Opening Comments

My last note, “Who the Hell is Don Williams,” about my new relationship with a Gambian Giant, Ali, and his music interests received a much bigger response than I anticipated. A shocking number of readers knew of Don Williams. Some readers commented on the fact that I rode in a beat up Toyota Camry on a long ride from the airport. Those who have read the Rosen Report for an extended period of time know that I am the last person to waste money. Frugal is my middle name and I am proud of that. If I made $1bn tomorrow, I don’t think it would change the fact that I always think about saving money. The most opened link was the one about whales getting help from people.

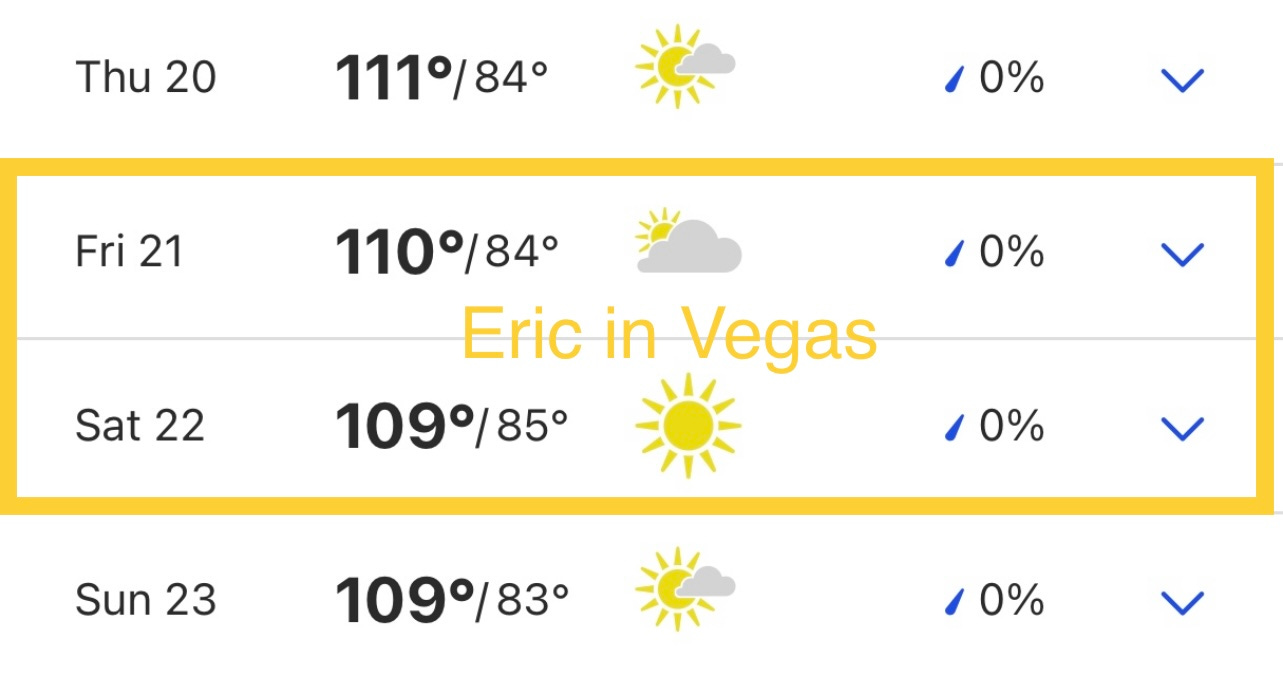

I am doing more speaking engagements and this week, I am in Vegas for an insurance conference as the keynote speaker to a large group. I leave Friday early am and am on the redeye Saturday. Good news, there is a heat wave, and it is 110 degrees, but down from 117. Check out the fact that it will be 102 degrees at 10pm.

Previously, I had written about 3i Members, a social networking and investment club which I have been involved with since its inception 18 months ago. To be crystal clear, I am a 3i member who pays full dues like everyone else. I am among the most active members in terms of involvement on the platform. I am on the Investment Committee, moderate panels, attend dozens of events each year around the country, help put together regular events in South Florida and have brought in 2-dozen friends who have joined the group. There are monthly meetings where deals are shown (PE, Venture, R/E, Credit, Funds, Structured Credit..), and members have the ability to invest if they choose to do so with no obligation. 3i Members makes no money off any deal flow and are agnostic about who does the deals. Although I have invested in a half dozen deals, my favorite part of 3i is the networking and I have made new friends through the group. There are so many impressive members and many of them are industry leaders, CEOs, entrepreneurs, and thought leaders. Last year, I went to holiday parties in NYC, Austin, and Miami to meet new people. The Rosen Report is now partnering with 3i, and I will be moderating regular panels and interviewing innovators and market leaders more regularly. The content will be for both the Rosen Report and the 3i network. 3i Members is now the first sponsor of the Rosen Report. The other nice thing about 3i is it has a philanthropic angle where many of the members believe in giving back, and 3i helps to raise awareness for many charities around the world. If you have interest in learning more about 3i, reach out to me via email at rosenreport@gmail.com and I will connect you with the team. Below is the new logo.

On August 2nd, in conjunction with 3i Members, I will be doing a virtual event with three major players in the residential Real Estate market. John Burger from Brown Harris Stevens (NYC), Devin Kay (South Florida) and Tim Davis (Hamptons) have agreed to sit down with me as part of a 3i Members meeting. I asked all three of them for a favor to discuss developments in their respective markets. They have collectively sold over $17bn of real estate and cater to high-end clients. I am very excited and will be sharing the video with my readers after it is completed. I know them all personally and their credentials are impressive selling many ultra-high end luxury homes, condos and co-ops. Their clients are a Who’s Who of the rich and famous. Currently, they collectively have 17 listings over $15mm and 9 in the $30mm or higher range.

I am in the Hamptons, but leaving Thursday night and back Sunday. A lot more video content is coming in conjunction with 3i Members as well as other speaking events which I will put in future reports.

Markets

$750bn Bond Maturity Wall

Consumer Loan Rejection Rates Rising

CFC Mozilo Died

Mr. Beast is Raking it In

Consumers Squeezed-Using HELOCs

LA Mansion Tax Impact

Naples Condos Going for $50mm?

Commercial R/E from RXR Perspective

$1.2bn Miami Land Deal Falls Apart

Ken Griffin Buys Palm Beach Office Building for $83mm

Eye on the Market-Cembalest-Impact of Poor IPO Performance

Michael does it again with his piece on the impact of recent poor IPO and SPAC performance on portfolios in a piece called, “Mr. Toad’s Wild Ride.” Great charts and informative too. The flurry of 2020/2021 IPOs have generally done poorly vs the equity market, wiping out 0.5 to 3.0 years of prior IPO portfolio gains depending on the sector. Technology has been the best sector for IPO investors, even after accounting for 2020/2021 vintages. Only 15% of repeat financial sponsors consistently brought IPOs to the public which have outperformed the equity market.

Eleanor

I went to Cape Cod last week for the first time in my life. A reader who I have become friendly with invited me to lunch with his Aunt Susan and Uncle Dave who are big supporters of the Rosen Report. Clearly, this family has a VERY high IQ and great taste in newsletters. I did not ask, but presume they are all in MENSA based on their love of my newsletter. I drove 1.5 hours on a Friday morning from Marion, Mass in the rain and arrived early. I picked up my friend at his house and he gave me a tour of the area.

So much water frontage everywhere made for beautiful views despite the dreary weather. Lots of boats with beautiful homes of varying sizes all around. I loved the colorful shutters on many of the homes as well.

We went to their tennis club for a bite to eat, and although I am not a fan of creamy chowder, I thought it was quite nice. We are in New England after all. It was clear my readers were anxious to talk about the world, and I was excited to chime in with my thoughts and stories.

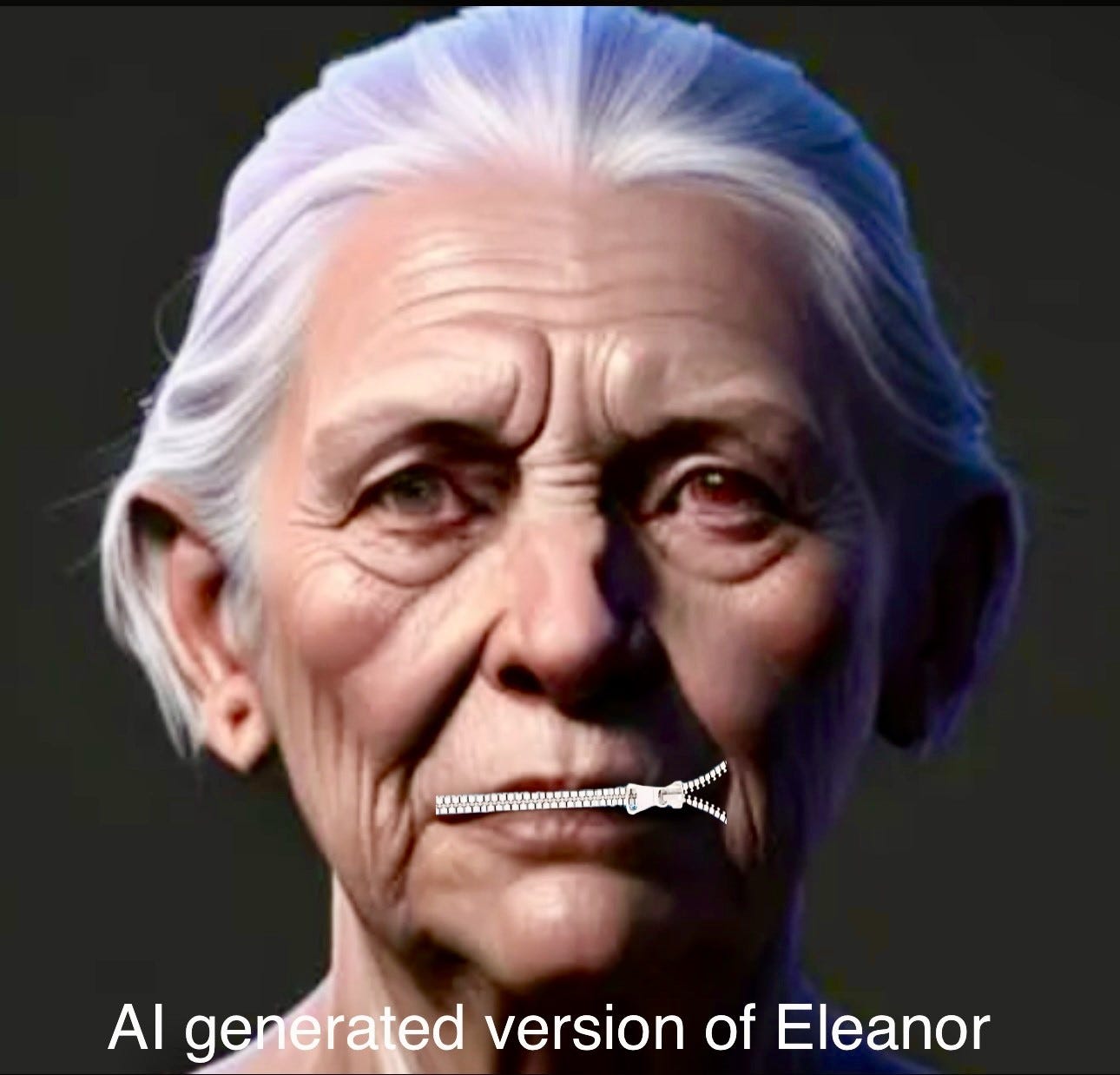

Uncle Dave started telling a story which was interesting, but I could tell his wife was getting a little antsy as she had heard it before. Aunt Susan said something to the tune of, “Let Eric talk. I did not come here to hear you.” Shortly after, I heard her call her husband the name “Eleanor,” and I was a little confused. After the 2nd time she called her husband, Dave, Eleanor, I had to ask what was going on. Apparently, the uncle’s mother, Eleanor, was a talker and did not let others get in many words. People would say, "Eleanor could actually talk a hungry dog off a meat wagon!” As a result, the inside joke when someone speaks too much is to call them “Eleanor.” I loved this story and have decided any time I am with someone who talks too much to call them Eleanor.

I went on-line and generated this AI version of Eleanor and my daughter, Julia, used some kind of editing software to add the zipper.

Uncle Dave’s-I mean Eleanor’s-story ended and we had a chat about all things in the world from food to politics to markets and golf. It was such a pleasure being with them and when Dave tried to hijack the table again, we all called him Eleanor. It was so funny.

The family could not have been more lovely and were quoting some of my old stories back to me. After, “Eleanor” invited me to check out Eastward Ho, a top golf course in the state, and I took a tour of it. I did not have my clubs but must tell you it is one of the most spectacular courses from an aesthetic point of view I have ever seen. I did not have my clubs but must tell you it is one of the most spectacular courses I have ever seen from an aesthetic point of view. Rolling fairways with magnificent bunkers and every hole has a view of the water. I felt truly lucky to have seen it and hope to one day play the course. This is a link to Golf Digest showing stunning pictures and talking about the rankings.

Despite three hours of driving in the rain for lunch, I had a great time and got to meet readers who truly appreciate the Rosen Report. It was a lot of fun and I have a new saying for those who like to hijack conversations…ELEANOR! I hope my readers follow suit and Eleanor becomes the official name of heavy talkers across the globe now that the Rosen Report is read on 6 continents.

Quick Bites

Earnings have been stronger than expected. As of Tuesday, I read that 84% of companies which reported have beat expectations. Stocks rose Wednesday as the corporate earnings season continued, with the Dow Jones Industrial Average registering its longest winning streak in nearly four years. The Dow traded up 0.31%, to close at 35,061.21. The S&P 500 climbed 0.24% to 4,566, while the Nasdaq added 0.03% to finish the session at 14,358. After Netflix subscriptions jumped 8% after a password sharing crackdown and the stock was up slightly. TSLA reported and the stock was up slightly. The 2 and 10 Year Treasuries did not move a ton, but the 30 year was -6bps.

Interesting Bloomberg article entitled, “The $785 Billion Junk-Bond Maturity Wall Has Never Been So Close.” The story outlines large upcoming debt maturities for bonds largely issued during the pandemic. Today, tighter lending standards and higher rates are making it harder and far more costly to refinance. The world’s riskiest borrowers are starting to run out of easy-money era financing and feeling the pinch as they return to a tougher market shadowed by aggressive central banks. Junk-rated companies staring down a $785 billion maturity wall are in a race against time to replace debt that they secured when major central banks across the world slashed rates and boosted quantitative easing programs to keep economies afloat in 2020. On average, these companies now have 4.7 years to put fresh financing in place, the least amount of time ever, according to a Bloomberg global index.

I am not sure anyone who has written about the consumer more than I have in the past few months. Every four months data on loan rejection rates comes out by the Federal Reserve and an astute reader pointed it out to me this week. The rejection rate for auto loans increased to 14.2% from 9.1% in February, a new series high. For perspective, auto loan rejection rates were 5.8% in October of 2022 and in October 2018 it was 4.5%. Rejection rates increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5%, 30.7%, 13.2%, and 20.8%, respectively. My point is simple, credit is tightening sharply and the consumer has spent much of the free money and excess savings. Credit card balances are at all-time highs with 24% interest. Credit card and auto delinquencies are rising in spots as well. This is something to watch. I have been very early on this (too early). Jamie Dimon and the Conagra CEO are starting to discuss this topic more frequently recently. Forbes on the rejection rate increases.

Good Bloomberg article about Angelo Mozilo. He propelled Countrywide Financial Corp. (CFC) to become the largest US mortgage lender during the housing boom only to see the company crash in the 2008 financial crisis, has died. He was 84. The housing bubble that burst in 2008, sending the US economy into a recession and erasing almost $8 trillion in value from the stock market, was built on exceptionally cheap and available credit extended to homebuyers along with creative options to repay their debt. CFC was a pioneer in the field, and Mozilo became a public face of the financial crisis. Time magazine, citing Countrywide’s loosened lending standards and exotic mortgages, named him one of the “25 People to Blame.” Mozilo’s long tenure as CEO ended in 2008 after Countrywide, running out of funds to finance loans, agreed to be acquired by Bank of America Corp. for $4 billion. Even at a heavy discount, the sale came to be seen as a painful mistake by Bank of America, which over subsequent years paid more than $50 billion to resolve regulatory probes and litigation tied to Countrywide. Most of the “forced” purchases during the GFC turned out to be a disaster. CFC and Bear come to mind at the top of the list. The credit losses and lawsuits took billions away from the acquirers, not to mention the negative press and management time. Countrywide was the biggest mortgage originator in the country doing over $2bn/day before they blew up.

In the fall of 2016, Jimmy Donaldson did not seem like a future celebrity multimillionaire. The shy 18-year-old had been posting videos on YouTube for five years from his mom’s North Carolina house without much traction. His mother urged him to go to college, but he dropped out of East Carolina University after two weeks. Instead of going to class, he spent most of his time on campus editing videos in his car. “People would tell me, ‘All you do is talk about YouTube videos. You’re too obsessed with YouTube. Get a life.’” After he quit school, his mother was so disappointed that she kicked him out of the house, he says. But his decision paid off. Seven years later, Donaldson, better known online as MrBeast, has 167 million YouTube subscribers – more than any other individual creator on the platform. He has 85 million followers on TikTok and 39 million more on Instagram. At 25, he oversees a fast-growing empire that may be worth more than $1 billion. My point is simple. Not everyone is meant to get an Ivy League education and take a fancy job. More “influencers” are CRUSHING it on social media and making millions or billions (Kardashians). Mr. Beast is a huge influencer with power and he is making a ton of money, even if I don’t find most of his posts interesting, they are entertaining. He gives back through philanthropy and his videos are incredibly well done and can spend millions on each video. He has over $10bn views on his videos.

Other Headlines

Musk Says Twitter Ads Plummet As Battle With Threads Heats Up

Elon Musk said that advertising revenue for Twitter has dropped 50% amid a “heavy debt load,” just as competition between the platform—which recently started to pay creators for advertisements—and Mark Zuckerberg’s rival Threads continues to intensify. Elon Musk says Twitter cash flow is negative due to ad revenue declines, ‘heavy debt.’ Months before the deal for Musk to buy TWTR closed, I suggested he overpaid by $29bn and people told me I was crazy. I don’t think I was wrong despite Musk slashing costs and employees.

I believe the biggest negative impact of WFH is on young people in search of mentoring. I am a big fan of the hybrid model.

Microsoft closes at record after revealing pricing for new A.I. subscription

Goldman Sachs misses on profit after hits from GreenSky, real estate

Tesla Begins Cybertruck Production After Yearslong Wait

Looks cool and has a range up to 500 miles. Prices range from $50-70k according to this article. I may buy one. Cool video of the truck.

Massive US Oil Caverns Sit Empty and Will Take Years to Refill

Nation’s oil reserve is at 40-year-low after historic drawdown. Reserves have been massively depleted and I feel it is a very risky proposition not to have them at more reasonably full levels. The US consumes 1/3rd more oil/day today than in 1984, the last time we were at these levels and the US population is +40% since 1984. Irresponsible.

Powerful message from an industry veteran with an interesting take on the strikes.

Trump told by special counsel he is criminal target in Jan. 6 probe

What are Trump’s annual legal fees? I think it is official that we need new candidates for 2024 not named Trump, Biden or Harris.

Michigan attorney general charges fake Trump electors over alleged 2020 election crimes

Black, Hispanic NYers who failed teacher’s test strike $1.8B in NYC settlement

Roughly 5,200 black and Hispanic ex-Big Apple teachers and once-aspiring educators are expected to collect more than $1.8 billion in judgments after the city stopped fighting a nearly three-decade federal discrimination lawsuit that found a certification exam was biased. NYC spends $38k/pupil/year in public schools and the results are awful.

15-year-old boy in critical condition after shooting on NYC street

Scary pictures and video. Sorry, the streets need to be safer. Bragg, do your job.

My dad passed away 10 years ago—he left me these 6 rules for a happy life: ‘Come home for dinner’

I agree with these points: 1. Quit whining and get the job done. 2. Take your time to give thoughtful responses. 3. Don’t be penny wise and dollar foolish. 4. Come home for dinner. 5. Build credit responsibly. 6. The best way to remember loved ones is to love others.

Moms share viral ‘pure genius’ packing hack: ‘About to change your life’

I must admit this idea is amazing, especially for kids going on a trip. Watch the short video.

Many of my readers are very wealthy, but the importance of savings plays a role at all income levels. My claim to fame was I always lived WELL within my means and was a great saver. I was fearful of going back to being a lower income family and put all my money away. I feel like controlling my expenses is key.

‘Golden Bachelor’ Revealed: 71-Year-Old to Lead ABC’s Senior Dating Series

I would not watch the regular Bachelor if you paid me. I surely will not watch the elderly version.

Top Scientists Misled Congress About Covid Origins, Newly Released Emails And Messages Show

I was vilified for suggesting the Lab Leak early days. So many unsubscribes with nasty comments about my view years ago. The scientists publicly said the lab leak was “conspiracy theory” and privately said it was a “serious possibility” in emails to Fauci and his team. The US FINALLY cut funding to the Wuhan Lab over stonewalling the probe. What took so long?

Seems as though there are more sightings. We are definitely not alone.

Real Estate

US Homeowners Are Tapping $9 Trillion in Real Estate Wealth -Higher mortgage rates have made cash-out refinancing less attractive and pushed more people to take out home equity lines of credit. Americans are increasingly tapping their greatest source of wealth, getting home equity lines of credit to borrow against the value of their properties, which skyrocketed in the pandemic real estate rally. Helocs have become more popular as mortgage rates surged from record lows, making cash-out refinancing unattractive to most homeowners. In recent years, lenders scarred by the financial crisis kept a tight grip on Helocs, which are considered relatively risky for banks because the credit line functions as a “second lien” that’s paid off after primary mortgage obligations. But 30-year loan costs at almost double early 2022 levels have squashed the refi boom, making financial institutions more open to Helocs, said Greg McBride, chief financial analyst at Bankrate.com. “The phones in the mortgage refinance department aren’t ringing,” he said. “The way to get equity out of the home has swung to the Heloc.” Consumers have been squeezed by inflation, higher rates and wages which have not kept up. They are borrowing against homes and credit cards and dipping into savings to keep up. This is not sustainable.

In early 2023, L.A.’s luxury real estate market experienced a boom as deals were closed before the April 1 implementation of Los Angeles’ Measure ULA, known as the “mansion tax.” In the first quarter, the number of $5 million-plus homes sold increased by 35 percent, with Brentwood, Pacific Palisades and Hancock Park proving particularly active. Before the tax went into effect, Brad Pitt sold a compound for $33 million, while Mark Wahlberg sold a mega-mansion for $55 million. After April 1, taxes on those properties would have been about $1.8 million and $3 million, respectively. Measure ULA adds a transfer tax of 4 percent for sales above $5 million and 5.5 percent for deals above $10 million; real estate transactions in the city below those levels pay the already-established transfer tax rate of .56 percent. Idiotic policies which continue to drive the wealthy out of the state. CA has among the highest income taxes, highest R/E taxes, highest gas cots, highest energy costs, highest crime, highest homeless, awful public schools…. No wonder why the wealthy are leaving in droves. You cannot tax your way into prosperity.

I was shocked when a reader sent me this about Naples condos. Naples Beach Club in Naples, FL is currently being redeveloped and is offering the most expensive & luxurious condos in all of the Naples area and beyond. Starting at $14,500,000 Naples Beach Club condos max out at $50,000,000 (1st picture). The land Naples Beach Club consists of is 125 acres with 1,000' of beach frontage on the Gulf of Mexico. It is located west of 41 and immediately to the north of Olde Naples. Florida is booming and the wealth migration continues and is driving prices to stratospheric levels. I don’t follow the Naples market as closely, but did research to find the most expensive homes sold in 2019 (pre-pandemic) and the bottom two pictures give some details. Note how long these homes took to sell (3 and 5 years). High quality higher-end homes can sell in days now despite a slight slowdown. I remain in shock that Naples condos can go for $50mm+ today. The pandemic changed the game for South Florida R/E prices which on the higher end are up 2-5 times in many cases.

Great New York Magazine article on NYC office market and RXR’s Rechler opens up on the market in the piece. According to Cushman & Wakefield, Manhattan’s office-vacancy rate is around 22 percent, the highest recorded since market tracking began in 1984. When you include sublet space, more than 128 buildings in Manhattan currently list more than 200,000 square feet of space as available for lease, according to data from the firm CoStar. The available space in these buildings alone amounts to more than 52 million square feet: the equivalent of more than 40 skyscrapers the size of the Chrysler Building. Certain areas and building types are particularly endangered — the Garment District lofts once favored by tech start-ups, the generic glass gulch of Third Avenue in the 40s and 50s — but the pain is widely distributed. Many large property owners are now performing triage, trying to determine which buildings are still worth anything like what they paid for them. Today, three years after the pandemic emptied office buildings nationwide, Rechler has been forced to reckon with the possibility that the buildings that were worth so much not so long ago may now not even be worth keeping. Corporate tenants are typically locked into multiyear leases, which guarantee stability in the commercial real-estate market for a time. But every month, more leases expire, giving tenants an opportunity to rethink their space, and every day, employers are staring at empty desks. Many companies, which had been trying to squeeze more workers into less space for years, are not renewing. That leaves an office landlord facing hard choices.

I wrote about the record $1.2bn land sale in Miami a few months back, but this WSJ article suggested the deal fell apart. The current owner paid $236mm in 2011 for the property (former Miami Herald HQ) which is now back on the market. I understood that the buyer who walked was going to do some type of mixed use with residences, office, retail.

Billionaire Ken Griffin snapped up a property on Palm Beach’s Worth Avenue for US$83 million, located next to a former Neiman Marcus store that his firm has planned to use as an office. With the latest purchase, Griffin now owns both properties at 125 Worth Ave and 151 Worth Ave, according to spokesperson Zia Ahmed.

Thanks for the kind words. Glad You are enjoying the report. Gradon is an interesting character, but I have much better hair!

Eric- I have only recently become a subscriber and I really enjoy your comments, content and stories. I happened to see an article about Graydon Carter and his newsletter, Air Mail, which made me think of you. This article was in the July 18 Evening Standard. A quick synopsis follows:

"....Air Mail is now big enough to support ‘a large-scale print magazine’ later this year. It will be heading for coffee tables everywhere.

Amid the welter of the weekend press, there’s one guaranteed Saturday morning treat.

It’s the latest Air Mail from Graydon Carter. Air Mail is the former Vanity Fair editor’s weekly digital newsletter. As he promises, with classic Graydon panache and lack of understatement, his missive “unfolds like the better weekend editions of your favourite newspapers”..."