Opening Comments

My last note on customer service received a lot of positive feedback and stories about good and bad service from my readers. The most opened links were on the new stealth bomber and the epic takedown of Lauren Boebert.

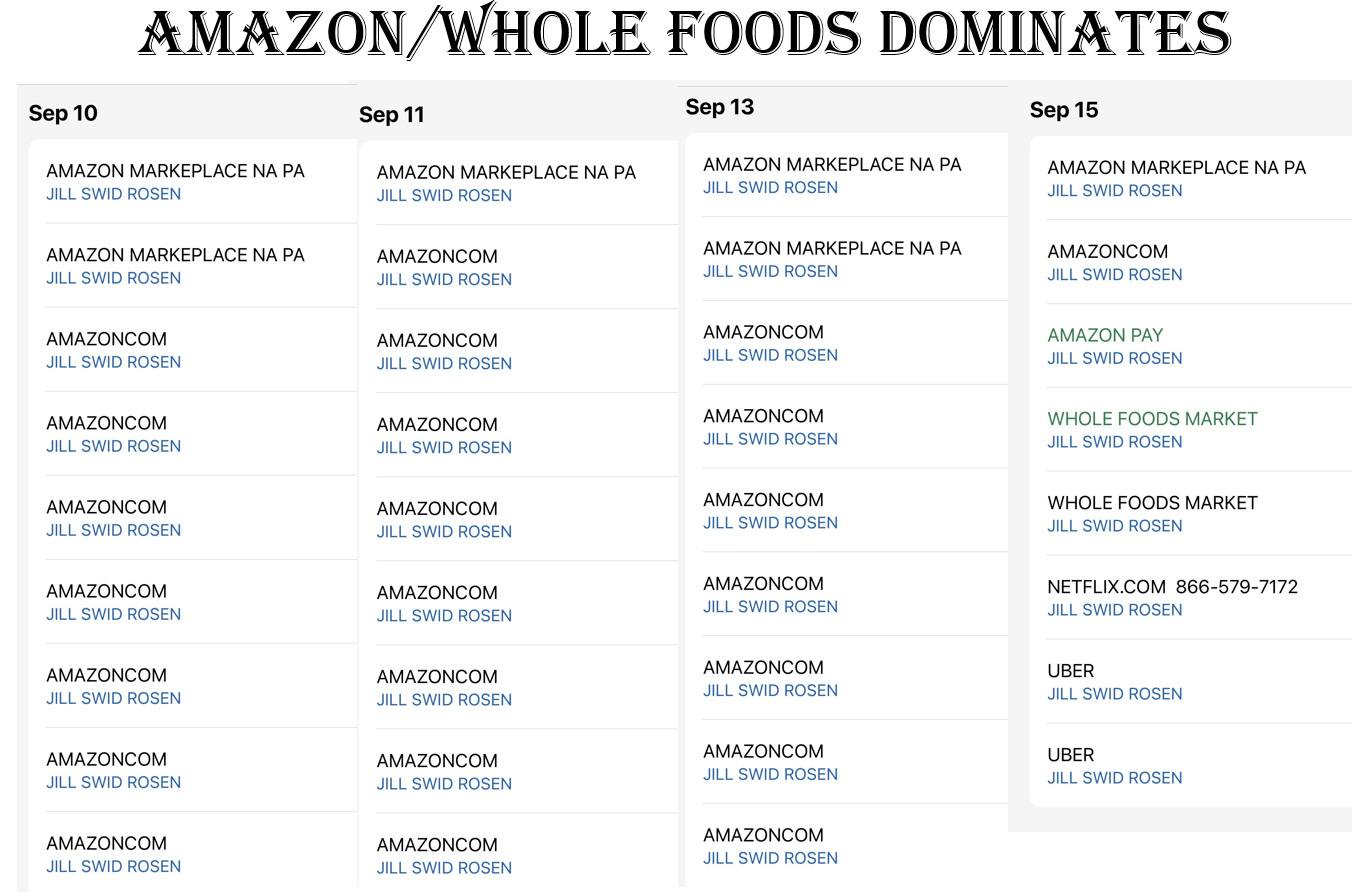

I just got my Amex bill which is shared between me and my wife. I rarely use that card and might account for 5% of the charges. We had 170 charges and 82 of them were Amazon or Whole Foods. The Amazon/Whole Foods charges accounted for 27% of the total bill by dollar amount, as many Amazon purchases are under $20. My point is that Amazon is so entrenched in our lives that it is truly frightening. Bezos is a genius, and the $1.3 trillion market capitalization is there for a reason. The company has made lie far easier to order at the click of a button and come to your home in a matter of hours.

Markets/Rates/Market Breadth

Consumer Charts

The US Can’t Lead the World

Baltimore Schools are Failing

Ackman’s Love of NYC

Color from NYC Condo Developers

Distressed Office Article

New $100mm Building Sold for $16mm 4 years later

Rent Stabilized NYC

Video of the Day-Rosen Hosted Market Webinar

Given my partnership with 3i Members, I host webinars and podcasts as a joint production between the Rosen Report and 3i. Thursday, I was fortunate enough to speak with my good friends, Alicia Levine and Peter Boockvar, two remarkably well-versed market experts. They are regulars on CNBC and are a wealth of knowledge. I always learn from listening to them and Thursday was no different. 3i Members were allowed to listen to the podcast live and ask questions and this one received some of the most positive feedback of any of my webinars and I am excited about the information contained within it. Great charts too. I came up with a dozen topics including:

The link to the video is here.

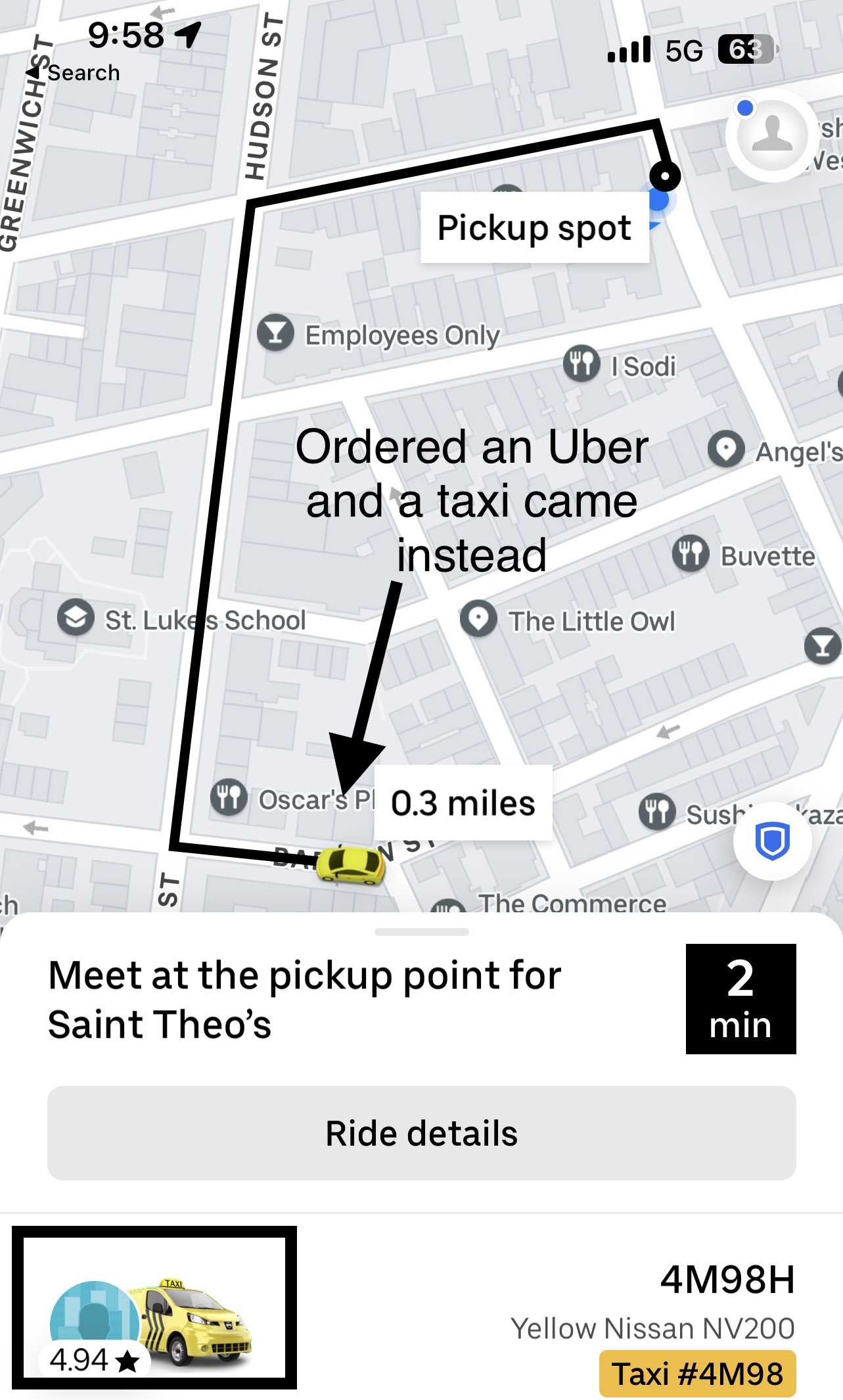

Eating My Way Through NYC

My trip to NYC was amazing. The energy in the city is impossible to beat. I love going back to NYC in short bursts and consuming what the city has to offer. I will say given the UN was in session, President Biden in town, Prince William, and some climate protests, the city was in gridlock. The traffic was brutal. I took the subway around town 5 times and never once felt unsafe. However, the homeless issue was noticeable and made me change subway cars on multiple occasions. An Uber can cost $30 for a mile and now taxi cabs can come in place of an Uber. I really do not understand how a young professional or person who does not make big money can afford to live in Manhattan between sky-high rent, cost of food, Ubers and everything else.

My readers know that all trips to NYC result in some great dining experiences, and this trip was no different. I ate 6 dinners in 4 nights to be sure I got my fill of food and have outlined my experiences below. I was down 13lbs from an all-time high, but gained 3lbs in 4 days. Yes, I double-booked on two occasions to be sure I got my fill before heading to the culinary wasteland of Boca Raton. Two must-go places are Torrisi and Oiji Mi. I will outline all of my dinners below in order of when I ate them.

Maki Kosaka-Sushi-Good Value. Two steps above Surgarfish, but below the greats like Shuko, Nakazawa and others. The vibe at Kosaka is hardly amazing, but the sushi is good and the value is reasonable. I sat next to a surgeon from Sloan Kettering and his wife who is an engineer. Lovely young couple which made for interesting conversation. I am definitely going back. I loved the Bluefin Tuna.

Oiji Mi-Michelin Star Korean in the Flatiron-ANOTHER level of greatness. The room is beautiful. The service is fantastic and the food is stunning from both a presentation perspective and taste. It is fully priced for a reason. I would only say the portions are small and left me wanting more. They have a pre-fixe or ala cart options. I have never been a huge fan of Korean food, but wow, this place is impressive. I ordered the Beef Tartar and the scallops which were both out of this world. I am definitely going back.

Torrisi-Major Food Group (MFG) Italian in Little Italy. I have been to 90% of the MFG restaurants and this is my favorite. The room, service, ambiance, food, and presentation… are all stunning. The place is special. Good luck getting a reservation. The entree portions are not huge, but it does not matter. My favorite dish was the Spaghetti with Lamb Amatriciana which was another level of special. It is a top 5 pasta dish in Manhattan. The charred Clam Boule was amazing too. I love everything about it. I am definitely going back assuming I can get in.

Saint Theo’s-West Village Italian. The scene is why you go here. The food is underwhelming. The West Village is hip, cool, young and a personal favorite, but there are far better food choices (i Sodi, L’Artusi, 4 Charles Prime Rib, Via Corota, Nakazawa, Semma….). I would go back for a drink, sit outside and people-watch but not eat dinner.

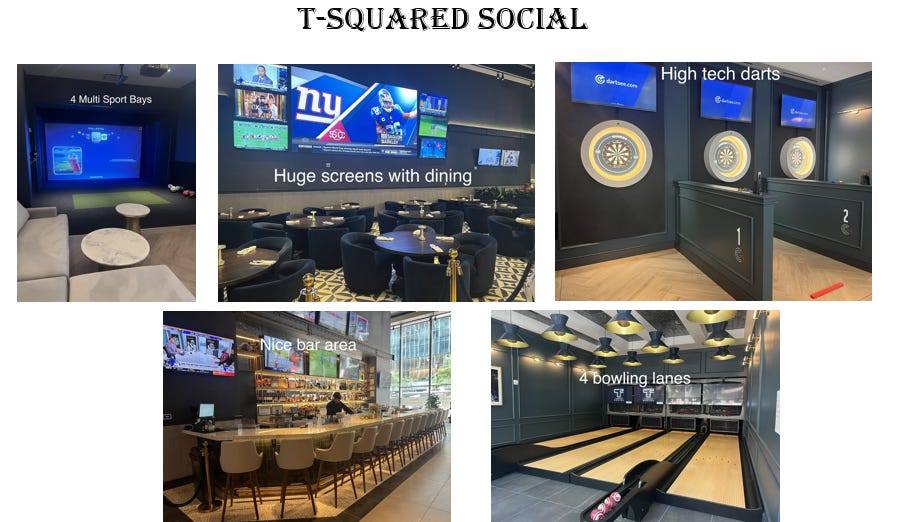

T-Squared Social-This is Tiger Woods and Justin Timberlake’s new sports bar creation. The concept is great (4 sports bays for golf, football, and baseball), 4 bowling lanes, electronic darts, massive TVs with lounge areas to watch games and a great-looking bar area. The issue is the food is INEDIBLE. Shocking that you can spend that much money to build out a place and have awful food. It was the grand opening. I will never eat here again. In the history of Lobster Rolls, this was the worst of all time and it was recommended. Hey Tiger and Justin, give my son a golf lesson and my daughter some singing tips and I will come in and teach the chefs how to cook. Deal? I will give you a money-back guarantee that I blow the doors off anything that is made there currently. The food is unacceptable.

Zuma-Sushi Midtown. I love the room and was once told the buildout was $20mm. The sushi falls short for the price. I would take Maki Kosaka sushi over Zuma at their respective price points, but Kosaka is very low-key with no real vibe. Zuma is worth going for the experience and room, but just not my favorite sushi for the price.

It is hard to beat the excitement, vibe, culture, and dining experiences in NYC. Going back gives me a big smile, but coming home to Florida reminds me of the other reasons why I left 6 years ago.

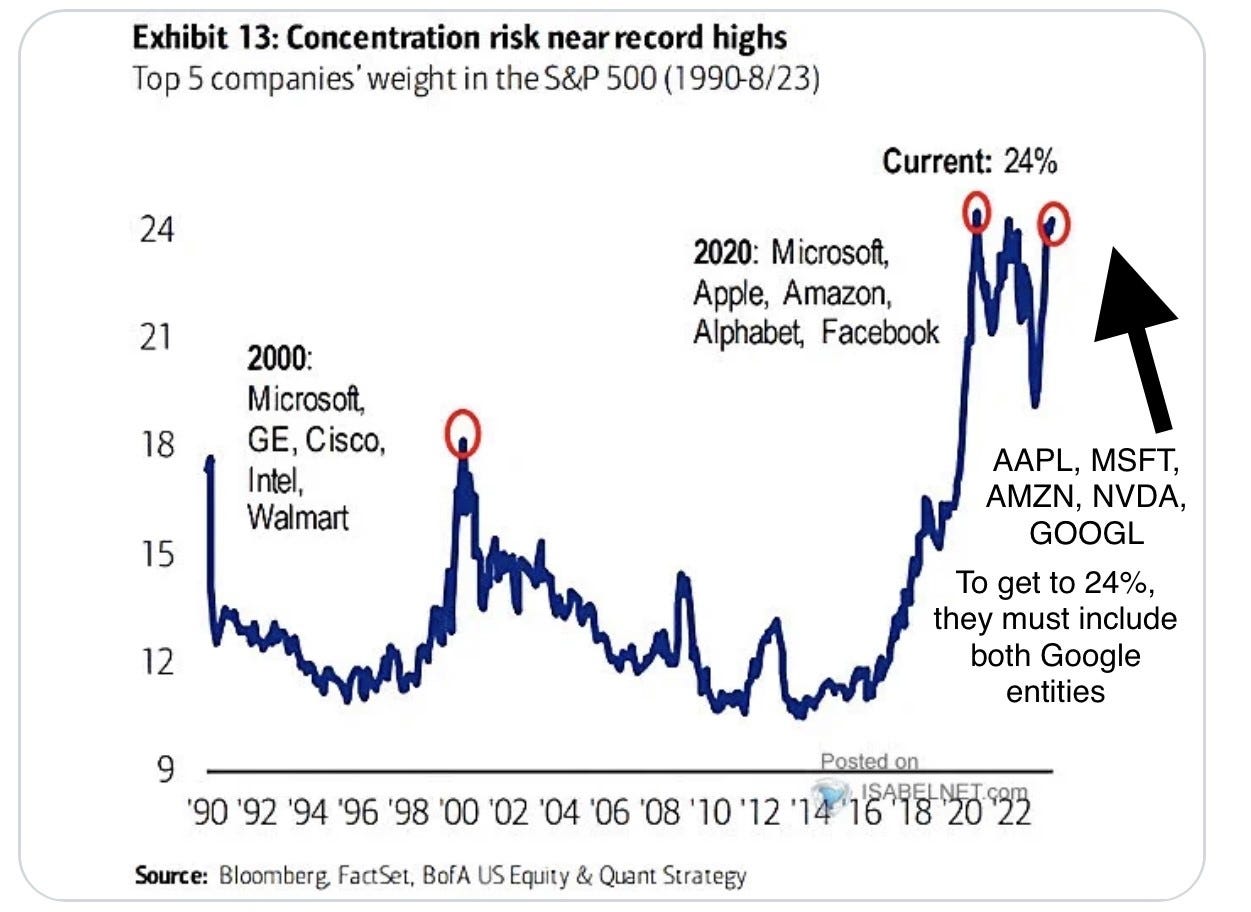

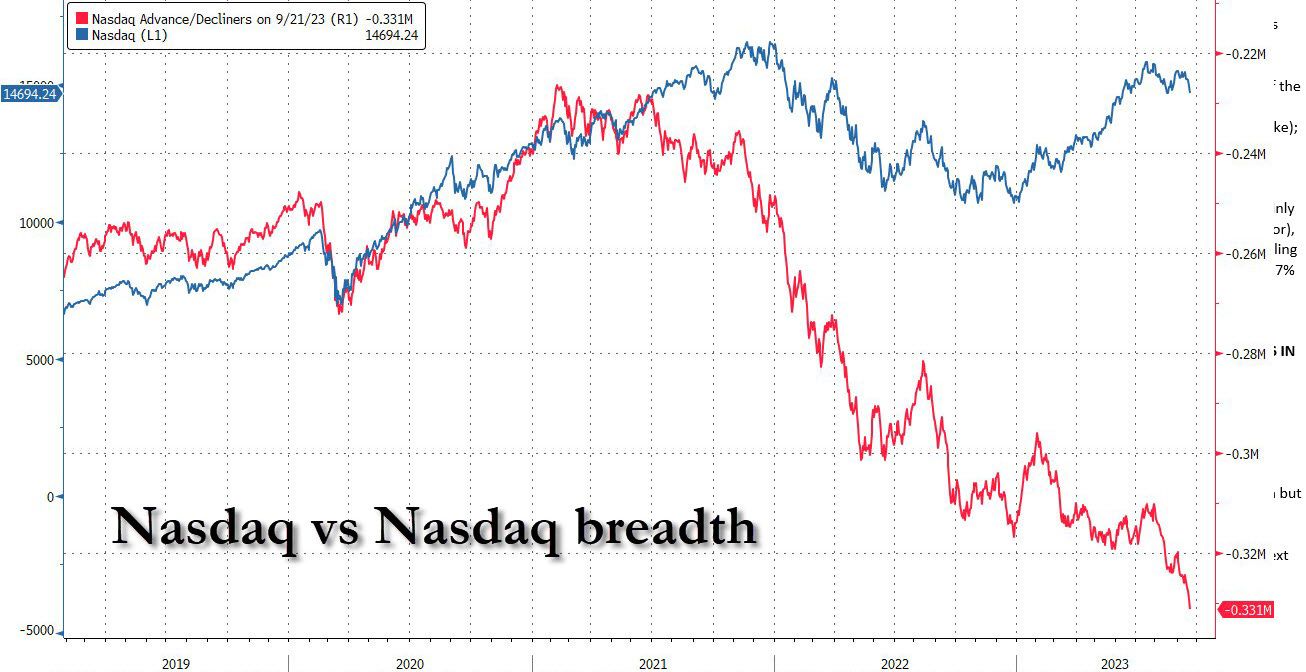

Quick Bites

Markets-On Thursday, stocks fell Thursday, deepening losses for the week, as Treasury yields climbed to multiyear highs amid the Federal Reserve’s plan to keep interest rates at higher levels for longer. The 10-year Treasury yield hit 4.49%, its highest in more than 15 years, with the latest catalyst being weekly jobless claims data showing a still strong labor market that could encourage the Fed to stay in hiking mode. The 2-year yield hit 5.19% after the jobs data. For the week, stocks were down with strikes, higher rates, geopolitical issues, and debt ceiling/shutdown concerns. The S&P 500 and the Nasdaq have dropped 2.9% and 3.6% this week, respectively. That marked the third straight negative week and worst weekly performance since March for each. The blue-chip Dow slid 1.9% on the week. MTD, the S&P is -4.2% and the Nasdaq-5.4%. The third chart shows 24% of the market cap of S&P is in a handful of names, and the last chart shows continued market breadth concerns in Nasdaq. I would rather see more stocks performing in a broader rally to show market health. Another way to see the lack of breadth is the S&P 500 is +15% and Russel 2000 +3% YTD. Low breadth also means long-only managers will underperform due to concentration limitations.

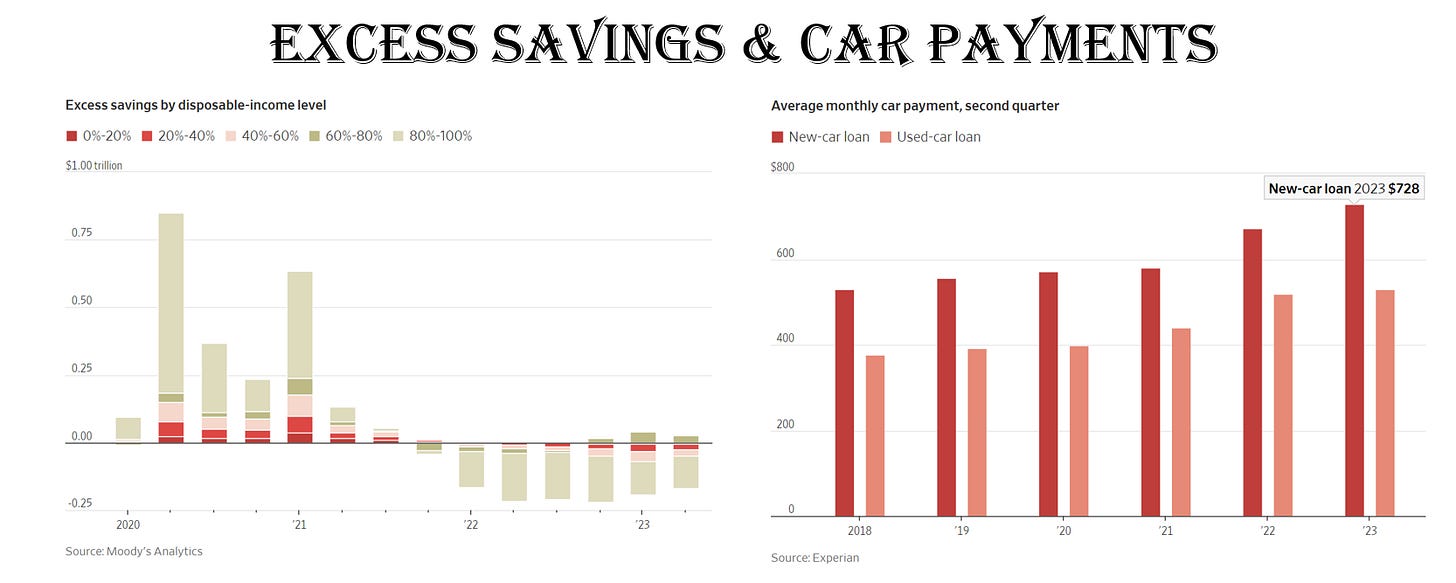

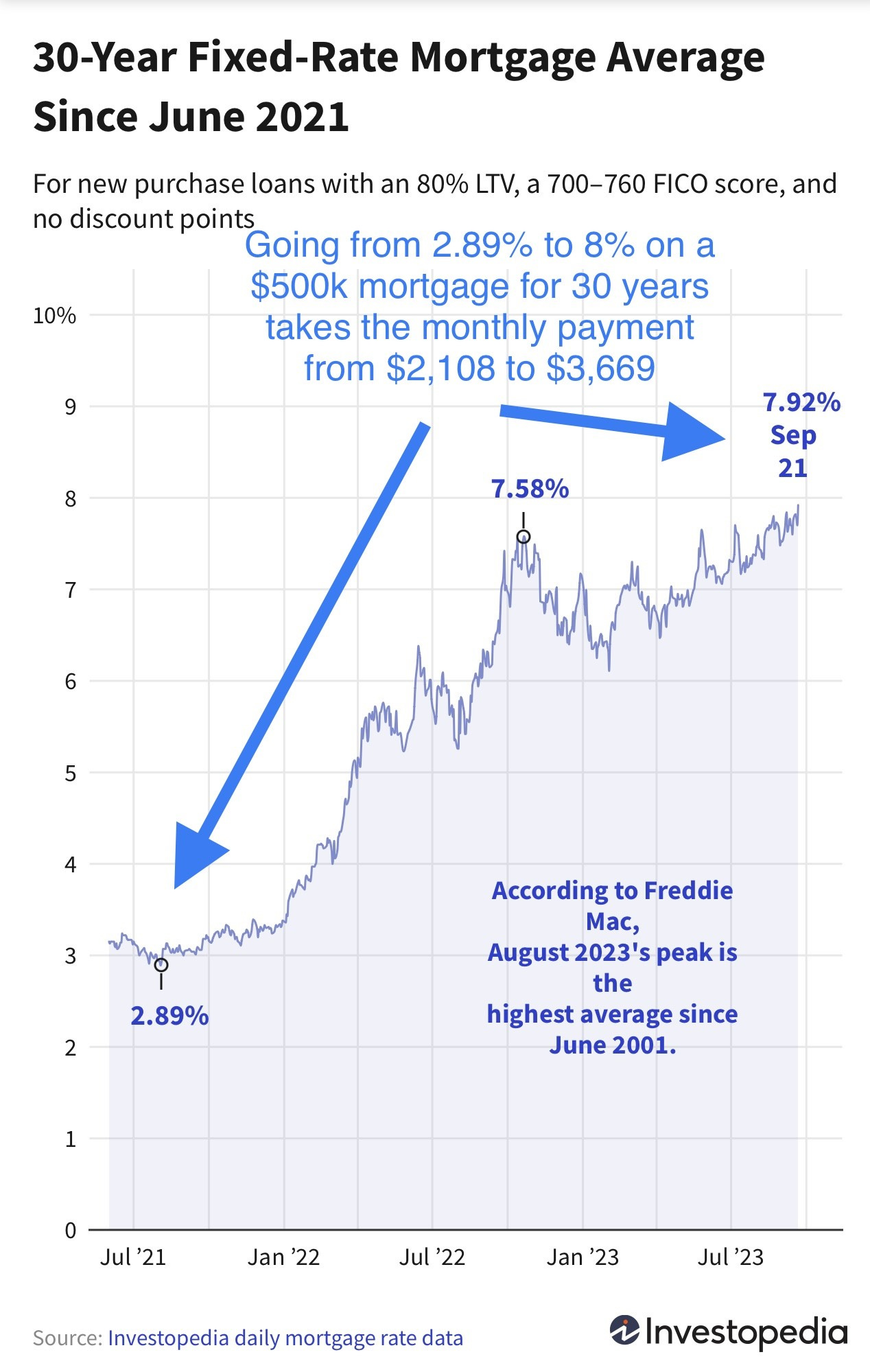

Good WSJ article entitled, “How U.S. Households Got Turned Upside Down by Higher Interest Rates. Consumers are only now beginning to feel the full effects of the Fed’s higher-for-longer policies.” There is a lot to unpack in the article with many good charts. The summary is higher rates are stinging the consumer, and despite the fact that they have been resilient, consumers are stretched thin. I have written extensively about my consumer concerns and excess savings crashing (1st chart) and massive auto loan payments (2nd chart). I have written about credit card delinquencies and rising delinquencies (3rd chart). The fourth chart shows the # of customers who took out a short-term loan for the first time in the prior year. I continue to believe the consumer is stretched and although they have been spending on experiential matters (travel and restaurants), we will see things slow. We heard from major retailers that the consumer was pulling back. Also, the article outlines that it is more difficult to get credit with 58% suggesting it is much harder (14%) or somewhat harder (44%). I added charts that were not in the article as well. In a CNBC article, Goldman gives its view on cards. Credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis, according to Goldman Sachs. Losses currently stand at 3.63%, up 1.5 percentage points from the bottom, and Goldman sees them rising another 1.3 percentage points to 4.93%. This comes at a time when Americans owe more than $1 trillion on credit cards, a record high, according to the Federal Reserve Bank of New York.

Good Bloomberg article entitled, “The US Can’t Lead the World If It Can’t Govern Itself.” In short, the article suggests the polarization in America is tearing it apart and it is hard to lead the world with chaos from within. The world has a stake in this story. How can America lead a global struggle between freedom and tyranny if it can’t even preserve its own democracy? This weakness is now the bull’s-eye for all enemies of the international order and democracy. China and Russia are doing everything they can, with disinformation and propaganda, to stoke America’s polarization. I will take it a step further and suggest the lack of centrist politicians and moving to the Right or Left is helping create a large divide. I registered as an Independent because I felt both parties were not doing a good enough job. The gap between the poor and the wealthy is too large. The divide on immigration policy, spending, entitlement reform, LBTGQ related issues, regulatory policy, energy policy, foreign policy, taxation, crime, and abortion… is too big and we need to find more common ground. I feel confident that neither front-runner is qualified to hold office and am disappointed that this is the best America has to offer.

This is a scary article entitled, “At 13 Baltimore City high schools, zero students tested proficient on 2023 state math exam.” In those 13 high schools, 1,736 students took the test, and 1,295 students, or 74.5%, scored one out of four. One is the lowest level, meaning those students were not even close to proficient. The TOP 5 Baltimore high schools had an 11.4% proficiency rate. We are failing our children. We can give money to illegal immigrants and foreign countries and waste HUNDREDS of BILLIONS each year on frivolous spending, make drones and rockets that can do amazing things, yet we cannot teach our own basic skills in the classroom. The articles suggest it is not a funding issue and the leader of the public school system makes $445k. Think about the long-term ramifications of thousands of young Americans without basic skills in math or English. What will they do for work? To get out of the vicious cycle, education is key. We can do better.

Good Post article on Bill Ackaman and why he remains bullish on NYC. Having just been to NYC for 4 days, I will tell you the energy, vibe and excitement do not die. The article goes into detail on Ackman’s passion for all things NYC, and I like his solution for workers to be remote in July/August, but in the office other than that.

Other Headlines

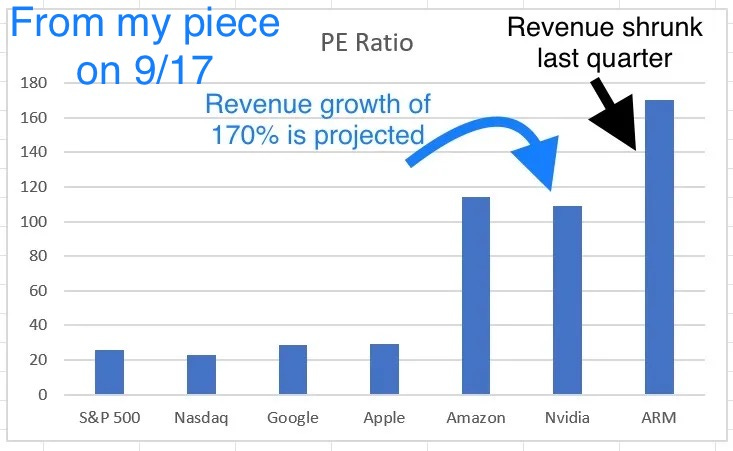

Wall Street’s ‘meh’ response to tech IPOs shows Silicon Valley’s valuation problem

This is not ideal as more companies try to go public. In a recent piece, I showed why ARM was overvalued at a PE of 170. After an IPO at $51, it hit $69 and is now at $51 after dipping below the IPO price.

Russia’s indefinite ban on diesel exports threatens to aggravate a global shortage

I suggested tight supplies would push oil up to $100 and nothing I have read suggests otherwise.

Corporations say they have a new No. 1 risk, and they’re spending big to defeat it

Fears about government regulation have spiked sharply this year and are now the No. 1 threat to business, according to chief financial officers surveyed by CNBC. I remain a free-market capitalist and prefer smaller government and generally, less regulation.

McDonald’s to raise royalty fees for new franchised restaurants for first time in nearly 30 years

UAW targets 38 facilities at GM and Stellantis for expanded strikes; skips Ford

More than 75,000 Kaiser Permanente workers threaten strike if labor agreement not reached

Social Security Benefits Are Growing Too Fast

We have major deficit and spending issues. This article suggests Social Security benefits are growing too fast. Don’t forget that the population is aging and we have massively underfunded plans by tens of trillions. Stan Druckenmiller estimates total underfunding of government obligations could be $200 TRILLION. The Cato Institute estimates underfunding of Social Security and Medicare is $163 Trillion.

Biden leads Trump in potential New Hampshire rematch, though dissatisfaction with both remains high

62% of New Hampshire residents say they would be dissatisfied or worse if Trump retook the presidency and a 56% majority say they’d be dissatisfied or worse if Biden won reelection. Scary #s for the leading candidates. Biden approval down to 39%. The new ABC/WaPo poll came out and Trump is in the lead 51/42. I am in shock given 91 indictments.

I agree that today is not the time to increase prices on goods but do feel we need better trade agreements. I would like to see more manufacturing in the US and with AI/Robotics, I feel that will happen.

US general says Trump was angered by invite to wounded soldier: "Nobody wants to see that"

I keep suggesting we need new blood and Trump and Biden are both not the right person for the job.

Sen. Bob Menendez of New Jersey and his wife charged with bribery

I just feel as Americans we deserve better. There are so many awful politicians and we keep electing the bad ones. Both sides are guilty. Remember, Menendez said Trump was “compromised” by Russia. Menendez was found with $480k in cash but claims his innocence. He beat one corruption case previously. Even the cognitively compromised, hoodie-wearing Senator, Fetterman. is now calling for Menendez to step down.

NYPD counterterrorism unit’s ranks could be slashed by up to 75%

Members of the NYPD’s Critical Response Command – described as one of its “first lines of defense against a terrorist-related attack,” are likely to be reassigned to regular patrol due to police shortages. What could possibly go wrong?

Troops plagued by filthy conditions, squatters in military barracks

The Problem with a Chicago Municipal Grocery Store

I have been clear that I do not believe City, State or Federal governments are the best stewards of capital and would prefer less government intervention. I am opposed to a Muni-run grocery store. Many Chicago grocery stores closed and blamed theft. How much theft will take place at these stores run by the inept government of Chicago?

I am not sure $25k sushi dinners, and $5.8k 5-star Paris hotel stays send the right message to striking writers.

Miserable after age 9? After childhood, happiness doesn’t peak again until age 70!

Take care of your teeth and gums. Oral health can affect your brain.

Saudi crown prince says he will keep ‘sportswashing’ as criticism of the practice grows

Remember, I wrote an extensive article on this topic, “The Economics of Absurdity.”

Missing 10-year-old Florida boy steals mom’s car for 200-mile joyride with sister

Although this was a bad idea, I am impressed a 10-year-old can drive 200 miles.

Florida Man Steals $33,000 Worth of Rare Coins, Cashes Them in CoinStar Machine for $29.30

The Florida Man strikes again.

Real Estate

I had conversations with quite a few R/E investors/developers in NYC during my trip and the common theme on residential was a material slowdown and lots of concern. Buyers are struggling with higher rates, work from home, crime, homelessness and general poor policies in NYC. I spoke with building owners who are trying to sell units and finding far less traffic today and growing concern about rising carrying costs with higher rates and labor costs to run a building. Jared Helpern (Douglas Elliman NYC) told me that entry level (studio/1 Bed) apartments are slow due to rates but higher end remains decently busy. However, this WSJ article outlined 35 Hudson yards was seeing discounts of up to 50%. I would not consider living in Hudson Yards. Jared suggested the rental market has cooled slightly and more concessions are showing with free rent, owners paying broker fees..). In an unrelated matter, Rite Aid is planning on closing up to 500 of 2,200 stores under its bankruptcy plan. More retail coming on the market, as each store is nearly 15k feet on average.

Good Real Deal article on the growing amount of distressed office space with concerning statistics. Troubled loans tied to office buildings across the U.S. are on the rise, with commercial borrowers in Chicago, Denver, Philadelphia and San Francisco among the hardest hit. The rate of delinquent or specially serviced commercial mortgage-backed securities 2.0 loans rose to 6.8 percent in August, up from 4.5 percent in June last year, the Silicon Valley Business Journal reported, citing figures from Kroll Bond Rating Agency. More properties face foreclosure as landlords struggle to fill vacant offices while refinancing office towers becomes a tougher challenge. CMBS 2.0 conduit loans made after the Great Recession make up $600 billion in commercial real estate debt, or 13 % of the $4.5 trillion commercial real estate debt market. The national office distress rate was 8%. Of the nation’s top 20 markets, the distress rate of commercial mortgage-backed security loans last month was 7.2 %, according to KBRA, after rising in 15 cities. Chicago tops the list for troubled loans at 22.7%, followed by Denver at 19.1%, Philadelphia at 14.2% and San Francisco, where a third of its offices are empty, at 13.9%.

This Real Deal article outlines how a 2019 built small office/retail building next to Penn Station sold for less than 25% of the cost to build it. I have been into the building and it was very nice. The building was auctioned for $16.5mm after costing approximately $100mm to build. I am told despite the fact that the world was given a chance to bid, only 3 showed up. Marathon alleges they were owed $64mm at the time of the sale, but I am told it was $68mm with interest. The building sold for $300/ft or approximately 85% of the cost for a 4-year-old building in an area with some of the highest foot traffic in the city. The total availability rate in Manhattan is 19% with downtown at 22.7% and Midtown at 17.4%. I can guarantee you there is a lot more coming behind this foreclosure in major cities (Chicago, NYC, LA, San Fran, DC, St Louis, Minneapolis, Portland, Seattle, Philly…). I am not convinced the $16.5mm price was a steal for the building given the concessions to rent and vacancy time. On a related note, I connected with a big R/E lawyer who is working on a foreclosure. He told me getting court dates is becoming increasingly challenging in NYC for foreclosures, meaning they are piling up. What does this mean for R/E tax receipts given the far lower valuations? NYC has seen an exodus of wealth, and corporations and now R/E taxes will need to come down sharply with lower prices just as deficits are ballooning. The current projected deficit for NY State is projected to be $9bn next year. I will take the over on that one.

Another a Real Deal article on the topic of rent stabilized buildings in NYC. As struggling landlords scramble to unload rent-stabilized buildings before the bank comes calling, a recent sale shows just how big a haircut some are willing to take. Barberry Rose Management sold 16 rent-stabilized buildings for $47 million this month. The properties span Sherman, Post and Vermilyea avenues in Inwood and include 519 West 143rd Street and 574 West 161st Street in Washington Heights. The brokers on the deal, Cignature Realty’s Lazer Sternhell and Peter Vanderpool, said the sale took “a bit longer than expected,” but ultimately, Barberry Rose and buyer Coney Realty, settled on a “good price.” These days, a good price for a rent-stabilized portfolio pencils out to a 44%t discount. Barberry Rose, headed by Lewis Barbanel, bought the buildings for $83.6M in 2016, property records show.

Rosen Report™ #616 ©Copyright 2023 Written By Eric Rosen