Opening Comments

Very good feedback on the last report which was longer than I would have liked, but ended up with 70% open rate. That is about as good as it gets since the peak of the pandemic when it hit 90%+ under lockdowns. I hope my last bullet in Quick Bites upsets you. It sure upset me.

In an effort to shorten the piece a bit, I have spent more time curating “Other Headlines” and ordering them into formal sections. For example today, there are sections for Business/Economy, Ukraine and Inflation with many stories in each.

I will do my best to publish at least a short note on Sunday, but I am on the road with Jack Sunday/Monday. If I get one out, it will be abbreviated.

Picture of the Day-Ukrainian Sad Goodbye

Yellow Eyed Queen

Quick Bites

US Markets, Inflation

Markets Research Piece

Dimon & Gross on Inflation

Ruble, State of the Union

Toll On Kids

Another Subway Incident-Poop Smeared on Face

Other Headlines-Expanded and Itemized

Virus/Vaccine

Data-Improvements Continue

Real Estate

Palm Beach Island Condo Stupidity ($21mm)

East Boca Overpriced Home

Picture of the Day-Ukraine Story

I don’t generally attach an ESPN article in the Rosen Report, but this one was sent by a reader and helped to make the war in Ukraine more real for me. As a parent of two children ages 14 and 16, I could not imagine doing what the parents had to do. War is real and I tried to speak with my kids about understanding how good their lives are relative to other kids their age after reading this article.

Tennis player Dayana Yastremska wrapped her arms around her father, tears running down her cheeks. She had to let go. A small boat was waiting to whisk her and her 15-year-old sister, Ivanna, away. Her father had driven them from their home in Odessa, Ukraine, some 150 miles south to Izmail, a smaller city in the Danube Delta. Throughout their early-morning drive on Friday, a day after Russia invaded Ukraine, she saw the devastation the war already had wreaked. Smoke, buildings turned to rubble, an eerie quiet. Her father parked the car in Izmail, and the family walked the last five minutes to the harbor, to the boat that would take Dayana and her sister to Romania. Their father kissed her forehead as she held onto two suitcases, her entire life packed haphazardly in them. "I don't know how this war will end, but you must take care of each other, and strive for your dreams, build your new life and always be together," her father said to her. "Don't worry about us, everything will be fine." In matching pink sweatpants, the sisters walked away from their parents, rolling their suitcases to the boat. When the boat's engine whirred, they waved vigorously at their parents, at the country they were forced to leave behind, at everything they knew to be home.

Open the link to read the full story. Bring your Kleenex.

Yellow Eyed Queen

Giving my reports is among the most challenging things I do before hitting send. If I have a catchy title, the open rate goes up a bit, so I am trying a name which will throw the readers for a loop. Today’s note is about a few fish species and two of them are the Queen Snapper and the Yellow Eye Snapper, so I combined the names for the title.

I recently befriended a die-hard fisherman and new Rosen Report reader. We went on a day trip approximately 90 miles into the Atlantic Ocean on his boat. We were targeting a few species of fish including Wahoo and Snapper. Wahoo are among the fastest fish in the ocean and can swim up to 60 mph. They have incredibly sharp teeth and hit your line like a freight train. You need to use a wire leader or the toothy fish will generally cut your line. We fished a technique called “high speed trolling” which means we dragged very large lures (islanders and cowbells) at 15-18mph. Normal trolling is 6-8mph. Many times, Wahoo swim in packs and you can get hit on multiple lines within seconds. The world record Wahoo is 184lbs. My largest is 50 lbs. I have had the 100 pounder on my bucket list. But unfortunately, this trip did not result in a big one.

Wahoo on a cowbell (not from this trip)

On the trip, we only caught two Wahoo and nothing was big. See below, what do you think happened to the tail of this one? It got sharked.

Islander lures-The three on my left are my favorite colors

We also did a form of fishing called, “Deep Dropping.” We used a large electric reel and a 5-10 pound weight to get the bait to the bottom in water depths between 800-2,000 feet. Given it is so dark down there, we put lights near the bait to help attract fish. It takes few minutes to get the line to the bottom, and we hope to catch large snapper and grouper of varying varieties. This is the “LP” or Lindgren Pitman electric reel which can send line down thousands of feet. Trust me, we catch some strange looking fish down there. Monday, we caught a shark which looked like an alien with the craziest green eyes. I could not take a photo as we needed to get it get it off the hook safely. I went on-line and believe the shark was a Sixgill Shark. I grabbed a picture off the internet.

The reel reads 750 which is the equivalent of almost 750 feet as it is revolutions of the spool with each revolution being counted as one. It read 1,300 at bottom in approximately 1,150 feet of water. This reel can easily catch an 800 pound swordfish in 1,500 feet of water.

We tried a new spot with coordinates I was given, and let’s just say it was MAGIC. On the 1st drop, I got hit hard and landed this beautiful Yelloweye Snapper which weighed over 13lbs. Many believe this is the best tasting snapper. It is by far the largest one I ever caught. I generally catch 3-6 pounders. Note the size of the pupil, and it is not too hard to figure out why it is called a Yelloweye.

The next drop I got this one Queen Snapper which is one of my personal favorites.

Then the next drop, this beauty came up and was my largest Queen Snapper ever at over 17lbs. The coloring on the tail of these fish is spectacular. Again, note the size of the pupil given they live at the ocean depths between 600-2,000 feet beneath the surface.

Like most everyone, my life has taken plenty of twists and turns in it. I have been fortunate to overcome some early setbacks and feel one of the best decisions I ever made was leaving NYC to move to South Florida almost 5 years ago. Although just like every other decision you make, it has its issues. Days like Monday are so special despite not bringing back a ton of fish. I went with two good friends, and we had plenty of laughs on a beautiful day. Despite all the turmoil in the world, we got away from our phones for 12 hours (no cell service) and just had fun with lots of jokes and plenty of banter. Of note, when I got back into service approximately 15 miles from shore, I had 42 texts, hundreds of emails and 11 voicemails. Some of them quite frantic, “Eric, it is unlike you to be so unresponsive….” Well, when you are in the middle of the ocean on a last minute trip, it is a little hard to get a signal! We have all become too connected in my opinion and could use some time away.

My son, Jack always would go with me on such trips, but time on the ocean means he is not on the golf course. So it is rare for him to come along in the past couple years. Here are pictures from when he loved fishing more than golf and they sure bring back great memories. Looks like he was having fun to me and I do not recall a smile like this at any time on the links. The first one is a small Queen Snapper and the 2nd one is a 13 lb Mutton Snapper.

Quick Bites

Stocks rebounded sharply on Wednesday despite a continued surge in oil prices amid the intensifying conflict between Russia and Ukraine. The Dow gained 596 points, or 1.8%, to close at 33,891. The S&P 500 added 1.9% to 4,387, while the Nasdaq rose 1.6% to 13,752. The gains effectively reversed losses from Tuesday’s session. It was a broad rally, with nearly every name in the 30-stock Dow moving higher. Shares of Caterpillar rose more than 5%, while Intel rose 4.4% and Goldman Sachs climbed 2.5%. Tuesday markets were hit and today they rebounded sharply. Powell indicated he wants a 25bps raise in March. Oil is ripping and now at $111/barrel (+7.6% on day) and Natural Gas is $4.8 (+5.6% on day). Crypto was largely flat, a rare decoupling with equities. The rates moves have been substantial and are outlined in a bullet from Oppenheimer. The 10-Year Treasury is back up to 1.88% (+17bps on the day).

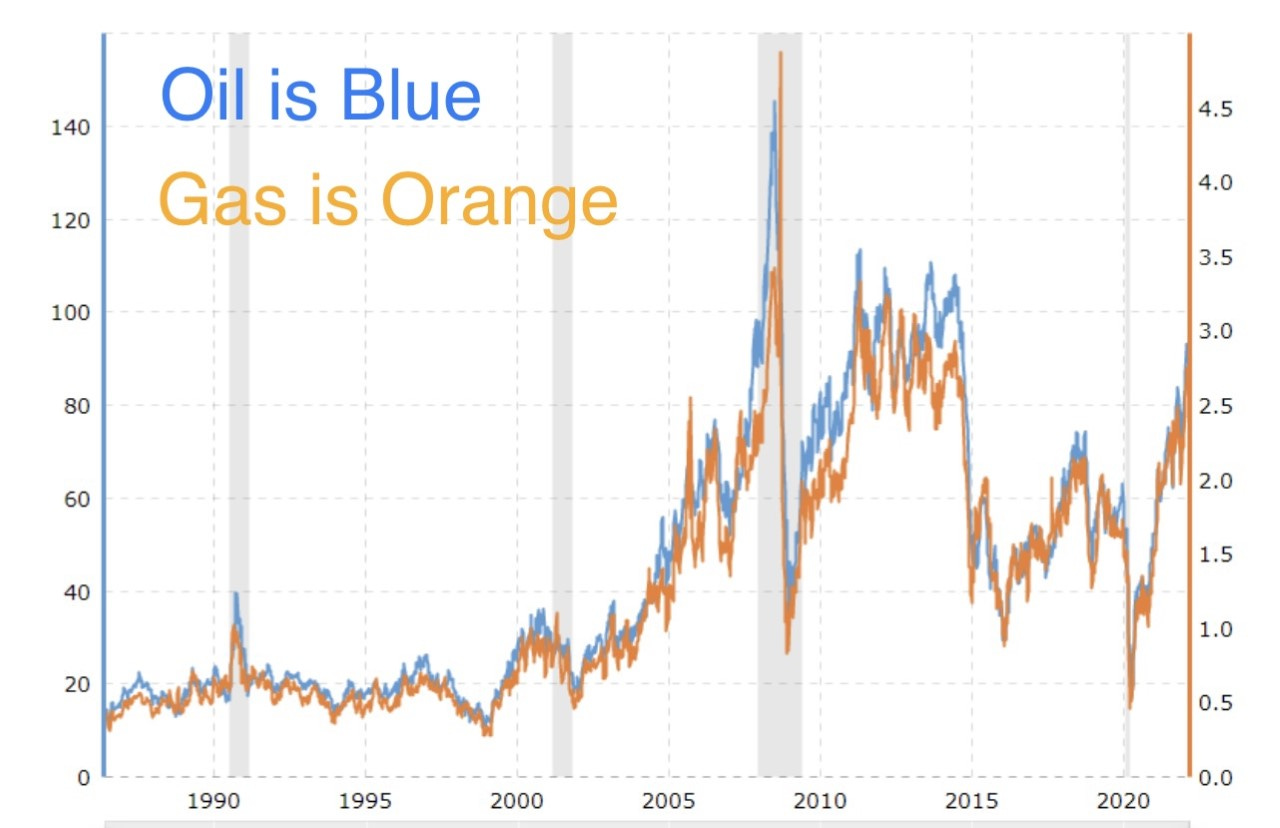

In recent weeks, I had suggested that I felt inflation would peak in coming months, and it was more of a 2021 and early 2022 issue. The situation in Ukraine is making me a bit nervous about my call. Oil hit $112.5/barrel today and some experts are calling for $150-200. Oil is now at an 11-year high. The first chart shows the move in oil. The second chart compares oil (blue line) and gasoline (orange line), and as you can see, the correlation coefficient is high. The link is interactive, and you can click on it to see the exact price of oil and gas. US gas prices average $3.66/gallon relative to $2.73/gallon one year ago. The all-time high was $4.11/gallon in July of 2008. Higher gas is a regressive tax and fear it can go decently higher. Aluminum and wheat have rallied sharply as well as natural gas and coal. Wheat traded “limit up” today and was the highest in 14 years. European natural gas surged as much as 60% at one point to an all-time high on Wednesday. Remember, Europe gets over 40% of its natural gas from Russia. This morning, CNBC reported that US oil consumption is approaching 21mm barrels/day. This is up from what I had seen which was in the 19mm/barrels range. Again, the US should be energy independent and not reliant on Russia or anyone else for oil. This CNBC interview today suggested that there is a minimum of a two million barrel a day shortfall if Russia is unable to sell its oil into the market. A shortfall of 25% of that would have a massive impact on oil prices. In the past year, oil is +100%, natural gas is 90%, corn+49%, wheat+62%, beef+15%, lean hogs +35%, aluminum is +69%, gasoline +31%. You get the idea.

This was from an informative note from Oppenheimer about rates, inflation, GDP and was sent Tuesday night. With the moves today, these numbers are less relevant, but the points made are interesting. The rate moves today were massive. 10 year yields dropped over 10bps to 1.72%, 2 year yields dropped 9bps to 1.34%. Today, the 10 year is back to 1.86%. At the same time odds of any hike at all in March dropped below 100% (92%) and total hikes in 2022 dropped to only 4.7. For context, 1 week ago we had a 40% chance of a 50bps hike in March (25 bps locked in) and over 6 hikes in 2022. The market is betting the risks associated with a war in Europe and heavy economic sanctions will compel the Fed to proceed with much greater caution in their rate path. That might be a good bet, but if 50 bps is off the table and the Fed develops a less hawkish posture on balance sheet runoff, they risk losing credibility, exacerbating inflation and just kicking the can down the road, especially considering the developing inflation backdrop. The next wrinkle for the Fed to contend with is the potential for a rather material slowdown in economic growth. Atlanta Fed GDP Now printed their 1Q GDP estimate at 0.0% today, down from .6% last week and a high of 1.5% 2 weeks ago. Recall this is down from 4Q annualized GDP 6.9% (which had a large inventory building component). We’re pretty far along into the quarter and the Fed’s “nowcast,” which is a running estimate of real GDP based on available data for the current measured quarter, is saying we’re not far from a contraction. This highlights the risk of a Fed policy error in which we’re hiking into a slowdown. This is what the 2s10 curve is signaling as well at 37bps, near the flattest levels we’ve seen this cycle. Surging inflation, decelerating economic growth and geopolitical crisis all converge to create a nearly impossible needle to thread.

Jamie Dimon said the West's sanctions on Russian banks could have "unintended consequences." He also told investors they should get used to market volatility, given the high levels of uncertainty. The US and its allies cut certain Russian banks out of the SWIFT global payments system in response to the war in Ukraine. Dimon, in an interview with Bloomberg TV, told investors they should strap in because volatility in financial markets is here to stay, after a calm 2021 that saw US stocks consistently hit record highs. The past 5 days, the VIX (volatility index) has moved in a 30% band between 27 to 35 (2nd chart). Yes, volatility is here. Bill Gross is getting more concerned as outlined in this Bloomberg article largely due to inflation concerns.

A combination of sanctions and worldwide support for Ukraine has sent the Ruble tumbling. The chart below is for 1 month and you can see the fall in the past week. The Ruble fell approximately 30% against the dollar on Monday.

State of the Union-I was hoping President Biden would bring his “A” game given the importance of the speech. I felt his opening and closing were good enough, but found the majority of the speech was lackluster. He received bipartisan support for his Ukraine comments. Again, I am pulling for the pilot and want him to succeed as the cost of failure is too high. The headline from the WSJ Opinion page summarized the event the best for me: Biden Misses the Moment in His State of the Union Address even though the content of the piece was less informative than the headline. CNN had a “slightly” different take suggesting Biden delivered a “stirring rallying cry” for the free world. This Washington Post article does a good job of fact checking some of Biden’s outrageous claims. Biden made it clear the US will send in troops to protect NATO countries, but will not send troops into Ukraine. Biden tried to resurrect his agenda in the speech. Sorry, I do not think we need Build Back Better right now. Biden praised Ford and GM for job creation and EV spend, but failed to mention Tesla and the fact that they have done far more on every front. The President mumbled a bit and said Iranian rather than Ukrainian (Kamala’s reaction here) and said America rather than Delaware. At points, he seemed to have lost his train of thought or place on the teleprompter. I have a lot of respect for these speech writers, but believe this one fell short for me due to the gravity of the time. In the end, I believe we needed an “A” out of our President and were delivered a “C+.” Note, Pelosi did not rip up this speech as she did for Trump. I will also note the timing of the new mask mandate coincided with the State of the Union. To me, it should have been a while ago. This Yahoo article outlined 5 Takaways from the Speech 1) Masks, 2) Nyet to Putin, 3) Return to Normal, 4) Fund the Police, 5) What was said & Left Unsaid. As an aside, I felt Iowa Governor Kim Reynolds gave a coherent 14 minute rebuttal which can be found here.

We have been through over two years of a horrible pandemic where kids were unable to attend school/learn on-line, then had to wear masks for 8 hours a day, social distance, have no birthday parties, play dates, homecoming, prom, missed vacations, camps, sporting events, family gatherings….Now, as things are getting back to “normal,” we are discussing nuclear war. My 14 year old daughter is asking a ton of questions about war, nuclear war, Taiwan. Asking if we will be bombed and all the kids in her school are talking about it. Many of them are scaring the hell out of her. I am getting texts from my daughter all day: “Will there be bombs here?” “What do we do if a bomb comes?” “China bombed Taiwan?” “Can Russian missiles hit South Florida?” “Should we have a bunker?” What is the long term impact on children for the past two years and the current uncertainties and turmoil? Last weekend, my daughter had one of her 1st Bar-Mitzvah parties to attend. Why? Almost all were cancelled due to the pandemic for two years. By now, she should have attended 20 or more.

I do get some notes from people who tell me I am being too hard on crime in NYC, Chicago, SFO, LA…These are big cities and crime happens I am told. I get others who say I am not doing enough to highlight the deterioration in living conditions. This story has sent me over the edge. A man smeared poop on a woman’s face on the subway platform. The sicko accused of smearing feces on a woman’s face in a revolting Bronx attack has a lengthy rap sheet — and was released without bail in separate assault cases last month, authorities said Thursday. Frank Abrokwa, 37, has been arrested more than 20 times since 1999, including on Feb. 5, when he allegedly slugged a man in the face at the Port Authority Bus Terminal, according to cops and a criminal complaint. Here is a link which outlines what Abrokwa said to the police and the judge. In short, he said, "“S--T Happens,” to the cops and F--k you, bitch to the judge. Sorry, there is no one who can tell me the system is working, and people who have been arrested dozens of times are out to terrorize innocent people. Until there are consequences for bad acts, why should they stop? Bragg, you are wrong. Nothing you can tell me will make these stories less absurd. Do something about it or step down and let someone else make the tough decisions. This felon, Abrokwa, was let go without bail due to the fact the charges were not bail-eligible under the new laws. Remember, this same man attacked someone saying “F–king Jew, I’m going to kill you.” The law abiding, tax paying citizens who add value to the community are the ones harmed. The hammer attack in the last piece? My friend is 6’2” and 220 pounds and an expert in Krav Maga. He now walks the street with a knife and feels unsafe for the first time in his 30 years in NYC. If he feels unsafe, how should everyone else feel?

Other Headlines

Business/Economics

‘We’ll be heard’: California could grant fast food workers unprecedented power

Ford will split EVs and legacy autos into separate units as it aims to boost electric business

Companies added 475,000 jobs in February, better than expected, ADP says

War Related

Ukraine war: Kremlin adviser urges ceasefire, says Putin's invasion 'embarrassing' for Russia

Russian troops reportedly slaughter cop’s children, parents, partner

This story is VERY concerning.

Russia takes aim at urban areas; Biden vows Putin will ‘pay’

Ukraine's president says Russian missile hit site of Babyn Yar Holocaust memorial

Putin’s popularity soared after Russia invaded Crimea. This time, it’s different

Putin’s obsession with Ukraine has made analysts question his rationality

China will not join sanctions against Russia, banking regulator says

Russian aviation sector isolated as Boeing suspends parts, maintenance

Russian Hit Squad Sent to Assassinate Zelensky ‘Eliminated,’ Ukrainian Official Says

Incredible photos show smouldering Russian convoy blitzed to ashes by Ukrainian resistance as Putin’s Kyiv siege stalls (Incredible pictures in link)

Global hacking group Anonymous launches ‘cyber war’ against Russia

Russia’s Sberbank collapses 95% on London stock exchange as it exits Europe

Russia says its economy is taking 'serious blows' as isolation grows

Interesting CNN article with good data points.

Ukraine accepts dogecoin, other cryptocurrencies for donations as funding rises to $35 million

Ukraine announces postage stamp creation contest; examples include image of Zelenskyy spanking Putin

Inflation Related

With inflation and Ukraine, Powell must thread a needle on Capitol Hill this week to calm markets

Wheat prices soar to highest since 2008 on potential Russia supply hit

Target Raises Minimum Wage to $24 an Hour in Some Markets This Year

Mortgage rates plunge just as home prices set another record

Virus/Vaccine

The positive trends continue, but as you can see in the chart, the rate of improvement in case reductions is slowing. New cases fell to 59k and were -58% despite only a 4% reduction in testing. Hospitalizations fell 445 to just under 48k and ICUs fell 44% as well down to under 9k. Deaths dropped 18% to 1.9k, but now total deaths in the US are over 950k. The John’s Hopkins Positivity rate is now 4.6% after hitting 30% in the Omicron peak.

Real Estate

A reader sent me a link to a condo being offered at $21.75mm in Palm Beach. It sold 11/1/21 for $17.6mm. Now, it is the most expensive condo ever offered on the island. To me, the building looks dated as it was built in 1986. Given the size of the condo is approximately 4,095 ft, we are talking an offering price of over $5,300/ft for a 3 bedroom/3.5 bathroom condo at the Breakers. It gets better. I called the broker, and the quarterly maintenance is $42k. I asked why so high and does this include membership to the Breakers. “This is just what it costs to run the building and no, it does not include Breakers membership,” he said. For perspective, the Bristol has the best amenities, is new and is in the $1.6/ft per month for maintenance. The amenities at the Bristol are insane. The apartment discussed is charging $3.4/ft. Additionally, you have to pay real estate taxes which would approximate $250,000+/year. The reason I am writing this is something is wrong if an apartment which looks like this goes for $5,000/ft with massive maintenance expenses or anywhere close to it. Your carrying costs are basically $500k to own a 4,000 ft condo with no mortgage? No inventory down here and the migration continues. The kitchen is not even impressive. Nothing down here surprises me anymore in terms of prices, but this seems very high to me.

I was told of a house for sale near me and I have throw up in my mouth about the asking price of $9.6mm. The address is 428 East Camino Real across from the Boca Resort. It is a VERY busy street, but worse the house is the 3rd one in from the intracoastal drawbridge. This bridge opens every twenty minutes and when it does, the cars are backed up for up to 1/2 mile (in front of your house). This means you cannot get into or out of your house CONSTANTLY. If you told me I could live there for $3mm, I would be unable to handle the traffic and might have a nervous breakdown. The house was knocked down as new construction begins. I have included a picture of the map of the house. I have outlined the bridge and the thick red line is the traffic and it goes for hundreds of yards beyond (east) of this house. I cannot wait to find out the details when this one sells. If anyone is dumb enough to buy this for almost $10mm, mine should be worth more than I thought. The lot is 16,700 ft and the house will be 5 beds and 6 baths and total 6,736 feet. The vacant lot is being offered at $3.85mm. The builder is charging almost $5.8mm to build the house or $860/ft. When I moved here, building costs were well under $400/ft. The house last sold 5/21 for $2.47mm. The second picture is cars in front of the lot. The bus is blocking it and there were 35 cars behind the bus waiting for the bridge. SERENITY NOW.