Opening Comments

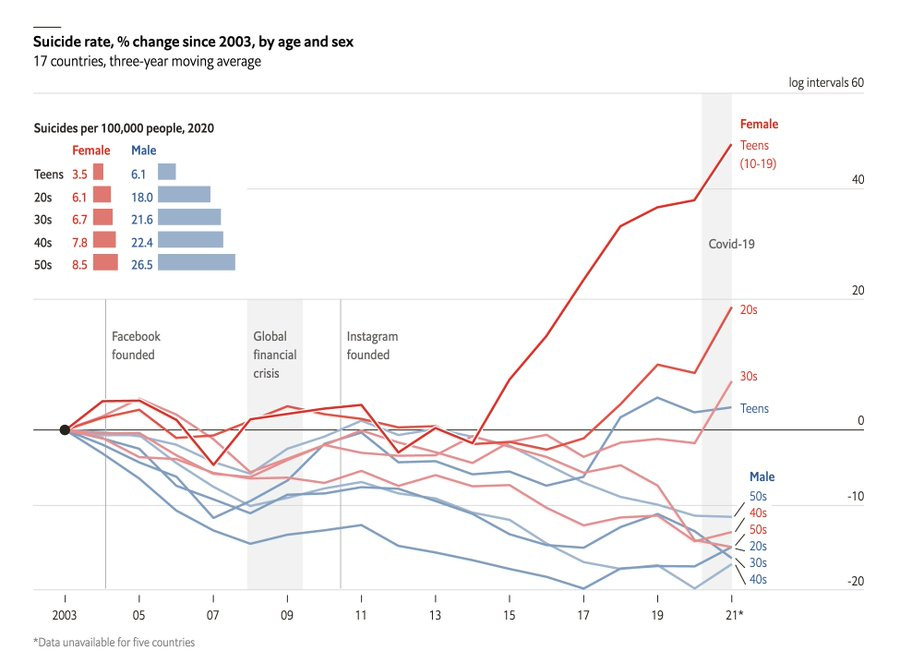

My last note was about the impact of social media on teens. The most opened links were the insane workout video and the short Milton Friedman video explaining inflation.

I am off to CA tomorrow at 6:00 am. I have lunch with a group of 3i Members on Monday and then a Dodgers game with one of my favorite people in my 30 years in markets. I am looking forward to seeing some old friends and making new ones.

Then off to the Kelly Slater Wave pool Tuesday afternoon in Fresno. This year, we have drone footage. For those who don’t recall, this was me last year at this time. I am getting old, but not bad for a guy who surfs one day/year. Such a good group of people and many are great surfers! No photo editing. Me at 53 last year. I hope to get out an abbreviated piece on Wednesday between waves.

I had a great day in Miami educating buyers on R/E development deals at the high end ($20-30mm lots) and then went to an amazing wine-tasting event at the Reserve on the water and watched professional Padel players. When I play Padel, I look nothing like the professionals. I ended up grabbing drinks at two Pura Vida restaurants on Friday. Guess how much these drinks cost? NEVER AGAIN. However, my Uber from downtown Miami was $59+tip to Boca. The trip was 47 miles. In NYC, it would have been over $200.

Investing Your Cash

I think it is very important to spend time understanding yields for your cash/short term investments. I am maniacal about picking up yield and going across money market funds, treasuries, term deposits and bank CDs… to determine how I can maximize my returns on my cash positions while maintaining liquidity to make my hard money loans. It had me scrambling this week as I am in the process of doing a loan against an array of assets in a complex structure and had to carefully pick how to raise the money to fund the loan while considering tax consequences. For years, investors were paid zero on cash and now that yields are 5%+, the onus is on you to spend time to educate yourself on the alternatives. I strongly suggest speaking with a representative of the bank where you have your money to help educate you. I am on the phone every week with the team at JPM to work together to get the most out of my cash.

Markets

AI Impacting Wall Street Jobs

Bitcoin Halving Explained

Cost of Home Ownership

Cost-Benefit of Colleges

NYC Townhouses Out of Fashion Due to Security?

Larry Robbins on His Move to Florida-Great Quote

Barry Diller Buys $45mm Lot in Miami

South Florida Golf Market is on Fire

Video of the Day-Comedian Nate Bargatze

I have a favorite new comedian named Nate Bargatze. I think he is the funniest comedian today and here is a short video showing off his greatness. He is clean and “matter of fact” in his delivery. Here is a longer version of clips.

Zumba Shoes

I know there are shoes for most occasions. I have my fair share of shoes for everything from tennis, golf, beach, fishing, gym, biking, hiking, running, basketball, business casual, suits, formal, beach, rain, snow…. Most sports require a specific shoe and I appreciate that. However, I just saw my wife, Jill, with two boxes of shoes that said, “Zumba Wear.” I thought this was some kind of Saturday Night Live skit. I said, “What the hell are these?” It turns out Jill’s Zumba partner, bought her specific Zumba shoes as my wife has become more of a “Zumba Regular.”

Because I am a little bit crazy and a bit intellectually curious, I Googled “How many brands of Zumba shoes are there?” Of course, Amazon came up and checked it out. This is really a thing. There are 7 pages of Zumba shoes on Amazon at 55 shoes per page. The price ranges from $25-99. They are reasonably priced, but I never would have guessed there are so many Zumba shoe choices.

When you factor in colors, the choices are multiples of what I could have imagined. The pink below comes in green and white as well. So, if you do Zumba and are just wearing sneakers, shame on you. Be the Zumba pro you always wanted to be and get yourself the proper kicks. I expect my wife’s Zumba level to go up two notches with her fancy sneakers.

In a related story…One of my most famous notes was written via email before I used a formal service and could not find it. The note was entitled, “BINGOAT,” about my prowess in Bingo playing in the children’s division before the pandemic. I once went 5 for 7 playing 10 cards while the 5-year-olds played one. I crushed them winning a free ice cream sundae each time. I wanted to start my line of Bingo shoes as a result of the success that made me so famous, I was often called the “Tom Brady of Bingo.” More accurately I called myself the “Tom Brady of Bingo” and don’t recall anyone else calling me that name. Given there are Zumba kicks, I do not see why Bingo shoes are out of the question. Sadly, the Bingo game stopped during the pandemic and brought my bingo shoe dreams to an end.

Quick Bites

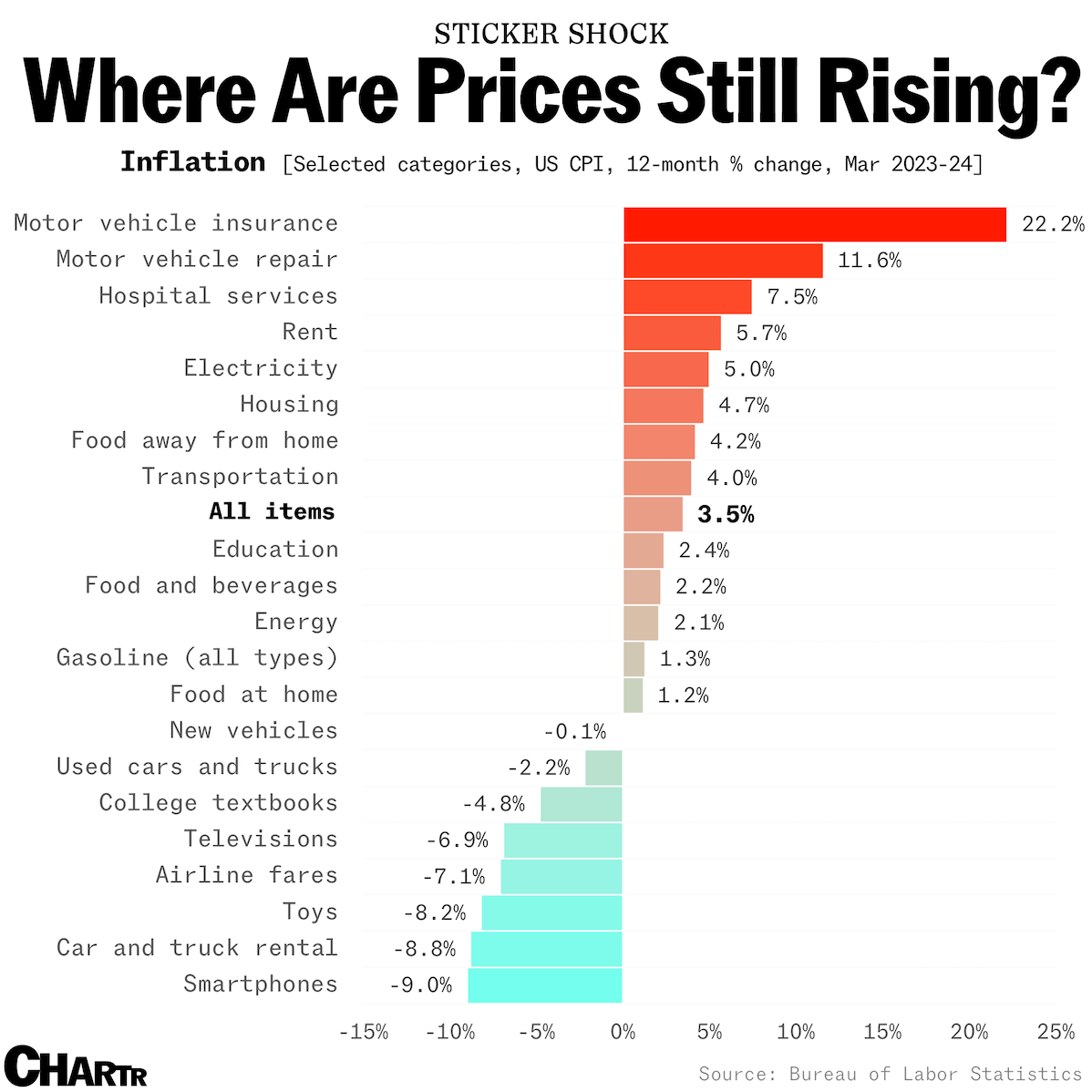

After a hot CPI report, the PPI (wholes prices) came out at +.2% for March, less than the .3% estimates. JPM and Wells Fargo reported on Friday and both stocks were down (JPM -6%,), Stocks sold off Friday with the Dow -1.2%, S&P-1.5% and the Nasdaq -1.6%. Again, the Russell underperformed at -1.9% bringing the YTD to -1.2%. On the week, the S&P fell 2.4% as hot inflation data on CPI spooked markets. Since the beginning of April, 2-Year Treasury yields are +27bps to 4.89% and 10-Year Yields are +31bps to 4.52%. Oil prices rebounded as there was a growing view of an Iran attack on Israel this weekend (happened) bringing the YTD move to +19%. Couple this with Saudi production restrictions and we can see $100 oil on the horizon. On the inflation front, I found this chart from Charlie Bellow and Finance Buzz to be telling concerning fast food inflation.

This NYT article is entitled, “The Worst Part of a Wall Street Career May Be Coming to an End.” It is about AI replacing entry-level jobs and raises questions about the future of Wall Street. Pulling all-nighters to assemble PowerPoint presentations. Punching numbers into Excel spreadsheets. Finessing the language on esoteric financial documents that may never be read by another soul. Such grunt work has long been a rite of passage in investment banking, an industry at the top of the corporate pyramid that lures thousands of young people every year with the promise of prestige and pay. Until now. Generative AI — the technology upending many industries with its ability to produce and crunch new data — has landed on Wall Street. And investment banks, long inured to cultural change, are rapidly turning into Exhibit A on how the new technology could not only supplement but supplant entire ranks of workers. The jobs most immediately at risk are those performed by analysts at the bottom rung of the investment banking business, who put in endless hours to learn the building blocks of corporate finance, including the intricacies of mergers, public offerings and bond deals. Now, A.I. can do much of that work speedily and with considerably less whining. One thing is for certain, the world changes and we must adapt. I fondly recall working long hours early in my career. Building models, writing decks, and investment memos. It was part of my training. My question is if junior people are not developing these skills, how will they become senior bankers/traders without the experience?

Given the huge rally in Bitcoin, I thought this CNBC article explaining “halving” was worth a look. The halving occurs when incentives for bitcoin miners are cut by half, as mandated by the code of the bitcoin blockchain. It’s scheduled to take place every 210,000 blocks, or roughly four years. As a refresher, miners run the machines that do the work (essentially solving a very complex math problem) of recording new blocks of Bitcoin transactions and adding them to the global ledger, also known as the blockchain. Miners have two incentives to mine: transaction fees that are paid voluntarily by senders (for faster settlement) and mining rewards — 6.25 newly created bitcoins, or about $437,500 as of Thursday morning. Sometime between April 18 and April 21, the mining rewards will shrink to 3.125 bitcoins. The incentive was initially 50 bitcoins, but that was reduced to 6.25 in 2020. Given more institutional players participating in recent months coupled with halving on the mining front, it should be a stronger technical for Bitcoin. The chart below shows how mining has been restricted over the past 15 years. Of note, BTC is -7% in the past week after being hit hard this weekend and is trading at $64k after being $71k Friday.

This is a WSJ article entitled, “The Hidden Costs of Homeownership Are Skyrocketing-Rising Insurance Premiums, property taxes and maintenance costs show little sign of abating.” The article details how sharply higher costs are pinching homeowners and forcing them to skip repairs. When you factor in home prices, rates, insurance, taxes and maintenance, many homeowners are unable to keep up and the article outlines multiple examples.

Insurance Premiums+20% from 2021-2023

Home Maintenance +8.3% last year

R/E Taxes+4.1% nationally. In Charlotte+31.5% & Indianapolis +19%

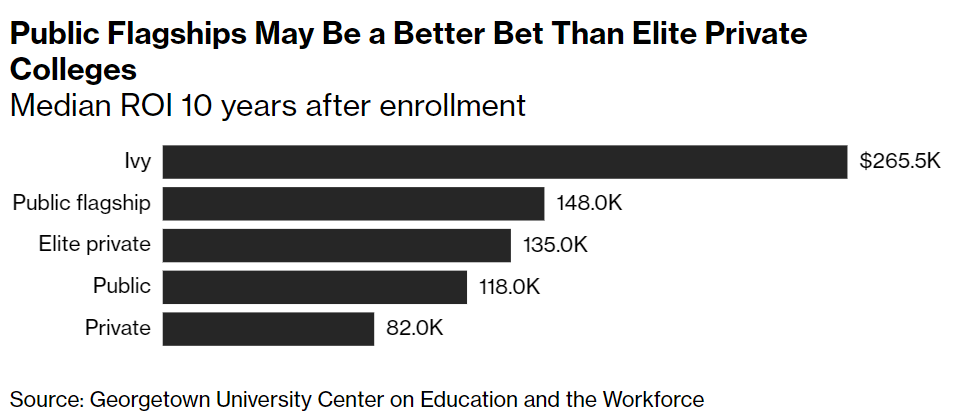

I have written extensively about the cost/benefit of colleges today and this Bloomberg article has an interactive link to compare schools. It suggests if you did not get into many top colleges, you are probably better off financially when factoring in the cost relative to the career income. Many of the Ivy League, Stanford, MIT… were high cost and high return. Some schools were more reasonable cost with a solid return if you can access the link (Milwaukee School of Engineering, Kettering University, University of the Sciences, GA Institute of Technology…) A Bloomberg News analysis of more than 1,500 nonprofit four-year colleges shows the return on investment at many elite private institutions outside the eight Ivies is no better than far-less selective public universities. In fact, the typical 10-year return on investment of the so-called “Hidden Ivies” — a list of 63 top private colleges — is about 49% less than the official Ivies and 9% less than states’ most prominent universities, known as public flagships. The link allows you to compare schools with a few interactive areas. Well done, Bloomberg.

Israel

The big news over the weekend was Iran sending 300 drones and missiles to Israel for the first-ever direct attack. Historically, Iran funded terror groups or proxies to strike Israelis. A “senior Israeli official” was later quoted pledging an “unprecedented response” to Iran’s attack and urging Israelis not to go to bed due to what was coming Tehran’s way. However, Biden told Bibi U.S. won't support an Israeli counterattack on Iran due to fears of escalation. This article suggests 99% of 200 drones were intercepted according to officials. Is this the beginning of an escalation or just a message? This article suggests that Iran offered Israel an “off ramp” to conclude the attack. However, Iran vows a “stronger and more resolute” attack if Israel retaliates. I believe Israel should use this to destroy Iran’s nuclear capabilities. The world has allowed Iran too much leeway in obtaining nukes and the country’s leaders continue to want to murder Jews and end the state of Israel. I agree with John Bolton, the attack was a “massive failure of Israeli and American deterrence.” Also of note, Iran threatened Israel’s supporters if aid is given to Israel to help a counterattack.

Three sons of Hamas leader Haniyeh killed in Israeli airstrike

U.S. says it will provide unspecified support for Israel’s defense in Iran drone attack

Iranian special forces seize a cargo vessel in a key shipping lane, state media reports

Warren predicts ICJ will find Israel committed genocide in Gaza

Elizabeth Warren suggested Israel’s bombing of Gaza could be found to be genocide by the International Court of Justice. She later tried to walk back the comments. In WWII the US and Allied forces killed 2,000,000 civilians in Japan and Germany. Would she call for genocide there?

Just two US colleges are doing enough to fight antisemitism — while Ivy Leagues fail, report says

Penn Fund donations down 21% from this time last year amid leadership crisis, donor backlash

Any Jew who gives to this school is an idiot.

Campus Antisemitism Report Card

I just put down the “F,” “D” and “A” marks.

Other Headlines

JPMorgan Chase shares drop after bank gives disappointing guidance on 2024 interest income-

From Dimon’s annual letter-“The deficits today are even larger and occurring in boom times — not as the result of a recession — and they have been supported by quantitative easing, which was never done before the great financial crisis,” “These markets seem to be pricing in at a 70% to 80% chance of a soft landing — modest growth along with declining inflation and interest rates,” Dimon writes, adding that the odds are actually a lot lower.”

Risk of 1987-Style Meltdown Sparks Ruffer’s Record Cash Bet

UK asset manager of $27bn is holding 2/3rds of its assets in cash, which is an incredibly shocking amount for a money manager. The thesis is around a major pull-back in risk assets and are buying puts and credit default swaps as hedges. They have averaged 5% cash and an 8.1% annual return.

Trump Media shares end week down nearly 20%, losing billions in market cap

I crushed this stock in my comments in the past two weeks regarding overvaluation and it is still too high despite the 50% decline. It is trading at 1,100 times sales. Remember, user growth is -50%.

Manhattan court must find a dozen jurors to hear first-ever criminal case against a former president

California spent billions on homelessness without tracking if it worked

When people ask me why I have no faith in the government, I can site countless examples of waste. How can anyone spend billions on anything without understanding if the investment is working? Over $20bn was spent. Based on my time in CA (again tomorrow), I am not convinced the $20bn has had the desired outcome as you trip over homeless people. Half of the homeless people in American live in CA and the # of homeless in CA is growing.

Afghan Migrant On Terror List Released By Immigration Judge, Free To Roam USA

Homeless NYC migrant who ‘swiped’ historic FDNY boat freed without bail — immediately strikes again

Wait. No consequences for crime leads to increased bad behavior? Who would have thought it?

Teens assault, attempt to rob Uber driver at gunpoint while filming attack

Welcome to NYC where there is no consequences for crime. The kids in question appear to be 11-17 years old. Scary pictures.

85-year-old Idaho woman hailed as 'hero' in fatal shooting of home invasion suspect

The amazingly strong woman was beaten and handcuffed yet killed an intruder.

WEF Demands Governments Censor ‘Negativity’

The WEF is a joke on many levels. They take private planes and yell at people about climate change. Now they want to censor you.

The timing of this headline makes perfect sense and I am leaving for CA on Monday.

Price of Godiva Chocolate Boxes Are Going Up as Cocoa Prices Soar

I am prepared. I just made cookies, brownies, and banana chocolate chip muffins and still have this left over.

A $1,400 SUV payment? A $1,600 truck payment? Sounds ‘absurd,’ but it’s becoming more common.

17.4% of new cars were financed with a monthly payment of over $1,000, compared with 5% in February 2020. The average transaction price for new vehicles jumped from $38,130 to $47,060, and the average interest rate on new-car loans went from 5.7% to 7.1%.

Why car insurance costs are skyrocketing and leading to higher inflation

One of my friends was quoted $1,000/month to insure a $35k car for his 16-year-old son! According to the CNBC article, since December 2021, auto insurance costs are +45.8%. Call my sponsor, Lang, for your insurance needs.

Barred Morgan Stanley Banker Joins Firm That Got His Trading Leaks

No chance I would ever hire this guy.

USPS proposes raising the prices of 1st class stamps to 73 cents

Inflation has averaged 3.97% since 1969 (my birth year) and stamps have gone up 4.75% per year on average during that period.

Worrying figures show STD rates skyrocket among Americans 55 and older

Adults in the US over the age of 55 are contracting Chlamydia, Hepatitis C, and syphilis at a much higher rate than they were just 10 years ago.

The rich are getting second passports, citing risk of instability

Michelin Announces 10 New York Restaurants Up for 2024 Awards

I will be in NYC this summer for about 30 days. I will have so many places to review that I might gain 10 lbs.

Residents of this state pay $987,117 in lifetime taxes. Guess which one?

15 US Agencies Knew Wuhan Lab Was "Trying To Create A Coronavirus Like COVID-19": Rand Paul

Bird flu is spreading to more farm animals. Are milk and eggs safe?

Vietnam sentences real estate tycoon Truong My Lan to death in its largest-ever fraud case

This should deter future fraudsters.

Stabbing rampage at Sydney mall leaves at least seven dead, including attacker

Real Estate

I thought this article about NYC wealthy residents not wanting to live in townhouses over safety concerns was interesting. I would not live in a townhouse in NYC and would want a doorman building for my family. Owning and living in a townhouse has long been a peak status symbol in NYC, and achievement that places one amongst Rockefellers, Carnegies, Fricks, Vanderbilts and the like. But, amid growing concerns about crime — a recent poll from Citizens Budget Commission found that just 37% of New Yorkers rated public safety in their neighborhood as excellent or good, down from 50% six years ago — the migrant crisis and squatters, that’s changing. Some wealthy Gothamites are now fearful of living in charming West Village brownstones or sprawling Upper East Side limestone mansions that cost tens of millions of dollars. One NYC R/E broker commented, “During COVID everyone wanted to be in a townhouse because of the minimal contact and privacy,” she said. “After COVID, that shifted. Now, people prefer to be in doorman buildings.” Recently, she had a West Village couple sell their townhouse and move into a new development in the Financial District citing security concerns. And, last summer, a family of four backed out of a roughly $3 million townhouse deal she had negotiated in Williamsburg.

Interesting Fortune article about Larry Robbins (hedge fund manager) entitled, “$2.3 billion hedge fund manager on his move from New York to Florida.” Larry bought a Rosen Report reader’s home a few months ago in Palm Beach Gardens while his family builds a home in Hobe Sound. “I know of no business that has generated long-term success by driving away its highest paying customers,” Robbins said during an hour-long interview, his first since disclosing his plans to investors. “I am in fear for New York’s most vulnerable to become victimized by the great migration.” I agree 100% with Robbins’ comments on NYC and the policies driving out the wealthy residents. More young and successful people want out due to safety, taxes, cost of living, and quality of life concerns. You don’t win by pushing out your best customers! Read the dizzying statistics in this article about Wall Street bonus levels and taxation. Here is one example” Wall Street makes up 2.1% of NY State jobs and 27.4% of state taxes.

I have written extensively about high-end R/E in South Florida and touched on golf. This Post article is entitled, “Rich New Yorkers drive-up Florida country club fees to over $1M: ‘A luxury golf arms race,’” and outlines numerous examples of the insanity. When I moved down in 2017, almost every course was looking for members. The most expensive club in FL was LaGorce in Miami at $150k. Today, LaGorce is over $700k with a long waitlist and you only get back a small fraction of the initiation back now. Shell Bay is $1.3mm and full unless buying a condo there. A course near me, Boca Rio was not doing very well when I moved down (older membership) and they sent me a postcard every month with a free round and lunch for me to check it out. The initiation was minimal, maybe $10k It is now $325k and full with a list. Let’s just say, I have not heard from Boca Rio since the pandemic boom. Emerald Dunes has a 100 member wait despite a $700k initiation fee and high dues. A dozen years ago, it was $75k on the heels of the Global Financial Crisis. There are now almost 10 new courses going up in the Palm Beach to Hobe Sound area. Panther National is an amazing course and started at $400k. I don’t know the exact price but believe it is $575k now. Apogee is up to $675k and will eventually have 3 courses. Don’t forget about the Discovery property, Ken Bakst of Friar’s Head with two courses, Chris Shumway’s club, and others. Steve Witkoff is at it again in Palm Beach at Dutchman’s Pipe, having taken over Banyan Cay. It is being redone and is $300k to join with many top pros committing to it. I am hearing great things. The prior course was $20k not too long ago. Golf was dying and the pandemic saved it. I believe it will slow down again. Too costly to justify today at the new entry prices and the dues at some of these clubs are downright offensive. Shout out to a new public course called, “The Park” by Gil Hanse which is amazing in West Palm Beach.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #673 ©Copyright 2024 Written By Eric Rosen.