Opening Comments

My son, Jack, and I are in Saucon Valley, PA at the club which just hosted the US Senior Open. A few days of golf before heading back to NYC for some food and then likely back to Mass for golf before heading back to Florida. One irritating thing about most schools in Florida is the start of the year is mid-August. All schools should start post Labor Day like they do in NY. Going from mid-September to mid-June makes a ton more sense and August-October in Florida are the worst months from a weather, humidity, heat and rain perspective. My daughter, Julia, starts high school August 15th as a freshman.

Jack and I spent one night in NYC on the Upper East Side. I spoke with a doorman who told me that there has been a lot of tire deflations/slashings on the block of 64th between 5th & Madison (high rent district). The cars attacked are SUVs and the attackers leave a note about the gas guzzling vehicles and call themselves the “Tire Extinguishers.” Here is a news story on the subject from June. When we left the city Monday am, I saw this at a bar in the West Village which I thought was kind of crazy. Picture from my phone for those who question it as authentic.

Today I combined Picture of the Day with the main story as there are a lot of pictures and I am trying to keep things tighter. In today’s piece there is a common theme in Quick Bites and Other Headlines around slow down, layoffs, inflation peaking and a challenging environment.

What Lurks Beneath the Sea

Quick Bites

Markets

WMT/UPS Earnings/Inflation

Alphabet/MSFT/Chipotle Earnings

German Natural Gas Crisis

Euro Electricity Prices

Manchin/Schumer Energy/Tax Bill

Falling US Birth Rates Explained

Other Headlines

Virus/Vaccine

Data-Improvements From Past Weeks

Real Estate

General Comments-LA Office Building

Biggest Inflows/Outflows of People in Cities

No Real Surprises Here

Commercial R//E Data

Other Headlines-Good Articles

What Lurks Beneath the Sea

My readers know I spend a lot of time in or on the water. I have surfed for 40 years and am an avid fisherman. I have seen some crazy things in the water in my life which has taken me all over the world. I have surfed and fished in Mexico, California, Canada, Puerto Rico, Bahamas, Barbados, Fiji, Maldives, Louisiana, New York, New Jersey, Florida, Jamaica and others as well. While surfing, I have seen sharks, lion fish, sea urchins, whales, sea snakes, crocodiles and trust me, I have left the water at times over fear when something just felt wrong. Of course, I need to put in a couple old surfing pictures from my 40s. I made the mistake of going snorkeling in Fiji and saw big sharks and sea snakes. I surfed scared the rest of the time. Sea snakes are among the most poisonous snakes in the world.

The first story is about a whale which was breaching in front of many boats. Looks like a good idea to be up close, right? One boat got a little too close and a humpback whale landed on the bow of the boat when it jumped out of the water off the coast of Massachusetts in the area of White Horse Beach in Plymouth. Thankfully, no one was hurt, but wow, that could have ended poorly. The link to the story and short video is here. Humpacks are only approximately 50 ft and 60,000 pounds, so nothing to worry about in a 19 foot boat.

The next story about the dangers of the sea took place in Stuart, Florida while fishing. A 73-year old woman from Maryland was fishing after a sailfish jumped out of the water and pierced her lower abdomen as her friend was reeling in the fish. The full story is here (no video of it). I have caught over 100 sailfish on my boat and they are fun and beautiful. I release 100% of them. I can tell you that they are strong and their bills are like 20-grit sandpaper. The picture is me releasing one. I have a glove on for good reason and they can hurt you in a hurry. They jump and skip on the water all the time. Here is the crazy video of me on my boat catching three at one time and getting stung by the man of war while trying to revive the sailfish.

The last story includes a crazy 3 minute video of a man diving in a clear cage for “Shark Week” on Discovery. He gets attacked by a 16-foot Great White Shark in terrifying fashion. He lives to tell about it, but this is one hell of a fright. There is a 100% chance I crap my pants if this happened to me. The video is only a few minutes and well worth the look. The shark attacks the cage and breaks it throwing the diver into the water. I would be scared to take a shower if this ever happened to me.

Could you imagine being the guy in this plastic thing getting ready to be eaten by that mouth? Stuff of nightmares. One second after the picture below, the shark bit the cage and the diver was knocked into the water.

Quick Bites

Stocks rallied Wednesday after the Federal Reserve announced its much anticipated 0.75 percentage point rate increase to fight inflation, but hinted that it could slow the pace of its hiking campaign at some point.

The Dow jumped 436 points, or nearly 1.4%, to 32,198. The S&P 500 gained 2.62% to close at 4,024. The Nasdaq climbed 4.06% to 12,032. To me, the important comment from Powell was, “As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.” On the year, the Dow is -11.4%, S&P-15.6% and the Nasdaq-23.1%. The 10-Year Treasury was largely unchanged, but the 2 year rallied 6bps to 2.98%. The 2/10s spread is now -18bps. Oil is back to $98/barrel (+3.3%) but natural gas was -3.6% to $8.7 after being over $1 higher yesterday. Cooling temperatures probably contributed to the sell-off. Bitcoin was + 8.7% and Etherum +17.3% on the day and are now at $22.7k and $1.6k respectively. Five weeks ago, ETH was in the low $900s. I feel the Fed is on the right track with two aggressive rate hikes. They were accommodative too long, but are showing they mean business and the markets are reacting positively. Inflation has peaked in my opinion. I remain disappointed in the continued Fed actions over decades. They need to be better and more responsive rather than falling behind the curve.

Walmart cut its quarterly and full-year outlook and suggested inventory is building as people have less discretionary income due to inflation. It has left WMT with more clothing and larger ticket items such as appliances and TVs resulting in the need to discount. WMT stock fell 9% after the announcement. Walmart said it now anticipates adjusted earnings per share for the second quarter and full year to to decline around 8% to 9% and 11% to 13%, respectively. I called for inflation peaking in recent weeks and we have seen commodities tumble, cars, R/E and other assets fall from high levels and housing slow sharply. I continue to believe we are seeing peak inflation. This WSJ Opinion piece by Donald Luskin on inflation is interesting. Check out expected inflation in 13 months’ time (2.3%). Also of note, UPS discussed lower than expected volumes by 222k packages a day during earnings. The miss was partially attributed to lower volumes with Amazon. What is that sound? Demand Destruction. UPS stock was -3.5% on the news.

Alphabet missed on earnings and revenue for second quarter due to advertising and cloud. Revenue growth slowed to 13% in the quarter from 62% a year earlier, when the company was benefiting from the post-pandemic reopening and consumer spending was on the rise. Microsoft missed, but positive guidance had the stock up 5%. The miss cited exchange rates and advertising challenges as well as lower PC revenue. Chipotle reported disappointing sales, as price hikes helped to boost profits, but scared off inflation weary consumers. Facing higher food, packaging and labor costs, Chipotle also said it would hike prices again in August. Same store sales were +10.1% vs +10.9% expectations. Meta missed on top and bottom lines and gave a troubling forecast due to a weak advertising demand environment and the stock fell 3% after earnings.

I continue to write about the German natural gas disaster because it was easily avoidable with better leadership and decision making. Retiring coal and nuclear facilities too early, being reliant on alternatives not ready for prime time and assuming Putin/Russia will be there to help were clear mistakes. The US has the resources to be energy independent, yet vilify those who produce it. Russian energy giant Gazprom on Monday said it would halve gas supplies through its main pipeline to Germany, keeping European countries in a state of uncertainty as they scramble to prepare for winter. Starting Wednesday, the daily gas flow through the pipeline will be 33 million cubic meters, Gazprom said, citing problems with a turbine. That amounts to about 20 percent of capacity — half of the level it had been. Natural gas prices rose almost 20% in Europe in the two days post the Russian announcement. US Natural gas is hit a high $9.8 MMBTU Tuesday vs a 2022 low of $3.6 given the heat wave in the US, while Euro Nat gas is in the $53 MMBTU range. The crisis in Europe has forced more gas to be converted to LNG to ship overseas given the huge price disparity. However, the US is at the LNG production limit. Europe is rationing gas now and this article suggests Europe is condemned to a rescission as a result of the situation.

Let’s go to Euro electricity prices and you will clearly see the pain on the consumer without government aid and the impact on manufacturing goods. I think the charts speak for themselves. I also had my energy expert friend and reader help me convert prices to show what my electric bill in Florida would be in France today without government assistance. My last bill was $930 (highest in the summer in Florida and about 1/2 in the winter). This includes all kinds of set up fees, transmission, taxes and natural gas fees used for electricity production. My price is $40 MWh and France is $500 MWh for the electricity portion. If I look at my electric alone of $515 without the other fees or fuel, it would be approximately $6,500 in France without assistance from the French Government. I read the government has frozen price increases due to the issues, but do not believe all countries are doing this. I did not factor in fuel charges which are 7 times higher in Europe than the US to keep it simple. But if I did factor those in, the French bill would be even higher.

This news story hit at 5pm tonight and details are sparce, but it is important. Manchin and Schumer have reached a deal on energy and tax policy according to numerous articles. Manchin said in a press release that his agreement with Schumer “would dedicate hundreds of billions of dollars to deficit reduction by adopting a tax policy that protects small businesses and working-class Americans while ensuring that large corporations and the ultra-wealthy pay their fair share in taxes.” I have not seed details, so I don’t have a strong opinion yet.

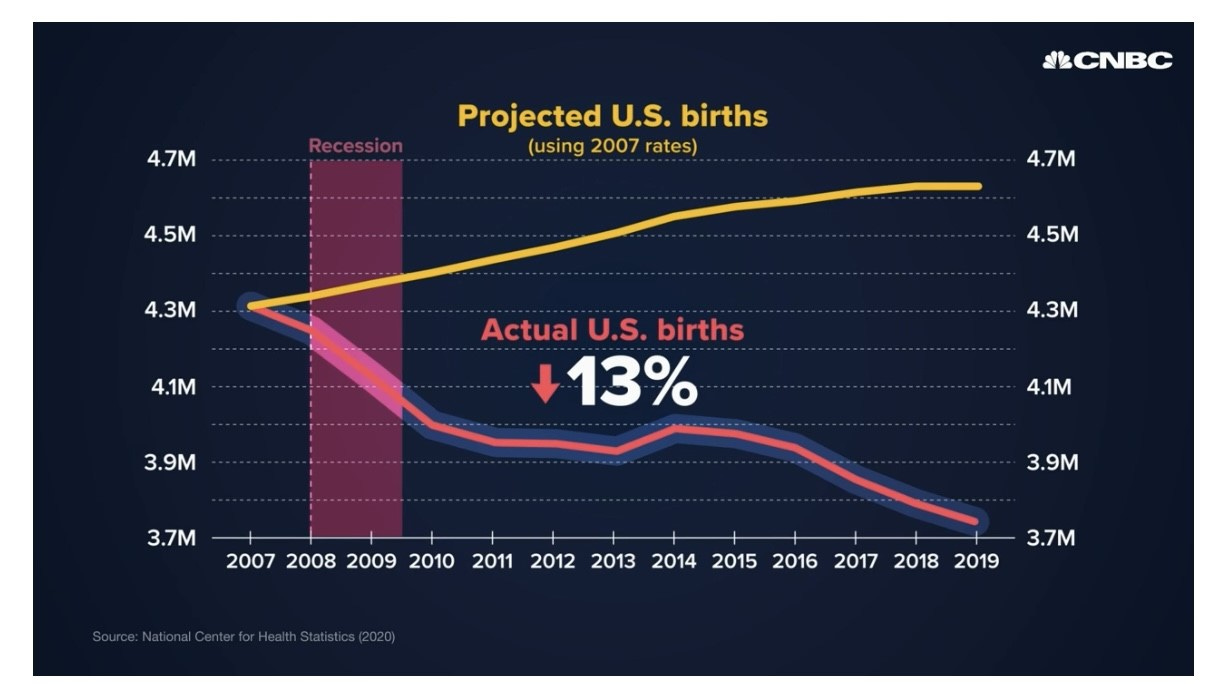

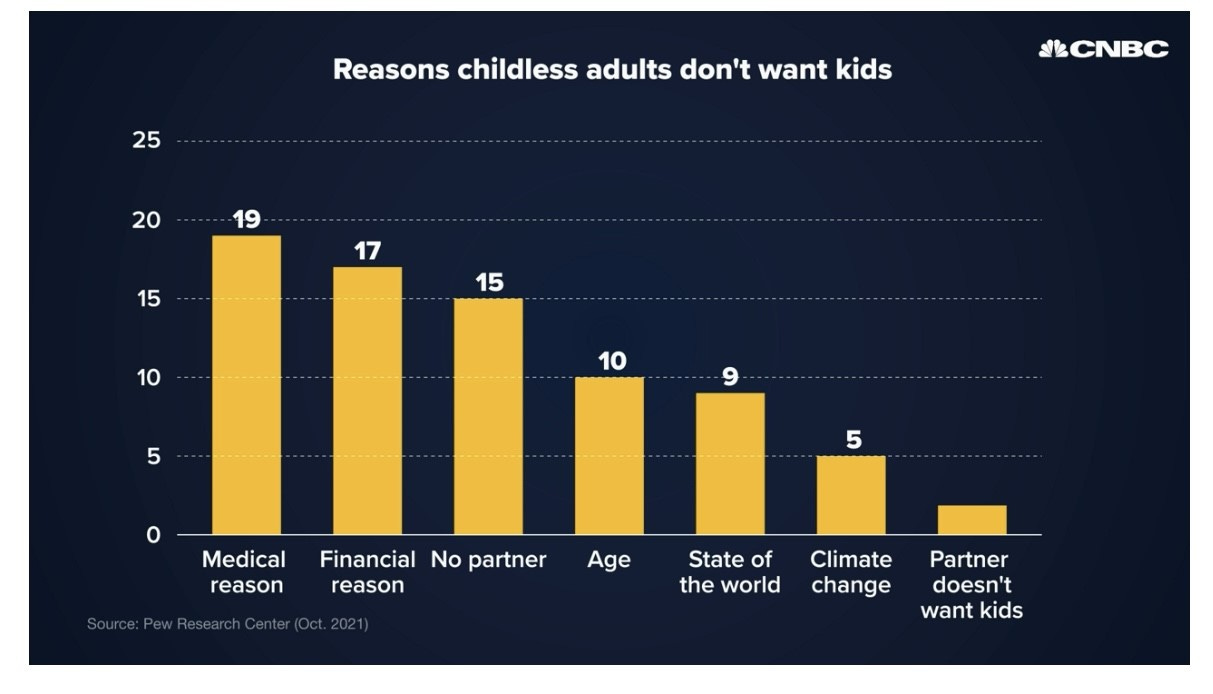

The birth rate in the US is falling and a surprising number of my readers have reached out to me about this topic. The video is only 3 minutes and has good charts. I have included a few below. Financials play a big role in the decision making process for having kids. Recessions lead to lower deaths and post the great recession, births declined and have continued to do so (2nd chart). Many younger folks are not looking to settle down, buy a house and start a family today. I would love to see the 1st chart from 20 and 50 years ago.

Other Headlines

Rising food prices mean smaller burgers and pizzas at restaurants

I can tell you that given I have travelled extensively this summer, over 50% of the restaurants I attend seem to have smaller portions. The other day, I had the smallest piece of chicken for $40. The $15 guacamole is insulting.

Calling In Sick or Going on Vacation, Workers Aren’t Showing Up This Summer

From June 29-July 11, 3.9mm Americans did not work due to Covid relative to 1.8mm for the same time last year. For vacations, 4.8mm took vacation during the period in question vs 3.7mm last year.

Mark Zuckerberg ‘visibly frustrated’ over worker’s vacation question

Interesting exchange with an employee. More layoffs coming where Zuckerberg suggested it was one of the worst market downturns in recent history and Meta will be implementing higher standards of performance for employees suggesting many won’t make the cut.

Shopify sinks 16% after company plans to lay off 10% of workers

The company also stated that inflation and rising rates would weigh on consumer spending.

General Motors’ Income Tumbles 40% on China Loss, Parts Shortage

Curtailing hiring.

Trump should be worried after 'crushing' loss of support from the WSJ and New York Post: columnist

I agree with the tone of the articles that he is unfit to hold office again. Despite liking most of his policies, I feel he is a detriment to the country and do not want him to run. Throwing his name in the ring will give the Democrats fodder to raise big money from all the billionaire haters.

Merrick Garland does not rule out prosecuting Trump over Jan. 6

Schumer Strips Anti-China Security Provision From Major Semiconductor Bill

I don’t understand why as a country we don’t play hard ball with China. They are the worst partners ever.

FBI, DOJ accused of burying Hunter Biden dirt: Sen. Chuck Grassley

Concerning allegations if proven true. I would say the same if government agencies did this for a Trump kid.

Flashy Brooklyn bishop defends lifestyle after $1M jewelry heist

He wears Gucci suits, diamond chains, massive diamond watches and drives a Rolls, but it is not his fault he was targeted in a $1mm heist. Of note, he did 5 years for fraud and grand larceny.

Girl shot in head was witness to deadly Philadelphia traffic cone attack, reports say

The girl shot witnessed the four children kill the man with a traffic cone. They have not caught the shooter.

Eric Adams calls cop attack reason for NY bail reform fix

Horrible story of a 16-year old who just was arrested for robbery and released. He attacked an officer who stopped him for not paying a subway fare. Check out Mayor Adams short video. Without changes, these cities are screwed.

I wrongly suggested it was bail reform. The attacker was charged with a lesser offense not bail eligible. The DA was a friend of Zeldin and apparently wanted it to look like a bail reform issue to make Zeldin (tough on crime) to look good. I wanted to correct the record.

NASA satellite images show how much Lake Mead has receded since 2000

'Sextortion' cases against CEOs, Hollywood celebs explode

Concerning story. Given I know my readers, I have a feeling this will be the among the most opened links.

Highly potent weed creating marijuana addicts worldwide, study says

Struggle opening jars? Here's why that might indicate more serious health issues

Tickets to Adele's Las Vegas Residency Cost as Much as $41,000

I love Adele, but you lost me long before $41k/ticket. I would not pay $41k to see the Beatles, Led Zeppelin or Jimmy Hendrix! Two people, airfare, hotel, dinner and show for almost $100k. Hard pass.

Apple Watch Series 8 rugged model to reportedly introduce new design

Russia says it wants to end Ukraine's `unacceptable regime'

Right now, if Zelensky ran for President in the US, I think he would win if he were American.

Virus/Vaccine

The good news is case growth was -2% and appears to be stabilizing. However, positivity remain uncomfortably high at 18%. Hospitalizations, ICU and deaths continue to grow, albeit at slightly slower levels.

Fauci: Covid Restrictions Should Have Been ‘Much, Much More Stringent’

I wrote over a year ago it was time for Fauci to retire and move on. He has been wrong about so much and funded the gain of function research in the Wuhan Lab. His idea that restrictions should have been “Much more stringent,” is idiotic. The country is in turmoil 2 years later from the economic impact of the shutdowns and the massive stimulus which resulted. If you had co-morbidity, lock down. I am not convinced the lock-downs were as effective as Fauci believes and the economic impact of much more stringent lockdowns would have been devastating. Remember, he suggested masks do nothing early in the pandemic. Sorry dude. Time to retire with your $400k+ pension. Countless articles suggest lockdowns did not have a big impact on reducing deaths. However, we know the economic impact to the tune of trillions. Could you imagine more stringent lockdowns?

WHO: Monkeypox could spread well beyond men, gay, bisexual communities

Real Estate

In the past couple months, I have written about R/E prices peaking in both residential and commercial markets across the globe. Here is another concerning example about the LA office market. After nearly a year on the market, the Union Bank Plaza in downtown Los Angeles is poised to sell for $155M — far less than the $250M it was once expected to command. That sale price is significantly less than the $208M KBS Realty Advisors paid when it purchased the tower at 445 South Figueroa St. from Hines in 2010, property records show. As leases expire, the new rents will be fractional to the old given the large vacancies, work from home and exodus from many cities. Historically, if you owned a building over a 10-20 year period, you made a lot of money as rents increased dramatically and valuations went up sharply. Many owners who have had buildings for 10-20 years are now significantly under water.

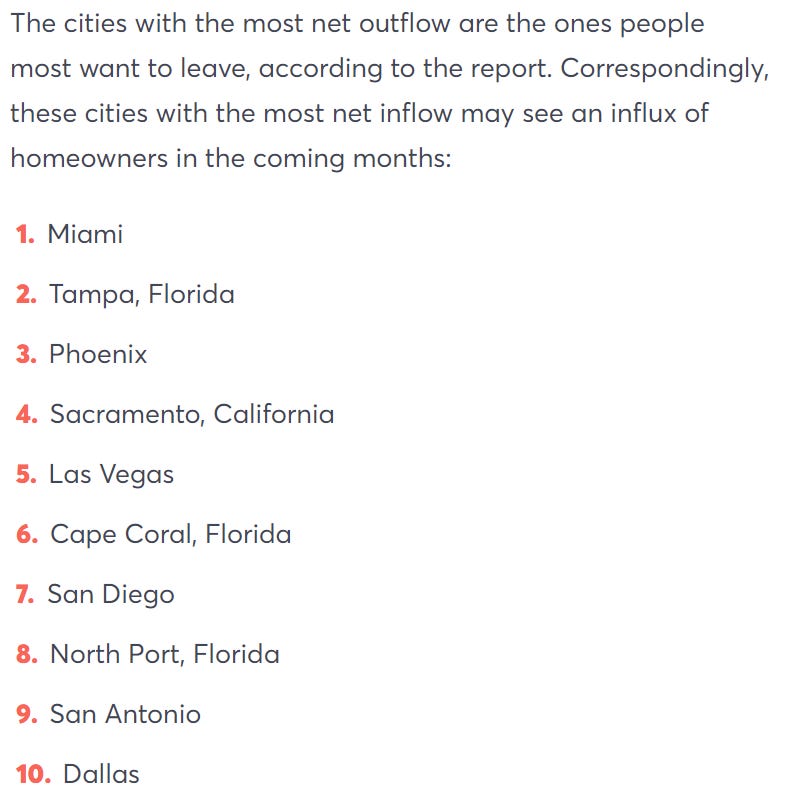

I thought this CNBC article about flows to and from cities was worth a look based on the number of inquiries I receive on this topic. From coast to coast, prospective homebuyers are on the hunt for affordability — even if it means leaving their city to find it. A record number of potential U.S. homebuyers are seeking to relocate, according to a report published last week by real estate brokerage firm Redfin. The report ranked the cities Redfin users appeared most likely to try to leave — San Francisco, Los Angeles and New York topped the list.

Interesting Bloomberg article about commercial real estate slowing down. Real estate prices are sinking, deals are collapsing and lenders are tightening their fists. Even commercial-property darlings like apartments and warehouses, where values soared through the pandemic, are losing steam as interest rates climb. Steven Lurie, a Los Angeles real estate attorney, said deals by clients for an industrial property in Portland, Oregon, and apartments in Denver fell apart as rates rose in May. In June, a buyer withdrew a nearly $18 million offer for a new apartment building near Los Angeles. A backup offer came in this month for 10% less. US commercial-property transactions reached a record $375.8 billion in the first half, a lagging indicator because deals often take months to close, according to Jim Costello, chief economist for real estate at MSCI Real Assets. The market now is slowing fast, he said. There are already signs of a decline: US commercial-property prices sagged 5% in the second quarter and may drop as much as 5% more this year, according to Peter Rothemund, co-head of strategic research at Green Street. Apartment prices sank 4% in June from May, while warehouse values dropped 6%, Green Street reported. Commercial real estate lending is expected to contract 18% this year to $733 billion, according to the Mortgage Bankers Association. That’s a stark reversal from mid-February — before Russia invaded Ukraine, before the Federal Reserve began hiking rates to control inflation — when the MBA projected more than $1 trillion in financing.

Other R/E Headlines

Mortgage demand declines further, even as interest rates drop a bit

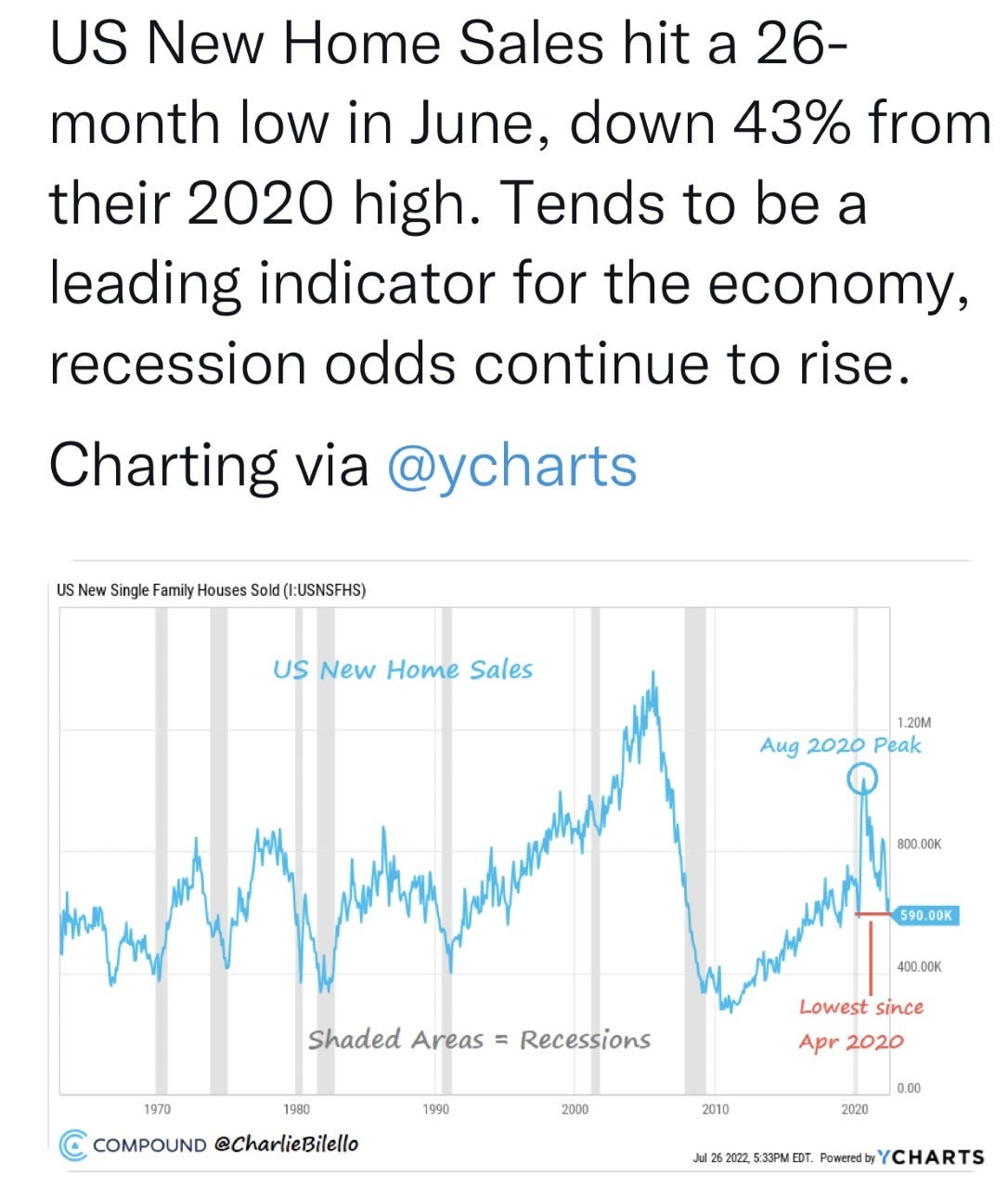

Homebuilders boost incentives as they suddenly struggle to sell homes

Sales of newly built homes fell more than 8% in June from the prior month and were 17% lower than June of 2021, according to a report Tuesday from the U.S. Census. Inventory also rose to a 9.3-month supply, up from 5.6 months at the end of last year.

Low-Cost Cities With Strong Economies Remain Attractive as Housing Market Slows