Opening Comments

My last piece was about my first big bonus and the most opened links were iPhone settings which preserve battery life and Bank of America’s warning of the new 5% yield world.

Unfortunately, my reign as the top tennis player in the world came to a crashing halt. I knew the luck would run out and it did just that. Dave 2.0 (just lost 17 lbs) and I were eviscerated by Doug and Josh in 3 games of 21. There was nothing pretty about it. I believe in mean reversion and my one day of amazing play will likely be followed by many days of poor play.

COVID cases are on the rise (+24% over the past two weeks.) The positivity rate is 12.2% up from 4.1% in June. At least a dozen readers have reached out to me in the past two weeks telling me they tested positive with congestion, headache, fever...

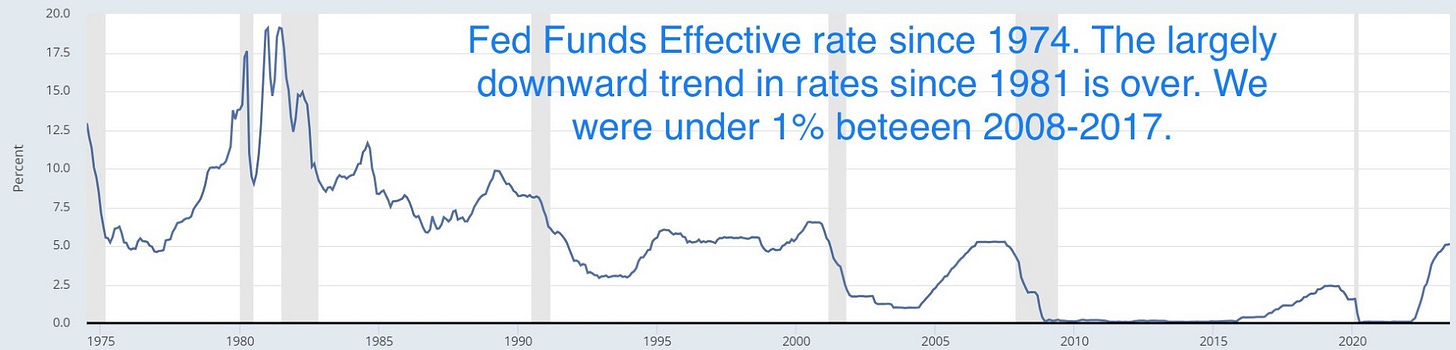

I just liked this chart sent to me by one of my biggest contributors, Robert. I had discussed this in general, but not in pictures.

Markets

New Era of Rates

$1 Trillion Left EACH State NY & CA

More Signs the Consumer is Cracking

The Message Plus Sized Models are Sending

New Home Sales

Jumbo Mortgages

$80mm NYC Condo Sale

$16mm+ Boca House Sale

Stunning Malibu Spec Home Listed for $74mm Sold for $26.5mm

Picture of the Day-Kit Mullet Contest

I saw this NY Post article on the Pennsylvania 6-year-old mullet champ and had to share it. There are some strong showings in the article. 300 kids entered the contest with $5k to the winner. Let’s not forget my high school “adorable” mullet in 1986. How in the hell did I always have dates with this moronic look? When you see my favorite movies from the 1980s, you will understand I was in high school which helped to put my best picks into perspective.

My Favorite Films Of Each Decade (1930-1990)

At one point in my life, I loved the movies and looked forward to going to the theater. I have only gone to the movie theater twice in four years (Top Gun & Oppenheimer) and my recent experience where we had to walk out of the show had me thinking about some of my favorite films. As a result, I am starting in the 1930s and going by decade through the 1990s. Clearly, I cannot discuss all of them, but try to highlight my favorites. I don’t have pictures of all the movies, but have the names and highlights with as many pictures as I could fit. I am not a fan of science fiction or superhero movies, so none of the Star Wars, Star Trek, Lord of The Rings, Marvel movies could ever make my lists. I am sure my readers will tell me about the great ones I missed, one of the reasons I wrote this note. I attached a short clip of each movie in the name so you can get a taste. I have bolded my one or two favorites from each decade.

1930s-Wizard of Oz (1939), Gone with the Wind (1939)

Two of the all-time classics. No, the Wizard of Oz was not the first time color was used in film, but the use was so dramatic, it is memorable. Clark Gable and Vivien Leigh were such stars in Gone With The Wind which received 13 Oscar nominations and won 8 of them. “Frankly, my dear, I don’t give a damn,” was said by Rhett Butler (Gable) to Scarlett O’Hara (Leigh) in Gone with the Wind.

1940s-It’s a Wonderful Life (1946), Casablanca (1942), Citizen Kane (1941), Pinocchio (1940)

I am sure everyone has seen these, especially It’s a Wonderful Life every holiday season. Casablanca has so many memorable quotes which you can see here. The movie was nominated for 8 Oscars and won 3 of them.

1950s-12 Angry Men (1957), On the Waterfront (1954), Some Like It Hot (1959), North by Northwest (1959), Singin’ in the Rain (1952), A Streetcar Named Desire (1951)

The actors in 12 Angry Men and On the Waterfront are amazing. Brando was the star of both On the Waterfront and Streetcar. The scene from the Waterfront in the back of the car where Brando tells his brother “You was my brother Charlie, you should’ve looked out for me a little bit,” is one of the best scenes I can recall. Must see flicks. Some Like It Hot is a classic with Marilyn Monroe, Tony Curtis, and Jack Lemon.

1960s-Guess Who’s Coming to Dinner (1967), Cool Hand Luke (1967), To Kill a Mockingbird (1962) and The Graduate (1967)

Guess Who’s Coming to Dinner was about a White woman who brings home a Black man (Sidney Portier) to meet her family. It is from 1967. Spencer Tracey was the father and believe it was his last movie. Katherine Hepburn was the mother. Remember, at the time of the movie, interracial marriage was illegal in 17 states. Cool Hand Luke is on my all-time favorite list. Wow, Paul Newman was a cool cat and the movie had an amazing cast. To Kill a Mockingbird is my favorite book and Gregory Peck is remarkable in the film. Who does not love Dustin Hoffman and Anne Bancroft in The Graduate? Best soundtrack ever? It was scandalous in 1967 and now it is on Bravo every night with more skin.

1970s-The Godfather (1972), Jaws (1975), Taxi Driver (1976), One Flew Over the Cockoo’s Nest (1975), Kramer vs Kramer (1979), Grease (1978)

The Godfather had 11 nominations and won 3 Oscar awards. Jaws scared the living crap out of me and I was scared to take a bath or jump in a pool. DeNiro, Nicholson, Hoffman, Streep in the other films, come on, man. These are top-notch classics. I remember watching Grease as a kid and thinking it was pretty cool.

1980s-E.T. the Extra-Terrestrial (1982), Dead Poets Society (1989), The Breakfast Club (1985), Airplane (1980), Raiders of the Lost Ark (1981), Scarface (1983), When Harry Met Sally (1989), 16 Candles (1984), Stripes (1981), Fletch (1985)

Spielberg strikes again with ET. My favorite Robin Williams movie was Dead Poets Society. The classic John Hughes film, The Breakfast Club, is on everyone’s list who is in my age range. Scarface is remarkable for so many reasons and one of Pacino’s best films. Raiders, Harry Met Sally, 16 Candles, and Stripes are all must-see as well. When you consider the movies I picked from the 1980s, you just have to laugh. So much fun. This was me for Halloween last year as Fletch. No wig. Jill went as 80s disco.

1990s-Forrest Gump (1994), Goodwill Hunting (1997), The Silence of the Lambs (1991), Fargo (1996), Titanic (1997), Schindler’s List (1993), Pulp Fiction (1994), The Shawshank Redemption (1994), Goodfellas (1990), Austin Powers (1997)

When I saw the preview for Forrest Gump, I thought it looked so stupid that I vowed never to see it. Clearly, I was wrong. Goodwill Hunting was a remarkable movie with a great story and world-class acting. The Silence of The Lambs was another scary flick that had me looking over my shoulder. Shawshank was memorable on so many levels, it is hard to describe. My favorite comedy from the 1990s is Austin Powers. At one point, I might have memorized 80% of the movie.

Tell me your favorites. What did I miss?

Quick Bites

Stocks rallied sharply Wednesday ahead of Nvidia earnings. The Dow closed 184 points higher, or 0.5%. The S&P 500 gained 1.1% to end the day at 4,436.01, its best daily performance since June 30. The Nasdaq climbed 1.6% to 13,721.03, making for three straight days of gains. Nvidia CRUSHED earnings and was +8% after hours. The stock is up almost 240% YTD with a market cap of over $1.2 trillion. Treasury markets rallied ahead of Powell’s speech Friday with the 2-Year down 7bps to 4.97% and the 10 year -13bps to 4.20%. Oil slid below $79/barrel on weak manufacturing data out of Europe and Japan coupled with a build in US gasoline inventory.

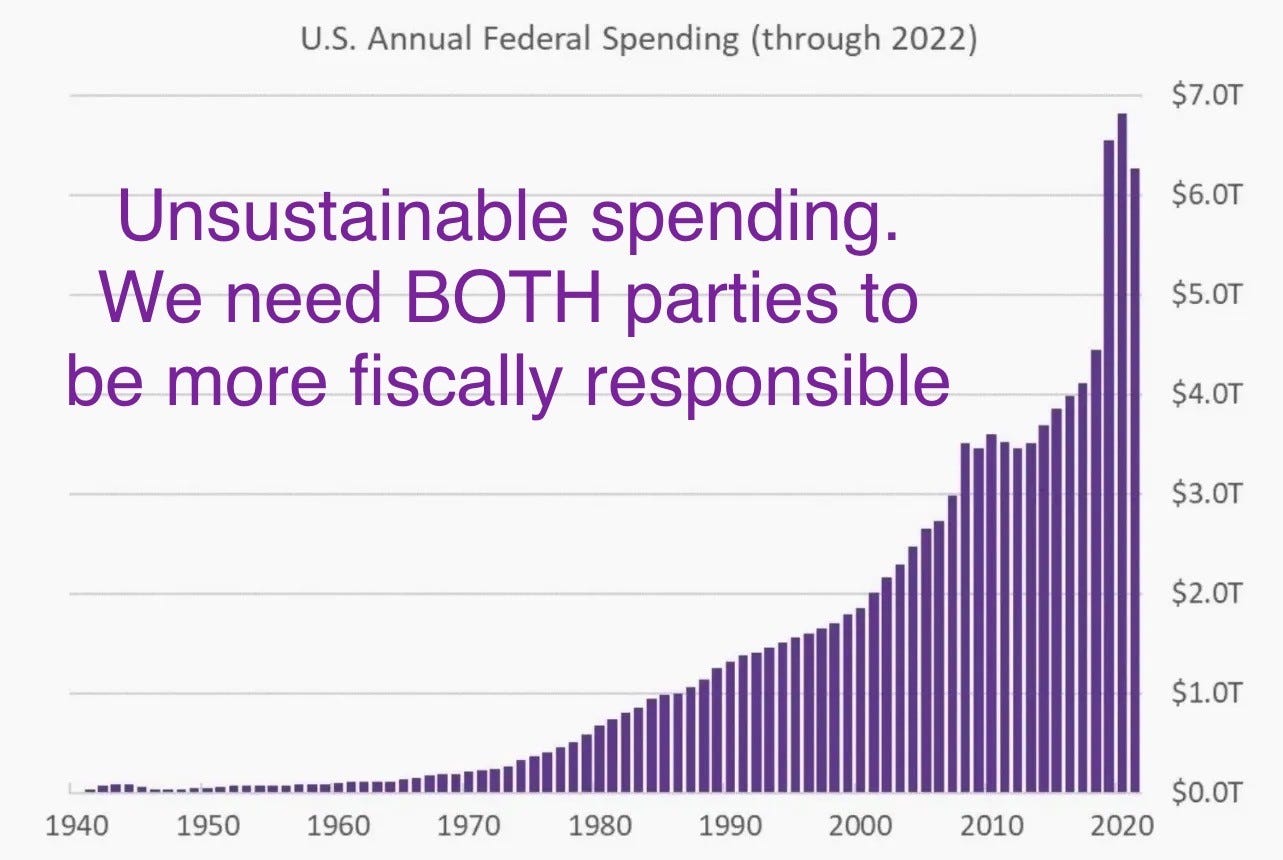

I thought this WSJ article, “Why the Era of Historically Low Interest Rates Could Be Over,” had an interesting perspective. Despite the Federal Reserve’s raising interest rates to a 22-year high, the economy remains surprisingly resilient, with estimates putting third-quarter growth on pace to easily exceed its 2% trend. It is one of the factors leading some economists to question whether rates will ever return to the lower levels that prevailed before 2020 even if inflation returns to the Fed’s 2% target over the next few years. At issue is what is known as the neutral rate of interest. It is the rate at which the demand and supply of savings is in equilibrium, leading to stable economic growth and inflation. Analysts see three broad reasons neutral might go higher than before 2020. First, economic growth is now running well above Fed estimates of its long-run “potential” rate of around 2%, suggesting interest rates at their current level of 5.25% and 5.5% simply aren’t restrictive. Second, swelling government deficits and investment in clean energy could increase the demand for savings, pushing neutral higher (check out last chart on Federal Spending). Third, retirees in industrial economies who had been saving for retirement might now be spending those savings. The markets are pricing in cuts in 2024, but I don’t see the Fed going back to near zero anytime soon. The 10-Year hit 4.35% on Monday and was .31% in March of 2020. I have been critical of the Fed and Treasury Department for good reason. They were 100% wrong on “Transitory” inflation. Check the last charts on how S&P 500 companies (ex-financials) pushed out maturities and locked in low rates relative to the US Government. Unfortunately, the morons in the government did not follow suit and it will cost US taxpayers TRILLIONS over time.

Interesting Bloomberg article entitled, “New York and California Each Lost $1 Trillion When Financial Firms Moved South. The drip, drip, drip of the finance industry’s exit from New York and California has been measured anecdotally, one at a time, these past few years. Elliott Management decamped to West Palm Beach. AllianceBernstein to Nashville. Charles Schwab moved to suburban Dallas. Now, for the first time, there are hard numbers quantifying the exact scope of the exodus. Both states have in the past three years lost firms that managed close to $1 trillion of assets, Bloomberg News calculated after going through corporate filings from more than 17,000 firms since the end of 2019. To be sure, the New York-area remains the most powerful center for asset management, but down south, the upheaval is fueling a boom. Miami’s house prices are soaring and a spate of new office buildings are under development. In Dallas, the finance industry is expanding at the fastest pace since the 1980s oil bust, with new campuses to accommodate thousands of employees for Goldman Sachs Group Inc. and Wells Fargo & Co. coming on the heels of Charles Schwab Corp.’s move to the area in 2020. Taxes were always high in CA and NY and are only one part of the equation. The continued deterioration in the quality of life and work from home is having a big impact. The article shows 104 firms moved from NY to FL. NY alone lost $993 billion in assets that moved headquarters out of the state.

I have been raising the alarm on the US consumer for 6 months. Yes, I was early. However, I see more signs of cracking every day. Missed Car Payments A Menacing Sign for New Car Market is one example. Severe delinquency for auto loans, based on seasonalized rates, is at the highest since at least 2006, and the trend could be an ominous sign. Also, people paid huge premiums for cars during the pandemic and prices are crashing which will hurt lenders. Auto delinquency rates are rising. On the credit card front, check out the massive spike in delinquencies in recent months which is WORSE than 2008 and note the massive growth in card balances (over $1 trillion today). For perspective, card debt was $370bn in 2008, $650bn in 2010, and $750bn in 2021. What happens in coming months? On Wednesday, Foot Locker shares plunged 30% as it slashed guidance and blamed ‘consumer softness.’

I have written often about obesity issues in the US. As of 2020, 42% of Americans are obese and 67% are overweight. In 1960, the US obesity rate was 10.4%. “For the first time in history, there are now 200 million more

overweight and obese people in the world than those starving and

underweight; over-nutrition is now a real problem,” was a quote from Dr. Tim Spector, The Diet Myth. Processed foods, unhealthy diet choices, sedentary lifestyles, video games, and smartphones… have all contributed. Given my father’s passing of a heart attack at age 39, I take my health quite seriously and eat a balanced diet and exercise. This CNN article outlines “Plus Sized Fashion” for women. In both the United States and the UK, the average woman today is a size 16 (though a British 16 is equivalent to a 12 in the US). Sixty-seven percent of US women are considered plus-size. Given the diseases seen as more prevalent by obese patients largely caused by poor diet habits (diabetes, cancer, heart disease, stroke, high blood pressure, sleep apnea and many others, I do not support the glorification of being overweight and out of shape. Now, exercise magazines have 250-pound+ people on the cover. To suggest it is healthy or the new “normal” is disingenuous. Just like showing anorexic models as healthy sends the wrong message, so too does glorifying obesity. An article suggests that 51% of the world will be obese by 2035 which is the equivalent of over 4 billion people. The global obesity rate was 23.9% in 2008. Houston, we have a problem. I am hopeful that these new “wonder drugs” will help reduce the weight issues and the diseases caused by them. However, better lifestyle choices in your diet and exercise will make you much healthier without drugs or side effects. I do not pass judgment if your choice is to be overweight but don’t tell me it is healthy.

Other Headlines

American workers are demanding almost $80,000 a year to take a new job

According to the latest New York Federal Reserve employment survey released Monday, the average “reservation wage,” or the minimum acceptable salary offer to switch jobs, rose to $78,645 during the second quarter of 2023.

Run It Cold: Why Xi Jinping Is Letting China’s Economy Flail

Palo Alto Networks shares rise more than 16% after earnings report

Dick’s shares fall 24% as retailer slashes outlook over theft concerns

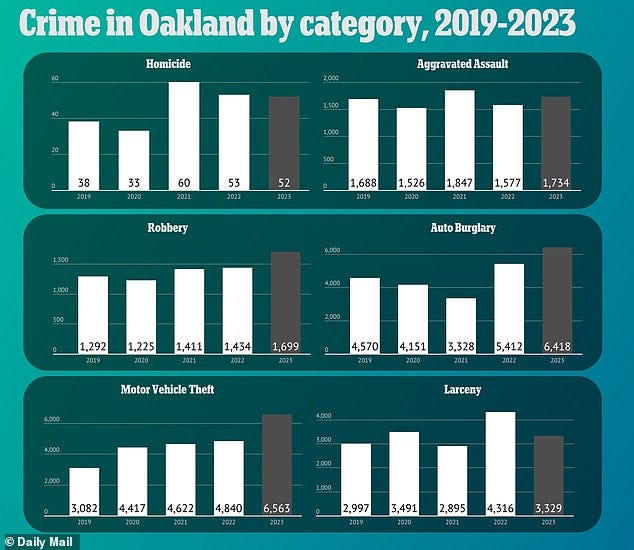

I believe in consequences for crimes and am not supportive of soft-on-crime DAs who allow people to be repeat offenders wreaking havoc on retail, consumers, and employees.

Goldman Is Cracking Down on Employees That Aren't in Office Five Days a Week

Attendance was still less than half of pre-Covid levels across 10 of the largest US business districts as of early August, according to data from Kastle Systems. Summer Fridays are cancelled.

Cracks Deepen for America’s Biggest Hospital Landlord: Struggling Tenants, a Bailout on Hold

MPT REIT owns over 400 hospitals and is now closing facilities and cutting services. The stock is -55% YTD and has a dividend yield of 16.6%.

73 Percent of GOP Voters In Survey Touted By Trump Say He Should Participate in First Primary Debate

He should be in the debate. I don’t want him to win. I hope someone does really well and challenges Trump. I also hope we have a better choice from the Dems.

Biden Economy Job Disapproval Up

Clearly, Americans are not thrilled with Biden. I feel we deserve better.

Vivek Ramaswamy could surprise everyone at first Republican debate

Ramaswamy Truths "1. God is real. 2. There are two genders. 3. Human flourishing requires fossil fuels. 4. Reverse racism is racism. 5. An open border is no border. 6. Parents determine the education of their children. 7. The nuclear family is the greatest form of governance known to mankind. 8. Capitalism lifts people up from poverty. 9. There are three branches of the U.S. government, not four. 10. The U.S. Constitution is the strongest guarantor of freedoms in history." The debate is 8/23 at 9pm on Fox and will include Pence, DeSantis, Haley, Ramaswamy, Burgum, Scott, Hutichinso and Christie.

In talks with prosecutors, Hunter Biden’s lawyers vowed to put the president on the stand

Weiss Was Preparing to Let Hunter Biden Walk With No Charges…Until This Happened

The more I read about the ongoings in DC, the more concerned I become. Weiss let statues of limitations expire on clear-cut felonies (tax evasion, gun felony, possible FARA-Foreign Agents Registration Act violations), but IRS whistleblowers exposed it.

San Francisco Supervisors vote to uphold sanctuary policy

San Francisco Supervisor Matt Dorsey proposed removing "sanctuary" protections for fentanyl dealers. Half the city's dealers are here illegally. A poll showed 70% of SF voters support the proposal. Yet every Supervisor but Dorsey voted to keep protecting the dealers. Bad policy hurts law-abiding constituents.

82% of NYers call migrant influx a serious problem, 58% want to stop the flow

America is the melting pot and I am all for LEGAL immigration and having a sound policy. However, what we have now is pandemonium and we cannot control or afford it. We need a plan and limits on the number of immigrants that we can handle each month. The current policy is absurd and more liberal politicians are complaining about systems being overwhelmed.

Pittsburgh 'active shooter situation' reported, police say 'hundreds of rounds were fired'

This was as of Wednesday afternoon.

Disturbing photos/video in the link of an incident that occurred at 6:15 pm and left the woman with severe injuries.

Driver Imani Lucas, 29, charged in NYC hit-and-run; may have suffered manic episode

Here’s how much money Americans in their 50s have in their 401(k)s

$189,800 according to Fidelity Investments.

Even millionaires are feeling financially insecure, report finds

Hilary in photos: See flooding, damage in Southern California after storm moves through

California gas prices soar to the highest point of the year

CA is at $5.26/gallon and the national average is $3.85.

The most expensive cars sold at Pebble Beach, even amid disappointing auctions

To show your appreciation for the free Rosen Report, readers should start a GoFund Me page to buy me the $30mm Ferrari. That would be nice.

Chef Michael White inks latest major restaurant deal in East Midtown with new Italian eatery

He is behind Marea, one of my favorites (opening in Palm Beach as well). White is betting on Midtown, a bold move. The link list other prominent chef eateries opening soon as well.

With Lionel Messi playing soccer in the U.S., single-game ticket prices surge by more than 1,700%

I am yet to attend a Messi game down here but am told it is pandemonium. It is similar to the Jordan impact when he was at his greatest.

It is believed he was on the plane which crashed, but not confirmed. Generally, Putin enemies fall out of windows or die of radiation poisoning. It was clear Prigozhin’s days were numbered. There were 10 people on the plane.

Real Estate

Great short video from the All-In Podcast which outlines an example of lenders pulling back sharply. David Sachs outlined an example of a loan he has which is coming due. It is a $9mm loan on a $15mm building and the lender will only give him $2.4mm instead of the current $9mm and demanded that David put up securities of $6.6mm for securities for collateral. The lender also asked that he personally guarantee the loan. The bank would be doing less than 20% LTV. This is the new world. I have written about this regularly. Each day that goes by, I am more confident that the pull-back in lending, higher rates, and lower valuations in many commercial R/E areas will lead to real pain.

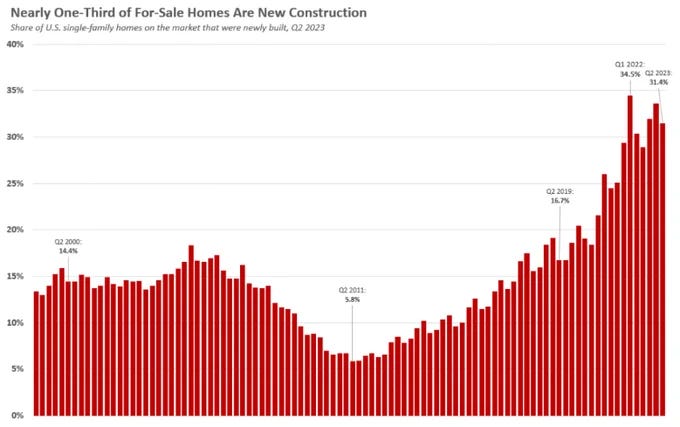

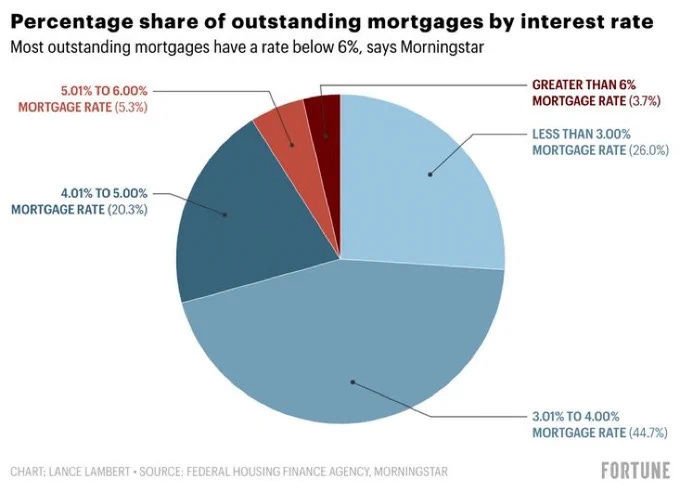

I thought this chart showing new home sales making up 31% of homes for sale in the 2nd quarter was interesting. It is the highest rate ever in the 2nd quarter. Clearly, the sharp uptick in rates is preventing many from moving as the new rate is sharply higher than the one owners are currently paying. Today, just 3.7% of borrowers have a rate of 6% or higher, but 26% are paying below 3% and 91% of all borrowers are paying below 5% for their mortgage. I wonder what these numbers look like in 3 to 5 years?

Banks are tapping the brakes on big home loans known as jumbo mortgages, which they have typically viewed as a low-risk way to attract wealthy customers. In the past year, the Federal Reserve’s steep interest-rate increases and a series of bank failures have dimmed their appetite. Now affluent home buyers are no longer getting the special treatment and preferential rates they hoped for.

Rates are rising faster for jumbos, which are typically above $726,200. Jumbos usually carry lower rates than regular-size mortgages, but that has reversed in recent months. The going rate on a jumbo was 7.44% on Friday, versus 7.20% for a typical smaller loan, according to mortgage-data and technology company Black Knight. The availability of jumbos has been falling for three straight months, the Mortgage Bankers Association said.

An apartment on Billionaires’ Row in New York is selling for around $80 million, making it one of the priciest deals in the city so far this year, according to two people familiar with the situation. The apartment is located at the condominium 220 Central Park South. The seller was a company tied to New York-based Nima Capital, an investment firm headed by entrepreneur Suna Said, according to property records and people familiar with the situation. Said couldn’t immediately be reached for comment. The entity paid $65.59 million for the Central Park-facing apartment in 2020, records show. The buyer couldn’t be determined. The unit spans close to 8,000 square feet, according to the building’s offering plan. Another $10,000/ft deal at 220 CPS. The amenities and views are remarkable. I don’t love the location and the smaller apartments (under 3,000 ft) are underwhelming to me. Small kitchens.

I saw this house just went under contract in Boca Raton, Royal Palm Community. The last asking price was $16,995,000. The SRD-built home is on the golf course is 8,344 ft. The place looks good. I love the garage doors which are shockingly expensive. This type of home would have sold in 2017 in the $6 million+ range. I bought the most expensive home ever sold on the golf course for $6.3 (at the time) in 2017 for perspective. My lot is 20% larger as well and in a better location.

Crazy WSJ article entitled, “First Asking $74.8 Million, a Malibu Spec Mansion Fetches $26.5 Million at Auction.” Amazing pictures and $26.5 seems too cheap to me for this oceanfront home, but it is NOT in the heart of Malibu. Clearly, overpriced initially. The article discusses the slowing high-end spec market and this is a perfect example.

Great movie for sure. Thanks

eric- not naming Heat as a best movie of the 90s is a severe miss.