Opening Comments

My last note was entitled, “I am the REAL Eric Rosen” and was a hit. The most opened links were the golfer ripping off his shirt and screaming and the link outlining the new Core Club in NYC. One of the Eric Rosen imposters (had breakfast with him Wednesday) sent out this video of our meeting and interaction which is pretty funny.

I was at a 3i Members event at Red Pine (new Chinese restaurant) in Boca and it was very good and was held in a great private room. My friend Mitch Robbins owns it and I really enjoyed the food, room and service. I have not found better Chinese food in South Florida. I think I ate 8 scallion pancakes and felt as though the food improved since my first outing during the grand opening.

Hard to believe it is October. This means Florida comes into its own soon and the weather gets impeccable in weeks. It means Halloween is around the corner and my favorite awful candy (candy corn pumpkins) are back. I will be planting my herb garden which will be epic this year. It also means my friends from the north will be heading down to visit as well. Florida from mid-October-end of May is amazing.

Markets

Jane Fraser on the Consumer

Bad Republican Debate

Real Estate-Expanded Section Today

Reader’s Example of Bank Tightening in R/E

Miami Office

More High-End Home/Condo Sales-Eric Schmidt $63mm

Waldorf Miami

Wells Buys $550mm Office (Old Nieman’s) @ Hudson Yards

UK Home Seller Discounts

New vs Existing Home Sale Prices in US-GREAT CHART

Goldman Intern Survey

Approximately 3,000 interns from over 500 schools in over 50 offices took a survey. The link to the survey can be found here and is interesting to hear the perspective of a Type “A” college kid trying to make it on Wall Street. There are far more charts than the few I shared. Peter, a former colleague sent me the link.

The History of the Rosen Report and the JPM Daily "Missive"

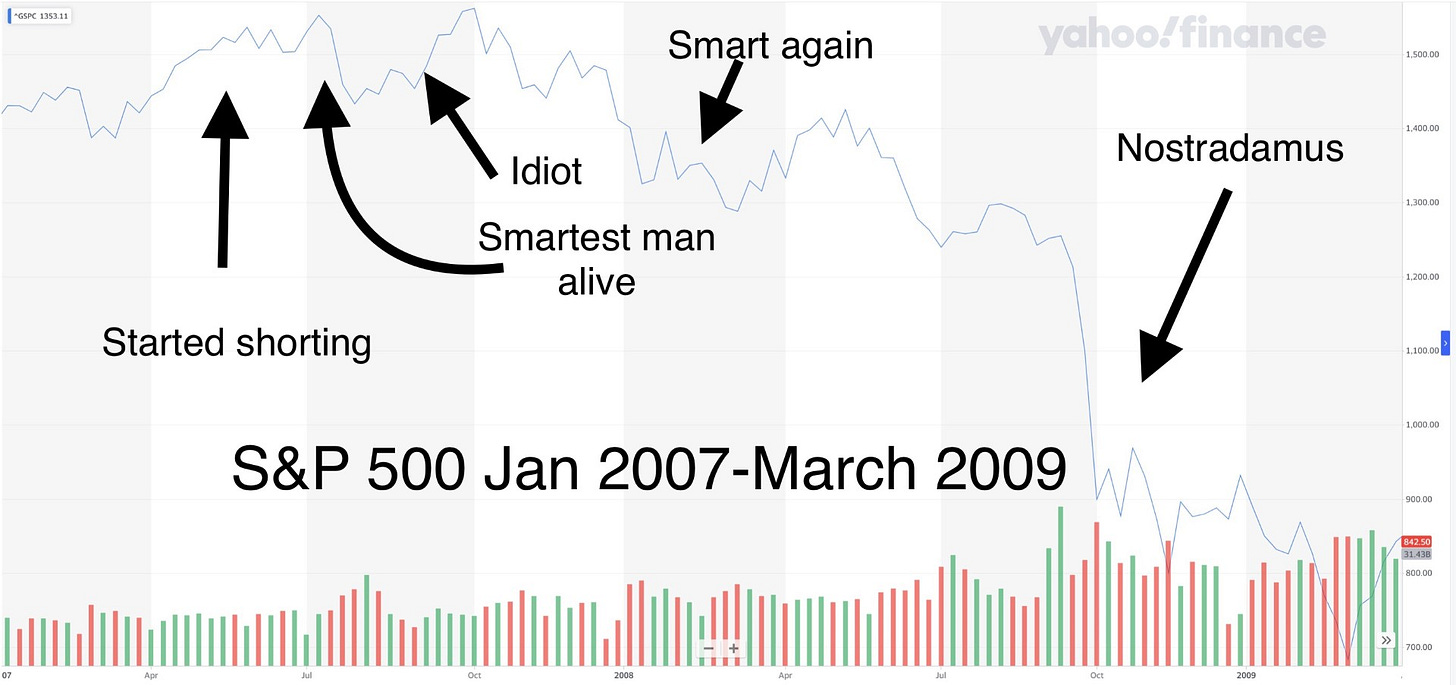

I am often asked how I put this monstrosity together and the genesis, so I will catch everyone up so we are all on the same page. In July of 2007, I became nervous about the world and felt too many things were priced to perfection. Housing was booming, stocks were high, bonds were priced to perfection and the cost of being short was low as volatility was low. I started writing a daily “missive” to a handful of senior management including Jamie Dimon, Jimmy Lee and a few others. It outlined some concerns and why I was short. Most told me I was wrong, but it did not stop me from writing this internal memo at least once a day(published @ 630am) and often twice (evening edition). Eventually, it was forwarded, and more and more requested to be on my distribution. I believe it peaked at around 20,000 (most of the Investment Bank and people in the Private Bank and Commercial Bank. It also was forwarded around to clients and other investment banks.

My early calls for Armageddon were proven true and my short notes which gave examples of the illiquidity, price moves, yields on high-quality bonds and loans became something of legend. Many in senior management, including Jamie has given me praise for being early. One highlight was at a party some years back and Jamie walked up to my wife Jill, and said something to the effect of, “You know Eric was early and right on the crisis and his daily emails are something I miss.” My wife was beaming after the interaction, and truth be told, I was fired up too. Below is an example of a note from July 31, 2007. I was short risk and there was a rally that cost my desks some money, hence the “OUCH!” As you can see, I remained undeterred and convinced things would deteriorate. I talk about the Bear short and me covering shorts due to volatility. I reset shorts in a massive way late in 2007 and the rest was history.

In July of 2008, one year after my first “missive,” my predictions had come to fruition, and I felt like Nostradamus. My business was doing very well with the help of my hand-picked team of assassins who were great at their jobs.

On 7/24/08, I did not write my morning note which had become a daily occurrence for the past year. My cell phone rang and it was Jamie Dimon. “Eric, it is 9:30 am and I don’t have the Rosen Daily Missive. Are you ok?”

I said, “Jamie, I have been better. I am in the limo heading to the cemetery to bury my mom.”

He could not believe no one told him and apologized. I promised a report the following day. When I got to my mother’s home after the funeral, there was a massive bouquet of flowers and food for an army from JPM. It was very thoughtful. I tell this Jamie interaction story in a 1 minute video here and it also outlines the pre-cursor to the universally loved Rosen Report.

Fast forward to February of 2020, as the pandemic was starting, and I received a bunch of calls and emails from my former readers asking for my opinion. I started writing a rambling note that included links (not hyperlinks) to news stories and sent it to 18 people. It grew by word of mouth to the point an email would no longer suffice and bounced from Mail Chimp to Constant Contact to Substack. I have never paid for an ad word or promoted it other than the highly sought-after Rosen Report swag.

To write a report, I start by thinking about my theme piece which is generally a personal story about business or something I did. Many tend to be self-deprecating, a lesson learned or something that happened to me during my career.

In order to write the remainder of the piece, I read hundreds of news stories across the WSJ, Bloomberg, CNBC, NY Post, NY Times, CNN, Fox News, Yahoo News, Microsoft News, Apple, Drudge Report, the Real Deal…. I also read hundreds of emails and texts sent to me each week with story ideas as well as other newsletters. I have two dozen readers who collectively send me 500 news stories each week for perspective; I appreciate the assistance and it helps me a great deal. I speak with hedge fund managers, PE investors, the venture community, small business owners and anyone who wants to tell me their story. I pick a handful of news stories I want to highlight in Quick Bites and then 30 or so for Other Headlines. For the real estate section, I check another dozen publications from CRE Daily, WSJ, Bloomberg, the Real Deal and speak with real estate brokers and developers.

The day before publication, I start editing them down as the note is far longer than the final production. The morning of publication, I send the note to my sister, Debbie, to take a look for any errors, bad links or mistakes. Realistically, each one is close to 20 hours of work due to the reading and editing.

I have spent almost 15,000 hours so far writing these newsletters. My readers tend to be well-educated, successful, Wall Street, fund managers, R/E Developers/Investors, entrepreneurs and also some aspirational, younger readers who are trying to learn. I am seeing growth recently in new women readers which I am very excited about.

Thanks for supporting the Rosen Report, and far more video content is coming. I just hired a team to help me with my YouTube channel and will be doing more social media posts and speaking engagements resulting in video content. If you need a keynote speaker, panel moderator or discussion leader, let me know, the calendar is filling up thanks to leads from readers.

Quick Bites

The Dow retreated on Friday as investors followed the latest news about a potential government shutdown and looked to the end of what has been a tough month. The Dow and S&P 500 were higher earlier in the day, as traders cheered data showing inflation may be easing. However, Saturday, the house passed a 45 temporary spending plan to alleviate the government shutdown. The latest reading of the personal consumption expenditures price index, which is the Federal Reserve’s preferred inflation metric, came Friday morning. So-called core PCE, which strips out volatile food and energy prices, rose 0.1% in August and 3.9% annually. Economists polled by Dow Jones expected that the core PCE would advance 0.2% on a monthly basis and 3.9% year over year. But investor concerns about the potential for a government shutdown weighed on the market later in the session. Oil fell back to $91/barrel, but was up 28% on the quarter due to tight supplies. Treasury yields were down 1-2 bps on Friday, but remain generally near high recent yields for much of the curve.

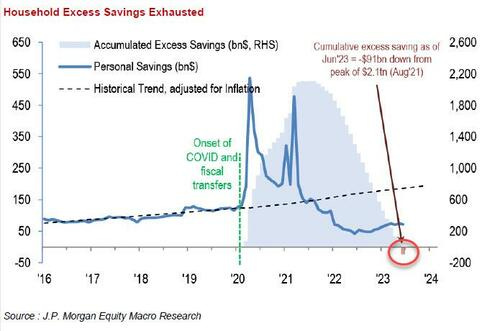

Citibank is a shadow of its former self. At one point they were a dominant force and they have had a comedy of errors and a revolving door of leadership. There was a conference this week and the CEO, Jane Fraser, made comments on the ‘cracks’ emerging among some consumers as savings dry up. Lower-end consumers have shifted buying patterns to save money as their bank accounts dwindle in size, according to Fraser. “Particularly [for] the bottom end of the consumer, that’s the one that we’re starting to see cracks, you’re seeing some shift in the buying patterns to lower categories in the spend,” Fraser said. “It’s a resilient consumer, but it’s a softer one.” I have been making this point for months and now we are seeing more CEOs talking about the consumer in a concerning manner.

The latest data has the savings rate at 3.9% after peaking at 33.5% in 2020. It is well below the pre-pandemic levels now as the consumer has burnt through all the free money.

I watched the Republican Debate and there was a lot of calling out Biden and Trump by most of the candidates. Criticizing the border crisis was front and center. I just beg America to have other candidates than Biden and Trump on the ballot in 2024. I found Haley to be pretty good. DeSantis had good answers about being tougher on China. Vivek wants to do away with the birthright citizenship 14th Amendment for children of illegal migrants. I felt there were more pressing issues to discuss than that. Lots of yelling and talking over each other. I did not love it. Tim Scott aggressively went after Vivek and would not let him talk. In the end, Trump and Biden have nearly insurmountable leads and absent a miracle or alien invasion, it will be the geriatric show of criminals in the next election. Below is the survey from Drudge on who won the debate. I agree that Haley looked the best at the debate. Having 7 people on the Dias is a waste of time. Narrow it to three people for the next one; Pence, Scott, Burgum and Christie need to be disinvited from the 3rd debate.

Story out about Younkin potentially jumping in the race. Could be a meaningful development for the Republicans if it comes to fruition.

Other Headlines

Ray Dalio says the U.S. is going to have a debt crisis

I am concerned on this topic. I just am not yet convinced it is near term.

In short, he does not like 30-year treasuries and feels it could yield 5%.

Costco says its one-ounce gold bars are selling out fast

Sells for 4% above spot gold price. Another sign people are losing faith in the US $ and the Fed/Treasury.

Nike misses on revenue for first time in two years, but stock pops as earnings, margins beat

China sales grew by 5%, slightly below expectations. Stock jumped 10% but is -20% YTD.

Weight-Loss Drugs Estimated to Save Airlines Millions

If flyers lose 10 pounds, United saves $80 million

Wire Transfers From Chinese Oligarchs To Hunter Biden Listed Joe Biden’s Home Address

According to Hunter’s memoir, Beautiful Things, he was living in CA at the time of the wire. I believe there were 27,000 copies sold of Hunter’s memoir the 1st year but Hunter was paid $2mm. There is no smoking gun on Joe taking money but the circumstantial evidence is enough to warrant further investigation and cooperation from the various agencies that have not been forthcoming. Again, begging for new blood in the race not named Trump or Biden. America and the world deserve better….and younger.

Biden administration moves ahead with new plan to cancel student debt

Trump legal news brief: 1st Georgia defendant takes plea deal in 2020 election interference case

Robert F. Kennedy Jr. Planning to Announce Independent Run

It will clearly draw some votes away from him. Biden is polling poorly with low approval ratings and fears of his age and cognitive ability. Kennedy as an independent is a big help to the Republican party in my opinion. “Bobby feels that the DNC is changing the rules to exclude his candidacy so an independent run is the only way to go,” according to a Kennedy campaign insider.

Rep. Jamaal Bowman triggered a fire alarm in a House office building amid voting on a funding bill

I am hardly formal, but I do not feel hoodies and shorts are appropriate for the Senate floor.

Dianne Feinstein, California’s longest-serving senator, dies at 90

First, it is called Social Darwinism to film while robbing and 2nd, the Philly DA will probably give each of the arrested people a free lunch and a new car. Krasner does not believe in consequences for crime. 61 people were arrested for the crime spree over two days.

Seagoing bandits terrorize San Francisco Bay, residents say nearby homeless surge to blame

NY woman who fatally shoved singing coach, age 87, is sentenced to more time in prison than expected

Are we going to see more people actually receive consequences for crimes in NY?

US' illegal immigrants crisis: Elon Musk visits Texas to show 'unfiltered' view of border situation

Musk interviews local officials about the emigrant crisis at the border.

Wild videos show flooded LaGuardia Airport terminal, travelers attempting to flee ankle-deep waters

Crazy pictures and video.

107-year-old shares her secret to a long and happy life: Don’t wait for your dreams to come true

Florida man tells police bag of cocaine found in car must have blown in from the wind

Real Estate

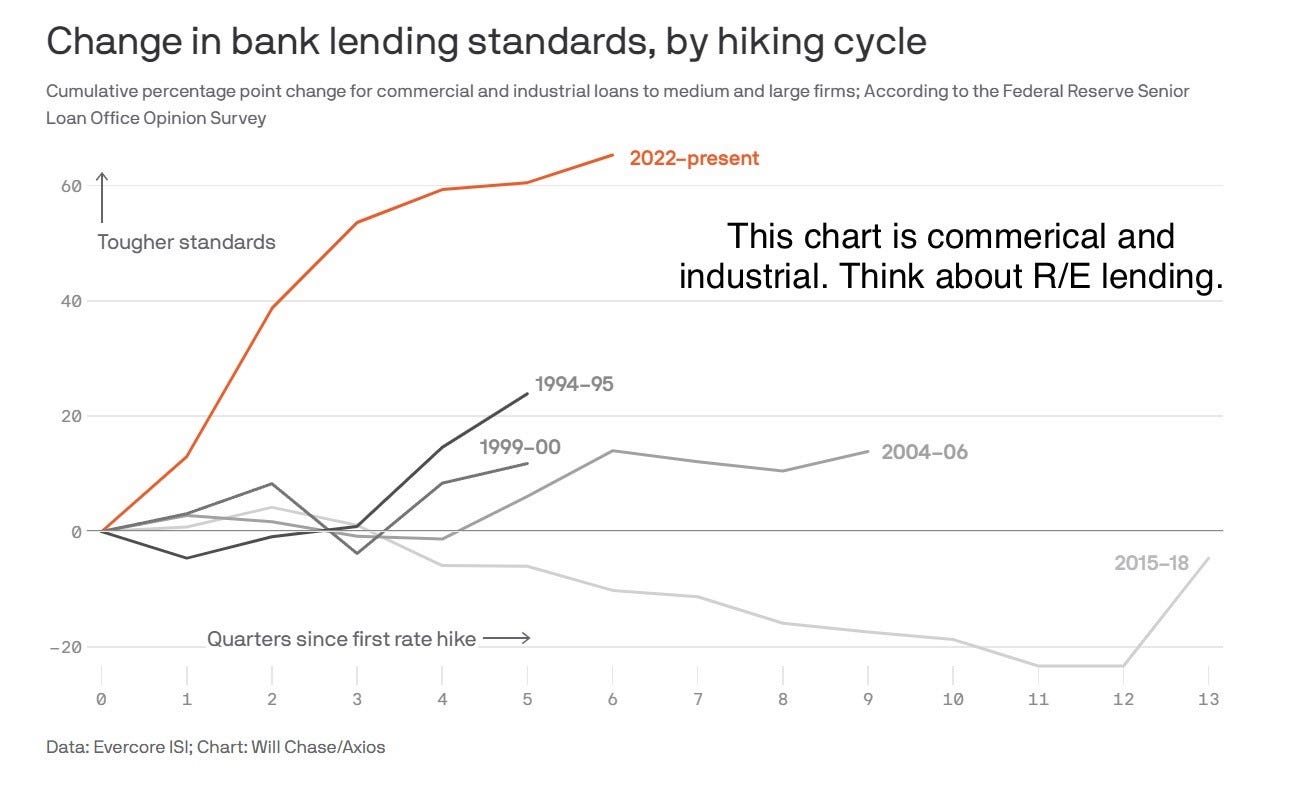

A reader and close friend is a real estate developer and has a long-standing relationship with a bank (M&T). My friend owns an office building which is 60% leased going to 70%. The long-standing relationship bank called due to the non-recourse nature of the debt despite the fact that the loan matures in four years. The bank required a new appraisal which came out at the same level as the debt, which means the owner did not meet the debt coverage and loan-to-value covenants. The bank sent the work-out banker to the site and he became very aggressive demanding the owner put in more money to pay down the debt despite the fact that the loan is not maturing near term. The owner said, “You can take the building, we are not putting up any more money in this market.” If a big check was not written to bring the loan into compliance, the lender wanted the owner to personally master lease the vacant space, which would be released as new tenants come into the building. The lender made it clear they are spending a great deal of time on loans that are no longer covered by the value of the R/E assets and are becoming overwhelmed due to the market. It is clear that the bank has no leverage and does not want to take back the assets. The banker mentioned the regulators are requiring banks to set aside capital on performing non-performing loans (meaning debt is being serviced, but loan is no longer in compliance) unless borrowers bring loans into compliance. The owner said it felt like a conversation during the Global Financial Crisis. Every side of the commercial R/E market I speak with (lenders, developers, owners, brokers) is growing concerned. Obviously, office and retail is at the top of my mind, but even many hotels and some apartment buildings with debt coming due at the new rates are starting to struggle. Banks are demanding more equity to make loans and feel we are in the early innings. Land deals that are levered and anticipated building something are struggling given the cost of debt and taxes that are now. I put in a recent piece that in NYC, getting on the court docket for foreclosures is getting more challenging. I feel strongly that real opportunities will be coming soon. In the 2nd Q, the office delinquency loa rate went from 2.7% to 4.9%. I wonder where it is 1 year forward?

This is a perfect example of how not all office markets are under pressure. Miami Class A rents grew 14.6% in the 2nd Q on a YoY basis. South Florida Monarch Alternative Capital and Tourmaline Capital Partners are buying the 801 Brickell office tower in Miami for around $250 million, The Real Deal has learned. If the deal closes at this price, it would mark a record for a South Florida office investment this year. The deal is expected to close late this week or early next week.

On high-end Miami residential, Eric Schmidt (former Google CEO) bought two homes on Sunset Island II for a total of $63mm, bringing his home count up to 6. One of my broker contacts has put $75mm under contract in the past 30 days all in Miami and feels there is a new wave of buyers looking for high-end listings. The buyers have ranged from upgrade buyers moving within Miami to buyers from NY, Chicago, California, Boston, Connecticut and New Jersey. He is also putting on $125mm of new listings, primarily from people who just were not using the properties enough to warrant owning them.

WSJ article on a $50mm condo in Miami’s new Waldorf Astoria Residences. It is 13,100 ft and the pictures and views are amazing. This is a link to the Waldorf Residences. Wealthy buyers want amenities and services and the list here is impressive even if it is not my favorite Miami location. A buyer is in contract to purchase a roughly 30,000-square-foot penthouse directly above this unit, according to Ryan Shear, a managing partner at Property Markets Group, one of the developers. The unit was sold as raw space and is receiving a custom build-out for the buyer, he said. He declined to comment on the contract price, citing a nondisclosure agreement, but said it would likely surpass the current Miami-area condo record, which was set in 2015 with a $60 million deal at Faena House in Miami Beach.

Wells Fargo is paying more than half a billion dollars to occupy the space at Hudson Yards that was once leased by high-end department store Neiman Marcus, according to a report. The bank is planning to convert the 400,000 square feet of space at 20 Hudson Yards into offices, according to Bloomberg News, which cited “people with knowledge of the deal.” In 2015, Wells Fargo bought 500,000 square feet of office space at nearby 30 Hudson Yards, where the company keeps its securities, investment banking, and capital markets divisions. I think the project at Hudson Yards is amazing. I just feel the location is a problem to get there. I would not want to work in Hudson Yards unless I lived in a place that made the commute easy.

Interesting Bloomberg article, London Price Cuts Boost UK Home Discounts to Highest Since 2019. The charts are pretty clear.

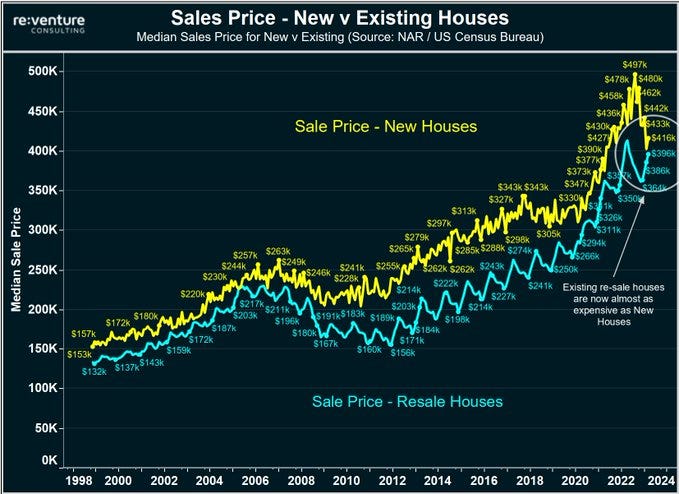

Check out this chart on new vs existing home sale prices in the US. High mortgage rates have homeowners unwilling to sell given the massive increase in rates. I would buy new vs used for a 5% difference.

Rosen Report™ #618 ©Copyright 2023 Written By Eric Rosen