Opening Comments

I am shocked about how strong of a reaction my last report, “Skiing is for Billionaires” received. I lost count of the number of emails, texts, and calls with similar stories and my note was reposted a bunch of times. MULTIPLE readers including an Olympic Medalist emailed me about Powder Mountain being incredible, reasonably priced, and having fantastic terrain. Crowds are limited and it has 8,464 skiable acres (the largest in the US). Here are pics of Powder Mountain from the Olympian reader:

A couple of quick points about the Rosen Report. Many readers get it intermittently because their servers block Substack (20%+ of readers). Make my email safe. Remember, you can always find current and prior reports on my Substack page or if you search “The Rosen Report.” I publish almost every Wednesday and Sunday. I also post on LinkedIn-not only the reports-but when I have something to say between newsletters, I send out a blurb. You can follow me on LinkedIn here, and be sure to always receive the note even if your server blocks Substack. Lastly, some servers truncate the Rosen Report, and you need to hit “View the Entire Message,” by hitting the link.

I wrote of a garage worker who was shot twice and then shot a suspected thief. There was a question of whether the DA, Bragg, would charge a man despite the self-defense angle. In a POSITIVE twist, Bragg did not charge the garage worker. I have been critical of Bragg for all the right reasons, but need to give a shout-out when he comes to a rational conclusion. Will he follow it up by prosecuting career criminals, and violent repeat offenders?

Markets

Oil Market

Dimon Letter/Barry Sternlicht Thoughts

Small to Medium Sized Company Bankruptcies

Indictment Update

Real Estate-EXPANDED SECTION TODAY

Hochul Housing Proposal Upsetting Suburbanites

Manhattan R/E Sales Plunge

SFO Office Vacancies up to 30%

US Housing Prices/Apartment Sales Drop 74%

Video of the Day-The Future of the NBA

There is a 19-year-old basketball player named, Victor Wembanyama in France who is hands down, the best NBA prospect in ages. He is 7’4” tall and can dribble like a point guard. This link has a 13 second video of Wembanyama dribbling and taking a 3-point shot. He misses and gets his own rebound with a one-handed put back dunk. Trust me, this kid is another level. His stats this year are 20.3 points, 10.0 rebounds, 2.7 blocks and 53.5% three-point shooting. Unheard of for a man of this size. His wingspan is approximately 8’. They call him, “The Alien,” after Lebron coined the phrase for Victor. He wears size 20.5 shoes.

Handwritten Thank You Notes...Or Else!

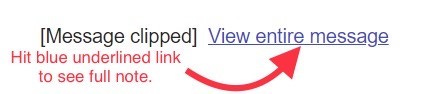

My mother had some crazy rules to live by, and I am not sure if she was more adamant about any rule than writing handwritten thank-you notes. I would guess I was about 8-years-old when I received my first personalized stationary with my initials on it. I vividly recall the paper being off-white with the blue initials “ESR” on the top. If I was given a birthday gift or someone took us out to dinner, I was expected to write a handwritten note IMMEDIATELY. I don’t mean tomorrow; I mean that day. I believed there is some grace period of a few days, but my mom, not so much. When you are a kid and your mother is screaming about you being inconsiderate for not writing in a timely fashion or writing a good enough note, it sticks with you.

I remember writing a note that was not very strong. “Thank you for taking me to the game. I had a great time. Sincerely, Eric.” My mother lost it. “You don’t start the note with Thank you. You did not take enough time to write a thoughtful and sincere note.” I was 10-years-old, what the hell did I know? She ripped it up in my face. Lesson learned.

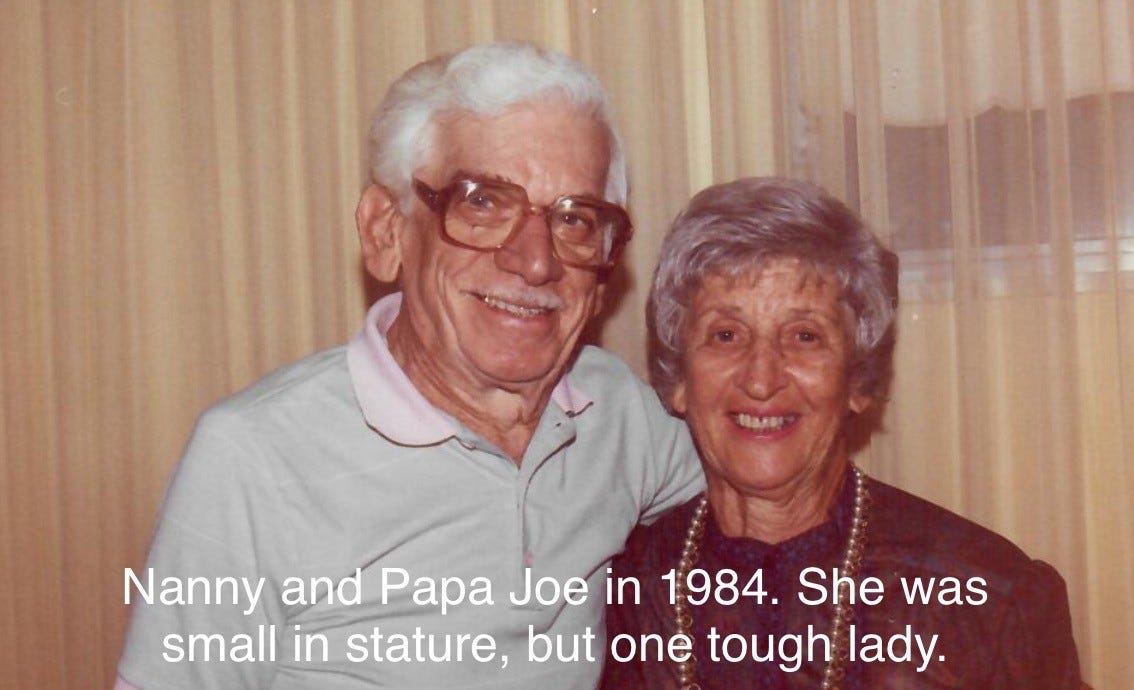

My grandmother, Nell, also known as “Nanny” was keen on handwritten notes as well. She called it “The Unwritten Law,” regarding writing thank you notes. Despite being my father’s mother, she and my mom saw eye to eye on this topic.

Fast forward over 40 years and my wife, Jill, and I are just like my mother and grandmother. The kids have their own stationery and must write handwritten notes when someone does something nice for them or buys them a gift. Jill and I start screaming like my mother when notes are not written in short order. It is almost as though you need to write the note while you are unwrapping the present, or it is rude. Unwrap with one hand and write with the other as Julia is doing below.

My wife and I recently were invited to a Bat-Mitzvah in Miami and were sent a lovely Thank You note IMMEDIATELY after the party by the young girl. According to my wife, the young girl had not even entered the grace period for the thank you note, and we received it. Jill made a point of telling the girl’s mom, Jessica, about how impressed she was with the note, and the mother was beaming. I guess the Rosens are not the only ones who believe in “Handwritten Thank You Notes...Or Else!”

In an age where shorthand texts and emails are written “TY, Thanx, tnx…” in an effort to show appreciation, I find handwritten notes more powerful and meaningful than ever. To all my readers out there, take this advice to heart. Shock someone in a positive way with a nice and thoughtful handwritten note. You will make someone’s day and make my mom proud. She passed away in July 2008 due to complications from cancer. If you have a job interview, think about a thoughtful handwritten note rather than an impersonal email.

While researching for this piece, I uncovered a Bloomberg article entitled, “Don’t Forget to Write! Why Letters and Cards Are More Important Than Ever,” from July 2022. Lots of good stuff, but this line says it all, “Handwriting is the most personal, and hence the most sincere, form of communication.”

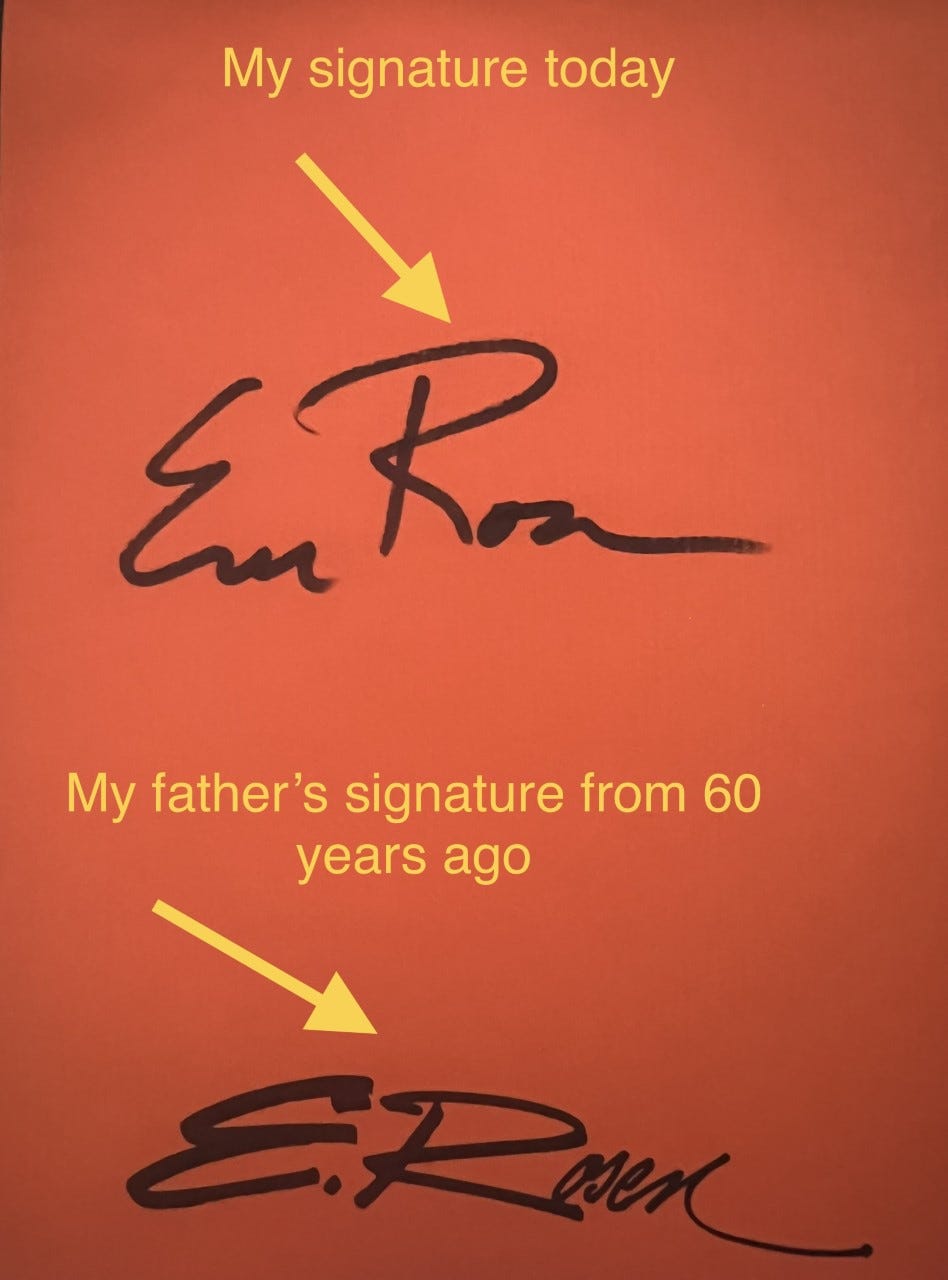

As an aside, those who are long-time readers of the Rosen Report know my father passed away when I was five-years-old. I found his notepad with his signature on it and shockingly, mine looks eerily similar. His name was Edgar Rosen, so we have the same initials.

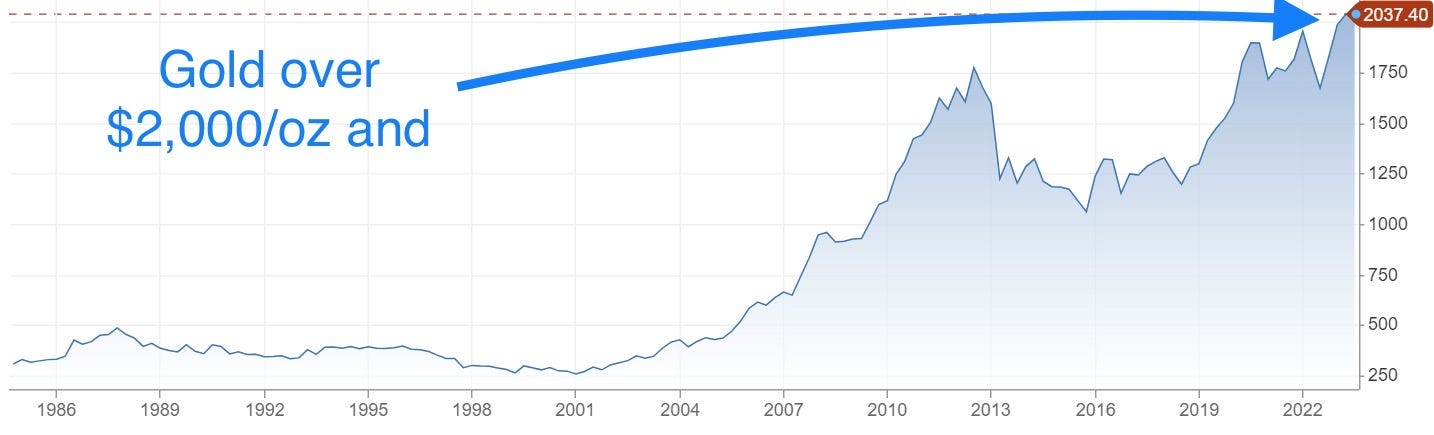

Quick Bites

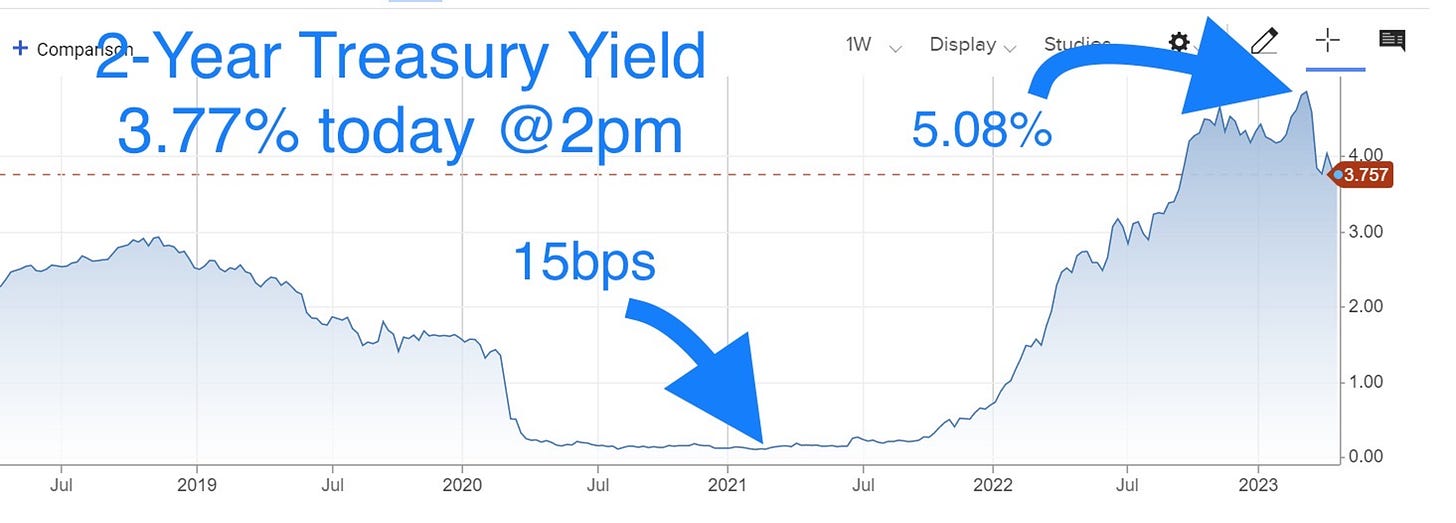

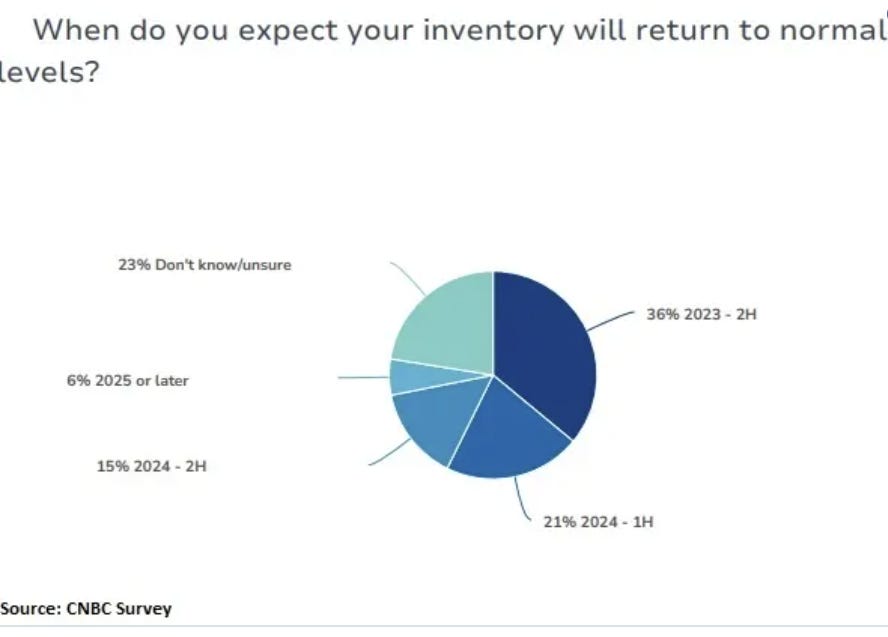

Fed's Mester says rate target will need to go over 5%. As of mid-day Wednesday, the futures market was pricing in a 40% chance of one more 25bps hike and a December Fed Funds of 4.15% vs 4.82% today. This implies a few cuts prior to year-end. Treasuries broadly rallied today on weaker-than-expected payroll data (145k vs 210k estimate). The 2-Year Treasury bond now yields 3.79%, down from 5.08% on March 8th. The S&P fell Wednesday as traders assessed the state of the global economy following a losing session. The broader market index traded 0.3% lower, while the Nasdaq Composite dropped 1%. The Dow was up slightly, bolstered by an outperformance by health care stocks. First Republic stock remains around $13/share or -89% on the year and it was $147 in February 2023. Western Alliance Bank stock was -12.5% today, but was down 19% earlier in the day. Deposits ended up -11% in the 1st Q. This CNBC article on inventory gluts impacting earnings as the economy slows is worth a read. The US Dollar remains under pressure and after peaking at 114 last September it is now under 102 relative to the DXY. The currency market is clearly questioning how much the Fed can raise rates. Also, more countries (China, Russia, Saudi, Malaysia Brazil, Argentina, UAE....) are trying to reduce reliance on the US Dollar. I get it, but what is the real alternative today? Gold is over $2,000 an ounce on economic fears and lower rates. BTC is back over $28k and is +71% YTD.

RDI-5. RDI Explained.

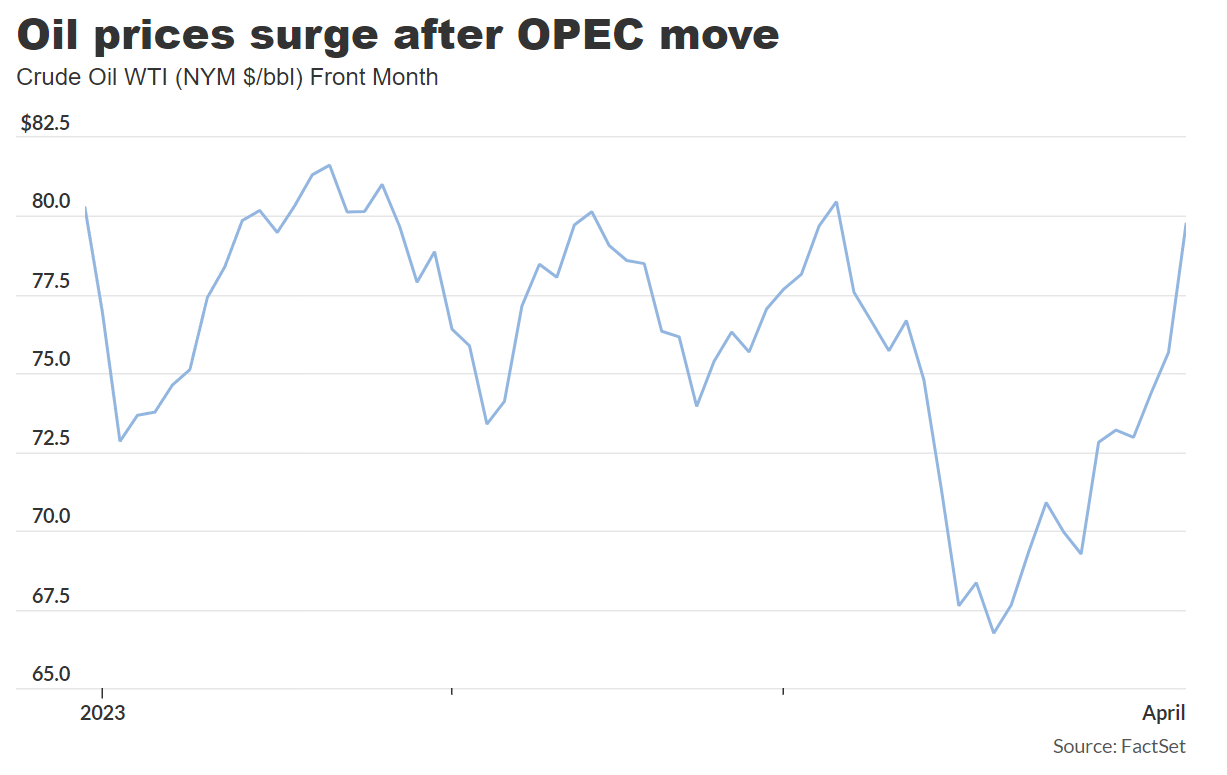

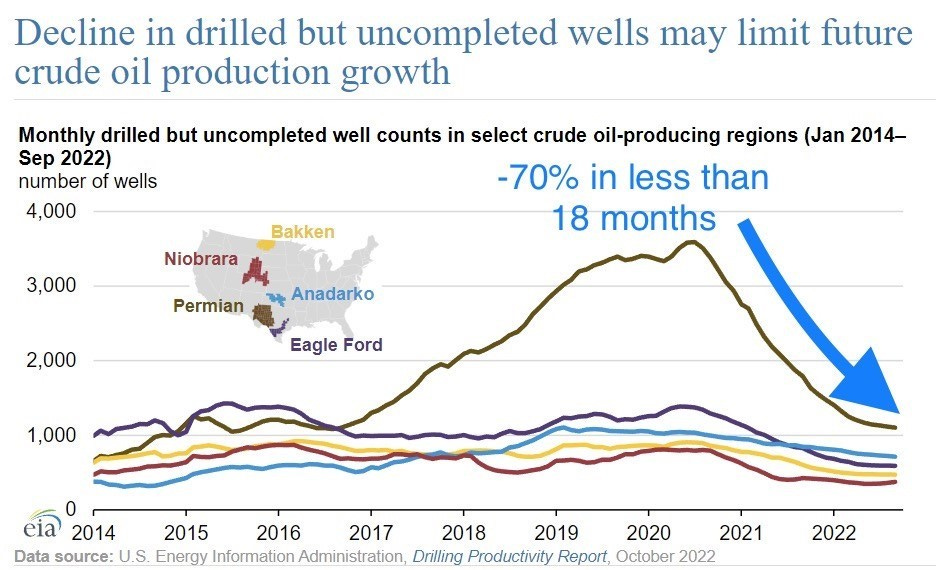

In Sunday’s note, I highlighted the 1.2mm cut in oil production from OPEC+ and the market saw a 6% increase in oil prices on Monday. I get that the economy is slowing and a recession is likely which is keeping a cap on oil prices. Late in 2022, I wrote about my concerns that oil is going higher at some point in 2023 due to supply shocks. Yes, oil was flat on the year after a rough 1st quarter, but the supply side is my concern. The vilification of the oil industry, largely in the US and Europe is making the market more vulnerable to shocks from OPEC, Russia, and other counties. Future oil production levels are a concern and the 2nd chart is telling (albeit it a few months dated). The market is tight, and China is back online. Also, the US will need to buy back millions of barrels of oil to refill the Strategic Petroleum Reserve (SPR) which was depleted to manipulate oil prices. I won’t be shocked if we see $100 oil in 2023. I am not suggesting it lasts for a long time. Even with the backdrop of economic fears, the supply picture is incredibly tight globally. One article suggested gasoline prices could hit $4 due to the cut, while gas averaged $3.5 just prior to the news of the cut.

Jamie Dimon’s 43-page annual letter was published this week. “As I write this letter (full letter here), the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come. But importantly, recent events are nothing like what occurred during the 2008 global financial crisis. Regarding the current disruption in the U.S. banking system, most of the risks were hiding in plain sight. Interest rate exposure, the fair value of held-to-maturity (HTM) portfolios, and the amount of SVB’s uninsured deposits were always known – both to regulators and the marketplace.” Clearly, Dimon was critical of the regulators, rating agencies and management. Two other broad topics that Dimon touched on, besides the financial results of JPMorgan, were the need for investments in climate technology and resiliency programs and the rise of artificial intelligence. Dimon wrote extensively about supporting clients and investing in the community and commitment to DEI. In a related topic, Barry Sternlicht was on CNBC for an extended time Tuesday morning. He feels inflation will fall fast and showed a chart of actual rents vs CPI shelter. He told a story of a bank that held a $300mm loan on an NYC “B” office building they offered it to the owner for $70mm and he turned it down recently. Sternlicht was positive on apartment buildings, housing in general (limited inventory), and hotels but negative on office space. He continued his discussion of the great migration and felt that high-end South Florida properties would hold up in value, and many “Blue” states will continue to see outflows due to taxes, policy, crime, and quality of life. Barry was negative on regional banks and the length of the credit crisis and lending is getting pulled back sharply. There is an auction of $30bn of CRE loans from Signature Bank, and Barry plans on bidding on them out of his equity portfolio and expects 20%+ returns. On his debt portfolio, he is holding cash, as he believes additional opportunities are coming. There is a very informative 29-minute Sternlicht interview from CNBC Tuesday, but you need to have “Pro” to see it. Interesting answers in the interview and is very critical of “Blue” states relative to “Red” states. The 2nd chart was from Barry and quite telling on actual rents relative to the Fed’s measure.

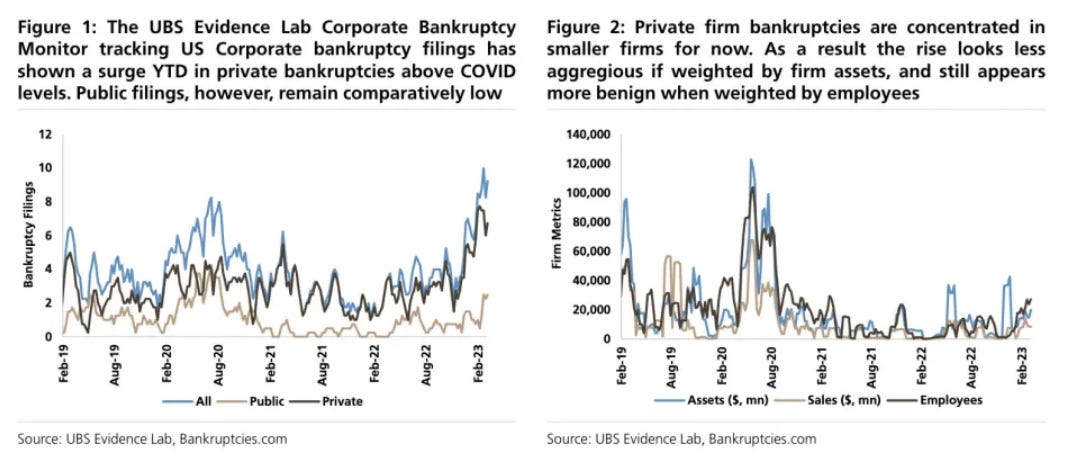

I felt this story was interesting and concerning about rising bankruptcies in small to medium sized companies. Warning signs of a potential credit crunch were flashing even before Silicon Valley Bank's stunning collapse, as this year sees record high bankruptcy filings by small- to mid-sized private businesses, according to UBS. So far in 2023, private bankruptcy filings have outstripped a peak set in the early stage of the COVID pandemic by a wide margin. Smaller and regional banks are "critical" to small and medium-sized businesses as they hold 40% of loans and debt at those companies, said UBS. Companies with fewer than 500 staff members make up 58% of the privately employed workforce in the US, Pantheon Macroeconomics recently wrote, underscoring the key role those businesses hold in the world's largest economy. With many small and medium banks in turmoil and pulling back lending, what do the next 12 months look like? There is a good article on the flight to money funds adding strains on small banks, and I agree this is a big issue.

“Heading to Lower Manhattan, the Courthouse. Seems so SURREAL — WOW, they are going to ARREST ME. Can’t believe this is happening in America. MAGA!” he posted on Tuesday afternoon. Trump was charged with 34 felony counts on Tuesday for falsifying business records around payments for hush money for porn star, Stormy Daniels as well as two other related hush money payments. As I understand it, Trump’s lawyer, Cohen made the initial payment to Daniels and Trump then repaid Cohen and then some over many months. Each payment was a “false business record,” disguised as legal services. This accounts for a majority of the counts, I believe and include payments to Karen McDougal as well as a doorman. Trump was not handcuffed, or placed in a jail cell and no mug shot was taken. Trump pled “not guilty.” If convicted, the maximum sentence is 4 years for each count. I continue to believe this specific indictment by Bragg was politically motivated and a mistake. There are plenty of other issues (GA election interference, confidential documents, Jan 6th) to indict Trump which I feel are more likely to result in a meaningful conviction. I spoke with multiple Federal Court Judges and criminal defense attorneys who all agreed the current charges are suspect, even though there is a strong view against Trump. Even Trump haters, John Bolton and Mitt Romney slammed Bragg’s “weak” case and called the charges an “overreach.” This is the Trump indictment statement of facts, which is an interesting read.

Other Headlines

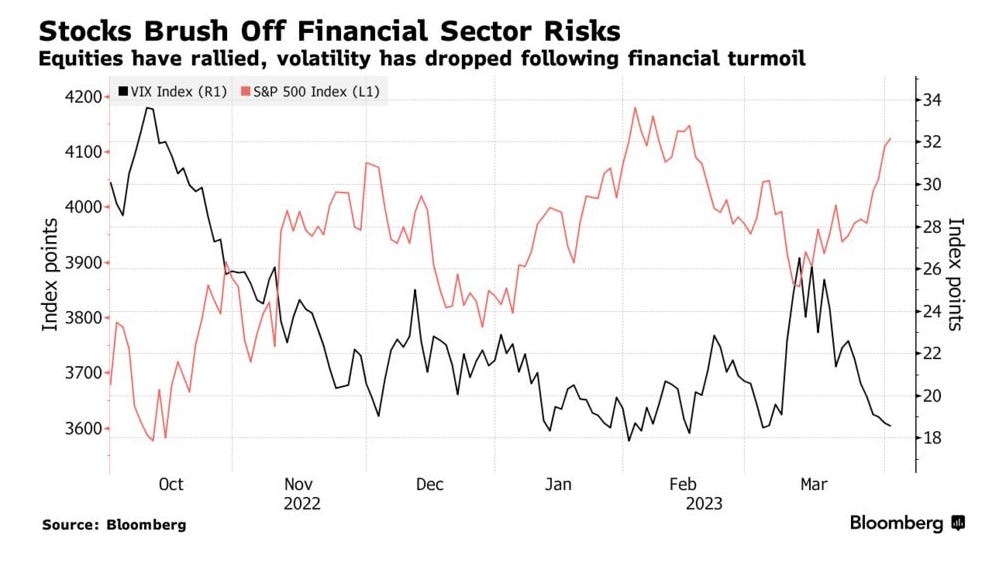

JPMorgan Warns Stocks Are in ‘Calm Before the Storm’

Past two weeks of inflows driven by short squeeze, fall in VIX

Equities likely to ‘retest last year’s low,’ Kolanovic says

Job openings tumbled below 10 million in February for the first time in nearly two years

Barry Sternlicht mentioned he cannot find housekeeping staff in hotels and in Hawaii, for example, he is paying $30/hr and joked that you might need to make your own bed as a guest.

Tesla shares drop after deliveries report raises investor concern that more price cuts are coming

Stock is up 80% YTD despite the move lower.

Google to cut down on employee laptops, services and staplers for ‘multi-year’ savings

Johnson & Johnson to pay $8.9 billion to settle talc cancer claims

Frank founder criminally charged with fraud over $175 million JPMorgan deal

It keeps getting worse: Florida property insurance rates set to jump up to 60%

This is a BIG issue as insurers keep pulling out of the state, housing prices are exploded, and demand is through the roof. Very hard to get policies and the costs are skyrocketing.

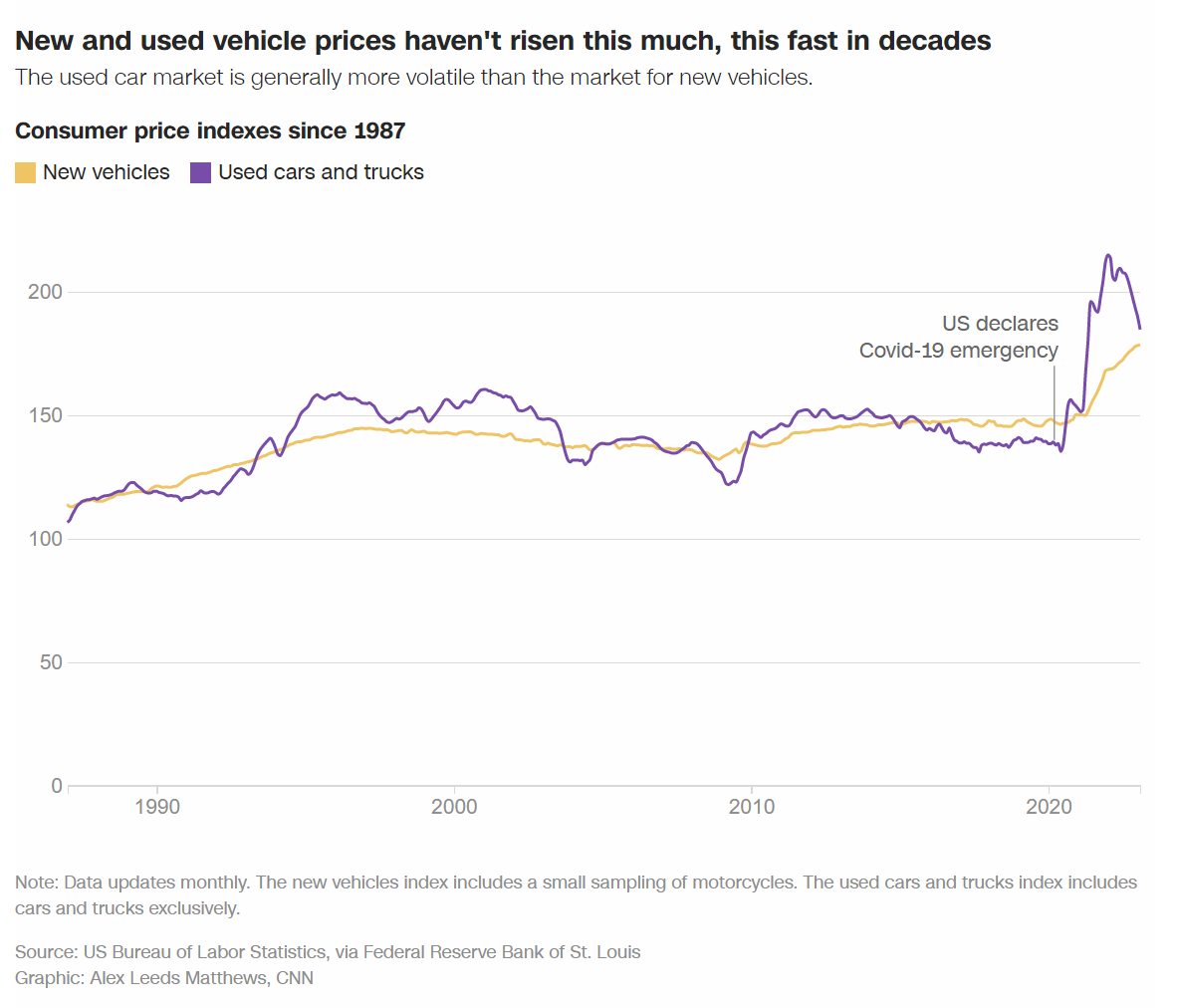

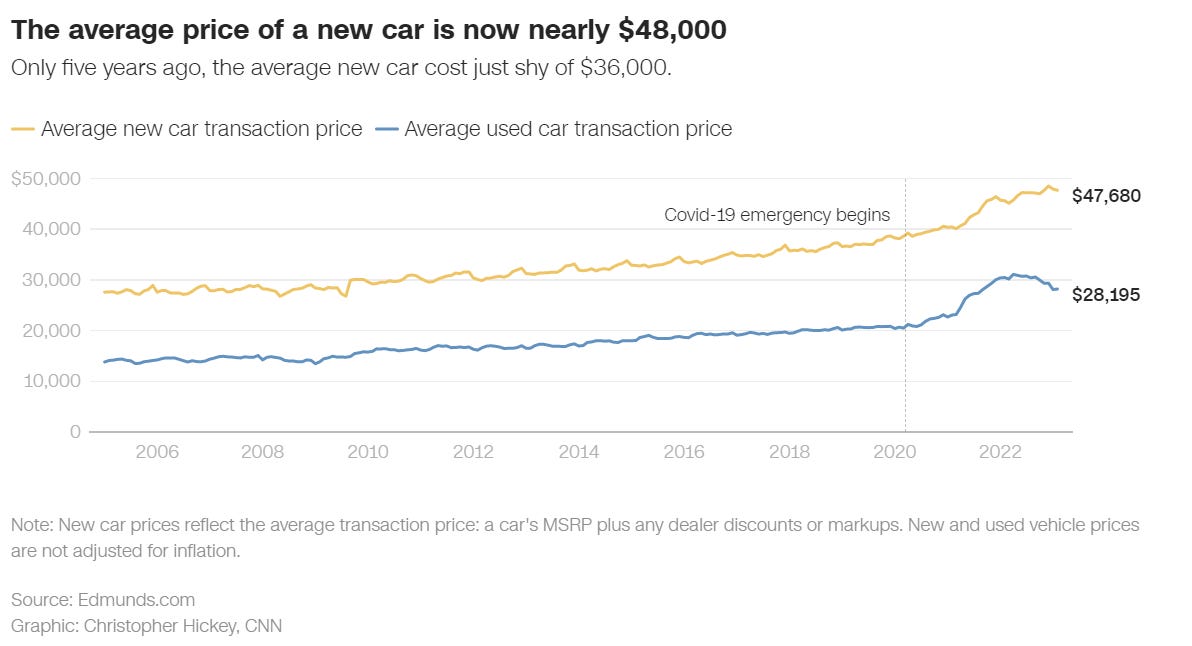

This is one of the worst times to buy a car in decades. Here’s why

Cash App creator Bob Lee, 43, killed in San Francisco stabbing

He had also worked at Google and was the Chief Technology Officer of Square.

Chicago mayor: Progressive Brandon Johnson wins election, succeeding Lori Lightfoot

I hope for the sake of my hometown that Johnson is tougher on crime than Lightfoot, but I am not optimistic. Johnson’s opponent, Villas, campaigned with a tough-on-crime message and was backed by Chicago’s Fraternal Order of Police, and Johnson was backed by Chicago’s Teachers Union. Johnson has a history of “Defund the Police,” messaging.

The China BS never ends. Not to be trusted. The US needs to wean itself off of China and manufacture critical things in the US. We need to adopt rules like China to prevent citizens from buying R/E and companies in the US. The Chinese government will never play fair.

Saudi Arabia’s Crown Prince is No Longer Interested in “Pleasing” the U.S.

Interesting article as more countries are moving away from the US Dollar for certain trade. OPEC+ decision to cut 1mm+ barrels/day is a strong message.

Italy has banned ChatGPT. Here's what other countries are doing

How do you allow this to happen. These awful rules are endangering the lives of innocent people. Please make it stop.

Penn to stop awarding dean's list recognition to undergraduate students

The absurdity never ends. The best academic institutions are inserting awful policies in the name of “equity.” Not sure about you, but I want to invest in companies who want to win and hire people who want to succeed. I don’t want to own companies with a bunch of employees who have been given participation trophies. As a country, we are pushing down the best in brightest.

Texas man uses Apple AirTag to track down person who stole his truck, then kills him

U.S. passport delays may be four months long — and could get worse. Here’s what to know

My wife has waited two months for her passport.

Graphic video shows an entire 5-foot long alligator being removed from stomach of an 18-foot python

The first Burmese Python was found in the Everglades in 1979 and was likely due to someone releasing a pet. These invasive species have overtaken the eco-system in the Everglades causing some mammal populations to plummet by 90%+. These massive snakes are eating anything and everything in their path and the regular hunts to cull the population are not doing enough.

I agree, taking credit for other people’s ideas is a non-starter.

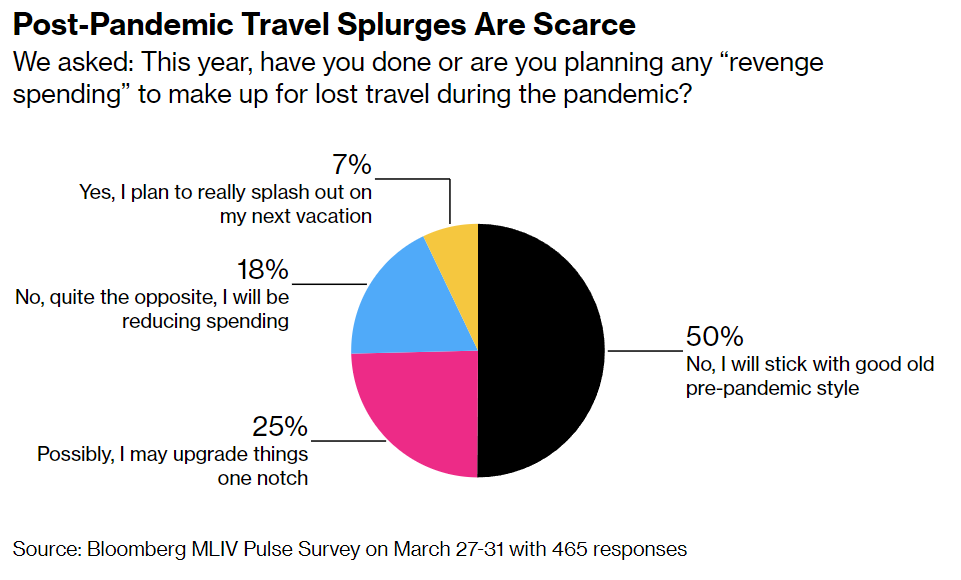

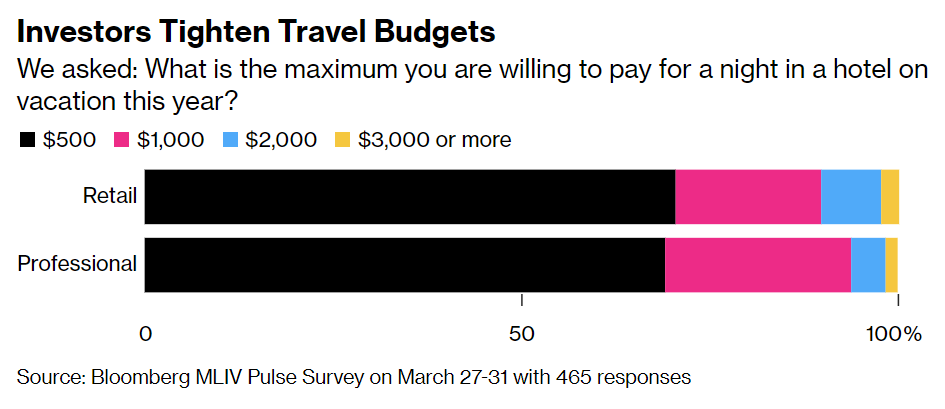

Hotel Rooms Over $500 a Night Are Too Much Even for Rich Travelers

In light of the last piece, “Skiing is for Billionaires,” I thought this areticle was interesting, as it suggests people don’t want to spend too much. You would never know this if you go skiing.

Georgia teen Trent Lehrkamp speaks out after hazing incident

Read this story and do your best not to cry. WHAT IS WRONG WITH PEOPLE? Boys forced him to drink a dangerous amount of alcohol, and hallucinogenic mushrooms, spray painted him from head to toe, and urinated on him. It is disgusting. The victim was on a ventilator as a result of the incident and could have died. Could you imagine being the parent of the child injured or one of the boys who did this to him?

It does not pay to be a Russian Oligarch or Putin official. They are dropping like flies according to the Sun article. Picture of each person in the link.

Real Estate

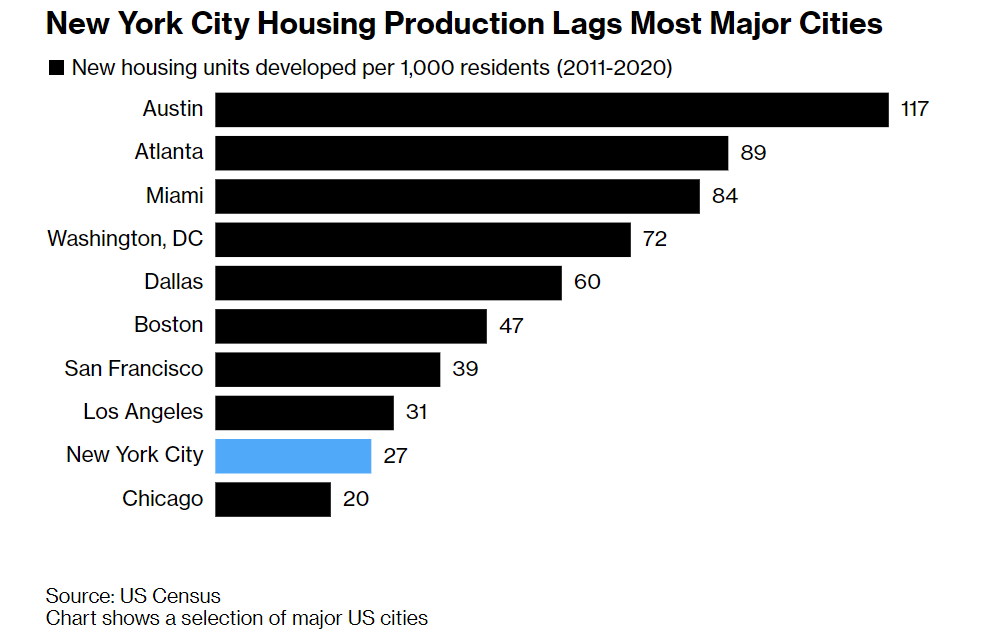

Across the state, but especially around the wealthy suburbs of New York City and Long Island, politicians and residents are sounding the alarm about Governor Kathy Hochul’s plan to address a housing crisis. The New York Housing Compact is designed to add about 800,000 units over the next decade by requiring New York City and its suburbs to increase housing by 3% over three years. It would rezone neighborhoods near train stations to allow for more homes and apartments to be built in less space, while jurisdictions that fail to meet the targets or reject proposed developments risk having their zoning regulations overruled by the state. Bronxville, a village of just 6,600 residents and 2,500 homes 15 miles north of midtown Manhattan, is a classic study in why Hochul’s plan is generating so much tension. The compact would require constructing 75 units of housing, while rezoning near the village’s Metro North stop to allow more density would permit building up to 7,000 new housing units, effectively tripling the village’s current size. This would destroy Bronxville, and residents are livid. Plan is for a bunch more units in towns like this one. Read the article.

Manhattan real estate sales fell 38% in the first quarter, as buyers and sellers battled over prices and mortgage rates remained volatile, according to new reports. Total sales volume fell to $4.4 billion in the quarter, with 2,242 apartments and townhouses sold, compared to 2,546 sales in the first quarter of 2022, according to a report from Douglas Elliman and Miller Samuel. The average sales price fell 5% to $1.95 million and the median sales price fell 10% to $1.075 million, according to the report. The drop in sales and prices follows a 29% decline in the fourth quarter, and suggests that the nation’s largest real estate market is correcting after a post-pandemic boom in prices and demand. The big question for brokers, buyers and sellers is where the new “bottom” will be in Manhattan. Brokers say the biggest challenge for deals is the wide gap between buyer and seller price expectations. Relatively low levels of inventory, or unsold listings, means that buyers still don’t have much choice in Manhattan.

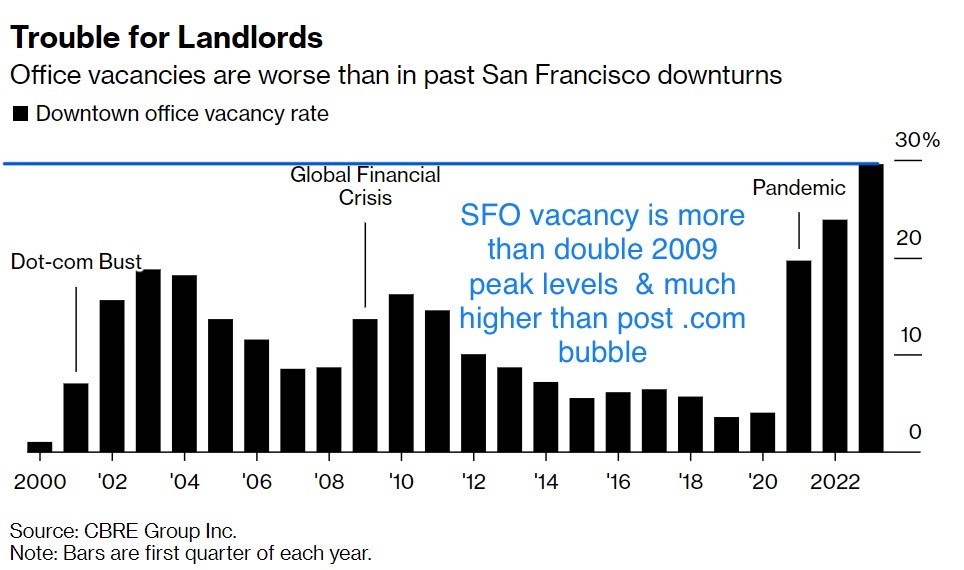

Dealmaking has plunged, hurting revenue in a city where voters approved a property transfer tax increase in 2016. Closing prices on the few office buildings that traded have fallen by half from pre-pandemic heights, when properties fetched $1,000 a square foot. And as office vacancies climb, it’s unlikely that there will be a wave of new leases in the near-term, said Colin Yasukochi, a researcher at CBRE Group Inc. On top of soaring vacancies, rising borrowing costs are undermining property values and making it tough for landlords to refinance debt. Columbia Property Trust, a unit of PIMCO., is more than 60 days delinquent on mortgage payments for two downtown office buildings. Veritas Investments, one of the city’s largest owners of rental housing, defaulted in November on a $344 million mortgage on 62 apartment buildings, which were appraised at more than $1 billion less than three years ago. The chart below is telling. At 29.5% vacancy and mid-30s% availability in SFO, we are more than double the peak vacancy rate of the Global Financial Crisis. Post the .com crash, vacancy peaked at 18.7% for perspective.

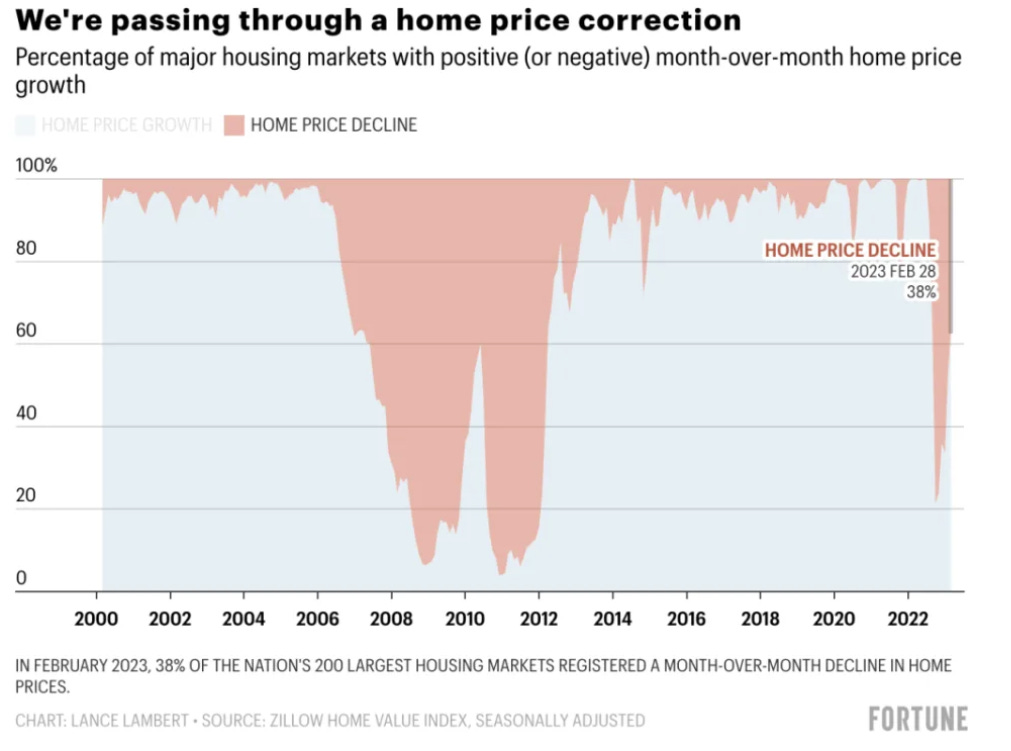

In the second half of last year, the U.S. housing market slipped into the first price correction since the housing bust bottomed out in 2012. Through January, national home prices as measured by Case-Shiller have fallen 3% on a seasonally adjusted basis—or 5.1% without seasonal adjustment—since the June 2022 peak.

Out West, the correction was particularly sharp as markets like Phoenix and Seattle saw home prices fall 10.4% and 16.3%, respectively, from their peak. In the eastern half of the country, the correction is much milder as some regional housing markets, including Cleveland, saw prices decline by less than 1% since the peak. But the story is already changing: As the housing market moves into its busier spring seasonal period, the correction is losing steam. Indeed, among the 200 largest housing markets tracked by the Zillow Home Value Index, only 38% of major markets notched a month-over-month home price decline in February. At the height of the correction in September, 79% of markets fell on a month-over-month basis. Rates are easing a bit from the over 7% 30-year mortgage levels of a few months ago. Lots of info in the article.

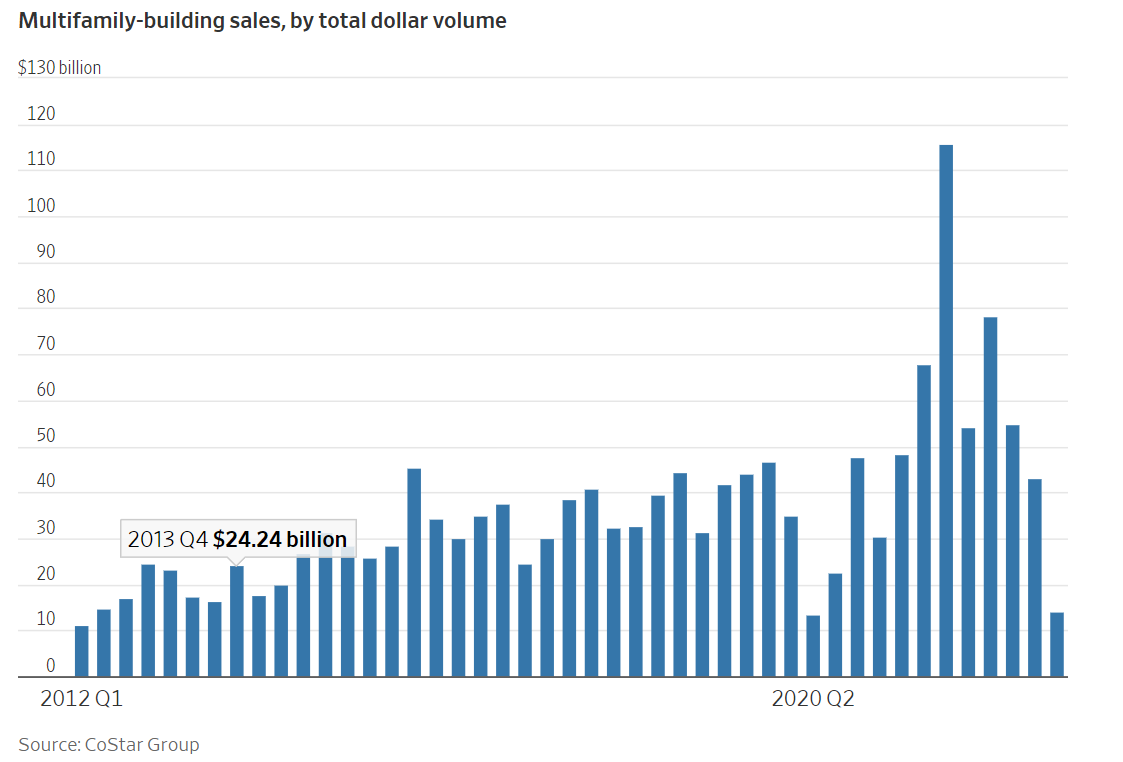

Apartment-Building Sales Drop 74%, the Most in 14 Years

Interest-rate increases, and banking upheaval push down demand for multifamily buildings

While Bragg's case against Trump may be legally weak I think the Bulwark's Charlie Sykes made a very astute observation: "He is the only man in American presidential history who could pay off two porn stars, orchestrate a criminal conspiracy to cover it up in the final crucial days of a presidential election, and have people think that it was 'trivial'."