Opening Comments

The last report was well received and the #1 opened link was about the 2.5 year old who tested into MENSA.

I was in Merion, MA and it is a beautiful place. We went to Kittansett and golfed for a couple days and got to see some of our dear friends, Newcomb and Chili, which is always fun. We saw our friend, Jean, who is 89 years old and she was golfing and carrying her own small golf bag. How impressive is that? You go, Jean (avid reader). I presume her energy is due to reading the Rosen Report which is scientifically proven to improve all outcomes.

We went out to dinner and I was amazed at the lobster roll prices. When I was in town two years ago, the prices were around $25. Today, they are $40-50 for rolls and one person told me of a $65 lobster roll. I had a $42 roll and was not blown away by the roll.

We are off to Pennsylvania today for some golf practice for Jack and then back to NY. The start of the summer has been a bit disappointing from a tournament results perspective, but we have another 6 or 7 weeks of the summer to make some progress.

We stayed at a hotel and I am pretty convinced a herd of elephants was tapdancing from 2-5am last night. I just checked in to PA hotel and the rates are quite different. Pre-Covid, it was basically $110 ish a night for the Springhill Suites. In 2020, it was $55/night and I was there basically alone. I just booked three nights for an average of approximately $200/night. It is basically quadruple the lows and just under double pre-pandemic prices.

Picture of the Day-Tricked Out Trump Lover Car

When Barry Manilow Gives Advice, Take It

Quick Bites

Markets

Yield Curve

Peaking Inflation

Coal Makes a Comeback

Red States are Winning in Economic Recovery

Highland Park, IL Mass Shooting

Other Headlines

Virus/Vaccine

Data-Positivity Rate Going in Wrong Direction

Real Estate

My General Comments

Average House Down Payment-Lower Than I Thought

London Price Discrepancy (Homes to Apartments)

Picture of the Day

When I was in Boca, I played tennis at the Resort with my friend, Josh. Let’s just say playing two times in 7 months due to injury does not make you a better player. I was so scared of getting hurt, I was like an old man out there. When we left to go to the parking lot, we saw this tricked out car. The passenger side of the car was the same as the driver’s side, but Melania was there rather than Trump. Are the women in back the owners of the car? Check out the license plate, DPLRBLE=DEPLORABLE. I give these people an A for effort, but they need to get a life.

When Barry Manilow Gives Advice, Take It

I have never accused of being in the Barry Manilow fan club despite the fact that he has 28 top 10 songs including 13 #1 hits. He is known for songs like Mandy, Copacabana, Can’t Smile Without You and Ready to Take a Chance Again. After hearing this story, I may become President of the Manilow fan club.

I have some great friends in South Florida and my new pals, Jaron and Lisa moved from LA last year. Jaron was a music star in his day and has many friends in the entertainment industry. Jaron introduced me to a famous saxophonist named Michael Lington and his wife, Keri. I had them all over for dinner while I was down in Florida last week. The menu included Waygu Ribeye, ginger/garlic shrimp, roasted broccoli and cauliflower with leeks, shallots, garlic and Meyer Lemon, caramelized onions and more.

Below is Manilow from 1976.

Michael Lington opened for Barry in 2018 and told me this story which made me really respect Manilow. Lington (sounds like Linkedin) opened the first show of the tour and thought things went well.

Barry called him into his dressing room the following day and said, “Michael, I watched your performance four times on video and have some notes for you to consider.” Michael was in shock. Barry had taken the time to review is performance multiple times and wrote four pages of detailed suggestions on how to improve the performance. As Michael listened intently, Barry had the video on the TV and kept stopping it to point out suggestions which were down to intricate details. “Here, you need to wait for the spot light to shine before walking on stage. Here you need to stand at a 45 degree angle to not turn your back to the audience.” The intention was to improve Michael’s performance and the audience experience. Michael felt like an overwhelming majority of the comments were valid and took them to heart. As the lessons were wrapping up, Barry said, “We are going to do your sound check together.” Michael was surprised as he had no idea Barry had gotten Michael’s band together and all the lighting and stage crew. Barry, took control and barked orders to the crew as to what to do to improve the show. Barry cancelled his own sound check to improve Michael’s. This is what consummate professionals who are mentors do.

After the next show, Barry flew with his team to the next tour stop and Michael was on the tour bus. When Michael awoke at 7am, there were emails from Barry with more suggestions which came at 11:30pm, 2:15am and 5:30am. Barry is 79 years old today, so he was approximately 75 at the time of this story. Again, Michael was astonished that Barry took the time throughout the night to impart wisdom.

Barry Manilow has been active since 1964 and is approaching 60 years of performing. His attention to detail, desire to give his audience the best show and professionalism is a testament to his work ethic and character. He made Lington a better performer and artist because he cared enough about mentoring a young musician and giving his fans what they deserve…The Best Show Possible. This is why Barry is still selling out major venues for over 50 years. This is a great lesson to young people on what it takes to be successful and when you make it, do what you can to help others. Michael is very grateful for the wisdom imparted by the great performer, Manilow.

As an aside, Barry had many hit songs and wrote most of them. One of his big hits was, “I Write the Songs,” but Manilow did not write that one. How ironic is that given the title of the song?

Barry, if you read the Rosen Report and have any suggestions to improve it, I am all ears. I would play you the guitar and sing, but fear your only suggestion would be to quit doing it as I am beyond help on the music front despite all my practice. As an aside, given I did all this Manilow research, I listened to a dozen songs and I must tell you that they are damn good. My son thought I was crazy belting out “Mandy” in the car, but what the hell does he know?

Quick Bites

U.S. stocks moved slightly higher on Wednesday as investors pored over the latest minutes from the Federal Reserve. The Dow gained 70 points, or 0.23%, to 31,038. The S&P 500 added 0.36% to 3,845. The Nasdaq rose 0.35% to close at 11,362. Stocks bounced after the Federal Reserve released the minutes from its June meeting, showing that the central bank was committed to bringing down inflation. Fed members said the meeting on July 26 and 27 likely also would see another 50- or 75-basis point move, the minutes showed. A basis point is one one-hundredth of 1 percentage point. I am concerned about sentiment and the global economy, but felt yesterday’s closing and today’s price action was constructive. I do feel that inflation is starting to come down as I suggested over a month ago (see other bullets). The fed will raise for a couple meetings, but the economic slowdown will make it hard to raise into it.

The closely watched Treasury yield curve is sending a warning that the economy may be falling or has already fallen into recession. The curve between the 10-year Treasury yield and the 2-year yield has become inverted, meaning the 2-year is now higher than the 10-year. “There’s something afoot in investor sentiment that is difficult to ignore, given the inversion is occurring with 10-year yields below 3%,” said one bond market strategist. I have written about this for months and am a believer in the 2s/10s being predictive of recessions. As of Tuesday’s close, this is what the curve looked like after inverting again during the day. The 1st chart is recent history and the 2nd shows the gray bars of recessions after each time the 2s/10s goes negative. It was at zero on Tuesday evening.

Over a month ago, I suggested inflation was peaking and we are seeing more signs of it with commodities. Oil fell below $100/barrel on Tuesday (-8%), and further on Wednesday. It was trading at $98 as of the close Wednesday. Remember, oil closed at $123 in March. Oil is at a 12-week low on global recession fears. This WSJ article is entitled, “Falling Commodity Prices Raise Hopes That Inflation Has Peaked.” Economic concerns seem to be driving markets with stocks and commodities falling while Treasuries are rallying. I believe demand destruction is real and the sentiment indicators are worsening. Markets don’t like uncertainty. The first chart is one month oil. The second graph believe is pretty telling.

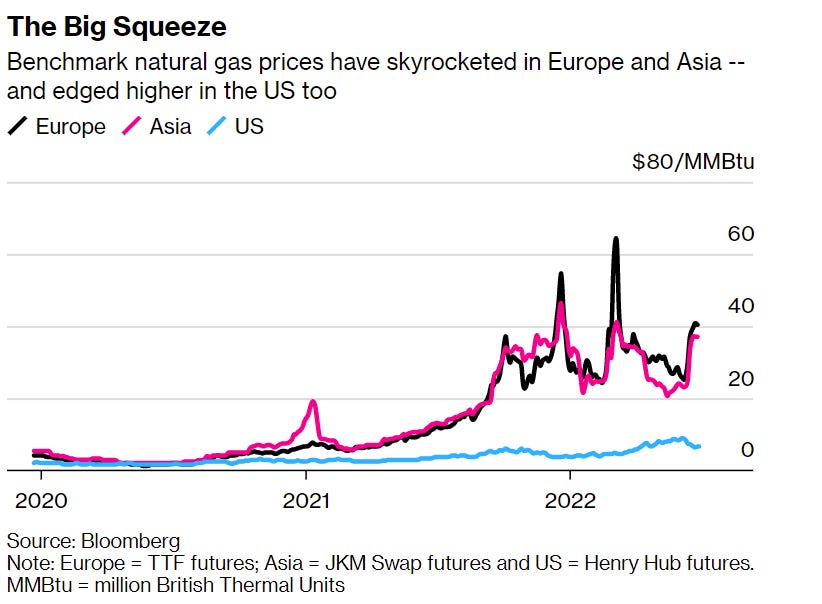

In an interesting sidebar, this WSJ article is entitled, “Coal Makes a Comeback as the World Thirsts for Energy.” To me, it is ironic that the shortages are leading to coal making a comeback. This article discusses the 700% increase in Natural Gas prices in Europe and the chaos which it is causing. Horrible decisions on energy policy from both sides of the pond have gotten us here to require coal. Retiring all the nuclear plants early and becoming too reliant on alternatives before they are ready is now allowing dirty coal to come back.

Given upcoming mid-term elections, there is a lot of talk about red vs blue states and governors with attacks heating up between Newsom (CA) and DeSantis (FL). This WSJ article is entitled, Red States Are Winning the Post-Pandemic Economy-Workers and employers moved away from the coasts to middle of country and Florida, sparking swifter recoveries there. What do the blue states have in common and what do the red states have in common? I heard a R/E legend speak recently and he was clear that he will not invest in blue states and is focusing on Florida, Tennessee, Texas, the Carolinas and will not consider California, Illinois, New York. He feels the trends will continue and is putting his money where his mouth is and he is a billionaire. The link discusses state finances being impacted. The wealth which has left CA, IL, NY for FL, TX, NV and others is stunning in my opinion. A bunch of great statistics in this link. The article discusses, home prices, tax rates, school enrollment…

Another mass shooting, but this time in Highland Park, IL. It is an affluent suburb of Chicago. The shooter was perched on a rooftop and fired at least 70 rounds killing 7 people and wounding dozens more. The shooter has been identified as Robert “Bobby” Crimo. Although the reports I read are not suggesting a hate crime, Crimo was kicked out of a local synagogue over Passover according to one report. He had supposedly planned this attack for weeks. His social media posts are concerning and can be found in these two links with talk of graphic murder, suicide and death. According to various news articles, Crimo threatened to kill his family in 2019 and had two police encounters the same year. I do not know the answer to solve this problem. I have no issue with more thorough background checks, including social media posts. There is a slippery slope of first and second amendment rights here, but the status quo is not an option, as too many innocent people are dying needlessly. Crimo should never have been sold guns in my opinion given his history. This link shows a story where a toddler was orphaned due to both parents dying in the massacre. There have now been more than 300 mass shootings in less than 200 days, according to data compiled by the non-profit Gun Violence Archive, including a racist killing spree in Buffalo, New York, that left 10 dead, and the massacre of 19 young students and two teachers at a school in Uvalde, Texas. I want a mandatory death penalty for anyone convicted of these shootings. I want it by firing squad.

Other Headlines

Euro slides to 20-year low against the dollar as recession fears build

This means your trip to Europe is cheaper. I went on my honeymoon almost 20 years ago and it was 1.25 vs today it is sub 1.02 dollars to the Euro. The dollar strength against the other currencies is something to watch and may turn out to cause some major issues for the US and other countries. I will explain more in an upcoming piece.

US, UK, Europe, Japan will be in recession over next 12 months

Bank of England’s Bailey warns global economic outlook has ‘deteriorated materially’

Tesla is no longer the world's largest EV producer

China’s BYD sold more than TSLA in the first 6 months.

Biden Approval Rating Plummets to New Low, Marking Year of High Disapproval

58% disapprove and 36% approve of job Biden is doing. The article is Newsweek.

Rudy Giuliani, Lindsey Graham and John Eastman subpoenaed by Fulton County DA in election probe

Ray Dalio is having a good year with Bridgewater’s flagship fund gaining more than 30% so far

Despite not being the biggest Bridgewater fan, this is an impressive return in a challenging year. with many high-profile managers getting slammed.

Tiger Global’s Flagship Hedge Fund Has First Gain Since October

Tiger eked out 3.4% gain in June; hedge fund remains down 50.1% for first half of the year

I would really like to better understand the marks on the private/illiquid positions in various high profile funds which are a meaningful portion of the portfolios in some cases.

Short-staffed hotels are hiring robots as unions push back

I find this interesting as hotel managers are short-staffed by dozens or even up to 100+ on larger properties. The long-term impact of people not wanting to work will make companies find alternatives like this one.

NYPD worker assaulted by man on NYC subway, cops said

Fractured eye socket. Remind me why people are leaving NYC for greener pastures.

10 Killed, At Least 62 Wounded in Fourth of July Weekend Shootings in Chicago

Violent Chicago mob attacks state trooper’s car with firecrackers and bricks

100 people descended on the trooper’s car. Citadel is leaving Chicago for good reason. When the wealthy take their toys, incomes, spending, philanthropy and head elsewhere, it leaves a BIG budget deficit.

'Squad' members introduce resolution calling Israel founding 'catastrophe'

I question how any Jews can side with the Progressive’s view of Israel and I am the single least religious person ever. I have never been to Israel.

Fitness crisis? Just 7% of U.S. adults have good cardiometabolic health

Having travelled extensively again this summer, I can tell you that too many people are obese, and we have a major crisis in the USA which is 100% fixable. People need to eat healthier and do more exercise.

Virus/Vaccine

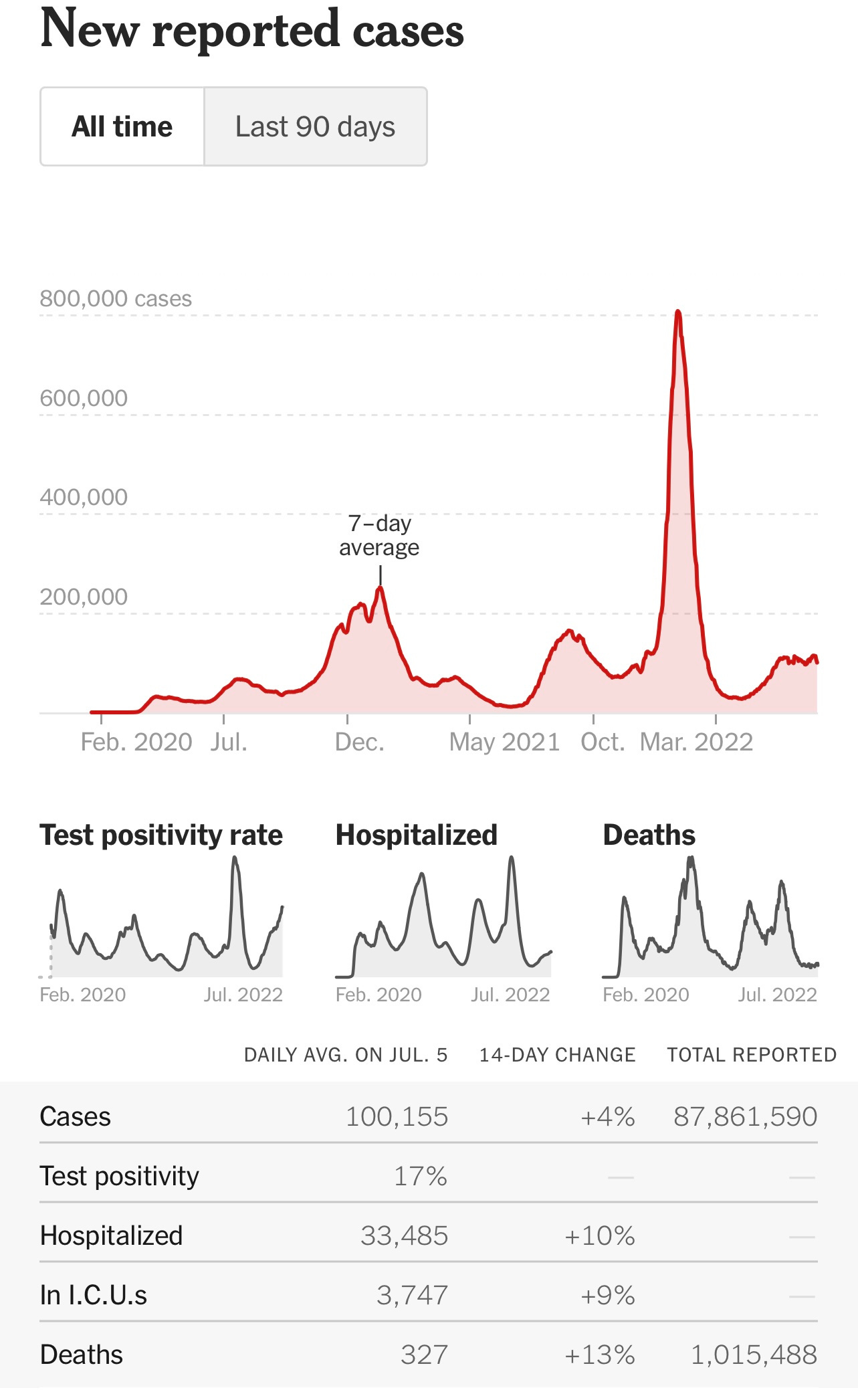

In less than four months, the positivity rate has gone from 2.1% to almost 17% for the US. I see some noise in the data, so I am going to reserve comment until I see how things play out Sunday.

Real Estate

In 5 weeks, I have been to Louisiana, Mississippi, Tennessee, Kentucky, West Virginia, Pennsylvania, New York, New Jersey, Massachusetts, Alabama and Florida. I have had real estate discussions with people in virtually every stop and there are some consistent themes. Homes staying on markets longer, prices are coming down, inventory is building (from obscenely low levels). In my community in Florida, I am definitely seeing building inventory and houses on market longer with limited activity, but some of it is seasonal. I am also starting to hear about more contractors who have time to take on new projects despite having no availability months ago. More jobs are being cancelled or the scope of work is being reduced. Six months ago, finding a contractor was near impossible. In one positive development, the Treasury market has rallied on economic fears, which should help mortgages rates come down a bit (starting already). Below is the 30 year fixed mortgage rate from the US Government website and it is starting to tick down slightly after basically doubling since early in the year.

Here’s the average down payment on a house today — and it’s a lot less than 20%. I was a bit surprised and concerned by this CNBC article which suggested that in 2021, the average down payment on a home in 2021 was just 7% for first-time homebuyers and 17% for repeat buyers. However, on a positive note, in May 2022 that 25% of buyers had enough cash on hand to purchase a house without needing any financing.

London’s property market is in flux with house prices continuing to rise and apartments declining in value. Apartments are down more than 11% from their peak in August 2020, with the median sale now less than 400,000 pounds, according to an analysis of UK Land Registry data for April by Bloomberg News. The figures, which are smoothed to remove outlier transactions, show the median price paid for a house reached a new high of almost 634,000 pounds ($768,500). Good charts in the link.

Other R/E Headlines

Manhattan apartment sales fall 30% in June, prices remain high

Interesting stats in the article. One quote “Throughout the second quarter, that slowdown has accelerated: fewer signed contracts, fewer bidding wars, more price reductions, and a gradual increase in available inventory.” I spoke with a broker and heard a discussion on CNBC today which was consistent. In the past 6 weeks, we have seen a major drop off in showings, offers and activity. Part of this is seasonality, but things are slowing between the major wealth destruction across equities, fixed income, crypto, fears of lower bonus payouts, layoffs and rising rates are all contributing. Sentiment and fears of a recession/staflation are in play as well. I spoke with a couple Wall Street guys who are talking about layoffs and sharply lower bonus pools. This will weigh heavily on the NYC and Hamptons R/E markets.

LA office leasing slows with deals “falling out of contract”

Total sf declined 20% in Q2, Savills report says

Full-blown ‘flight to quality’ in San Francisco office market

Class A buildings, trophy spaces “dominated office demand” in Q1