Opening Comments

I had a couple small dinner parties on Thursday and Friday. On the menu over the two nights: fresh wahoo cevice, wagyu steak, garlic/ginger crusted salmon, lemon chicken, saffron risotto, scallion and garlic mashed potatoes, roasted cauliflower and broccoli with shallots, leeks, garlic, 7 types of chocolate in the chocolate chunk cookies, oatmeal raisin cookies with butterscotch and apple crumble pie. Yes, I made 100% of it. I am getting so efficient in the kitchen, it does not take me a long time anymore. On Friday night, our kids entertained the group by each playing music, and they crushed it. I got involved and played a few songs on the guitar and harmonica and Adam, one of the guests belted out the tunes including Helpless-Neil Young, Wild Horses-Stones, And it Stoned Me-Van Morrison and a few others. Lots of fun.

Be sure to check out the job listing below the table of contents. Interesting opportunity. Today’s piece has a TON of pictures which makes it longer, but the writing is the same length as usual. Remember, some email systems truncate the report and you need to hit “View entire message.”

Job Listing-Looking for Talented Analysts for Hedge Fund

Picture of the Day-Humans May Evolve To Have Deformed Bodies

Wahoo are Chomping

Quick Bites

Markets

Jeff Gundlach on Bonds

Elliot/Singer on Market-NEGATIVE

Brands With the Most Value-GREAT CHARTS

Paul Allen Art Collection with My Thoughts

Other Headlines

Crime Headlines

Real Estate

Waterfront Bay Road Lot Listing for $39.9mm

Rents Continue to Fall

Bloomberg Housing Article (Positive)

Other R/E Headlines

Virus/Vaccine

Job Listing-Looking for Talented Analysts

I am trying something new today by sharing a fantastic lead for job openings. A good friend is launching a new $750mm credit driven strategy at a very large multi-manager platform. The focus will be on liquid and catalyst-linked opportunities spanning high yield, distressed, special situations and equities. He is looking for hungry and entrepreneurial colleagues to fill out his team. Ideal candidates have at least 5-8 years of experience. If you think you are a fit, I am happy to connect you. Let’s help my friend build a great team to generate amazing returns.

Picture of the Day-Humans May Evolve To Have Deformed Bodies

Hunched back, clawed-hands, and second eyelids could be common features of human anatomy in the future, a recent computer model reveals. The shocking, hopefully tongue-in-cheek report warns that overusing technology could somehow steer human evolution in a direction that leaves people looking deformed compared to what we consider normal today. Researchers worked with a 3D designer to create images of a “future human” that accounts for all of the problems long-term tech use may cause. Given the amount of time my kids are on the phone, I fully expect them to look like the pictures below by the time they are my age. I think I may be getting the Text Claw already.

Wahoo Are Chomping

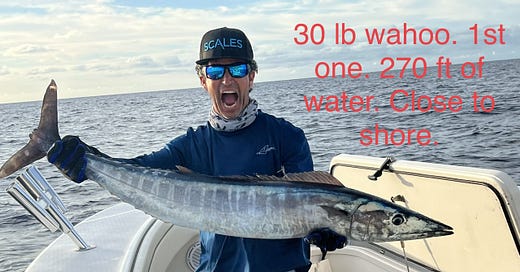

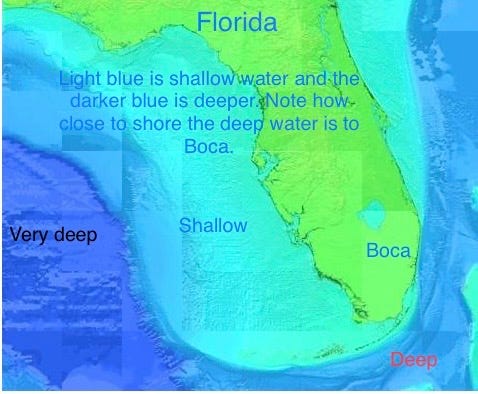

I have frequently written about South Florida fishing and the various species of fish I target depending on the time of year. There are distinct seasons which determine which species you are likely to catch. As water temperatures start dropping back into the high 70s, the sailfish and wahoo show up as the mahi and blackfin tuna leave.

The nice thing about Southeast Florida is the fishing is good close to shore this time of year, and the water gets deep fast. This is very different from Central Florida or the West coast where you need to go out extremely far (40-100 miles). On Thursday, November 2nd, I went fishing and was at the boat at 6:20am. We started fishing at 6:50am and were “doubled-up” by 7:05am. Doubled means two fish at once.

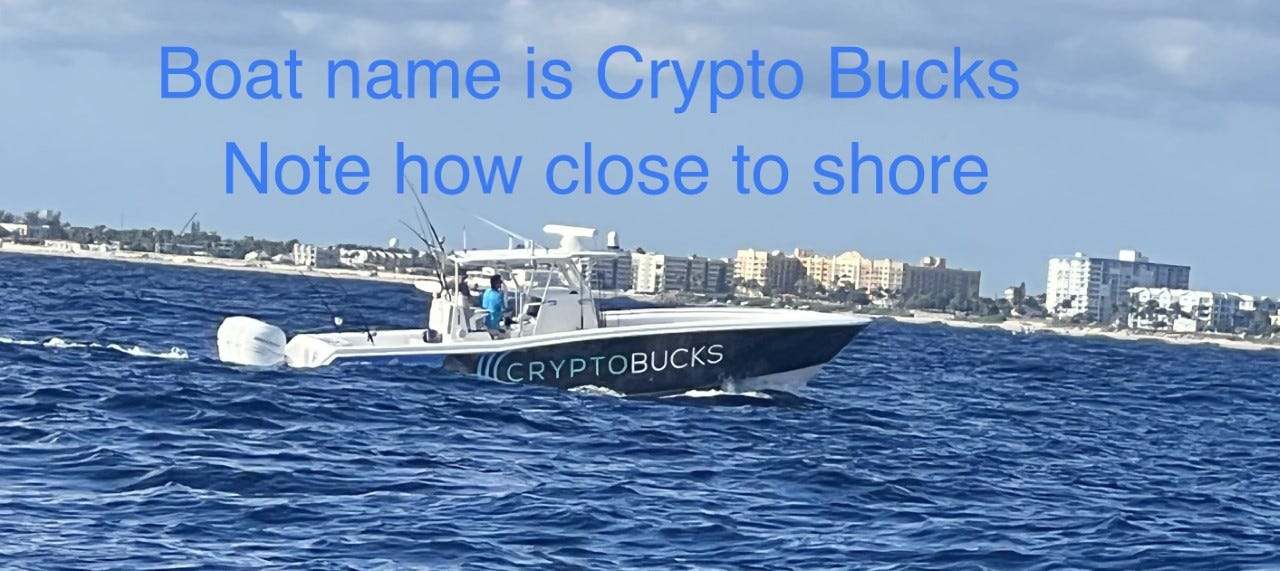

Saw this boat with a fun name. We were catching fish right near this boat.

To me, wahoo are the best tasting fish in South Florida. They are among the fastest fish in the ocean and can swim 60mph. When they hit your bait, they pull out lots of line, and it is a blast fighting them. Please note, Wahoo have extremely sharp teeth and can cause severe injury. I wrote about an incident on my boat while in Bimini where a young man was badly bitten by a wahoo as he did not handle it properly. I am not lying, I thought he may die on my boat. A massive cut on his leg required 50 stitches due to his sloppiness, and he fishes for a living. Thankfully, he just missed the artery. I have the picture, but it is too disgusting to share. Point is be very careful.

Back to fishing. After the line broke on one rod, I ran over to help my friend, John. It was a larger wahoo and need to gaff it. I went to the back of the boat by the engines and as I gaffed the fish, I slipped as water is back there on the ground and fell, almost losing the beautiful fish into the propeller. I jumped back up with my cat-like reflexes and nailed the beast again and carefully brought him on the boat. Given the teeth, I dragged him to the fish box to let him settle before taking pictures.

I am a little superstitious with my hats that I wear while fishing, and clearly, the last two hats had bad mojo. Looks like I am sticking to the black Scales hat for a bit.

I decided to run out looking for mahi as the season is ending and my freezer is almost empty. I drove out to 800 feet (8 miles) of water looking for weeds, birds or debris and ZIPPO, so I headed back in and decided to troll back to shore and WHAM, we were doubled up again. I grabbed the small rod which was meant for mahi (dolphin), but the wahoo was too big for the rod and the little lure, and I lost it. The rod had a smaller wahoo, and I did a much better gaff job on it.

The tide, wind, water temperature, moon… all play a key role in fishing, especially wahoo. When they all line up (not the case today), it could get epic. My best wahoo fishing is done in the Bahamas between November through March. There are days we can catch 8 fish or more in a few hours and they tend to be larger.

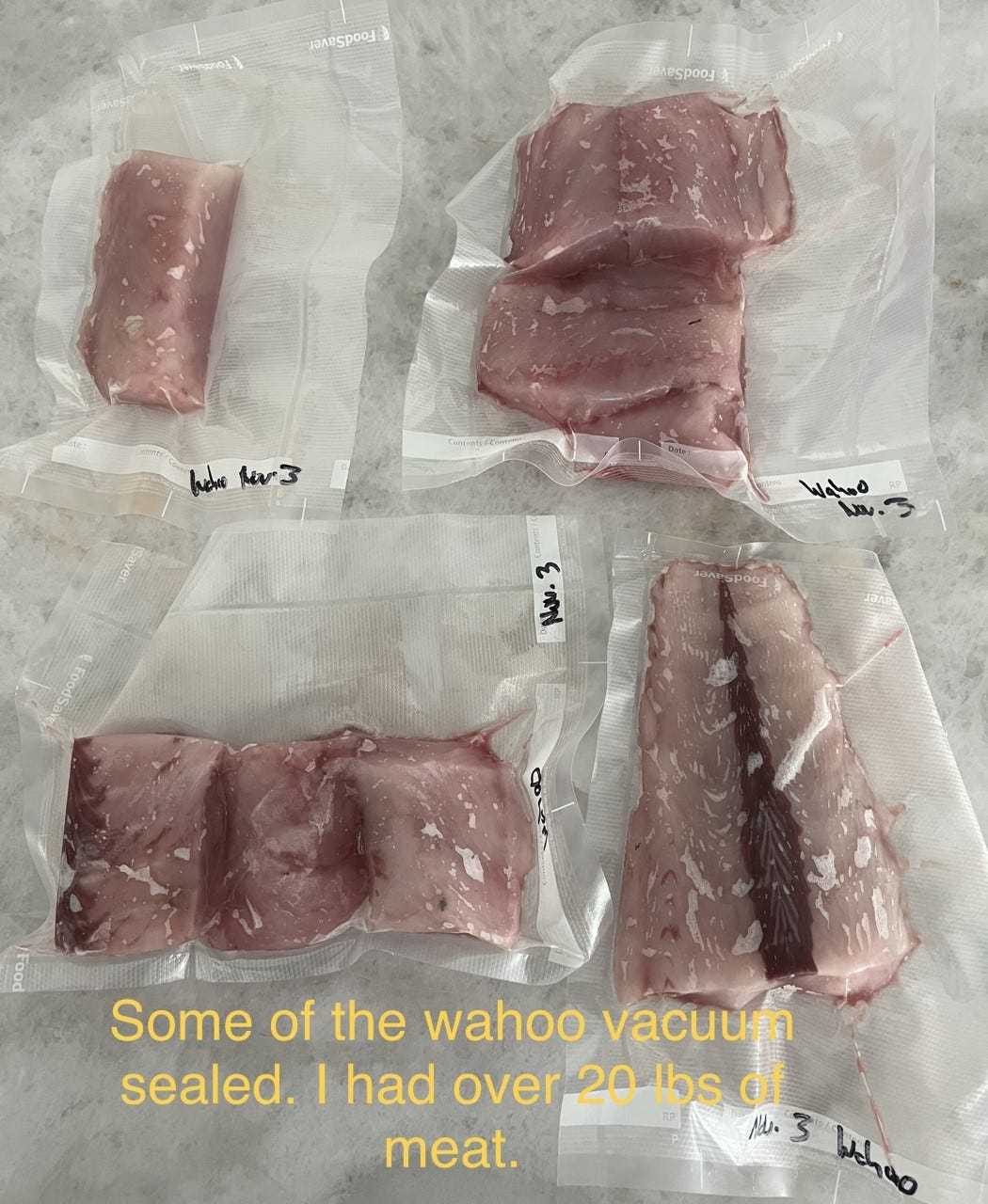

We were back at the dock by 10:15am. Hate on South Florida all you want. If you love the outdoors and want to fish, it is pretty amazing. The only downside of catching fish is cleaning them and the boat, which was a bit of a disaster (took me over an hour). Then, I had to vacuum seal the fish which took me over 30 minutes. Here is small sampling of the vacuum sealed fish which goes in the freezer. I have over 3 times this amount including what we ate. I expect to catch many more wahoo this season. The meat is like tuna and I sear it, use it in ceviche, tacos or grill it.

Quick Bites

Stocks rallied on Friday, but finished the week lower, as investors drew conflicting conclusions about what the latest payroll numbers mean for future Federal Reserve rate hikes. The Dow gained 402 points, or 1.26%, to close at 32,403. The S&P 500 advanced 1.36% to settle at 3,771, and the Nasdaq rose 1.28% to finish at 10,475. All the major averages capped off the week with losses. The Dow shed 1.4%, ending four weeks of gains. The S&P and Nasdaq fell 3.35% and 5.65%, respectively, to break two-week winning streaks. October’s no-farm payrolls report on Friday left investors divided, fueling some concern that the Fed will persist with its hiking campaign since the labor market added 261,000 jobs. Others interpreted the findings as a sign that the labor market is beginning to cool — albeit at a slow pace — since the unemployment rate rose to 3.7%. The 2-Year Treasury sold off sharply on the week (+23bps in yield), given Powell’s comments and closed at 4.65% The 2s/10s Yield Curve is -49bps, which is at recent lows and another sign of recession (see below). Every time 2/10 curve inverted since the late 70s, there has been a recession as seen in the chart below with grey vertical lines as recessions. Oil rallied 5% on Friday to $92.6 and was +7% on the week. Hopes of China ending the lockdown and an EU ban on Russian oil helped to raise the market, despite the fact that Biden has released 180mm from the Strategic Petroleum Reserve which is now at lows since 1984. Bloomberg article entitled, “Biden Feud With Big Oil Ratchets Up Just as World Needs More US Oil.” Second chart is on capital markets activity in October and you can see how slow it is as outlined in the WSJ article entitled, “Raising Money on Wall Street Hasn’t Been This Hard in a Decade”

DoubleLine Capital CEO Jeffrey Gundlach said the bond market has become far more attractive than stocks, such that investors could get an 8% annualized return. The so-called bond king said Treasurys are now “potentially a profit maker,” in an interview on CNBC’s “Closing Bell: Overtime.” He added that his copper-to-gold indicator suggested that the benchmark 10-year Treasury yield is overvalued by 200 basis points, meaning the price has room to go up. Bond yields move inversely to their prices. Buying safe government bonds allows investors to shop for riskier, more opportunistic credits in the market, Gundlach said. Spreads on non-Treasurys have widened, including guaranteed mortgages, junk bond yields, emerging market debt and asset back securities, he added. With 10-year Treasury yielding around 4% and riskier credits yielding about 12%, Gundlach said investors could build a bond portfolio with an 8% return, and the strategy also has a natural hedge. I’m a big fan of “Gundy,” and my colleagues all knew this about me. One smart ass put a big picture of Gundy in my office, and I left it up there for years. I agree that bonds are a way to go. I started buying bonds a couple weeks too early. The High Yield Bond market yields just under 9.4% today. Below are US Treasury Bond yields.

In a letter sent to investors, the Florida-headquartered hedge fund, Elliot, told clients that they believe the global economy is in an “extremely challenging” situation which could lead to hyperinflation. Elliot told its clients that “investors should not assume they have ‘seen everything’” because they have been through the peaks and troughs of the 1987 crash, the dot-com boom and the 2008 global financial crisis and previous bear and bull markets. They added that the “extraordinary” period of cheap money is coming to an end and has “made possible a set of outcomes that would be at or beyond the boundaries of the entire post-WWII period.” The letter said the world is “on the path to hyperinflation”, which could lead to “global societal collapse and civil or international strife.”

They estimated that markets have not fallen enough yet and equity markets could drop more than 50% would be “normal,” adding that they couldn’t predict when that would happen. There are so many “frightening and seriously negative possibilities” that it is hard not to think that “a seriously adverse unwind of the everything bubble” is coming. I am not suggesting I agree 100% with this thesis. However, I do believe we have challenges ahead and cracks are showing in the system. I am of the opinion that the economy will slow and inflation will slow further next year requiring the Fed to cut rates. I will be surprised if the lows were already made in stocks.

Given the elusive nature of brands, determining a brand’s financial value is a difficult task. Despite a brand’s intangibility, it’s hard to deny just how effective a strong one can be at boosting a company’s bottom line. With this in mind, Brand Finance takes on the challenge of identifying the world’s most valuable brands in the world in its annual Global 500 Report. The graphic, using data from the latest edition of the report, highlights the top 100 most valuable brands in 2022. Brands take many years of hard work to create to have real value. The article is interesting, and enjoyed the chart below. The top 10 list is a snippet from the piece. Many other good charts in it. Good charts and info in the link.

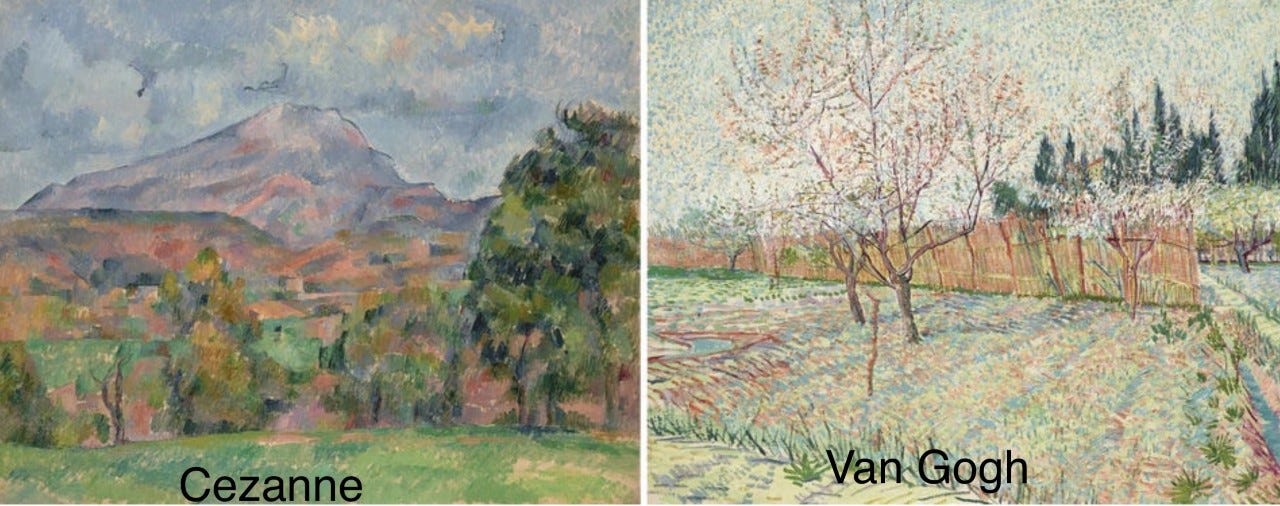

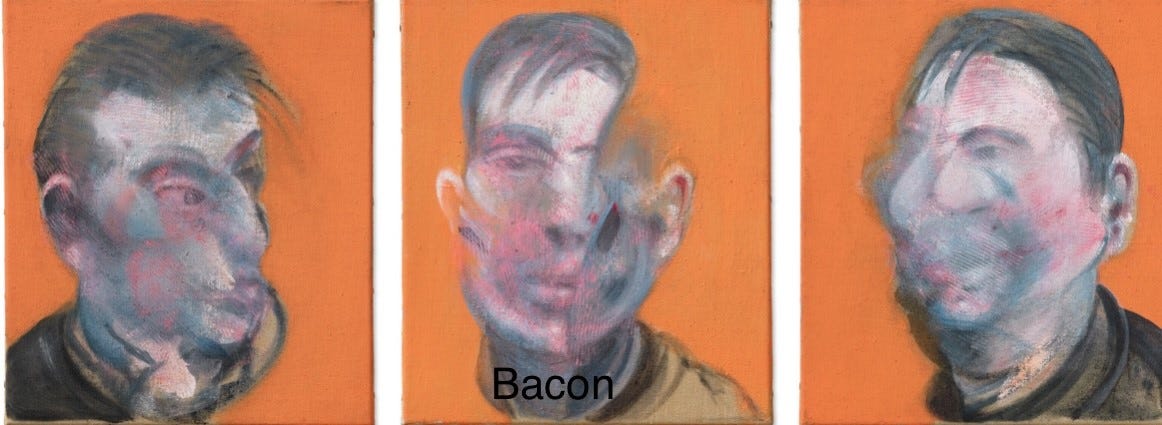

More than 150 masterpieces owned by the late Microsoft co-founder, Paul Allen,—including works by Botticelli, Cezanne, Seurat, Monet and Hockney—paint a portrait of the billionaire as a passionate collector. Next week they go on the block at Christie’s and will break a record for the most expensive sale of all time. I went through the collection, and it is incredibly impressive given the importance of some of the pieces and the breadth and diversity of the artists. I have never seen a more varied collection of artists and periods. The Macklowe collection sold in the last year for $922mm, and this collection is estimated to sell for over $1bn. Three lots are estimated at over $100mm. Great works by Jasper Johns, Georgia O’Keeffe, Manet, Lichtenstein, Picasso, Van Gogh, Klimt, Calder and many others. Allen loved landscapes and two below are estimated at $100mm+. I am a huge Lichtenstein fan, but Allen’s is a disappointing one. There are some underwhelming pieces in the collection, but those are dwarfed by the importance of the good ones. Some truly amazing pieces in this collection, and as I understand it, the proceeds go to charity. The last picture is a Francis Bacon. I do not like his work, but the estimate is $25-35mm. Hard pass.

Other Headlines

The Huge Problem That Nobody Cares About

NYTimes article on the National Debt at $31 trillion.

Bank of England expects UK to fall into longest ever recession ever

Amazon pauses hiring for corporate workforce

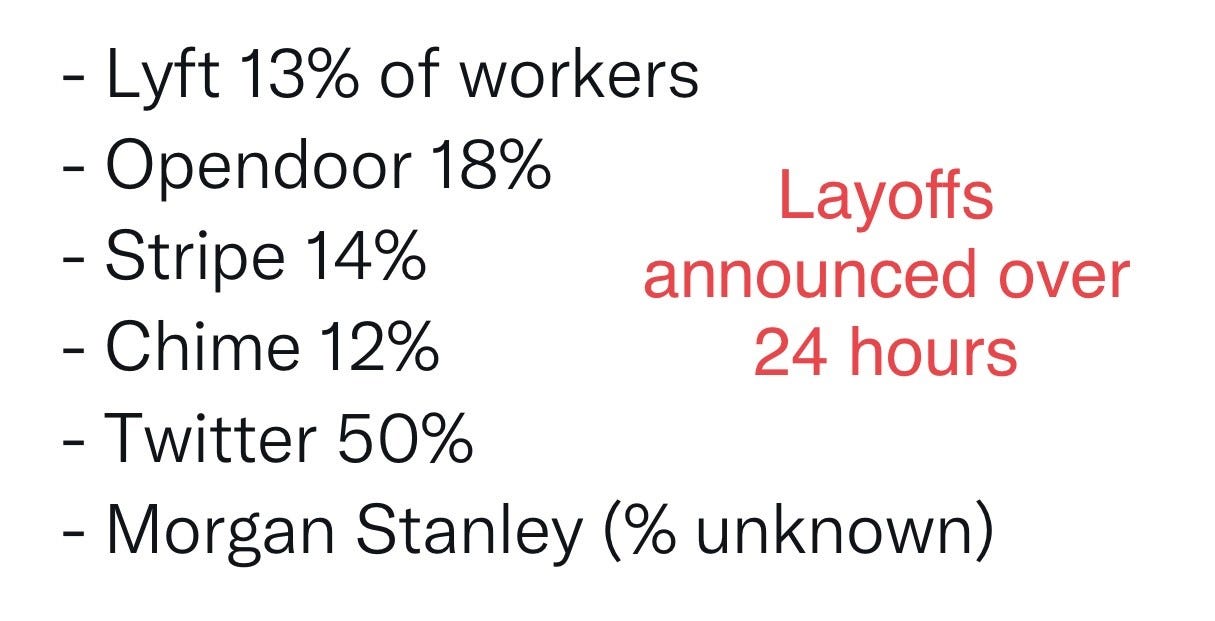

Many tech firms were on a long-time hiring tear, and many are pausing or laying off now. Stripe lays off 14% of workers. Twitter plans to eliminate 50% of Jobs to Cut Costs. Lyft cuts 13% of its workforce.

Twilio's stock plunged 35% as quarterly loss, outlook spooks investors

Stock -84% YTD.

Elon Musk says Twitter has had ‘massive’ revenue drop as advertisers pause spending

I stand by my comment that he overpaid by $25bn+ for Twitter. Also, this takes his eye off his other companies (TSLA, SpaceX, Boring, Neuralink).

Carvana tumbles after posting declines in nearly every aspect of the car reseller’s business

The stock was $361 in August 2021 and is now $8.76/share. -96% YTD

Thanksgiving dinner will be a lot more expensive this year, report finds

Iron-Ore Prices Buckle as China Property-Market Slump Drags On

A submerged buoy-like device is harnessing the sea’s ‘epic amounts of energy’ in Scottish trial

Sounds interesting. I don’t understand how this works.

Which will happen first — a Trump indictment or 2024 presidential announcement?

Oprah snubbing Dr. OZ to endorse Fetterman days before the 2022 midterms is raising some questions

Sadly, Fetterman is in a diminished capacity due to a stroke. I would say the same if he were a Republican. He is not fit to serve and his debate and interviews show it. Oprah, would you want him as the CEO of your company? Funny, I thought you launched Dr. Oz on your show.

Homelessness has risen 70% in California’s capital. Inside the staggering emergency

Will L.A. Voters Approve ‘Soak-the-Rich’ Ballot Measure to Raise Taxes on Mansion Sales?

Proposed transfer tax on any property over $5mm at 4% tax and over $10mm 5.5% tax in addition to the existing .45% tax.

What does it take to get into an Ivy League? Admission, more

Good bios of kids who were accepted. Let’s be clear, I would be washing dishes for a living if I tried to get into college today.

Surprise! Midtown East has one of NYC’s best new restaurants

Monterey on E 50th. Same owner as Dagon, which I enjoyed despite the horrible location.

Average person believes they hit peak health at 34, began noticing signs of aging at 42

Nets suspend Kyrie Irving: ‘Currently unfit to be associated’ with team

This comes a little late in my mind. Nike suspended its relationship with Kyrie as well. Why is the NBA not saying more about Kyrie?

Remember, MrBeast has 100mm YouTube subscribers. The guy is making insane money. I want to trick or treat at his house next year, and I will bring 20 different costumes to keep going back.

Crime Headlines

Homeless man with 25 prior arrests busted in rape of NYC jogger, is suspect in two other sex crimes

If the Republicans end up doing better than thought a couple weeks ago, I believe crime and inflation have a lot to do with it. He choked her so hard, several bones broke in her neck.

Brooklyn judge weighing soft sentence on attempted murder if suspect apologizes

Man arguing with staff stabbed by another patron at NYC’s Ruth’s Chris Steak House (Midtown Manhattan)

Shavell Jordan Jones kills girlfriend, 3 of her relatives — including 4-year-old girl

Oregon families find razor blades in Halloween candy

What the hell is wrong with people?

Shots fired at Republican candidate Pat Harrigan's North Carolina home

This happened weeks ago and did not see any coverage on it. Kids were home at the time.

NJ Synagogue Threat: FBI Says Credible Information Developed

Why is there so much Jew hate? Only 15mm Jews in the world out of 8bn people.

South Dakota Senate candidate Joel Koskan charged with felony child abuse

This is a DISTURBING article. He needs to be in jail.

Real Estate

I have often written that North Bay Road in Miami Beach in the 50s and 60s on the bay is the most sought after address. Marcello Claure (Softbank/Sprint) is selling a vacant lot and asking $39.9mm. It comes with plans for a 14,000 ft home. He paid $11.1mm for the .6 acre property in 2020. My broker friend believes this is worth $35mm minimum. With a new, modern home, it could be worth $75mm. How many places in the US, could you have bought a lot in 2020 for $11mm and sold it 2 years later for $35mm+? Not many.

From Peter Boockvar. Over the weekend, Apartment List.com released its November National Rent Report (covering leases for new tenants as opposed to extending expiring ones) and said "Our national index fell by .7% over the course of October, marking the 2nd straight m/o/m decline, and the largest single monthly dip in the history of our index, going back to 2017. These past two months have marked a rapid cooldown in the market, but the timing of that cooldown is consistent with a seasonal trend that was typical in pre-pandemic years. Going forward it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market." This said, new rents are still up 5.9% y/o/y and "continues to outpace the pre-pandemic trend, even as it has slowed significantly from last year's peaks" but that is a sharp slowdown from the 18% y/o/y increase at this point in 2021.

A reader sent me a Bloomberg article entitled, “US Homeowners Have a Fat Equity Cushion for Real-Estate Downturn.” The article is definitely has a positive spin on the housing market being short on inventory and high on homeowner’s equity.

1) Out of 58.1 million outstanding mortgages in the US, only about 227,100 homeowners were facing possible foreclosure. Just to put this in perspective, the shortage of inventory for houses is estimated anywhere from 2 to 5M units. Only 0.6% of the US houses are possibly facing foreclosures.

2) Florida is flourishing: They are 19% more equity rich houses in Florida from Q3 2021 compared to Q3 2022.

Other R/E Headlines

House hunting this weekend? There's more out there now

Inventories +33.5% in October from one year ago.

Virus/Vaccine

Hearing about more readers getting infected. A trainer at a gym told me it seems that many of his clients are sick. Positivity rate up a touch, as are cases.

Finland's Covid death toll could be exaggerated by 40%, THL says

Very few patients under 60 have died solely from the virus since last spring, a top specialist at the health agency says.

Thanks.