Opening Comments

My last note was about the making of the Rosen Report. The most opened links were the Goldman intern survey and phrases for better etiquette.

I am back in NYC from October 10-12 then off to Houston for one night for a board meeting. I am very excited about the webinar in conjunction with 3i Members on Commercial Real Estate with Adam Spies, Brian Goldman and Eli Elefant on October 11th which is a live event for 3i Members. I will put out some excerpts after the event.

Jeff Bezos is such a genius. I needed a new Mandoline slicer and found a great one on Amazon at 1:30pm on Sunday. It was delivered to my door at 8:25pm the SAME DAY. I got to read dozens of reviews and saved myself a minimum of 45 minutes going to a store to buy it. No wonder so many retail stores are closing and Amazon does not need to worry about shoplifters.

It is my wife’s birthday today, so we are grabbing a bite in town to celebrate. Happy Birthday, Jill.

Markets

Bloomberg Recession Call

Why Consumers Are Pinched

Top 1% Income by State

Top Restaurant/Chefs

Boca Homes on My Block for Sale

Barry Sternlicht on the World

China Property Market Charts

Picture of the Day-Fentanyl Deaths

Beau is one of my biggest contributors and sends me countless news stories each day which are massively helpful for my piece. He sent me this concerning link about the cause of death by age in 2001-2 vs 2020-21. Note the 18-44 age group (2nd line) on the right side. Virtually every state is purple meaning the leading cause of death for 18-44 is Fentanyl or other synthetic opioids. We have a major problem and need to have a solution. Securing the border is one of the things we can do to prevent drugs from entering the US. The death of so many young people is impacting US life expectancy. Clearly, pandemic-related deaths played a big part in the reduction of life expectancy as well. A life expectancy study published recently showed that 56 countries surpassed the US in life expectancy in recent decades. Although most countries were impacted by COVID-19, the US has seen a disproportional hit to life expectancy and I believe opiates have played a big role.

My 3 Hour Interview with Bill Gross and Mohamed El-Erian

It was July 2008 and I received a call from an executive recruiter that PIMCO was looking for a global head of credit. I told them I would appreciate the opportunity to meet with the key decision-makers.

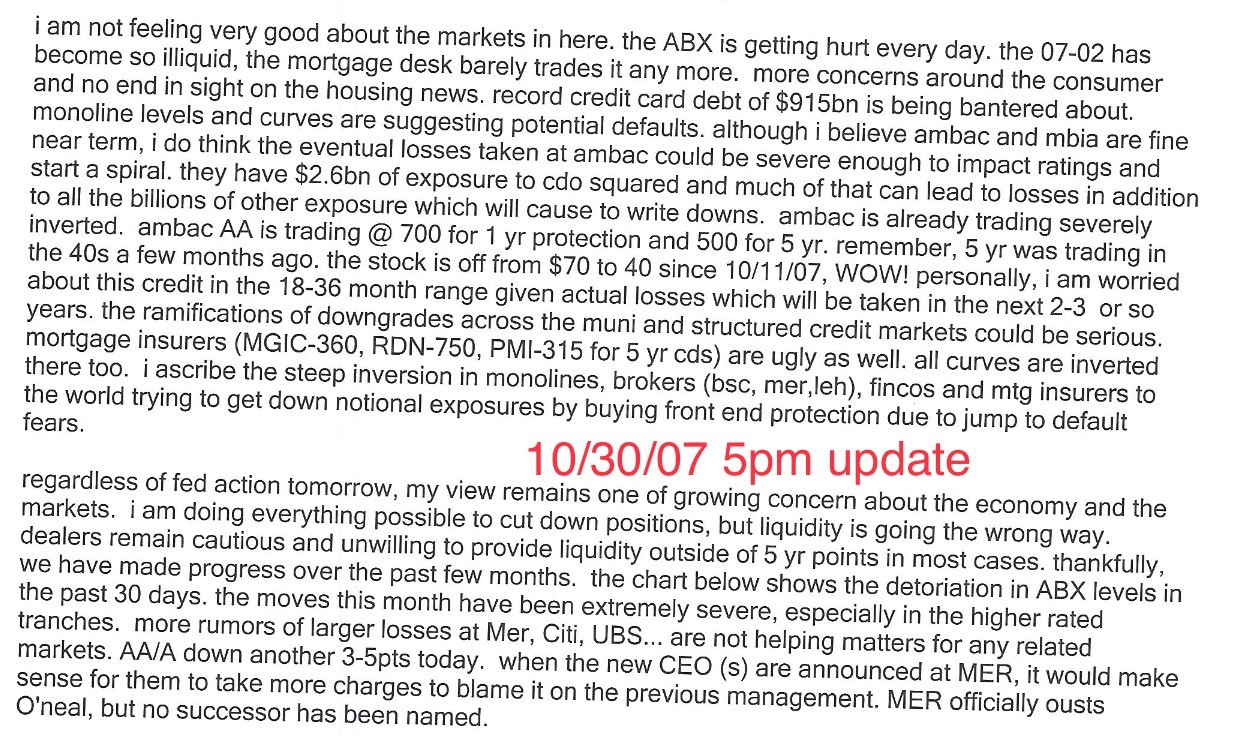

Initially, Chris Dialynas met me and let me know there would be meetings with three people; Bill Gross, Mohamed El-Erain and Chris Dialynas. I had well over 3 hours of meetings and at two points, all three were in the room grilling me for some time. I was fielding questions about my market views, and given I had made the call one year prior on Armageddon, they questioned how I connected the dots. My call was quite well known given my daily piece which was widely circulated. PIMCO was not positioned defensively and let them know why I felt they were wrong. I recall Mohamed asking, “What if you are wrong?”

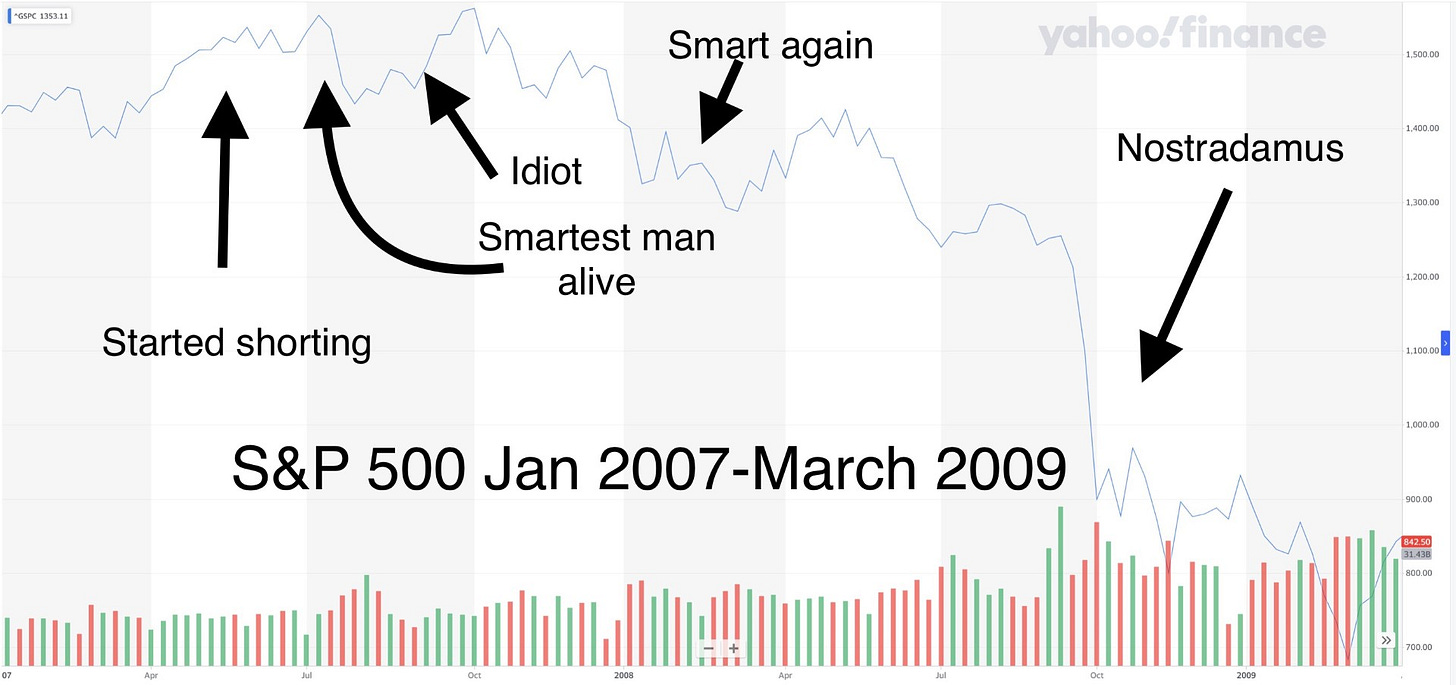

I looked at him dead in the eye and said, “There is no chance I am wrong and I am positioned accordingly,” and outlined the data to support my thesis. My desks were so short that had I been wrong, I would have been fired. I had never had such clarity of thought on a market call in my life and I explained why. Below is a sample report I wrote in October 2007. Yes, I have all of them which are from July of 2007-Feb of 2010.

After a short break, Gross came back again and the three senior PIMCO executives were there for a second time. They continued to pepper me with questions and then he said, “Eric, you went toe to toe with us for hours. I hope you are wrong, but must tell you, that was an impressive display of market knowledge and sticking to your guns. You did not let our views influence your thought process and not many people would have such tenacity.”

Remember, Bill Gross was the BOND KING. It was one of my proudest career moments when Bill Gross gave me such a big compliment. Bill, Mohamed, and Chris were incredibly impressive. They asked amazing questions and were very knowledgeable about markets even though I did not agree with them on where the economy was headed and the impact of further deterioration. Yes, I turned out to be correct in my market call, but would have rather been wrong based on the carnage which transpired. I enjoy listening to Mohamed today and find him to always be incredibly thoughtful and articulate on all market-related topics.

I often look back fondly at that marathon interview session with three PIMCO heavyweights. Unfortunately, the job never materialized and they ended up going internally with Mark Kiesel, who is one hell of an impressive person. He also perfectly called the housing market on multiple occasions. Given they manage about $2 trillion in assets, I think they did just fine without me. Interestingly, Bill Gross does not like stocks or bonds today and feels stocks are over valued.

Quick Bites

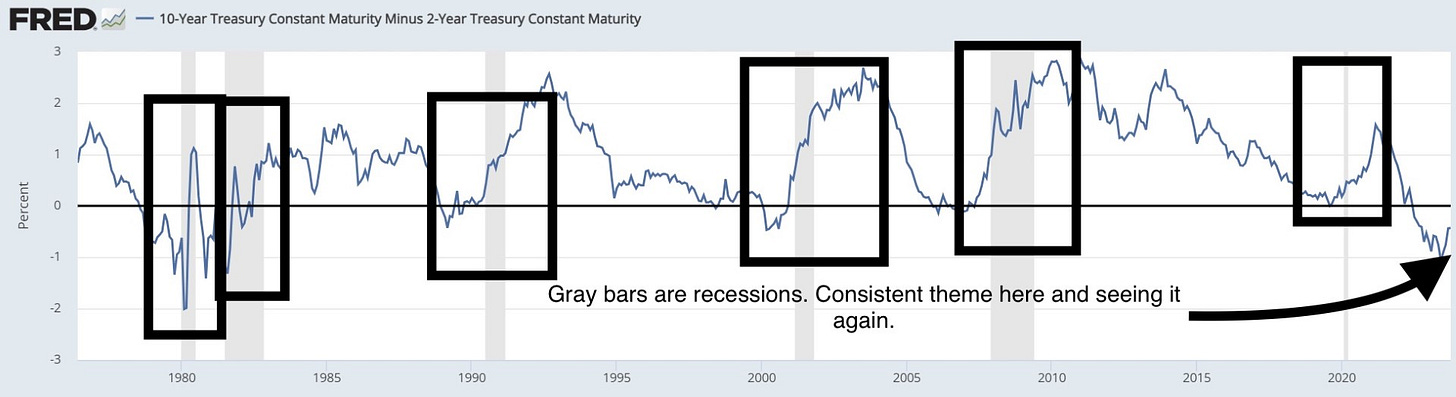

Treasury yields climbed sharply after the government shutdown was avoided and the market is fearing higher for longer, also contributing to the rate moves. The 10-year is now at levels not seen since 2007 (hit 4.88% Wednesday) but were yielding 4.72% Wednesday afternoon. ADP private payrolls came out Wednesday at 89k vs160k estimates which helped push Treasury yields lower on the suggestion the economy may be slowing. I have written about the Treasury curve about 100 times and the predictive nature of inversions when it comes to recessions (see Gundlach comments below). The chart below shows a consistent theme of re-steepening prior to recessions. The 2/10 curve was - 108bps in June and now -32bps. Stocks rallied Wednesday after a few days of selling off as Treasury yields fell. On Monday, the utility sector was hit hard with the rate move and the Utilities SPDR Fund was -6% at one point on the day but settled -4.8% and -10.8% for the 5 days ending Monday. Oil is off the highs and has been driven by economic concerns offset by the strong dollar. Wednesday, oil dropped almost 5% to $85/barrel. Of note, gasoline demand is falling. The US $ has rallied sharply over the past few months. Remember, many large companies have 50% or more of revenues from overseas and bringing those revenues back into US dollars will be costly given the rally (Coke, Tesla, MSFT and others have been discussed). As of 3pm Wednesday, the Dow, S&P 500 and Nasdaq were all 7-8% lower than 52-week highs. YTD, the Dow is -.1%, S&P+ 11.1%, Nasdaq +26.6%, and Russell 2000 -1.8%.

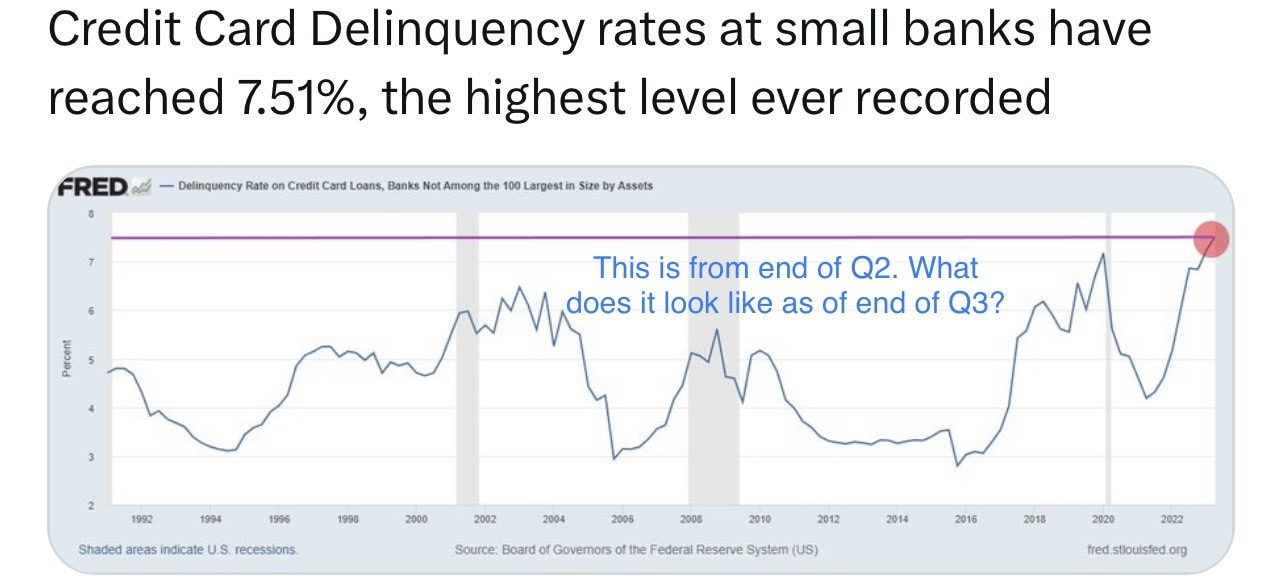

I thought this Bloomberg article had an interesting perspective and agree with a bunch of the points made. It is entitled, “Why a US Recession Is Still Likely — and Coming Soon,” and lists a host of reasons including rates, oil, strikes, student loans, consumer weakness, bank lending tightness, global weakness, potential government shutdown and others including history. I am including some of the many amazing charts. I have written about many of these issues and feel the lack of market breadth in the concentrated rally is concerning. I would also suggest the continued carnage I am seeing in the commercial R/E space with more to come and my questions about regional banks. I believe the market is not factoring in all the concerns. The impact of higher rates as many loans are coming due is also a concern and will lead to sharply higher interest expenses for corporates and governments. I do not believe we will see a deep recession at this point, but not convinced the Fed will thread the needle given how utterly awful they have been in creating inflation and years of bad market reads by Bernanke, Yellen, Powell, and all the other fancy PhDs. The last charts were not from the piece (currentmarketvaluation.com) but show stock performance during recessions to highlight that assuming a slowdown, markets should have some bumps ahead. One reader bought an Audi last month and the salesman sold 35 cars in August and only 5 through September 16th. Let’s see if this is just a one-off situation, but I believe things are slowing. Interestingly, my friend searched using Bard AI and found his best car deal on it.

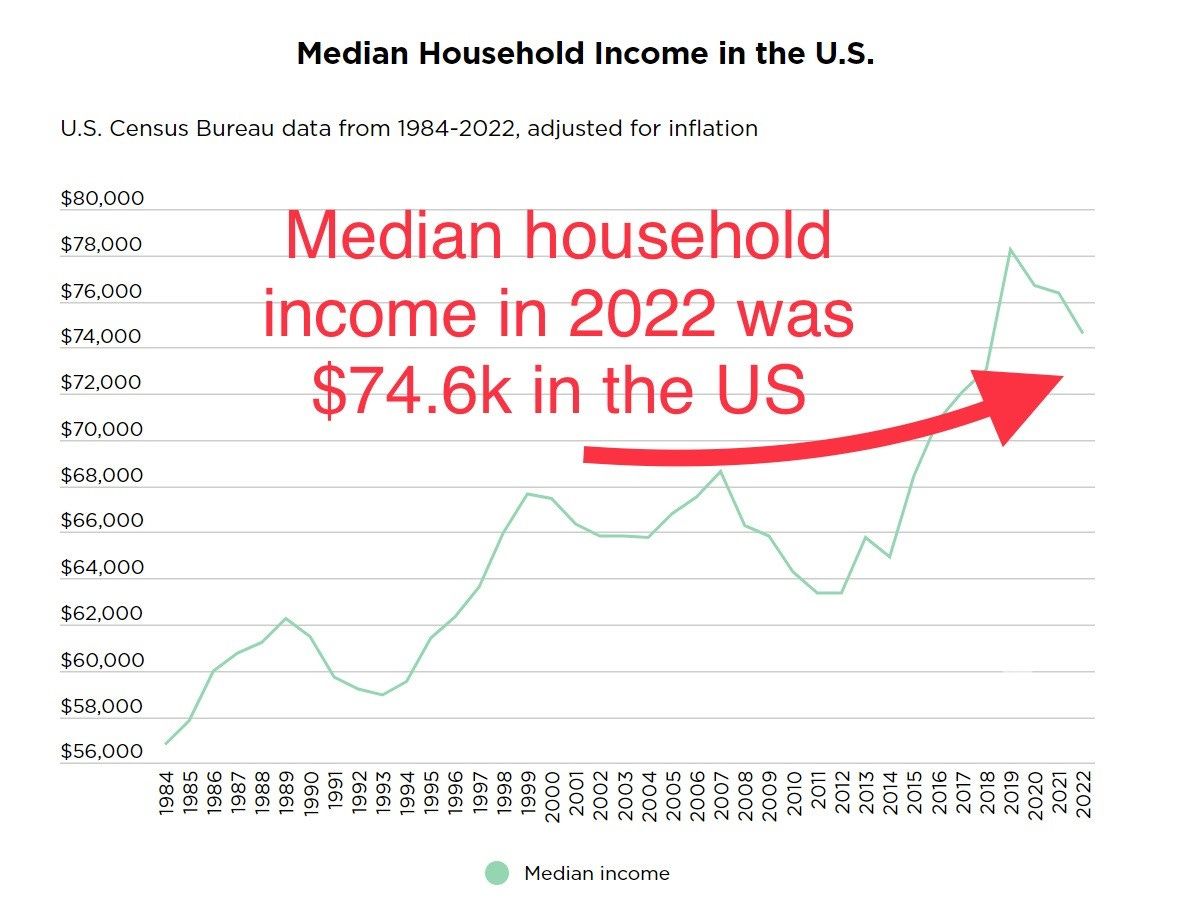

Great WSJ article entitled, “Why Consumers Are Mad About Inflation Even Though It Has Fallen,” and it shows the substantial increase in prices since the beginning of the pandemic. Yes, prices are rising more slowly and some are off the highs, but still sharply higher than levels from late 2019. The article goes into detail about how prices for food, gasoline, vehicles and other things remain far higher than pre-pandemic. On services, anything I see is up 25-40%+ related to the house (Landscaping, pool, pest control…). When I go to restaurants I see some prices +40-50% in South Florida. This WSJ article is entitled, “Americans Are Still Spending Like There’s No Tomorrow.” I just question how much longer it can last. The US consumer is resilient, but with crashing savings, record credit card debt, higher rates, and wages that have not kept up with inflation, the consumer must pull back.

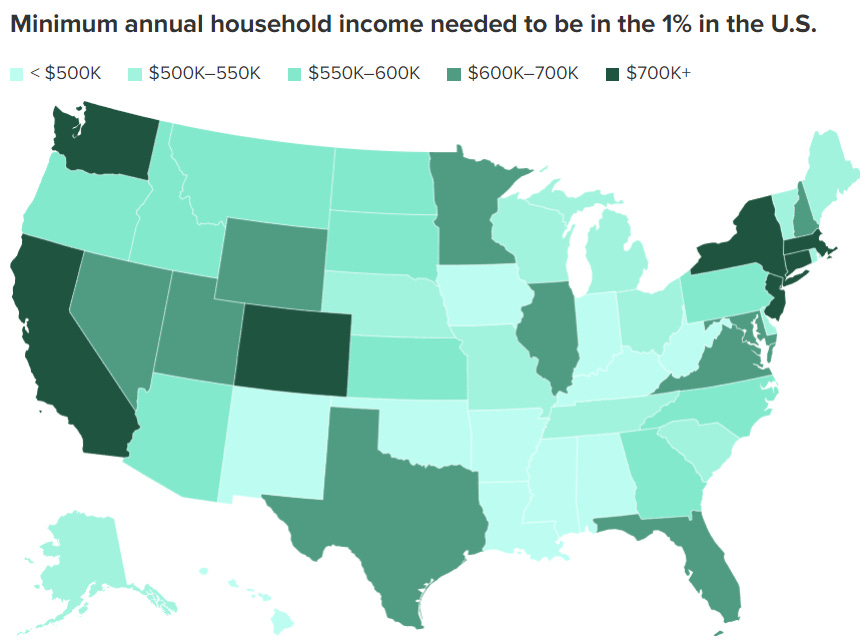

Earning $1,000,000 a year would surely be enough to live comfortably in the vast majority of places. But in one state, it means you’ve just crossed over into the top 1% of earners. Your household needs to bring in a whopping $952,902 to crack the top 1% in Connecticut, the highest threshold for any state, according to a recent SmartAsset analysis. That’s nearly three times the income needed to be in the 1% in West Virginia, the state with the lowest threshold at $367,582. Earning $700,000 a year would put your household in the top 1% nationwide — and well above the middle class — and in any state in the South or Midwest. But that still won’t cut it in seven states. The Northeast dominates the rankings, with five of the 10 states with the highest 1% thresholds lying in this region. The average income needed to be in the 1% is $696,358 in these states. That’s a higher income than is needed to be in the 1% of households nationwide, which is $652,657, according to SmartAsset. How many reasons do people need to move to FL, TN, NC, SC, TX, NV, MT...? Cost of living, taxes, weather, crime, mandates, homelessness…

I know I have a lot of “Foodies” as readers and any of my restaurant comments receive a lot of attention. A reader sent me this link to “Food & Wine’s Best New Chefs and Best Restaurants in the US for 2023.” I enjoy finding new restaurants and emerging chefs. When I have a great meal, I try to speak with the chef to learn what they did to create it and then go home and try to do it myself with some of my own style. I have been perfecting a redfish dish with grapefruit and fennel over cannellini beans which I had at Herbsaint in New Orleans in August. I am getting closer and I will be using the cannellini bean puree to serve other dishes now. I reached out to the chef who gave me a couple of pointers.

Other Headlines

Banks are bracing for a recession as Treasury yields surge

Banks are increasing reserve levels as seen below

Bill Ackman says the economy is starting to slow and the Fed is likely done hiking

AB 1228 applies to fast food chains with at least 60 locations nationwide except for those that make and sell their own bread. It takes the minimum wage to $20/hr from $15.5.

Sphere Entertainment stock soars more than 15% after Las Vegas venue opening

Did Dolan actually get something right? Shocking. Sphere calls itself a “next-generation entertainment medium” that aims to bring a fresh take to live entertainment, fit with a futuristic dome-shaped arena and wall-to-wall video screens.

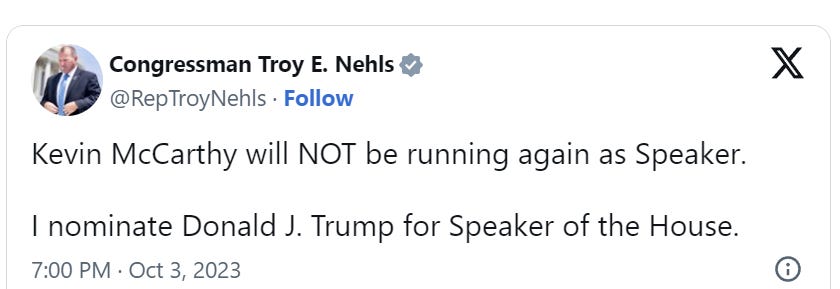

House ousts Kevin McCarthy as speaker, a first in U.S. history

McCarthy was voted out as speaker when a small band of eight hardline conservative Republicans joined all Democrats to approve a “motion to vacate” introduced by Florida GOP Rep. Matt Gaetz, a longtime foe of McCarthy’s. This article suggests Scalise (Louisiana) and Jordan (Ohio) are leading contenders for the speaker role. This article suggests some are supportive of Trump being Speaker. Yes, that Trump. Apparently, the speaker does not need to be a member of Congress, but there are rules on indictments/serving time.

Gov. Glenn Youngkin's PAC raises over $4 million in 48 hours from billionaire donors

Gov. Gavin Newsom chooses Laphonza Butler to fill Dianne Feinstein's Senate seat

Jack Smith Demands Trump Gag Order Citing Attacks On Judge And Witnesses In Cases Against Him

Donald Trump wanted $5 billion from Bankman-Fried not to run for US president

Let me be clear, SBF, I will not run for President if you pay me $100mm. You get off cheap.

John Kelly goes on the record to confirm several disturbing stories about Trump

Iran official admits country’s role in terror bombing that killed 241 US military members: report

220 Marines, 18 sailors, 3 soldiers, 17 US civilians, 58 French troops were killed in 1983 terror attack in Beirut. How do we continue to find ways to help the terrorist Iranian regime with money? The precedent we set with Iran is awful. I had this picture from Michael Ramirez in a recent piece and will use it again. Negotiating with terrorists is a bad idea and will only lead to worse outcomes and more hostages.

A poll from the research firm Consumer Science and Analytics Institute (CSA) found that 41% of citizens would support such a limit. That number rose to 59% support among 18-24-year-olds.

COVID vaccine poll finds more than half of adults are likely to say 'no thanks' to the vax

Meanwhile, 70% of Democrats say they'll get the new vaccine, the survey found.

Store clerk set on fire with stolen lighter fluid as he confronts serial shoplifter

Please look at these pictures which took place in the Bay Area of CA. How disturbing. What are the ramifications and consequences for these actions?

Sorry, this is the wrong outcome and the root cause of a major problem in Blue states. We need more consequences for bad acts in my opinion. Read the story and decide for yourself.

Texas Rep. Henry Cuellar carjacked at gunpoint by three assailants outside his DC apartment

Tom Hanks says AI version of him used in dental plan ad without his consent

Doing this more than 5 times each day slashes heart disease risk by 20 percent!

Climbing 5 flights of stairs a day can reduce heart disease.

Cell phone shocker as 97% of kids use their device during school hours and beyond, says study

Psychologist compares phones to drugs: They 'reel kids in and keep them hooked. ‘ More than 50% of kids get 237 notifications per day — while some receive as many as 4,500 every day, according to Common Sense Media's findings.

Real Estate

A house 6 down from me just went on the market in Royal Palm in Boca Raton. The house last sold in September 2019 for $5.9mm and was new at the time. It was built by SRD, very reputable builders who have built more homes in this neighborhood than anyone. It is listed for $12mm, which I believe to be an aspirational asking price. I want to put things into perspective. I bought my house (golf course lot) in May of 2017 for $6.3mm and it was the highest-priced golf course house ever sold at the time. Today, there are 6 homes asking between $15-19.3mm on the course and all have decently smaller lots than mine. Also, I feel mine is the best location.

Links to the 6 expensive golf home listings:

My lot is approximately 18k feet and this house for $12mm is on a 12k ft lot NOT ON THE GOLF COURSE which here is called an interior lot. I also included a very nice new build (same block) by my builder, Compson. They build a great house and stand by their work. It will be interesting to see where these new listings sell for, as they are comps to my house. I feel mine has the best location and lot by far (only one neighbor), but it is no longer brand new. My landscaping, pool, yard, closets and chipping green… are at another level given my lot size. I would estimate mine in the $14-15mm range, but once these other two sell, I will have a better idea of where things clear. I walked through both listed homes and they are quite nice inside. I do love the garage doors aesthetically on the 1857 address and the kitchen at 1758 is stunning. All three homes are within 350 yards of each other. Remember, the Park Avenue PH I sold in 2016 to Sandy Weill is -20% since I sold it. The listing pictures here were from when I owned it. Our Boca house will be for sale soon too as we are soon to be empty nesters and downsizing is coming. Listings are growing down in my neighborhood. In May of 2017, there were 71 homes for sale. In December of 2021, there were 4 and now there are 37 and many sitting on the market longer.

I had the pleasure of listening to a podcast with Barry Sternlicht, one of the most important people in the R/E game. Barry is a legend, and I almost went to run his family office a dozen years ago. He famously left Connecticut for Miami many years ago. Barry has run Starwood Capital for over 30 years and manages over $115bn in assets. He is constantly on CNBC and given my respect for his views, I often cite them. Like me, Barry is incredibly critical of the Fed and government spending from Congress. Barry went into detail about the concerns around the consumer (record debt, crashing savings, higher rates…). I wonder where my readers heard this before? Barry spoke of rising rates and their impact on the consumer, borrowers, corporates… Barry questioned Biden’s spending bills and the fact that it is creating a false narrative on the strength of the economy while the private sector is slowing. Barry wants Congress to be more fiscally responsible. Wow, was this Barry interviewed or the author of the Rosen Report? Barry feels short-term fixed-income investments are viable today given the uncertainty. Barry condemned both parties and suggested the Republicans ran big deficits under Trump. Barry believes opportunities in the office market are coming. He reiterated his view that the states that are winning are Florida, Texas, Tennessee, and others are non-union states and there are no taxes. Barry discussed the cost of doing business in Blue Cities is uncompetitive. He also discussed lower building valuations will be a drag on property taxes and create a death spiral, another point I continue to make. Barry believes AI will take on White Collar jobs faster than Blue Collar and thinks that will impact the need for office space. Nothing earth-shattering here, but more consistent thoughts with what I have been preaching for quite a while.

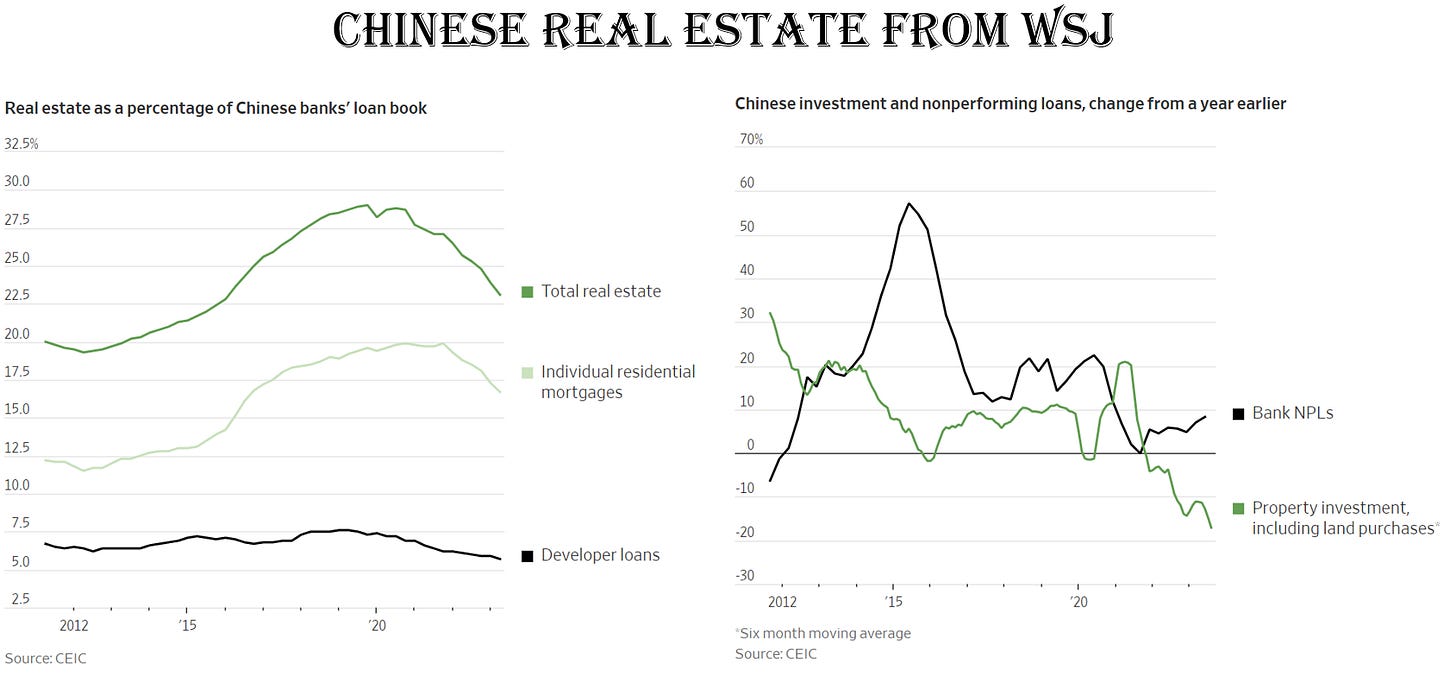

Lots of good charts in this WSJ article, “Does China’s Property Bust Make a Financial Crisis Inevitable?” When property markets go bust, banks often follow—most famously in the U.S. in 2008. Now China is in the midst of its own property blowup, with major developers teetering and housing sales—in floor space terms, year-to-date—at levels last seen in 2015. Does that mean a financial crisis is in the making? Not necessarily, thanks to some surprising quirks of China’s housing market and Beijing’s heavy hand in the financial system. But the cost will likely be serious damage to bank balance sheets, impairing their ability to support growth for years. The bottom chart is concerning for the US too. Major cities get a big chunk of taxes from commercial R/E and the valuations are coming down. I continue to believe tax hikes are coming in cities hardest hit.

Rosen Report™ #619 ©Copyright 2023 Written By Eric Rosen