Opening Comments

The last piece was on Tuna Fishing In Louisiana and was well-received. I had an old link to the lodge in the note and this is the accurate link to the lodge I stayed at in Venice, LA. I will be going back. I would consider a Rosen Report Fishing Trip if enough people wanted to go. The most opened links were the Goldman Sachs executive productivity hack and the scary website which can find all pictures of you on the internet.

My orthopedic surgeon, who is on speed dial, has me back to Physical Therapy. My calf is torn, but my Achilles is still intact. I will be limping around for a while. My awkward gait injured my Achilles. Do I walk funny to protect my calf and injure my Achilles or walk normally and have calf pain? It is really an old man’s problem. I am fitting right in down in Boca with all the old people. You cannot make up my injuries. NFL running backs and pro boxers are less injured than I am.

Congrats to Coco Gauff on her US Open Title at 19 years old. Great tournament and result for the young American. Great acceptance speech from a poised teenager.

For all my new readers, it is important to note that you can help contribute by sending me story ideas, improvement ideas, and constructive criticism… to help me improve the product. The best email is rosenreport@gmail.com. I respond to all inquiries, but sometimes they go to spam and it takes a couple of days to find them. Also, note that some email servers truncate the Rosen Report and you need to hit “View entire message.” If you like what you read, forward it to friends and hit the like button.

This headline is amazing and moved it up to the top. Those who are fascinated by the J.F.K. assassination should check it out. J.F.K. Assassination Witness Breaks His Silence and Raises New Questions. Former Secret Service Agent, who found a bullet claims 3 shots were fired.

Pictures of the Day-Good Charts on M1, Savings, Credit, Home Leverage

Markets

Howard Marks on Upcoming Defaults

Impact of Higher Rates by Peter Boockvar

Florida Homeowners Insurance

$30 Trillion in US Home Equity

WSJ-Home Prices Bottomed?

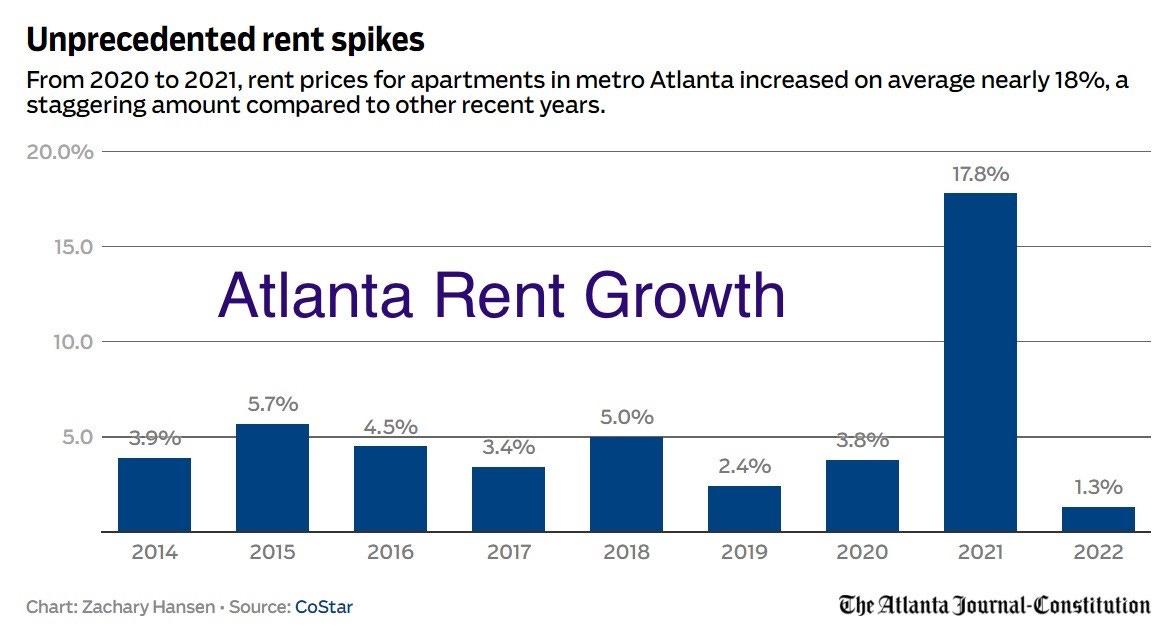

Apartments Softening in Spots

Chicago “Trophy” Office Building Issues

Real Estate “Doom Loop”

Pictures of the Day-Good Charts

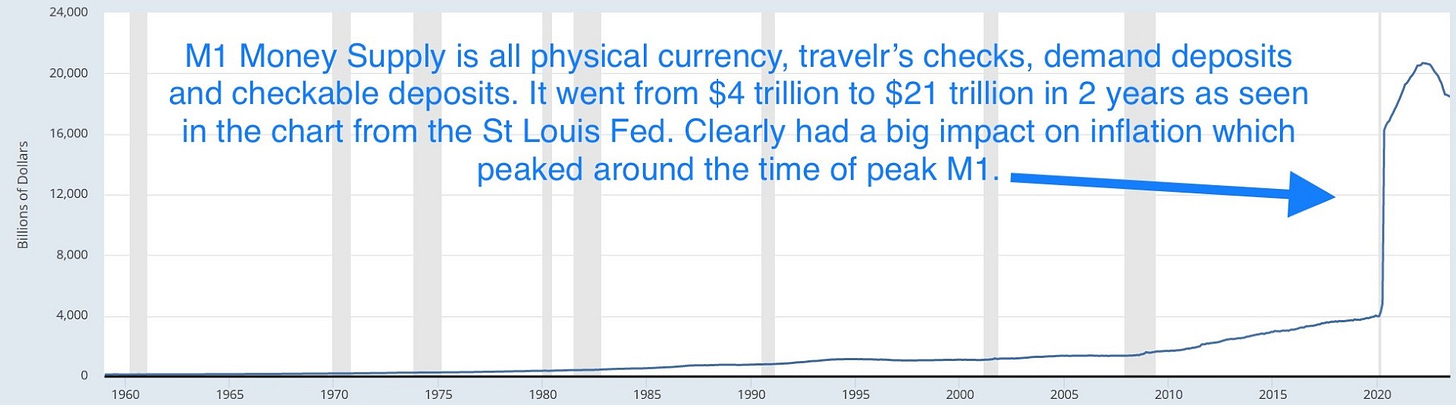

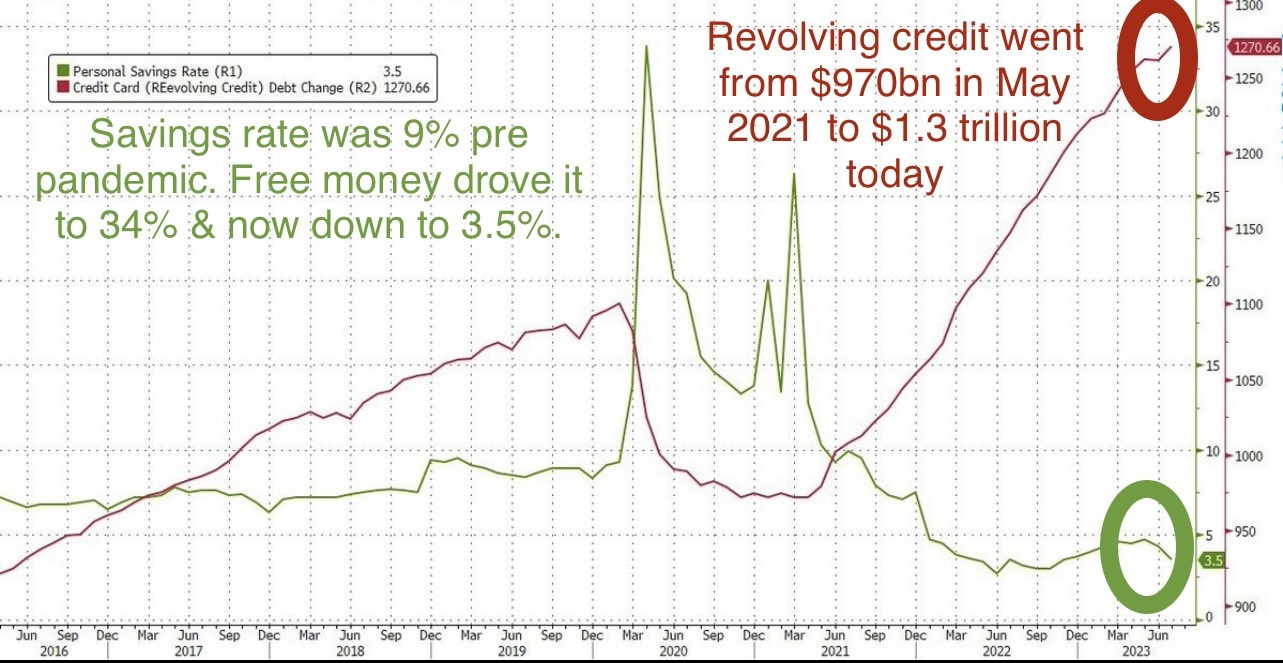

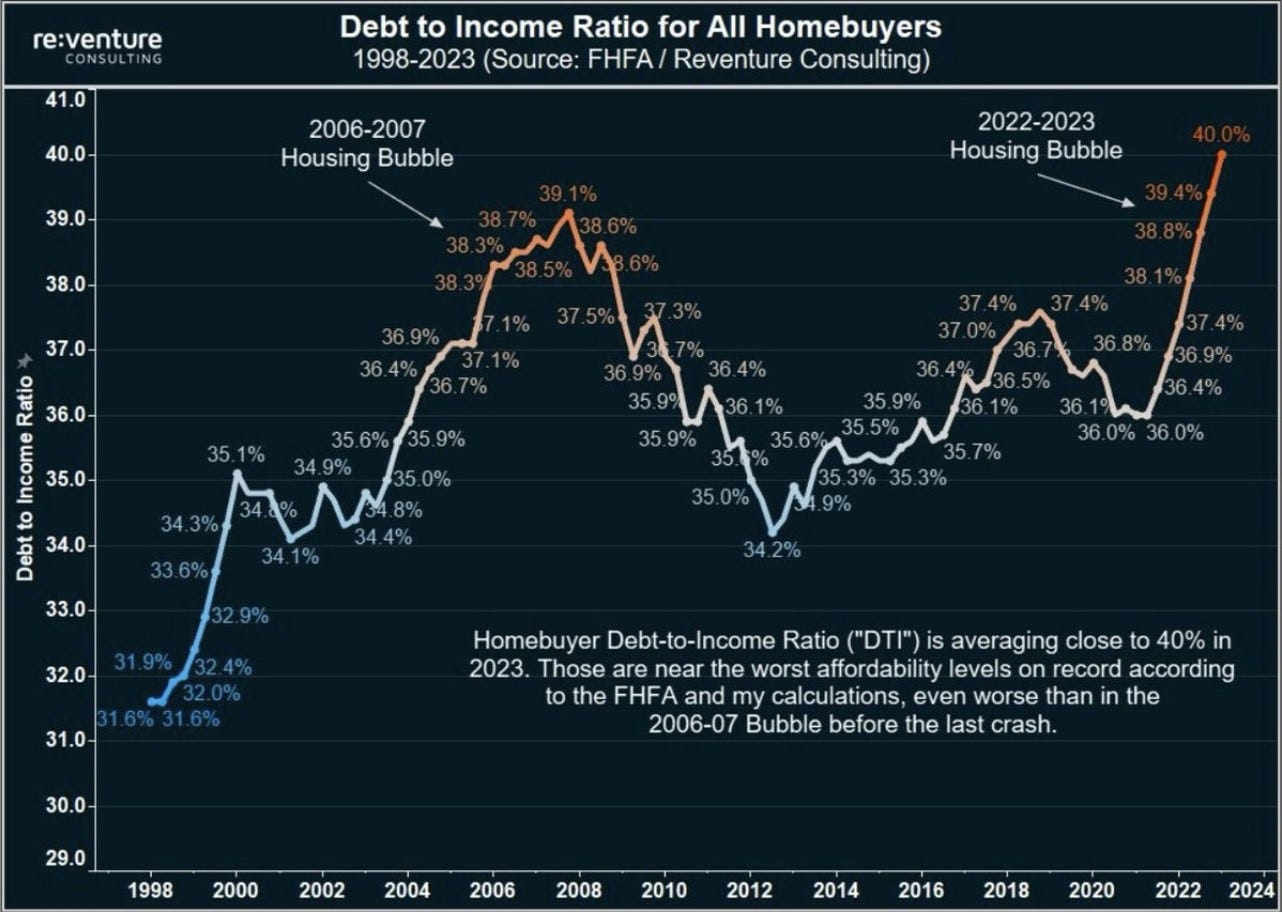

There are some charts on M1 going around social media, so I went straight to the Fed to get this of M1 (1st chart). We had M1 go from $4 trillion to $21 trillion in just over two years. Do you think this helped to contribute to pesky inflation? It sure did. Over 80% of all US money was created since 2020. The 2nd chart shows the personal savings rate going from 9% pre-pandemic to 34% (free money to stay home) and now back to 3.5% as consumers have spent all their excess savings, in part due to inflation. The revolving credit balances have exploded to $1.3 trillion (+31% since May 2021) while savings has crashed. The last chart outlines the growth in the debt-to-income ratio for home buyers as housing affordability is awful in large part due to runaway inflation largely caused by the ineptitude of the Fed. We are at a 40% debt-to-income ratio which is higher than prior to the Global Financial Crisis. Goldman claims so much wealth has been created, all is good. I am not so sure.

Spirit Airlines Has No Spirit

It was the summer of 2017, and I was in the process of fixing up the house we purchased in Boca while I still lived in NYC. The timing of flights worked out and I made the awful decision to try Spirit Airlines on a flight from Ft Lauderdale to NY. Yes, I had Jetsmarter (prior report), but the flights were full when I needed to fly. When I say, “Never Again,” I ain’t lying about Spirit. It was among the worst experiences I can recall. If they give you the flight for free, you are overpaying for it.

I believe the base rate of the flight was like $39. The old adage, “You get what you pay for” has never been truer. I got to the airport and went to the gate, and the horror story began. Given I went to Florida for the day, I only had a small backpack with my laptop.

My $39 ticket did not include a seat, bag or any extras. They wanted to charge me $49 for my backpack and then $40 for a seat. I paid for both making my $39 ticket approximately $128. I had a middle seat and let me tell you it was small. I was 160lbs and my ass barely fit. Luck would have it, I had a bouncer from a nightclub in the window seat at 6’5” 350lbs, and on the isle, I had a giant of a man who was 6’3” 300lbs. Their largeness totally encroached on my personal space and they were laughing about it. Not sure what I could do other than laugh given they looked like they belonged on the World Wrestling show and collectively, weighed 4x my weight. What are the chances that I sit in between 650lbs of people in the smallest seats known to mankind? Of course, it happened to Eric Rosen on the one time he flew Spirit.

It was the longest 5 hours of my life (delayed and sat on tarmac) and there is NOTHING TO EVER GET ME TO FLY SPIRIT AGAIN. Life is short, and I would rather rent a car and drive for 24 hours then take another Spirit flight. The service was awful, you had to pay for water, and the seats were for Lilliputians. They charged me for a backpack! Spirit has no spirit.

Due to flight times and the fact I was in the Hamptons this summer, I had to fly Frontier from Islip to Ft. Lauderdale and the base rate looked reasonable and then you had to pay for a seat and $69 for a small carry-on. Oh yeah, the only flight was 5:45am, so I had to get a 4am Uber to make the plane. They charged $20 if you wanted to check in with an attendant. By the time I was done picking a seat, taking a carry on and buying the ticket, it was 50% more than the advertised price.

I am a JetBlue man and loyal as hell. I fly them anytime I can, and the experience is amazing. I highly recommend JetBlue, and the service, seats, and price are fair. I am Mosaic and that is well worth it. Think about this Spirit story before booking your summer travels. It seems cheap, but the trauma lasts a lifetime.

Quick Bites

Stocks rose slightly on Friday but logged a losing week amid renewed worries that the Federal Reserve may raise rates more than previously expected. The S&P 500 edged up 0.14% to snap a three-day losing streak and finish at 4,457. The Dow Jones added 76 points, or 0.22%, to close at 34,577, while the Nasdaq eked out a 0.09% gain to settle at 13,762. Major averages also capped off a losing week. The S&P and Nasdaq dropped 1.3% and 1.9%, respectively, for their first negative week in three. The Dow finished about 0.8% lower. Energy stocks rose Friday as oil prices continued their recent rise as oil settled at over $87/barrel at a 9-month high due to supply fears. Remember, early in the year, one of my calls was the potential for $100 oil despite the economic slowdown. It was a contrarian play, but I felt supply constraints would push oil higher. Oil is now +30% in a couple months and +11% YTD. The S&P energy sector increased 1% and posted a 1.4% weekly gain. Major winners included Marathon Petroleum and Phillips 66, both up about 3%. Valero Energy jumped 4%. Treasuries yields rose slightly Friday on the front end and the 2-year is now 4.9%.

Oaktree Capital Management co-founder Howard Marks said he expects more companies to default on their debt as higher interest rates make it harder for struggling companies to raise capital. “When you go through a period when it’s super easy to raise money for any purpose or no purpose, and you go into a period when it’s difficult to raise money, even for a good purpose, clearly many more companies are going to founder,” Marks said in an interview taped for an upcoming episode of Bloomberg Wealth with David Rubenstein. When asked whether he expects more defaults in the buyouts or real estate industries in the next three years, Marks told Rubenstein that the combination of having less money and a higher cost of capital will leave a “hole” that some firms can’t fill. “You can’t live on a shot of adrenaline every morning for 13 years,” he said. “I would like to see the Fed get to a neutral position, which is neither stimulative nor restrictive.” This Bloomberg article entitled, “US Bankruptcy Tracker: Courts See Busiest August on Record,” would echo Marks’ concerns. The month of August saw at least 23 big bankruptcy filings, marking the busiest August of any year since at least 2000, according to Bloomberg-compiled data.

I am a big fan of Peter Boockvar and his market and economic information through his daily blog, The Boock Report. On Friday he wrote about the impact of the substantial increase in rates from zero and gave a bunch of compelling examples. Here is an excerpt: "All the talk of us having a recession has vanished" said NY Fed president John Williams in a Bloomberg interview. If only 550 bps of rate increases over 18 months will be so easy with its gentle impact on the economy and just because it hasn't happened yet doesn't mean the impact of the current much higher rate world is over. We have to understand that it is not really the current level of interest rates in an absolute sense that bites. What bites is that it comes after 15 years of interest rates that didn't really exist. From September 2007, right before Bernanke started slashing rates and QE began, through February 2022, right before the Fed starting raising rates, the 2 yr yield averaged 1.00% and the 10 yr yield averaged 2.40% vs 4.94% and 4.25% right now respectively. Also, the average 30 yr mortgage rate in that time frame averaged 4.22% according to Bankrate vs about 7.5% today. The average credit card interest rate was 14.4% vs 22.2% today. The average 60-month loan to buy a new car was 4.40% vs 7.44% today. Used car borrowing rates today are double digits in many states vs about 5% in the years before Covid. On the corporate side, the average yield a junk-rated credit paid in those 13 years was 5.44% vs the current rate of about 8.50%. For an investment-grade company, the average rate paid was 2.93% vs 5.76% on offer today. Smaller companies that don't have access to the capital markets are paying double-digit interest rates on loans. As so eloquently Jim Grant said in his latest issue, "It was the zero-percent era that made a 5%-plus rate dangerous."

I have often written about the homeowner’s insurance dilemma in South Florida. Many insurance providers have run for the exits and those few still around are raising rates at a fantastic clip. This Bloomberg article is entitled, “Ultra Rich Pay $620,000 to Shield Mega Mansions From Disaster Risk,” and suggests that was a recent quote for a home on Star Island after paying $200,000 the prior year. In the past three years alone, rates in the Sunshine State have tripled. Farmers Insurance recently joined more than a dozen insurance companies that have stopped writing home policies in the state, concluding that the risks are simply too great. Others have abandoned California. After the deadly wildfires on Maui, some worry the same might happen in Hawaii. For the billionaires and mere multimillionaires who have flocked to places like South Florida, a five- and six-figure policy, while costly, won’t break the bank. But even for the moderately wealthy, insurance costs are beginning to verge on unaffordable: The cost of so-called high-value insurance, loosely defined as policies covering homes worth more than $1 million, is outpacing the rise in premiums for more modestly valued homes by anywhere from two to 70-fold. Today, nearly 15% of all the homes in Florida are uninsured, almost double the national average. The article has many examples. I can tell you that numerous friends have had their policies canceled in recent months and are scrambling for coverage at 3-4 times the cost with higher deductibles and less coverage. I wanted to sell my home and buy one on the water but will not do that now given the insurance costs and lack of insurers willing to provide coverage on the water. The article discusses California and Aspen insurance rates due to wildfires. This CNBC article is entitled, “Senators take up looming insurance crisis as policy issuers flee Florida and California.” DeSanits has helped to push through legislation to help on the insurance front, but it will take time to take impact premiums. Major tort reform should help.

Other Headlines

I am asked this question a lot and JPM gives an interesting perspective, and I agree with the conclusions. I found this amazing Visual Capitalist 1-minute link on how the reserve currencies have changed over time. Please check it out. Ends in 2020, but you get the idea. The US $ is definitely trending downward as a reserve currency.

Goldman Sachs CEO David Solomon sees Wall Street rebound if tech IPOs perform

Walmart cuts starting pay for new hires who prepare online orders, stock shelves

My last note had pictures of the day of a softening labor market and this is a perfect example.

Slowing inflation is dragging on Kroger sales, even as consumers still feel a pinch

Help Wanted: Women to Fix America’s Infrastructure

Bipartisan law adds millions of jobs at a time of worker shortages

Apple’s 2-Day Slide Nears $200 Billion on China iPhone Curbs

This CNBC story suggests that China banned iPhone use by government employees. Check out this headline “Hedge fund investor Dan Niles says Apple is now his largest single stock short.” He cited the Chinese government ban, Huawei’s resurgence, and the re-start of student loan payments.

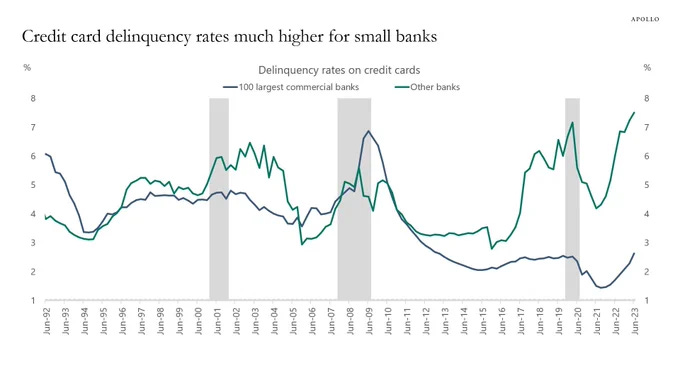

Delinquency rates at small banks rise to 7.5%, the highest on record.

Meanwhile, delinquency rates at large banks are at 2.9%, well below levels seen at small banks, but up from a low of ~1.5%. The same banks that almost collapsed in the regional bank crisis have exposure to historically high delinquency rates.

Ultra is considered $30mm+. The Asian Ultra fell by 11% in 2022, Europe fell 7.1% and North America dropped 4%. Lots of data in the article.

ADL chief fires back at Elon Musk for waging campaign of harassment against the group

Biden’s unpopularity could give Trump his shot at reclaiming power

This is a CNN article and is damaging to Biden while it suggests Trump could beat him despite 91 criminal charges across four cases. The article outlines Biden’s weak approval ratings (39%), age concerns, the economy under Biden…

This article suggests Biden trails Haley in polling. Shocking many Republicans are in the hunt against Biden. It is more of a statement of Biden’s weakness than their strength. Again, CNN polling.

Mar-a-Lago worker struck cooperation deal with prosecutors in Trump documents case, ex-lawyer says

Trump overstated net worth by up to $3.6 billion per year, NY AG alleges in new filing

You mean Trump embellished his net worth? Seems so unlike someone with no ego.

Former Trump adviser Peter Navarro is convicted of contempt of Congress in Jan. 6 investigation

DeSantis built a massive network of big donors. Many have ditched him.

Nancy Pelosi says she’ll seek House reelection in 2024, dismissing talk of retirement at age 83

35+years of being a Representative is more than enough. Time to retire and day trade your portfolio. She does it so well.

Special counsel to indict Hunter Biden in gun case this month, DOJ says

Weiss and the DOJ allowed the statute of limitations to expire on Hunter’s tax evasion crime ($2mm). There should be consequences for Weiss and the DOJ.

Get him for perjury. The laptop is not his according to 1st Son, Hunter. There are literally thousands of pictures of him naked or scantily clad with hookers, guns and crack. He dropped off the laptop at a computer repair shop near his house and has ATM receipts right near the repair shop.

A majority of Americans believe Joe Biden, as VP, was involved with son’s business dealings

This is a CNN poll. A majority, 61%, say they think that Biden had at least some involvement in Hunter Biden’s business dealings, with 42% saying they think he acted illegally, and 18% saying that his actions were unethical but not illegal.

Chris Christie Hits Trump With Receipts After 'Lunatic' Attack

I agree with Christie’s comments in this interview.

Mayor Adams warns migrant crisis will ‘destroy’ NYC, rips Biden for failing to help

A horrible immigration policy with 5 million+ crossers and no plan. I am all for immigration in a well-thought-out policy with monthly limits that US cities can digest. Give people a plan to become citizens. Cities cannot handle the inflows of over 100k/month. Lack the infrastructure, funds, housing, schools and staffing.

Influx of migrants at NYC high school overflows classes, forces students to other building

Deep lacerations on her head and a broken leg at the hands of four young suspects. The incident happened in front of her young children. How traumatized do you think a child would be seeing their mother savagely beaten? The defend-the-police victim has now changed her tune.

RIP Beverly Hills: Video shows high-end retail stores now shuttered amid LA crime wave

Beverly Hills is becoming a ghost town, as high-end retail stores exit the once-luxurious city near Los Angeles amid a spate of high-end smash-and-grab gang robberies. The pictures are concerning. Think about lost jobs, business owners, the value of real estate, taxes, impact on bank loan exposures…. What happened to the consequences for robbery?

The IRS plans to crack down on 1,600 millionaires to collect millions of dollars in back taxes

Urgent warning to Apple users as spyware infiltrates devices with zero clicks

Switzerland Is No. 1 in 2023 U.S. News Best Countries Rankings

These 10 nutrition mistakes could be taking years off your life: Here's what to do instead

I happen to agree with all 10 items on the list.

One guy glued himself to the floor which took time to undo him. I hope they go to jail.

Covid hospitalizations spike with new variant as school returns, U.S. readies vaccines

Of course, it is a Florida Man. There is a great website called, “Florida Man,” which outlines all the stupid things done by men from Florida. Some good ones: Shoplifting Florida man flees store, strips naked as steaks fall out of his pants, Florida man sets hospital bed on fire to get nurse’s attention, Florida man breaks into home, sucks on sleeping man’s toes. All I can tell you is it is right up there with “The People of Wal-Mart.”

WHO sounds major alarm over ‘concerning’ Covid wave coming this winter as deaths soar

China On 'High Alert' After US, Canadian Ships Transit Taiwan Strait

Most rain in Hong Kong since 1884…

I thought these two short videos of a few seconds each were crazy. I have never seen any rain like this and I have lived through dozens of hurricanes.

Real Estate

That’s roughly $200,000 cash per homeowner in equity that can be tapped, which is the amount most lenders will allow you to take out while still leaving 20% equity in the home as a cushion. The article walks through ways to tap equity given higher rates and beats rates on credit cards.

This WSJ article is entitled, “The Fall in Home Prices May Already Be Over.” After declining on a year-over-year basis for five consecutive months—the longest run of declines in 11 years—U.S. home prices rose in July. The surprisingly quick recovery suggests that the residential real-estate downturn is turning out to be shorter and shallower than many housing economists expected after mortgage rates soared last year. Scarcity is a big reason. High interest rates have prompted homeowners to stay put rather than buy new homes and take on more expensive mortgages, resulting in an unusually low inventory of homes for sale. Sales could keep shrinking in the coming months as mortgage rates hover above 7%, and the housing market heads into the typically slower fall and winter. But even if that happens, prices are unlikely to fall significantly, economists say, because there still aren’t enough homes for sale to meet demand. In my last note, I wrote about low inventories and the supply/demand imbalance due to so few homes being built post the Global Financial Crisis.

A reader in the R/E game sent me this note on softness in the apartment segment:

A subsidiary of MSC Investment & Management LLC defaulted on a loan at Virginia Highlands Apartment Homes at 609 Virginia Ave., resulting in it being taken back by its lender H.I.G. Realty Financing for $65 million. No other bids were placed on the nine-building, 270-unit complex, which Mableton-based MSC acquired last year for $81 million.

Another property owned by a MSC subsidiary — Celebration At Sandy Springs at 7000 Roswell Rd. — was also scheduled to go through foreclosure Tuesday, but the sale was postponed, according to the lender’s attorney Greg Null. No further details on the delay or the status of MSC’s $47.5 million loan with Orec Structured Finance Co. were provided.

Both deals were on three-year low floater loans….. Both older deals (Virginia Highlands, 1988, Celebration, 1968).

This CNBC article is entitled, “Apartment rents are on the verge of declining due to massive new supply,” and suggests the number of new units under development is at a 50-year high. The suggestion is rents are going lower due to the substantial increase in the number of new units.

601W’s trophy East Loop asset is now worth less than the loan attached to it.

One of the most prominent towers of Chicago’s skyline, the 83-story Aon Center was valued at $414 million, down nearly half from the $780 million it was worth when a $536 million loan secured by the property was issued in 2018, according to a report from credit ratings agency Morningstar.

This WSJ article is entitled, “Real-Estate Doom Loop Threatens America’s Banks-Regional banks’ exposure to commercial real estate is more substantial than it appears.” Bank OZK had two branches in rural Arkansas when chief executive officer George Gleason bought it in 1979. The Little Rock lender today has billions of dollars in commercial real-estate loans, including for properties in Miami and Manhattan, where it is helping fund the construction of a 1,000-foot-tall office and luxury residential tower on Fifth Avenue. Regional banks across the country followed a similar playbook, gorging on commercial real-estate loans and related investments in big cities over the past decade. With the commercial real-estate market now in meltdown, those trillions of dollars in loans and investments are a looming threat for the banking industry—and potentially the broader economy. The banks are in danger of setting off a doom-loop scenario where losses on the loans trigger banks to cut lending, which leads to further drops in property prices and yet more losses. Bank OZK hasn’t pulled back from lending, but it has started to see some signs of market trouble. That indirect lending—along with foreclosed properties, trading portfolios, and other assets linked to commercial properties—brings banks’ total exposure to commercial real estate to $3.6 trillion, according to a Wall Street Journal analysis. That’s equivalent to about 20% of their deposits.

Rosen Report™ #612 ©Copyright 2023 Written By Eric Rosen