Opens were down a touch in my last note despite some of the most positive feedback in recent months. If you missed it, read the title piece, as people liked it. The title was “My Long and Winding Road to Wall Street.” I heard from quite a few who did not receive it for some reason. Be sure to make this email safe, as many servers assume it is spam over time.

Julia and I are skiing in Park City at the Canyons. It is DUMPING snow here. An upcoming piece will be discussing the insanity of costs. It might be called, “Skiing is for Billionaires.” Short report today, as I wanted to spend time with my daughter on the slopes. As an aside, I am so dry, my skin is falling off. One of the best ski days I can recall. Now my legs are paying the price.

Given skiing, I am sure I missed so key stories today. Apologies. I felt as though with the Fed and banks, I needed to get something out.

Markets

Fed

1st Republic

CS Cocos and UBS

CRE Loans/SVB

Home Sales

Office REITS Under Pressure

Picture of the Day-An Interesting Picture and Chart

The 1st pic is from a few Forbes covers and wow, did they get them wrong. The Forbes curse strikes again, and again and again. SVB is on Forbes BEST Bank list in 2023. Then you have major fraudsters in Elizabeth Holmes and SBF being touted for their greatness. Short the stock it if it makes the cover of Forbes unless it is me who is on the cover. Don’t forget about the Adam Neumann cover (WeWork) or the Kanye cover. Both imploded shortly after. The second chart is from DB/Jim Reid, and I feel it is informative about the friction costs of rising rates. Again, Fed is responsible for leaving rates zero for too long and buying over $100bn in bonds a month through QE, when R/E was on fire and inflation was raging. Look at the various crises which occurred shortly after raising rates over the last 50 years.

Thrill of Victory and the Agony of Defeat

I presume many of my readers are too young to remember ABC Wide World of Sports and Jim McKay, who would open the show with the crazy video of the Slovenian ski jumper, Vinko Bogataj, who spectacularly crashes on a jump. The 20 second video can be found here and will bring back memories for those who are in 45-70 years old. Today’s story is actually in reverse, meaning it should be The Agony of Defeat and the Thrill of Victory.

All my readers are well versed about my son, Jack, and his passion for golf which takes me to awful small towns for tournaments, which are always culinary wastelands. This link will take you back to June of 2022 and the bullet hole in our hotel window in Zachary, Louisiana. We stay in gross hotels and try not to die.

Today’s story is actually about my daughter, Julia, and a golf tournament. She does not take golf seriously but can play. If I caddy for her, she can shoot even par to 4-over on 9 holes at our club. However, on her own, she struggles reading greens, club selection, wind, pin positions… She decided to play in the Women’s Club Championship, a two-day medal play event in Boca. This means the total score from the two days of golf determines the winner. I was very excited and NERVOUS for her.

No caddies were allowed, and I was a little worried about Julia on her own. She opened up with a very respectable 78 in the wind and was the clubhouse leader. Remember, Julia has only played in a couple 18-hole tournaments and a few 9-hole events. She has always had me as her caddy. Sleeping on the lead, despite the fact that the tournament is not exactly the US Open, weighed heavily on Julia. She awoke early Sunday and was clearly nervous. She would not eat and was anxious to get to the range to practice.

The wind was blowing 20mph, and she started off slow with a bad front 9 primarily due to poor putting. She had a 4-putt and a bunch of 3-putts despite having two different putting opportunities for eagle on the front 9. Putting is truly her nemesis. She started the back hot with a bunch of pars. Then the weight of the competition got to her, and she imploded on #16. Given she thought she lost the tournament, she was very upset and looked like tears would flow. She did not realize; she was still in it. After the 36 holes, she finished tied with another woman.

There was a playoff. On the 1st playoff hole, Julia hit a beautiful drive, while her opponent did not hit it so well. The woman hit her 2nd shot into the trees. I could not tell Julia what to do, but the right answer for Julia was to lay up and just make a par and win. Julia brought out the 3-wood and hit it poorly into a cross bunker some 55yards from the pin. This is the hardest shot in golf. When I asked Bernard Langer about a similar shot he said, “I try to never leave myself a 50-yard bunker shot. If I cannot clear the bunker easily, I lay up.” Bernard won over 120 professional tournaments in the world including two Masters. If he thinks it is a hard shot, it is a hard shot.

Julia’s opponent was in serious trouble, and my daughter did not realize how hard of a shot she left herself to seal the win. Julia went up and hit a PERFECT bunker shot to inside 15 ft. If I gave her 100 golf balls, she would not be able to do it again. Julia won the tournament with a clutch shot. She went from the Agony of Defeat in near tears to the Thrill of Victory within 40 minutes. Now, Julia has told me she likes golf and will practice. Let’s see how that goes. I just wish Jim McKay was there to call the end of the tournament on ABC for Julia!

I am proud she stayed with it and got her 1st 2-day tournament win. The field was hardly stacked, but a win is a win, and I hope this helps Julia find a passion for the game. Maybe we can see Jack and Julia as the Men’s and Women’s champs at some of our golf courses? This is the Thrill of Victory picture with the pro. I did not have a picture of the Agony of Defeat after #16 or I would have posted that one too.

Quick Bites

Stocks rallied Tuesday following Treasury Secretary Janet Yellen’s reassurances to safeguard against further banking crises. Stocks tumbled on Wednesday as the Federal Reserve continued hiking rates (25bps), while at the same time acknowledging turmoil in the banking sector could slow the already fragile economy. Regional bank shares led the slide with the KRE ETF -5.7% on the day and the KBW index -4.7%. Adding to the stock market’s decline and the drop in regional bank shares were comments from Treasury Secretary Janet Yellen, who told the U.S. Senate appropriations subcommittee that the U.S. was not currently working on “blanket insurance” for bank deposits. The Dow fell 530 points, or 1.63%, closing at 32,030. The S&P 500 dropped 1.65% to end at 3,937. The Nasdaq Composite declined 1.6% and closed at 11,670. Treasuries rallied with the 2-year -22bps to 3.96% and the 10-year -16bps to 3.45%. Remember, the 2-year was 5.06% two weeks ago. The market is now pricing in two cuts in 2023. However, Bitcoin is over $27k and is +63% on the year.

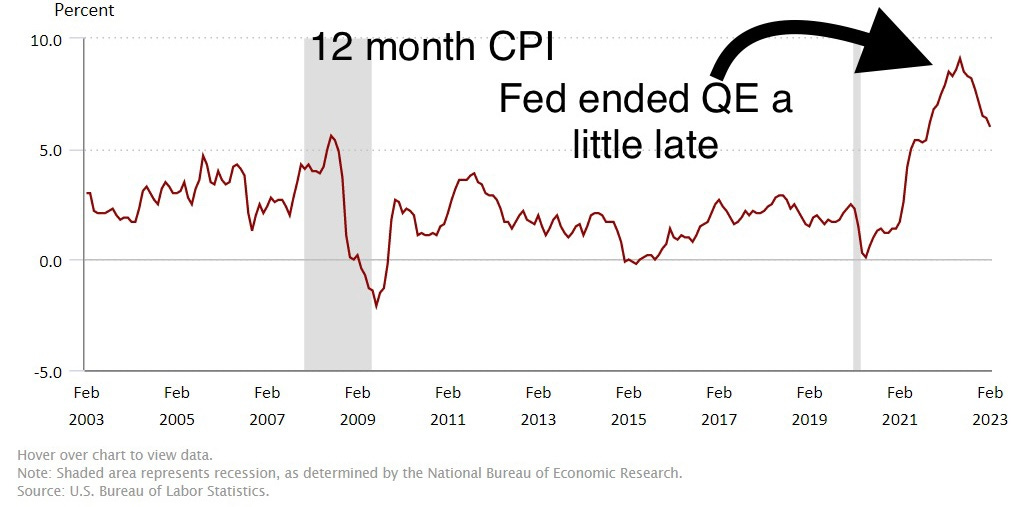

At a press conference after the latest Federal Open Markets Committee meeting, Powell described the banking system as “sound and resilient” but said the central bank was monitoring a change in the availability of credit for consumers and businesses. “Financial conditions seem to have tightened, and probably by more than the traditional indexes say. ... The question for us though is how significant will that be — what will be the extent of it, and what will be the duration of it,” Powell said. Fed has no credibility and Powell should not have a job. Period. His call to have zero rates and continue with QE will inflation was elevated, and housing was in bubble territory with zero inventory will go down as one of the worst calls in history. I felt the Fed had to hike today, but probably should not have. Needed to try to gain some credibility.

I was clear in my Sunday note about 1st Republic and the deposits from friendly banks being a short-term solution. Well, the stock was -47% on Monday, and it was announced JPM was hired for strategic alternatives including a dilutive capital raise or the sale of the company. The stock rallied 29% on Tuesday but remains - 89% YTD (less than 3 months) after another 15% sell off on Wednesday. The stock is down sharply since the $30bn deposit infusion as well. Do we really think there are only a few regionals in trouble? Pac West is down 55% YTD after being -17% today. Stock is -77% over 1-year.

The WSJ article entitled, “Smaller Banks’ Critical Role in Economy Means Distress Raises Recession Risks” The gist of the article is that banks outside the top 25 largest account for approximately 38% of all outstanding loans according to the Federal Reserve. Check out the chart below. Further, the article talks about smaller banks tightening lending standards to improve capital ratios. Let’s not forget lower deposits which provide cheap capital the banks use to lend to other customers. In a related matter, the rejection rate for auto loans jumped to 9.1% from 5.8% in October according to the NY Fed. Another WSJ article, “Anxiety Strikes $8 Trillion Mortgage-Debt Market After SVB Collapse,” suggests banks will be selling some mortgagee holdings and pressuring the market. The positive news is inflation should get under control more quickly with the banking crisis and pull-back in lending. However, earnings will come down and the consumer is likely to come under more pressure. I expect sharply worse consumer data in coming months.

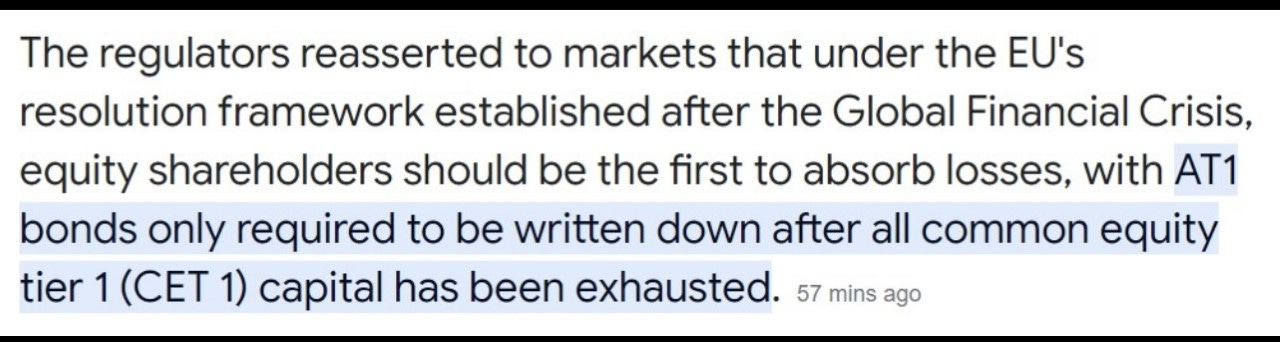

I am not an expert on Contingent Convertible bonds or COCOs, but new them better when I was more involved. The owners of Credit Suisse’s $17 billion worth of “additional tier one” (AT1) bonds who have been left fully in the cold. Swiss authorities said those bondholders would receive absolutely nothing. The move is at odds with the usual hierarchy of losses when a bank fails, with shareholders typically the last in line for any kind of payout. The European market for such bonds is worth about $250 billion, according to the Financial Times. It is not the write-down of Credit Suisse’s AT1 bonds that has rocked investors, but the fact that the bank’s shareholders will receive some compensation when bondholders will not. Ordinarily, bondholders are higher up the pecking order than shareholders when a banks fails. But because Credit Suisse’s demise has not followed a traditional bankruptcy, analysts told CNN, the same rules don’t apply. I was surprised by the news on this topic. The first picture was posted by Mohamed El-Erian on the CoCos. UBS did not want to buy CS, and I am not supportive of this deal. I worked at UBS, and the culture is NOTHING like CS. What does UBS get for the deal? The cost of their credit went up sharply after the CS deal was announced. Credit Derivatives on UBS spiked. See 2nd pic. I am not surprised by the demise of CS. I have written 100 times about the ineptitude of the management, outsized risks, and the fact they step on every banana peel in recent history. CS bondholders are preparing a lawsuit and I hope they win.

Other Headlines

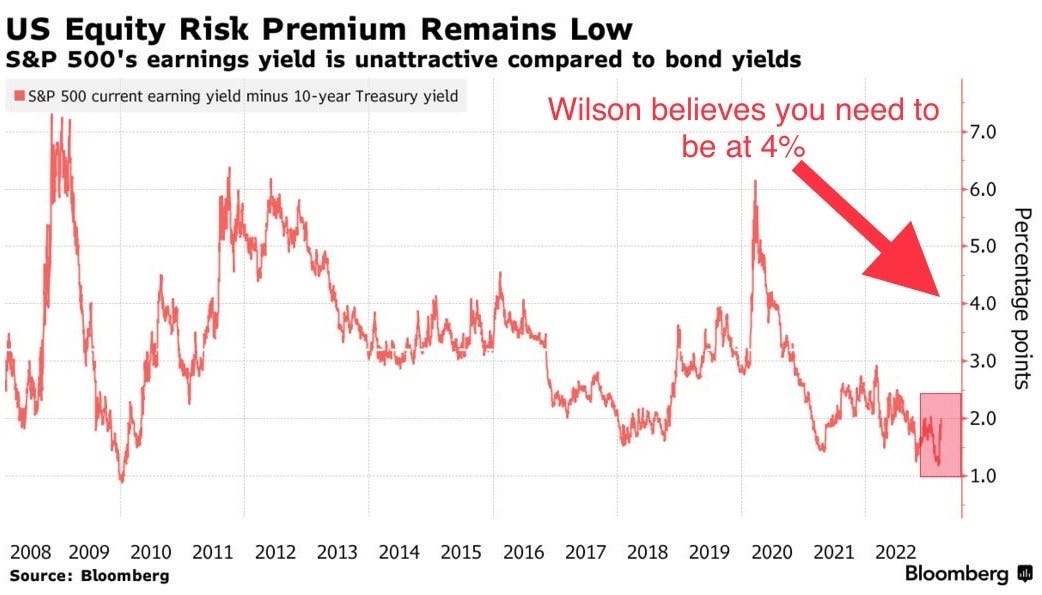

Morgan Stanley Strategist Says Bank Stress Signals Bear Market End

Earnings estimates will drop amid falling growth expectations.

S&P 500 remains unattractive and credit crunch risks rising.

The U.S. Needs Economic Regime Change

The cost of stopping inflation would have been lower if the Fed had faced the problem earlier. Good Opinion piece in the WSJ. I agree the Fed is largely to blame and is inept.

SVB’s Loans to Insiders Tripled to $219 Million Before It Failed

Nothing to see here folks. Record insider loans.

Please remind me why we should ever give South Africa another dollar? We gave them $1bn in November 2022, and this is how they thank us?

JPMorgan Chase can be sued by Virgin Islands over Jeffrey Epstein sex-trafficking claims

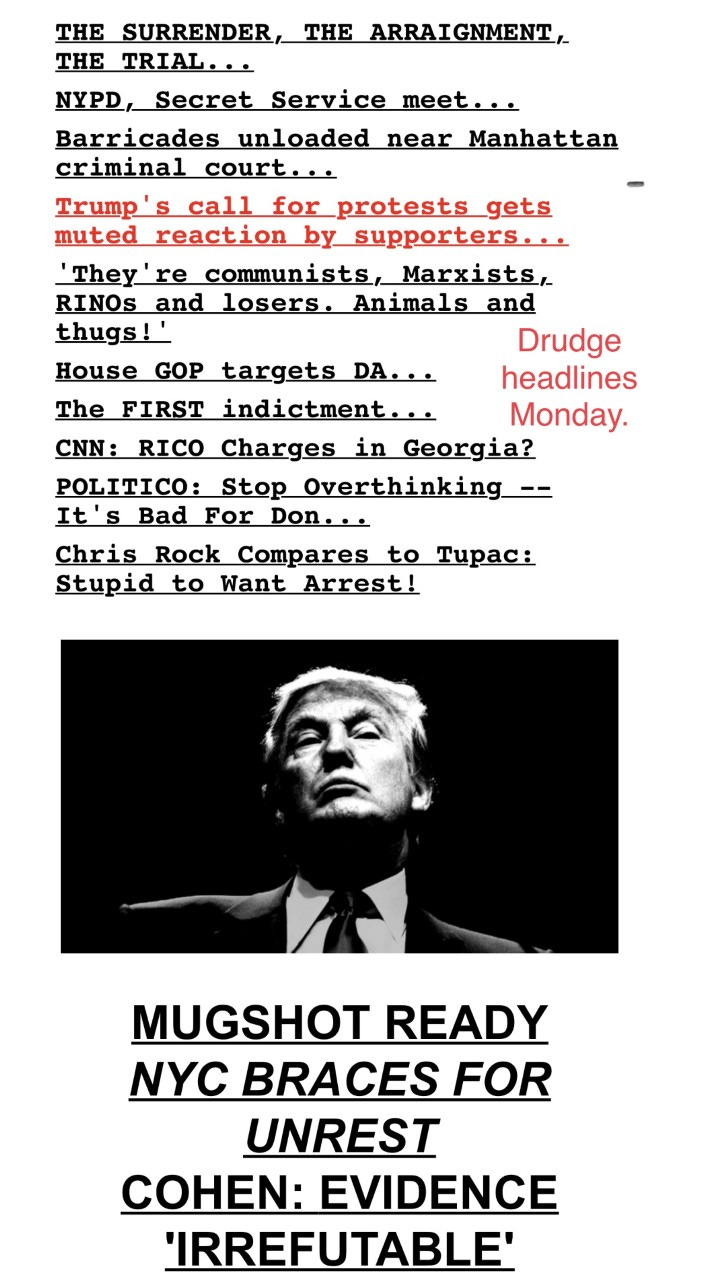

I just thought this picture I took of DrudgeReport headlines Monday was interesting around Trump and the indictment.

It’s about time.

Two NYPD cop cars set on fire in Flatiron District

A few blocks from my last apartment in NYC.

Squatters torment homeowners across US with no resolution in sight: 'It's a problem'

Crazy that this happens to people.

2 dead, 5 others injured in Brooklyn crash

Scary video.

Miami Beach Wants to Cancel Spring Break, Sets Curfew After Deadly Shootings

Spring Break got out of control in Miami this year resulting in shootings and fights.

St. Francis Brooklyn stunningly cuts entire athletics program

In its statement the school cited “increased operating expenses, flattening revenue streams, and plateauing enrollment in part due to a shrinking pool of high school graduates in the aftermath of the pandemic” as reasons for the need to restructure.

Stanford investigating after swastikas and a Hitler image are left on a Jewish student's door

It is the third instance of swastikas' being found on campus in the past two weeks, according to the university. Not sure what is going on at Stanford, but I am not super fired up about the behavior of what is supposed to be the best and brightest.

Boston middle school survey asking students about oral sex, transgenderism prompts parents' outrage

Read the comments from these little kids. Many did not know what the survey was asking, as they are too young for this. Why must we try to indoctrinate children at such a young age?

Upper East Side residents complain NYC neighborhood 'full of s--t'

I will never forget when I bought a new pair of my favorite dress shoes, Sutor Mantellassi, and the 1st time I wore them I stepping in dog poop in NYC. I was livid.

TikTok CEO appeals to U.S. users ahead of House testimony

Ban it. China is not our friend and TikTok is dangerous for kids.

Potentially deadly fungus Candida auris is spreading at an ‘alarming rate,’ CDC says

Man diagnosed with stage 4 colon cancer at 29 shares symptoms: 'It hit me pretty hard'

New video from 2021 shows Fauci, DC mayor being rejected on vax tour

World Happiness Report: The world's happiest countries for 2023

Real Estate

New York Community Bank’s deal to buy loans from the Signature Bank excludes the failed institution’s multifamily mortgages. The snub could signal problems with those loans, which primarily cover the troubled rent-stabilized sector, or simply that NYCB didn’t want to be overweighted in that area. Either way, it may diminish hope for workouts among the many rent-stabilized building owners facing distress. NYCB, through its recently acquired subsidiary Flagstar Bank, picked up $12.9 billion worth of Signature’s total $74 billion loan portfolio Sunday in a deal with regulators who seized the major multifamily lender a week before. NYCB said the deal included none of Signature’s commercial real estate portfolio, which totaled $35 billion at the end of 2022, or its $19.5 billion multifamily loan book. “We did not acquire any multifamily or commercial real estate loans,” said spokesperson Salvatore DiMartino. “Zero.” The rent stabilized sector has been decimated since the idiotic laws passed in NYC. The result is the valuation of these properties is down 50% or more. As refinancings come due, many will be turned back over to the bank. I am dying to get involved in this space, but until there is hope of the laws reverting, it is hard to consider.

Sales of previously owned homes rose 14.5% in February compared with January, according to a seasonally adjusted count by the National Association of Realtors. It was the first monthly gain in 12 months and the largest increase since July 2020, just after the start of the Covid-19 pandemic. Higher mortgage rates have been cooling home prices since last summer, and for the first time in a record 131 consecutive months — nearly 11 years — prices were lower on a year-over-year comparison. Finally, more signs of a housing correction which is badly needed to help get affordability under control. With banks pulling back lending, I expect more pressure.

The share price of Brookfield’s Downtown L.A. office fund dropped to a new low of $1.73 on Monday afternoon, putting it within striking distance of the New York Stock Exchange’s $1 listing requirement. Brookfield DTLA Fund Office Trust Investor, which owns 7.6 million square feet of office space across six towers in Downtown L.A., has suffered major losses over the last year, as vacancy rates across the buildings has remained stubbornly high and Brookfield has admitted it defaulted on $785 million worth of loans connected to two properties. The stock was down 19% on Tuesday and is now at $1.34/share. Stock -67% YTD through Wednesday. Office markets are getting killed, and there are substantial loans at regional banks. The crisis is not over. NY office REIT SL Green is -73% for the past year and Vornado is -69% for the same period through Wednesday.

The Barney’s building sold for $37mm. The building last sold in 2016 for $103.5mm.