Opening Comments

I recently wrote a piece entitled, “Binge Watching” which received lots of commentary and all kinds of suggestions of shows to binge watch. I mentioned a show which received a lot of attention called “Outer Banks,” which requires the suspension of disbelief. The new season dropped, and I was forced by my kids to partake in the lunacy. The show was passable previously, but the absurdity ranking is so high, I can no longer subject myself. My IQ was falling by merely sitting on the couch and watching the drivel. Rosen out. The critics are panning the new season for good reason.

I have not been to a fast food restaurant in decades. However, while travelling to Atlanta, my son and I stopped at Chipotle, and that will be the last time for me. It was awful and expensive. $32 for 2 people with two waters. They call it fast-casual. I call it disgusting and overpriced. Two days later, and I still don’t feel right.

I could never live in Georgia because of my environmental allergies. Given I am an idiot, I forgot my allergy meds and may have knocked my brain off the stem by sneezing so much in 24 hours. My eyes were killing me. Check out the rental car hood after one day. Also note my new logo as the Rosen Report is now officially legit. Fancy, right?

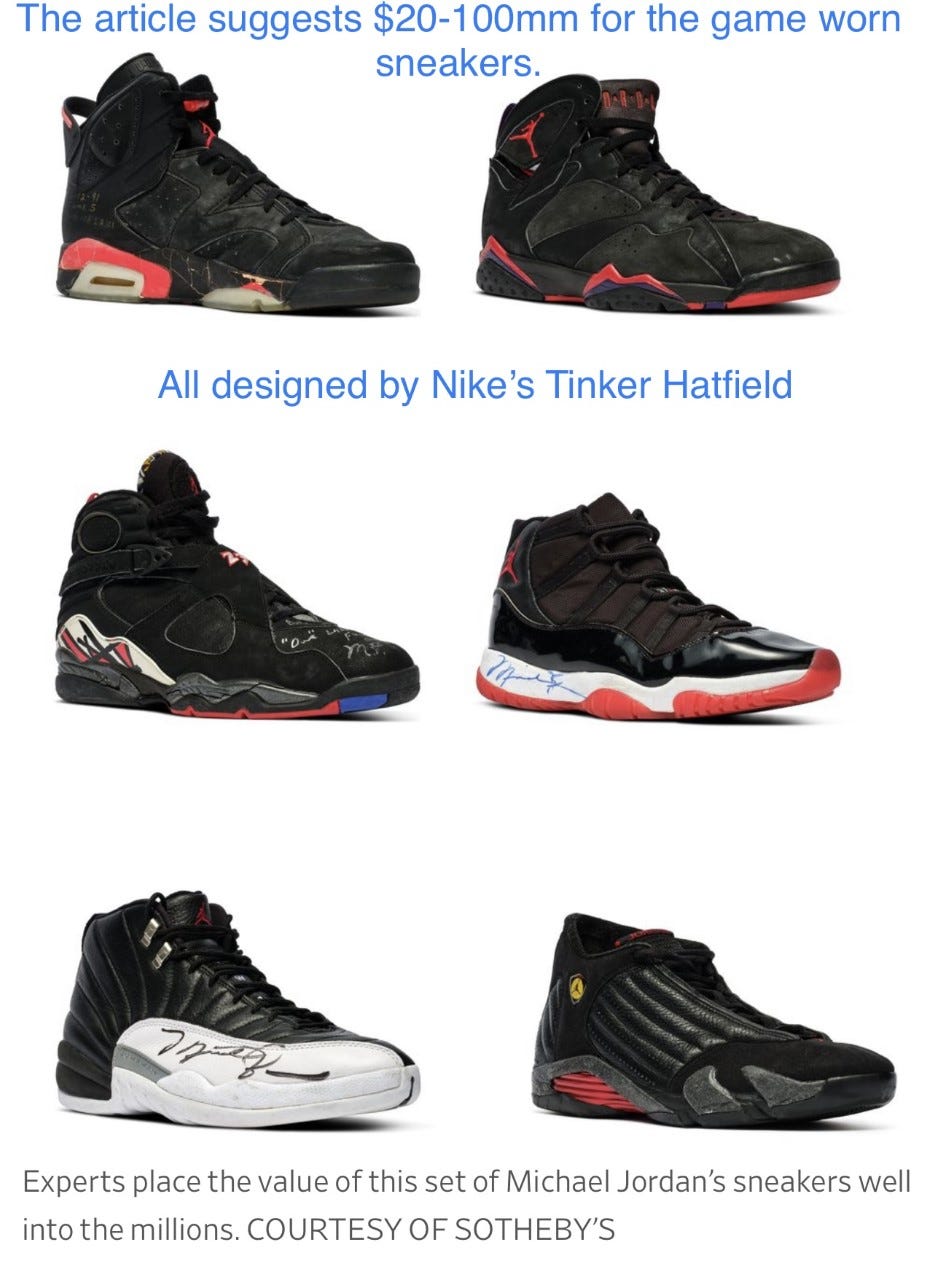

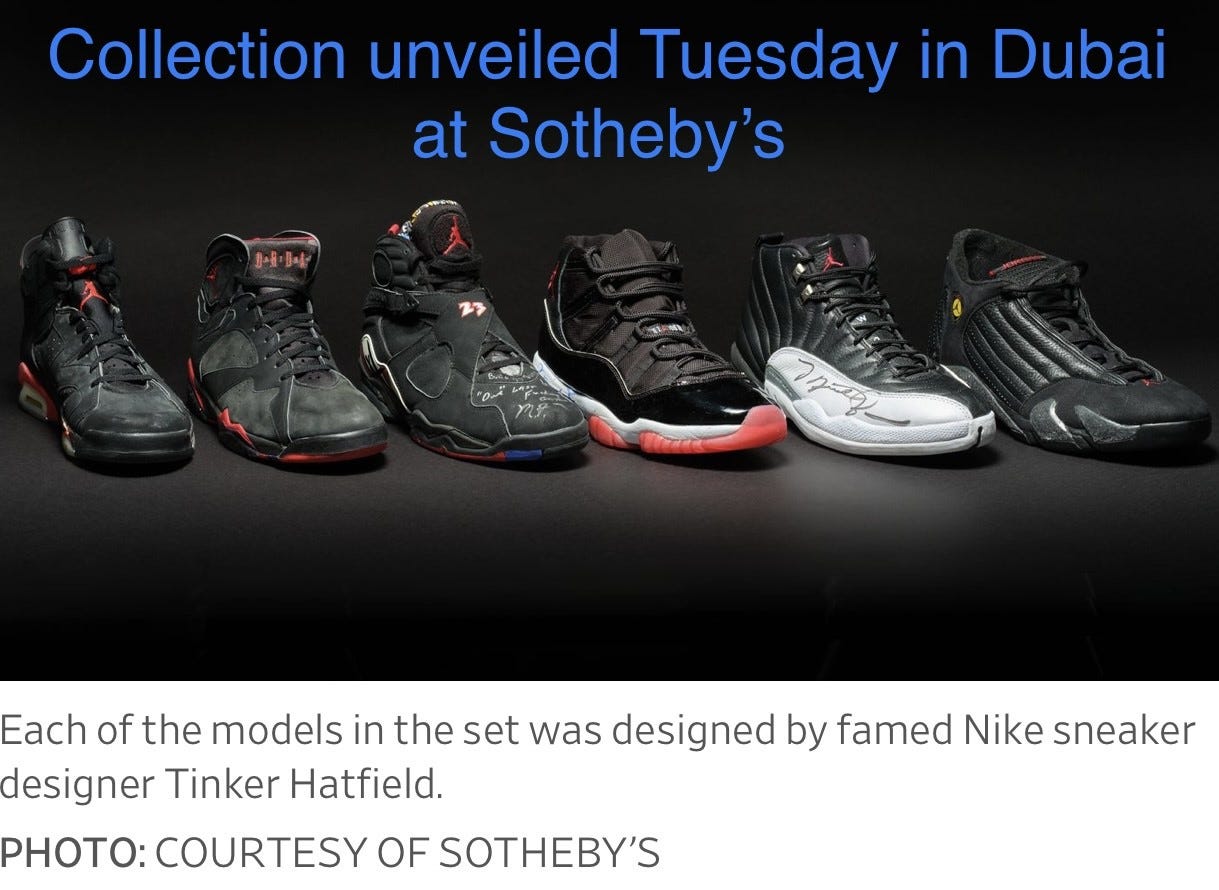

Picture of the Day-MJ’s Championship Air Jordan Sneakers for Sale

Markets

Stock Market PEG Ratio-Peter Lynch

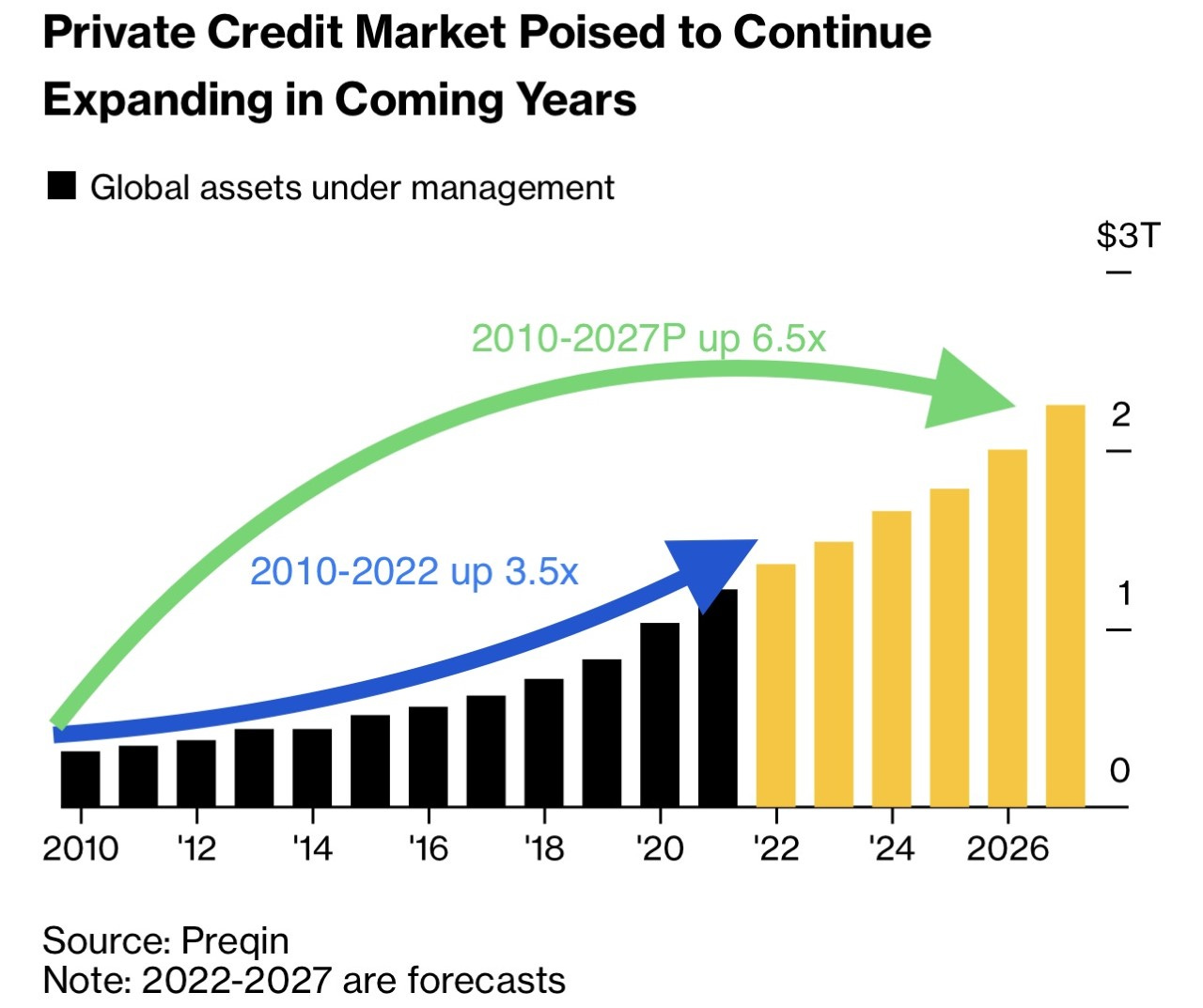

Private Credit Market Growth

Fox News Lawsuit

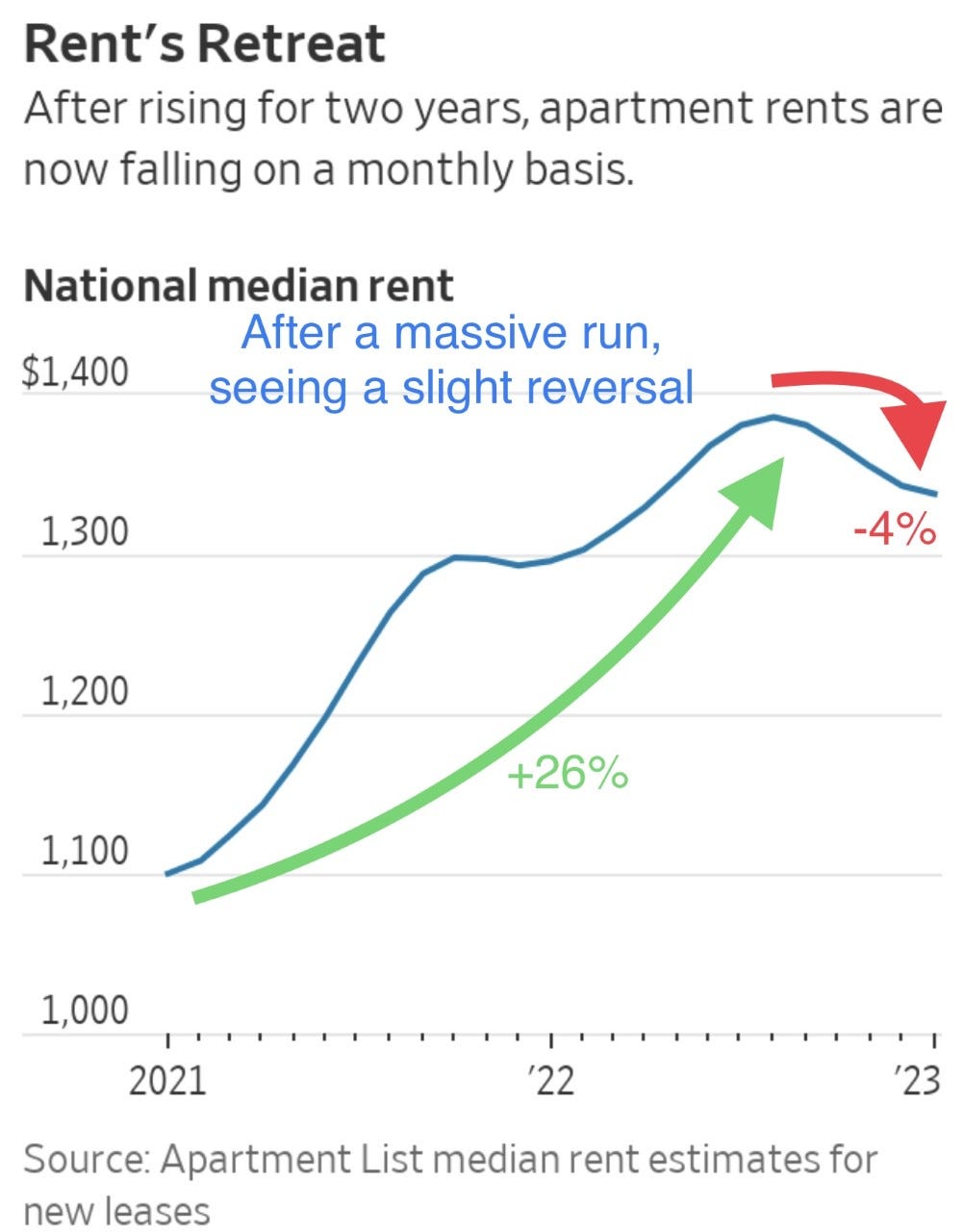

Rents Declining

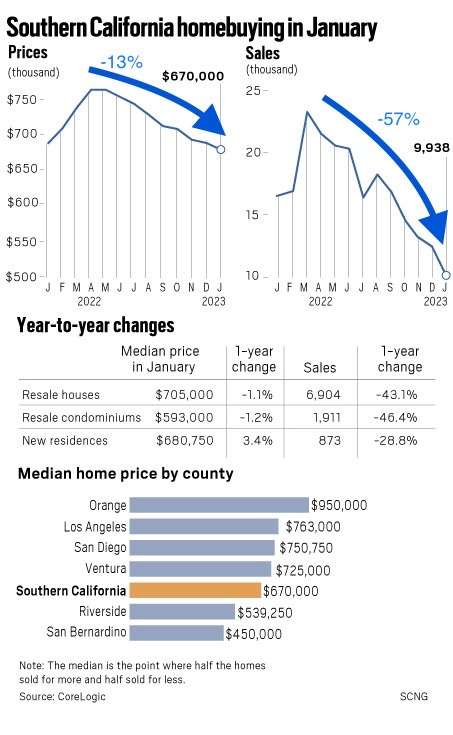

Southern CA Housing Issues

Picture of the Day-MJ’s Championship Air Jordan Sneakers for Sale

The high-top Nikes, showing clear signs of hardwood wear. A communications director for the Chicago Bulls, Mr. Hallam received the individual shoes directly from Mr. Jordan after the final buzzer in the Hall of Famer’s championship games, according to Sotheby’s. The set, dubbed “The Dynasty Collection,” includes an Air Jordan 6 (1991), Air Jordan 7 (1992), Air Jordan 8 (1993), Air Jordan 11 (1996), Air Jordan 12 (1997), and Air Jordan 14 (1998). The collection is considered the “Holy Grail,” for sports memorabilia. Sotheby’s sold a Jordan-worn jersey from the opening game of the 1998 NBA finals for $10.1 million dollars. My friend, a collector, told me he thinks $50-60mm, and the buyer is likely to be Middle Eastern or Chinese.

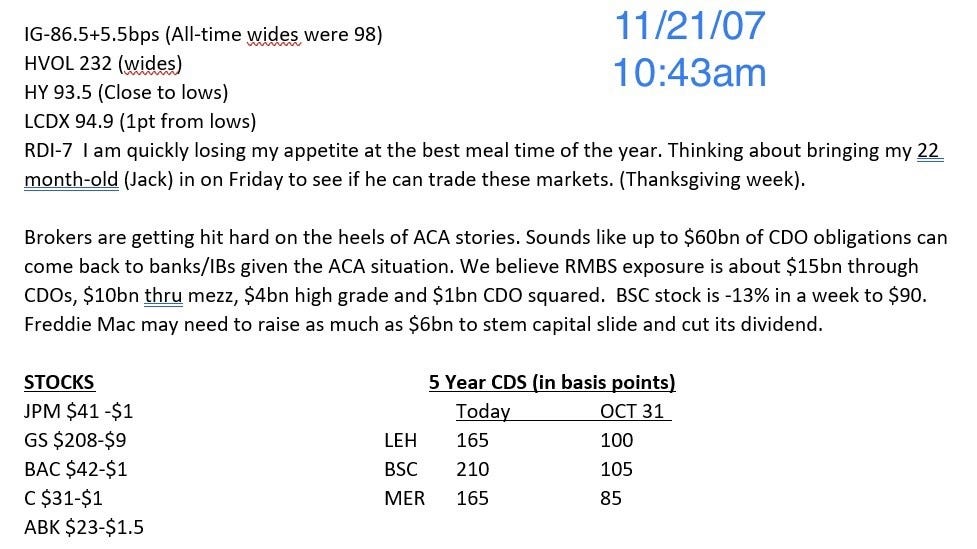

Rosen Depend Index. Yes, Those Depends

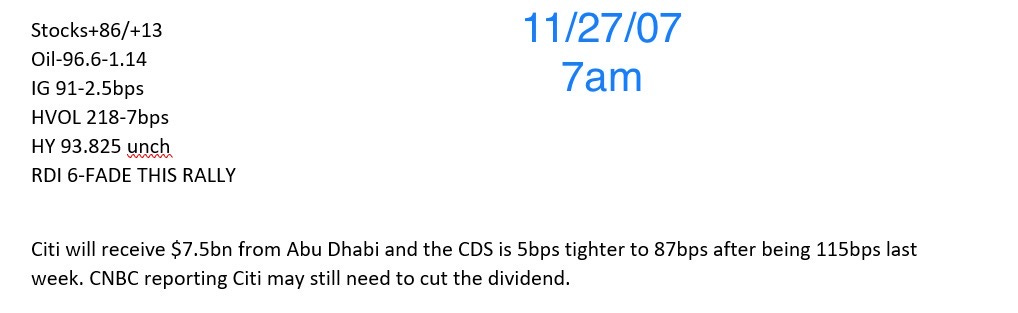

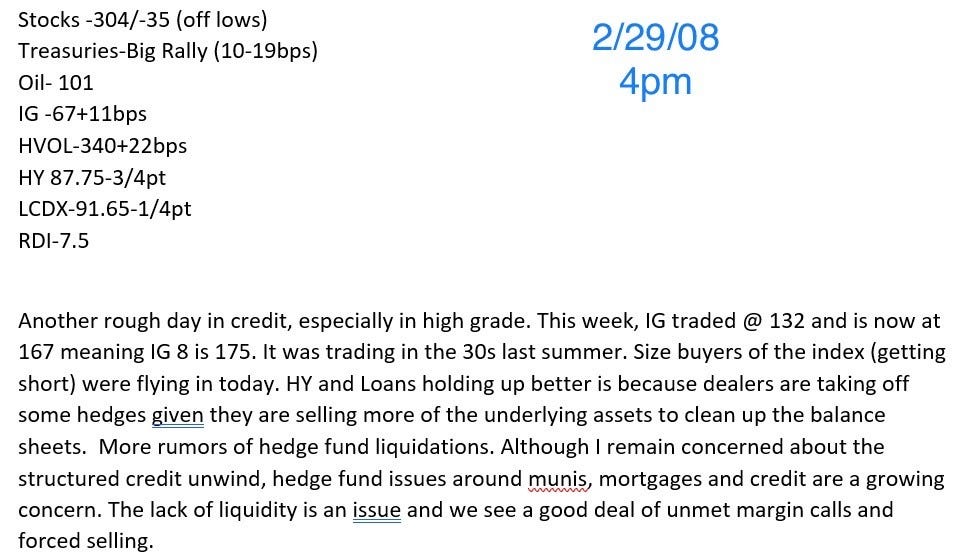

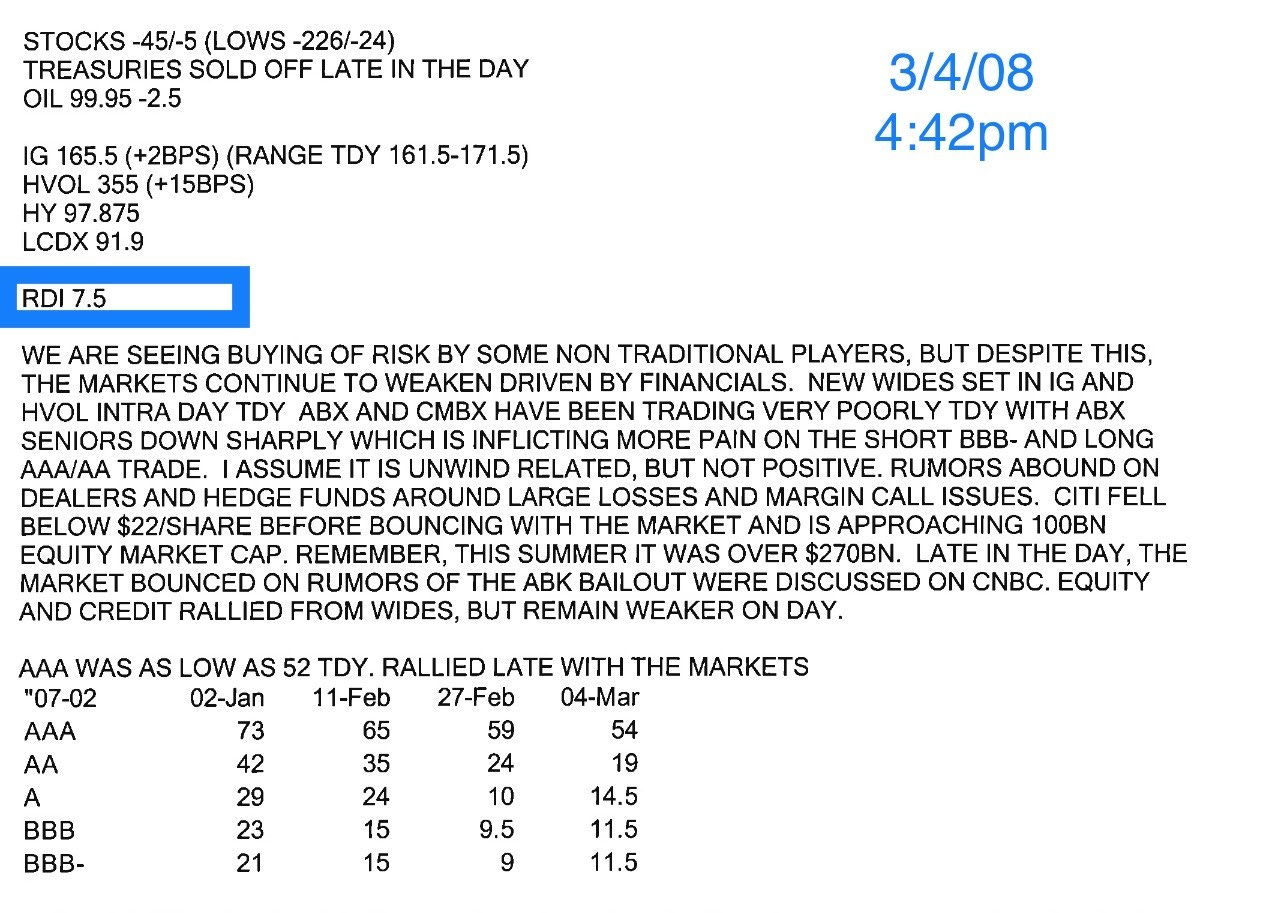

As written in recent reports, I started writing emails to senior management about my concerns around the markets in the summer of 2007 after telling them verbally of my concerns. Various people on the senior management team would call me regularly for color on what was going on as a result. One such person was one of my all-time favorites from JPM, John Hogan, the head of Risk Management for JPM. John is a fire-plug at about 5’9” and 200lbs of muscle. I don’t recall the exact day, but apparently it was in the fall of 2007 when he asked me a question about how I was feeling. I responded with, “I need to run to Duane Reade to buy some Depends Undergarments, as I think I might crap in my pants.” It was my way of telling John I was concerned about the markets, and the Rosen Depend Index (RDI) was born. On my emails where I quoted market levels, I would end with RDI and it was on a scale from 1 to 10. However, at some point in 2008, I was just so negative, I stopped putting in the RDI, as I felt the financial system could crash and levity had left my system. I bought gold and sold all stocks I could in 2007 (bank restrictions from selling/shorting in your own account). Despite having a great market call, I was quite nervous about the ramifications of it.

People loved the RDI, and I would get calls from all over the markets with one question, “What is the RDI?” When I went to risk meetings, senior management wanted to know my thoughts, because I was early in my call of Armageddon and the RDI became popular. So much so, that the co-head Head of the Investment Bank, Steve Black, brought me a massive box of Depends in late 2007 to a risk meeting, and it drew cheers from the conference room. Remember, people were nervous and the world becoming increasingly unstable. A little levity was needed.

I was unable to uncover the 1st email with the RDI, but here are some samples from the crisis. On December 18th 2007, just before I was going on holiday, I finished my note with RDI of 4.5, but range in 2007 was 1 to 9. Some of the notes below were excerpts as I wanted to give a flavor of a handful of reports without overwhelming. The ones with charts are closer to full ones.

The Global Financial Crisis was an insane time brought on by careless lending and leverage. I was fortunate to have the seat at JPM at the time, which allowed me to be involved in so many interesting aspects of financial markets. I was with Fed officials and often interacted with senior management of a variety of buyside and sell-side firms. My early calls of concern in 2007 gave me a good deal of credibility. Despite the chaos and my fears, it was the most exciting time in my career, and I felt as though I was making a big difference. We were massive outperformers, and it felt good for my team to be a part of it.

Quick Bites

The month of February was not so kind to the markets after a great January. On the month, the Dow was -4.2%, S&P -2.6% and Nasdaq -1.1%. YTD through the 2/28 the Dow is -1.5%, S&P+3.8% and Nasdaq+10.3%. The big drivers of the weak February results were better than expected jobs data and continued inflation which drove yields sharply higher. In the month of February, the 2-year Treasury yield is +64bps and the 10-year +44bps with fears of higher for longer given the stronger than expected data. The S&P 500 fell Wednesday, the first day of March, as traders struggled to recover their footing following a losing month and bond yields continued their climb. The broad market index fell 0.47% while the tech-heavy Nasdaq lost 0.66%. The 2 and 10 year Treasuries sold off 8bps and now yield 4.88% and 3.99% respectively. The Dividend Yield on the S&P 500 is now 1.69% and the 1-year Treasury yield is 5.05%. Treasuries are just too attractive on the front end from my perspective. I was too early in this trade, but so short dated (3 months to 3 years), that I am fine. Salesforce beat after hours and the stock was up 13%.

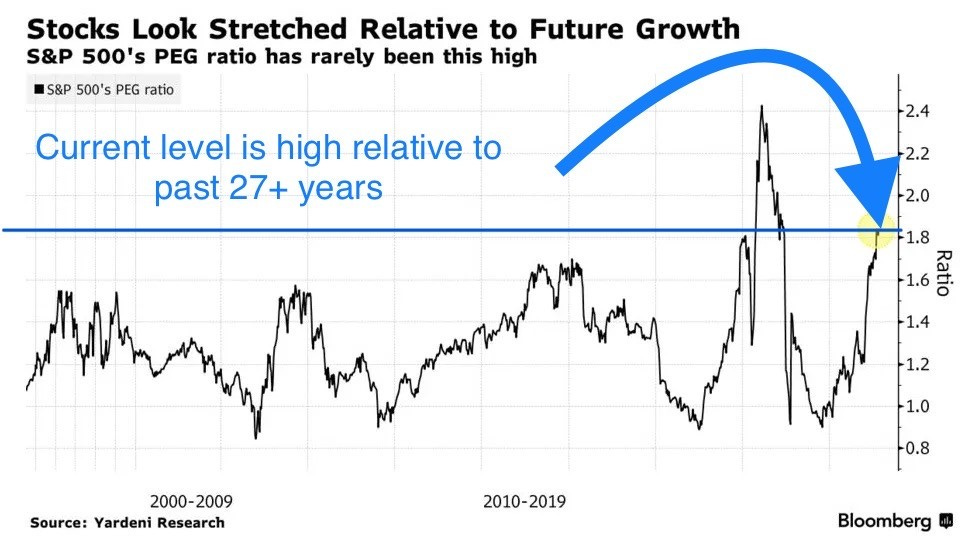

Interesting Bloomberg article entitled, “Warnings of a Stock Market Bubble Finally Prove Too Much for S&P 500.” The model, a tool of Fidelity Investments legend Peter Lynch a generation ago, is the PEG ratio, the market’s price-earnings multiple divided by its forecast growth rate. The higher it is, the more expensive shares are — and right now, at about 1.8 based on longer-term estimates, the indicator’s message strikes many as ominous. The PEG ratio is far from perfect in my opinion, but is something you should look at in conjunction with other ratios and factors when considering how to play the markets. My concerns are around the consumer and rising debt levels, crashing savings, increased auto delinquencies and record credit card debt with high interest all while battling inflation are more of an issue to me than PEG. A record 36% of U.S. adults now have more credit card debt than savings. This is up from 27% in 2022 and 21% in 2021.

Good Bloomberg article on Private Credit disintermediating banks. Wall Street’s vaunted leveraged finance desks are reeling. Billions of dollars in losses on mistimed loans have forced them to dramatically scale back lending, leaving the private equity firms that rely on them to help fund acquisitions in a bind. Enter the likes of Apollo Global Management Inc., Blackstone Inc., HPS Investment Partners and Ares Management Corp. Direct lenders, already among the largest players in leveraged buyout financing, see an extraordinary opening to grab market share — and hang onto it for the long haul. Their strategy, in part, involves staking a claim to increasingly larger loans, deals once exclusively the domain of banks due to their sheer size. The four are among the shops offering $5.5 billion to fund Carlyle Group Inc.’s purchase of a 50% stake in Cotiviti Inc., in what would be the biggest ever transaction of its kind. With the growth of Private Credit funds, I see this trend continuing, especially as traditional lenders are pulling back. Oaktree announced a raise of $10bn to help finance takeovers in an attempt to take advantage of the lender retreat.

I have written extensively about media bias and do my best to call out both sides when I see something wrong. The more that comes out about Fox News and the handling of “election lies” with respect to Trump, Dominion Voting Systems and the election, the worse it looks. Rupert Murdoch testified that Fox News popular commentators “endorsed” Trumps false claims the election was rigged. Murdoch further testified that he doubted Trump’s conspiracy theory right away. Murdoch replied in an email to former House Speaker and Fox Corp. board member Paul Ryan that veteran host Sean Hannity “has been privately disgusted by Trump for weeks.” On January 5, Rupert and Suzanne Scott (Fox News CEO) discussed whether Hannity, Carlson, and Ingraham should say some version of “The election is over and Joe Biden won.” Scott told Rupert that “privately they are all there” but “we need to be careful about using the shows and pissing off the viewers.” So nobody made a statement. To me, this is a clear case of major anchors saying one thing while believing the opposite. I am not a lawyer, but the excerpts of this trial seem quite damaging and in favor of Dominion. To be clear, the left media has been wrong and disingenuous about a lot of topics, yet continued with the narrative. Both sides are to blame. I would like to see more balance and earlier admissions of being wrong.

Other Headlines

Warren Buffett calls stock buyback critics ‘economic illiterate’ in Berkshire Hathaway annual letter

I agree with Buffett.

David Einhorn says investors should be 'bearish on stocks and bullish on inflation'

Bridgewater Exits Ray Dalio Era With Hedge Fund Overhaul, Bets on AI and Job Cuts

Target ekes out slight growth in holiday-quarter sales, but warns of continued slowdown

Kohl’s shares sink after big holiday-quarter losses

Massive miss with a loss per share of $2.49 vs .+98cents expectation. Also a weak outlook for 2023. Stock fell 8%. Inflation was blamed. More retailers are downwardly revising the outlook for 2023.

Goldman CEO David Solomon says asset management is the new growth engine

Powell’s Debt-Limit Alarm Echoes Stealth Lobbying Effort in 2011

Despite high inflation, Americans are spending like crazy — and it's kind of puzzling

Again, I question how long this can go on.

Stubborn inflation will remain at a very high level, German central bank president says

Shocking, 'impossible' gas bills push restaurants to the brink of closures

One Chinese restaurant bill went from $800 in December to more than $8,000 in January. How in the hell can a restaurant stay in business in Southern CA? I believe CA is among the worst states to live in terms of gas prices, nat gas prices, income taxes, real estate taxes, homelessness, crime, mandates, natural disasters and traffic. No wonder why wealth and corporations are leaving in droves. My family almost moved to La Jolla, CA in San Diego in 2017. What a good miss.

Elon Musk Is World's Richest Person Again After 100% Tesla Stock Surge

Apple Suppliers Are Racing to Exit China, AirPods Maker Says

GoerTek invests $280 million in a new northern Vietnam plant

Tech giants want suppliers to diversify amid US-China tensions

Lightfoot is out, Vallas and Johnson are in — the April runoff

One of the worst mayors in history did not come close to re-election. With 99% of votes in, Lightfoot had 17%, while Vallas almost 34% and Brandon Johnson 20%. Maybe things are turning, as she did not win re-election and DA, Chesea Boudin, was recalled in SFO. Maybe people are starting to realize awful polices are just awful. 1st Mayor in Chicago in 40 years to lose and blamed gender and racism. How about bad policies?

Inspector general investigating Pete Buttigieg's extensive private jet travel

I thought Mayor Pete could be a good Democratic candidate for President (Harvard Magna Cum Laude, Rhodes Scholar, Oxford, Military Service, 7 languages…), and felt his debates in the Primary and background were impressive. His track record as Transportation Secretary has been a complete disaster and my initial beliefs have changed.

'Huge' parts of Austin left 'unpoliced' after city contract fight triggers mass officer exodus

I loved Austin when I went in October, but a big homeless problem.

Florida student to be charged as adult in attack on staffer

17-year-old kid can get up to 30 years. Excellent. I hope he gets max sentence.

Trans child molester Hannah Tubbs crafted new female identity in jailhouse call with dad

Crazy story of soft-on-crime policies, and now the child molester is identifying as a female after his arrest to get into a female prison.

Bronx grocery store cashier pummeled in shocking caught-on-video attack

Scary video. If I were DA, the assailant, caught on video, would face serious jail-time.

Lilly to cut insulin prices by 70%, cap prices at $35 per month for people with private insurance

Zero-calorie sweetener linked to heart attack and stroke, study finds

Here’s why being obese is even deadlier than you might think

“Existing studies have likely underestimated the mortality consequences of living in a country where cheap, unhealthy food has grown increasingly accessible, and sedentary lifestyles have become the norm,” says study author Ryan Masters, an associate professor of sociology at CU Boulder, in a university release.

I’m a professional organizer — this is my three-second decluttering rule

Tom Brady To Chase Stand-Up Dream After Delaying Fox Sports Gig

Awful idea. Please Tom, DO NOT DO THIS. Perfect example of leaving your lane. You have a $37mm/year contract to be a football broadcaster on Fox. I think you will do very well there. Stand up, not so much.

Iran can make fissile material for a bomb 'in about 12 days' - US official

Real Estate

Good WSJ article entitled, “Apartment Rents Fall as Crush of New Supply Hits Market.” Apartment rents fell in every major metropolitan area in the U.S. over the past six months through January, a trend that is poised to continue as the biggest delivery of new apartments in nearly four decades is slated for this year. Renters with new leases in January paid a median rent that was 3.5% lower than they would have paid last August, according to estimates from listing website Apartment List. It was the first time in five years that rent fell every month over a six-month period, according to the same estimates. The softening rental market follows an unprecedented run for the apartment and home-rental industry put into motion by the pandemic. Pent-up demand for housing exploded in the months after the introduction of Covid-19 vaccines in late 2020 and a surge in people searching for apartments lifted rents 25% over two years. I have many large apartment building owners on my distribution. More are telling me about higher vacancy rates, falling rents and apartments staying vacant for longer after a period of craziness during the pandemic.

Southern California has seen volumes dry up recently. Closed sales this past January — which reflect deals signed during the holiday season — fell to 9,938, the lowest number of transactions in records dating back 35 years, real estate data firm CoreLogic reported Tuesday, Feb. 28. An average January has about 17,000 closings. January’s sales tally was down 42.8% from January 2022, when homes were selling twice as fast. Sales have dropped from year-ago levels for 14 consecutive months. Prices also have been dropping on a monthly basis, falling for eight straight months, CoreLogic figures show. The median price of a Southern California home — or the price at the midpoint of all sales — fell to $670,000 in January, CoreLogic reported.

Other R/E Headlines

A rush of homes go under contract in January, but it’s unlikely to last

A sharp drop in mortgage interest rates brought homebuyers out in force in January.

New York City’s Luxury Housing Is Now More Expensive Than London’s

In 2022, $1 million bought 33 square meters (355 square feet) of prime property in New York and 34 in the the UK’s capital city—a change from 2021, when London was the more expensive location. Monaco kept its title as the most expensive residential market, with $1 million bringing buyers just 17 square meters, according to the report.

Palm Beach's old guard annoyed by newcomers from the north

As I mentioned, South Florida lacks the infrastructure to handle the migration of people who are coming in droves, and the locals are complaining.

Amazing!!!! Lucky timing.

Hi Eric, I retired from the Canadian oil and gas industry in 2007 at the age of 53. I was in Palm Springs playing golf with the VP of oil and gas in a large Canadian Bank in April 2008. We were looking at million dollar condos and I asked him how people could afford them. He said no money down and no mortgage payments. I asked him how does that work? He told me it doesn’t and how the real estate bankers farmed out the loans. He told me a big crash was eminent. Came back to Calgary and sold all my stocks. Crash came. Oil dropped to $40. In the fall, I got back into oils stocks and doubled my money in 3 months. I still have more money than when I retired and I don’t need Depends. I really enjoy reading your reports.😎😎😎