Opening Comments

I really enjoyed moderating the Luxury R/E Panel and received positive feedback. The link to the full podcast was by far the most opened. So much interesting info from top brokers in Manhattan, Hamptons, and South Florida. The other link which received a lot of opens was the Google recruiter’s tip after applying for a job.

I wrote a piece a few weeks ago entitled, “Who in the Hell is Don Williams?” People loved the story and my relationship with Ali, my new, 6’10” Gambian friend. I had some hardcore Don Williams fans share some of his songs and I must tell you, I actually heard of a few of them. No, Don Williams should not be on anyone’s “Best Of” list, but he did have these songs: I Believe in You, Be Your Man (Smokey & the Bandit 2), and Tulsa Time were actually songs I have heard before. Also of note, Williams had some impressive sideburns which deserves some respect, but he ain’t no Elvis.

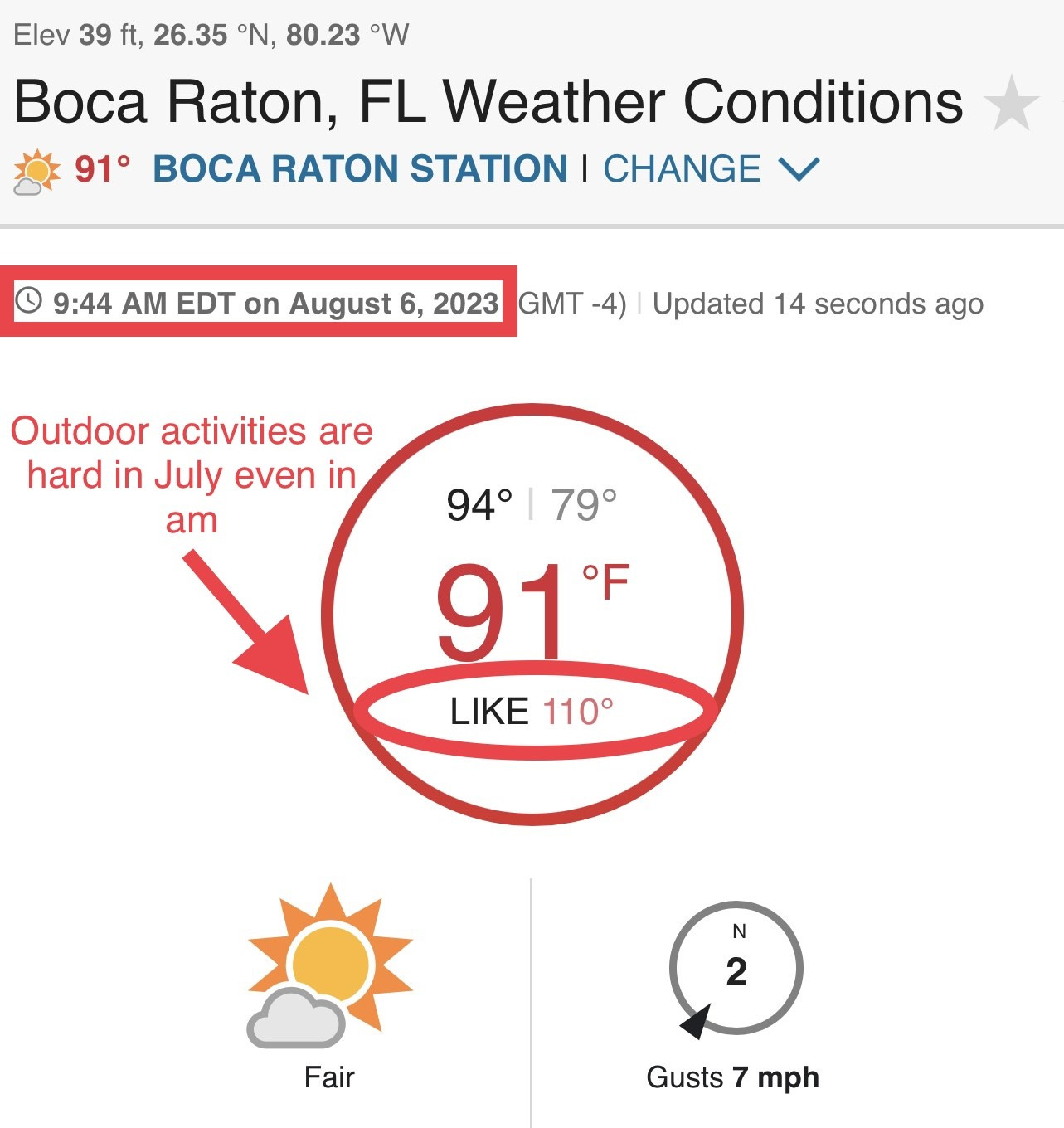

Being back in Florida means I am back in the heat. I played tennis early and it was still too hot for me. I quit at 57 minutes and could not continue. November cannot come fast enough.

Markets/China Deflation

Bank Downgrades

Wall Street Firms Market Concerns

Hindenburg Research

Google Pays Apple Nearly $20bn/Year for Search

Great Charts-Home Prices, Rent v Buy, Office Vacancies…

Brett Baier Palm Beach Home for $37mm

Best Places to Retire

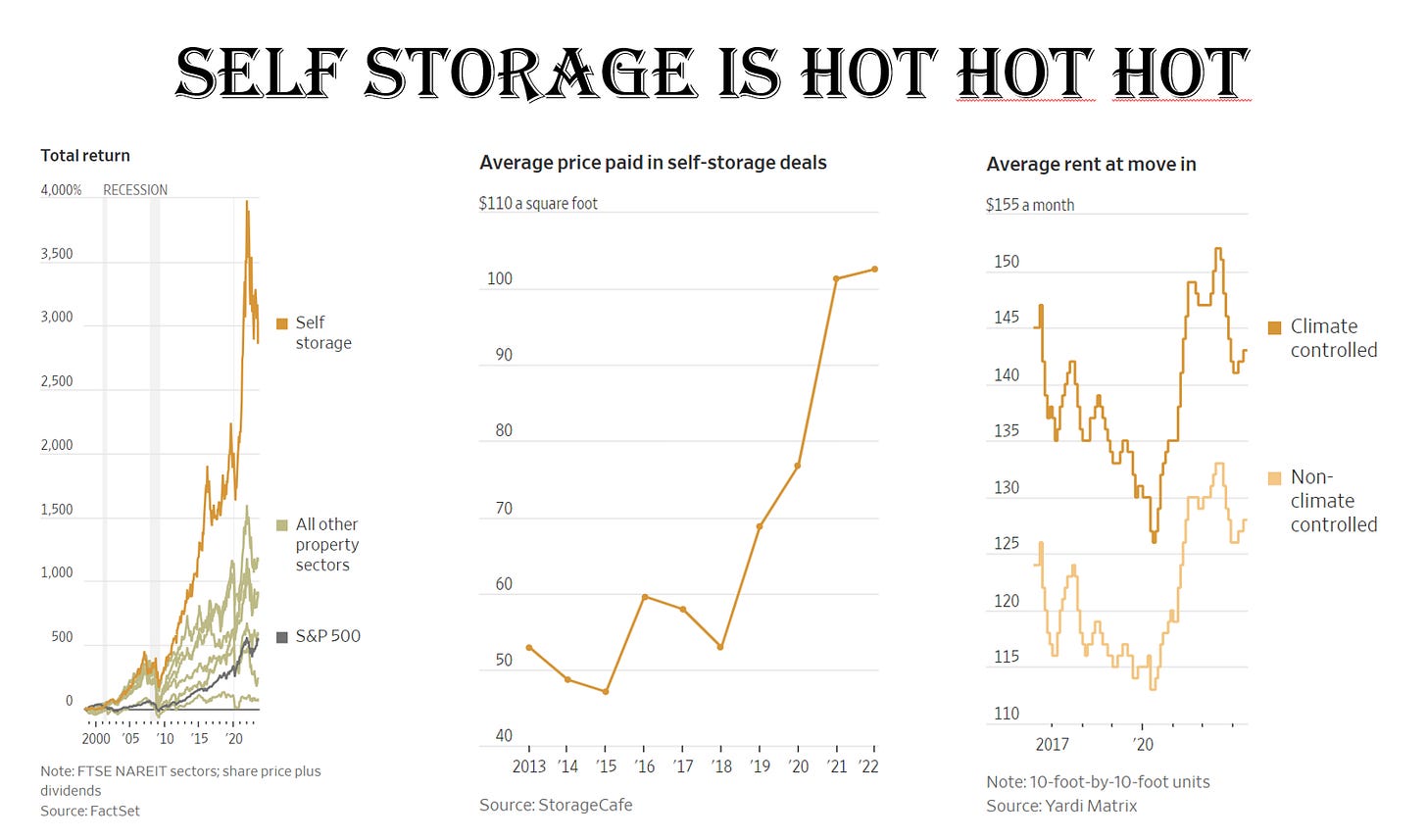

Picture of the Day-Self Storage Market

I wrote a piece on 9-8-21 entitled, “Is Hoarding in my Genes,” about my need for a storage facility despite living in an 8,000 ft home with a 4-car garage and the most ludicrous closets and storage units imaginable. I have received two double-digit rent increases in two years. I thought this WSJ article entitled, “Is There a Limit to Americans’ Self-Storage Addiction,” was interesting. Storage is a rare investment that has done well in good times and spectacularly in periods of economic upheaval. Profits exploded during the pandemic when bedrooms became offices and basements became gyms and the displaced items had to go somewhere. Shares of publicly traded storage companies trounced the broader stock market—and every other real estate class—from the late 1990s through the end of last year. During the pandemic, they even beat the celebrated FAANG tech companies.

If You Build it, They Will Come-The Reef Road Story

When I decided to launch a hedge fund in 2012, I called my former colleagues from JPM, most notably, Jeff Nusbaum. He and I co-founded what became Reef Road capital. Jeff started working with me in 1997 and we were attached at the hip. He came in as an Associate from Cornell Business School and after the third day interning in my division, I said, “Jeff, you know you are never leaving me, right?” He has a knack for quickly assessing an investment or business opportunity and spotting value that others don't see. But even more importantly, as a colleague and partner, he consistently does the right thing for the right reason. We built some great businesses together over 19 years (JPM & Reef Road) along with a fantastic team that included many incredibly talented traders, research analysts and salespeople. I would say that hiring is clearly a core competency of mine and my track record can prove it at Chase, JPM and Reef Road Capital. The fund was named for a famous surf break in Palm Beach called, Reef Road, where I surfed my first big wave at 14 years old. As a reminder of my surfing skills, I am inserting surf pictures of me from April of this year after a long surfing hiatus. Any excuse to show these will be used.

Based on my success at JPM, my recognition in the market for calling and successfully navigating the Global Financial Crisis, and what I felt was a skill at marketing a business, coupled with my partner Jeff’s complementary experience, I was certain we would raise billions. I had the right references and connections and was certain the money would flow with ease. I was WRONG. In the early days of our fundraising, when we were really just a concept of a business, Jeff and I went on the road across the country, meeting with many dozens of investors, and the feedback was generally the same, “You have an impressive pedigree and history of success together but let me know when you fill in the ‘TBDs,’ as you need more meat on the bone.” I was devastated, as I was convinced it would be easier. We had a pitchbook, but “TBD-To Be Determined” was in various boxes for other positions in the firm as well as for service providers to the fund.

One of the most bizarre fundraising experiences I've ever had in those very early days was during a west coast trip when we went to Seattle and met with an allocator. He was warming to us but was hardly a hot lead. Our dialogue was with one of the senior partners of the firm, so we were glad to be in discussion with a key decision-maker. The gentleman was extremely thoughtful and helpful to us - he focused on emerging managers and seemed like he genuinely wanted to go to bat for us. Two weeks later, he called and said he was coming to NYC and wanted to run through due diligence. Jeff and I met with him for several hours in a borrowed conference room at one of the banks. At the end of the meeting, he said, “I am in for $25mm.” It was our first money raised and Jeff and I were pumped.

I called the NEXT day to thank the allocator for believing in us and a voicemail said, “Michael is no longer with the firm, if you need follow-up….call Bill.”

I honestly thought we were being pranked.

I called Bill and told him the story and he said, “Did Michael sign any documents?”

I responded, “No, he did not.”

Bill told me "Well then there's nothing more for us to discuss. Good luck,” We went from the thrill of victory to the agony of defeat in less than 24 hours. What are the chances a partner at an allocator gets fired in the hours after telling us he was going to invest $25mm in our fund? He must have known and just tried to screw with us.

It was clear that a substantial investment into the management company was needed, so we decided to formally hire a team, get office space(747 3rd Avenue) and hire a world-class Chief Operating Officer who was Chief Financial Officer of Citadel (Ken Griffin’s firm), and his business development colleague. We were off to the races. We launched in 2013 with approximately $400mm with a seed investment from Donald Sussman’s Paloma. We were fortunate to assemble a remarkable team of professionals, largely from our days at JPM. There's no question that starting a standalone business was an amazing challenge, and there were many ups and downs, but we made a point to enjoy the process. It was also important to us to make sure everyone on the team felt like they were contributing meaningfully and would be properly rewarded. Below are just some of the firms where Reef Road employees worked prior to joining.

Building the fund was a great deal of work, but really enjoyed it and have an appreciation for the great fund managers who have built a massive business who consistently outperform. It is hard to manage money, manage a team, raise funds and juggle all that needs to be done to be successful, while consistently posting strong returns. We peaked at about $1bn and am proud of what we built despite the initial challenges.

We generated alpha in an environment that didn't give a lot of opportunities and managed through some sticky times in the market - launching during the taper tantrum, '15/'16 energy meltdown, 5% High Yield market…all while running a very low net risk book with substantial cash positions. We stuck to our core competency and did not have the dreaded “mandate creep,” which blows up so many funds during challenging markets.

Quick Bites

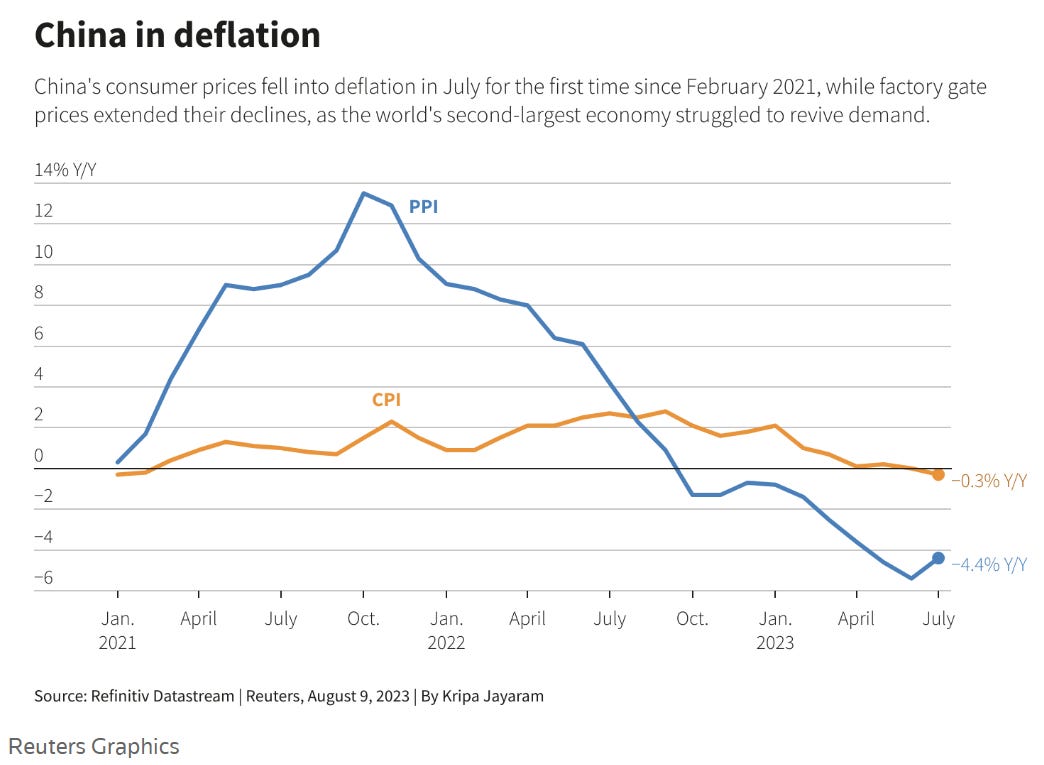

Stocks slid Wednesday as Wall Street awaited fresh inflation data coming later in the week. The Dow lost 194 points, or 0.5%. The S&P 500 shed 0.7%, while the Nasdaq dropped 1.2%. Those moves precede a much-anticipated U.S. inflation report, with July’s reading of the consumer price index slated for release Thursday. ZipRecruiter’s earnings commentary was telling about the weakening labor market. "Employers continue to respond to the enduring macroeconomic uncertainty with caution.” Ziprecruiter July revenues were -31% and accelerated at the back of the month pushing the stock -15% before finishing -10%. The number of job openings and employers' willingness to pay for those job openings has been declining significantly from the peaks of 2021 and 2022. The cumulative impact of higher rates, tighter lending standards and inflation may be starting to more aggressively show in the labor data in the coming months if these comments continue. Oil hits new recent highs (+7% YTD to $84/barrel) as tighter supply offsets China demand concern. China’s consumer sector fell into deflation and factor-gate prices extended declines in July and despite this, oil prices are up?

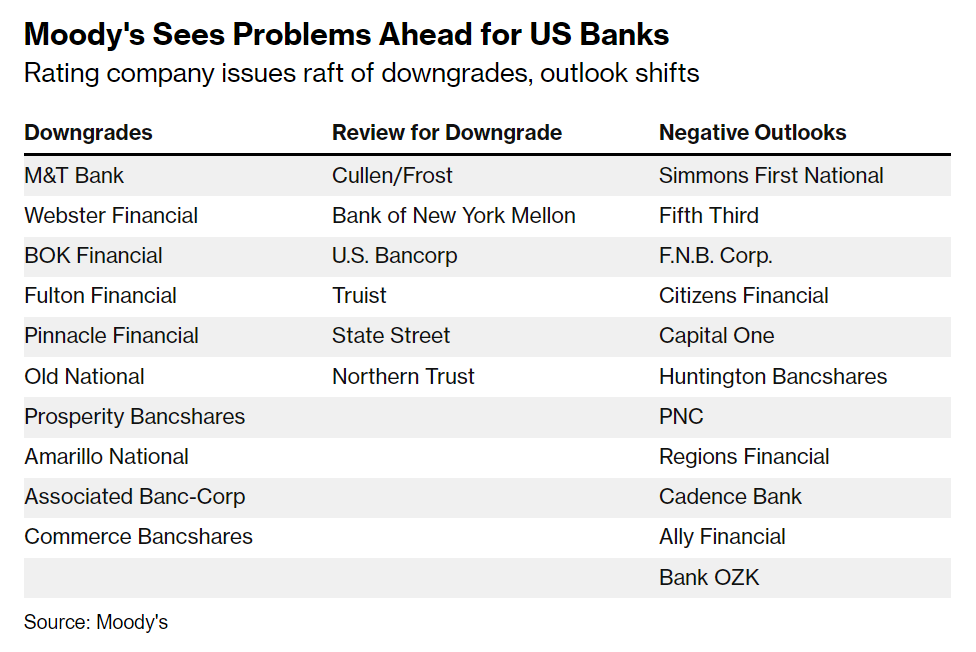

US bank stocks declined after Moody’s Investors Service lowered its ratings for 10 small and midsize lenders and said it may downgrade major firms including U.S. Bancorp, Bank of New York Mellon Corp., State Street Corp., and Truist. Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate are among strains prompting the review, Moody’s said late Monday. The downgrades helped push crypto higher and BTC is back up to $30k.

Some Wall Street analysts are sounding the alarm for a coming sell-off in stocks. That comes as the S&P 500 enjoys its best year since 1927, gaining 18% from January. Stocks so far have blown past investors' expectations for 2023 – but some analysts are bracing for a sell-off as the market approaches new highs.

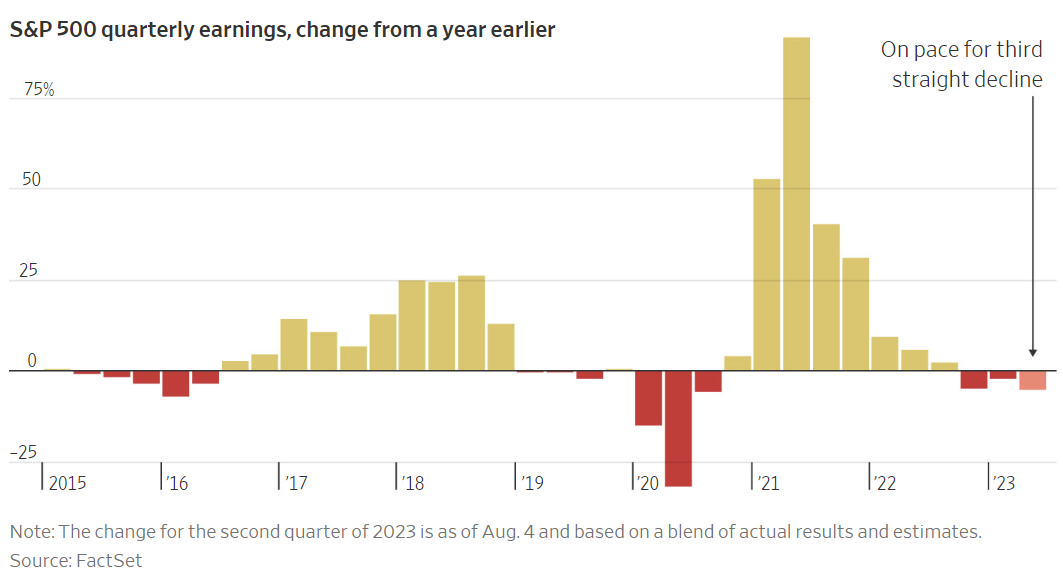

JPM cites the delayed impact of interest rate shocks (takes time to get through the system) and mounting geo-political risks. Wells Fargo discusses inflation risks. Blackrock is concerned about corporate margins. Rosenberg Research is growing more concerned about corporate profits. This WSJ article entitled, “Breaking Down the Worst Earnings Quarter in Years,” is interesting and I thought these charts were telling.

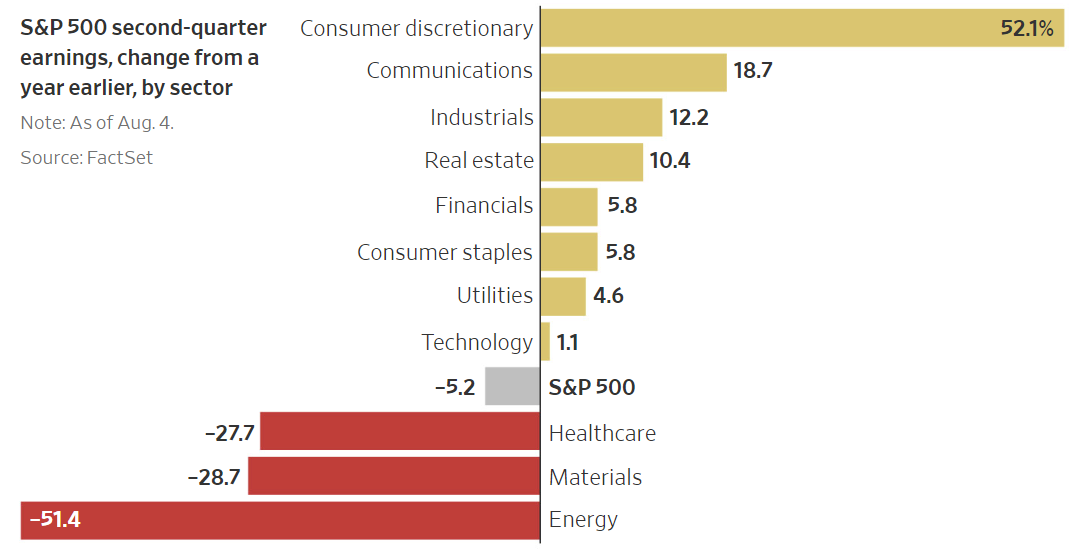

Great Bloomberg article about Hindenburg’s Nate Anderson and the carnage caused by his research this year. In mere months this year, he erased as much as $99 billion of their combined wealth while knocking $173 billion off the value of their publicly traded companies. Many smart fund managers and investors quit short selling after the awful “Reddit” short squeezes from the pandemic era. I will hand it to Anderson; he has conviction and does not seem to back down. The article suggests he is not motivated by money and lives in a 2-bedroom apartment in Manhattan. What drives him is exposing what he sees as misbehavior and knocking down companies he deems offensively overblown. Either way, the chart below is compelling but missed big on Nikola with the 3-month return of +62% after his research.

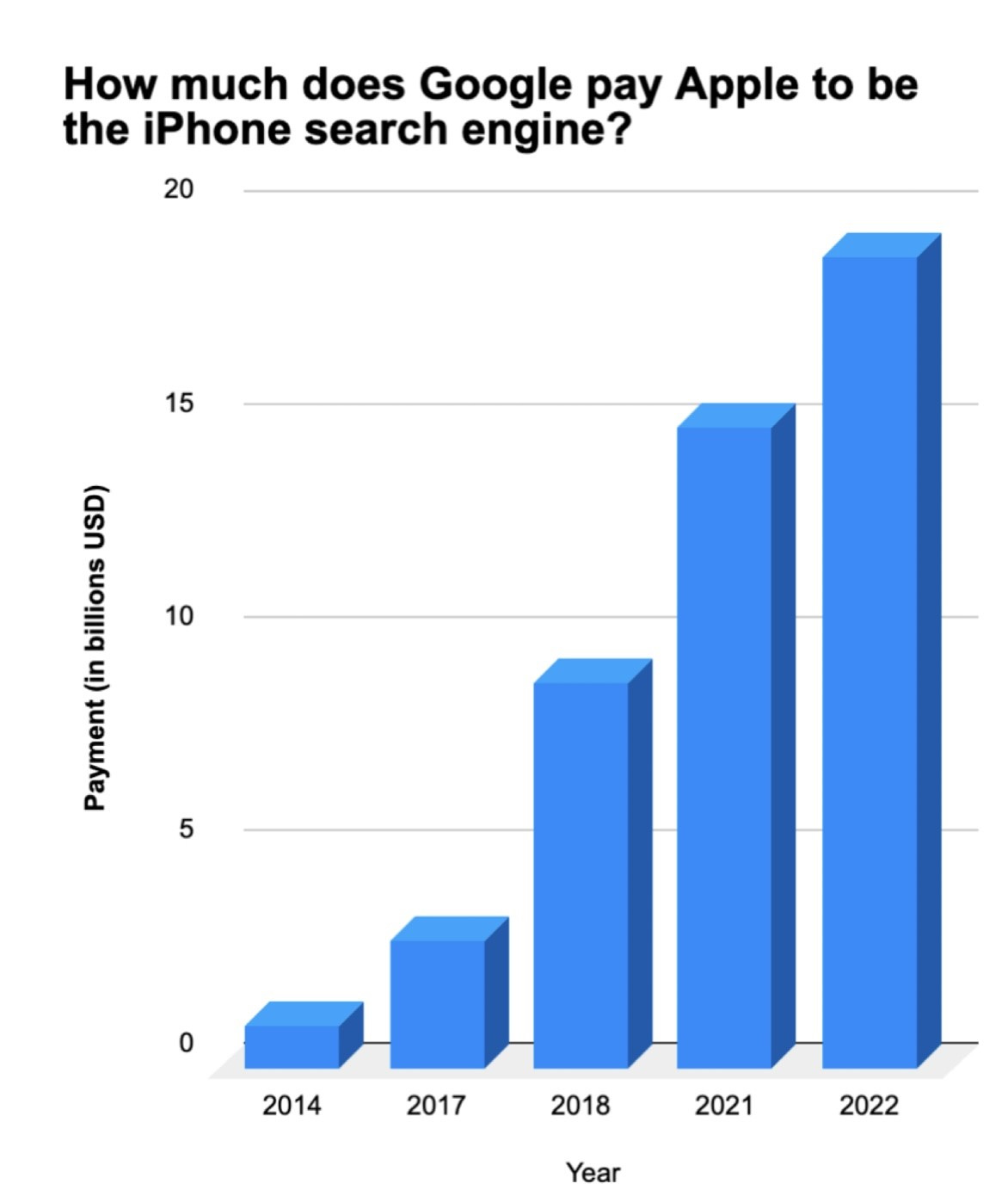

A reader who helped me write my piece on Cyber Security, sent me this picture. Why do you think Google is willing to pay almost $20bn/year to Apple to be the search engine? This article suggests the Apple/Google search agreement is anti-competitive. Your search data is valuable and Google is paying up to get as much information as possible. This Wired article also outlines ways Google tracks you and things you can do to prevent it. He gave me some other interesting points as well:

Google trackers are on at least 75% of the top million websites – tracking your every movement on the internet

Google tracks every video you’ve ever watched on YouTube (oh, by the way Google owns YouTube)

Google tracks every place you’ve been using Google Location Services

Google tracks how often, when, and where you use your Apps.

Google knows all your text messages (unlike Apple iOS, messages are not encrypted by default)

Google tracks your photos (yes, even those deleted ones)

Other Headlines

“We disagree with the market’s expectation that soft landing is the most likely outcome, e.g. our global economists see 65% chance of a recession either this year or next year vs. 35% for a soft landing,” Kolanovic wrote Monday.

Credit Suisse’s top market strategist says recession is still coming and stocks may have peaked

Specifically, Garthwaite expects a recession in the first quarter of 2024, meaning that stocks are “now very close to the point at which markets should peak prior to a recession.” He also said that complacency has set in among clients, which could be a sign that stocks are overvalued.

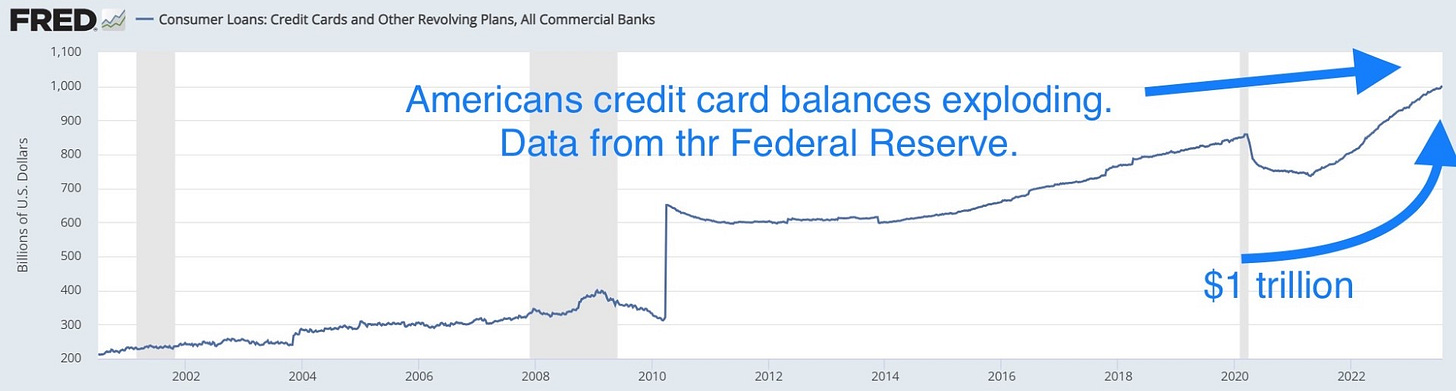

Credit card balances jumped in the second quarter and are above $1 trillion for the first time

I have written about my consumer concerns for months. Inflation, higher rates, and the inability to control spending have families borrowing at record levels (and record rates) to fund their lives. Delinquencies are outlined in the report and going the wrong way as well. Card balances are +25% since 2019. Student debt payments are set to resume, which will only add to the monthly expenses of tens of million consumers.

Americans are pulling money out of their 401(k) plans at an alarming rate

Texas Power Prices to Surge 800% on Sunday Amid Searing Heat

Electricity prices for the grid rose to more than $2,500 a megawatt-hour for Sunday evening, up from Saturday’s high of about $275, according to data from the Electric Reliability Council of Texas, the grid operator.

Treasury Auction Deluge Set to Test Investors’ Appetite for Debt

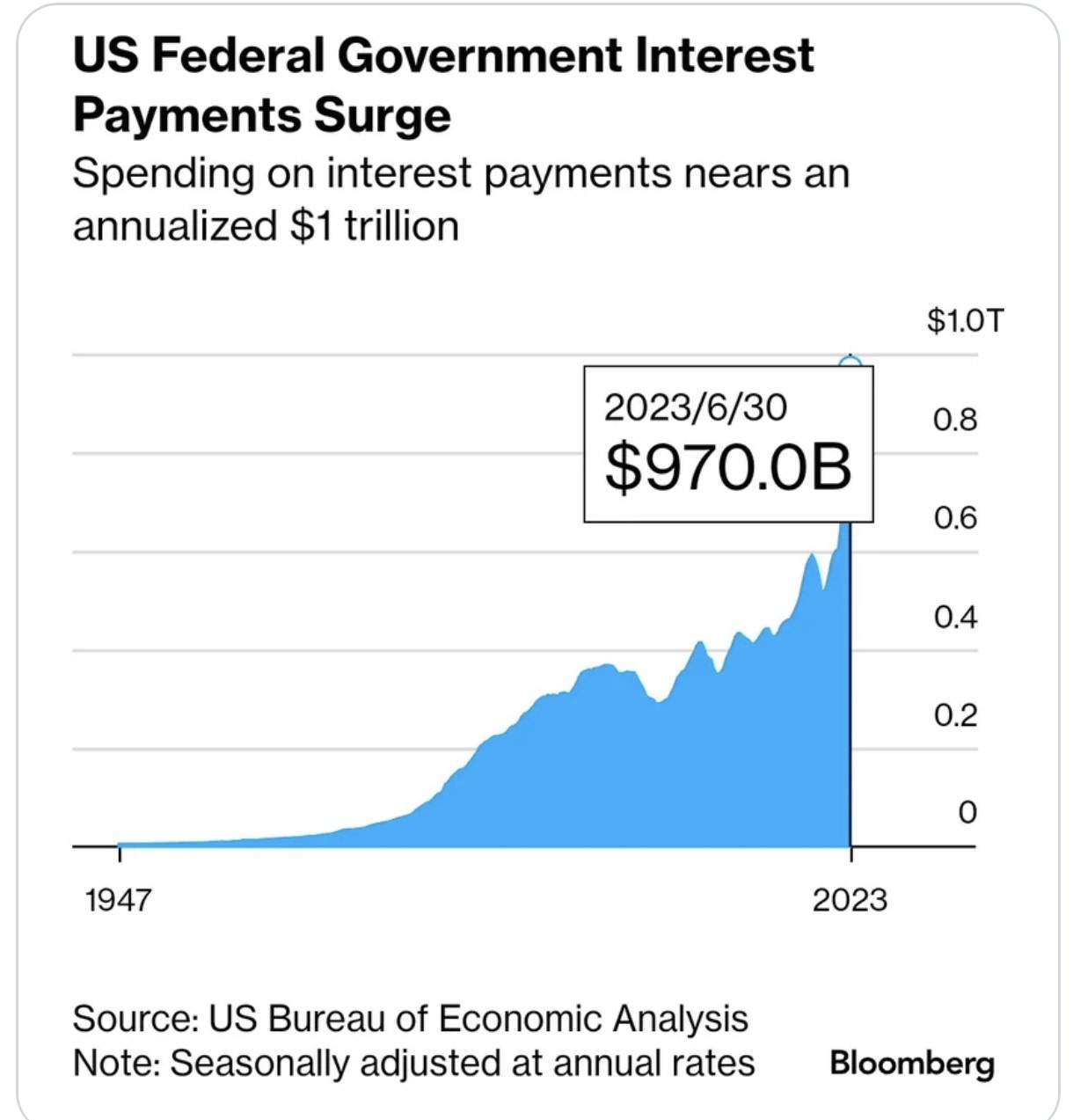

The last data I saw showed that annualized interest income was $970bn (2nd chart). We have a spending problem and now a funding issue. The idiots could have locked in incredibly low rates a couple of years ago. More of your tax dollars are wasted.

Wood has been wrong about a lot of things. If she is right, what would that mean for the US Dollar?

Palantir reports 13% revenue growth, issues guidance that tops estimates

Stock was +3% after the earnings release.

Disney earnings are out — here are the numbers

Stock down slightly post earnings.

UPS cuts margin and revenue forecasts as new labor contract weighs

The founder was a bad person who did questionable business practices. Softback, of course, funded them.

Roblox shares drop 20% after company misses estimates on top and bottom line

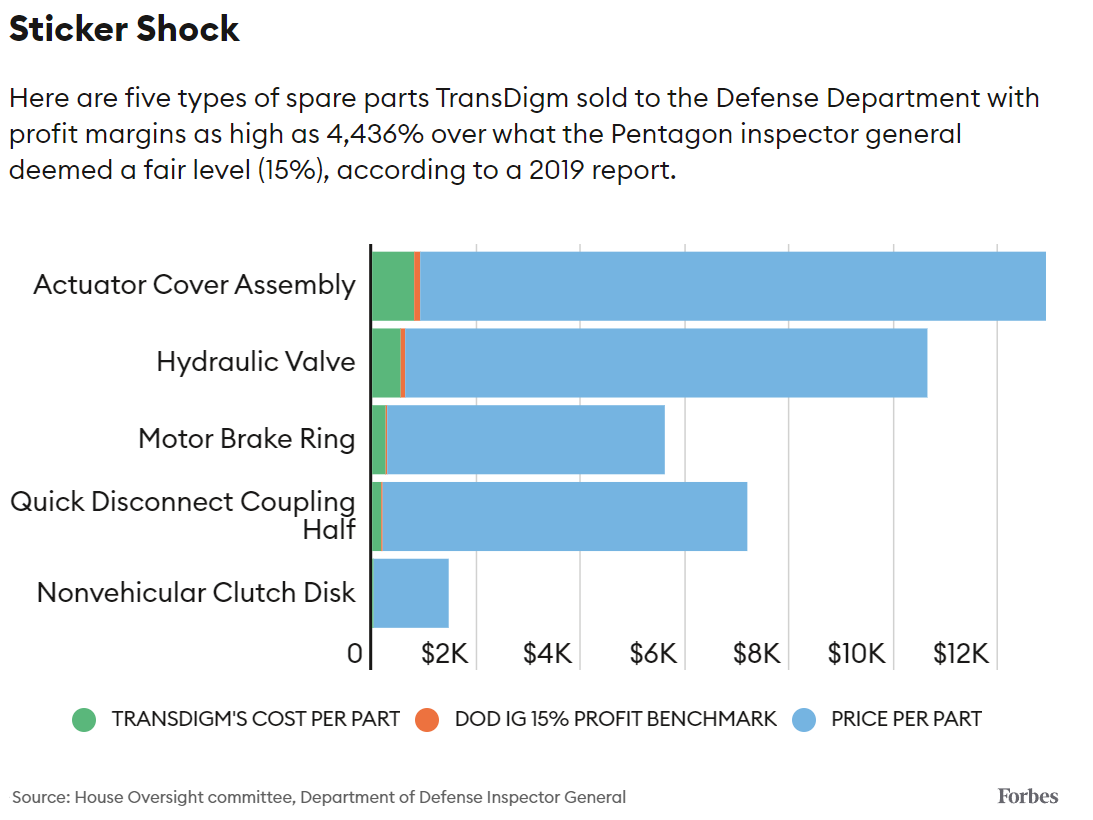

Meet The Billionaire Who Built A Fortune ‘Price-Gouging’ Customers Like The Pentagon

I have written extensively on government waste, deficits, and ballooning debt levels. A reader sent me this great Forbes article which only solidifies my point. We MUST demand better. The idiots in DC are wasting YOUR money. These are good times for Nicholas Howley. TransDigm, the airplane-parts maker he cofounded, has sidestepped allegations of excess profits of as much as 4,436%, the stock has hit record highs, and Forbes has determined that Howley’s net worth now has three commas. My piece from last month outlined numerous areas of waste. This is the story that makes me even more upset given my dislike of the Chinese government: “Chinese-run biolab in California that was experimenting on deadly viruses was awarded over $500,000 in US TAXPAYER cash.”

I just want to understand something. A crack addict kicked out of the military who does not speak Russian or Chinese and is not an expert on their business was paid MILLIONS while his dad was VP and people think this is normal? We need a serious investigation into how deep this runs as the suggestion that $20mm or more was paid is too much to ignore. Hunter’s business partner went to the White House 36 times and remember Joe has never once spoken with Hunter or his associates about business (YEAH RIGH). The Biden family accounts have had 170+ suspicious activity reports from banks. We can no longer suggest there is nothing to see here and require answers from the FBI, DOJ, IRS…. I feel the American public has the right to know the truth. Remember, we were lied to prior to the last election by the Bidens, FBI, Social Media, and popular press… about the Hunter Laptop being Russian disinformation when they knew it was real. Remember, I am not a Trump guy and want neither to be the next president. I just want the truth and new leaders for each party.

Ron DeSantis Met With Swathes of Empty Seats at Iowa Event, Photo Shows

I was wrong, as six months ago I was of the view that DeSantis would win the Republican nomination. Money is pulling and he is playing to no crowds. The awful picture is in the link.

McConnell heckled with calls to 'retire' during speech at Kentucky event

The list of those who are past their prime continues to grow in DC. McConnell is not alone. Feinstein, Fetterman, Biden, Grassley, Sanders…Let’s get some new folks in there. Term Limits and Age Limits are needed.

So the ex-FBI agent involved in investigating Trump for Russian collusion was working for a Russian oligarch and evading US sanctions and money laundering? You cannot make up these accusations.

Arkansas cop arrested after trying to have sex with undercover officer posing as underage girl

These sting operations are amazing where an adult poses as a child on line and these pedophiles come over only to be met by police.

Teen girl allegedly slugs Asian woman in possible hate crime on NYC subway

I want harsher mandatory sentences for clear hate crimes.

Social Darwinism at its finest.

Brazen NYC crew behind $3M auto theft ring busted after flashing wads of cash, cars on social media

They pled guilty to more than 200 thefts including 54 vehicles and $3mm in goods. Check out the pictures in the link. Another Social Darwinism award. The bigger question is will they serve time or get out to do it again? We know Bragg does not like to give criminals consequences.

Disgusting judge.

The end of affirmative action at colleges poses new challenges, and risks, in corporate hiring

Fair Work Commission rules IAG’s firing of Suzie Cheik for not typing enough on laptop was fair

An Australian woman was fired from an insurance company after 18 years when her keystrokes were monitored and management realized she was not working the hours she professed.

Obesity Drug Wegovy Cuts Risk of Heart Attacks and Strokes by 20%, Study Shows

People with obesity or overweight and a history of heart issues taking the Novo drug were 20% less likely to suffer a cardiovascular event than those who took a placebo. Given 42% of Americans are obese and 67%+ are overweight, these drugs should be game-changers over the next 10-20 years as prices fall, availability improves and results are better understood. Obesity and its ramifications of it are dire to individuals and the system (diabetes, hypertension, high cholesterol, stroke, heart attack, osteoarthritis…).

On a related note, this article is crazy “Scientists working on a fat-loss pill which makes you skinny no matter how much junk food you eat.”

I cannot imagine this one. A hawk was carrying a snake that fell onto a woman mowing her lawn. The snake wrapped around her arm and struck her in the glasses leaving venom. Then the hawk attacked the woman and took back the snake. The woman’s arm was ripped up from the hawk. Talk about a bad day.

Real Estate

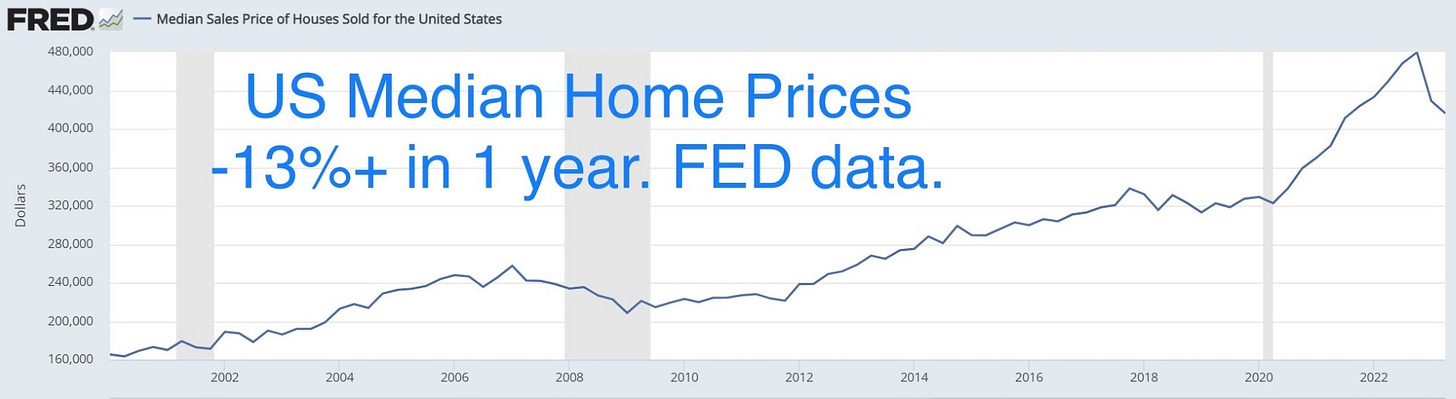

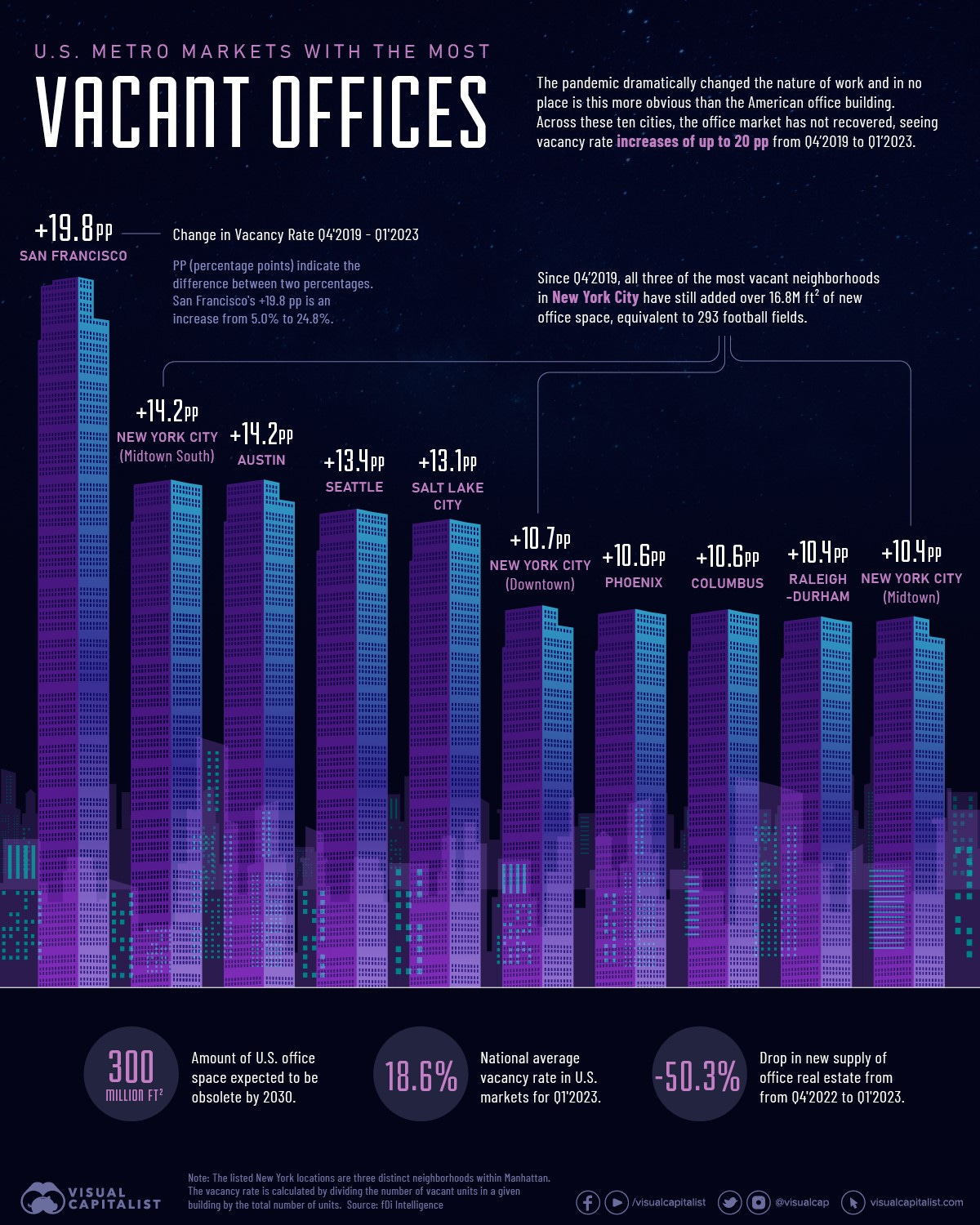

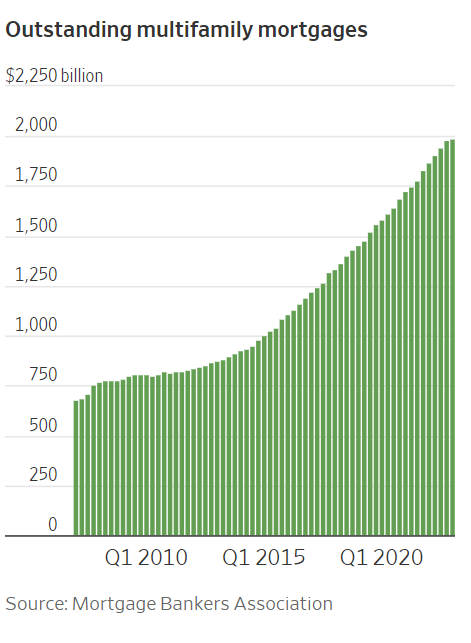

Fed data shows median home prices -13%+ since the 2nd Q of 2022. Clearly, rates are the biggest contributor to the decline as the average 30-year mortgage went from approximately 5% to 7%. This article shows 30-year fixed rate (conforming) mortgages are now at 7%+. Also, the crazy bidding wars during the “free pandemic money,” have stopped. The 2nd chart shows rent vs buy which has a massive disparity. The third chart from Bloomberg shows property values by segment over the past year. The fourth chart is interesting and shows the vacancy rate changes in some key markets from Q4 2019 to Q1 2023. SFO is worse now and is now 32%, not 25%, but you get the idea. A good WSJ article is entitled, “A Real-Estate Haven Turns Perilous With Roughly $1 Trillion Coming Due,” is about the apartment building market (4th chart).

Fox News host Bret Baier is upsizing in Palm Beach, dropping $37 million on a house in an off-market deal. Records show Baier bought the house at 125 Wells Road from Roberta Weiner. Bret Baier is a Fox News star and host of “The Special Report with Bret Baier.” Here is the listing for the new home. The inside looks nice, but the outside is not my style. The listing shows built in 1992, but was clearly redone more recently. Very close to the ocean (4 houses from beach) and the lot is .59 acres. It last sold in 2013 for $10.9mm. In March of last year, Baier and his wife, Amy Baier, bought a flipped home from designer and real estate investor Tommy Hilfiger for $12 million. They listed it for $16.5 million in June, Realtor.com shows. Looks like I need to get into the TV news business. I am building up my reel with podcasts and the Rosen Report. Put me in, coach.

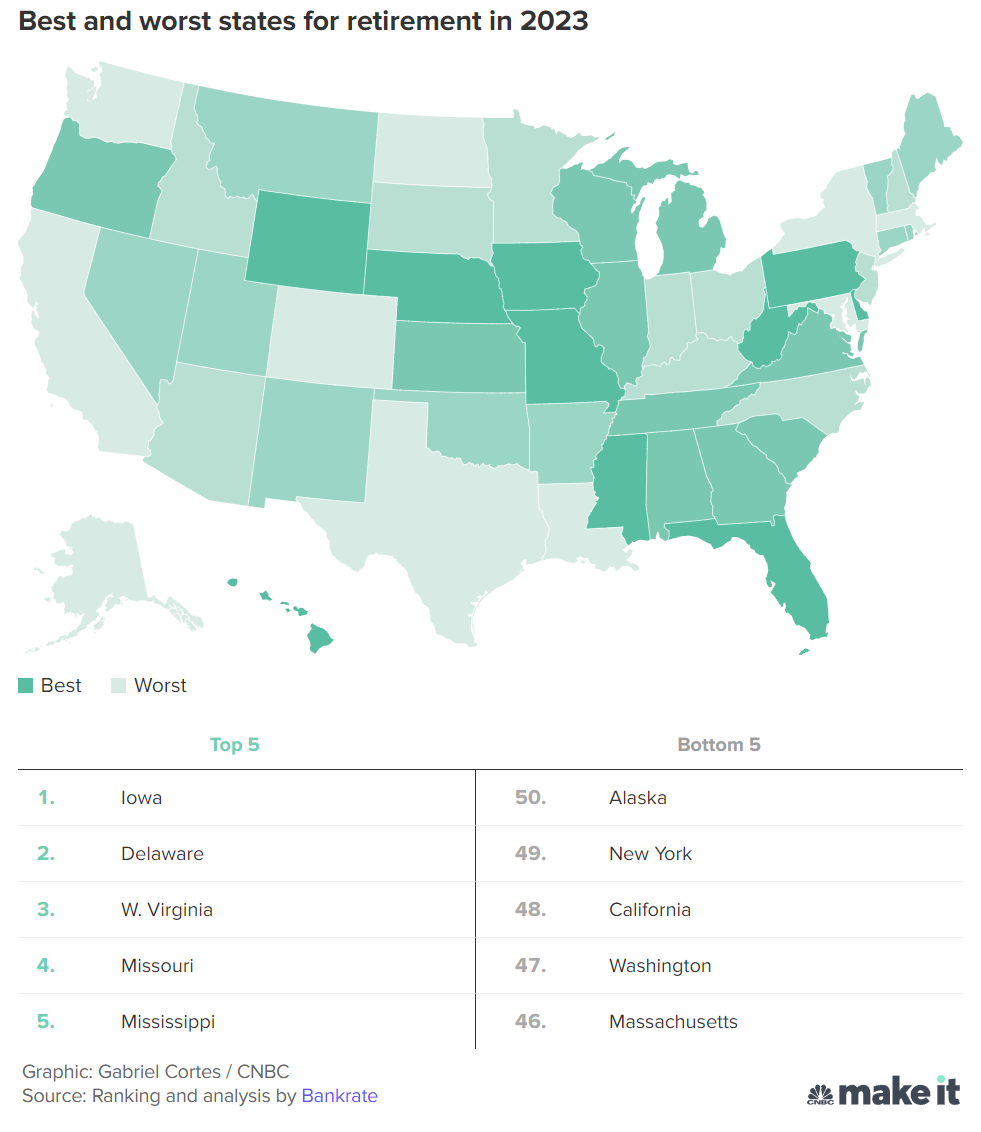

I thought this CNBC article was interesting about the best and worst places to retire. I don’t agree with all of it as I would never live in ANY of the top five states they recommend, but Florida came in at #8, while California was #48 and New York was #49. To determine the best and worst places to retire, Bankrate analyzed all 50 U.S. states and ranked them across five weighted categories:

Affordability (40%)

Well-being (25%)

Healthcare quality and cost (20%)

Weather (10%)

Crime (5%)