Opening Comments

My last note was about my favorite movies between 1930-1999 and asked for feedback and the responses were overwhelming. I was run over with dozens of movie ideas and I will agree that I could have added the following: Psycho (1960), Deliverance (1972), The Sting (1973), Animal House (1978), Back to the Future (1985), Top Gun (1986), Platoon (1986), Princess Bride (1987), Saving Private Ryan (1998), Coming to America (1988), Braveheart (1995), Usual Suspects, Something About Mary (1998), and too many others to name. I rewatched every trailer and it brought back a ton of memories. From my last note, the most opened links were Run It Cold: Why Xi Jinping Is Letting China’s Economy Flail (Quick Bites Today) and the video of and pictures of the women in Oakland being beaten.

Wednesday, I am heading to New Orleans for a fishing excursion out of Venice, LA with one day of Deep Sea fishing for tuna, wahoo, and grouper off the oil rigs some 50+miles from shore. The other day, backcountry redfish will be the target. I hope my catch will look like these from various trips. I was invited by a loyal reader. There is a storm brewing in the Gulf of Mexico, but it is projected to hit the Panhandle of Florida. Let’s hope that is the case.

The other day was our 19th Wedding Anniversary, and the family went to dinner at Casa D’Angelo in Fort Lauderdale. The food was solid (much better than Boca location) and the room was decorated nicely. I just can’t help being frustrated by the cost of food and drink today. It is hard to get out of a restaurant for less than $100/person and I am the only person who has a drink. I would rather stay home and whip it up myself while hitting my own wine collection, but on special occasions, we go out to celebrate. My go to spot near me is Cafe Maxx in Pompano and has been in business for 40 years.

Markets

Income Taxes Due to Yield in the New World

Republican Debate

Consumer Card Delinquencies Up Sharply

China Slowdown in Charts

Best New NYC Restaurants Opening this Fall

Hating on South Florida

Rent Stabilized Apartment Market Issues

Landlords with $1.2 Trillion of Debt

Tenants Downsizing for Office Space

WeWork Investors Who Lost Money

The “King’s” $49mm Miami Mansion Is For Sale

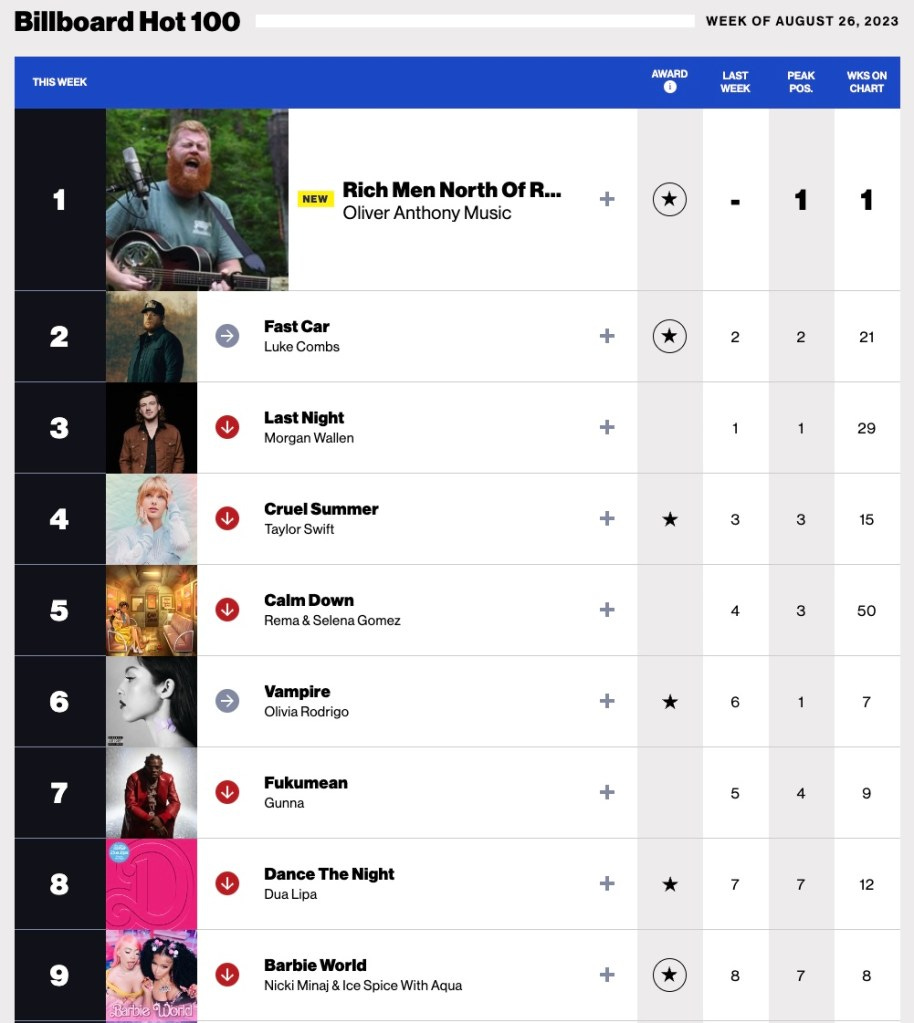

Picture Of the Day-Rich Men North of Richmond

I listened to the hit song, “Rich Men North of Richmond” by Oliver Anthony and it is clear the message resonates with Americans given its climb up the charts. The lyrics are very clever. This is the video of viral song which is #1 on the Billboard 100. Here are the lyrics. ‘Rich Men North of Richmond’ singer Oliver Anthony earning $40K per day after turning down $8M record deal. Oliver was upset at the use of the song at the Republican debate and let them know about it.

Exceeding Potential

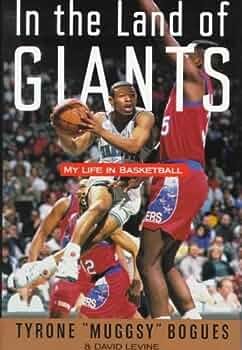

Everyone does not have the same skillset, IQ, or potential. There is no amount of practice I can do to become Michael Jordan, Tiger Woods, Tom Brady, Rob Gronkowski, Jimi Hendrix, Albert Einstein, Elon Musk, Pablo Picasso, Prince or countless others. My goal in life was to exceed my potential and I am comfortable with the fact that I feel I did just that based on my childhood-lack of mentors, public schooling, and limited exposure to the business world.

I am doing more speaking engagements (keynote, motivational, moderating panels…). I recently went to Las Vegas to speak at an insurance conference for FinFit. The theme was “Inspire,” and one of the sections I discussed was about exceeding potential which is 2 minutes long and can be found here. Watch it and tell me what you think. If you like what you see, get the word out, as I am doing more speaking engagements and could use your assistance to help me book them. I will be putting more excerpts from the video in upcoming reports as well.

I used two NBA players at the opposite end of the spectrum to make my point. Shaq went to LSU for college for 3 years and averaged 22 points and almost 14 rebounds a game and I watched him play in amazement. Shaquille O’Neal also had an amazing career as a 7’1” 350 lb, 4-time NBA champ, finals MVP, 15 times All-Star, and scoring champ who averaged 24 points and 11 rebounds per game. Then we have Muggsy Bogues, a 5’3” 137 lb player who was in the NBA for 14 years averaging 8 points and 8 assists per game with no titles or major individual accolades. He was the smallest player in the NBA and countless other veterans praised Muggsy for his tenacity and aggressive defense.

Despite the fact that I am a huge Shaq fan, I don’t think it is a close contest on exceeding potential. Bogues exceeded his potential by far more than Shaq. In high school, it was clear that Shaq would be an NBA star and remember, he was 6’4” at 11 years old. What do you think Muggsy’s coach thought about him in high school? No one thought he would be in the NBA, let alone for 14 years. As an aside, Muggsy’s father served time in prison but his mother was a pillar of strength during his teen years.

Yes, Shaq is in the Hall of Fame and had a magnificent career, but lacked the work ethic to be the greatest despite his physical gifts. Kobe was interviewed and said if Shaq had his work ethic they would have had 12 rings and Shaq would be the greatest of all time.

Shaq missed 5,317 free throws and shot 52.7% from the line. Could you imagine if he shot free throws like Dirk Nowitzki (at 88%) or many others who shot 80%+. Shaq could have had 8 or more titles with 80% free throw shooting combined with being in better shape. With 80% from the line, he would have scored another 3,071 points in his career and moved from 8th to 6th on the all-time list.

The 1980 US Olympic Hockey team beating the Russians and winning the gold medal could be the best example of exceeding potential. Given the Cold War, there were massive political implications and the US stepped up despite being down 1-0 early in the 2nd period. Al Michaels famously screamed, “Do you believe in Miracles,” when the US beat the Russians. I remember watching the game on my small Sony Trinitron TV. I was so impressed by the victory that about a dozen years ago I bought this (pictured below) at a charity auction signed by the entire 1980 Olympic Hockey team. The Russians had won the prior 4 Gold Medals, and the following three and were so dominant they beat the US NHL All-Star team 2 out of 3 games in 1979. The US Olympic team averaged 22 years old and the Soviet Union team averaged 26 years. The US team clearly exceeded its potential by a mile.

When I think about potential, all we can do as individuals is try to exceed our own to the best of our abilities. Not everyone can be a superstar, but we can give 120% to become our best. With hard work and some luck, anything is possible and you too can be the next Muggsy Bogues in your own field. I feel I was able to accomplish far more than I should have on paper and feel I always gave it my all to get it done.

Quick Bites

We had some volatility this week with a sell-off followed by a rally and the S&P and Nasdaq ended up on the week. YTD, the Dow+3.6%, S&P +14.8%, and Nasdaq +29.9%. Seasonal factors, concerns about the global economy and the increase in rates are all playing a factor. On Friday, Powell called inflation “too high” and warned that “we are prepared to raise rates further.” Optimism was fueled, in part, by Powell’s confidence in continued economic growth in the U.S., as he cited “especially robust” consumer spending and early signs of a recovery in the housing market. I am seeing the consumer continue to crack (see consumer bullet). The Treasury market was mixed with the front-end weaker and longer bonds slightly lower in yield. The 2-Year was +6bps to 5.08%, 10-Year flat at 3/23% and the 30-Year-2bps at 4.28%. Oil is back up to $80 with soaring diesel prices (+5%). The VIX was -12% on the week and back below 16.

When rates were near zero, my interest income was abysmal. Now that I am earning more money on cash, the tax bills will be growing, and found this WSJ article interesting. “Investors Are Finally Making Money on Bonds and CDs. Be Prepared to Pay Taxes.” Over the past five weeks, investors have put a net $91.1 billion into money-market funds, according to Refinitiv Lipper data as of last Wednesday. U.S. government bonds, high-yield bonds and bond funds, and a host of other fixed-income assets have been similarly popular. The driving force pushing Americans back into fixed income is returns. A CPA said, “Rates have been so low for so long, people aren’t used to actually receiving interest income and they don’t realize it’s taxable.” I will make 4 times my money on cash and short-term treasuries equivalents relative to last year.

I continue to harp on the slowing consumer and numerous earnings reports (Despite Powell’s comments) have discussed consumers pulling back on spending (Dick’s, Foot Locker, Nike, Gap, Home Depot, Target, Nordstrom, KSS, Macy’s,…). Macy’s credit card business was crushed with sharply higher write-offs than anticipated and a 24% decline in credit card sales. Check out the chart below from the Fed on delinquencies on cards from smaller banks. Remember, we have seen savings crash, auto and credit card delinquencies rise despite the student loan payment moratorium. Also, lenders are pulling back as auto loan rejection rates hit 14.2% last month after being 4.5% in 2018.

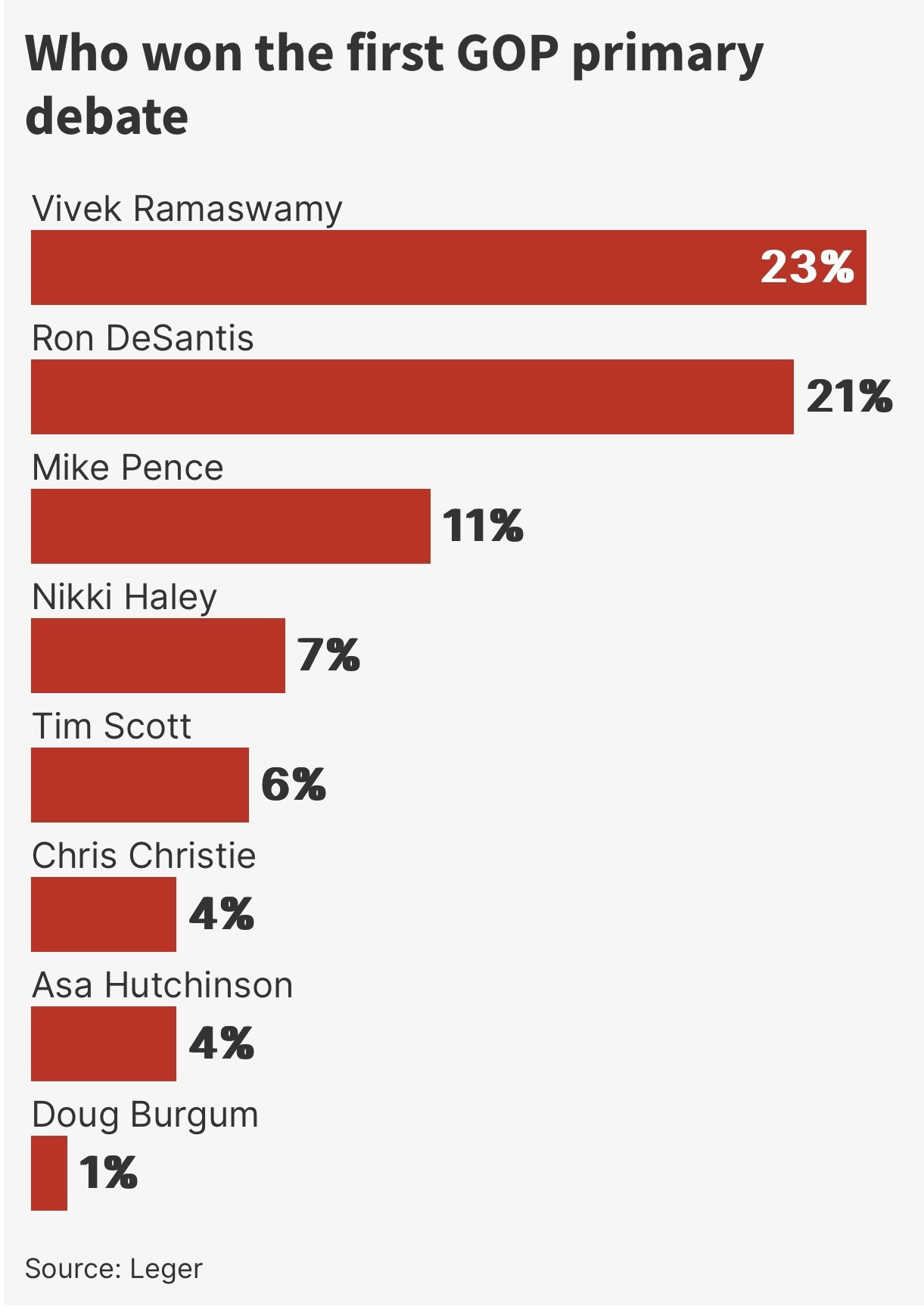

I watched the Republican debate Wednesday night hoping for someone to steal the show to unseat the current Republican leader. Unfortunately, I saw very little to wow me, but the lack of Trump on the Dais allowed the candidates to explain their policies. Ramaswamy was clearly in everyone’s sights and was the most attacked by far. He also defended Trump quite a bit which drew cheers from the crowd. Vivek’s commented that if President, he would not support Ukraine and Haley crushed his foreign policy experience. DeSantis did not step up and to me, came out a bit robotic and flat. His big backers have fled and I don’t feel he did enough to bring them back, but this post-debate poll suggests he went from 14% to 21% and Haley from 3% to 11%. I did not feel DeSantis was attacked which suggests to me the others do not feel he is a real threat. Christie was aggressive with some good zingers, but he is universally disliked and the crowd was very unsupportive. Christie said “Trump is not fit for office-Someone’s got to stop normalizing this conduct,” and I agree. Haley blew up Republicans for being fiscally irresponsible (I agree both parties can take blame) and did well on foreign policy. Here are some links summarizing the debate from both sides: CNN, FOX, NBC CNBC. As an aside, the crowd was very pro-Trump. Hutchinson, Burgum, Christie, Scott should drop out now. DeSantis, Ramaswamy, Haley and Pence should have one more go but sadly, I do not see a real path given too much loyalty to Trump and where he sits in the polls even if he is found guilty. If Trump was unable to run and DeSantis or Ramaswamy are the Republican candidate, I could see Trump loyalists just not show up to vote. I would have liked to see Younkin in the debate. This article outlines thoughts from a body language expert and suggests DeSantis was nervous and Ramaswamy was “comfortable.”

China is in trouble and this WSJ article is entitled, “China’s Crisis of Confidence in Six Charts-Chinese households are losing faith in the nation’s future and could drag down the entire economy.” I spent time with an American who has lived in Beijing for over 25 years and saw plenty of signs of trouble recently. He too felt the youth unemployment is far higher than the government suggests. China suspended the publication of youth unemployment data after it reached 21.3% in June and some suggest it could be 40%+ today. The 2nd chart shows the Chinese HY R/E index which is -82% in a couple of years. The 3rd picture shows just how reliant the world is on growth from China from 2000-2020. I am not an expert on China, but it seems to me something bigger could be brewing here.

If you read the Rosen Report, you know I LOVE food. There is a Bloomberg article entitled, “New York’s 15 Most Anticipated Restaurants for Fall.” I know some of the chefs, but I have yet to attend any of these (not all opened yet). If you go, let me know about your experience. This article suggests NYC’s Most Exciting New Fine Dining Restaurant Is In The Subway. The Korean-influenced Nōksu, offers a 15-course tasting menu and the entrance is on the way to the F train at 32nd and Broadway.

Misipasta, Williamburg, Brooklyn

Uzuki, Greenpoint, Brooklyn

Mama’s Too!, West Village

L’industrie Pizzeria, West Village

Radio Star, Greenpoint, Booklyn

Bangkok Supper Club, West Village

Chef’s Table at Brooklyn Fare, Midtown West

Sip & Guzzle, West Village

Theodora, Fort Green, Brooklyn

Cafe’ Carmellini, NoMad

Metropolis By Marcus Samuelsson, Financial District

Unnamed-Don Angie Restaurant-West Village

Coqodaq, Flatiron

Sushi Sho, Midtown

Other Headlines

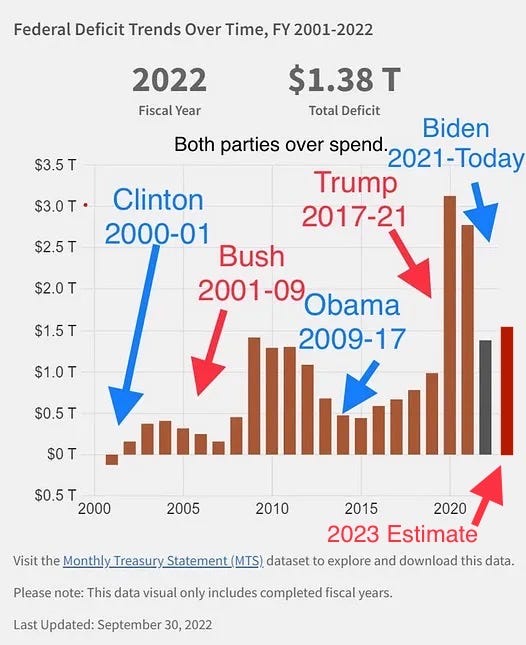

US Budget Deficits Are Exploding Like Never Before

Most politicians need to be more fiscally responsible. We are spending far too much money as rates are rising, Central Banks and Commercial Banks are not buying Treasuries as before, and many Central Banks are actually selling bonds. Massive bond issuance is coming and concerning. The 2nd chart shows CBO estimates and they are notorious for being wrong on the low side. We need to balance budgets or run a surplus when times are strong as is the case now. We are at $1 trillion of interest/year now and growing fast.

SEC Takes On Private Equity, Hedge Funds

Commission votes 3-2 to approve sweeping new rules aimed at increasing transparency, driving down fees. Side letters offering better terms will be restricted and the SEC will require quarterly financial statements detailing performance and expenses.

Instacart files to go public on Nasdaq to try and unfreeze tech IPO market

It will be the 1st significant venture-backed tech IPO since December 2021.

Nike falls for record 10th straight day as Foot Locker woes, China slowdown hit stock

Gap reports mixed second quarter and decline in sales across all brands

Gap, Old Navy, Banana Republic and Athleta – in the second quarter, noting continued uncertainty among consumers.

Subway sandwich chain sells itself to private equity firm Roark Capital

It appears the final price was approximately $9.6bn.

Zillow Offers 1% Down Payment to Lure Struggling Homebuyers

The 1% offering is lower than Freddie Mac’s best of 3%. What could possibly go wrong with a 1% down payment after a massive run up in home prices?

Donald Trump mugshot released after Georgia booking, first ever for a former US president

Trump says he's 6'3" and weighs 215 pounds. The men of TikTok are proving him wrong.

Trump lies about a lot of things and apparently, it includes his weight and golf. He claims he shot 67 to win his Senior Club Championship. I am going to take the over on 75. No chance he shot 67. He is raising a lot of money in recent weeks ($20mm) and $7.1mm since mugshot.

Biden’s food stamp expansion linked to 15% jump in grocery prices

The program expanded 27% on average from pre-pandemic levels and funding has more than doubled.

On the Trail: Why Bernie Sanders is back in NH on Saturday

Sanders delivered a speech entitled “The Agenda America Needs” at Saint Anselm College’s New Hampshire Institute of Politics. Speech video here and he was supportive of Biden.

Fight breaks out on train after a man fell asleep on another man’s shoulder

The kid gets knocked out. You can tell me whatever you want. The aggressor needs to go to jail. I am currently working with almost $100mm of buyers looking to leave NYC for South Florida. Watch the video and maybe you will better understand it.

NBC sports anchor Bruce Beck robbed of wallet outside Rockefeller Plaza studio

Why marriages fail in 2023: Lack of support named the main road to splitsville

Approximately 50% of new marriages end in divorce and the rate is higher for subsequent marriages.

15-Year-Old Student Leaps From 9th to 12th Grade, Recognized By City For Academic Achievement

Scary story of a 5-year-old who was dropped off at the wrong place in 105-degree heat and wandered around looking for help. He was found safely.

Moment Orlando's first self-driving shuttle bus CRASHES just two days after launch

I would not get in one of these self-driving cars for at least 10 years.

OnlyFans owner pays himself $1.3M a day from adult-content site

Putin says Prigozhin ‘made serious mistakes’ in first remarks since plane crash that likely killed the Wagner boss. DNA Evidence confirms death.

Zelensky’s $5 Million Villa in Egypt

Luxury villa is located next door to estate owned by Angelina Jolie. The article suggests the villa is in Zelensky’s mother-in-law’s name and was purchased in May of 2023 for $4.85mm.

Real Estate

Funny RealDeal article clapping back at the South Florida haters is entitled, “South Florida by the numbers: Empire (State) strikes back.“ After two-plus years of seeing record numbers of their citizens, wealth and businesses relocate en masse to Miami and Florida, New York’s legacy media outlets took the gloves off this month and unloaded on the Magic City and the Sunshine State in breathtaking fashion. Citing some recent trends showing a slowdown in local population growth and increases in costs of living, the New York Times, Wall Street Journal and Fortune all pounced with aggressively critical columns and articles, making little effort to conceal any latent bitterness. (Even a positive article detailing the soccer superstar’s extraordinary and delightful impact on the region featured the headline “At Inter Miami, Lionel Messi’s Only Complaint Is the Humidity.” Seriously?) But while the Covid-inspired surges may indeed be moderating and Miami real estate faces some legitimate challenges, there are plenty of reasons for continued optimism in both the near and long term. We calmly respond with facts and independent research in this edition of “South Florida by the numbers.” Hate on South Florida all you want. I have moved 100+ families to South Florida and NOT ONE has moved back to NYC. Dropping the mic now. Today, I am working with 6 families who want to spend a total of almost $100mm on homes in South Florida. Yes, I am going to get my R/E license.

Landlords listed 42,275 rent-stabilized apartments as of April 1 of last year, with most of those apartments marked as “newly vacant,” the IBO said. The agency said 13,362 units sat empty for at least two consecutive years — up from 12,300 in 2021 — suggesting they were vacant for reasons other than the routine movement of tenants. The issue of empty and “warehoused” apartments is fueling intense debate, with policymakers proposing legislation that would force owners to bring apartments back on the market. City officials enacted a grant program for landlords with empty units in need of renovation. Landlord groups say owners have no choice but to keep low-cost units empty because they cannot earn enough from rent to cover needed repairs and renovations, highlighting empty apartments to angle for a change. Still, thousands of rent-stabilized apartments remain unaccounted for. Landlords registered around 836,000 rent-stabilized units last year, the IBO found, down from more than 944,000 in 2019, the year new laws restricted owners’ ability to raise rents and deregulate apartments. The idiotic new laws for rent-stabilized apartments are hurting landlords and tenants alike. The unintended consequences due to bad policy hurts everyone. This article is entitled, “Want to end apartment warehousing? Ease up on rent-control laws.”

Bloomberg’s article entitled, “Landlords With $1.2 trillion of Debt Face Rising Default Risks,” was an interesting read. About $1.2 trillion of debt on US commercial real estate is “potentially troubled” because it’s highly leveraged and property values are falling, according to Newmark Group Inc. Offices are the biggest near-term problem, accounting for more than half of the $626 billion of at-risk debt that’s set to mature by the end of 2025, the brokerage estimates. Office values have tumbled 31% from a peak in March 2022, when the Federal Reserve started raising interest rates, according to property analytics firm Green Street. Concerns are mounting that defaults will increase as property values fall and costs rise for landlords who need to refinance at higher interest rates. Overleveraged owners are often more motivated to stop payments than sink money into buildings with diminished prospects for returns. Blackstone Inc., Brookfield Corp. and Goldman Sachs Group Inc. are among investors that have defaulted or relinquished offices to lenders this year.

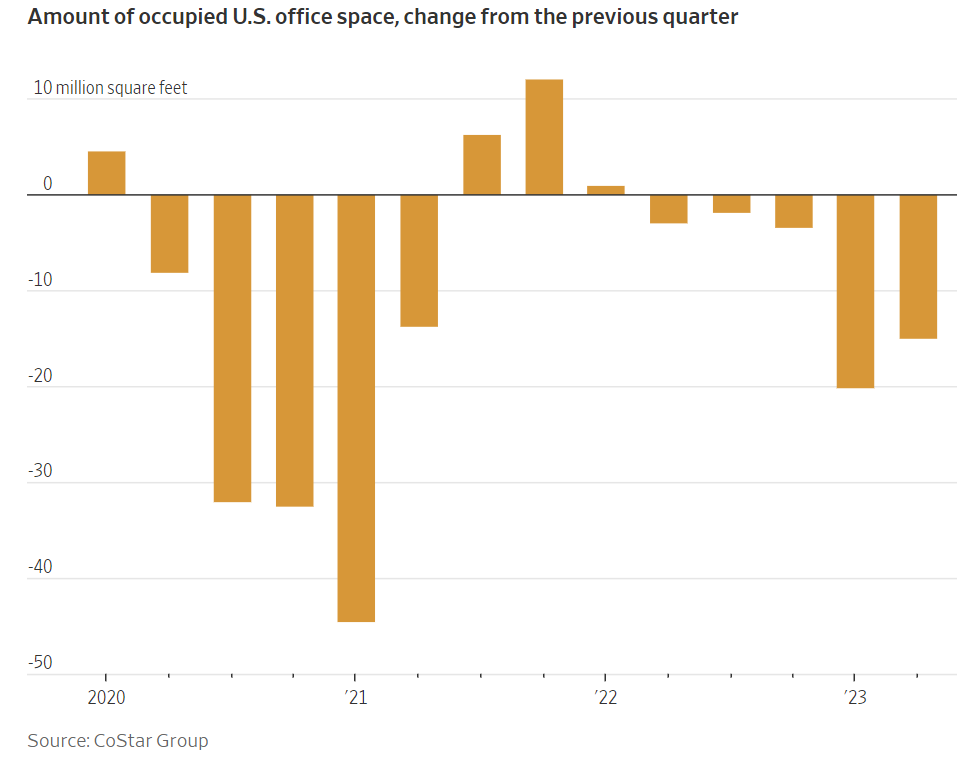

This is a WSJ article entitled, “Office Tenants Are Renewing Leases—but for Far Less Space A record 217 million square feet of sublease space is also weighing down office values.” The good news for office landlords is that lease signings have been increasing this year. The bad news is that the average new lease is considerably smaller than before. That means companies are committing to spend less on office space for years to come. The need for less workplace space reflects how employers across the U.S. have embraced—or at least have come to tolerate—hybrid strategies that allow employees to work more from home. Consequently, firms feel they need less space and are signing deals of up to 15 years for fewer office floors. In the second quarter, U.S. businesses signed new leases for an estimated 97.5 million square feet, up from 57.4 million square feet in the second quarter of 2020, the low point of the pandemic, according to data firm CoStar Group. Yet in the second quarter, the average U.S. office lease size was 3,275 square feet, or 19% less than the average lease size between 2015 and 2019, CoStar said. “If a tenant signs a lease for 100,000 square feet and they move out of 150,000 square feet somewhere else, that’s a negative event for the market,” said Phil Mobley, CoStar’s national director of office analytics.

WeWork’s implosion isn’t only impacting the co-working giant. Real estate firms who bet on WeWork when it went public are now experiencing the pain of the company’s slide into potential nothingness, Bisnow reported. That was not welcome news to firms like Cushman & Wakefield. When WeWork went public two years ago at an $8 billion valuation, the commercial real estate brokerage invested $150 million. As WeWork’s market capitalization sank to $275 million on Friday, Cushman’s investment also plummeted. A document WeWork filed in March with the Securities and Exchange Commission revealed that two of Starwood’s opportunity funds owned 12.5 million shares. If those shares were purchased at the $10 share price during the initial public offering, the $125 million investment would be down to $1.6 million, as of Friday. Others set to suffer at the hands of WeWork’s near demise include real estate investor Cohen & Steers (8 million shares owned as of the spring), Chinese investor Oceanwide (1 million shares), development firm war horse (800,000 shares) and naturally, ousted WeWork founder Adam Neumann (20 million shares). Of course, Softbank was crushed. This CNBC article suggests they invested $18.5bn into the company. I am not a fan of Adam Neumann or the way he does business. I would never invest in anything that guy does and am in shock Andreesen backed his new venture, Flow.

My friend, and avid Rosen Report reader, Chris Burch, listed his North Bay Road Home for $49mm after buying it for $14mm 3.5 years ago. I have been there and must tell you that it is amazing after his extensive renovations. The views are remarkable and Chris has great taste. The kitchen is bonkers. It has 140 feet of water frontage on Biscayne Bay. The “King” as his friends call him is a remarkable success story and has been incredibly supportive of me over the years. He throws amazing parties and his friends are an impressive group of people who support and love him. He is downsizing, but must tell you to take a look at the view! The North Bay Road address in the 50s is among the most sought-after in Miami Beach. Not much for sale on this street which is move in condition.