Opening Comments

The most opened links in my last piece, I Lost the Club Championship were the video of the day of a sinking boat and the ghost town in China.

I am often asked what newsletters I read and there are only a handful I try to follow. I like the Boock Report by Peter Boockvar and he often contributes to my newsletter., Bari Weiss and The Ross Rant are others I read. Whitney Tilson’s newsletter gives a lot of information and he often sends me story ideas. Tilson also does deep dives and lately has been writing extensively on weight loss drugs. Obviously, anytime, I see anything from Mike Cembalest (JPM), it goes into the report as well.

The one big thing about being home is cooking every night. All the Yellowfin Tuna caught in July in the Bahamas is now dinner. Lots of steak too.

Markets

Treasury Yields

Mortgage Rates

$105 Trillion Global Economy

High-End Miami Remains Hot

World’s “Cheapest” Home

Fortress Office Loan Portfolio Purchase

More NYC Office Buildings in Trouble

CRE Loan Volumes Crashing Y-O-Y

Pebble Beach House for $29mm

Vacant Lots in Cities

Pictures of the Day

I went to Nashville last week for a 24-hour stay to visit a friend. My short time there was eye-opening. I cannot imagine how more construction cranes can possibly fit in a city of that size. New office towers are going up everywhere and the city is bustling with young people, hip restaurants, music, and energy. This link has a list of companies who have offices in Nashville and it is impressive including Amazon, Dollar General, HCA, iHeart, Nissan North America, AT&T, Dell, Kroger, Walgreens, Oracle… We went to Justin Timerblake’s restaurant The Twelve Thirty Club which is in the heart of the city. $25mm was spent in building out the impressive restaurant in the area they call, NashVegas. The food was very good and there was great live music. There is a great rooftop bar. In a prior trip, I went to Adele’s which had amazing food.

Nashville is no longer “cheap,” but I do enjoy my time there. Every restaurant big and small plays music. Four Seasons built condos and I am told they sold out in days. Nashville is BOOMING. Here is a link to the current listings at the Four Seasons Nashville. Pictures below were from my phone just driving around town. One aside. Generally, my flights are 100% full. My flight to Nashville had 25 people on it and flight back, maybe 70. All other recent flights have been 100% full.

My 1st Payday

I started my career at Continental Bank in Chicago in 1992 and entered the training program where I was paid $28k/year + $5k in moving expenses. After a miserable first job in the boring division called, “Large Corporates,” where we lent money to investment-grade companies, I got my dream job on the Loan Trading desk. I had always wanted to be in trading and thrived in my new role. The team was very supportive of me, and I was growing, learning, and developing my skills as an analyst, trader, and salesperson at the same time. Never underestimate the importance of doing what you love and working with people you respect. It was the single biggest development growth in my career in a short time. Personal growth and improvement were huge motivators for me. Back in the old days, business school was more important than today. I was planning on applying to full-time business school and told my boss, Walt, that if I got in, I was going. He said, “Eric, if you go to the University of Chicago at night, I will pay 100% of it for you.”

At the time (1995), I was making less than $100k and had $30k in the bank. The thought of spending over $100k on school was concerning, so I agreed to work full-time and go at night. It was a miserable three years of long hours and no social life. I continued to thrive at work, and in 1996 want to say I made $160k or so. As I was winding down at UofC and my trading prowess was growing, I was getting more interest from NYC firms to run trading desks. I went to Walt and explained what was happening and asked for his guidance. He let me know I should move to NYC to “make it to the big leagues.” Walt instilled confidence in me and was always very supportive. We still speak today.

Despite Walt’s vote of confidence, I was still a little concerned about moving to NYC. I called up my grandmother who was 91 years old and told her I had a great opportunity, but I had some reservations. I told her I feared failing and not being good enough to make in NYC. My little, old nanny ripped me apart and told me nothing could stop me from being successful. It was just the kick in the pants I needed, as I was not going to let my 4’9” grandmother trash-talk me.

I had multiple offers but went with Chase (which became JPM in 2004) to run the Par Loan Trading Desk. Two trading desks tended to be part of the same group. The Par Loan Desk which traded performing loans generally from the 92-100 price range and the Distressed Desk which handled lower dollar priced transactions. The person at Chase I would be reporting to was responsible for both desks and I would be running Par and he, Distressed.

I was thriving in my new job and building a great business. Trading activity was growing exponentially, and the clients were coming to Chase more every day for their trading needs. The team was shaping up and the new hires were working well together. Prior to my 1st year wrapping up, I was promoted to run both trading desks and my former boss would report to me. I don’t know if I ever had a better time working than in the early days at Chase. I loved my team and growing a business. From 1997-2004 were some of my fondest career memories.

At the end of the year, I was given a bonus from one of my favorite bosses of all time, Peter Schmidt-Fellner. I was there on a $500k guarantee and assumed that would be my compensation. Peter said, “Eric, you did a great job this year and we promoted you. We thought you deserved a bit extra to send the message that you are doing a great job. He told me my total compensation would be $1,000,000, and I was in shock.

I did not know what to say. I stuttered “Thank you for believing in me,” shook his hand, and left. In my dreams, I never thought I could make that much money. I went to the bathroom to collect myself. I could not believe what just transpired and the money I was paid. It was a surreal experience for someone with my upbringing who just turned 28 two-months prior. I was trying to process what just took place and I was struggling to do so. I always felt hard work would lead to results but never envisioned this kind of payday.

I walked into my office and called my mom to tell her my news. Remember, she never made more than $14k/year. My mother did not believe her son could possibly make that much money. I wrote her a handwritten note (I wrote a report on the subject) and sent her a healthy check. She called me to thank me and told me she “ripped up” the check as no one has that kind of money according to my mom, Pauline.

I have three or four days in my career which stand out as the most memorable and my first bonus day at Chase is one of them. I often think about how fortunate I am for having been given amazing opportunities by people who believed in me. Not bad for a latchkey, public school kid who should not have had the chance. If you love what you do and are fortunate enough to do it with people you like and respect, you never work a day in your life. Having a boss who believes in you makes it all the better.

Quick Bites

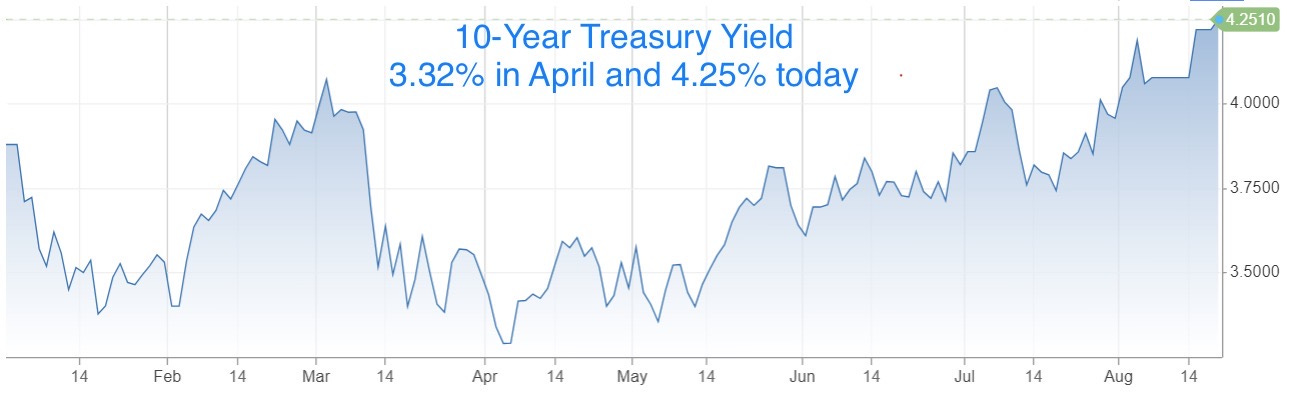

Thursday’s sell off was driven by global rates moving higher. The Dow ended the week lower by 2.2%, its worst since March. Meanwhile, the S&P 500 fell 2.1% and registered a third straight week of losses, a streak that hasn’t happened since February. The Nasdaq shed about 2.6%, tumbling for a third consecutive losing week — a first since December. This Bloomberg article is entitled, “Investors Are Leaving Stocks for the Allure of Risk-Free Payouts in Bonds.” Less than a month ago, I suggested VIX (volatility on the S&P) was too low at 13 and it hit 19 this week before settling at 17+.

The move in global Treasury markets has been substantial lately. The US 10-year Treasury hit its highest level since October 2007 (4.32%). In the UK, the 10-year hit 4.7%, the highest level since 2008. The US 30-Year is 4.38% and was under 4% a at the end of July. Although Central Banks tend to be closer to the end of rate increases, Quantitative Tightening is taking place which is adding to the global Treasury sell-off. The big moves in Japan, large US Treasury supply and big buyers gone (Central Banks) are driving the widening. The Fed and Treasury were so wrong on inflation being “Transitory” that inflation became more entrenched leading to higher for longer and causing far more damage than had they realized inflation was a problem sooner. Leaving Quantitative Easing going with zero rates while housing was on fire and not refinancing short-term Treasury bonds will prove to be very costly mistakes. Powell and Yellen will never work under the Rosen Administration.

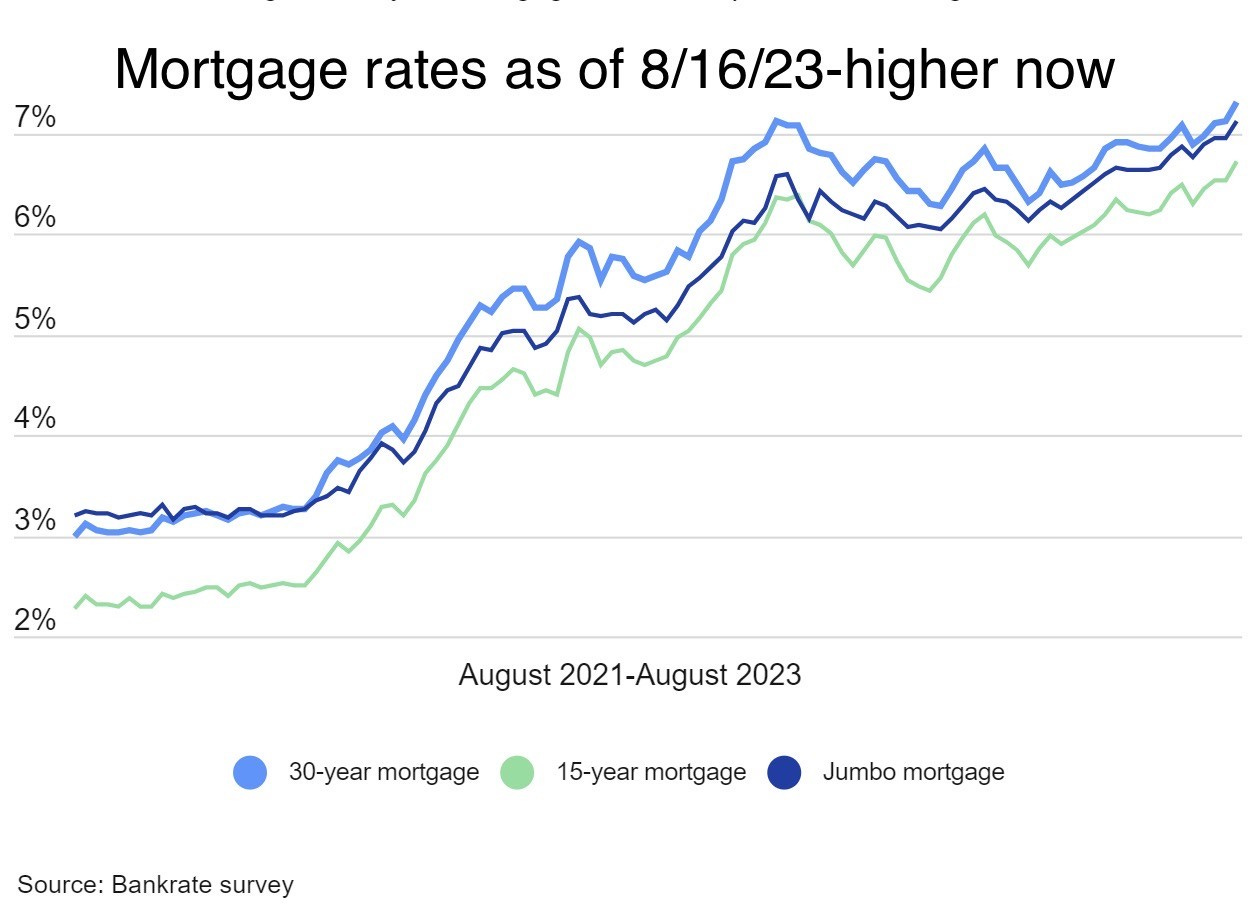

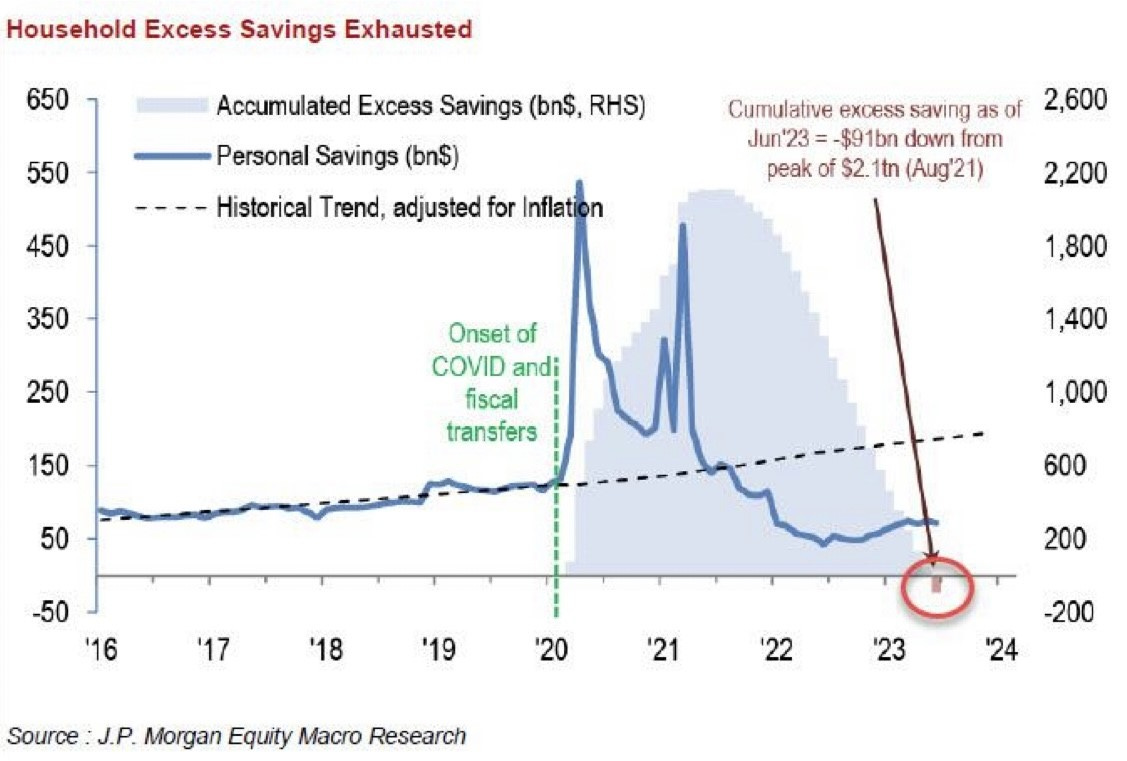

Check out this chart as of Thursday morning on the average mortgage rates from Bankrate. Remember, in 2020 and 2021, we saw 30-year rates under 3% and shorter-dated mortgages in the low 2% range. These new rates will prevent people from moving. If you have a $500k mortgage and were locked in at 2.5% relative to Thursday’s rate of 7.58%, your monthly payment goes from $1,971/month to $3,501/month. This Market Watch article outlines why we could see 8% mortgage rates soon. A recent surge in US mortgage rates has pushed affordability to the lowest level in nearly four decades. For house hunters, waiting for any relief is a risky gamble. Higher rates will hurt home prices, make refinancing maturing debt far more expensive, and add countless billions to the interest burden of the US Government. The cost to finance acquisitions or real estate projects continues to rise which will put a damper on deals. I have spoken with multiple R/E investors in the past week who are seeing far more cracks in deals with higher rates and the pullback in lending. I expect sellers to get more religion over the next year. I keep writing about the consumer and the impact of inflation, higher rates, exploding card balances, and crashing savings. The last chart shows the consumer is basically out of excess savings from the “free money” period. Excess savings went from $2.1 trillion to $91bn in 2 years.

A loyal reader who has become a big contributor sent me this story about the $105 trillion world economy. I thought the chart was great and figured my readers would appreciate it. By the end of 2023, the world economy is expected to have a gross domestic product (GDP) of $105 trillion, or $5 trillion higher than the year before, according to the latest International Monetary Fund (IMF) projections from its 2023 World Economic Outlook report. In nominal terms, that’s a 5.3% increase in global GDP. In inflation-adjusted terms, that would be a 2.8% increase. I thought this picture was informative and showed just how big the US and Chinese economies are relative to the basket. Look at how small GBR, AUS, FRA, Russia, JPN are relative to the US.

Other Headlines

BofA’s Warning of a ‘5% World’ Sinks in With Yields Pushing Higher

Three sectors to lead and three to lag in the young bull market

Interesting read.

Palo Alto shares rise on earnings beat, surprising investors who worried about a Friday report

Walmart raises full-year forecast as grocery, online growth fuel higher sales

“Modest Improvement” of sales of big-ticket and discretionary items.

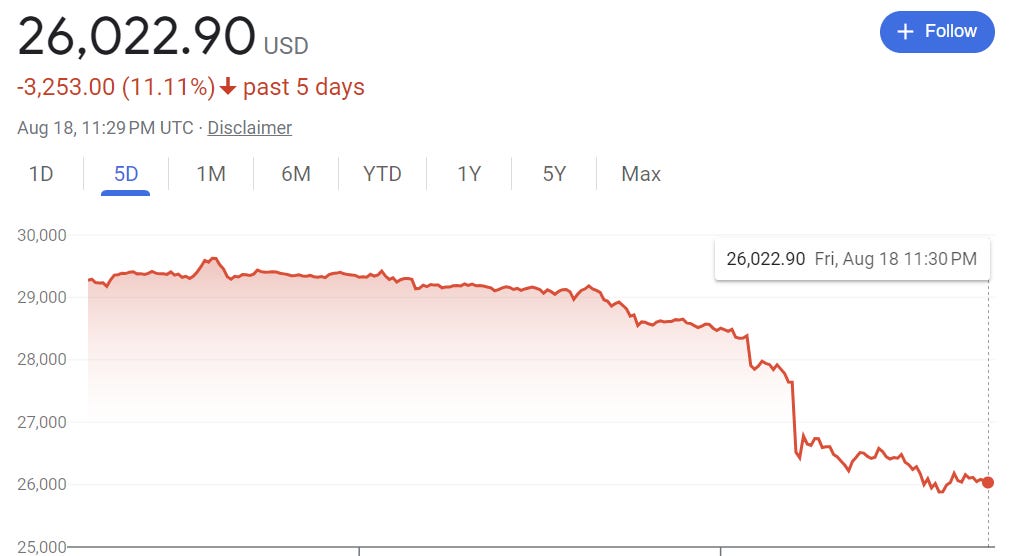

Bitcoin abruptly tumbles as much as 9% to just over $26,000 late Thursday

Story out that Musk dumped Tesla’s BTC. Bitcoin is -11% on the week.

The iPhone 15 could get one of the biggest upgrades in years: A new charging port

China’s property giant Evergrande files for bankruptcy protection in Manhattan court

The company has $340bn in debt.

Buyers of Bored Ape NFTs sue after digital apes turn out to be bad investment

Yes, I took a hit on crypto, but was adamant against NFTs and it proved to be a good call.

Barr is referring to the “documents” case and believes the Republican Party will move in another direction away from Trump.

Former US attorney general says Trump ‘should serve time’ if convicted

Many others suggest a former President cannot be protected. My gut says he will be convicted, but not serve time. House arrest?

Trump Plans to Skip G.O.P. Debate for Interview With Tucker Carlson

The Republican Party needs a new leader. Trump, go to the debates. You have a lot to answer for given 4 indictments, backers running away, and continued stupid commentary.

Joe Biden used email pseudonyms while VP to loop in Hunter on Ukraine, government business

Biden claimed to never speak with Hunter about business. More circumstantial evidence here. Even Newsweek is questioning matters.

Dozens of Chicago-area gas stations forced to slash hours over crime surge

One of my readers lived in San Fran for years and basically agreed the once-great city is uninhabitable. Policies matter.

Shocking video shows moment wild brawl breaks out at California Target store

NYC drug crisis reaches new low with addicts standing around with needles hanging out of their arms

The pictures are concerning.

Danny Meyer closing two NYC restaurants housed in historic hotel that’s now a migrant shelter

Wegovy could prevent up to 1.5 million heart attacks, strokes over 10 years, study says

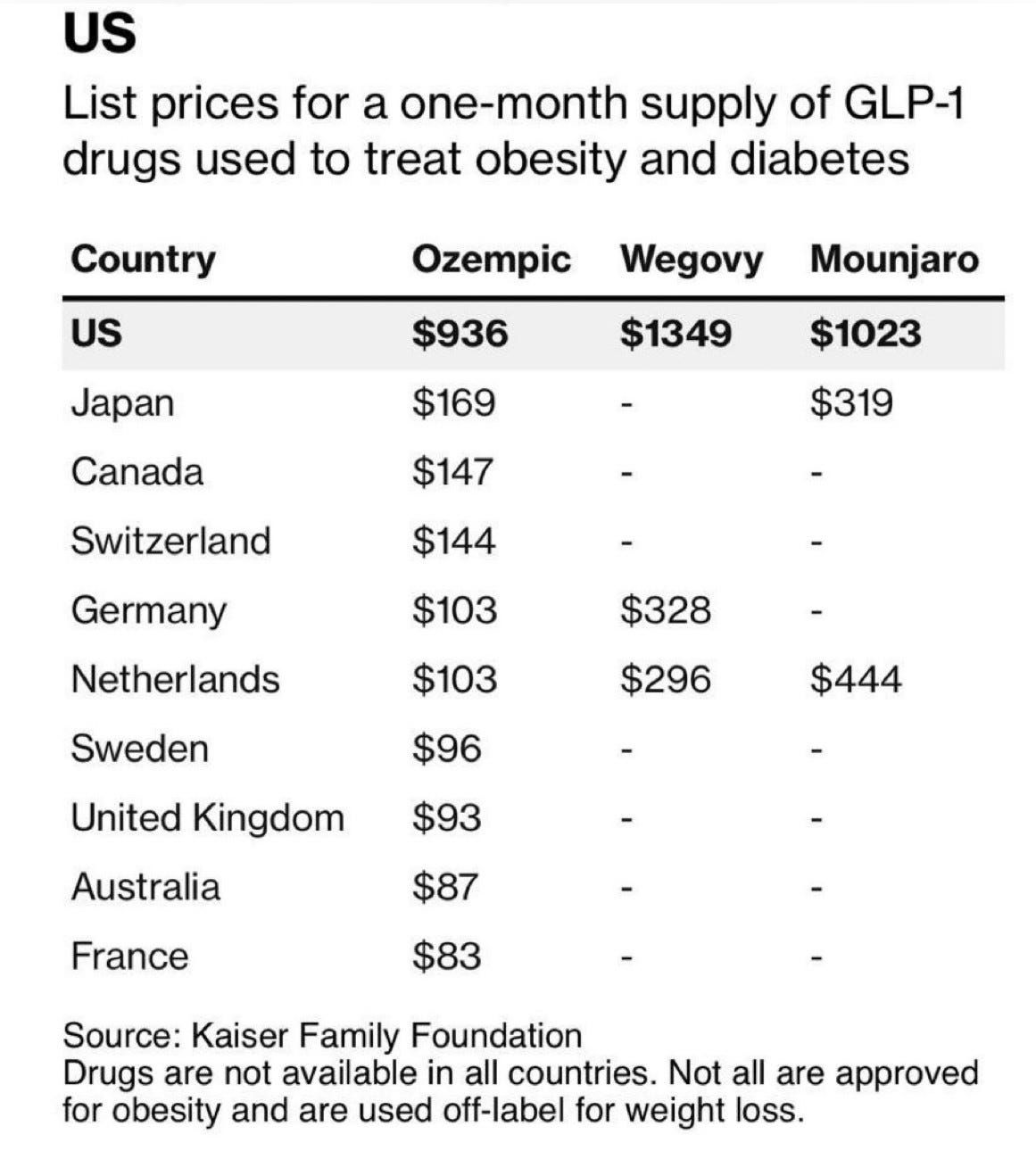

How do prices of drugs for weight loss in the U.S. compare to peer nations’ prices?

How is it that the US has the high obesity rates and pays the most by multiples from other countries? Why can’t the US negotiate better pricing? It seems to me that most drugs cost far more in the US than elsewhere. Why can’t the idiots in DC do something about it?

Post Malone dropped 60 pounds by cutting out this one popular drink

Despite the scary face ink, he looks much better. I have not had a soda of any kind in 37 years. I have also never tasted coffee.

Cancer cases are rising among younger Americans: ‘alarming’ trend

I found this Forbes article about total pet expenditures in the US quite concerning. $136.8bn was spent on pets in 2022.

Eat foods that reduce inflammation

Find reasons to laugh

Have a dependable community

Plan things to look forward to, and include your loved ones

Connect with something bigger than yourself

Harvard gut doctor avoids these 4 foods that cause inflammation—and what she eats instead

Fatty meats, Ultra-processed foods, Sugary drinks, Coconut & palm oil

The biggest reasons for divorce are lack of family support, infidelity, and compatibility according to a survey by Forbes Advisor.

Hawaii delayed diverting water that could have helped Maui wildfires, letters obtained by CNN allege

Jewish MMA fighter beats antisemitic troll into submission in Vegas fight

Natan Levy's opponent denied six million Jews died in the Holocaust... until he lost his fight.

Greece’s notorious rip-off restaurant strikes again: Tourist charged $770 for shrimp and a drink

Crazy examples in the story.

Pacific coast battens down the hatches as Hurricane Hilary threatens ‘catastrophic’ flooding

Dengue cases prompt mosquito-borne illness alert in Miami, Fort Lauderdale. What to know

Trust me, Dengue is no joke. Each year there are some cases in South Florida and I was an unfortunate victim a few years ago.

He learned football on YouTube in Africa. Can he make an NFL roster?

Fun story.

Sweden raises its terror threat level to high for fear of attacks following recent Quran burnings

Real Estate

Miami remains a hot market despite the usual summer slowdown in R/E transactions. Devin Kay from Douglas Elliman put $30mm under contract in the last 5 days including two units at the Surf Club (west facing 2 bedrooms) in the $3,500/ft range, and a 3 bedroom at Shell Bay to an NBA basketball player. Another 2nd Floor Surf Club unit sold for $18.5mm or $4,600/ft (Devin was not involved). Devin also has $90mm in new listings coming including waterfront homes & trophy condos in Miami and homes in Boca. Separately, lots on Sunset Island went under contract for $35mm and another for $22mm (.45 acres). This Venetian Islands lot was listed for $26.5mm and was offered $22mm (passed) and just sold for $18-19mm a few days ago. This Bloomberg article is entitled, “Billionaire Stephen Ross’s Related Buys West Palm Beach Site for Condos.” The project, called South Flagler House, will include two 28-story towers connected at a base lined with stepped gardens. Related’s purchase price was $195 million. The sellers — Hines and Frisbie — purchased the site last year for nearly $42 million, mapping out plans for South Flagler House and bringing on the architect. Pricing at South Flagler House, featuring two- to five-bedroom residences, will start at $7.5 million. Amenities will include a pickleball court and lounge, 25-meter (82-foot) lap pool, hot tub and spas. Construction is expected to start next year.

I always write about expensive homes and thought this CNBC story about the “World’s Cheapest Home” was coming from a bit of a different angle. This listing price is $1 for the Detroit area 2 bed/1 bath 742 square foot house. The best offer thus far is $30k. The pictures in the link are a bit scary.

Fortress Investment Group has acquired roughly $1 billion of office loans from Capital One (COF) with an eye toward a turnaround in New York City’s office sector, Commercial Observer has learned. The private lender purchased the loans this week in a move that signifies a “big bet on the rebound of New York City’s office sector,” one source said, with Big Apple office loans accounting for a large chunk of the portfolio, sources told CO. The loan portfolio’s specifics couldn’t be gleaned, but Capital One’s lending activity in New York City’s office sector includes The Durst Organization’s 855 Avenue of the Americas and 40 Exchange Place. The Capital One office loan sale occurred amid challenging market conditions for banks seeking to sell CRE loans, with lenders including Goldman Sachs and JPMorgan Chase encountering obstacles in recent months unloading certain debt off their books, Bloomberg reported last week.

This article suggests Charles Cohen is struggling to make payments on various buildings in NYC (3 Park Ave, 222 E 59th St, 750 Lexington, and the Decoration & Design Building a 979 3rd Ave). Others are listed in the article as well.

New reports from the Federal Deposit Insurance Corporation and Mortgage Bankers Association show a somewhat puzzling state of commercial real estate: more than $3 trillion in outstanding loans but commercial and multifamily loan originations down 53% year-over-year in Q2, although up 23% from Q1. First, the FDIC’s 2023 Risk Review. At the end of 2023 Q1, bank-held CRE loans had exceeded $3 trillion in value. Community banks had 28%, or $865 billion, of the CRE loans on bank balance sheets, “a share that remains outsized compared to their holdings of 15% of total loans.” “There was a 74 percent year-over-year decrease in the dollar volume of loans for health care properties, a 66 percent decrease for office properties, a 55 percent decrease for retail properties, a 55 percent decrease for industrial properties, a 48 percent decrease for multifamily loans, and a 32 percent decrease for hotel properties,” the report said. As rates continue to climb, what do you think that will do to deal volumes and prices?

There is a Robb Report article about a 1927 home in Pebble Beach that is for sale with amazing views. A half-basketball court. A swanky wine cellar. Two putting greens. It’s difficult to believe this amenity-rich home is one of the oldest in all of Pebble Beach. Bella Vista, built roughly a century ago on the Monterey Peninsula, has hit the market for a whopping $29 million, The Wall Street Journal first reported. The stunning Spanish Revival residence is perched atop the golf-centric community’s Strawberry Hill and is being offered up by Brian and Kelly Swette, the founders of Sweet Earth Enlightened Foods. This is the listing for the house, which sits on 2.6 acres.

I understand R&D and failed drugs. Why is it multiples more expensive in the US? Why charge all other counties so much less?

Drug research is incredibly expensive and it’s questionable how good Big Pharma’s IRRs even are.

Every other country piggybacks off of American innovation. Negotiating down drug prices would lead to less global innovation limiting society’s best chance to improve longevity.

Per Tyler Cowen in his book Big Business:

He has also presented evidence that two-thirds of the life expectancy boost for elderly Americans over the period 1996–2003 was due to prescription drugs (0.41–0.47 years out of 0.6 years total increase).

Data on Big Pharma IRR (pre-pandemic):

https://endpts.com/pharmas-broken-business-model-an-industry-on-the-brink-of-terminal-decline/?utm_medium=email&utm_campaign=461%20Thursday%20050318%20Mercks%20Alzheimers%20study%20raises%20fears%20for%20PhIII%20pipeline%20Another%20snap%20OK%20for%20lung%20cancer&utm_content=461%20Thursday%20050318%20Mercks%20Alzheimers%20study%20raises%20fears%20for%20PhIII%20pipeline%20Another%20snap%20OK%20for%20lung%20cancer+CID_7c3ddea2d547d0c359647b43221d5baf&utm_source=ENDPOINTS%20emails&utm_term=Part%201%20of%20this%20blog