Opening Comments

Feedback from the last note, “Kidney Donation and Perfect Scores May Not Be Enough To Get Into College,” was very strong. My research took countless hours, and the IvyWise team was a big help. I heard many interesting stories the college admissions process. One thing I learned is some schools “track” the prospect’s time on the website, and opens of emails, website videos, emails sent to admissions… to see how truly interested they are in the school. I had no idea! I did not mention the “needs blind” process at Ivy League schools today which means they accept you before the school knows if you need financial aid. Again, I am not wed to four-year degrees today. Too much money and they are not for everyone. More kids should consider vocational schools, and the money saved on education can be used to start a business after some work experience.

Markets/Fed

JPM/First Republic Deal

Looming Credit Crunch

Money Migration Away from NYC/CA

Off-Market Homes in Boca

LA Apt Sales Falling

Impact of Regional Banks on CRE

Picture of the Day-Kingfish Caught This Morning

I went fishing early this morning and the water was dirty (too much rain). You want BLUE water which is clean. If it is green or brown, the good fish (tuna, dolphin, wahoo, sailfish) are not around. Unfortunately, it was slow, but got this 28 lb kingfish which was fun. Note the teeth on these bad boys. Need to use wire to catch them as they cut your line otherwise.

Riding the Perfect Wave Won't Come Cheap

I have traveled the world to surf over the years. Some of the places include Fiji, Maldives, Mexico, Costa Rica, Nicaragua, California, the entire East Coast, Puerto Rico, Bahamas, Barbados… However, surfing requires the sun, moon, and stars to align for the perfect wave. You need the proper swell direction and size, tide, wind, and no crowd. When it comes together, it is special, but it is oh-so rare. Most surf breaks work on very specific swell directions, size, wind, and tides. It is infrequent that the wave lasts all day as conditions change and windows tend to be hours, not days. I have traveled far for horrific waves or crowds so thick; it was a big disappointment.

I had long heard about the Kelly Slater Wave pool in Fresno, CA. The videos showed perfect man-made waves. I was finally offered the chance to partake in a session thanks to Johnny P’s invitation. In the days leading up to the trip, I was so excited, I felt more like my 15-year-old self than the 53 years I am today. This link explains the remarkable technology behind the perfect wave.

I flew to LAX on last Thursday and had dinner with a friend. Then I had breakfast Friday with an old friend and former client in the distressed business. It was great to reconnect, so much so that the breakfast lasted almost 3 hours. I was off on a 200-mile drive north in search of the perfect wave near Fresno, CA. Driving through the gates I started getting nervous and excited. I was worried about embarrassing myself with better surfers who have far more water time.

There are a myriad of waves from beginner to top professional offered at the Ranch. The beginner is a slow, small crumbling wave and the highest pro wave is a fast barreling ride of perfection. I did not bring ANY equipment, as the Ranch provided boards, wetsuits, leashes, and anything you need to surf. Interestingly, the water is fresh and less buoyant than salt water. The result is you need more volume (longer, wider, thicker) surfboard to help you float.

We had 12 who came on the trip, and I wanted to watch the 1st session to learn the wave’s timing and breaking patterns. When you know a wave, you surf it much better. It is akin to knowing what pitch is being thrown at you, a hell of a lot easier to hit it out of the park. The first session was at night under the lights. It was 60 degrees and the water temperature was in the high 60s requiring a full wetsuit.

My first session was fun, but given the temps, wind, light conditions, and rust from not surfing, I felt I did ok, not amazing. Also, I got into the water at 10:10 pm Pacific Time, which was 1:10 am Eastern and I was quite frankly exhausted.

The next day, we had a solid breakfast, and I was up again at 10 am for my water time. I went smaller on my surfboard using a 5’8”x19.875x 2.75 board which was 32.8 liters. I generally surf something about 29 liters, but due to the fresh vs salt water angle and my 10 lb COVID-related weight gain, I needed a little extra float.

I felt this board was much more manageable for me (3” smaller than the 1st session), and I got some much better barrels. The wave is unique in that you need to paddle in the opposite direction of the wave to catch it. If it is a wave that is going right, you need to paddle at a 45-degree angle away towards the left, drop in, due a sharp turn right and then ride the wave. The waves are fast and given far fewer factors (swell direction, tide, sea bottom, crowds..), the wave is far more predictable. The wind is the only factor not under control.

Not only did I have a blast on my day sessions Saturday, but hanging with the guys on the trip was a ton of fun. Johnny P put together a great group of people who made the trip more memorable. At 53-years-old, I don’t know how many more surf adventures I have in me. Given a technical glitch in the wave-making equipment, we lost some water time Saturday afternoon, but we are going again next year, as the KSW agreed to make it right with more time when we return. I am anxiously awaiting surfing again and just as importantly hanging out with my new friends and having a blast. I also felt the team at KSW were very attentive and the service and food were better than I would have thought. The best memory was being in the water when Johnny P got an uncomfortably long barrel (10 seconds), and he was staring at me while he was in it.

As an aside, I had no major injuries, but my legs were so sore after 45-second rides that on Monday, I was walking like I rode a Clydesdale bareback across the country. I got a massage when I came back to Florida and cried when she eviscerated my thighs, but the pain was worth it for the fun and new friends made. Also, I have pictures to prove it!

The one point to know is perfection does not come cheap. Depending on the season, the cost is approximately $80k-115k+ to rent for the day which effectively gives you 12 hours of surfing, food/drink, accommodations, boards, wetsuits, coaching…Just bring some clothes and they have you covered. Obviously, you divide that up by the number of surfers on the trip.

Quick Bites

The Fed raised for the 10th time since last March, but signaled it coul dbe done lifting rates. Officials said in their new statement Wednesday they would monitor economic and financial-market developments and the effects of their earlier rate increases “in determining the extent to which additional policy firming may be appropriate to return inflation to 2% over time.” However, traders noticed what the Fed didn’t say this time in its post-meeting statement. The central bank appeared to soften its language about future rate increases by dropping a line from the March statement that said, “the Committee anticipates that some additional policy firming may be appropriate.” The market is now predicting 50bps of rate cuts prior to the end of 2023. I have spoken about this for at least 6 months and still believe that happens. Today, the Dow closed lower by 270 points, or 0.80%. The S&P 500 dropped 0.70% to close at 4,090.75. The Nasdaq slid 0.46% to close at 12,025.33. The indexes notched three-day losing streaks. The regional bank crisis will persist unless the Federal Reserve cuts rates, according to Jeffrey Gundlach. Job openings fell more than expected in March and were the lowest level in two years. Treasuries rallied sharply today with the 2-year -14bps in yield (3.83%) and the 10-year-9bps (3.35%). Oil has been getting smacked and is -9% since Monday on economic fears. I felt and remain concerned about supply constraints, but right now, demand concerns are winning the price battle. Gold continues to rally and is at over $2k (+.9%) after the Fed signaled a likely pause in hikes.

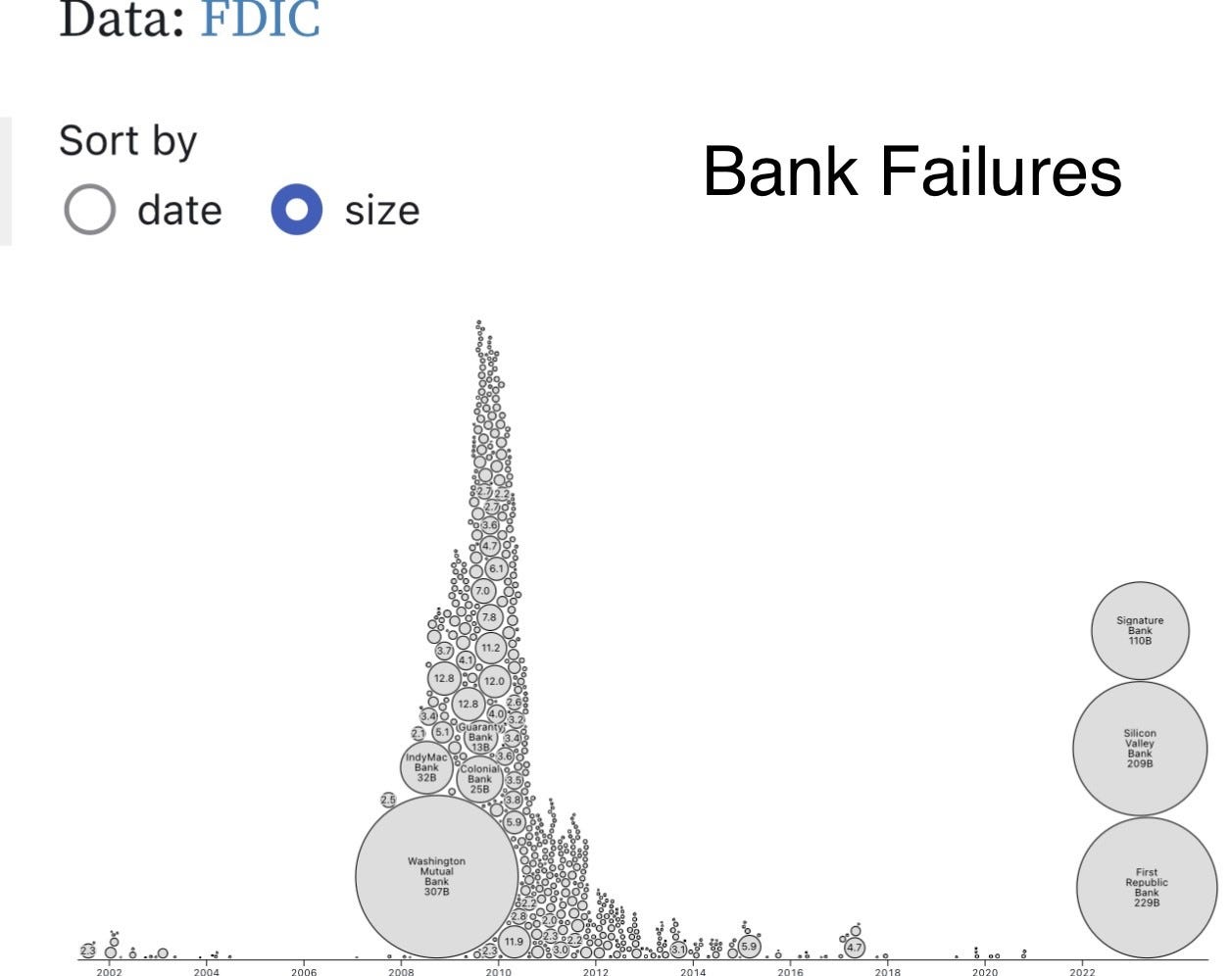

First Republic was seized by regulators and a “substantial majority of assets” were sold to JPM. JPMorgan is getting about $92 billion in deposits in the deal, which includes the $30 billion that it and other large banks put into First Republic last month. The bank is taking on $173 billion in loans and $30 billion in securities as well. The FDIC agreed to share losses on mortgages and commercial loans that JPMorgan assumed in the transaction and also provided it with a $50 billion credit line. JPMorgan said it was making a payment of $10.6B to the FDIC. The transaction will cost the FDIC’s Deposit Insurance Fund an estimated $13 billion, according to the regulator. JPM is the biggest and best bank in town. My career was made at JPM, but at what point do the regulators prevent the largest financial institutions from getting bigger? Powell commented on this topic here and suggested the JPM acquisition of First Republic was an “exception.” I am struggling to get updated deposit data given the dramatic moves over the past couple of months, but the biggest banks account for something like 75% of the deposits. I am sure JPM learned from the BSC/WaMu deals and believe this was a far better deal for them economically. Jamie believes “this part of the crisis is over” after the First Republic transaction. “There are only so many banks that were offsides this way,” Dimon told analysts in a call shortly after the deal was announced. “This part of the crisis is over,” Dimon said. I rarely disagree with Dimon, but do on the banking crisis being nearly over, as the ramifications of a sharp pull-back in lending will reverberate in the system for some time. Also, the regional bank stock action Tuesday and after-hours Wednesday suggests the regional bank crisis is not over. PacWest closed down 28% on Tuesday and after hours on Wednesday FELL ANOTHER 58% to $2.8/share on a report that it is weighing strategic options (sound familiar)? Metropolitan closed down over 20% and FELL ANOTHER 19% after hours on Wednesday. What will depositors do? The KRE Regional Bank ETF fell almost 2% today and is down 5% after hours. Ex-DallasDallas Fed President, Kaplan suggested the US regional banking crisis is far from over and I am closer to his viewpoint than Jamie’s. Solid charts below outline things developing on the regional bank front. Note the returns on the 3rd chart done by Jim Reid at DB.

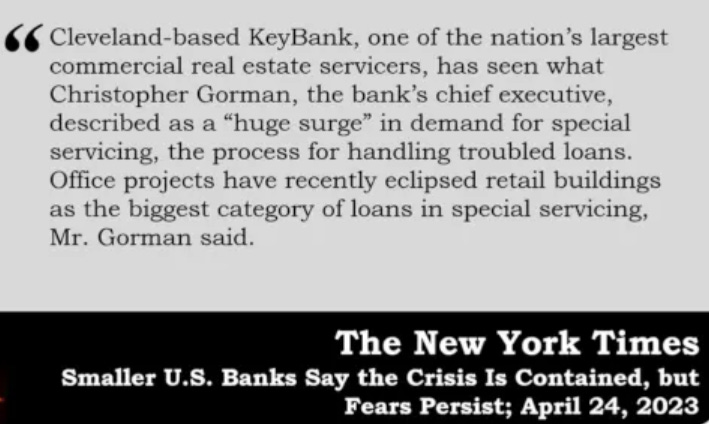

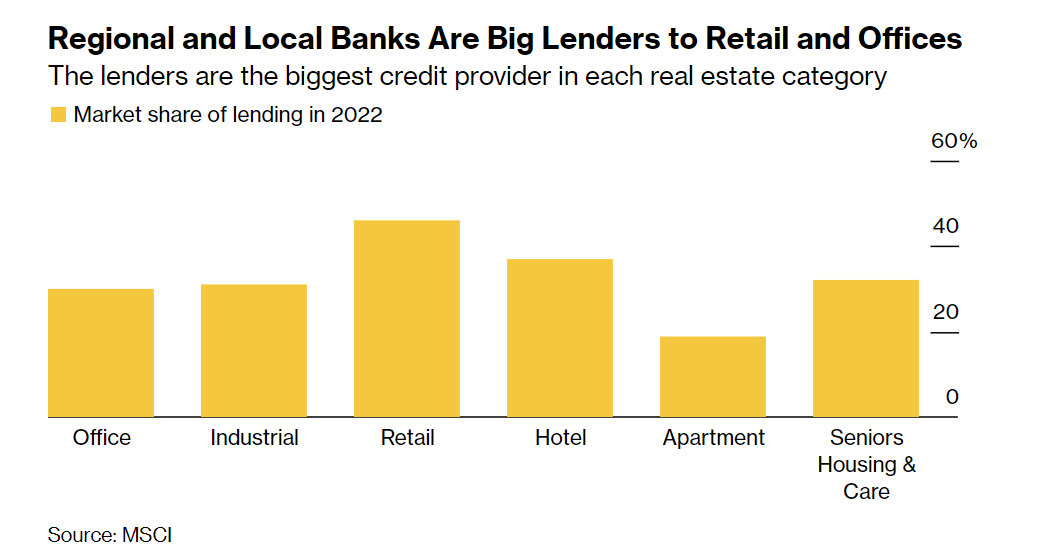

Good Bloomberg article entitled, “Signs Are Mounting That a Debt Crunch is Looming.” Great charts in the piece. Banks are increasing reserves for losses. Regional banks are critical for economic growth and lending and are clearly going to be pulling back given SVB, Signature, First Republic. The price action of regional bank stocks POST the JPM/First Republic deal is not giving anyone a great deal of confidence in the sector.

The Empire State’s pool of adjusted gross income shrank by nearly $16 billion in 2021 compared to just two years ago — representing a major loss in potential tax revenue compared to pre-COVID levels, according to newly released data from the Internal Revenue Service cited by the Wall Street Journal. The data shows New York lost a whopping $24.5 billion in state adjusted gross income in 2021 as residents relocated. That marked a major uptick from the state’s loss of $19.5 billion in 2020 and just $9 billion in 2019. Much of that has wound up in Florida, which has seen a $10 billion windfall in 2021 stemming from newly arrived New York transplants, according to the data. California lost out on $29.1 billion in adjusted gross income in 2021 – or more than triple the state’s loss in 2019, according to the IRS data. Fleeing residents cost Illinois $10.9 billion in lost adjusted gross income in 2021, up from $8.5 billion in 2020 and $6 billion in 2019. Follow the money. The Sunshine State, which does not have a state income tax, gained $39.2 billion in resident income in 2021 – an increase compared to its gain of $23.7 billion in 2020 and $17.7 billion in 2019. The wealth is leaving NYC, CA, NJ, CT, IL… by the droves. Maybe, just maybe, the policies in these cities don’t work for everyone anymore. The issue for me is given the growing deficits, rising homeless, high crime, and companies and wealthy individuals leaving, what does it mean they need to do to taxes to balance budgets? Either austerity measures or higher taxes or both will be needed to balance budgets. Another article goes into more details about Illinois, NY and California and suggests they have been ‘hemorrhaging high-earning” residents.

Other Headlines

The U.S. could hit the debt ceiling by June 1, much sooner than expected, Yellen warns

Yellen said a drop in tax receipts meant the U.S. could hit its debt ceiling as soon as June 1, earlier than Wall Street and Washington had estimated. I feel a deal will be reached, but worry about the noise between now and then. The term structure of the Treasury market shows a large spike in rates in the short term over concerns here.

Druckenmiller Warns US Debt Crisis Worse Than He Imagined

Very interesting take from my investing hero, Druckenmiller.

Hindenburg Research blasts Carl Icahn’s hedge fund as ‘Ponzi-like’ in latest short-seller campaign

Anything is possible, but my gut questions the report. Icahn owns almost all the stock here with very little in outsiders’ hands. The stock has a 24% dividend yield today. IEP fell -37%% in the past 5 days. Icahn denied the allegations in the report on Tuesday afternoon. Icahn’s net worth dropped billions on the report according to Bloomberg.

Ford posts stellar first quarter, boosted by fleet and legacy truck divisions

How Smart ChatGPT Actually Is, Visualized

Given how quickly AI “learns,” I would think these scores are quite a bit higher in 18 months.

Chegg shares droped 48% after company says ChatGPT is killing its business. Chegg popped 17% Wednesday.

‘Godfather of A.I.’ leaves Google after a decade to warn society of technology he’s touted

He received his PhD in AI 45 years ago and his comments should raise concerns.

More and more Americans don't want electric cars

I have had a TSLA for almost 6 years. Charging is hard and range is limited. Not to mention they are quite expensive. Price, lack of charging stations, range and time to charge were all listed as issues.

Tesla raises car prices in U.S., China and other markets after cuts

Pfizer earnings and revenue top expectations despite Covid vaccine sales decline

Jenny Craig tells employees it will shut its doors

New weight loss drugs (Wegovy, Rybelsus and Ozempic) helped to be an end to 40 years for Jenny Craig.

An alarming 39% of Americans say they have skipped meals to make housing payments

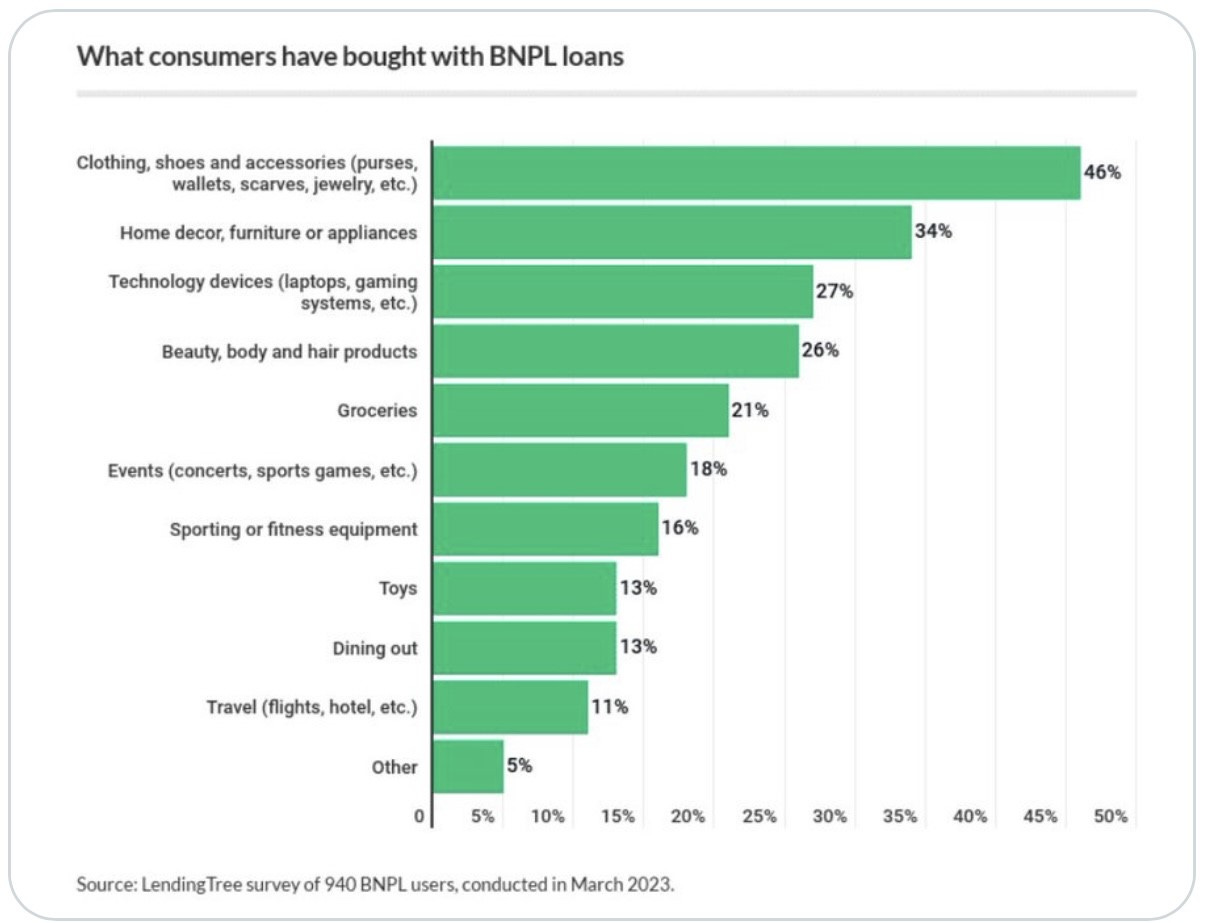

The US consumer is struggling under a massive debt load, rising rates, crashing savings and the impact of inflation. Look at what US consumers are buying with the help of Buy Now, Pay Later loans (BNPL). Groceries! Only 43% of Americans surveyed could cover an emergency $1,000 out of savings. 44% of Americans expect to apply for a BNPL loan in the next six months. Sorry, this data is concerning.

Trump opens up 36% lead over Ron DeSantis in new 2024 Republican poll

Once high-flying DeSantis has been crashing due to too strong of an abortion angle, heavy-handed Disney play and comments on Ukraine.

How the US is subsidizing high-risk homebuyers — at the cost of those with good credit

The new rule went into effect and I am adamantly opposed to high-credit quality borrowers paying more to fund lower-quality borrowers. Bad idea. Everyone should NOT own a home. Remember the Global Financial Crisis? One issue was the government pushing home ownership for all. Oops.

A Bionic Eye That Could Restore Vision (and Put Humans in the Matrix?)

Promising tests in rabbits, but a ways to go.

This former Tesla engineer is reinventing the home electrical panel

Amazing technology. Short video explains it. Must watch.

NYC subway rider, 30, dies after being put in headlock during outburst on train

Nordstrom closing two San Francisco stores over ‘deteriorating situation’ as crime in city surges

Awful crime policies, awful leadership and overly woke ways are crushing major cities. SFO is basically uninhabitable. So many stores are leaving and hurting those law-abiding, tax-paying citizens. Oh yeah, CA has the highest gasoline, natural gas prices and massive income taxes.

There’s No Game Plan’: Bud Light Sales Collapse amid Backlash to Dylan Mulvaney Campaign

In-store sales fell 26%. I wrote about the stupidity of this campaign given the nature of the beer drinker. KNOW YOUR CUSTOMER.

Brits back King Charles' bid to slim down monarchy to cut costs, poll shows

A poll shows only 2% of Brits support Camilla being Queen.

MYSTERIOUS UFOS SPOTTED OVER LAS VEGAS, LOCAL MILITARY BASE DENIES INVOLVEMENT

Video included. What is it?

Real Estate

I have a line on 4 new homes being built in Royal Palm. None are on the market. One is available shortly and three will be done in about a year. They will come turn-key. If you are interested, I will connect you. Prices start at $10mm. Welcome to the new world of South Florida. Remember, BEFORE you buy, be sure to get your kids into school. Housing is definitely softer with more inventory on the market, housing taking longer to sell and more price reductions. Royal Palm has 36 homes listed and more off market. In December 2021, there were 4 homes listed. In May of 2017, there were 71 homes listed. I feel many of the asking prices were unrealistic, and there has been a hesitancy to reprice sharply lower. I am of the view that South Florida will outperform the basket, but also believe we should see some cooling from the insanity given the broader markets, rates, ability to find schools and likely recession coming.

Sales and prices of Los Angeles County apartments have fallen off a cliff.

The number of units sold in L.A. County fell nearly 11 percent in the first quarter from the final quarter last year, while the year-over-year drop was 37.5 percent, the Commercial Observer reported, citing a report from NAI Capital.

At the same time, the average sales price per unit dropped 18.4 percent.

The Los Angeles County multifamily rental market houses 3.3 million people, but has been hit by an uncertain economy, high inflation and rising borrowing costs. The Measure ULA “mansion tax” that took effect April 1 is expected to further hamper multifamily deal making. The new law adds a 4 percent transfer tax on commercial real estate deals over $5 million, and a 5.5 percent tax on deals over $10 million. After the state and county lifted pandemic-era eviction protections, the apartment vacancy rate hit 4.2 percent, up 20 basis points quarter over quarter and 70 basis points higher than last year.

Pac West Bank stock was hit hard Tuesday (-26%) bringing the market cap to $240mm. The stock is -79% over the past year, and I question the viability. Who would leave their money there? PacWest is smaller than First Republic Bank with about $41 billion in assets. However, almost 80 percent of its loan book is dedicated to commercial real estate-backed loans and residential mortgages. When you look at the carnage in Regional Banks, it is clear there will be a massive pullback in lending and many assets will be for sale. This is quite deflationary as it will be far more challenging to get a loan. The Dallas Fed and the San Francisco Fed last week reported pressure on funding in their geographic regions, with projects being canceled and nonperforming loans expected to increase.

Cool waves!! Dying to go to Kelly's ranch! You still have got it with 53yo.