Opening Comments

My last note was about eating my way through NYC and the most opened links were Bill Ackman on his love affair with NYC and the video of the market panel with Alicia Levine and Peter Boockvar in conjunction with 3i Members. Lots of valuable information in the video from seasoned market experts who appear regularly on CNBC. I learned a lot.

The R/E section today has some doozies in there. You must check it out.

Markets

No Longer $18.4 Trillion of Negative Yielding Debt

Larry Summers on Deficits

“Zombie” PE Funds

$30k/month Boca Apartment

$30mm Ft. Lauderdale Waterfront Sale

San Fran Office Vacancy & Rising Tax Appeals

NY Mall Cost $350mm to Build in 2019 and Sold for $10mm

New Eye on the Market-Cembalest-ECONOMY & MARKETS-What was I made for: Large Language Models in the Real World

Today’s Eye on the Market covers AI and as usual, it is informative and fun. In short, he does not give AI the best grades as you can see below but goes into detail about his views. He also touches on oil and the recent rally.

Video of the Day-Nutcase Golfer Flexing Shirtless

There have been fights on golf courses countless times. This deranged lunatic stole someone’s golf ball and challenged people to fight. He takes his shirt off and flexes his unimpressive physique shouting, “This is a man that’s been to heaven.” I am not quite sure what it means, but love it. After flexing, he said “so, if you wanna test God, come and get it.” This man needs serious help. The video is only 30 seconds, but you can’t watch it only once. This article outlines a bunch of incidents with the law and suggests he has some serious problems including threatening his neighbor while only wearing his underpants.

I am the REAL Eric Rosen

My name is not particularly unusual. Eric Rosen is no Engelbert Humperdinck. I have been confused with other Eric Rosens over the years. There is an Eminem song called, “The Real Slim Shady,” and I feel as though I am the REAL Eric Rosen.

In my career, I have had a few mix-ups given there is another Eric Rosen on Wall Street. When I worked at JPM, I would often get odd emails that were clearly not meant for me. I quickly figured the other Eric Rosen was working at Onex at the time as a partner. I would respond to the emails from strangers with “I think you mean Eric J Rosen at Onex, not Eric S. Rosen at JPM.” I am not exaggerating, that I received dozens and dozens of emails over the years and even some texts meant for the imposter Eric Rosen. Many people have both Erics in their contact list given we were both in and around Wall Street. Eric J went from Onex to MSD Capital (Michel Dell) and our lives overlapped even more. He now is the managing partner at Hudson Hill Capital.

It was 2005 and I had just married my wife, Jill. She had jury duty downtown in NYC and a man walked up to her as they were waiting to be called. He introduced himself as Eric and asked her name. My wife said, “My name is Jill, what is your last name?”

He responded, “Rosen.” She said, is this a joke? Who put you up to this? My husband’s name is Eric Rosen.”

He laughed and said, “JPM Rosen?” She nodded and they had some fun chats together during jury duty.

I was invited by my father-in-law to a speech at the Council of Foreign Relations in NYC maybe 10 years ago. Eric Rosengren, the president of the Federal Reserve Bank of Boston was the speaker for a room of 50 people. I walked in to get my name tag and you guessed it, there was a mix-up. The name tag people assumed there was not an Eric Rosen and Rosengren so, they gave the President of the Federal Reserve in Boston my name tag with “gren” at the end and I did not have a name tag. I walked up to him after and said, “You are wearing my name tag and got a laugh.”

When I took my daughter skiing in March in Utah, and wrote one of my most opened pieces, “Skiing is for Billionaires,” given the ridiculous expense of skiing today. We went to a delicious restaurant called, 350 Main and I walked in and said, “Eric Rosen for a 6pm for two.” She said, “I am sorry, your reservation is for 8 people at 7:30.” Eric J strikes again I presumed. She looked harder and realized the REAL Eric Rosen had a 6pm for 2. Unfortunately, I did not see the other Eric Rosen and am unsure if it was J or yet another imposter.

In early June of 2023, I took my family to Cafe Maxx, the best restaurant in Broward or Palm Beach County in my opinion. I walked in and said, “Eric Rosen for 4 people at 7pm.” The host looked and said, “You have a reservation for 2 at 7:30.” Here we go again. I was hoping it was Eric J, but it was not. When the couple sat at the table next to us, I walked over and introduced myself. We had a fun chat.

I just received a LinkedIn message (below) from Eric Rosen I met from Cafe Maxx asking to grab a bite, something that I thought was a nice gesture. We got together for breakfast on Wednesday, September 27th, and struck up a friendship. His middle initial is also “S.” Son of a….Also, he lives a few miles from where I went to high school.

I just want to set the record straight. I am the REAL Eric Rosen and everyone else is an imposter.

Just today, I received over a dozen emails and texts regarding a NY Post article citing Eric Rosen but it was not me.

The Real Eric S. Rosen looks like me in the pictures below. Presume all others are imposters. Yes, will President Clinton, I look very young, I was 42 years old.

Quick Bites

Marko Kolanovic from JPM came out with a note today and suggested the S&P YTD gains are driven by 8 “mega-cap tech stocks, inspired by the AI narrative.” Further, he said, the equal-weighted or small-cap indices that are flat for the year are underperforming cash. He is not constructive on stocks (1st chart below). The consumer delinquency chart is something I have been discussing for months and Marko outlined it in his note. The AP headline on the potential for government shutdown is clearly starting to weigh on the market as well. Congress is moving into crisis mode as time runs short to avoid a government shutdown. I do feel we need to reign in spending but don’t love holding hostages to get there. We need fiscal responsibility, and balanced budgets and cannot give money to everyone who asks for it. This is the market summary link for today. Treasuries remained weaker with the 2-year yield up 6bps to 5.14% and the 10-year yield+5bps to 4.61%. Oil hit almost $94/barrel today after being up 3.7% after US crude stocks fell more than expected. Recall that in January I suggested $100 oil was in the cards due to supply shocks despite China. Global consumption is up to 103mm barrels/day, an all-time high, and is now +21% YTD and +40% from mid-June lows.

I have often written about the absurdity of Central Bank Policies leaving the gas on the fire for too long. I wrote about the $18.4 TRILLION of negative yielding debt in December of 2020. Well, check out the updated chart from Bloomberg. Negative yielding debt is now $400bn or down $18 Trillion in less than three years. I believe only Japan has negative yielding debt today. There was $18.4 trillion of negative-yielding debt 3 years ago. Sure seems like an eternity. Remember, the Treasury Department did not refinance enough out the curve with low rates. Last I checked. 44% of Treasuries were inside of 1 year and rates are far higher now. Check out this CNBC headline, “Dimon warns that the Fed could still raise interest rates sharply from here.” “I am not sure if the world is prepared for 7%,” he told The Times of India in an interview. Also, the Fed’s Neel Kashkari sees a 40% chase of “meaningfully higher” rates. Again, the Fed’s ineptitude and calling inflation “Transitory,” while keeping rates down and buying hundreds of billions of bonds only fueled the fire. I do not believe Fed Funds should go materially higher given the Treasury market is doing it for them but think of the interest burden for all those in debt (governments, corporates, consumers, developers, homeowners….) if they do.

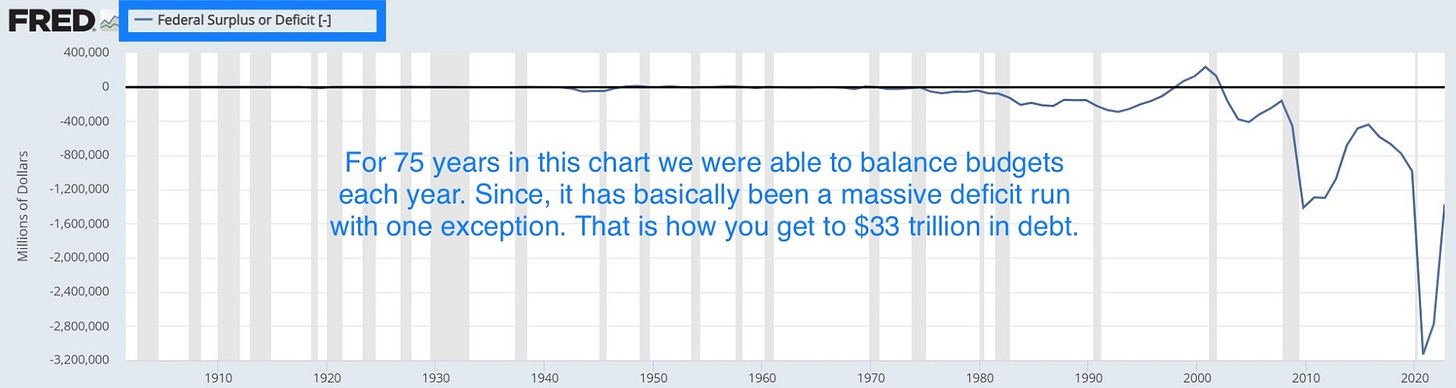

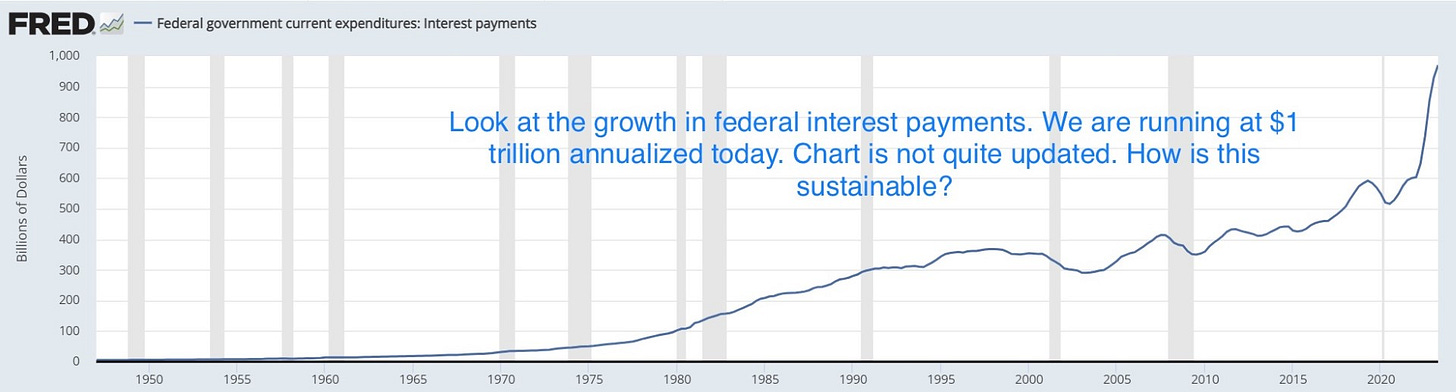

I am not the hugest Larry Summers fan, but you can’t deny he is an impressive person (Treasury Secretary, National Economic Council, President of Harvard…). The article entitled, “The Wisdom of Larry Summers,” is a short but interesting read. He makes 6 points about the economic debate. I will let those interested read them but want to highlight his last point and the one I have been screaming about the most. This is Larry’s point: Finally, I would suggest that substantial and accumulating deficits and debts are a substantial threat to national security and national power contrary to what is often believed in what sometimes seems like a post budget constraint era of economic thinking. . . . [Our] budget prospects are vastly worse than they were at the time of the Clinton administration’s successful budget actions and substantially worse than they were at the time of the Simpson-Bowles efforts. The budget deficits a decade out comfortably in double digits now seems as a share of GDP now seem a reasonable projection with primary deficits quite likely in the 5% of GDP range. Although both sides have contributed to the deficits, it is clear the Republicans have tried to temper spending. We need both parties to come together and be more fiscally responsible. These charts don’t lie. We were fiscally responsible for a couple hundred years and have run deficits since the 1980s for the most part and things have deteriorated significantly on spending and deficits since 2000 This has resulted in $33 Trillion of Federal Debt and $1 Trillion in annual interest expense with both growing too fast.

Interesting Bloomberg article entitled, “Private Equity’s Slow Carnage Unleashes a Wave of Zombies.” Across the $12 trillion industry, hundreds of private equity firms are lumbering on years after their funds’ intended twilight with no new fundraising in sight — a cohort that investors and regulators have dubbed “zombies.” Now, a historic shakeup of the industry is threatening to impose the same fate on more fading money managers whose past funds are inching toward limbo. After years of ramping up allocations that helped launch numerous private equity firms, many pensions have maxed out how much they can devote to the illiquid asset class. Instead, they’re steering cash to investments that are more attractive as interest rates climb. The result: Buyout firms that failed to build fresh war chests during the recent boom years of low interest rates are now finding it difficult to arrange fresh funds. The industry is on track to raise 28% less than last year, according to Bain & Co. “If you haven't raised a new fund in the last five years, the perception is you may become a zombie,” Todd Miller, co-head of private capital advisory at Jefferies Financial Group Inc. “You need to raise new capital to feed the junior team.”

As a sign of the great migration, this Bloomberg article is entitled, “Florida Overtakes New York as Second-Biggest US Housing Market.” The total value of US housing rose more than $2.6 trillion in the past year, Zillow said, defying predictions that higher borrowing costs would lead to a prolonged slump. Low levels of supply, enhanced by the lock-in effect — which has left current mortgage borrowers reluctant to give up their low-cost loans — have pushed nationwide prices to a new high. The gains haven’t been evenly spread across the country. In California, which contains about one-fifth of the US housing market, prices have declined since June 2022. But in Florida, the value of residential property has risen $160 billion in that period — pushing the Sunshine State ahead of New York in the national rankings. The amount of wealthy readers who call me each week looking to leave the NYC and surrounding area is not slowing down materially. Today, I have approximately $100mm of home buyers.

Other Headlines

Stocks Flash Recession Warning as Trouble Spreads to Industrials

US small-cap and industrial stocks are dropping, typically signals of a recession, but in a year where equities have already beaten expectations some investors are dismissing the moves as little more than noise — for now.

Top Wall Street analysts are bullish on these dividend stocks

BlackRock, State Street Among Money Managers Closing ESG Funds

State Street Corp., Columbia Threadneedle Investments, Janus Henderson Group Plc and Hartford Funds Management Group Inc., among others, unwound more than two dozen ESG funds this year, according to data from Morningstar Inc. I wrote about the conflicts a few months ago and questioned the ESG focus based on continued poor returns.

The World’s Biggest Crypto Firm Is Melting Down

‘Every battle is a do-or-die situation,’ Binance co-founder Yi He writes

Amazon to invest up to $4 billion in Anthropic, a rival to ChatGPT developer OpenAI

U.S., 17 states sue Amazon alleging monopolistic practices led to higher prices

Median household incomes grew in 16 states and D.C. in 2022—see where they increased the most

The states on the list are shocking to me.

Only Richest 20% of Americans Still Have Excess Pandemic Savings

For the bottom 80% of households by income, bank deposits and other liquid assets were lower in June this year than they were in March 2020, after adjustment for inflation. The consumer is in real trouble with depleted savings, high credit card balances, high auto payments, and high prices due to inflation. Only the wealthy are doing fine. You heard about this issue in the Rosen Report 8 months ago.

Americans Finally Start to Feel the Sting From the Fed’s Rate Hikes

The average family of four makes approximately $75k/year. Here is one example which is squeezing them (auto payments). What about inflation, higher credit card bills, higher rent…

If you look at the totality of the mounting evidence, even Biden supporters need to start questioning the optics.

Biden makes history by joining US picket line

I agree with Musk below. The US is not efficient in manufacturing. Massive pay raises will force US auto makers to significantly raise the price of cars making them less competitive with foreign alternatives. The UAW peaked at 1.5mm members in 1979 and are around 383k today for perspective.

Judge rules Donald Trump defrauded banks, insurers while building real estate empire

A ruling in a civil lawsuit brought by NY Attorney General Letitia James, found that the former president and his company deceived banks, insurers and others by massively overvaluing his assets and exaggerating his net worth. Unless Trump wins on appeal, his NY business licenses are revoked according to the article.

Santos says Menendez should not resign: ‘He’s innocent until proven guilty’

Shocker, serial liar Santos supports Menendez. Menendez said the more than $480k in cash hidden in clothing, closets and a safe came from personal savings. Yeah, right.

Days After Biden Approves $6 Billion Ransom Deal, Iran Takes Another Westerner Hostage

I wrote about this in a recent report about yet another blunder with Iran. I did not like Obama’s Iran Nuclear Deal and have not liked any of the Biden arrangements. From time to time, I have put in a cartoon from Michael Ramirez, the two-time Pulitzer Prize-winning cartoonist. I thought the one below was perfect for the bad foreign policy moves on this subject.

When I was in NYC last week, I wanted to go to a store but last time I was there, I felt uncomfortable by the Roosevelt Hotel. The result is I passed on shopping. How many others do the same?

95-year-old veteran kicked out of nursing home to make way for migrant housing, lawmakers say

I do not believe the interests of illegal immigrants should be placed ahead of US citizens, let alone 95 year old war veterans.

Democratic El Paso Mayor: City at ‘Breaking Point,’ Sends Migrants to Sanctuary Cities

Attack in an alley in Bucktown in Chicago

A man was walking down an alley with a slice of pizza when he was viciously attacked from behind by two criminals. THIS VIDEO IS DISTRUBING. It shows a blatant disregard for human life. If the Left cities want to reverse the awful trends of business and wealth leaving, citizens fearing for their lives, and businesses closing…maybe, there should be consequences for such heinous acts. When these awful human beings are caught, what are the consequences? Cash free bail? Ken Griffin left Chicago and cited crime as the main reason. He donated $750mm to the city, paid hundreds of millions in taxes.

For 10 years, this was my main subway station.

At least 20 arrested in night of looting throughout Philly, police say

Foot Locker, Apple and Lululemon were hit.

Target Closes Nine NYC, West Coast Stores to Stop Losses From Rising Theft

This means lost jobs, lost money for R/E developers/banks, harder for law-abiding citizens to get conveniences and hurts R/E values of the neighborhood. Maybe having consequences for crime is an option?

NYC students going to school high ‘every day’ as drug incidents rise

So we decriminalized weed and kids come to school stoned? Are you surprised? There are at least 66 dispensaries in NYC.

Writers reach tentative deal with studios to end strike after nearly 150 days

World’s 50 best hotels for 2023 revealed

The top 20 are below. The link has the rest. My friend owns Nihi (#18) in Indonesia and I need to get there as I hear it is amazing.

The first tour inside Manhattan’s newest private club, with $100,000 membership fees

I was at the old Core Club and need to check out the new digs.

Taylor Swift effect: Travis Kelce sees huge spike in jersey sales amid romance rumors with pop star

Taylor, I want to send you some Rosen Report Swag, and I only ask that you wear the hats during your ENTIRE next show. I have a funny feeling my subscribers would get a nice bump.

For $741k/hr, I will speak about whatever you want. Hard to see Michelle give up this kind of money to run for President. Remember, she was my dark horse candidate from 1 year ago.

You must read about this crazy and elaborate prank.

Ozempic, Wegovy drug prescriptions hit 9 million, surge 300% in under three years

AI girlfriends are ruining an entire generation of men

I had no idea how prevalent the AI girlfriend thing had become.

One influencer created an AI bot of herself named Caryn, then gained over 1,000 users (i.e. real boyfriends) in less than a week and a waitlist of more than 15,000 people.

Worst-rated tourist sites across the globe revealed: ‘grubby’ US spot tops list

I have been to the Hollywood Walk of Fame and Busch Gardens and both were awful. I was surprised to see Taj Mahal on the list.

Break-dancing, flag football stuck waiting for L.A. Olympic Games ruling

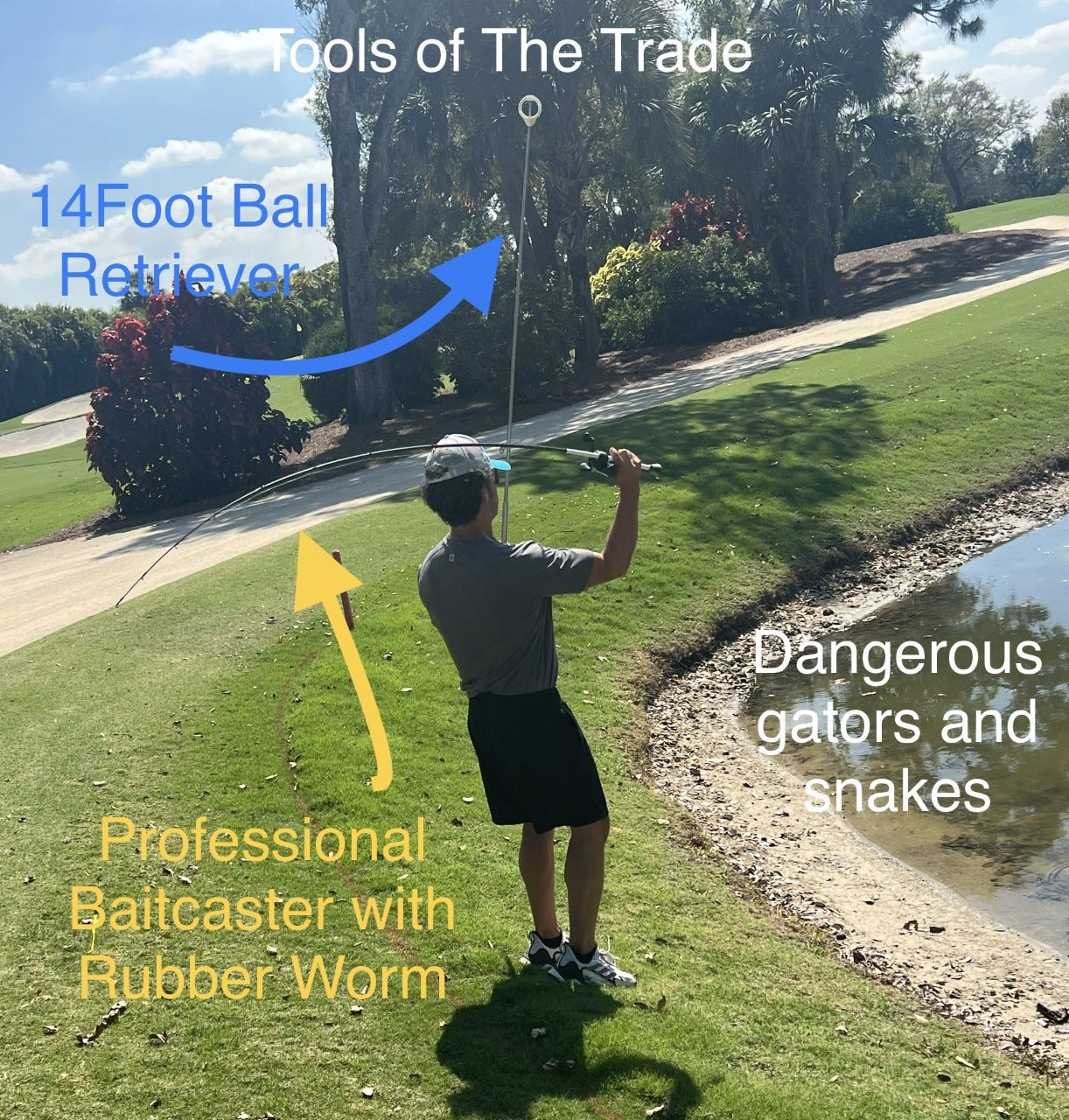

The Olympics are turning into a clown show of dumb sports. I wrote about my prowess in bass fishing while finding golf balls which I call, “Ball Hawking.” I want the combination sport in the 2028 games. I am guaranteed to be the gold medalist.

Real Estate

My wife called me the other day that the Alina (new building in Boca) is asking $50k for a 2 bedroom. I told her this was impossible and I needed to speak with whoever told her such ridiculousness. I called up her friend who let me know the building was asking $50k for a 3,450sq foot (3 bed/3.5 bath) model apartment which was furnished. 2,700 sq feet of terrace space. I told her, “It will never rent for that amount. If it does, my house will go for $200k/month.” I suggested she call back and offer $30k. She called back, it was rented for $30k/month just prior to her call. I believe this was a seasonal rental (4 or 5 months), not for the full year. Obviously, seasonal rental prices are higher by month relative to a 12-month rental. My point is simple, just because someone is asking a ridiculous price for sale or rent does not make it so. In a market that sees “aspirational” asking prices with 8% mortgage rates, don’t be shy. So you offend the owner. Who the hell cares? The finishes at the Alina are nice and I like the location (walk to a bunch of restaurants) and believe they make a good product, but the bad game of telephone suggesting $50k for a 2 bedroom is a joke. It also looks like the unit is on the first floor.

Just 40 days after it hit the South Florida real estate market with a hefty $33 million ask, a lavish waterfront home in Fort Lauderdale’s gated Harbor Beach enclave already has sold for the still substantial amount of $30 million, as first reported by The Wall Street Journal. Broward County’s priciest real estate transaction so far this year, the deal also set a square footage price record for the area at $3,174 per square foot. But it’s not quite the most ever paid for a home in the region nestled between Miami-Dade and Palm Beach counties. That milestone occurred this past August when a billionaire self-storage tycoon doled out $32.5 million for a 13,060-square-foot waterfront spec mansion in the Lauderdale Harbours community. If priced fairly, high-end seems to sell just fine from Miami to Jupiter. Little inventory is on the home market. The houses that sit are the ones that have dumb asking prices. One in my neighborhood is a tear-down asking $52mm. If it sells for more than $33mm, I would be surprised. No wonder it is sitting there with little or no serious buyers.

Great WSJ article, “Watching the Real-Estate Bust From the Streets of San Francisco,” with amazing interactive charts. San Francisco’s downtown properties were some of the most valuable in the country. Buyers loaded up on debt to get a piece of the booming city. Now vacancies are approaching twice the national rate, according to CBRE Econometric Advisors. Owners are on the hook for nearly $12 billion of office bonds, according to S&P Global. As landlords watch their loans mature, they will have a difficult time paying them off without willing lenders. Banks are already pulling back from making loans to office landlords, and commercial mortgage-backed security issuance plummeted this year. Also of note, assessment appeals for real estate taxes are rising and expect them to continue to do so. This means building owners ask the taxing authority to lower taxes given the building value decline. This will crush major cities from a tax revenue perspective or require the cities to raise the tax rate. Remember, when looking at the first chart, vacancy is 31.8% and availability (including sublease) is much higher (closer to 40%).

A reader, Justin, alerted me to the 340,000 square foot Empire Outlet Mall in NY selling for $10mm after costing $350mm to build. It opened in 2019 with an expectation of 100 retailers and there are currently 37. Apparently, no food court which is also a problem. What are the implications for something costing $350mm to build and selling for $10mm a few years later? I just don’t think the markets are considering the ramifications of such carnage. Liens on the building were $316mm and then an additional $52mm is also owed according to the article. I wrote about a new building in NYC that cost $100mm and sold for $16.5mm. This is happening more frequently now. I expect more pain over the next 24 months as debt comes due and financing markets remain constrained. Check out this headline, “London is suffering an office ‘recession.’ Meta just paid $181 million to dump a lease.” Meta paid 7 years out of an 11 year lease.

Rosen Report™ #617 ©Copyright 2023 Written By Eric Rosen

Love 350 Main!