Opening Comments

In my first two years in Florida, I went to Miami 4-5 times a year and two times was for Art Basel each year. During the pandemic, I went less for obvious reasons. In 2022, I have been to Miami 18 times now in less than 4 months, as many friends have relocated down there recently. Conventions are back, and I go down for lunch, dinner, meetings... New restaurants have opened, which has drawn me 50 miles south to Miami. My point is, I have basically gone more in less than four months than I did in four years. It is a testament to the great migration. As long as the tri-state, Chicago and California continue to overcharge and under-deliver, I don’t expect it to let up much… as long as families can find a house and a school the flow of people should continue. The best meetings are between 11am-3pm in Miami, so I can avoid rush hour traffic on either side. Going down for dinner during the week is a solid 1.5 hours.

One correction in the last piece about term limits and age of Congress. I did not know, Dingell died, and his wife has the seat. Apparently, Dingell took it over from his father, so the family has dad a seat in Michigan for a total of 88 years (Father 22, John 59, Debbie 7 years). John, thanks for catching my error.

I continue to grow readership, but not at a fast enough pace. Please forward to friends and help me grow it. Also, forward story ideas, feedback… I would guess 25% articles I use are sent to me by readers. A couple dozen of the readers tend to send a disproportionate number of ideas. Keep them coming. Also, hit the like (heart) button under my name if you like what you read.

Adam, a reader, sent me this link as a follow up to my UFO story the other day. It is a Rogan interview with a military pilot who saw a UFO and discussed his sighting. Just listen to the 1st 25 minutes. 100% credible story. I am convinced we are not alone.

I was out all afternoon. Sending this one remote. Hope I picked up all the latest news. Got the Tesla earnings in Other Headlines.

Picture of the Day-Drunken Fall

White Flies: The Enemy of the Florida Landscape

Quick Bites

Markets

Netflix Hammered

Fed/Recession

Apple Store Unionizing?

Job Happiness

China Lockdown

Nuclear Warheads Globally

Impact of Social Media

Pandemic on Infant Development

Other Headlines

Virus/Vaccine-Case Growth Accelerating

Real Estate

General Comments

Crazy Boca Example

Mortgage Rates Impact on Sentiment

Cities Averaging $500k/Home

Picture of the Day-Drunken Fall

I am guessing she was pretty darn drunk at brunch to fall like this.

A woman has gone viral after she went head over heels for her friend’s boozy birthday brunch. Lindsey Clark, 40, from North Shields, England, was trying to collect a friend’s jacket from behind their restaurant booth when she got stuck upside-down — feet pointed to the ceiling — behind a banquette for about 10 minutes. Through their laughs, her friends recorded the hilarious moment when two young men working at the restaurant struggled to pull Clark out of the tight area.

White Flies

I love a beautifully landscaped yard. I think the Hamptons estates are stunning, and I enjoy seeing an amazing house surrounded by perfectly manicured privet or boxwood hedges. They are dense, lush and deep green in color. I love seeing them just after they have been trimmed with no leaves out of place.

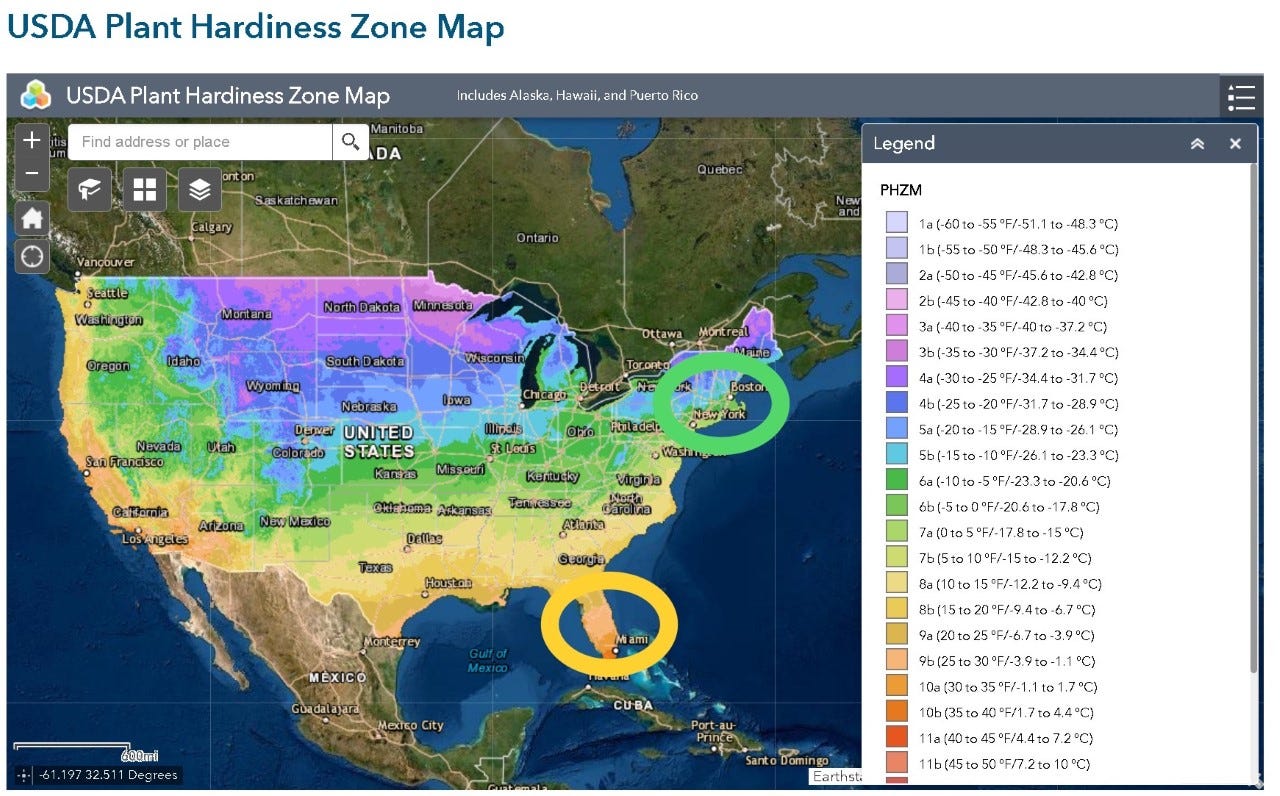

There are different growing zones, and the South Florida zone does not allow for privet growth. The Hamptons are in growing zone 6a, and South Florida is in 10b.

As a result, I made the executive decision to plant Ficus as a form of privet around the front and back of the house and on one side to block the neighbor. It was as close as I could find to privet in terms of the sculpted look I wanted to create. Given my wife, Jill, grew up going to the Hamptons, it was an easy sell to her as well. I have enjoyed the Ficus, but white flies have crushed me over the years. This season in particular, the white flies wreaked havoc on Ficus around South Florida. It is like nothing we have seen in decades. The flies come by the thousands and chew up a plant in a day. When the pest control guy came, he hit the bush and a swarm of white flies took off and flew everywhere. It was crazy. I did not even know they were there.

This is a healthy Ficus. Nice and tight leaves with a deep green color. They look great.

About two months ago, I noticed the top of my Ficus was bare in a matter of hours. I had the pest control come and spray like crazy. Too late, its gone and won’t come back until after the growing season (May-October). The pest control guy was coming 3-4x a week and could not get the white flies under control, so I am giving up.

I have called my landscaper irritated that my plants are crushed. We had to cut down 4 feet of the Ficus to get them to look decent, and they remain far from perfect. He has had so many issues that he has thrown his hands up and suggests his clients to take Ficus out as the flies are out of control. It is a constant battle and no matter how much you spray, the white flies seem to be winning. I broke down and am removing all of Ficus to plant Callophyllum trees starting in two weeks. This gives the new plantings the ability to grow and take hold before the storm season in the fall. As you can see below, I will need to plant some shrubs below the tree given the growth starts at about 4 or 5 feet from the ground. When I heard the price of plants I almost fell off my chair. Quite irritating and yet another example of inflation. The cost of the trees is up 40% since pre-pandemic. I am now ordering a hit on all white flies. I want them all dead! If they are costing me my beautiful Ficus and tens of thousands of dollars, I want them to suffer.

There are a lot of great reasons to live in Florida: Weather, Taxes, Cost of Living, Quality of Life, Golfing, Fishing, Tennis, Less Regulation, Almost Non-Existent Homeless, Lower Crime… but one of the downsides apart from a culinary and cultural wasteland, humidity and hurricanes are those damn white flies if you like Ficus!

As a funny aside, on Sunday night, I was starting to write the piece for Wednesday in my office in front of my fancy new computer. I heard a scream. It was the blood curdling scream that a woman from NYC would make if she saw a snake or a lizard in the house. It was the latter. Super hero, Eric Rosen, stepped up to the plate and caught the massive, man eating beast with huge teeth and poisonous venom. I am fearless. This is me letting said lizard go. You can see my nice and healthy Ficus in the background for the last time in front of my house. I was standing at my front door to allow this deadly beast to live. The plants are gone in 10 days. Son of a …Should I make an NFT of this picture? Last Ficus, hands of Bruce Lee, venomous lizard…. Sounds like $20mm NFT to me. Who has the opening bid? If Beeple’s ugly ass art went for $69mm, surely this memorable photo is worth $20mm. The proceeds will fund the development and improvement of the Rosen Report, a new boat and a large donation to the Ukrainian causes.

Quick Bites

I was surprised by the market’s move higher Tuesday on the heels of Fed’s Bullard suggesting 75bps was not off the table and rates moved sharply higher. It was a divided market on Wednesday as traders evaluated a rush of first-quarter results. The Dow rose on the back of strong earnings from Procter & Gamble, while the Nasdaq was dragged down by an epic plunge in shares of one-time darling Netflix. The 30-stock Dow was up 250 points, or 0.7%, to 35,161. The S&P 500 was essentially flat at 4,459. The Nasdaq Composite fell 1.2% to 13,453. Netflix fell 35% after its quarterly results showed a loss of 200,000 subscribers in the first quarter, its first reported subscriber loss in more than 10 years. The 10-Year Treasury sold off to 2.83% after hitting 2.94% on Tuesday.

Shares of Netflix cratered more than 25% on Tuesday after the company reported a loss of 200,000 subscribers during the first quarter. It’s the first time the streamer has reported a subscriber loss in more than a decade.

Netflix blamed increased competition, password sharing (crackdown coming) as well as inflation and the ongoing Russian invasion of Ukraine for the stagnant subscriber growth. Netflix is forecasting a global paid subscriber loss of 2 million for the second quarter. The last time Netflix lost subscribers was October 2011 when it shed 800,000 paid users. “Our revenue growth has slowed considerably,” the company wrote in a letter to shareholders Tuesday. “Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally,. However, our relatively high household penetration — when including the large number of households sharing accounts — combined with competition, is creating revenue growth headwinds.” My Hedge Fund wizard, Aaron, called this one and had me sell in January convinced it would tank. THANK YOU. The stock fell 35% on Wednesday. You da man. This was discussed in my “Puff Piece” article from 1-23-22 on Aaron’s short of NFLX. Also of note, NFLX is now exploring lower-priced, ad supported plans after years of resisting. NFLX is down over 62% YTD. I found this article from CNCB informative on NFLX and legacy media. It is entitled, " Legacy media has disrupted Netflix. The consequence may be mutually assured destruction." Of note, Cathie Wood’s flagship ARK fund is down more than 60% from 2021 peak.

The Federal Reserve is setting out to do something it has never accomplished before: reduce inflation a lot without significantly raising unemployment.

Central bank officials think it is possible with calibrated interest-rate increases that slow booming demand just enough to take steam out of an overheated economy. But even one of the Fed’s closest allies, U.S. Treasury Secretary Janet Yellen, sees the risk of failure. “It will require skill and also good luck,” the former Fed chair said. During the past 80 years, the Fed has never lowered inflation as much as it is setting out to do now—by 4 percentage points—without causing recession. The ineptitude of the Fed never ceases to amaze me. Bernanke said, “Subprime is Contained" in 2007 in a speech to Congress. At the time, my desk was limit short anything that moved. I have been screaming for one year that the Fed policies were too dovish, and QE was moronic in this stage of the cycle with R/E on fire. I lack faith in the Fed for getting it right this time. The 1st chart is telling and reminds me of my University of Chicago MBA, where the professors had largely never worked outside of academia, I learned a total of ZERO which I can use in the real world. To me, the chart is quite concerning and can help explain why they get to the wrong answer so frequently. The 2nd chart shows the Fed Balance Sheet comprised approximately of 70% Treasuries and 30% MBS holdings. As you can see, the Fed has not started Quantitative Tightening yet as the balance sheet (from last week) is leveling off, but not declining. Look at Treasuries even before the Fed started to sell. The 10 year is +55bps in one month, and 120bps YTD. The 10-year yield is 2.83%.

An Apple retail store in the Cumberland Mall in Atlanta, Georgia, has filed for a union election. It is the 1st Apple store to do so. Over 70% of the store’s more than 100 eligible employees have signified interest in unionizing, according to a press release. We have seen similar stories out of Starbucks and Amazon. Given the strength of the market for talent, employees are able to make demands. In speaking with a leading real estate person recently, there are fears in the hotel industry as well. These unions will hurt margins and productivity over time. Look no further than the US Auto industry or airlines and the damage done.

The #1 reason people quit their jobs is not money. 62% of American who left their positions name a “toxic company culture” as the reason they left.

“A stifled, oppressive atmosphere is possibly the most powerful signal of a toxic culture, as well as the presence of aggressive behavior and negativity,” according to an article by the National Business Research Institute. I felt managing teams and managing risk were my strengths when I worked on Wall Street. I feel I helped create a culture of hard work, reward for a job well done, and actively gave feedback for development. I worked out or swam at 5am so I could be in the office by 6:15am. It was important I was first or among the first few people to arrive at the office at JPM. I wanted to set the tone. I made sure all employees received an in-depth review twice a year to let them know where they stood as well. On compensation, it was pay for performance and I did not hold back in paying people who performed at the highest levels. I once paid an associate $10mm in a year because he crushed it generating over $300mm in revenue. People knew they would be rewarded for work well done.

This is a CNN article discussing the economic impact of the lockdowns in China today. Nearly 400 million people across 45 cities in China are under full or partial lockdown as part of China’s strict zero-Covid policy. Together they represent 40%, or $7.2 trillion, of annual gross domestic product for the world’s second-largest economy, according to data from Nomura Holdings.

“Global markets may still underestimate the impact, because much attention remains focused on the Russian-Ukraine conflict and US Federal Reserve rate hikes,” Lu Ting, Nomura’s chief China economist and colleagues wrote in a note last week. Most alarming is the indefinite lockdown in Shanghai, a city of 25 million and one of China’s premiere manufacturing and export hubs.

The quarantines there have led to food shortages, inability to access medical care, and even reported pet killings. They’ve also left the largest port in the world understaffed. The Port of Shanghai, which handled over 20% of Chinese freight traffic in 2021, is essentially at a standstill. Food supplies stuck in shipping containers without access to refrigeration are rotting. This zero Covid policy is ludicrous and damaging. Given my extreme dislike of leadership in China, I hope this leads to economic calamity, and we see an uprising. The 1st link to the story contains lots of data.

With all the talk around Russian nukes, I wanted to research the topic I know little about. I found this informative article from a few years ago and some of this data was quite frightening such as the power of the B83 gravity bomb. Nine countries possess nuclear weapons: the United States, Russia, France, China, the United Kingdom, Pakistan, India, Israel, and North Korea. In total, the global nuclear stockpile is close to 13,000 weapons. While that number is lower than it was during the Cold War—when there were roughly 60,000 weapons worldwide—it does not alter the fundamental threat to humanity these weapons represent. For example, the warheads on just one US nuclear-armed submarine have seven times the destructive power of all the bombs dropped during World War II, including the two atomic bombs dropped on Japan. And the United States usually has ten of those submarines at sea. The destructive capabilities of US weapons range widely. The most powerful weapon—the B83 gravity bomb—is more than 80 times stronger than the bomb dropped on Hiroshima. The smallest weapon has an explosive yield of only 2 percent of that. Such “low-yield” weapons are specifically designed to be more usable, increasing the likelihood they may actually be used. The article details all the weapons in each country and interestingly, the US and Russia have 90% of all nuclear weapons. This link is from 2022 and has an animated chart showing global nukes and the changes over time which I found interesting. Watch the 1st 45 seconds as the data is presented in an easy-to-follow manner. The data varies slightly from the original story as it is a few years newer. At various points in the 1960s, the US had over 30k warheads and in the 1980s the Russians had over 40k.

I have written theme pieces on my concerns around social media and the impact on children. These “influencers’ use photoshop, and smoke and mirrors to appear perfect. It is unhealthy, especially for young girls. Unfortunately, there is no stopping it, but this article suggests more young people are giving up on social media. “When you delete it you realize you don’t need it,” 20-year-old Gabriella Steinerman told The Post. The economics major dumped both Instagram and TikTok back in 2019, and said the relief she felt after unplugging was almost immediate. I hope more kids follow suit and delete or at least become less addicted to social media. I have written about the incredible bias of social media and its influence on outcomes which is also concerning. Some influencers have over 100mm followers. My 8th grade daughter wrote a short essay on the problem with social media and the impact on young girls for an assignment last week. Kids are killing themselves due to being trolled on social media. They also cannot live up to the unrealistic crap they see from the Kardashian’s and others. Yes, it is 100% envy that people with zero talent are making billions. If I thought posing scantily clad would help grow readership, I would do it, but fear my readers would leave in droves.

Infants born during the pandemic produced significantly fewer vocalizations and had less verbal back-and-forth with their caretakers compared to those born before COVID, according to independent studies by Brown University and a national nonprofit focused on early language development. Both research teams used the nonprofit LENA’s “talk pedometer” technology to glean their findings. The wearable device delivers detailed information on what children hear throughout the day. It measures the number of words spoken near the child in addition to the child’s own language-related vocalizations. “It is the conversational turns that drive brain development,” said Brown’s Sean Deoni, adding he’s concerned for the long-term success of children born after the pandemic began. Tests showed, too, these babies experienced a significantly slower rate of white matter development versus the children from studies done before the pandemic. How many times have I written about unintended consequences around the pandemic? Too many to count is the right answer. Here is yet another example around infant development. The cost of the pandemic has been in the trillions of dollars, but the long-term ramifications of it are even more severe in my opinion. Thank you, China.

Other Headlines

Goldman Sachs Sees U.S. Recession Odds at 35% in Next Two Years

I believe the likelihood is higher given the dramatic shift in Fed accommodative policy.

Surprising to me, but a positive sign.

Tesla revenues grow 81% from last year

For the period ending March 31, 2022 Tesla reported $3.22 earnings per share, and revenue of $18.76 billion. Shares rose as much as 5% in after-hours trading.

CEOs made a median $20 million last year—254 times more than the average worker

Natural gas surges to highest level since 2008 as Russia’s war upends energy markets

Price of corn hits 9-year high as surge in commodities continues

Want to Retire in Portugal? Here’s What to Know, as Americans Move There in Droves.

I have not been in 25 years, but remember it was incredibly inexpensive, people were friendly, and it was quite nice. Some readers told me they were considering relocating there given the cost of living.

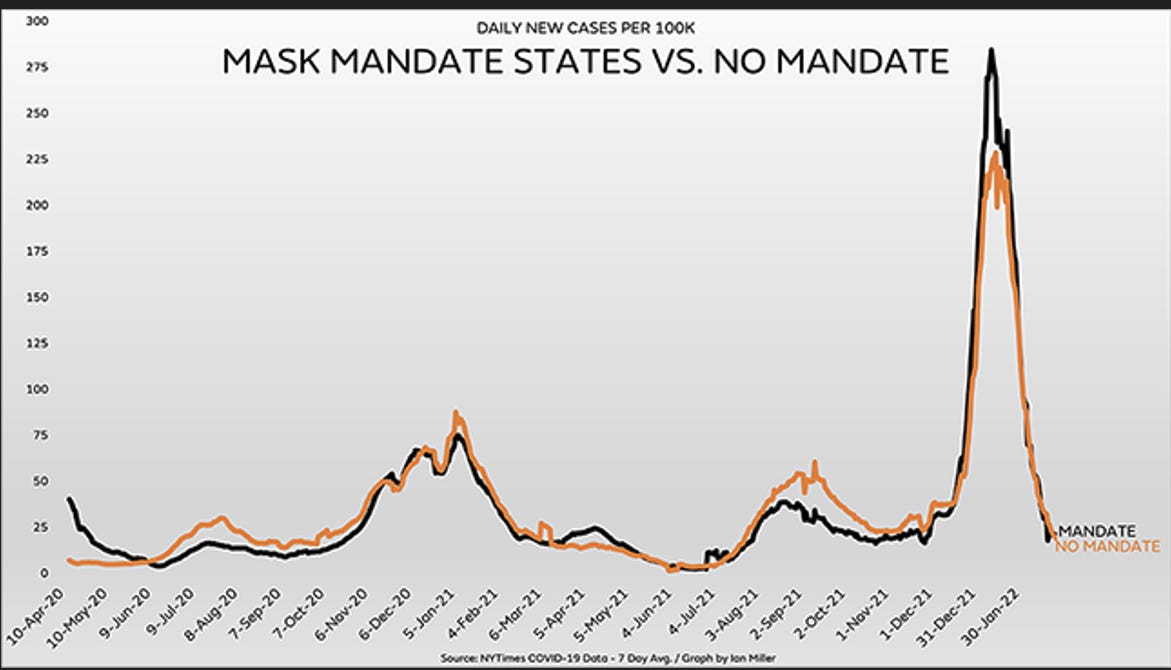

Judge Throws Out Federal Mask Mandate for Public Transportation

Federal judge in Florida says Biden administration’s Covid-19 mandate exceeds CDC’s authority. Wearing a mask for 4 hours on a plane was a waste of time anyway and uncomfortable. I do not believe masks bought at Costco from China did anything of substance to protect you and most people do not wear them properly and the charts below support my thesis. The TSA will not enforce the mas mandate as a result of the ruling. Biden is trying to get this over-turned.

Hunter Biden laptop: ABC, CBS, NBC spent only 25 minutes over 18 months covering scandal, study says

The Media Research Center analyzed all morning and evening newscasts on ABC, CBS and NBC, in addition to their Sunday morning offerings. The analysis found the three networks spent only 25 minutes and six seconds combined on the Hunter Biden laptop scandal over 18 months.

In my last note, I wrote extensively on the Twitter/Musk topic and my concerns about media bias. This story is another comical one where billionaire owned media outlets are being critical of Musk owning Twitter. You cannot make this up. WaPo, The Atlantic, Time, Bloomberg, LA Times all discussed as billionaire owned.

Outgoing GOP Lawmaker Issues Dire Warning About Rep. Marjorie Taylor Greene

Green is a nutjob. How in the hell did she get elected?

Murder convict vows to get ‘woke’ LA County DA’s name tattooed on face

A Los Angeles gang member convicted of murder praised District Attorney George Gascón for his controversial criminal justice reforms that reduced the inmate’s charges — and vowed to get the embattled DA’s name tattooed on his face, a report said. Read this article; it is sad and funny at the same time. Gascon, are you proud that gang member murders are praising you for your crime reform? “He’s making historic changes for all of us, fool. I’m just grateful, fool. Like, I got good news off that s–t,” Hernandez says.

These 7 skills separate successful kids from 'those who struggle': Psychologist and parenting expert

iPhone update adds 'pregnant man' emoji, other gender neutral cartoons

How many people will use this emoji?

Elon Musk buying Twitter could have ‘grave implications’ for civil rights, says Urban League

So insane that every other billionaire can own media (Time, Bloomberg, WaPo, The Atlantic, Boston Globe, US News… but Musk buying Twitter to level the playing field is unfair. It is actually laughable that the media is in a panic over this one.

Woman with 229 pounds of weed in her car runs out of gas on I-55 Bridge, police say

Police said $17k was found in the vehicle as well, so we know she could have afforded to fill up, even at these elevated prices. What an idiot.

Concerning headline from NYTimes around Ukraine/Russia

Virus/Vaccine

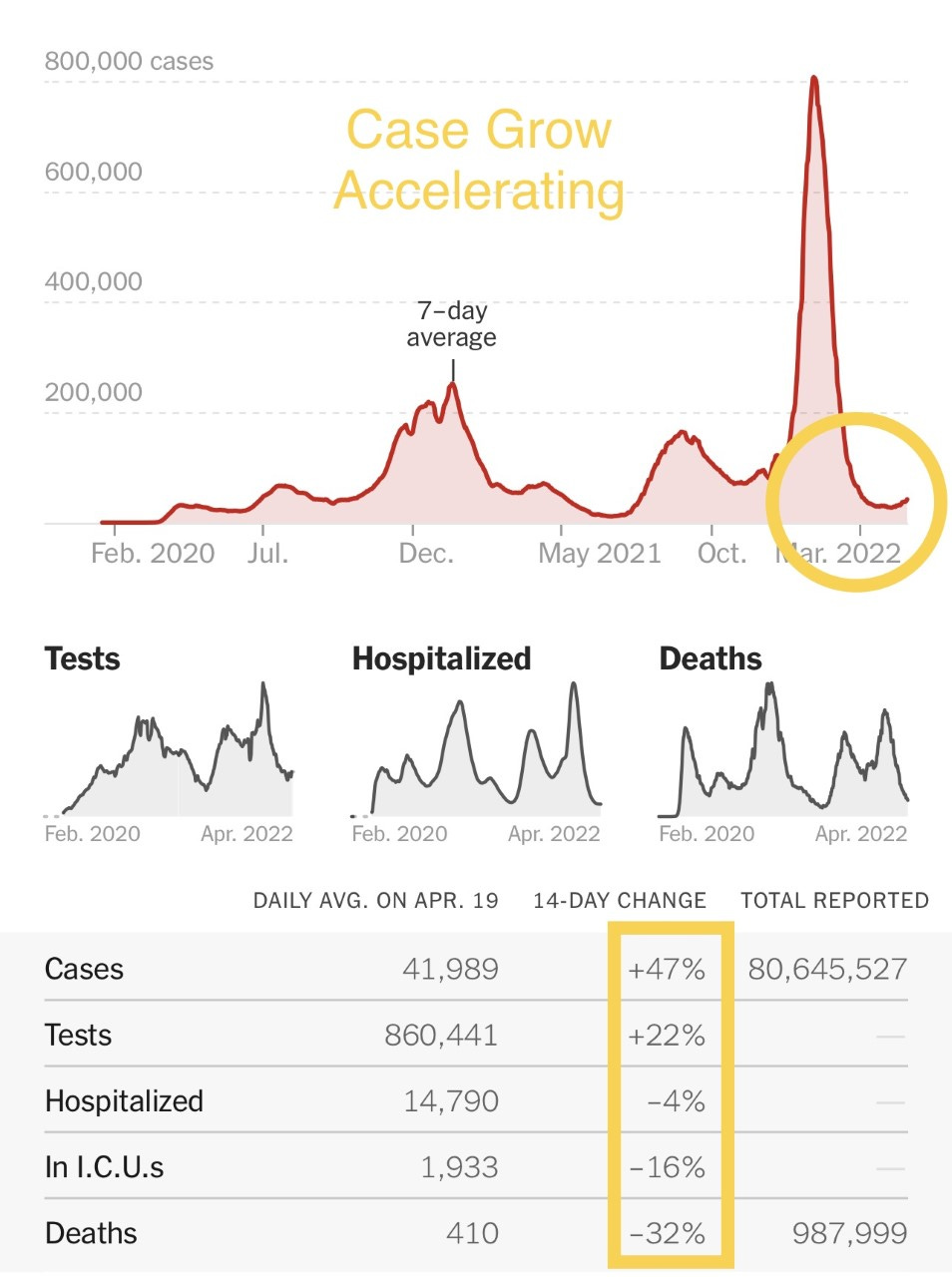

Case growth accelerated and is +47% from the prior two-week period. Cases are averaging 42k/day, but down sharply from peak levels of 807k/day. Declines in hospitalizations are slowing, as they were down 4%, but deaths were down 32% and are approaching 400/day. Peak was almost 3.2k/day.

Real Estate

In the never-ending migration story, I have confirmed from multiple people that the new Sweet Bay golf club in Hallandale Beach took between 50-60 members at $550k initiation. However, 80% of the initiation is refundable when you resign. The remaining members will pay between $700-750k. These numbers are unheard of for South Florida courses. Pre-pandemic, $150k was high. Huge wait lists, massive demand and the migration of uber wealthy leaving the tri-state, Midwest and California are making it easy to raise rates/fees. For all the haters out there, not many places get these kids of initiation fees apart from the Hamptons. The Greg Norman redesigned course has 18 holes, a marina for 48 boats and a 10-court racquet center. I played the course prior to the redo, and never felt it was special and believe they lack the land to make it amazing. I am anxious to see what I am told will be a very high-end facility. For $550-750k, it better blow me away. Witkoff is a remarkable developer and a solid golfer. If anyone can make it amazing, he can.

In a crazy Boca story, a friend sold his home for $9.5mm 12/20. It was a knockdown on two lots on a canal. It was for sale for a long time before it was sold. A builder bought it and developed two large homes on it. One just listed for $35mm and I am told the other one will be in the $30mm range. The bid for high end product, especially on water, is remarkable. I did not think these levels were possible. Homes look nice, but $35mm for this seems insanity. Let’s see where it clears, but given the market would think it would have a 3 in front of it. The water is a narrow canal. Hardly an ocean or intracoastal view.

Sharply rising mortgage rates are taking their toll on the nation’s homebuilders, as already pricey new construction becomes even less affordable. The average rate on the 30-year fixed mortgage stood at around 3.90% at the beginning of March, and is now up to 5.15%, according to Mortgage News Daily. Builder confidence in the market for new single-family homes fell 2 points to 77 in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index. Any reading above 50 is considered positive sentiment, but the reading marks the fourth straight month of declines for the index, which stood at 83 in April 2021. Of the index’s three components, current sales conditions fell 2 points to 85. Buyer traffic dropped 6 points to 60, and sales expectations in the next six months increased 3 points to 73 following a 10-point drop in March. “Despite low existing inventory, builders report sales traffic and current sales conditions have declined to their lowest points since last summer as a sharp jump in mortgage rates and persistent supply chain disruptions continue to unsettle the housing market,” said NAHB Chairman Jerry Konter, a builder and developer from Savannah, Georgia. Mortgage demand falls to nearly half of what it was a year ago, as interest rates continue to rise.

Across the nation, home prices have soared during the pandemic, as low home inventory ran into surging demand. Fervent competition ensued, and home prices have since gained 19.2% over the past 12 months, locking many would-be homebuyers out of the market. But while prices have been rising most everywhere, some housing markets have become prohibitively expensive to some prospective buyers. A recent analysis by online real estate and financial planning site OJO Labs found that a housing price benchmark that was once considered rare is now becoming increasingly common, as average home prices are now topping $500,000 in more and more cities.

Who's in the club?

Austin, is the newest arrival in the exclusive club, according to OJO Labs’ survey, which crunched the numbers of March final home sale prices in America’s largest cities. The list now includes 11 metro areas. Prices in some of these cities were already well above $500,000 even before 2020, while in others they have soared spectacularly since the pandemic started.

Here is the full list:

San Francisco (median home price: $1.3 million)

San Diego ($825k)

Los Angeles. ($720k)

Seattle ($626k)

Denver ($565k)

Boston ($560k)

Sacramento ($550k)

New York ($520k)

Portland, Ore. ($505k)

Salt Lake City ($503k)

Austin ($500k)