Opening Comments

I need to start with a correction to the record. I read the Picture of the Day wrong and crushed a dad for building a flame thrower for the kids. It was not a real flame. Clearly, writing a report from a plane while on your phone is not a good idea. Lots of emails on Nantucket and 20 to 1 love the place. A few prefer the Hamptons, but most of the emails were incredibly positive. The piece seemed to bring back memories for people who have visited the island.

Today is the exact 5 year anniversary of the Rosen family moving to Florida from NYC. So much has transpired in the last five years, and I hope to share some of my thoughts about it today. Yes, it feels good to sleep in my own bed with real sheets and towels.

Picture of the Day-Productivity Drops and Labor Costs Spike

Trading Chaos for Sunshine-5-Year FL Anniversary

Quick Bites

Markets

Softbank Earnings

Inflation Reduction Act-Winners/Losers

Travel Woes

Biden Approval Rating Remains Low Despite Wins

Trump Raid on Mar-A-Lago

Other Headlines

Virus/Vaccine

Data

Real Estate

My General Comments-A bunch of Boca Examples-Tide Turning. Data

Miami-Citadel Effect

Other Headlines

NYC Luxury Market

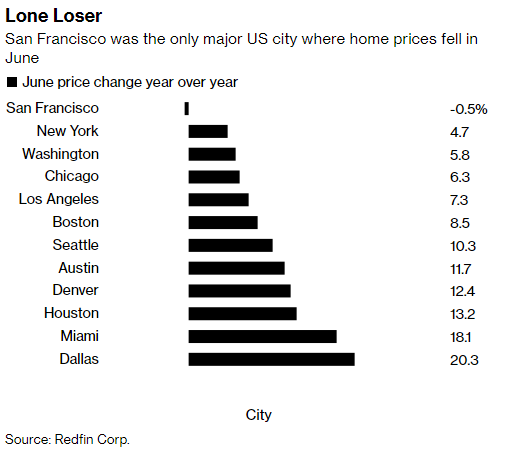

SFO Troubles

Housing Sentiment Tanking

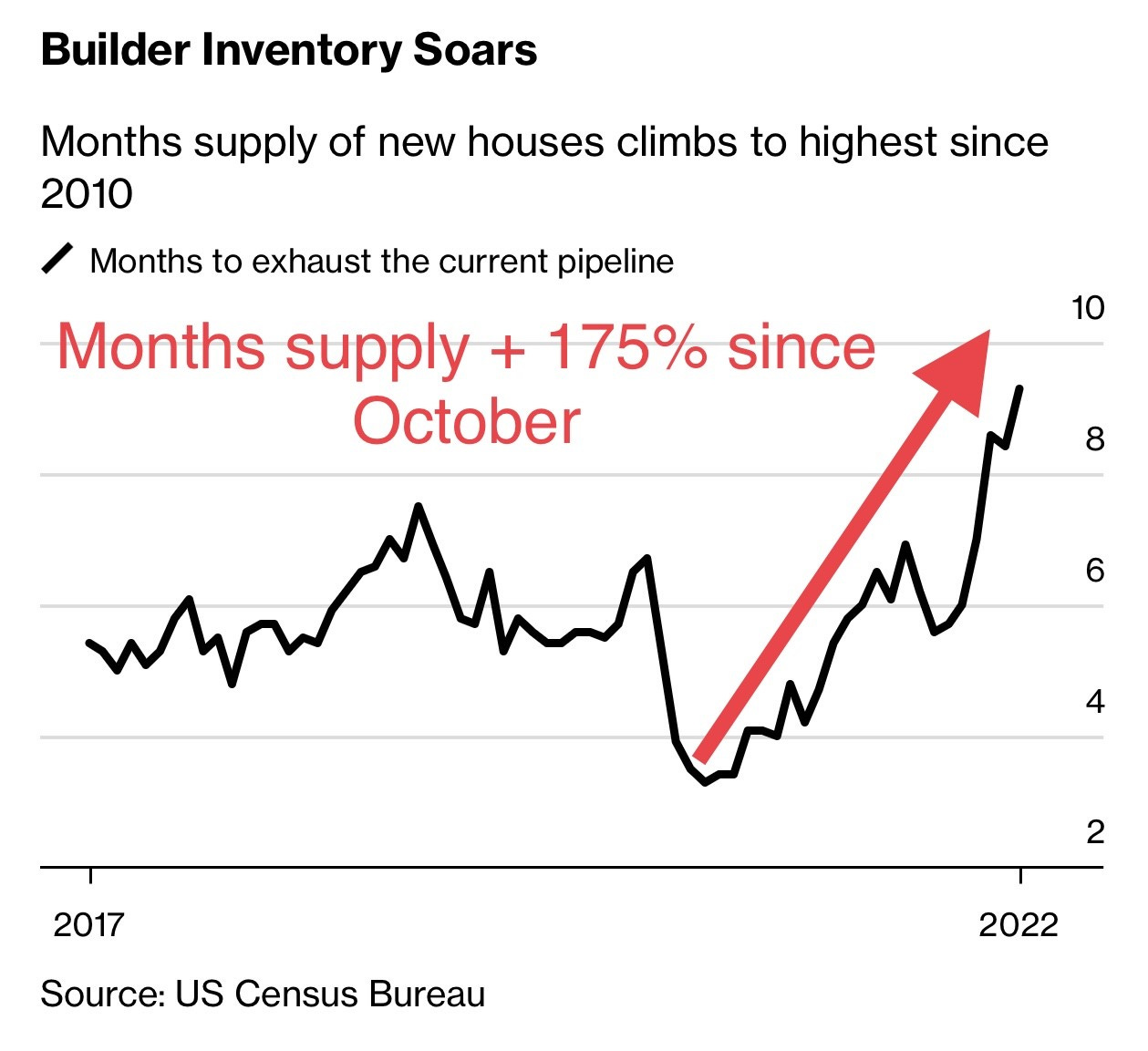

Builder Inventory Growing Sharply

Top and Bottom Best and Worst Places Globally

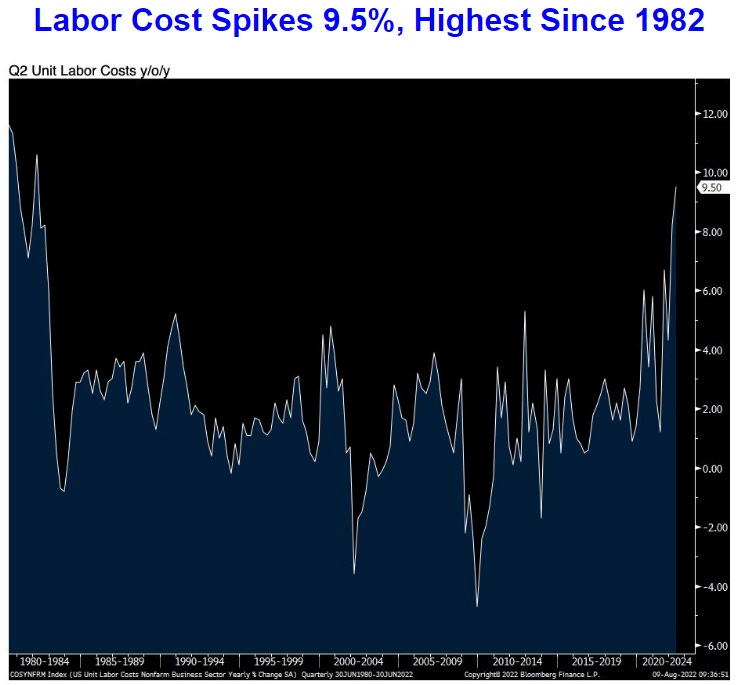

Picture of the Day-Productivity Drops and Labor Costs Spike

This article by Peter Boockvar shows productivity falling to lowest level in US going back to 1948 (1st chart), while unit labor costs spiked (2nd chart). The implication of the article is profits will be squeezed. Other good charts in the article too.

Trading Chaos for Sunshine-5-Year FL Anniversary

In 2016, I told my wife, Jill, that I was unhappy in NYC. I felt a combination of the quality of life, cost of living, weather, taxes and deterioration of the city under DeBlasio was taking its toll on me. Despite growing up with limited means, I liked the fact that in South Florida I could be outside all year and felt I had a happy childhood. Additionally, I felt the co-op life was horrible and believed the prices would come down sharply with all the new shiny condos with real amenities. Yes, I sold at the top.

We looked at San Diego and South Florida on numerous trips and decided Florida was better for us. I was running the hedge fund and NYC was a far easier commute to Florida. Also, Jill’s father was ill and it would be easier for all parties to get back regularly. We sold the co-op in NYC to Sandy Weill (NY Times article on the apt) and bought a much larger home with a big yard, 4 car garage and massive kitchen for 1/4 the price of the NYC apartment. You can’t do that anymore. My mistake was not buying a half dozen homes down here in 2017. They were giving them away at the time. In the R/E section today, I go into detail comparing prices and sales from 2017 to 2021 and today.

We bought the house in Boca Raton in May of 2017, and although it was brand new, did renovations to make it our own and moved in on August 10, 2017. Note to self, construction in Florida is far easier than construction in NYC.

We enrolled the kids at Saint Andrew’s School in Boca and started our new life. For me, I had been in NYC for over 20 years after 5 years in Chicago and my wife, her ENTIRE LIFE in NYC, so the transition was awkward. I quickly realized that we made the right decision, as my anger over my quality of life quickly eroded. The kids made friends and enjoyed the freedom of a yard, pool, golf cart and ability to be outside alone. When Julia has friends over, I tend to drive them to the beach club in the golf cart and they spend the day having fun in the water, slides, boat rides…. Slightly different from NYC.

My wife struggled with the transition and missed her family and life-long friends. Her father’s illness did not make matters easy, but she would go back to NYC once a month to see her family.

Jill quickly made friends with a group of women and started doing a book club, regular lunches and dinners, as well as walks, something my wife missed growing up in NYC. You don’t walk much in Florida, especially relative to NYC.

Since we made the move, the pandemic accelerated the migration to South Florida. Most of the result is positive: Far more well-educated, successful people have moved down, new restaurants (11 Michelin Stars in Miami) as well as Carbone and soon to be Rao’s, corporations moved creating real jobs, far more high-end homes and condos have been developed and the communities are getting younger with families moving in droves. The days of only blue haired 80 somethings is gone, and the influx of families has taken over South Florida.

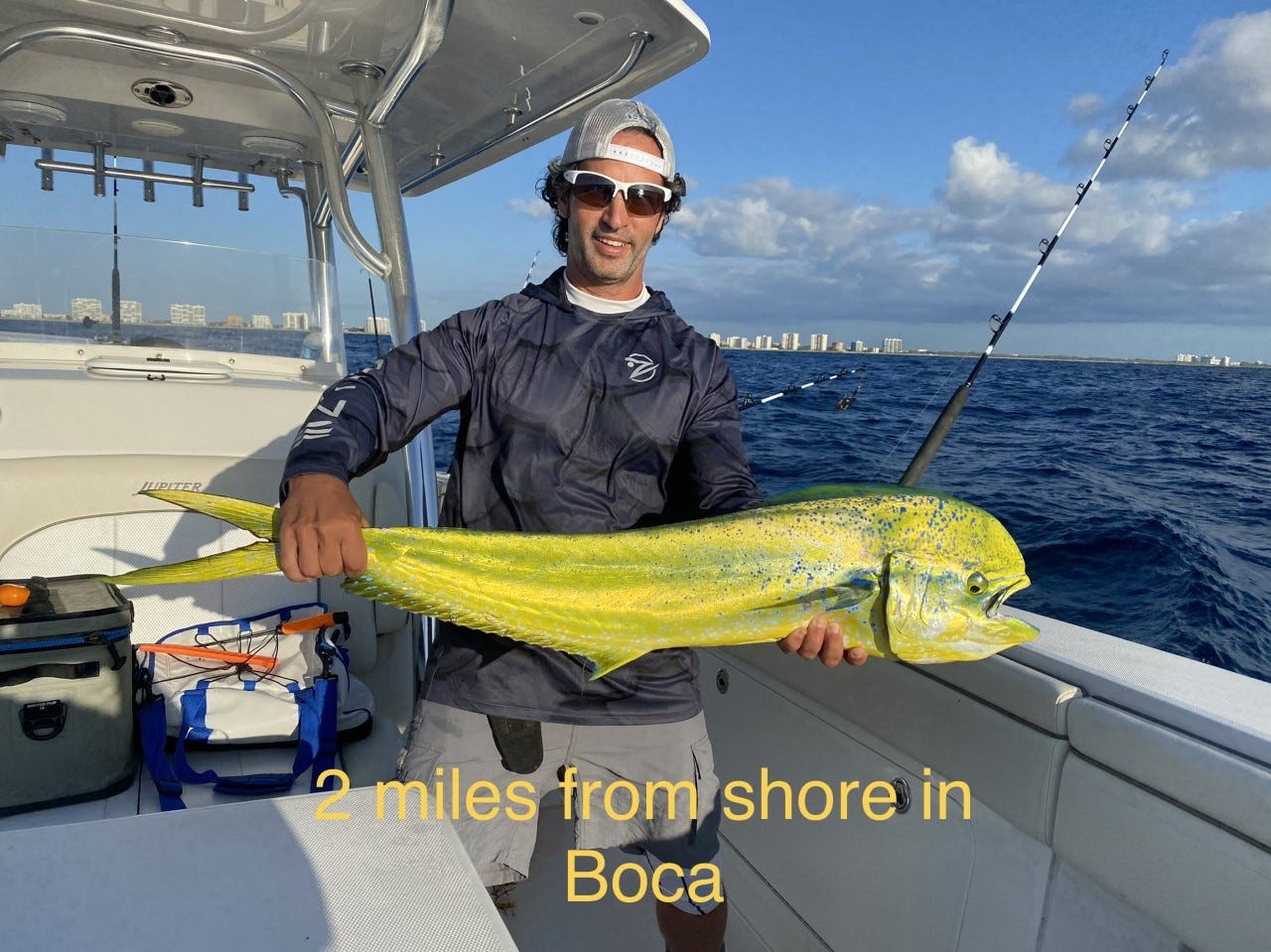

The issues around infrastructure due to the lack of schools, traffic, hospitals are notable. I do not know anyone who was more involved than I was in NYC in charities, Broadway shows, music, sports, art/furniture, restaurants… However, I realized that for me, time with the family was far more rewarding. My father’s death at the age of 39 was also weighing on me. I bought a fishing boat which is docked 1/4 mile from the house. We drive our golf cart to dinner. I can ride my bike to the beach in a few minutes and post pandemic, my friend group has exploded. Part of this is due to the Rosen Report, but the biggest factor is others have come to the realization that I did in 2016 and relocated to paradise. Note that in the 2nd picture I was a foot taller than Jack and now he is over 2” taller than me.

We picked Boca Raton after looking from Miami to Jupiter. I felt Miami was too congested with limited golf options (only gotten worse). I also despise Miami Airport. Because I was commuting to NYC, the fact that Boca was between Ft Lauderdale and Palm Beach Airports made sense. I think if I could do it again, I would have moved to Jupiter. I really like the community, Admirals Cove. However, economically, had I bought a waterfront home in Miami in 2017, it would have quadrupled in price.

I do miss parts of NYC and going back for a few days fills my desire for restaurants, cultural events and to see old friends and family. I will never say never, but don’t feel the need to live in NYC at this point, especially as the quality of life continues to deteriorate with horrific leadership, crime and ridiculous mandates and reforms. It would take a special job opportunity for me to move back and coincidentally, I have started getting calls in the past few months, so you never know.

I strongly encourage families to consider the migration, as many of the pre-pandemic issues with Florida have been sharply reduced, but the entry price is no longer pennies on the dollar. I am pleased with the quality of people down here now and almost every week someone new reaches out who could have been my neighbor in NYC. If you move down, find a school first as it is very challenging to get admitted today. I also suggest you get out for as much of the summer as possible and August-October are the worst from a weather perspective.

I have helped over 100 families move down here and have yet to have one who wants to move back to the Tri-State, Chicago or California. No, South Florida is not perfect, but so many incredibly smart, wealthy successful people have come down for a reason (Carl Icahn, Barry Sternlict, Danny Och, Ken Griffin, Tom Brady, David Blumberg, Keith Rabois, Steve Witkoff, Tommy Hilfiger, Charles Schwab, William Koch, Jon Oringer, Chris Burch, Paul Tudor Jones and many others). Also of note, major companies are opening or expanding presence here including: Goldman Sachs, Blackrock, Citadel, JPM, Oracle, Microsoft, Elliott Management, Starwood Capital and many others.

They have the means to go anywhere, but they picked South Florida. Why? It is not just zero state or estate taxes as a handful of other states have zero taxes as well. Eight states have no income tax and 38 states have no estate tax, so these educated and successful people had many options. Maybe they know something. But for the record, I was first!

Quick Bites

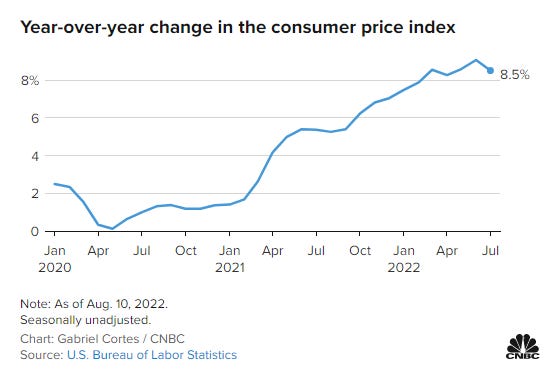

Inflation came in below expectations and readers of the Rosen Report know that if I got anything right over the last 18 months, it was my inflation call being too hot when the “experts” called it transient as well as my call for peaking in recent weeks. CPI was 8.7% in July down from 9.1% in June, while core remained unchanged at 6.1%. Data was better than economists estimates. Equities rallied sharply on Wednesday post the inflation data on the belief that rate hikes will slow. The Dow jumped 535 points, or roughly 1.6%. The S&P 500 gained 2.1% and hit its highest level since early May, while Nasdaq Composite rose 2.9%. Major tech stocks were outpacing the broader market on Wednesday, with Meta rising 5.7% and Netflix gaining more than 4%. The rates market reacted in a strong fashion with the 2 year rallying 6bps, while the 10 year rallied 1bps. On Tuesday, 2s/10s was -48bps (most negative since 1980) and after today, -42bps. Prior to CPI, there was a 67% chance of a 75bp hike and after the data, there was a 62% chance of a 50bp hike as inflation came in under expectations. The semiconductor industry is bracing for a challenging period with laptop sales slumping. Micron CFO said, “The market is worse than we thought it would be.” The sector has been hit between Intel, ADM, Nvidia and others. The semiconductor index was -4.9% on Tuesday and -27% for the year. US average gas prices are down $1 or 20% from June highs and average $4.01 today. Crypto has rallied recently and BTC is approaching $24k again and ETH is $1.8k+.

SoftBank posted one of its biggest losses at its Vision Fund investment unit for its fiscal first quarter, as technology stocks continue to get hammered amid rising interest rates. The Japanese giant’s Vision Fund posted a 2.93 trillion Japanese yen ($21.68 billion) loss for the June quarter. This is the second-largest quarterly loss for the Vision Fund. Masayoshi Son, SoftBank’s outspoken founder and the mastermind behind the Vision Fund, said in May the company would go into “defense” mode and be more “conservative” with the pace of investments after posting a record 3.5 trillion Japanese yen loss at the investment unit for the last fiscal year. Son said that he got overexcited during the period last year when technology stocks were booming but now feels “embarrassed” by that reaction. I have been consistently critical of the Vision Fund and management for years and for good reason. They were aggressive when valuations were exploding and spent tens of billions as valuations were peaking. Softbank sold its entire stake in Uber given the substantial portfolio losses. Buffett has a great line, “Be fearful when others are greedy, and greedy when others are fearful.”

This CNBC article outlines the biggest winners and losers from the Manchin-Schumer bill dubbed the ‘Inflation Reduction Act:” Losers: Big tax-avoiding corporations, drug companies, public company shareholder. Winners: Car companies, Utilities & Homeowners, Hedge Funds. I remain skeptical that it will reduce inflation and have the environmental impact as suggested. This clearly right leaning article gives the reasons it is not supportive of the legislation and some points include: higher taxes, damage to the drug industry, spending is front loaded and revenues back-loaded and much more can be found in the link. Of note, many question the validity of the claims around the bill and Socialist, Bernie Sanders, called it the “So-called Inflation Reduction Act because according to the CBO and other economic organizations that have studied the bill, it will have a minimal impact on inflation.” This article questions the 87,000 new IRS agents and suggests the funding is reckless. Other articles I read question how the IRS could possibly find 87,000 agents.

Delays also totaled in the thousands over the weekend. I can promise you that airports are a nightmare, and Jack and I were stuck in Boston for two days unable to get a flight out. Make sure to get to the airport early. Double check your flight status and itinerary and bring patience. JBlue booked me on the wrong date and I did not realize it until we got to the airport. The chart below shows TSA Pre-Check Daily data. As you can see, we are about 5% below the 2019 pre-pandemic levels and clearing 2.2-2.4mm/day. This compares with the 2020 lows of under 100k/day. A big issue is airlines offered thousands of workers early retirement in 2020, and now the airlines and TSA are massively under staffed causing delays and flight cancellations.

Although we have seen a bump of a few points, Biden’s average approval remains under 40% even by FiveThirtyEight/Nate Silver. I thought the recent wins which I have outlined in detail in my last few reports would have helped Biden’s approval rating more than it has. Maybe it takes time to work through the system. Like them or not, Biden has finally started getting some agenda items accomplished. I just believe he is un-electable given his age, track record and out of touch nature of his ways.

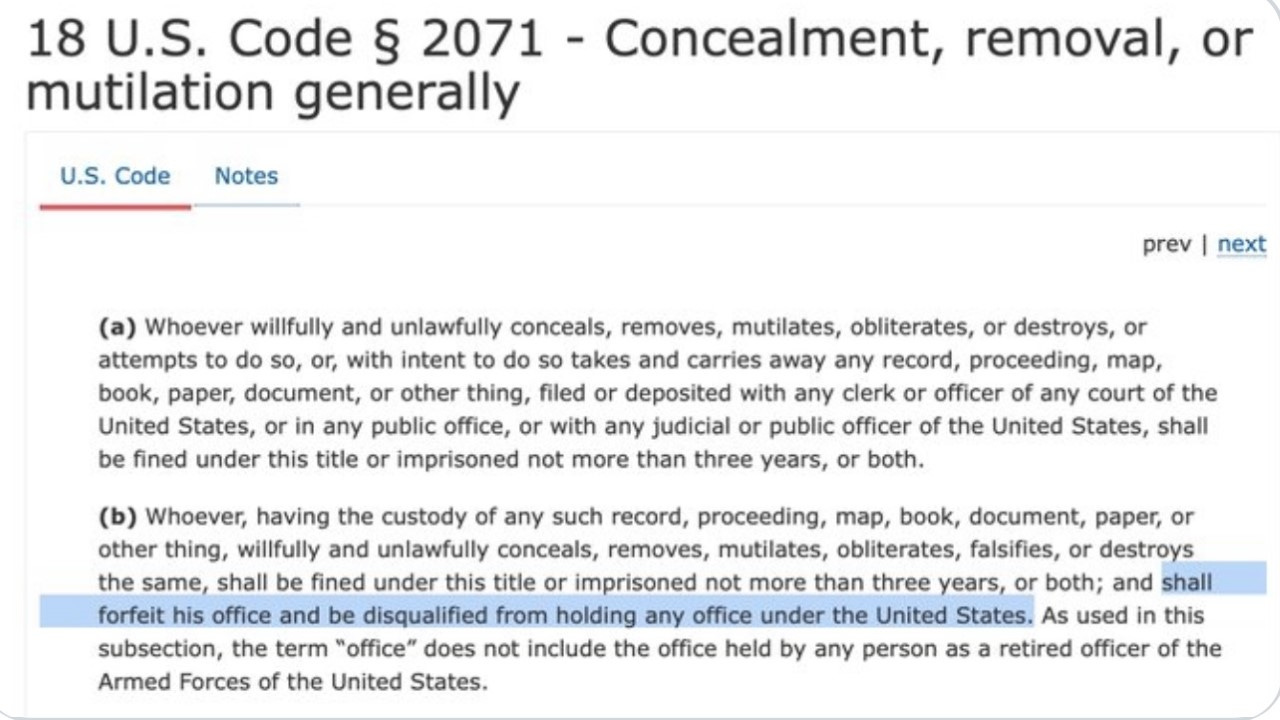

Much the way the leak of the Roe v Wade SCOTUS draft emboldened Democrats and helped to push Manchin to come around on the “Inflation Reduction Act,” I believe the raid on Trump’s home will help to rally the Right. The FBI executed a search warrant Monday at was part of an investigation into the handling of presidential documents, including classified documents, that may have been brought there. This article suggests agents cracked a safe. I hope the truth comes out, and the raid was justified based on facts. If they find something of substance, I have no problem with Trump facing consequences. If they don’t, I will question the validity of the action against a former President. Alan Dershowitz (liberal Democrat) said when dealing with “a former president and future candidate,” prosecutors “darn well have smoking-gun proof” of wrongdoing before conducting an unannounced raid. He questioned why a raid was necessary, saying that a subpoena for the documents should have sufficed. Remember when Hillary deleted 33,000 emails when she was Secretary of State claiming they were personal? Turns out 17,000 were recovered and many were not of personal nature. This article suggests that the US Code Title 18, Section 2071 is driving the raid. It would prevent Trump from ever holding office in the US (see third picture below) if the raid finds the former President violated the code. This CNBC headline was telling, “Mike Pence says FBI search of Trump’s home raises ‘deep concern,’ urges Garland to explain. Of note, there are pictures of a rumored Trump White House toilet with ripped paper with his handwriting on it which is also driving the chatter.

Other Headlines

JPMorgan’s Kolanovic Says Time to Trim Stocks, Buy Commodities

He has been bullish stocks and made a notable switch. He was ranked the #1 equity linked strategist.

Sweetgreen stock plummets after salad chain lowers forecast, announces layoffs and office downsizing

Consumers’ expectations of future inflation decreased significantly in win for the Federal Reserve

A New York Fed survey showed that respondents in July expected inflation to run at a 6.2% pace over the next year and a 3.2% rate for the next three years.

Britain's cost-of-living crisis worsens as rents and energy bills top $5k

Data Show Gender Pay Gap Opens Early

Disparities among male and female college graduates appeared within three years, a WSJ analysis of federal data for 2015 and 2016 graduates shows.

Bed Bath & Beyond jumps nearly 40%, AMC surges as meme chatter on message boards increase

Billionaires are funding a massive treasure hunt in Greenland as ice vanishes

Trump is having a bad week. Remember, he has been very critical of anyone invoking the Fifth Amendment and suggested it means your guilty.

ABC panelists say Kamala Harris not next in line if Biden doesn't run in 2024

Nancy Pelosi’s Taiwan Gambit Reshapes Political Risk in Asia

Crazy story of a Boston high school dean who was in a gang and had students deal drugs for him.

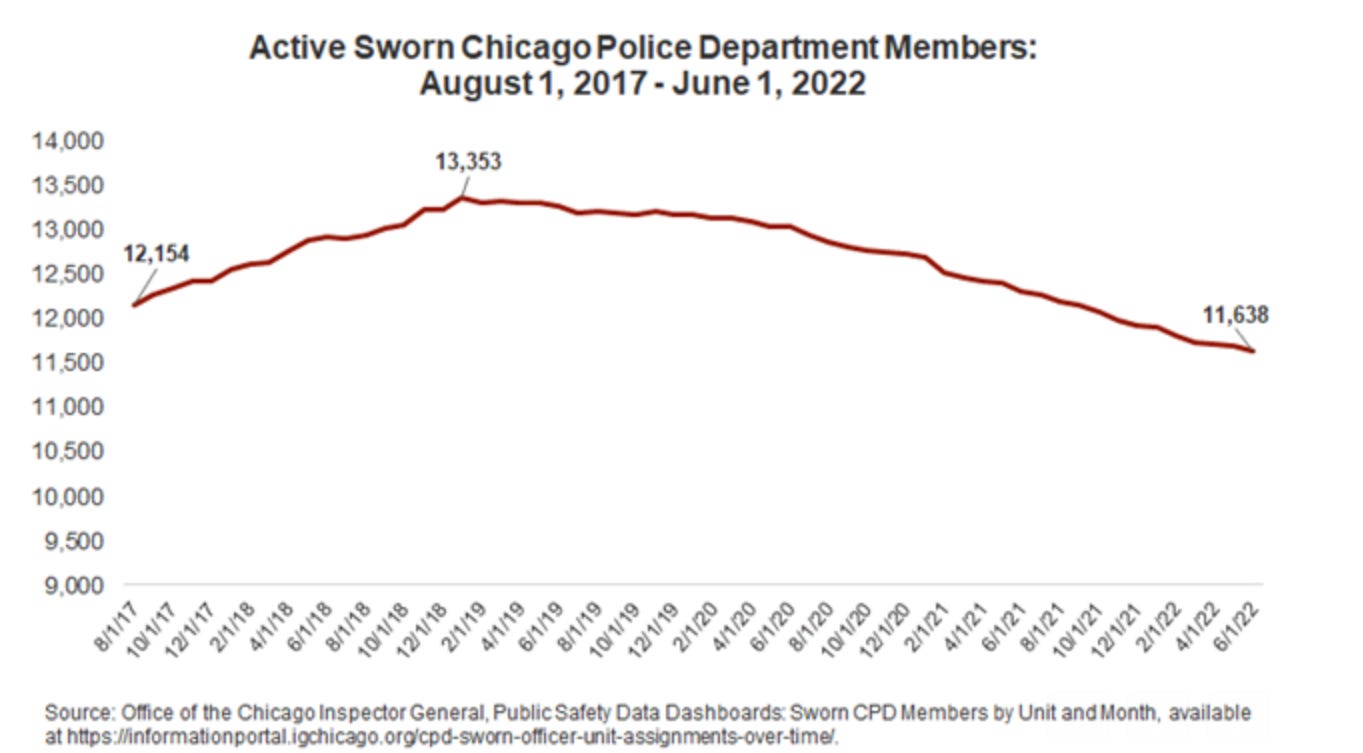

Given the crime situation and the vilification of the police, is it a shock?

NY Blood Center offering beer for blood

Blood levels are at 1 to 2 days and should be 5-7 days. Get out there and donate some blood for the community.

Axios agrees to sell to Cox Enterprises for $525 million

As multiple readers pointed out, this could be the Rosen Report. Any ideas? I will sell for far less than $525mm.

Pentagon says Russian casualties in Ukraine up to 80,000

I really believed this war was going to end quickly with a Russian victory. I cannot believe how poorly the Russian army has done and how weak they appear.

Virus/Vaccine

Improvements continue and cases dropped 15%. Good news. See chart below.

China warns of new Langya virus that has sickened 35 people

If this turns into another pandemic, there better be consequences.

Real Estate

I have written numerous times that when I moved to Boca, my community had 71 homes for sale for an average price of $4.9mm in August of 2017. At the peak last December, there were only 4 homes for sale for an average price of over $19mm. Today, there are 31 homes for sale for an average price of $16.1mm. There are at least 8 houses on the list which are knockdowns and maybe more which would bring up the effective average price to closer to $17.5mm when finished. When I moved here, you could buy an interior tear down house on a 12k foot lot for $1.3mm and now they are asking over $3mm for those lots with 40-year-old homes. Also, the price of construction is up sharply in that time. Homes are staying on the market longer and I am seeing more price reductions, something which was not happening in 2021, especially at the end of last year which was the peak of craziness. Below are some pictures are various price points to give you an idea. The link above shows all 31 homes for sale and a few which are recently under contract. My point is there is more to find relative to late 2021 if you are looking. I also started looking for a family who wants to relocate to South Florida and found far more listings in the $1-3mm in West Palm Beach and Jupiter. Things have cooled and the insanity has died down maybe absent the ultra-high-end Palm Beach and Miami market. However, prices remain sharply elevated relative to pre-pandemic.

More perspective, in 2017, there were 58 sales in my community and only 1 sold above $10mm ($12.4mm). Only 9 houses sold in excess of $5mm in 2017 and 7 of those were under $7mm. In 2021, of the 99 sales, 12 were over $10mm and the top was $25mm. In 2021, 49 homes sold in excess of $5mm. Today, there are 9 homes for sale over $20mm and 20 out of 31 homes are over $10mm asking price. Today, only 6 homes are listed for under $5mm, and I believe they are likely all knock downs.

I spoke with a R/E broker in Miami and people are talking about recent high priced home sales as the Citadel Effect. Rumors are that up to 300 highly compensated people will be relocating from Chicago to Miami over the next 24 months for Citadel. A Citadel employee spent $6.5mm on a house in Pinecrest on Southwest 94th Street. The sellers paid $3.4mm last April which results in 91% appreciation in short order. Think of the impact on the communities of the constant flow of wealthy people who spend money to support local businesses relative to the massive hole left behind where they left (NYC, Chicago, SFO, LA…). AOC does not understand the economics of such moves which is why she blocked Amazon from coming to her district.

Other R/E Headlines

San Francisco ‘Froth is Gone’ as Wealth Fades, Housing Slumps

Tech angst, rising interest rates and crime concerns are colliding to hit home prices in the nation’s most expensive region.

US Housing Sentiment Sinks to Lowest in More Than a Decade

The index, which reflects consumers’ views on the housing market, has fallen from roughly 76 to 63 year-over-year, according to a release Monday.

Builders Are Stuck With Too Many Houses as US Buyers Pull Back

The industry faces a glut of inventory after years of supply constraints fueled an affordability crisis.