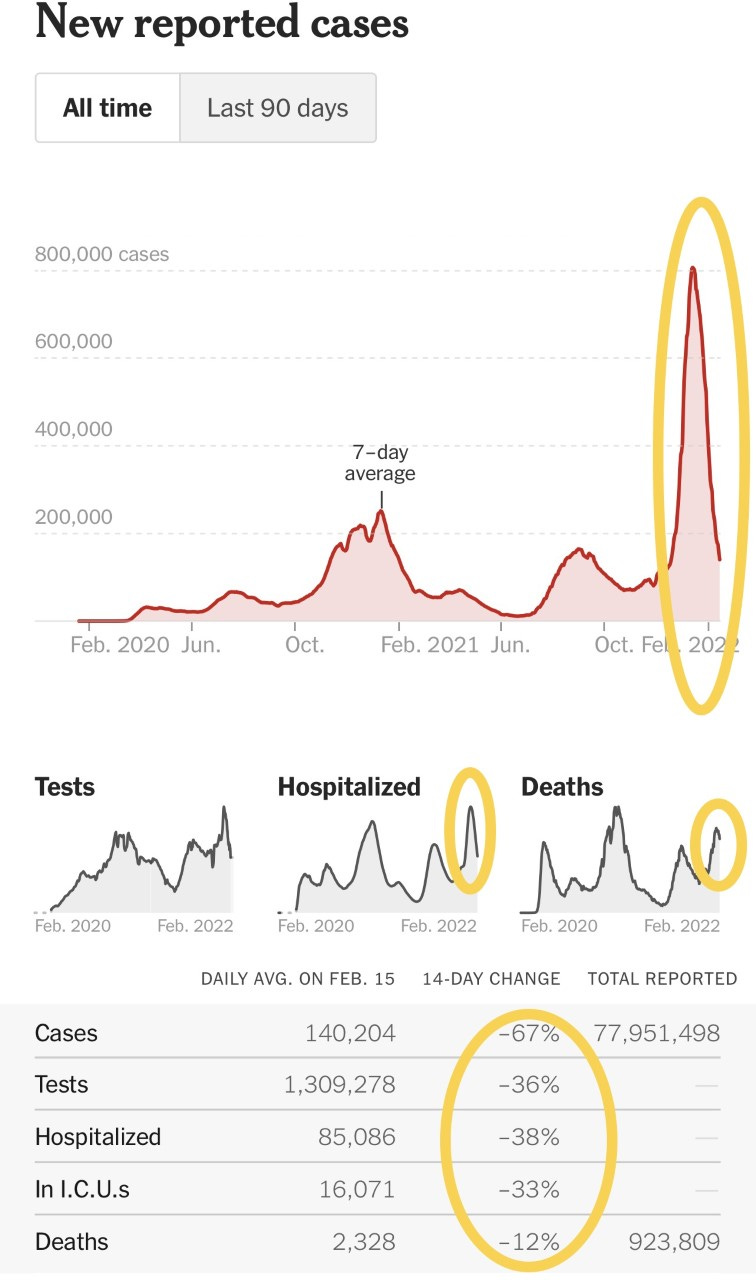

All the data is going in the right direction with cases continuing to decline sharply. From the prior two-week period, cases are -67% and are at 140k/day. Hospitalizations are -38% to 85k on average with ICUs -33% to 16k. Deaths are at 2.3k or -12%.

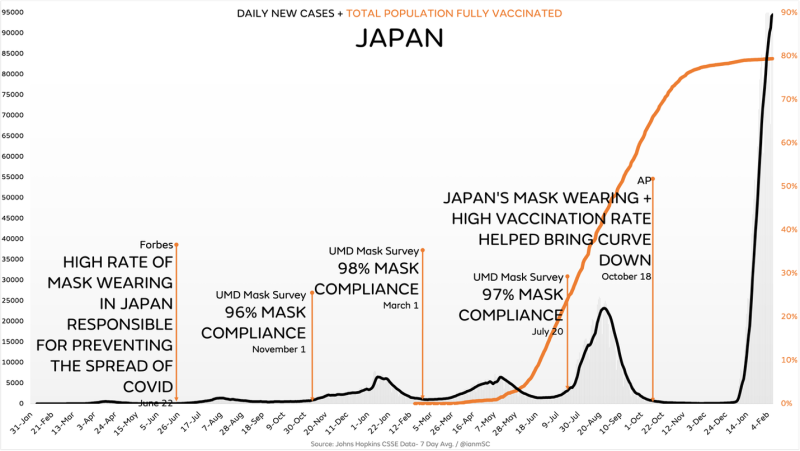

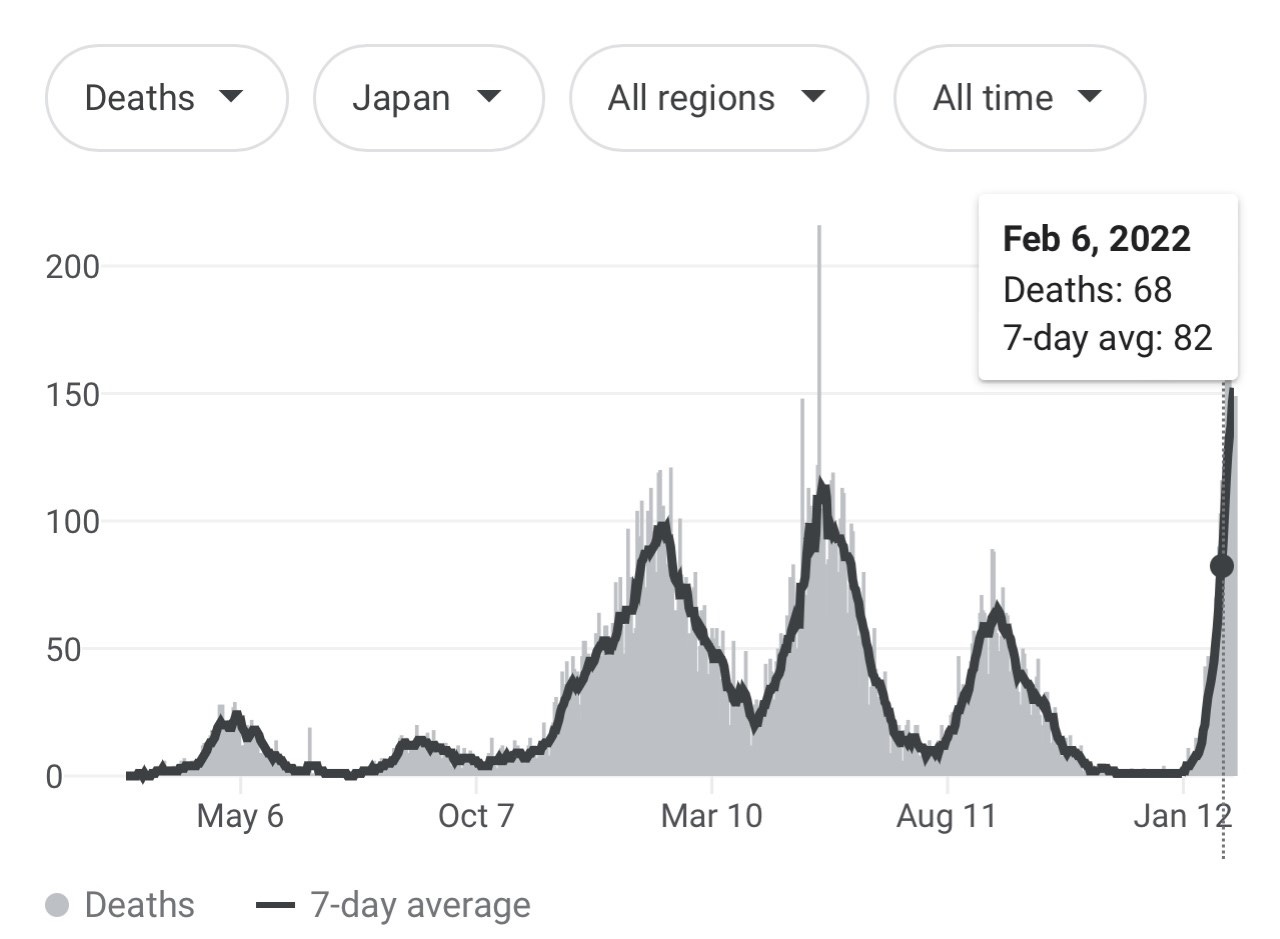

Interesting article about Japan and South Korea looking at vaccination rates, mask mandates (98% compliance for 12/17), yet a huge case spike. I also pulled in a chart of Japan deaths to see what they did during the period of higher cases despite high mask compliance and high vaccination rates (80%). Why Did Masks Stop Working In Japan And South Korea?

The CDC found infants less than six months old were 61% less likely to be hospitalized with Covid if their mothers received Pfizer or Moderna’s vaccine during pregnancy. Previous research had found the mothers’ antibodies from the Covid vaccine are transferred across the placenta to the developing infant.

Real/Estate

Luxury spec home builder Todd Michael Glaser flipped a Palm Beach estate that he planned to keep as his “forever home” for nearly $32 million, as waterfront properties remain in high demand in the tony town. Cardiologist Dr. Robert Fishel purchased the landmark mansion at 210 Via Del Mar via his BeachBoyz Development LLC, records show. A company led by Glaser sold the half-acre property for $31.7 million, 33 percent more than the $23.8 million he paid for the house in May of last year. In my life, I have never heard of more “flips” of high end R/E in a short time than the past 18 months. I have heard of hundreds of stories of high-end properties being flipped in months for $5-25mm of profit. It is not sustainable. A reader just flipped land on Palm Beach Island bought for $20mm and sold for just under $40mm in less than one year. Land! There is a new listing, 5401 Pine Tree in Miami on the water and listed by Devin Kay. It is 6000 ft on a 12,500 ft lot with 75 ft of water frontage (2nd picture).

I understand the demand in Miami and can tell you first hand it is ON FIRE. I do not understand Tampa as much. It is just not my favorite place and could not imagine living there. But according to Bloomberg, it too is on fire. I have readers who control many hundreds of thousands of apartments in the USA and EVERY one of them that I have spoken with has been in shock about how much rents have increased since the pandemic. Florida’s Tampa and Miami metropolitan areas are recording the biggest rent increases in the U.S., with workforce migration driving up the cost of living across the Sun Belt. Among the 50 largest metropolitan areas, Tampa ranked No. 1 with a 27% surge in rent in the 12 months through January, according to the Zillow Observed Rent Index. Rents also rose 27% in the Miami area, while they were up 26% in No. 3 Phoenix, the data show. The other metros in the top 10 include Austin, Texas; Las Vegas and two other Florida cities: Jacksonville and Orlando. The 2nd chart suggests things are leveling off and they need to in my opinion. Rents and home prices have escalated too much and there is an affordability issue as inflation on food, cars, energy, consumer products and everything else is up sharply.

Despite losing Tom Brady to retirement and not making it to the Super Bowl, Tampa Bay Buccaneers co-owner Darcie Glazer Kassewitz has just scored a different kind of win: a buyer for her multimillion dollar Florida mansion. The palatial $8.95 million spread was pending sale as of Friday, listing records show. Roughly 30 minutes north of the Bucs’ home at Raymond James Stadium, the property is in Avila, an affluent gated community that’s considered one of the most exclusive enclaves in Tampa. The home is tucked away behind its own gated entrance on 6 acres overlooking the community’s golf course, pond and conservation area. It’s dubbed a “one-of-a-kind estate,” according to the listing with Jennifer Zales of Coldwell Banker. I think this is one of the ugliest houses I have ever seen. Additionally, 6 acres and 29,000 square feet would go for a hundreds of millions in Miami in any good neighborhood. So my comment in the prior section on Tampa holds. If you can buy this monstrosity in an “exclusive” area of Tampa for $9mm, I am out on Tampa.

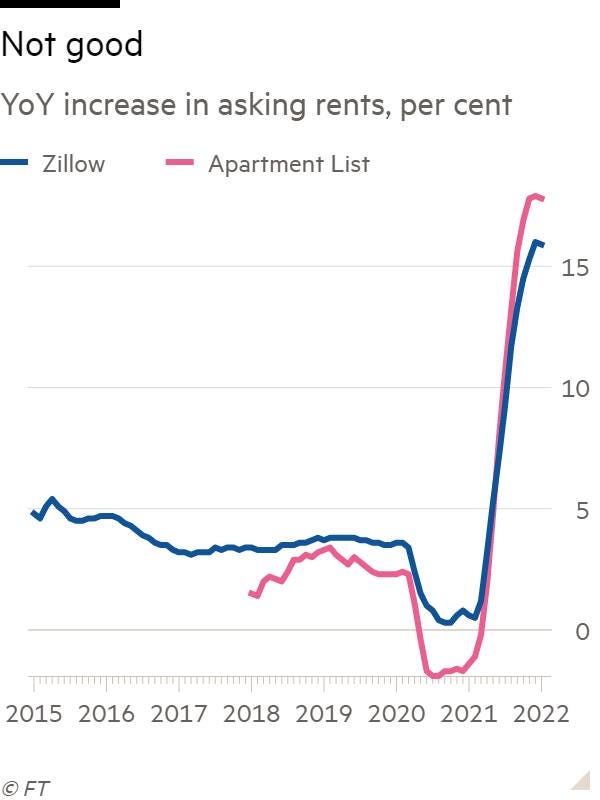

Robert, a loyal reader, sent me a note about rents from the Financial Times and the suggestion is elevated rents will be sticky. The 2nd chart is from Invitation Homes, a real estate company which rents more than 70,000 single family homes across the US. The 4th Q includes a 17% rise in rents on new leases and 9% increase on existing. Again, I am shocked at the strength in the housing market. Every landlord I speak with is giddy with the rent rolls today.

The price of lumber has been on a roller coaster since the start of the pandemic, and it’s climbing a big hill yet again. After falling back sharply from a record high in May of last year, lumber prices began climbing again in December. They are now about 22% lower than that peak, but still about three times their average pre-pandemic price, according to Random Lengths. That is adding to the cost of both building a new home and remodeling an older one. The National Association of Home Builders estimated the recent price jump added more than $18,600 to the price of a newly built home. It also added nearly $7,300 to the cost of the average new multifamily home, which translates into households paying $67 a month more to rent a new apartment.