Opening Comments

It has been slow ocean fishing for me this season after a hot start. I caught a nice bass this week and had to show my catch to get back a little street cred. Ocean waters are warming, and my favorite fishing season is soon to be upon us. I hope you will see some great pictures in the next 60 days of big Mahi, Wahoo, Tuna… The Tuna are showing up quite early due to warmer than normal waters.

In a shocking upset, #1 Purdue was beaten by #16 Fairleigh Dickenson in the NCAA basketball tournament on Friday. This is only the 2nd time in history that a #16 beat a #1. The first time was UMBC beating Virginia in 2018. Coming into this game, #1 seeds were 150-1, meaning the #1 seeds won 150 out of 151 games against #16 seeds.

Julia and I head to Park City to ski on Monday am and fly back on the red-eye Thursday. Low likelihood of a Rosen Report on Wednesday, given the travel and skiing. We are staying in the Canyons. If my readers are there, let me know. I snowboard, so no Deer Valley. Yeah, I am one of cool guys.

Markets

Bank Bailouts (1st Republic)

CS and REIT Pressures

Venture Markdowns

Trump Indictment

Mr. Beast-Friend or Foe?

South Florida Signs of Cooling in Spots

SFO Office Debacle Continues

Compass Report on SFO Home Prices-Not Pretty

Picture of the Day-Flying Bike

A new mode of transport being hyped as the “world’s first flying bike” has officially been released in Japan — with a nearly $555,000 online price tag, according to the company’s site. The 12-feet-long XTURISMO “luxury air cruiser” — inspired by the “Star Wars” universe — was developed by the aircraft company AERWINS. The 661-pound vehicle, a finalist in the 2023 Edison Awards, is designed to draw power from two large central rotors running on a 228-horsepower, gas-fueled Kawasaki motor. There is a short video in the link. So much for traffic jams. Call me crazy, but this looks dangerous.

My Long & Winding Road to Wall Street

What does DIV mean? What does PE mean? I asked my mom these questions in 1983 when I was 13 years old. She said, “I have no idea.” I had seen these abbreviations in the financial section of the paper and did not know what they meant. I found out that the local community college, called Broward Community College (BCC) offered classes on finance and options. I asked my mom if I could sign-up, and she supported it. I took Finance 101 and loved it. I was the youngest person by a mile, and in short order I was hooked. I was also the only person being dropped off by their mother. Not exactly great for street cred, but it was too far for me to ride my bike. Remember, my father passed away when I was 5 years old, and my mother did not attend college. I knew no one in finance and had no idea what Investment Banking was until I was a senior in college. I had never met someone from Wall Street in my life prior to my senior year of college. It is almost unbelievable.

I got an “A” in the first class and asked the teacher what was next. He had me sign up for a few different classes on finance, options, markets over the next year.

Within weeks, I told my mom, “I know what I want to do for my career, and it is finance.” I am not sure what that really meant, but sounded official and started my love of markets. When the 1987 crash happened, I had a $1,500 in the bank and bought $1,000 of Disney stock after it fell 24% in a day. Shockingly and luckily, I made some money, but sold it far too soon. I thought I was a mini-Warren Buffett, but quickly learned that not all my stock picks were so successful. I continued to work at various jobs in high school including: busboy, waiter, dishwasher, barback, pizza delivery, valet parking attendant… which helped give me money to “play the market.”

Given I had to pay for college myself, I went to school at Florida State because I was offered a partial scholarship based on an essay I wrote about my life story. It gave me $3,000 which was my tuition for a couple years. Yes, my tuition was about $1,500/year. In-state tuition was quite cheap 35 years ago. I worked and did not have any student loans when I graduated. I studied finance and accounting and did quite well. I had no connections to Wall Street and reached out to all the major firms (Goldman, Morgan Stanley, Bear, Merrill…). I received COUNTLESS rejections letters. I could not even get an interview. I was coming from a state school and not one of those fancy Ivy League or Liberal Arts schools.

My sister, Shelley, is 11 years older than I am and she lived in Chicago. She knew a woman, Hillary, who worked at Continental Bank and sent her my resume. Hillary sent it to HR, and I got an interview. Long story short, I got a job and was sent to training with about 20 other college grads. Most of the others went to major schools (Ivy League, Northwestern, fancy Liberal Arts schools, Michigan…). I stood out due to the fact I did not have a fancy diploma, relative to the others in my training class.

My head training manager was not my biggest fan and placed me in Large Corporates, arguably the worst placement for me. It was akin to “Equities in Dallas” from Michael Lewis’ book, Liar’s Poker. I was miserable. The job was awful, and I started questioning my love of finance, as the senior guy who treated me as though I was a secretary. Although the relationship improved over time, I did not like my job, and only learned how not to treat people if I ever became a manager.

When a trading position came open in the Loan Trading Group, I was given a chance to interview (crazy story for another time), and I got the job. My life was changed, and I loved my job, the people, the learning curve and my passion for finance and markets was rekindled. I was driven by the training manager’s view of me and wanted to prove to myself and to her that I could be elite. Thank you, Kathleen, for giving me the extra motivation to succeed.

I had a fortunate career as a result of my time at Continental Bank which became Bank America in 1994. I feel what I learned early on was helpful to drive me to work hard and achieve success.

After I finished the University of Chicago for my MBA, I took a job at Chase which became JPM. I ended up running the Credit Trading business, which was a great run with a fantastic team of people. I will never forget the standing ovation I got on the trading floor on my last day of work (sign of respect when someone senior leaves). It lasted for an uncomfortably long period of time and I was trying my best to hold back tears, which flowed regardless of my efforts. The team did a lot together and built a powerhouse business generating billions during the crisis, when other desks lost tens of billions in many cases.

In 2012, I also started a hedge fund, Reef Road Capital with my long-time partner in crime, Jeff. Again, we assembled an impressive team of dedicated people and built a good business in short order.

In the end, when you are given a chance, make the most of it. Chase your dreams. Be intellectually curious and work hard. When I ran the trading desks at JPM, I was in the pool or gym around 5am and at my desk at 6:15am to set the tone.

You may get lucky like I did and realize your wildest dreams. Growing up, I did not know anyone who made $25k/year. My definition of financial success changed about 50 times, as I started to realize the potential of what was in the art of possible. I will never forget my first $1mm bonus at age 27. When my boss gave me the bonus number, I tried not to laugh. I thought he was joking. I did my best to keep a poker face and not act too happy or too upset. I thanked him and thought to myself, “How in the hell did this just happen?” The path was circuitous, and I had some great highs and awful lows. I made plenty of mistakes. But in the end, who would have thought I would have achieved my successes when I was in 7th grade taking finance classes at a local community college or in the training class at Continental Bank in 1992? Surely not me.

Quick Bites

Let me get this right, Global Banking Crisis and stocks are rallying? Relative to Jan 1 2023, the 2 year and 10 year are -57bps and -43bps respectively, and the Nasdaq is +11% on the year. On Friday, the Dow lost 386 points, or 1.19%, to close at 31,862. The S&P 500 slid 1.1% to end at 3,917, while the Nasdaq was down 0.74% to 11,631. The bigger story for is on the week, the S&P was +1.4% and Nasdaq+4.4% despite the bank crisis pushing the KBW bank index -11.1% on the week. The only “positive” is the banking news will dampen inflation and rates are telling us the Fed will be cutting in 2023. As of Friday’s close, the market is pricing in approximately 50/50 chance of one 25bps rate hike and 80bps of CUTS in 2023. A month ago, the market was pricing in almost 4 rate hikes and ZERO cuts for the year. Crypto is rallying (BTC +23% on week to $27k) and energy is under pressure on broader economic concerns despite China coming on-line. The US dollar remains under pressure after peaking at 114 against the DXY in late September 2022, it is down to 103.9 or -.7% on the week, as the market is suggesting aggressive rate cuts are coming.

A group of financial institutions has agreed to deposit $30 billion in First Republic in what’s meant to be a sign of confidence in the banking system, the banks announced Thursday afternoon. Bank of America, Wells, Citigroup and JPMorgan will contribute about $5 billion apiece, while Goldman and Morgan Stanley will deposit around $2.5 billion. Truist, PNC, U.S. Bancorp, State Street and Bank of New York Mellon will deposit about $1 billion each. I find this to be a creative solution. No one wants to buy a bank and take over the labilities on short notice with limited due diligence after the debacles during the GFC. What is First Republic paying on the $30bn? It only needs to stay for 120 days. Then what? I don’t see this as a real long-term solution and given the -33% stock move Friday, the markets wised up to it as well. Bad management taking outsized duration risk should end differently in my opinion. Failures are part of the system, and I am worried about precedents being set. Moral Hazard issues in my mind. The morphine drip of zero rates, Quantitative Easing, free money, bank bailouts, guaranteed deposits… Where does it end? This article suggests there could be 186 other banks with similar risks to SVB. I am not suggesting the # is correct but will tell you other banks won’t make it in 2023. This CNBC article suggests midsize US banks asked the FDIC to insure ALL deposits for 2 years. Check out the swings on First Republic Stock which rallied sharply after the announcement of new deposits, only to give back 95% of the gain on Friday. Contributing to my belief that more pain is coming on the bank front were Yellen’s comments to the Senate that government refunds of uninsured deposits will not be extended to every bank that fails, only those that pose systemic risk to the financial system. I would not have any money in regionals and put it in a “too big to fail bank.”

Credit Suisse shares surged Thursday after the Swiss central bank agreed to loan the bank up to $54 billion to bolster confidence in the country’s second-biggest lender following the collapse of two U.S. banks. Yes, CS is large relative to the GDP of Switzerland, but I am not convinced the bank needs to exist, given it has been the worst managed bank of all-time. The stock sold off on Friday back to $2.01 with a recent low of $1.76. Split it up and sell it off to a bank who is not so inept. This weekend, UBS offered CS $1bn and CS is not happy with the offer which is well below the $7bn public value as of Friday close. Trust me, UBS is overpaying at this price. Buy the assets, not the entity which results in the liabilities and opens the door for future lawsuits Banks Borrow $164.8 Billion From Fed in Rush to Backstop Liquidity. I am convinced the last shoe has not dropped on the bank topic. Check out the REIT stocks with heavy NYC exposure. SL Green is -20% for the week, -31% YTD and 71% over the past year. Vornado is -15% for the week, 33% YTD, and 69% for the past year. What does this suggest for banks with heavy NYC office/retail exposures?

Tiger Global marked down the value of its investments in private companies by about 33% across its venture-capital funds in 2022, according to people familiar with the firm. The markdowns erased $23 billion in value from Tiger's giant holdings of startups around the globe, one of the people said. Its private portfolio includes big bets on hundreds of companies including TikTok parent ByteDance and payments company Stripe. While substantial, the markdowns -- including $9 billion in the second half of the year -- highlight the lag in private markets compared with similar fast-growing public companies. Tech stocks fell sharply last year, yet large venture-capital investors have so far reported more modest declines. SoftBank Group reported its $48 billion Vision Fund 2 saw a roughly 30% drop in valuations of its private investments between April and December, compared with a more than 50% drop in its publicly traded holdings. The banking crisis won’t help the IPO market or venture valuations. Many venture backed companies will struggle with funding going forward. I have been critical of the marks on private positions in the fund space, as I am not convinced many have taken adequate markdowns which are more reflective of the market environment. A huge number of companies raising new rounds are doing it at substantially lower valuations than the prior raises. Checkout.com cut its valuation to $11bn in December, -73% from the prior round which included Tiger Global as an investor. There are many others.

There are now dozens of articles on Trump’s expected upcoming indictment this week regarding $130k in hush payments to Stormy Daniels. With all the other things he is accused of around taxes, Jan 6th, real estate valuations, election interference...I am surprised the indictment is on the Stormy Daniels topic and something not more substantive. If he used campaign money, I get it. I spoke with lawyers and they tend to agree, even if they did not care for Trump. One suggested they should release the grand jury transcripts, and I think that makes sense too. In NYC, over half of felony cases were downgraded to misdemeanors in 2022, yet this is what they want to indict Trump about? Violent criminals get wrist slaps and we are worried about hush money to a porn star? I ADAMANTLY do not want Trump or Biden in 2024, but do worry an indictment on this charge will invigorate Trump’s base. Musk predicts Trump in a landslide if the indictment takes place. Trump is also calling for his supporters to protest. Here we go again. Time for new blood from both parties.

I have written about this character, Mr. Beast, the biggest person on YouTUBE in terms of followers at over 130mm. He makes tens of millions per year. He does outlandish things and creates insanely expensive high-quality content. He gives away millions of dollars in cash and gifts. He recently gave 1,000 cataract surgeries away for free (poor and uninsured patients) and gave them money after the procedure, yet he came under scrutiny for it. Then he gave 20,000 pairs of shoes to poor children in Africa and is vilified. The haters suggest he is giving away surgeries and shoes for the wrong reasons and there is a growing drumbeat hate on Mr. Beast. Do you think the 1,000 people who have sight are upset at Mr. Beast’s generosity and the gift of site? Are those who receive help and money hurt by Mr. Beast’s “abelism?” Do you think the kids who walk miles to school barefoot in Africa are mad at Mr. Beast for his generosity? I adamantly disagree that someone who is generous should be vilified for giving away millions and helping people. How much are the haters giving away to help people? What do my reader’s think about it? Watch this video of people now able to see and focus on the young boy’s reaction (1 minute mark) to sight and the $50k gift to attend college? Sorry, I really don’t care why Mr. Beast is generous, but am supportive of his chartable ways and the impact he has on people’s lives despite some of the silly antics which accompany it. There was talk he might eventually run for President. By the time he is 35, he could have 300mm+ followers, and we have learned in politics, anything is possible.

Other Headlines

Where wealthy investors are putting their cash after SVB collapse

Biden calls on Congress to tighten laws to claw back executive pay, levy penalties in bank failures

I love this concept and want to see it instituted.

First Republic Bank Executives Sold $12 Million in Stock in Months Before Crash

LME Rocked by New Nickel Scandal After Finding Bags of Stones

The London Metal Exchange has discovered bags of stones instead of the nickel that underpinned a handful of its contracts at a warehouse in Rotterdam, in a revelation that will deliver another blow to confidence in the embattled exchange.

CNN’s Burnett admits that evidence of Chinese funneling money to Biden family ‘doesn’t look good’

Marianne Williamson’s ‘abusive’ treatment of 2020 campaign staff, revealed

400K gallons of radioactive water leaked from Minnesota nuclear power plant; cleanup underway

NYC’s Fairway supermarket using facial recognition to bust thieves

Ridon Kola, 32, said he would 'crucify Yonkers cops and their bosses,' in an online post. Read the article. Sounds like a lovely person who hates Americans and the police who risk their lives to save ours.

CNN correspondent reporting on San Francisco street crime falls victim to car break-in

Remind me why the wealthy individuals and big companies are leaving SFO?

Protests erupt as French government forces through higher retirement age

Colin Kaepernick accuses white adoptive parents of ‘problematic’ upbringing, perpetuating racism

Jews popular in U.S. despite increase in antisemitic attacks

I was surprised by the findings here which shows Jews with a +28 rating.

Harvard career expert: The No. 1 'desirable skill' that very few people have—especially men

More Students Are Turning Away From College and Toward Apprenticeships

I agree 100% that less students should go into massive debt to get a 4-year college degree. Great statistics in the piece. 15mm enrolled as undergrads today and 800k are in apprentice programs. College enrollment is -15% in the past decade, and apprentices are +50% during that time.

College hopefuls have a new ultimate dream school — and it’s not Harvard, Princeton or Yale.

I am surprised Vanderbilt, Duke, and Yale were not on the list over some of these schools.

Disco Night at Mar-a-Lago (and Other Tales From Palm Beach’s Private Clubs)

A shocking # of readers sent me this article, so I am including it. Coincidentally, we went to Palm Beach for a birthday dinner on Friday night and then continued out for a late night at Cucina, a restaurant which becomes a nightclub. Quite the scene.

Real Estate

The lot on North Bay Road which was listed for $33.9mm and will be lowered to under $30mm despite an amazing view. Despite being a choice property, the demand is far higher for brand-new, move in condition, and people don’t want to go through 3-years of headaches despite amazing lots. As a result, there is a price drop. There is a consistent theme now with places which need work; prices are being lowered. I have received many emails in the past few days of price reductions in South Florida, but they tend to not be trophy condos and brand-new waterfront homes. My community in Boca, Royal Palm, is up to 34 listings. When I moved down, 71 listings and got down to 4 in December 2021. The current listings are back to 2020 levels are the migration started and the 60 available homes quickly became 20. Also, in my community, the higher-end homes ($15mm+) are definitely staying on market longer. Even the brand-new ones.

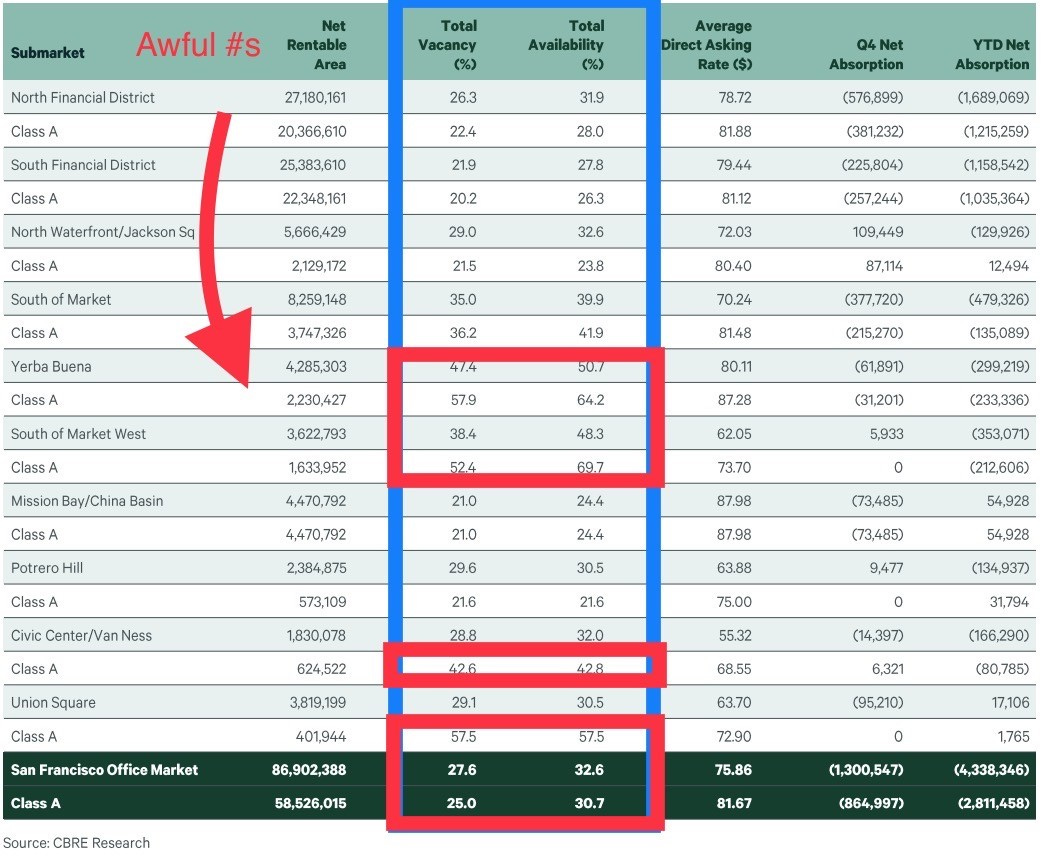

Major tech players are looking to sell their expansive corporate campuses in the area, or reconsidering new developments. Intel Corporation — the cloud computing, data center and semiconductor chip manufacturer — is aiming to sell its 505,000-square-foot office at 101-141 Innovation Drive. Meanwhile, Analog Devices — specializing in data conversion and signal processing — is also seeking a buyer for its 320,000-square-foot campus in Milpitas, located 15 minutes from the Intel building. While vacancy rates have contributed to the clearing out of Silicon Valley, the recent events that have transpired with Silicon Valley Bank have continued to shake the industry. Meanwhile, Google recently announced that it, too, was reconsidering the timeline for its Downtown West project in San Jose that was in the works. SFO is a shell of its former self and Work From Home, crime, homelessness and filth are clearly contributing to the continued carnage in the area on the office front. Why pay huge taxes and live among the homeless if you don’t have to anymore? According to CBRE, the SFO office market ended the 4th Q of 2022 with a 27.6% vacancy rate. The availability rate which includes space available for sublease is 32.6%. Some submarkets have over 50% vacancies and 70% availability. That is downright scary. Check out the chart done by CBRE and the vacancy/availability in various SFO markets. Some are over 50% vacant. Which banks are going to get killed on those? Think about the ramifications of R/E taxes on buildings which have seen the valuation slashed. What are the implications for the budget for SFO?

Is SFO housing solid? Not from what I have read. Check out the charts below from Compass from February 2023. Wealthy are leaving CA in droves, as are businesses. What does it do to the state and city budget? What about R/E taxes on homes and offices due to lower valuations? Note how quickly the chart falls off in recent months, with average prices down over $500k or 25%+ in a short time.

US households are now 'rent-burdened' for the first time ever, blowing 30% of their income on rent