Opening Comments

My last piece entitled, “Rosen Report Swag,” resulted in many requests for hats. Initially, they will go to my biggest contributors. Sounds like I need to order more. The most opened links were: 25-year-old tried 23 side hustles before launching a company that brings in $354,000 a month—his No. 1 piece of advice and the Fortune article, A recession might have been simpler than what awaits the U.S. economy.

I went to New Orleans to fish for a couple of days and it was epic. There will be upcoming reports, but here is a little taste. Shockingly, I retore my calf muscle a couple of weeks ago getting my butt beat on the tennis court and fishing for 100-pound tuna, was not a brilliant way to give the calf rest. I was invited by a Rosen Report reader who had entertained his clients along with his team. Great trip and I was lucky to be included. These are not the best pictures from the adventure but give you an idea of the fun. I will do a couple of pieces in the next month about the two days of fishing, which made for a great time with a fun group. If you want to fish in Louisiana for Wahoo, Tuna, Redfish, Snapper, or Tripletail, I have the solution.

Markets

Consumer, Yes Again

US Fertility Rates/Aging Population

Best & Worst College Majors

Woodstock Pricing-Shocking

$90mm 432 Park Condo Sold

Citadel Migration to Miami

Royal Palm Community In Boca Raton Homes

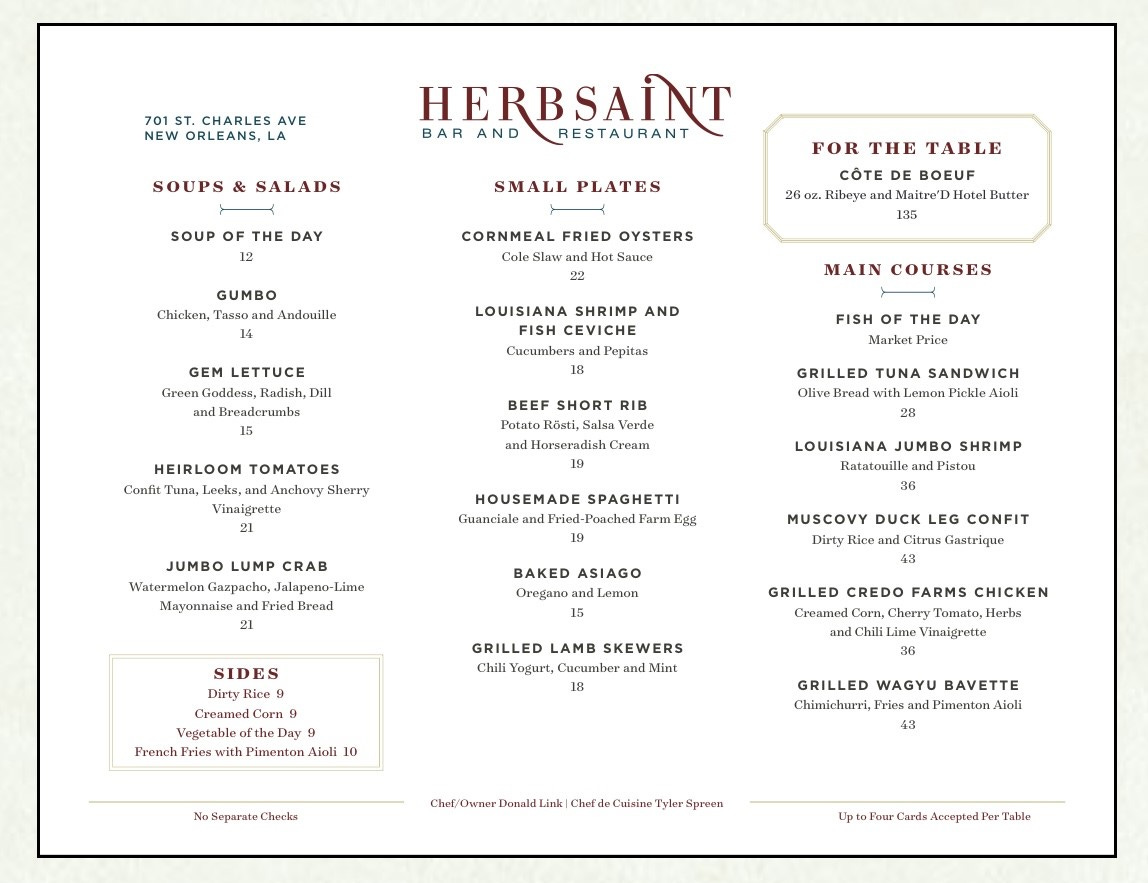

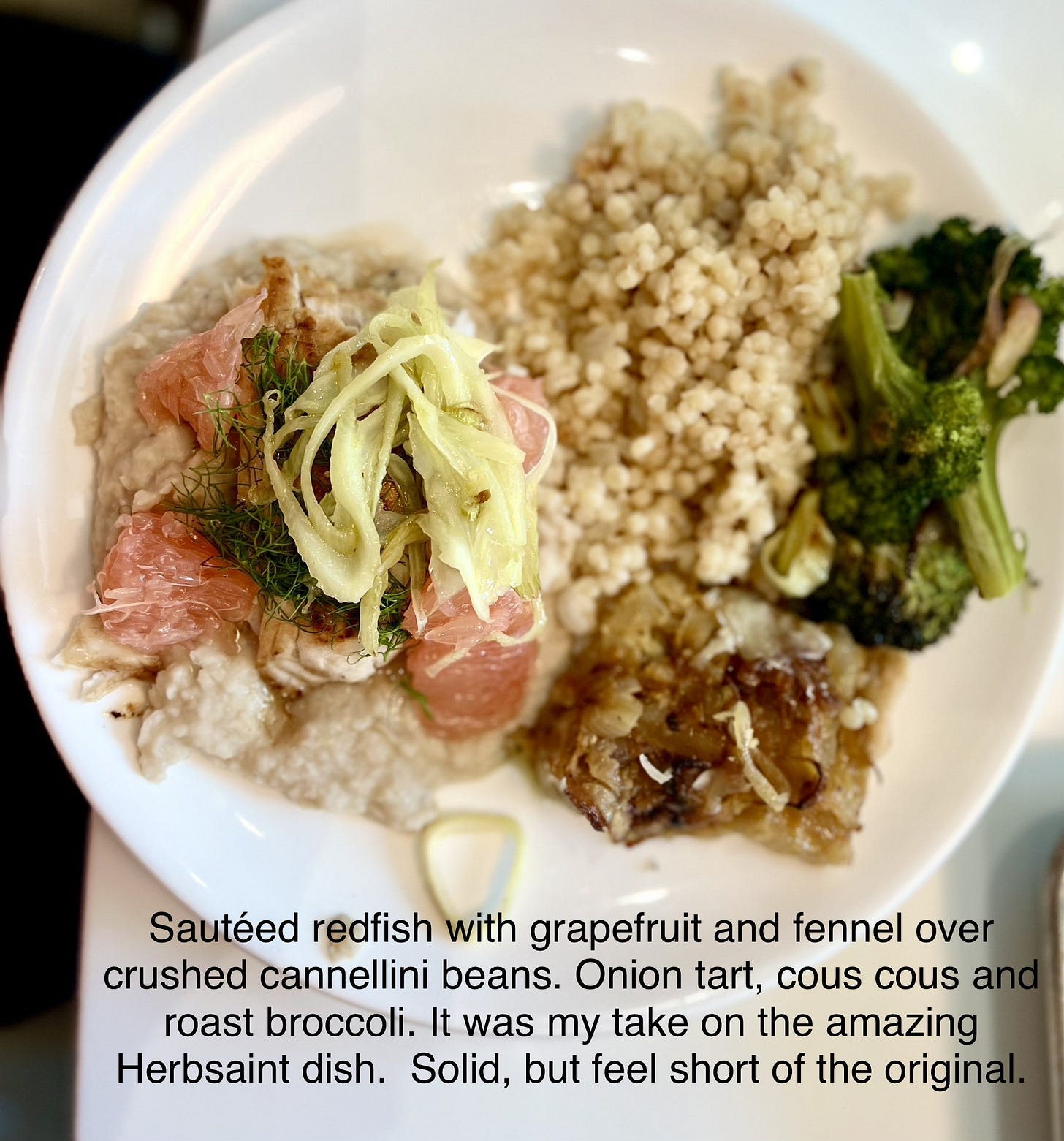

Pictures of the Day-Herbsaint New Orleans

If you read the Rosen Report, you know I am a freak about my food. I hate eating a bad meal. I did some research and found Herbsaint, a James Beard award-winning 25-year-old establishment. There are no Michelin Stars in New Orleans which is shocking. Of all the restaurants I have been to in New Orleans, Herbsaint is my new favorite. The short rib appetizer and redfish entrée over crushed cannellini beans with grapefruit and fennel made for a memorable meal. I went for lunch and was blown away by the food. I did not drink, but the wine list was impressive. My only complaint was the short rib appetizer was small. Why do the best restaurants give Lilliputian portions? I decided to remake the redfish dish Saturday night and thought it came out quite well for a first try but fell short of the original (last picture).

My Favorite Rock Bands 1960s-2000s

My piece on the Best Movies from 1930-1999 gained a great deal of attention and feedback. People had strong reactions and I appreciated the commentary; even the disagreements were welcomed. As a result, I thought about my 10 favorite rock bands from each decade, and I might get down to the song level in an upcoming newsletter. I could not include all music genres as it would have been too hard, but given the response from movies, we could have a series of these (rap, pop, hip-hop, Motown, country…).

Beatles, Rolling Stones, Simon & Garfunkel, Jimi Hendrix, Beach Boys, The Who, The Doors, Creedence Clearwater Revival, Pink Floyd, Grateful Dead

The Beatles are clearly #1 for the 1960s and quite frankly, the best of all time. They formed in 1960 and broke up in 1970 with virtually all their songs coming in the 1960s. They had 20 #1 hits and 34 top 10s. The Stones are amazing for so many reasons and have been great since the mid-1960s after forming in 1962. The Who formed in 1964 and I have seen them 4 times in concert. The recent showing last year was pretty weak and Daltrey forgot words to the songs, but they remain one of my all-time favorites. Baba O’Reilly is my favorite Who song.

Led Zeppelin, Pink Floyd, Eagles, Stones, Who, Fleetwood Mac, Aerosmith, Billy Joel, Eric Clapton, Queen

I am pretty sure Led Zeppelin would be everyone’s pick for the band of the decade. They formed in 1968 and broke up in 1980. Pink Floyd, The Stones, and the Who made it again on my list. I love the Eagles and saw them a half dozen times. One of my favorite concerts. I LOVE Billy Joel, but to me, his creativity came to a screeching halt in the early 1980s. His 1970s songs were my favorites. Aerosmith has stood the test of time and who can argue with Queen?

Van Halen, Guns & Roses, Bon Jovi, Metallica (not a big fan, but important), REM, Motley Crue, Red Hot Chili Peppers, Tom Petty, Journey

In the 1980s, there are a few bands who could be band of the decade: Van Halen, Guns & Roses, & Bon Jovi and all were full of 1980’s rockers hair. I was a big Motley Crue fan because my high school friend, Danny, drove me to surf and he blasted the band in his supped-up VW Bug we called, “The Beast.” In my high school, a girl student was the President of the Journey fan club and wore a Journey shirt EVERY single day to school.

Nirvana, U2, Pearl Jam, Radiohead, Alice in Chains, REM, Green Day, Smashing Pumpkins, Soundgarden

The band of the 90s has to be Nirvana, but my personal favorite was Pearl Jam. U2 has to be near the top as well. I was lucky to spend some time with Chris Cornell from Soundgarden as his son and my son were in class together and played in the same football league in NYC. Chris was always welcoming to my stupid music questions, and I was blown away with his skills as a musician and songwriter. This link explains how he wrote Black Hole Sun, one of the best Soundgarden songs. Such a shame he is no longer with us.

Green Day, Nickleback, Blink 182, Creed, Coldplay, Red Hot Chili Peppers, Linkin Park, Foo Fighters, U2, White Stripes

Of the decades I am writing about, the 2000’s were the least memorable for me from a rock music perspective. I am a big fan of Coldplay and Chris Martin. When my kids were little, we went to Chris and Gwyneth Paltrow’s house in the Hamptons and a musician would play songs for the kids. My kids had a blast and I thought Martin was a down-to-earth guy despite literally being a rock star. My son Jack was probably in Kindergarten and threw a ball and I swore it almost broke a window in their house. I wanted to cry. I am a big fan of the Foo Fighters and David Grohl who was the drummer for Nirvina. Great story; he was primarily a guitarist and Nirvana needed a drummer and he was so talented as a musician he passed the audition.

I did not mention one of my favorite songwriters of all time, Bob Dylan. I was not sure where he would fit, but Tangled Up in Blue is my favorite song of his. Other mentions would be Springsteen, Neil Young, Crosby, Stills and Nash, Heart, AC/DC, Rush, Cheap Trick, Jane’s Addiction, Lynyrd Skynyrd, Lenny Kravitz, ZZ Top, Boston, Bob Seger, Judist Priest, Ozzy Osbourne, The Ramones, Janis Joplin, The Kinks, Elvis, The Band, David Bowie, Steve Miller, Dire Straits, The Doors, The Police, and Genesis. Tell me what I missed. I am bracing for impact.

Quick Bites

The 30-stock Dow ticked up 116 points, or 0.33%, to close at 34,838. The S&P 500 added roughly 0.18% to finish the session at 4,516, and the Nasdaq inched down 0.02% to end the day at 14,032. The Dow and the Nasdaq added 1.4% and about 3.3% for the week, respectively, notching their best performances since July. The S&P 500 gained 2.5% to register its best week since June. Oil prices were set to snap a two-week losing streak as they rose for a fourth consecutive session on Friday due to tightening supplies and expectations that the OPEC+ group of oil producers would extend output cuts to the end of the year. Treasury yields were mostly higher Friday as traders weighed the latest U.S. jobs report. The U.S. Department of Labor said Friday that the economy added 187,000 jobs in August even as the unemployment rate ticked up to 3.8%. Payroll growth was driven by health care and social assistance, which added more than 97,000 jobs. The 2-year Treasury was +2bps to 4.88% and the 10-year was +9bps to 4.18%. Oil closed at $86/barrel and is now up 10% on the year after being down 20%. Since late June, oil is +27% and was +8% last week.

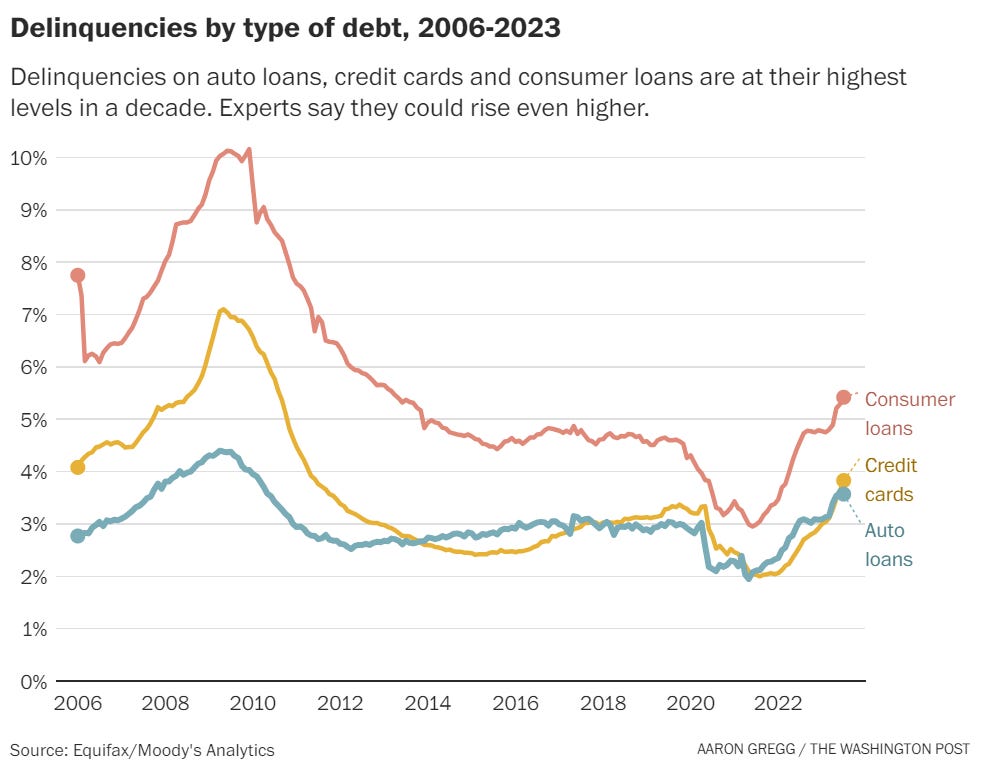

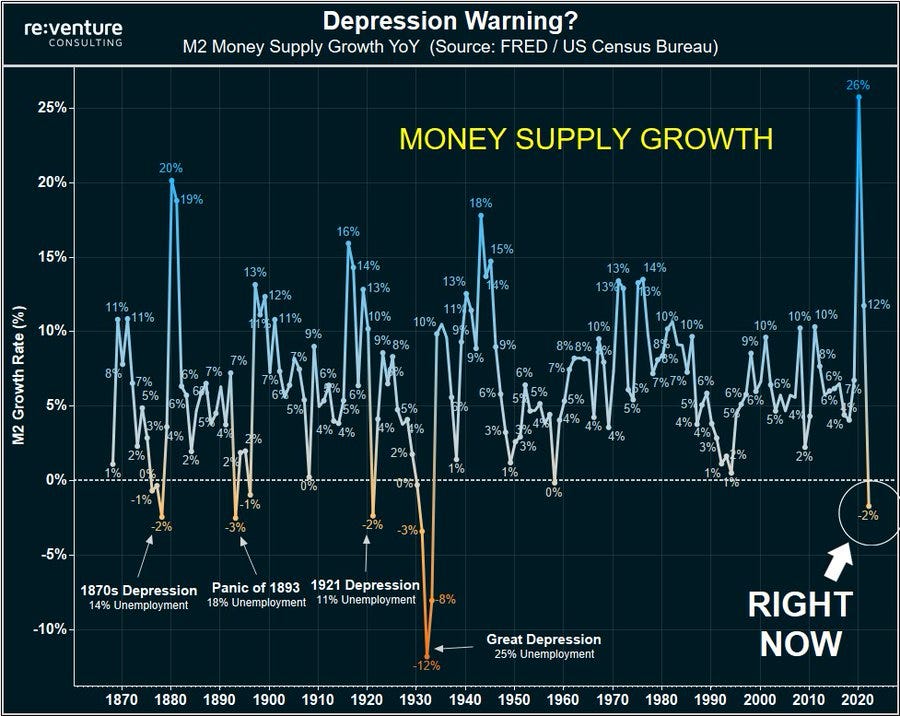

More Americans are falling behind on their car loan and credit card payments than at any time in more than a decade, a troubling signal of consumer stress as higher prices and rising borrowing costs are squeezing household budgets. The pain is most acute for lower-income earners, who have largely used whatever they managed to save during the pandemic with the help of government stimulus checks and breaks on obligations such as rent and student loans. Now, as the economy finds its post-pandemic footing, there are signs the hardship for millions of consumers will get worse before it improves. Another red flag: Shoppers are turning to buy now, pay later services to cover necessities such as groceries. Usage surged 40 percent in the first two months of 2023, according to data from Adobe Analytics. An increasing share of low-income Americans are behind on rent and struggling to afford food, adding to signs of growing financial distress in the economy. Among households using the Supplemental Nutrition Assistance Program’s boosted pandemic benefits, 42% skipped meals in August and 55% ate less because they couldn’t afford food, more than double last year’s share. I have been non-stop on this topic for over 6 months. I was early and it is now becoming mainstream. I am shocked at grocery prices. I was traveling this summer and had not done much grocery shopping. I bought a dozen organic eggs at Whole Foods last week for $8.79/dozen. The regular eggs were $4.59. Check out the 2nd chart showing the average monthly car payment is now $733/month relative to 2019 when it was $540/month. How much is $200/month after tax squeezing the US consumer?

This article outlines the US and the fertility crisis with the US birth rate at 1.6, the lowest level recorded since data was tracked in 1800. The article makes comparisons with Japan which has seen major issues with birth rate declines. In January 2023, Japan increased its financial incentives and offered 1m yen ($7,500) per child to families who moved out of greater Tokyo. According to the US Census Bureau (3rd chart), the US population is aging rapidly. In 1930, 7 million Americans were 65 or older (5%) and in 2020, it was 56 million (17%) and growing fast. I have been harping on entitlement reform; these charts only reinforce my view. We need politicians willing to make challenging decisions to raise age limits and institute means testing NOW. Deficits are exploding, debt is now $33 trillion and growing, interest expense is $1 trillion per year and rising while the population is aging, and healthcare costs are rising far faster than inflation. What could possibly go wrong?

I had a bullet in Other Headlines last year on this topic, but a reader reminded me about it and thought it was worth making it more prominent. It is about the top 10 most loved and most regretted college majors. I know many of my readers have kids attending college or soon-to-be, so thought it was appropriate. Journalism is the most regretted major. This article suggests the lack of trust and faith in the media today is playing a role. I agree.

Based on today’s theme of the best Rock Bands, I thought this Woodstock story was interesting. Before Woodstock was a cultural phenomenon, it was a financial fiasco. Organizers behind the legendary music festival in upstate New York, which celebrates its 50th anniversary this summer, said they wound up $1.3 million in debt after the historic 1969 event—roughly $9 million in today's dollars. But they eventually broke even years later thanks to album and movie ticket sales. In addition to basic problems like miles of traffic jams and a lack of sanitation and food for a colossal crowd estimated at over 400,000, Woodstock organizers failed to adequately fence in the concert area. As a result, many fans attended without paying for admission — which was $18 for the three-day festival, the equivalent of about $125 today. That meant festival producers had even less money than expected to pay Woodstock's performers, several of whom reportedly demanded twice their usual pay rate, upfront. Check out the small payments for the best bands in the world at the time. Compare that with what Taylor Swift is making according to Forbes Magazine which suggests each show brings in $13.4mm and Swift nets $4.5mm/night. Also, note that Swift’s new movie had record 24-hour pre-sales according to CNBC. She is unstoppable.

Other Headlines

Wall of Corporate Debt to Spark Recession in 2024, Fidelity International Says

Ahmed sticks by call for downturn amid hopes for soft landing

Macro strategist says add cash to brace for lagged rate impact

Rates Are Up. We’re Just Starting to Feel the Heat.

The article outlines various issues including households, commercial R/E and corporates, but highlights the corporate debt maturities being refinanced at sharply higher rates with $600bn in debt maturities this year. Higher rates take time to get through the system. It is forcing people to stay in their homes (if you sell and need a new mortgage, the rate can be double or more). Commercial R/E has related issues as well with large maturities.

Prolonged Hollywood strikes could lead to ‘an absolute collapse,’ says Barry Diller

X sets its sights on LinkedIn with a job listing feature

CEO Elon Musk called LinkedIn 'cringe,' said X competitor will be 'cool.'

Tesla shares close down 5% after price cuts, Model 3 refresh

The stock is still +127% on the year with a $770bn market cap.

Dell has best day on stock market since its relisting in 2018 after earnings sail past estimates

Shopify stock pops after company strikes ‘Buy with Prime’ deal with Amazon

DeSantis voted against Sandy aid a decade ago. Now his state needs the help.

Interesting article that outlines how DeSantis voted against Hurricane Sandy relief when he was in Congress.

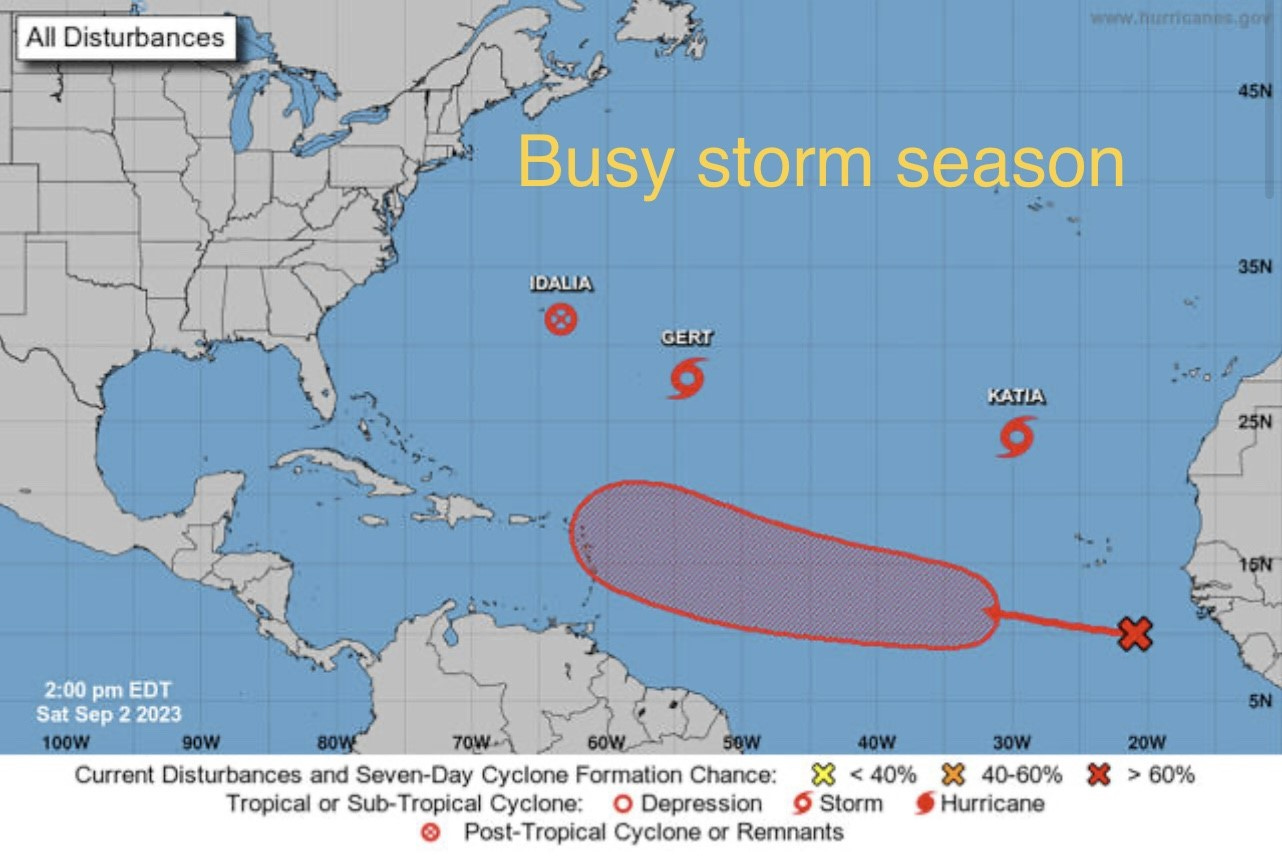

Powerful photos show Hurricane Idalia's path of destruction in Southeast

Hurricane Idalia windstorm insured losses could top $6Bn

Just what insurance companies needed. Rates only going in one direction.

Tropical Storm Katia forms, Idalia hits Bermuda while new system could target Caribbean

Brazen NYers are smoking weed everywhere—Saks, subway, US Open

I have complained about the smell of weed across NYC. I don’t feel it should be smoked on the streets, in Central Park and everywhere else. I don’t do drugs. I have never tried a gummy. Walking with young kids around NYC is not like it was a dozen years ago.

Suspect Michael Allen, 34 — who has 15 prior arrests, seven convictions including for assault and an open case for allegedly spitting on and kicking a police officer — was freed without bail on supervised release by Judge Lumarie Maldonado Cruz at the suspect’s Manhattan Criminal Court arraignment Friday, officials said. There has got to be a better solution than letting this repeat offender out time and again on supervised release.

NYPD officer sucker-punched by 45-year-old man trying to evade arrest in Harlem, wild video shows

Watch the video.

Not her first arrest. She should be deported.

Navy vet brutally mugged in Philadelphia while walking his dog, gets 100 stitches

Disgusting example of racism.

I’m sorry, the plan around crime in CA just isn’t working for the law-abiding, tax-paying citizens, store owners, and business owners. I am not of the belief that prison is the answer for all but can tell you that the answer is not to allow rampant crime with no consequences either.

"We’ll bring a significant number of people to the city — 40,000 people — and it will generate $57 million in the downtown economy," Benoiff reportedly said. "So it’s in all of our interests for it to go well, and for APEC to go well. This should be the focus of the city."

Saudi man receives death penalty for posts online, latest case in wide-ranging crackdown on dissent

According to court documents, the charges levied against al-Ghamdi include “betraying his religion,” “disturbing the security of society,” “conspiring against the government” and “impugning the kingdom and the crown prince” — all for his activity online that involved re-sharing critics’ posts. The Saudi Government sure treats its people with respect and freedom.

Illegal crossings of migrant families at US-Mexico border hits all-time high

Biden admin asks New York private businesses to help migrant crisis — by offering free services

Why should private business fund the administration’s immigration policy?

New Jersey Nursing Homes Slammed by COVID Surge as COVID Deaths Rise Across the US

Among the 615 nursing homes and assisted living facilities in the state, there are currently 158 active outbreaks affecting 534 employees and more than 1,300 residents.

Inside the town that banned kids from having mobile phones – the results were astounding

A longevity doctor says this is the No. 1 mistake that will ‘make you age faster’

The CNBC article outlines the ramifications of a lack of sleep.

Iran bans weightlifter for life for shaking Israeli athlete’s hand

Iranian government cited “unacceptable and unforgivable” actions.

It is believed to be the most powerful nuclear weapon and weighs 208 tons at 114 feet long. It carries 15 warheads, travels 11,000 miles, and can go 15,880 mph.

Real Estate

A five-bedroom condo in the supertall at 432 Park Avenue has gone into contract after asking $92 million. If the unit sells near its asking price, the deal would be among New York City’s most expensive sales of the year, according to The Wall Street Journal. The sale also includes two storage units and two adjacent studio apartments. The full-floor unit spans over 8,000 square feet. It was designed by Japanese architect Hiroshi Sugimoto for the seller, hedge funder and collector of Asian art Mitch Julis. He bought the apartment for roughly $59 million in 2016, according to property records cited by the Journal. He first listed the unit in 2021 for $135 million. If it sold for $90mm, it would be $11,250/ft. I do not like this location and would never live in the 50s on Park Avenue despite the amenities.

This Financial Times article is about the Citadel migration to Miami. The migration of New York financiers to Miami has created a shortage of luxury housing in upmarket suburbs, where buyers have purchased multimillion-dollar homes in search of easy commutes, more space and proximity to prestigious schools. Real estate agents say one firm stands out for driving demand: Citadel. Citadel, the $59bn hedge fund and market maker run by Ken Griffin, in June 2022 announced it would move its headquarters from Chicago, citing lower crime in Florida and the sunshine state’s lower taxes. “They’ve been buying here aggressively,” said Michael Martinez, a real estate agent with Sotheby’s in Miami, who recently brokered the sale of a $5mn home in Coconut Grove, a quiet salubrious suburb, to a Citadel employee. Most of the luxury homes he has sold in recent months have been to hedge fund buyers, half of them from Griffin’s firm, he estimates. “The Citadel migration is definitely occurring.” Citadel has moved almost 300 employees to Miami during what the hedge fund describes as a multiyear effort to shift its operations out of Chicago. One employee said the relocation benefits on offer were “generous”, helping to cover the higher cost of living in a city that has boomed since the pandemic. Finding homes is challenging. Getting your children into schools is even more difficult. When I moved 6 years ago, it was easy. In 2023, not so much.

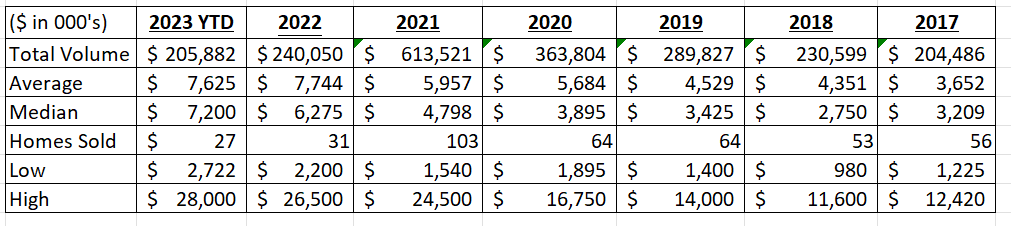

The community in Boca Raton called Royal Palm is where I moved in 2017. I put this chart together using closed-home data since 2017. You can see volumes peaked in 2021 during the COVID boom. Things are definitely cooling off as high-end homes stay on the market longer and inventory is rebuilding. When I moved down in 2017, 71 homes were for sale. It got down to a handful in December 2021 and back up to 32 are listed today. I still think too many sellers are asking unrealistic prices in the new world. Check out volumes with 27 homes sold YTD relative to 2021 with 103.