Opening Comments

Today’s note will be a bit abbreviated given my West Coast trip which took me between LA and Fresno to surf the Kelly Slater Wave Pool which is known as the Surf Ranch. I am sure I missed a few stories as a result of my travels.

I left Thursday night for LAX and returned on the redeye Saturday night with limited internet. An upcoming report will have full details, but you might want to check out the Pictures of the Day today. I saw signs for gas near Fresno for $6.77/gallon. I know CA has great weather, beaches, and mountains, but I could not live there given all the negatives. Lots of homeless, high crime, woke DAs, low public school rankings (#44 in the US), high-income taxes, high R/E taxes, high sales tax, highest natural gas and gasoline costs in the country, bad power grids, mandates, soft on crime policy and natural disasters (floods, droughts fires, earthquakes, mudslides).

A reminder that some email servers truncate my notes and you need to hit, “View Entire Message). Make the email safe so it does not go into spam. Remember, to send me story ideas.

If you missed my note on AutoGPT, check it out here. I felt that Quick Bites had a lot of good info. Interesting article about employees using AI technology to do their job so they can work multiple jobs full-time remotely. Yes, AI/Chat GPT/Auto GPT will be very disruptive as employees realize they can fire a lot of people and do it more efficiently. Great chart in my last AutoGPT note on productivity. Another good CNBC story about AI robots changing the retail sector.

Markets

Philly Fed Data Weakens and Polling Data

More Signs of the Consumer Slowing

Housing Prices

New Mortgage Rules Hurt Those with Good Credit

Picture of the Day-Surf Trip to the Kelly Slater “Surf Ranch”

When I surfed a lot, I felt I was at least respectable, but I rarely go anymore. It had been three years since I had been in the water and actually only surfed twice in 6 years. I was better than I feared, but when you surf with some really good surfers, you realize that father time is not your friend. I was fortunate to be included on the trip organized by Johnny P, “The Most Interesting Man in the World.” A group of 12 made the trek near Fresno, CA (middle of nowhere). The wave is truly amazing and once I get all the footage, I will write up a theme piece about it. For now, I am showing some pics of me. No, these are not edited in any way. Yes, I made it out of barrels but also got clobbered on a few. Yes, my legs and shoulders are quite sore and yes, I am going to need a massage today. Johnny, thanks for including me. Lots of fun and it was great to hang with the crew. I made some new friends. This is a 30-second video of two barrels. I will have better quality coming. The ride is up to 45 seconds and over 500 yards. Not bad for a 53-year old with no water time recently, but I wish I did better. We hired a photographer to be in the water, but have not seen any of that footage. I believe he should have gotten some of me deep in a barrel. Let’s hope so, I don’t know how many more surf trips I have left in me. By the way, Johnny got a crazy long barrel and I was in the water to witness it. Pretty cool. For those who surf, I was on a 5’8” board, but wider than my normal boards.

Tiger’s Legacy

I want to start this piece with the fact that I think Tiger did more for the game of golf than any of the greats before him. This is not taking away anything from Jack or Arnie, but Tiger changed the game and brought in young players and money never dreamed possible in the sport.

Tiger is hands-down the best junior and amateur golfer ever. NO ONE and I repeat NO ONE will ever win three consecutive US Junior Amateurs and then 3 consecutive US Amateurs. This is a record that will never be broken.

When he turned pro in August 1996 with the announcement, “Hello World,” he forever changed the game of golf and sports. He won twice in his first three months as a pro and won the Masters by 12 strokes the following year in 1997. I vividly recall the chills as I watched a Black man win a tournament where people with his skin color were not welcome for decades, as caddies or maintenance crews.

Tiger has had two distinct pro careers in my mind. The first is in green (chart) and ranges from August 1996 through the end of the 2009 season. This is the “Golden Era of the Tiger.” He had 71 wins and 14 majors in this stretch. His winning percentage was 30% and made the cut in 97.5% of his starts. In 1999 and 2000, he won a total of 17 times including 4 majors with a winning percentage of over 41%. Tiger made 142 cuts between 1998 and 2005, crushing Byron Nelson’s record of 113 which was done during WWII with limited competition. Due to Tiger’s dominance, and the fact that Tiger made golf “cool,” TV ratings skyrocketed and the money came pouring into the sport. Nielson, the TV ratings company estimated that Tiger’s impact resulted in a 35% increase in ratings in the late 90s when he played. His impact was called, “The Tiger Effect.” Some crazy Tiger achievements here.

When Tiger joined the PGA tour in 1996, total prize money was $101mm for the entire season. By 2008, it hit $292mm and in 2023, it is $428mm with many individual tournament purses between $18-25mm. Thank you, Tiger.

When Tiger limped off the US Open at Torrey Pines with the win in 2008 over Rocco Mediate in a playoff, I thought 25 majors was in his grasp. Then, self-inflicted wounds on and off the course derailed him. He admitted to 120 different extra-marital affairs which ended his 5-year marriage. His hard workouts and years of aggressively swinging the club took a toll on his body requiring many surgeries as well. Let’s not forget about the car crash in 2021.

Tiger is 14-1 in the majors when going into the final round with the lead. He had the “Tiger Slam” in 2000-2001 when he held all four major titles at once. Between 1997-2009, the best score to par in majors is Tiger -134, Phil +99, and Ernie Els+118. He beat Hall of Fame Players by hundreds of shots. Tiger has been the player of the year 11 times, the money leader 10 times, the Vardon Trophy winner 9 times, and the recipient of the Byron Nelson award 9 times. Here is a full list of Tiger’s golf achievements.

The other half of Tiger’s career started in 2010 and includes 10 wins and 1 major (red box in chart). His winning percentage was just over 8% during this run (still great, but fractional to the 1st half). He made the cut in 82% of his starts in this half of his career which was marred by injuries and started just after his fall from grace due to his off-the-field affairs which became public.

If you want to have a conversation of the greats, it is either Tiger or Jack in terms of wins and majors. Jack had 73 career victories including 18 majors and came in 2nd place a whopping 19 times in major tournaments. Jack had career earnings of $5.7mm with purses which were fractional to today’s levels. Tiger has 82 victories (tied with Snead for most) including 15 majors and came in 2nd place 6 times in major tournaments. Tiger has 41 European Tour wins and is 3rd on the list despite never playing full-time on the Euro Tour. Tiger career earnings are $121mm (much bigger purses than in Jack’s time). Jim Furyk won 17 times with 1 major. He won $71.5mm in his career. Had he started his career in 2022 (rather than 1992), he would have earned $620mm. With the new PGA guidelines, it would be even more today! Thank you, Tiger.

Seeing Tiger limp around the Masters Tournament was painful to watch. I now feel there is a better chance that Tiger has played his last tournament than he will win another major. Unfortunately, he has had at least 5 back surgeries, 4 knee surgeries, and the surgeries around the car crash in 2021 which rendered his right leg severely broken.

Tiger has been great for the sport of golf and all the players on the PGA tour and LIV tour have him to thank for their riches. I just can’t stop thinking about “what if” he had not had the self-inflicted off-the-field issues and injuries which clearly negatively impacted his career.

Tiger also pushed physical fitness and strength driving the new generation of players to hit the ball longer. Tiger changed the game in many ways for the better, and although it is close between Jack and Tiger, I give the nod to Tiger when I consider the totality of his career, even if it is over today.

Thanks, Tiger for giving all golf fans a lot to cheer about during your amazing golf journey from junior to amateur to professional to legend.

Quick Bites

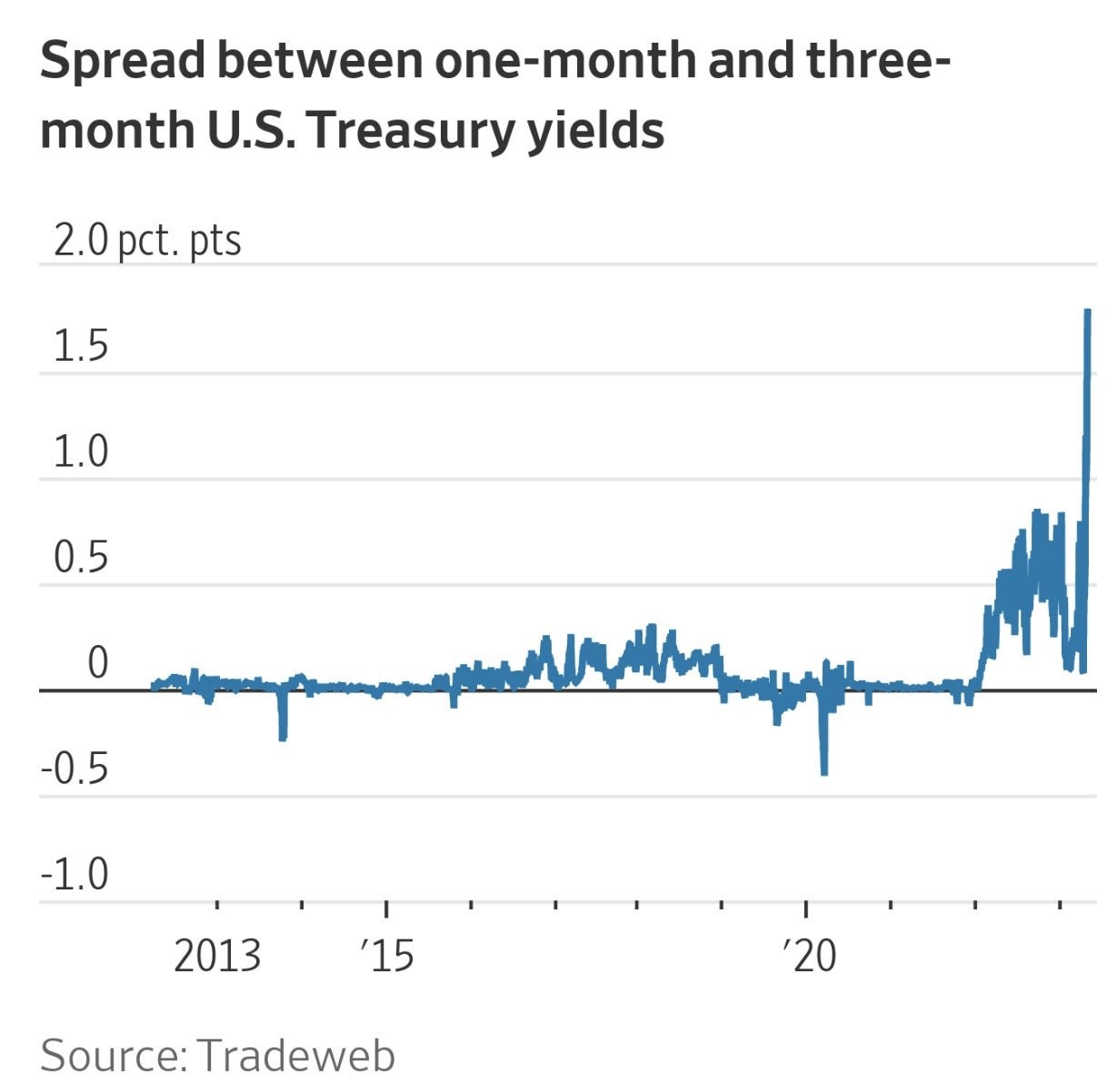

Although Friday saw stocks little changed, all major indices finished the week in the red, with the Dow falling 0.23% to snap a four-week win streak. The tech-heavy Nasdaq saw the biggest decline, falling 0.42%, while the S&P slipped 0.1%. “So far, earnings season is off to an uneventful start, with many companies meeting already reduced earnings expectations and that helps to explain the lack of movement in the major stock indices over the past few days,” said Carol Schleif, chief investment officer at BMO Family Office. The 2-Year Treasury finished at 4.18% (+10bps on week) and the 10-Year at 3.57 (+5bps on week). Interesting WSJ article about the debt ceiling issues impacting the spreads in short-dated Treasuries (chart). I do not believe we will see a default but do believe there will be some volatility around headlines between now and when cooler heads prevail. Oil has been volatile between economic fears pulling it lower and supply issues and China demand pushing it higher. Oil was -5.5% on the week despite a slight uptick Friday.

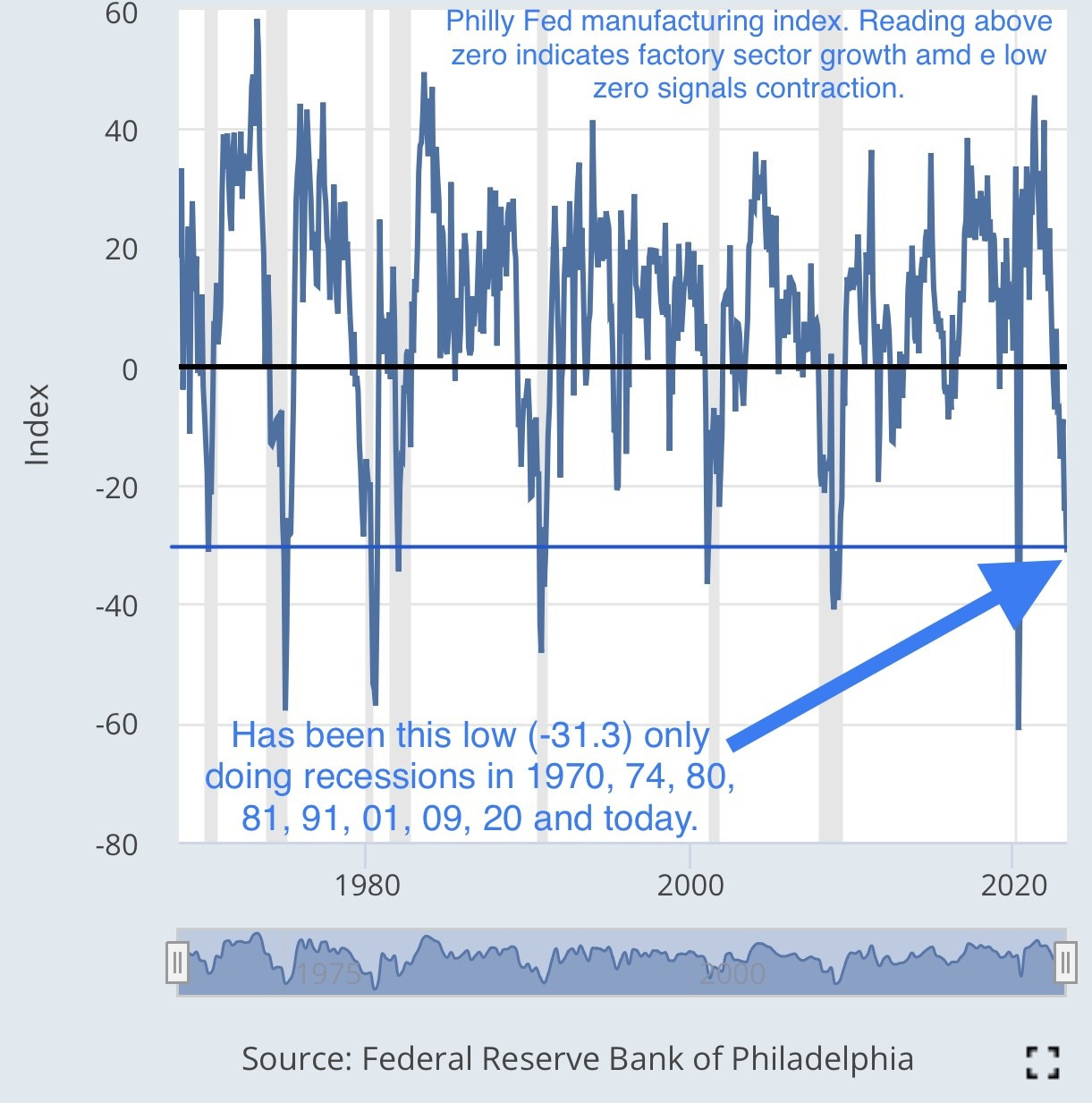

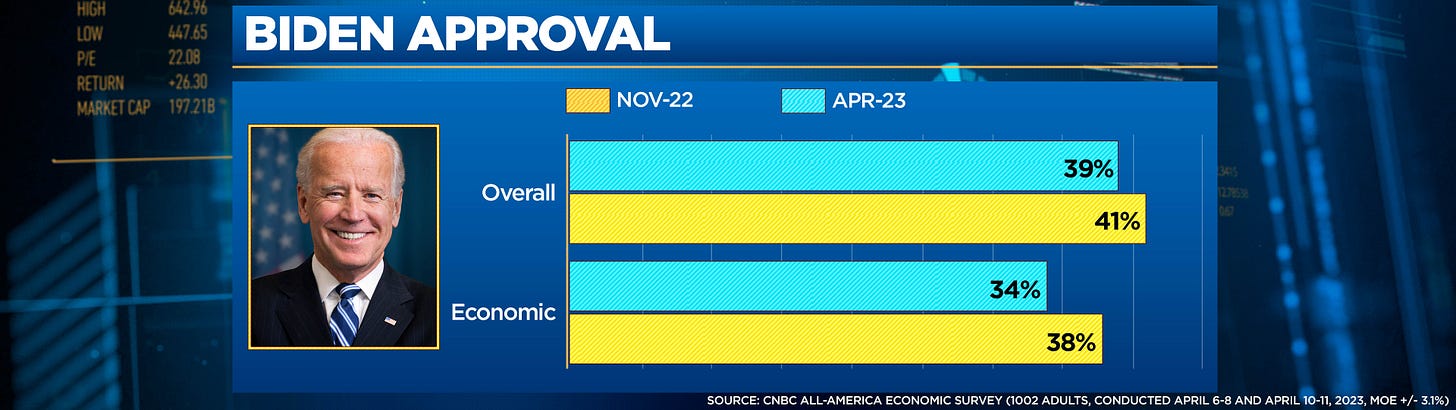

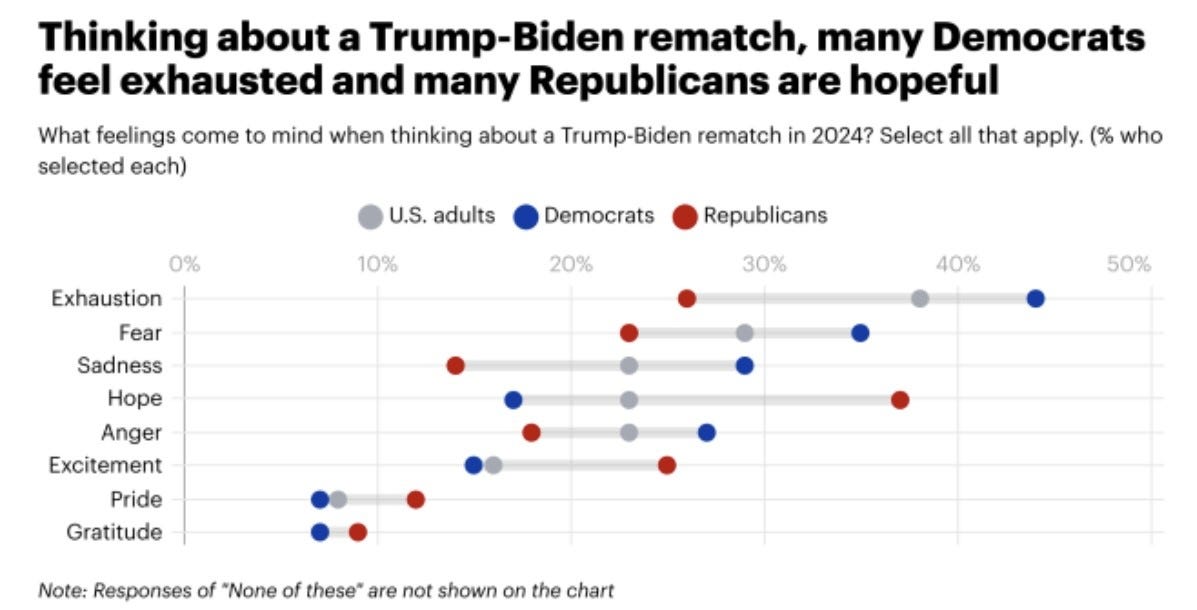

The Philly Fed Manufacturing Index fell to -31.3 in April from the March level of -23.2. The report noted that this is the eighth consecutive reading in negative territory as activity falls to its lowest level since May 2020, when the economy was crippled by the global COVID-19 pandemic. A record 69% of the public holds negative views about the economy both now and in the future, according to the latest CNBC All-America Economic Survey. Because of inflation, large majorities say they are altering their spending and lifestyles. Fully 81% of respondents say they are taking some action, such as spending less on entertainment, traveling less or using savings to pay for purchases. Biden’s approval numbers are awful (2nd chart) and 62% disapprove of his handling of the economy. CNN’s John King asked if the US wants 4 more years of Biden. Given how left CNN leans, it is a telling question. How do Americans feel about a Trump-Biden rematch? 'Exhaustion' tops the list. We need new, younger candidates and I am hoping Trump and Biden are not in the picture. Also of note, 70% of Americans and 44% of Republicans don’t want Trump to run and I am shocked it is is not 80%. An earlier poll found that 78% of Americans don’t want Biden to run. How embarrassing is this for the USA? On a positive note, US PMI is at 50.4, up from 49.2 last month.

I am not sure anyone has written more about the consumer trying to highlight my concerns early. I have been at it for over 6 months. I found this in Peter Boockvar’s newsletter- CDW, distributes tech hardware, software, computer peripherals, cloud computing products, mobile devices, network communication and security-related products to more than 250,000 business, government, education and healthcare customers in the US, UK and Canada. From the earnings release. "The first quarter was marked by a period of intensifying economic uncertainty that led our customers to spend more cautiously and prioritize mission-critical initiatives. This demand contraction resulted in first quarter performance below our expectations. Volume declines were most acute with our largest commercial customers and across transactional products. Solutions were more resilient, but performance also came in below our expectations. Given first quarter market performance and near-term conditions, we currently expect the US IT market to decline at a high single digit rate in 2023." Soak that in ahead of a slew of tech earnings reports coming in the next few weeks.” Discover Financial has its earnings call this morning but in their release they saw higher net charge-offs mostly across the board. "The credit card net charge-off rate was 3.10%, up 126 bps from the prior period and up 73 bps from the prior quarter. The 30+ delinquency rate for credit card loans was 2.76%, up 99 bps y/o/y and up 23 bps q/o/q. The student loan net charge-off rate was 1.04%, up 35 bps from the prior year and down 29 bps from the prior quarter. Personal loans net charge-off rate of 1.94% was up 82 bps from the prior year and up 45 bps from the prior quarter." JB Hunt in their earnings call said, “Simply stated, we are in a freight recession.”

Other Headlines

Morgan Stanley’s Seth Carpenter Makes the Case for Soft Landing

Tesla net income and earnings drop more than 20% from last year

The stock was -8% on the news.

Elon Musk had a rough week across his empire — Tesla, Twitter and SpaceX

Bad TSLA earnings, SpaceX Explosion of a rocket, and changes to verified Twitter accounts topped Musk’s bad week. This CNBC analyst crushed Musk setting the downside for TSLA at $69 ($165 today-down from $207 in March).

Procter & Gamble beats earnings estimates, raises revenue forecast as prices rise

Key takeaway is rising prices more than offset lower volumes (-3%)

Bed Bath & Beyond files for bankruptcy protection after failed turnaround efforts

Thank you Amazon for bankrupting another company. You either adapt or die. Lesson for those who manage and don’t adapt.

Amazon, Facebook, Google Headline Busy Earnings Week for Tech

JPMorgan’s Ties to Jeffrey Epstein Were Deeper Than the Bank Has Acknowledged

Google's 80-acre San Jose mega-campus on hold amid economic slowdown

How Facebook users can apply for part of $725 million settlement

Reddit, Airbnb and 8 more companies that let you work from home permanently and are hiring now

World's largest battery maker announces major breakthrough in energy density

I am not an engineer, but this looks like a seriously positive development. The suggestion is with 500 Wh/kg batteries, you can enable the electrification of aircraft. Musk suggested it gets interesting at 400 Wh/kg.

McCarthy unveils debt ceiling bill that aims to cut big parts of Biden’s agenda

Bronx Judge Naita Semaj to be yanked off criminal cases

Read what this judge did. Why should she even be a judge of any kind? She put an accused child killer back on the street.

Mayor Eric Adams says Biden's migrant crisis has 'destroyed' NYC

Maybe our border policy which allowed 5mm illegal immigrants into this country under Biden is not the right way to go?

At least 9 teens injured after shots fired at Texas after-prom party

No places are safe anymore. Sad state of the country.

6-year-old girl, parents shot after basketball rolls into man’s North Carolina yard

Statue of Man Breastfeeding At Former Women’s Museum in Denmark Prompts Criticism

I swear this is a real story. I am not that creative to make this up. IT was called the “Woman’s Museum” is now called the “Gender Museum.”

Bud Light replaces marketing exec behind Dylan Mulvaney partnership

I am all for inclusivity, but pushing transgender spokespeople for Bud Light was a bad idea.

Good thoughts here.

China building cyber weapons to hijack enemy satellites, says US leak

Just our friends in China. Nothing to see here. No sarcasm either.

Real Estate

Home sales fell across the U.S. in March, a sluggish start to the crucial spring selling season as higher mortgage rates squashed momentum from the previous month. U.S. existing-home sales decreased 2.4% in March from the prior month to a seasonally adjusted annual rate of 4.44 million, the National Association of Realtors said Thursday. March sales fell 22% from a year earlier. March marked the 13th time in the previous 14 months that sales have slowed. The housing market had a surprisingly strong February, when sales rose a revised 13.75% from the previous month. But after mortgage rates ticked higher, March sales resumed the extended period of declines.

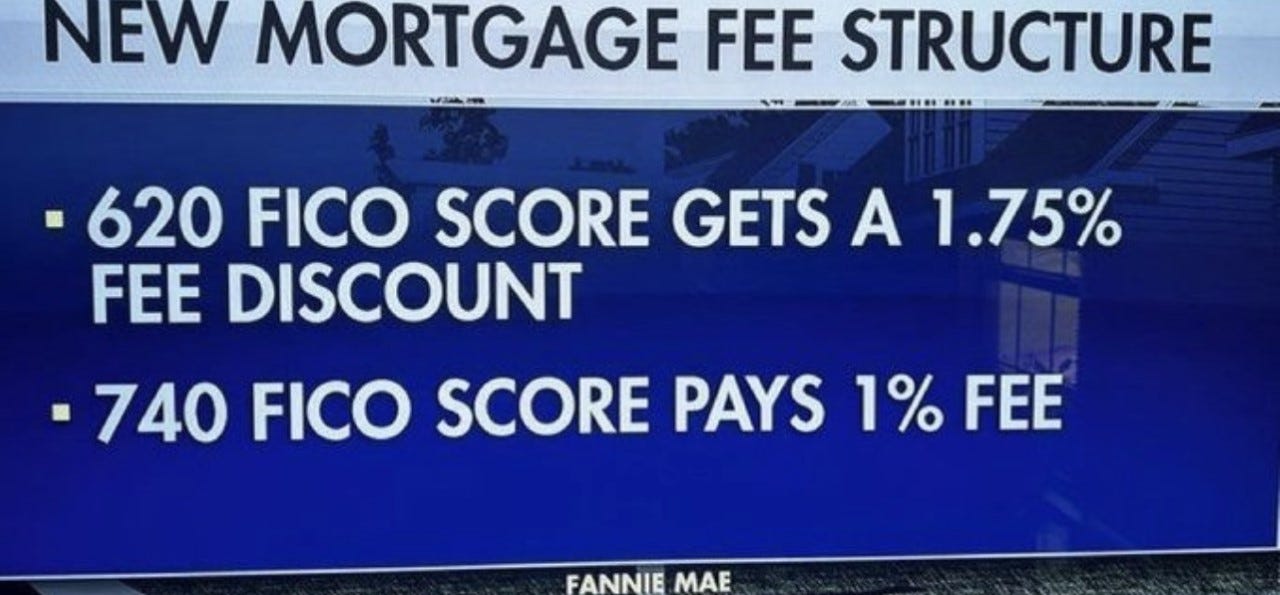

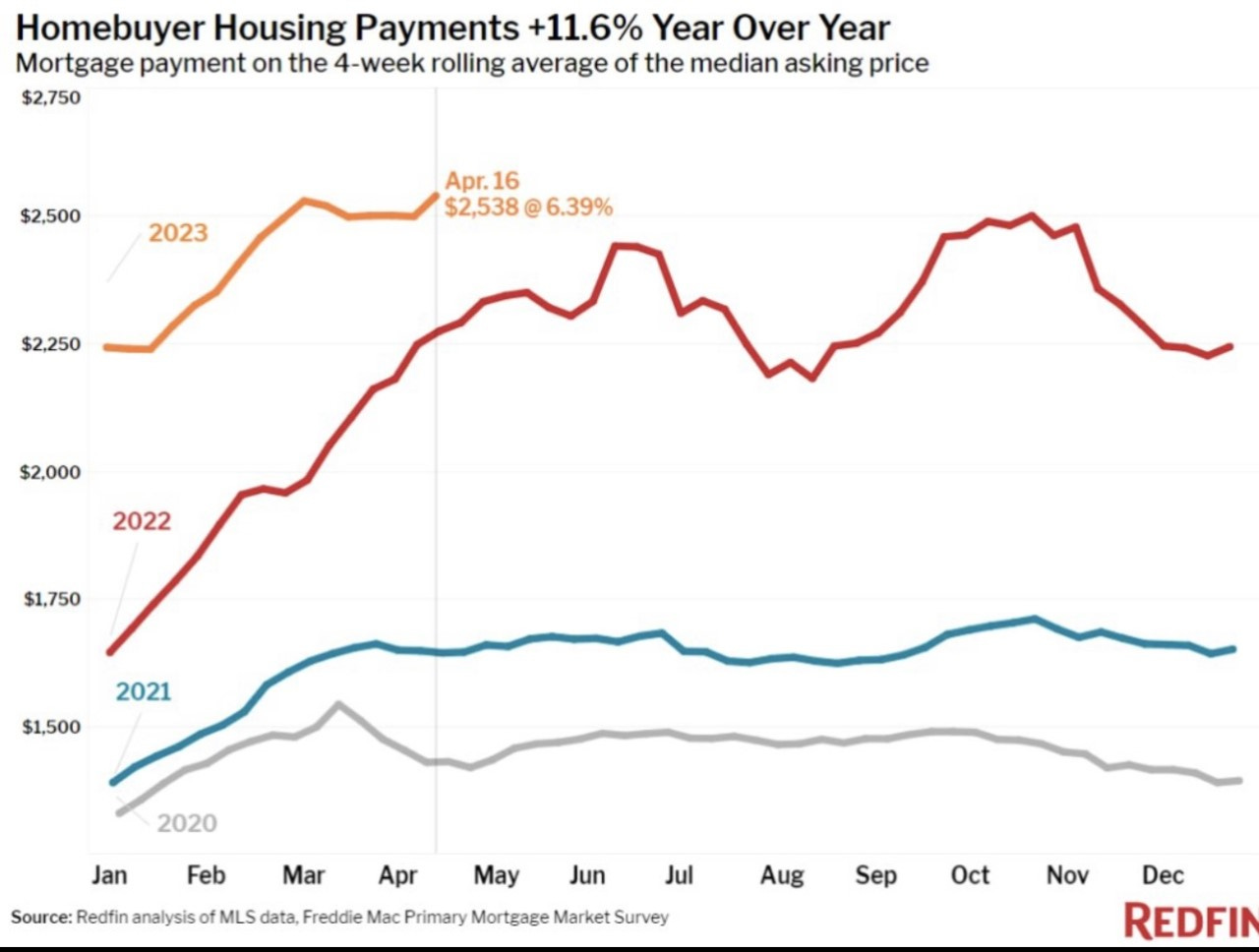

Income redistribution is an abiding value of the Biden Administration, and now it wants to spread that to mortgage lending. A new rule will raise mortgage fees for borrowers with good credit to subsidize higher-risk borrowers. Under the rule, which goes into effect May 1, home buyers with a good credit score over 680 will pay about $40 more each month on a $400,000 loan, and upward depending on the size of the loan. Those who make down payments of 20% on their homes will pay the highest fees. Those payments will then be used to subsidize higher-risk borrowers through lower fees. I am not supportive of this new plan. I worked hard and was fiscally responsible despite growing up with limited means. Why do we constantly try to push down those who work hard and achieve the American Dream? The 2nd chart shows housing payments increasing in 2023 due to higher rates. The median price home now is $2,538 per month.