Opening Comments

The last report, “Eleanor,” about people who hijack conversations received a lot of interesting commentary. The two most opened links were Cembalest’s piece on IPOs entitled Mr. Toad’s Wild Ride, and the packing hack you need to use for your next long trip.

I went to Vegas to speak at an insurance conference as the keynote speaker and stayed at the Mirage Hotel. I will write about what happened in a future report but suffice it to say that I feel the speech was a success, and the feedback has been quite positive. It was of the best responses I have ever received from a speech. I posed for hundreds of selfies and answered questions for 1 hour after the speech.

Not sure you have paid attention to the temperature, but it was boiling in Vegas. I had never been in 115 degree temperatures and can tell you it was painful. Friday had a Real Feel of 118. I will only say this statement, “Dry heat, my ass!” I am sick of the Arizona and Vegas people saying, “Really, it is not bad given it is a dry heat.” Stop lying to me and yourself. It was worse than Florida, especially at night. The heat was oppressive, and I cut the trip short because I could not be outside. These “Dry Heat Liars” are like the “Commuter Liars” who tell me door to door from Westport, CT to the office in NYC is an hour and 12 minutes. Yeah right. You know it is an hour 45 minutes best case. At 11pm it was 103 in Vegas. I met friends .5 miles away and was unable to walk due to fear of heat stroke. The cab ride was $26, which makes NYC seem cheap.

I called the Gambian Giant, Ali, to pick me up at the airport to take me back to Southamtpon. I read him my report, “Who in the Hell is Don Williams” about our previous interaction and he loved it. We had dinner together Saturday night.

I am very proud of how the Rosen Report has grown with a following of incredibly influential readers. I am humbled by the connections and friendships I have made. I learn a great deal from my readers who also contribute with story ideas, news links and charts for reports. I have my 1st sponsor (3i Members) and am doing far more speaking engagements. I am also working with more companies in various regards (boards, advisory, mentoring management…). If you think I can be of service, please let me know. As you may know, I have written approximately 1,000 reports over the past 3.5 years and have never charged or made money from it. My near 10,000 hours is starting to pay off. Just think, I almost stopped writing just a few short months ago. Some good friends thankfully talked me out of ending the newsletter.

I have a flurry of new readers and want to be sure you know that many email systems truncate the Rosen Report. Reminder to hit “View Entire Message.” Also you can follow me on LinkedIn or download the Substack App to be sure you don’t miss any reports. Some go to spam or disappear into the abyss.

Quick Bites

Markets

Expert Market Concerns

Kindergarteners with Savings Accounts

Berkshire Coming Investing in Florida Insurance

Barry Sternlicht on R/E Market Hurricane

Distressed Office Market

Housing Sales Slow Due to Lack of Supply

Sub Belt New Apartments Coming on Line

Video of the Day-Sebonack Golf Course Protests

Check out this short video which shows protestors at the $1.3mm initiation fee golf course, Sebonack last week. They are protesting wealth and climate change. They chant, “Tax the rich,” and suggest the land is Shinnecock land. There is some strong language in the link. I have played this course many times and it is stunning. I was there two weeks ago for dinner. Check out the stunning pictures of the course.

Pay By the Hair

I think my frugality is approaching legendary status. I wrote a piece in December 2021, entitled “You Had Me At Clearance Sale.” I prefer to brag about how much I save rather than how much I spend. I do drive a Kia Telluride after all. I sold another 4 in the last month through the Rosen Report which brings the total to over 60. I have written extensively about how much less expensive Florida is than NYC. It is laughable how much I save by living 1,500 miles south of NYC on everything and then throw in the tax savings on top of it.

I was in the Hamptons for a few days and am working on a few reports about what has gone on there. As a clue, one might be called, Botswana Wins over Hamptons in One Regard. Those Hamptons folks know what I am talking about.

My hair has also reached legendary status. Not unlike Sampson from the Bible, my hair gives me strength. For those new readers, a couple of pictures to catch you up on my hair’s greatness which goes back over 45 years.

Unfortunately, the hair, which my grandmother hated and resulted in her calling me the “Wild Man from Borneo,” needs to be tamed more regularly than most. I get my haircut from Beau in Boca for $30+$10 tip. I get it cut every 5 weeks and I was due, but in the Hamptons last week. I called around to find haircuts cost $75-150 for a men’s cut and more for women. I swear, I looked into flights to Florida rather than spend that much on a haircut. I would rather shave my head than pay $150 for a haircut.

Given my speaking engagement in Vegas last Friday, I needed a haircut immediately, as there is not enough petroleum products to tame this monster. I went to a local salon in Southampton which charged $75. I was livid, but went given I had no choice. They washed my hair (best part about any haircut) and an Ecuadorian woman came to my chair and asked what I wanted done. In the past 30 years, I always said, “Give me a trim of 1/2,” regardless of the length of my hair. When paying FULL price, I felt morally obligated to get more hair cut than normal, as I had to get the price per inch down commensurate with my Beau haircuts. The end result is I can now officially join the military and am ready to report for basic training ala Stripes (one of the best movies ever). I don’t know how many inches were cut, but I think lost 8 pounds.

To add insult to injury, Howard, CEO of the company where I was the keynote speaker, said something funny when he saw me for the first time at the conference. “Eric, what happened to all your hair? It’s gone.” Howard is follicly challenged and has been impressed with my hair historically, always commenting on its greatness. I had to tell him about my thought on cost per hair being cut and the resulting short hair. The Hamptons haircut is clearly taking away my mojo and my penny pinching ways strike again. Good news, the wild man from Borneo’s hair grows like a weed, and I will be back to full strength in no time.

There are many reasons to avoid the Hamptons (traffic, cell service, lack of restaurants, golf access, food costs, and overall challenges of the poor infrastructure). A new reason to hate on the Hamptons is the cost of a haircut and then the resulting baldness which ensues when you feel morally obligated to get your money’s worth. This is me after my $75 cut+$15 tip+$5 for the hair wash. A $90 haircut should get me a lunch with a nice bottle of wine too.

Quick Bites

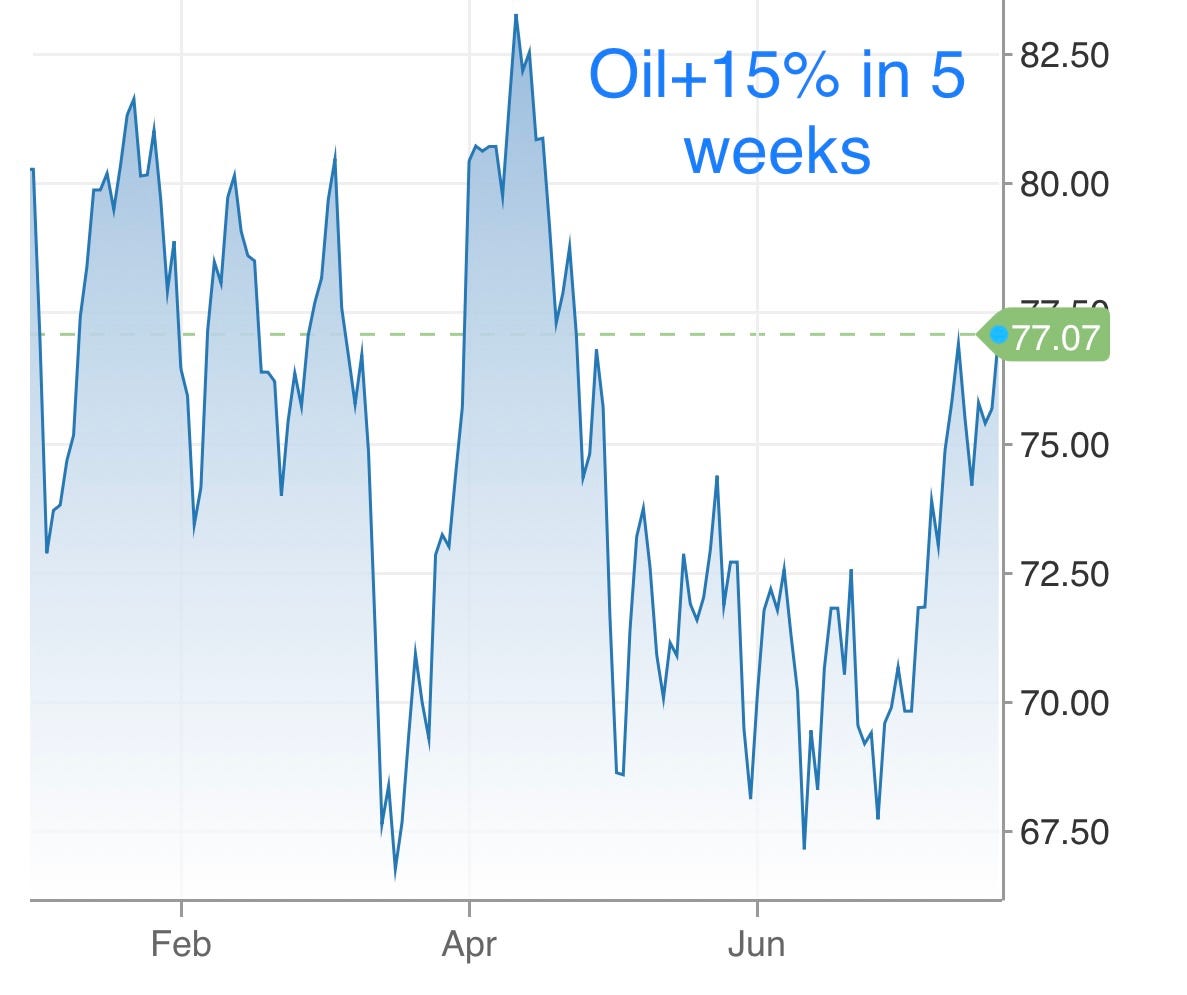

Stocks were mixed Friday as traders assessed the latest corporate earnings results, and the Dow stretched its winning streak to 10 sessions. On a weekly basis, the S&P 500 added 0.69%, while the Dow gained 2.08%. It was the second positive week in a row for the two indexes. The Nasdaq fell 0.57% for the period. Trading was volatile Friday as portfolio managers recalibrated their funds to account for an unusual Nasdaq-100 rebalance taking effect Monday. A large volume of index and stock options also expired Friday. 75% of earnings released have beat expectations. Treasuries were little changed and the 2-year is now 4.85% and the 10-year is 3.84%. You can get 5.4% in 1-year treasuries. Of note, oil has rallied for 4 straight weeks on tightening supply. WTI is now over $77/barrel and Brent is over $81. WTI is now down less than 3% on the year after being down big a couple months ago when it hit $67.

Interesting Bloomberg article entitled, “Selloffs, Inequality, China Tension: Here Are the Next Big Risks-Three Wall Street veterans weigh in on the dangers facing investors in coming years.” Boaz Weinstien (Saba Capital Founder) shared his concerns around the Fed’s limitations due to higher rates, Quantitative Tightening and the impact on higher borrowing costs on corporates with leverage. Weinstein questioned the Fed’s ability to stave off market sell-offs going forward. David Rubenstein (founder of Carlyle) believes worsening inequality is the big concern. He cites entitlement programs running out of money (where have we heard this before)? He also discussed income inequality and the $32 trillion in Federal Debt, up from $1 trillion when he worked in the Carter administration. Ida Liu, (global head of private banking at Citi) is most concerned about China, namely the Taiwan situation. She cited semiconductor production in Taiwan as something to consider as a future issue.

Great WSJ article entitled, “600 Kindergartners Were Given Bank Accounts. Here’s What They Learned.” Students are automatically enrolled in the Kindergarten to College Program and are given a Citibank account with a $50 balance. Students and their families are then encouraged to build up their savings through various incentives, including art competitions and scholarship opportunities for which winners can earn extra money for their accounts. The city also matches deposits from low-income families at certain schools. The accounts, which earn a small amount of interest, do have some restrictions: The money cannot be accessed until college and can only be directed to higher education-related expenses. The need for such programs stems from two of the biggest financial challenges faced by millions of American families: low levels of financial literacy and the skyrocketing cost of higher education. Most Americans lack basic financial knowledge, surveys find, a gap that can result in more debt, poorer savings habits and not having enough money for retirement. College tuition, meanwhile, averaged $10,950 for in-state students at public four-year colleges in the 2022-2023 school year and $39,400 for private nonprofit four-year schools, according to the College Board. These lessons on financial matters are critical for children. I think it is an interesting program. I feel we live in an instant gratification society and that is dangerous from a financial perspective. Being fiscally responsible is imperative for wealth creation. I just wish the politicians would consider that point too.

I have written extensively about the problems with homeowner’s insurance in Florida given many insurance companies refuse to underwrite new policies. The result is premiums are skyrocketing as much as 500%. However, superman might be coming to the rescue based on this article, “Warren Buffett’s Florida Bet Bodes Well for Troubled Insurance Market.” My friend, Ajit Jain (head of Berkshire’s Insurance Unit) said the firm increased its property-catastrophe exposure by nearly 50% this year including up to $15bn new risk in Florida. Leave it up to the smartest insurance minds in the world to come in when pricing gets stupid. Jain said, “We had a lot of powder dry and we were lucky that we kept the powder dry, because April 1 suddenly prices zoomed up again a lot higher than what they were on January 1, and starting to look attractive to us... Net-net, I’m very happy with the portfolio. It’s been a lot better — it is a lot better than what it’s been in the past. I don’t know how long it will last, and of course, if the hurricane happens in Florida, we could lose across all the units, we could lose as much as $15 billion. And if there isn’t a loss, we will make several billion dollars as profit.”

Other Headlines

One measure of ‘the market’ is up 34% this year while another is only up 6%—here’s why

Johnson & Johnson beats on earnings, hikes full-year guidance as medtech sales surge

TSMC reports first profit drop in 4 years as electronics demand slump continues

Half of Threads’ users have dropped off as Meta app struggles to hold attention

After a hot start, Threads traffic is plummeting from both a usage and time perspective.

The article suggests with price increases, typical bills could double by 2025.

California Looks Into the Future — and Sees Fewer Californians

I wonder why so many people are leaving CA? Taxes, crime, homelessness, woke policy, gas prices, weak power grid, natural disasters (fire, flood, drought, earthquakes, mudslides), traffic, gas prices, electric bills? I just can’t figure it out.

Box Office Fusion: ‘Barbie’ Heads for Staggering $155M-Plus Opening, ‘Oppenheimer’ Eyes $77M

I want to see Oppenheimer. I am not sure how much money it would take me to see Barbie.

FBI told Twitter Hunter Biden laptop was real day of Post scoop, official says

Concerning that Twitter continued to block the laptop story despite knowing it was real.

Brutal New Poll Shows Trump Losing Big to Biden, Even With Third Party Spoiler

We need a White Knight to come in and save the day. New candidates please.

There's Big Poll Movement in the GOP Primary

Suggests Vivek Ramaswamy is tied with DeSantis.

Judge sets Trump classified documents trial for May 2024, months before election

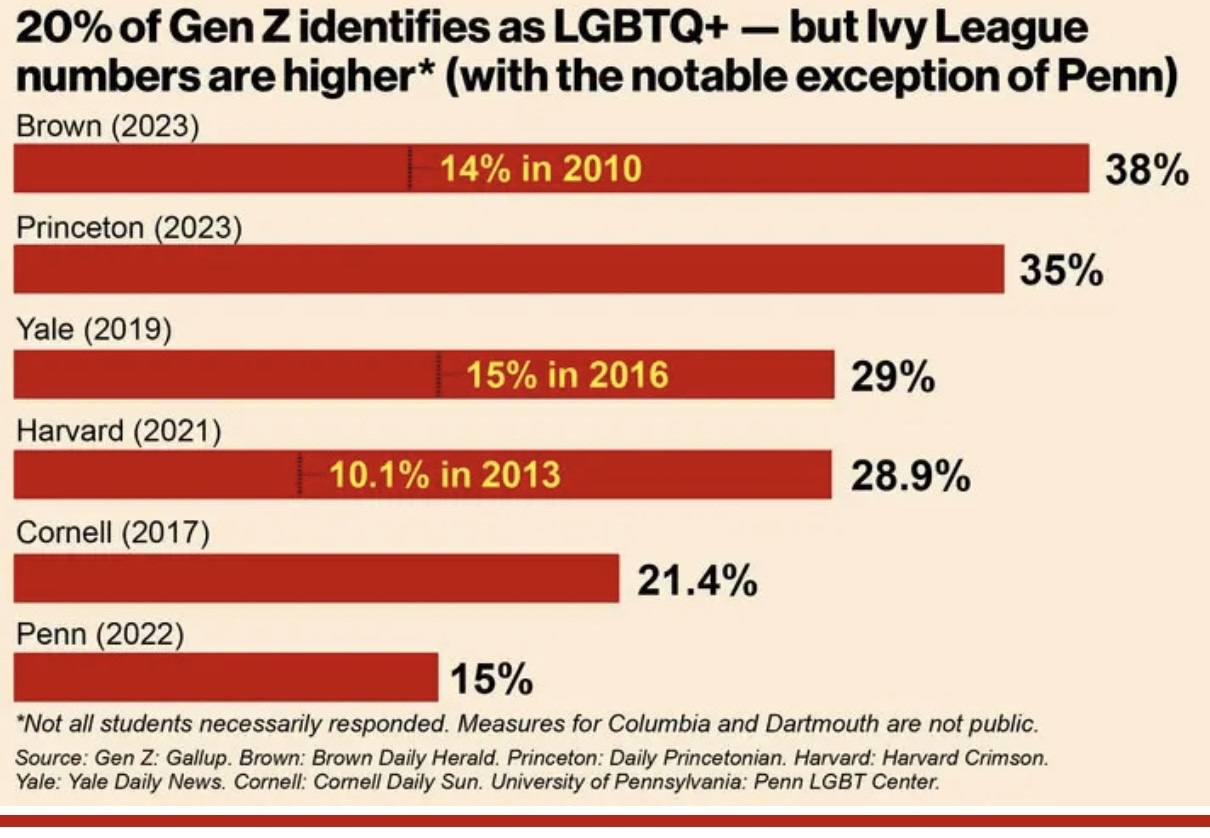

Ivy League LGBTQ+ numbers soar and students point to identity politics

Remind me why wealthy are leaving Chicago and major companies have left the once great city. I have dozens of friends in the Chicago suburbs and most claim they have not gone into the city for ANY REASON in years due to safety concerns. How astonishing. A city with vibrant culture, amazing sports, restaurants and people are scared to drive 45 minutes from the North Shore to experience it. Sorry, leadership needs to change.

Violent thieves in D.C. target pedestrians, cyclists, drivers day and night - Washington Times

Miami mom tried to hire hit man to kill 3-year-old son through parody website

What the hell is wrong with people?

Lowe’s worker axed after getting black eye trying to stop thieves

68-year-old woman attacked and then FIRED for violating company policy of interfering with crooks. We will look back at this time in history one day and not be able to digest the stupidity of the policies.

CEO of Company that Wants to Scan Your Irises: 'World ID' Is Coming 'Whether You Like It or Not'

Concerning but likely inevitable.

68-year-old who ‘un-retired’ shares the 4 biggest retirement myths 'more people need to talk about'

Love some of the points in this article from a former Monk and best selling author. Concerning-On average, a person has 11 negative thoughts every day, including “I’m not good enough” or “I’m not good looking,” according to a January poll of over 2,000 people.

'Cocaine sharks' may be feasting on drugs dumped off Florida coast

Crazy story suggests sharks may have been eating bails of cocaine and acting crazy.

An asteroid loaded with $10 quintillion worth of metals edges closer to US reach

I will take any fraction of the value of this asteroid please. Lots of brilliant Rosen Report readers. Any ideas on how I can get my paws on some of this?

How this Stanford freshman brought down the president of the university

Amazing investigative journalism by an 18-year old resulted in the George Polk Award.

Tony Bennett's Wife Susan Benedetto Shares Moving Tribute After Singer's Death at 96

What an amazing performer. Even Old Blue Eyes, Sinatra, was a huge fan. Sinatra said, “For my money, Tony Bennett is the best singer in the business.”

Real Estate

Any reader knows how much I respect Barry Sternlicht as an investor, especially in the R/E world. This Bloomberg article is entitled, Billionaire Sternlicht Sees ‘Category 5 Hurricane’ Spurred by Fed Rate Hikes.” “We’re in a Category 5 hurricane,” Sternlicht said in an interview taped in June for an upcoming episode of Bloomberg Wealth with David Rubenstein. “It’s sort of a blackout hovering over the entire industry until we get some relief or some understanding of what the Fed’s going to do over the longer term.” The predicament is unlike past real estate downturns, when aggressive risk-taking in the property industry bled into the broader financial system. This time around, according to Sternlicht, commercial real estate is collateral damage in the Federal Reserve’s efforts to calm inflation with rate hikes. Financing now is more expensive and harder to come by. Landlords with floating-rate loans are facing the prospect of higher debt payments. While office vacancies pile up in the remote-work era, demand for other property types — apartments, warehouses, hotels — remains strong for now. That could change in a recession. In the meantime, tight credit conditions are complicating developers’ efforts to start projects or refinance existing buildings. In one recent example, Starwood reached out to 33 banks for a loan on a small property and received just two offers, Sternlicht said. In the end, Barry is far closer to the action than I am. I think it is going to be challenging. I am not convinced it will be as bad as Barry suggests, but I hardly adamant about it. He is calling for up to 500 banks to fail and a second RTC (Resolution Trust Corp) which liquidated assets of S&Ls in the 80s and 90s. Fantastic Q&A in the link.

Of the $71.8B of troubled CRE assets, Office properties account for ~$24.8B, based on MSCI data (Bloomberg). The total amount of troubled assets could reach $162.3B given early indicators like delinquent payments, high vacancies, and maturing debt, with Office comprising more than a quarter of that figure.

BAM's former asset, the Gas Company Tower, which entered receivership after the firm defaulted on a $350M CMBS tied to the building, has seen its value decline 57%, from $632M in 2021 to $270M currently, according to Trepp (Commercial Observer).

Starwood Capital made news for defaulting on a $212.5M mortgage backed by Tower Place 100 in Atlanta's Buckhead area after the PE firm exercised both extension options on its loan (Bloomberg, Bisnow). Originally purchased for $192M in 2015, GS underwrote the loan at a valuation of $277M in Jun-18.

GS also noting the impact of its Office exposure in its Q2 results, with CRE losses driving writing downs in both equity and lending portfolios (Bloomberg, Presentation).

Finally, headlines also acknowledging the recent rally in Office REITs following SLG's 245 Park Ave deal with Mori Trust. Company set to report Q2 results after the close today (Bloomberg). To be clear, I question the $2bn valuation assigned to this transaction. It literally makes no sense to me.

Sales of pre-owned homes dropped 3.3% in June compared with May, running at a seasonally adjusted annualized rate of 4.16 million units, according to the National Association of Realtors. Compared with June of last year, sales were 18.9% lower. That is the slowest sales pace for June since 2009. The continued weakness in the housing market is not for lack of demand. It’s all about a critical shortage of supply. There were just 1.08 million homes for sale at the end of June, 13.6% less than June of 2022. At the current sales pace, that represents a 3.1-month supply. A six-month supply is considered balanced between buyer and seller. “There are simply not enough homes for sale,” said Lawrence Yun, chief economist for the Realtors. “The market can easily absorb a doubling of inventory.”

Interesting Real Deal article on the massive growth of new builds of Sub Belt apartments and the potential impact on pricing. A historic number of rental apartments is expected to come online in the next 18 months, the WSJ reported. More than 950,000 units are under construction, according to the U.S. Census Bureau, and many are in the Sun Belt, Green Street reported. Rent growth is already slowing or declining in many Sun Belt cities, where bidding wars were the norm only a year ago. Tenants are hitting their limits on how much rent they’re willing to pay, though, and some are making decisions based on their dire outlook for the economy.