Opening Comments

Julia and I flew back on the red-eye from Utah on Thursday at 11:59pm. We walked onto the plane and clearly someone puked on the prior route. The plane smelled awful, and it took a lot out of me not to throw-up myself. The longest 5 hours of my life.

I want to remind readers that some email systems truncate the Rosen Report and require you to “View the Entire Message,” by hitting the link.

For all the new Rosen Report readers, it is important to know that I encourage you to email me at Rosenreport@gmail.com with story ideas. I literally get hundreds a day and given I do this alone, my readers help contribute to content. I am all ears on ways to improve the newsletter as well.

I post things on LinkedIn more frequently than the Rosen Report on Sunday & Wednesday. You can follow me here on LinkedIn if you want even more of me.

Markets/RDI

Banks/REITS

My 1st Hand Experience on Fallout of Banking Issues

Sternlicht on Economy

CS Blames the US-Long List of CS Mistakes since 1986

NYC Waldorf Astoria-Delays Delays Delays

High-End Miami on Fire. Numerous Examples-$1mm Golf Course Initiation Fees and It is Full

LA Mansion Cuts Price to Beat the Huge New Tax

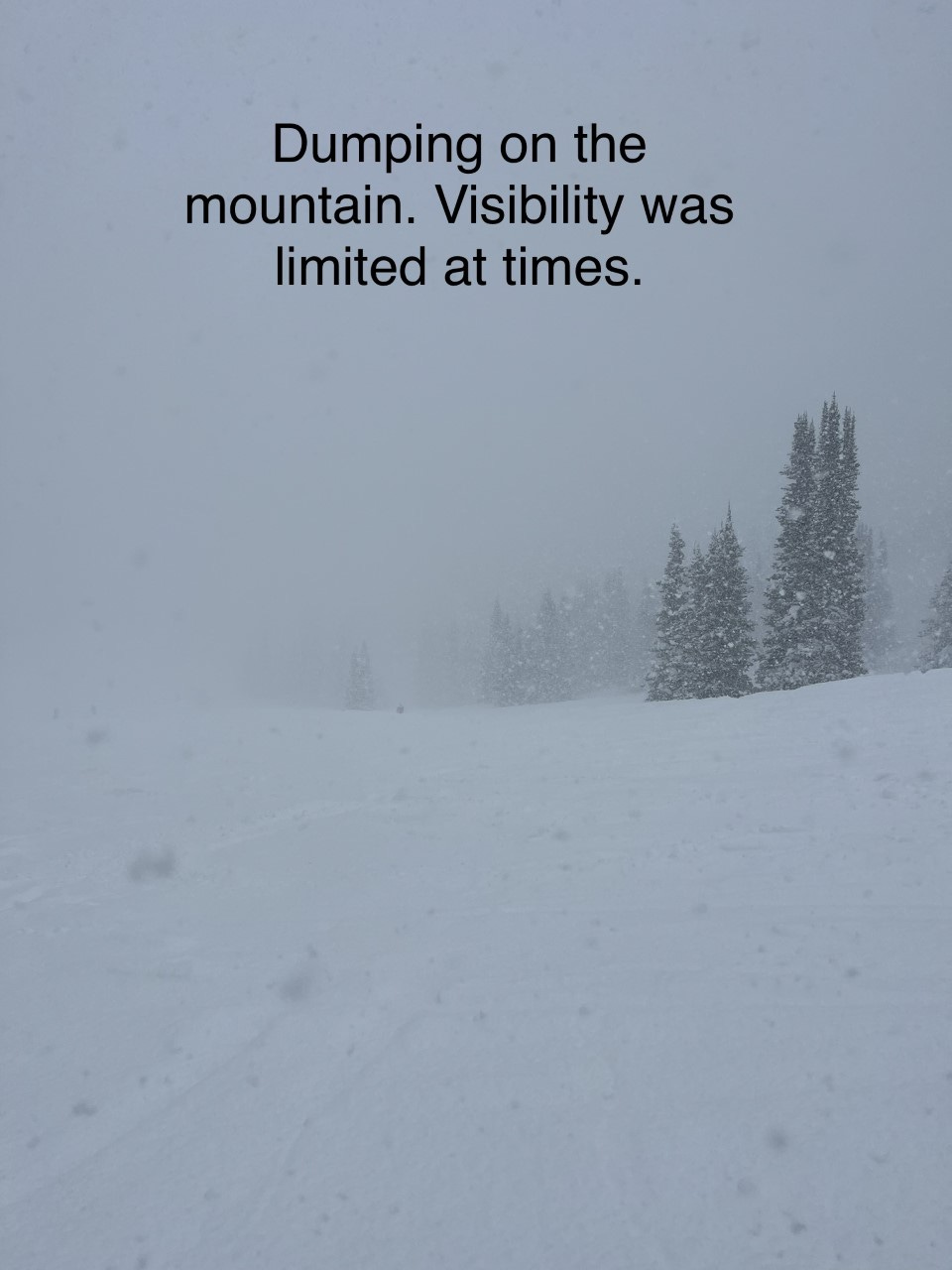

Picture of the Day-Park City Skiing

My 15-year-old daughter, Julia and I skied Park City last week in what turned out to be an epic trip from both a snow perspective and the fact that I was able to spend quality time with my favorite daughter. We got dumped on. The 1st chart was from Wednesday and then got dumped on all night Wednesday and Thursday for sections of almost waist high powder in the trees. Some runs were closed due to moose, and we saw one from the chairlift on our final run. I wish I rented a powder board rather than a traditional one. As an aside, my legs want to file for divorce from my body. They are killing me.

FICO Scores Explained-Part II-Inside Baseball

After a recent piece entitled, “FICO Scores-How the Hell?” I received a lot of emails, calls and text from my readers complaining about their credit rating. Many complaints were from Uber Wealthy readers who were disappointed with their credit score despite no debt and material assets/income. Given the power of the Rosen Report, I was able to connect with the CEO of FICO. He then connected me with members of his team, and I am giving a 2nd credit report update given the amount of attention the first report received. Hopefully, you will find this interesting and helpful. There are some good tips here on how to improve your credit score and what can detract from it.

As I mentioned, I have no debt, own a home (no mortgage), pay my cards on time, and thought I never had any issues. It turns out, I once leased a car and apparently my last payment was late, and it is hurting my score. I returned the car on time and don’t recall any issue, but apparently, the credit agencies have me with one late payment. My score between 740-770 could be 50-70 points higher without this single incident, which will last 7 years. I will never lease a car again for many reasons, and this is just one of them. Even one late car or house payment can be very detrimental to your credit rating.

Banks tend to look at your assets and income, something FICO does not consider as that information is not captured on your credit reports. FICO score is a tool designed to score a broad population. It is an inexpensive and highly efficient tool for predicting one’s propensity to repay debt. If you have a dispute or error, go to this site for information on how to fix it: https://www.myfico.com/credit-education/credit-reports/fixing-errors

It is important to pay bills on time. If you've missed a payment on one of your credit accounts, the late payment will usually get reported to the credit bureaus once you're at least 30 days past the due date. Lender penalties or fees could kick in even if you're one day late, but if you bring your account current before the 30-day mark, the late payment usually won’t be reported and hurt your credit. A 30-day late payment can hit your score for 7 years when it is then purged from the credit report per regulation.

Do not close unused $0 balance credit card accounts. Doing so may negatively impact your credit score. Since your credit utilization ratio is the ratio of your current balances to your available credit, reducing the amount of credit available to you by closing a credit card could cause your credit utilization ratio to go up and your credit score to go down. A higher utilization percentage raises red flags for lenders because it shows you’re using a higher amount of the credit you have available.

Amount Owed-the lower the utilization the better – less than 10% is the “sweet spot.” Note, in some cases, a low credit utilization ratio will have a more positive impact on your FICO Scores than not using any of your available credit at all.

A frantic reader who is quite wealthy sent me a note that his FICO score dropped due to his utilization going up from 30 to 42% in one month. This is despite no late payments.

Do not max out your cards. High utilization results in a higher likelihood of a missed payment and a lower score.

Have a clear understanding of how the reporting to the credit bureaus of credit card information works. Credit cards typically report your information to the credit bureaus once a month. This typically is on what's called the statement date or closing date. The closing date is the last day in a billing cycle. You then get the card statement with a due date. You pay in full. However, the balance as of the statement date is what is reported to the credit bureaus-not the amount that you paid. Some consumers will pay the balance online a couple days before the statement date so that the balance reported to the credit bureaus is zero or a very low number which may help the credit score.

Other Factors

It’s better for the score to have some debt and demonstrate you can manage it well compared to having no debt at all.

The score doesn’t consider income, net worth, investment or assets as they are not reported to the credit bureaus. A lender may well consider these other elements when reviewing an application for credit.

Generally, over 700, all good. 760 or higher is considered prime and it does not save you money to be an 850 versus a 790 for example.

Your length of credit history is important. Don’t cancel old cards which have a long record. It will hurt your score.

Myfico.com is a site to navigate to see how to improve your credit.

Thank you to the team at FICO for spending time to educate me and in turn, my readers on this important subject.

Quick Bites

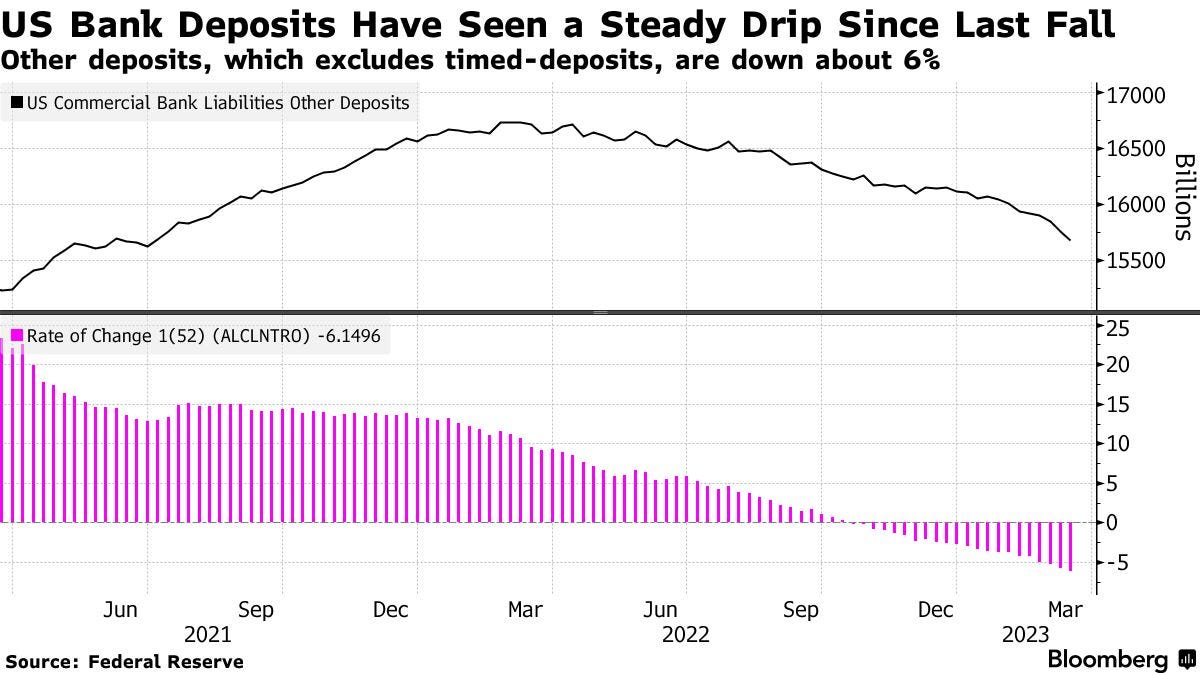

The Dow gained 133 points, or 0.41%, closing at 32,238. The S&P 500 rose 0.57%, while Nasdaq Composite ticked up 0.3%. The major indexes all had a winning week, with the Dow gaining 0.4% week-to-date as of Friday afternoon, while the S&P 500 and Nasdaq gained 1.4% and 1.6%, respectively. Investor’s concerns about credit markets after the collapse of SVB does not appear to haves fully spread to high yield debt just yet. The iShares iBoxx High Yield Corporate Bond ETF (HYG) has attracted nearly $800 million in inflows over the past week, according to FactSet. Meanwhile, the SPDR Bloomberg High Yield Bond ETF (JNK) has pulled in $381 million. I’m told High Yield trading volumes are lighter and liquidity is poor, not awful despite cash on the sidelines. I remain a bit surprised at the resiliency of the markets in light of financials, uncertainty Treasury markets, Yellen’s countless miscues… The Treasury market volatility is insanity. What is it telling us? The 2-year yield was 5.08% on March 8th and is 3.77% today. Second chart shows Fed Balance sheet reversing QT.

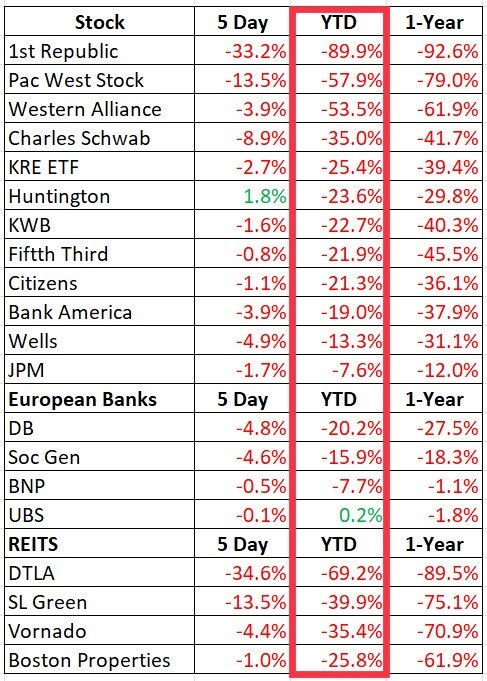

RDI-6. Surprised by the resiliency of equities. I feel CRE is the next shoe to drop and the REIT stock moves are telling. I do feel banks will be pulling back which impacts the economy and earnings. This link explains the world-renowned RDI for new readers.

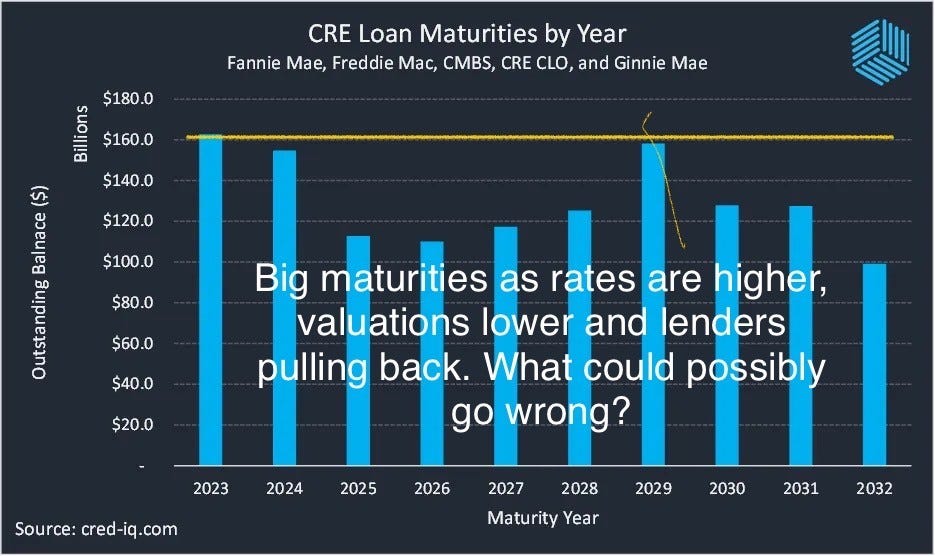

According to CNBC, $5.1 trillion in money market funds (all-time high) given concerns about regional banks. This Market Watch article discusses Bank America’s bearish stock market view and discusses MoneyMarket Funds and tightening lending standards. For the chart below, I ranked YTD performance (worst to best) for regional banks, European banks and a few office REITS. The regional banks are under-performing along with office REITS, while the larger US banks and Euro banks are outperforming. Regional banks are critical in funding consumers, small businesses and commercial R/E, and I inserted a chart from my last piece to showcase the importance. With deposits leaving smaller US Banks (-$98bn on the week and “other deposits -$78bn on week) and regional banks pulling back lending to shore up capital ratios, the impact will be felt in the economy. On Saturday, a CNBC article was published entitled, “U.S. reportedly considers more support for banks while giving First Republic time to shore up balance sheet.” The REIT dividend yields are getting very high and are not sustainable. Vornado dividend yield is 11.1%, SL Green is 15.9%, and Boston Properties 7.9%. REITs and other CRE owners will be scrambling to refinance properties given the regional banks are a major source of funding, and rates are higher and valuations are lower in most cases relative to the last financing. Adding to the pressure is approximately $162bn of commercial mortgage maturities in 2023, the highest year of maturities of the next 10 years.

I want to share some color on recent personal experiences. I sit on various boards, advisory boards and consult and some are early stage ventures. More companies are scrambling on the heels of SVB and Signature. Also, I have made multiple venture investments and I am seeing real pain. One is a consumer lending business which was doing very well until their funding sources dried up causing them to scramble and take in massively dilutive and EXPENSIVE money; 15% interest with 3x liquidity preference!!!!! The ripple effects are real from the 2023 banking crisis. I am not convinced the market understands the ramifications for the economy and venture backed companies. I moderated a panel for 3i last week and this 3 minute excerpt has some good takeaways on related topics and impact of the lender pull-back.

I am a BIG fan of Barry Sternlicht, one of the best R/E investors of our generation. He has been as critical of the Fed as I have been and was on CNBC last week. Starwood Capital CEO Barry Sternlicht said the U.S. is headed into a recession because the Federal Reserve has been hiking interest rates too aggressively. “The economy will have a hard landing. “You moved rates so far so fast that you had collateral damage,” Sternlicht said on Thrusday. Sternlicht said he and his colleagues looked at six regional banks over the weekend and studied their mark-to-market losses on assets. Starwood determined all of them are effectively insolvent. “By raising raising interest rates even yesterday, they’re just increasing the losses in the regional banks, which means they’ll have to go and borrow additional capital from the Fed,” Sternlicht said. “They didn’t even stress test these banks if rates rose, so they should have been the first ones to see what they were doing to the regional banks.” I agree with most of Sternlicht’s comments and his short video can be seen here.

I have crushed Credit Suisse at every opportunity possible. This is my last time dedicating Quick Bites space to this inept institution. This headline made me laugh, ”The Swiss claim the U.S. banking crisis ultimately toppled Credit Suisse.” The management turnover at CS has been prolific, and they have been absolute clowns. Sorry, don’t blame SBV or the US for the incredible ineptitude of CS management and the Swiss for letting it go for so long. This has been a slow moving train wreck for decades. This Guardian article outlines mistakes since 1986, and I am not convinced the article got all of them. I added a few but sure I missed some if you can believe it:

1986-CS helped Ferdinand and Imelda Marcos.

1999-Japanese Shredding Party where CS destroyed evidence and its license was revoked.

2000-Banking funds linked to a Nigerian dictator.

2004 Money laundering for Japanese Yakuza.

2009 US Sanction breaches.

2011-German Tax Evasion.

2012 US Sub-prime bond fraud.

2014-US tax evasion.

2016 Italian tax evasion.

2016-US anti-money-laundering fine.

2017-Money laundering fine for 1MDB.

2017-Euro tax evasion.

2018-Weak controls linked to dealings with Petrobas, PDVSA and Fifa.

2018-Lescaudron fraud conviction (CS Banker).

2018-Honk Kong jobs for business scandal.

2019-Corporate espionage.

2020-Bulgarian drug trafficking.

2021-Archegos collapse (CS lost $5.5bn)

2021-Greensill scandal.

2021 Mozambique tuna bonds.

2022-Horta-Osorio’s Covid Breaches

2022-Whistleblower reveals data exposing clients who conducted human trafficking, fraud…

2023-Regulators orchestrate a takeover by UBS and the Swiss National Bank pledged $108bn to support the takeover.

2023-DoJ Russia sanctions probe.

This is a mic-dropping against the argument that CS troubles are due to the US Banking Crisis.

Other Headlines

Jack Dorsey's Block shares plunge after Hindenburg report on fraud

VERY aggressive claims in the Hindenburg report.

Elon Musk Offers Employees Stock Grants Valuing Twitter at About $20 Billion

Ford Says It Will Lose $3 Billion on EVs This Year as It Touts Startup Mentality

Bill Gates Says AI Is the Most Revolutionary Technology in Decades

I am hardly the expert here, but I included a video about ChatGPT in November and believe AI will be one of the most disruptive technologies of our lifetime.

ChatGPT can help you write a standout resume in seconds—here's how

How Bank Oversight Failed: The Economy Changed, Regulators Didn’t

Overseers paid insufficient heed to risks of falling bond values and fleeing deposits. Social media and selling by smartphone made that worse.

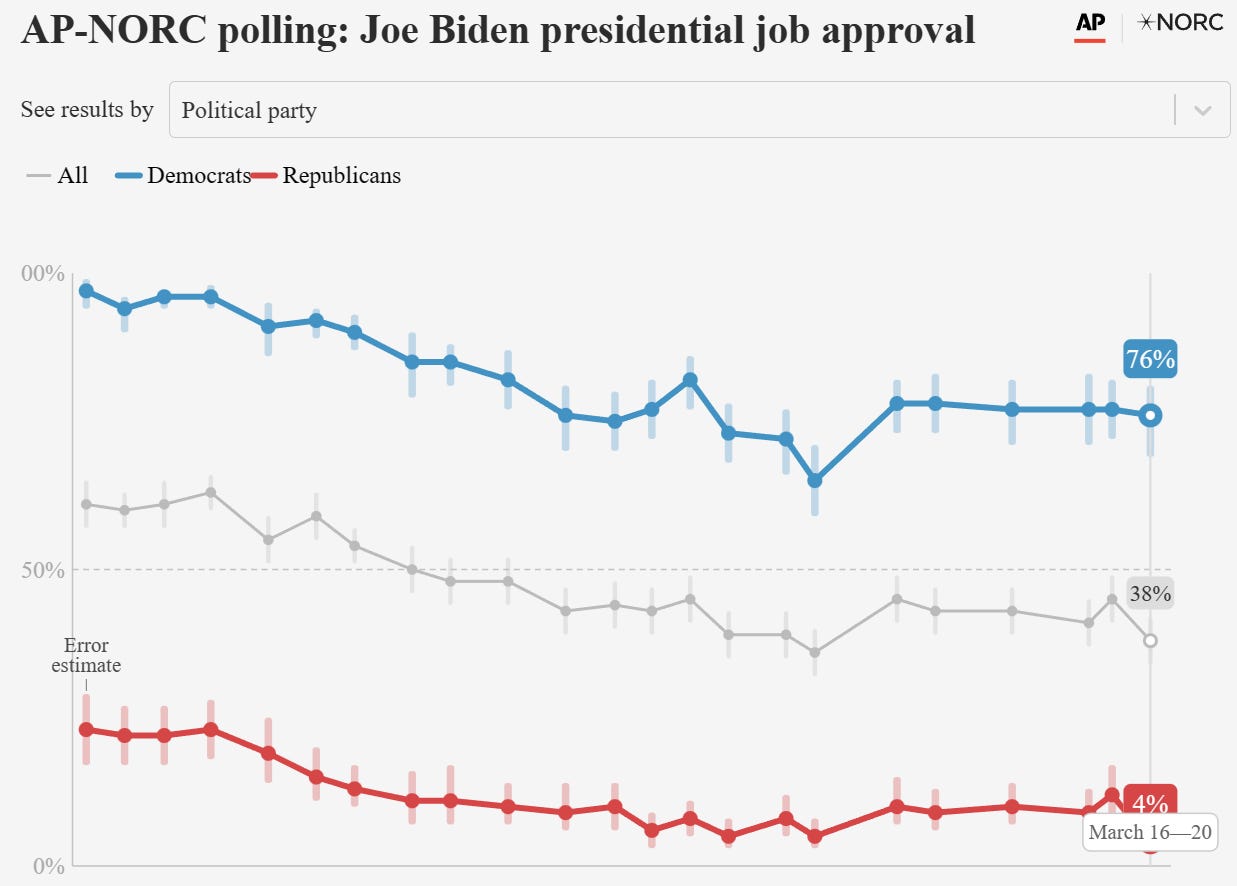

Biden’s approval slips to 38%, near the lowest of his presidency, new poll says

Trump posts disturbing baseball bat photo with Alvin Bragg, threatens ‘death and destruction’

Despite some good policies, he is unhinged. Please have someone new not named Biden, Trump or Harris for 2024.

Envelope with suspicious powder sent to DA Alvin Bragg's NYC office

15 Oldest US Congress Members: Age, Party, State

Term and age limits PLEASE.

NY Attorney General Letitia James hosting 'Drag Story Hour' for children: 'This is not the way'

Your tax dollars hard at work.

Transgender woman finishes in first place at New York City cycling event, sparks outrage

Prosecutors accept deal with George Santos in Brazilian fraud case

Republicans need to boot this clown. Yes, politicians lie, but Santos takes it to another level.

One pipe leaks 5 million gallons a day in Jackson, Mississippi

As residents had to boil their tap water and businesses closed because their faucets were dry, the break at the old Colonial Country Club squandered an estimated five million gallons of drinking water a day in a city that had none to spare. The ineptitude never ceases to amaze me. The city discovered the broken pipe in 2016! How in the hell?

Xi Jinping tells 'dear friend' Putin 'change is coming' as he leaves Moscow

China is not our friend and we need to rely less on China going forward for manufacturing.

We are failing our children. Less woke teaching and more basics. More charter schools are needed.

North Carolina teacher resigns after taping 11-year-old's mouth shut: 'He was humiliated'

Michigan College Set to Host Graduation Services Segregated by Race, Ethnicity, and Sexual Identity

“Graduation Celebrations” would be held for Asian, Black, “Latino/a/x,” Native Americans, and “Lavender” or “LGBTQIA+”

California lawmakers to vote on whether to allow penalties on oil companies for gas price gouging

Antisemitic incidents in the US are at the highest level recorded since the 1970s

Detroit murder suspect out on bond accused in fourth killing

We are failing the law-abiding, tax-paying citizens in favor of hardened criminals. You cannot make up these stories. A Michigan man accused of killing his mother, stepfather and ex-girlfriend after being released from jail on bond has been charged with a fourth murder.

Teen overdose deaths have doubled in three years. Blame fentanyl.

Maybe porous borders and soft on crime policies are not working? Great stats in the article about teen smoking (way down) and drinking (down as well). Scary details on the fentanyl issues we face.

Great article on the importance of taking a long term view and compounding.

Barnard psychologist Tovah Klein: Top key for raising successful kids

Alzheimer’s first signs may appear in your eyes, study finds

A Harvard Physicist Is Racing to Prove This Meteorite Is an Alien Probe

I hope he proves it.

This is NYC’s most thrilling new restaurant — and it’s in a mall

Bad Roman at the Time Warner Center looks amazing and is 100 yards from one of my favorites, Marea. If any readers try it, let me know your thoughts. I am hearing the place is packed.

Real Estate

Manhattan’s iconic Waldorf Astoria Hotel, which has been “temporarily” closed since February 2017, will not reopen until at least 2025. The article suggests Anbang Insurance bought the Waldorf for $1.4bn and has spent over $2bn thus far on construction. What an unmitigated disaster. To be clear, I would NEVER live on Park Avenue at 50th Street. AWFUL location to live. They could have knocked down the building and rebuilt it in the 8 years of construction. Welcome to construction of landmarks in NYC. When I bought my PH co-op on 74th & Park, the work was scheduled for 9 months and cost “X.” It took 4.5 years and cost “3X.” NOTHING could ever get me to do structural work in NYC. NOTHING. Never own in a co-op either. Too many restrictions and rules. There is a reason condos trade at a big premium to co-ops.

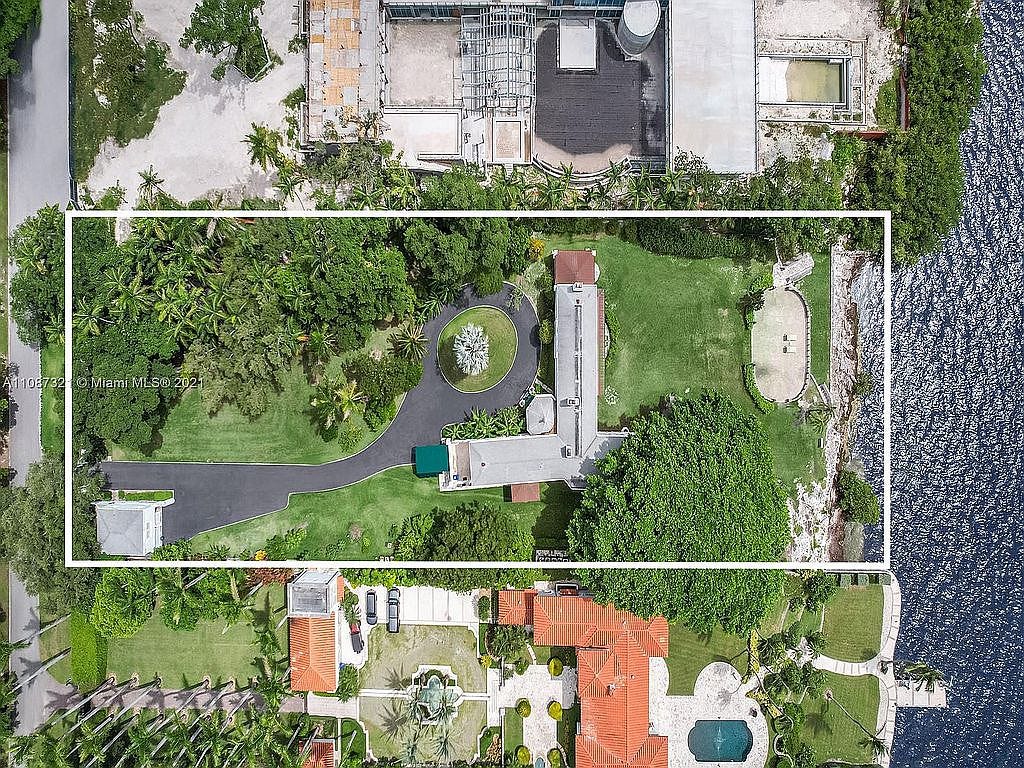

I keep talking about high end Miami and Palm Beach with limited supply and high demand. A company led by a wealth manager (Paul Morelli) paid $48.5 million for a waterfront home on Brickell Avenue in Miami’s Coconut Grove, adding to a multi-acre assemblage. Morelli also manages the trust that acquired the waterfront home next door at 3029 Brickell Avenue in late 2014 for $29 million, records show. Together, the properties total 2.7 acres, at a total cost of $77.5 million to acquire both. The owner could combine and redevelop the properties into a larger estate. I am told the $48.5mm purchase was a knock-down. This is a few doors down from Ken Griffin’s purchase of Adrienne Arsht’s $100mm+ home. The new Steve Witkoff development in Hallandale, Shell Bay is now 25% sold and my friend, Devin Kay has sold almost all of them. The golf course has taken members at over $1mm, UNHEARD of for South Florida. The course opens in October of 2023, but the condos won’t be built until the end of 2025. I am told the Shore Club Private Collection, designed by AM Stern, has seen 5 units sold for over $5k/foot and the PH is in contract in the range of $70mm (8,000 ft). These are NYC prices. Many of the buyers are owners at 15CPW or 220 CPS in NYC.

I wrote about the LA County law which goes effect April 1, 2023 which puts a large tax (4% and 5.5%) on all RE (residential and commercial) sales over $5mm and $10mm respectively. A mansion has slashed the price in order to move it prior to the new tax going into effect. The Brentwood estate, now known as the Star Resort, was built by veteran spec developer Ramtin Ray Nosrati, who sold it back in 2021 for $44mm. About a year after buying it, Feinberg put the home back on the market for $48mm but couldn’t find any takers. Feinberg brought in Dan Malka of Ikon Advisors to implement a more aggressive pricing strategy, and the original asking price was chopped down $10 million, or almost 21%. Malka told CNBC yearly real estate taxes on the Star Resort run his client around $550,000 a year, plus about $20,000 a month in utilities. “Plus, the staff and so on, so probably a million dollars of expenses [per year],” Malka said.