Opening Comments

My last note was about my interview of David Costabile and Brian Koppelman from Billions. It was so much fun. The most opened links were the tips on healthy kids from Japan and the video of the dangers of public restrooms. I will be writing more about the Billions interview in the coming weeks. There was an amazing story by Brian Koppelman that needs to be told.

Lots of new readers. Remember, my readers contribute with story ideas, comments, and feedback. Rosenreport@gmail.com is the best way to reach me. At least 30% of the story ideas come from my readers. Also, some servers require you to hit “View entire message,” to see it all.

"It's Not the End of the World, But You Can See It From There"

Markets

Twitter One Year Later

$46.5bn METAverse Loss

EV Update from OEMs

Another Mass Shooting in the USA

High End Austin, TX

US Housing Inventory

Homebuyer Traffic Falling Sharply

Major NYC Office Refi and Implications

Pictures of the Day-The Reach of the Rosen Report

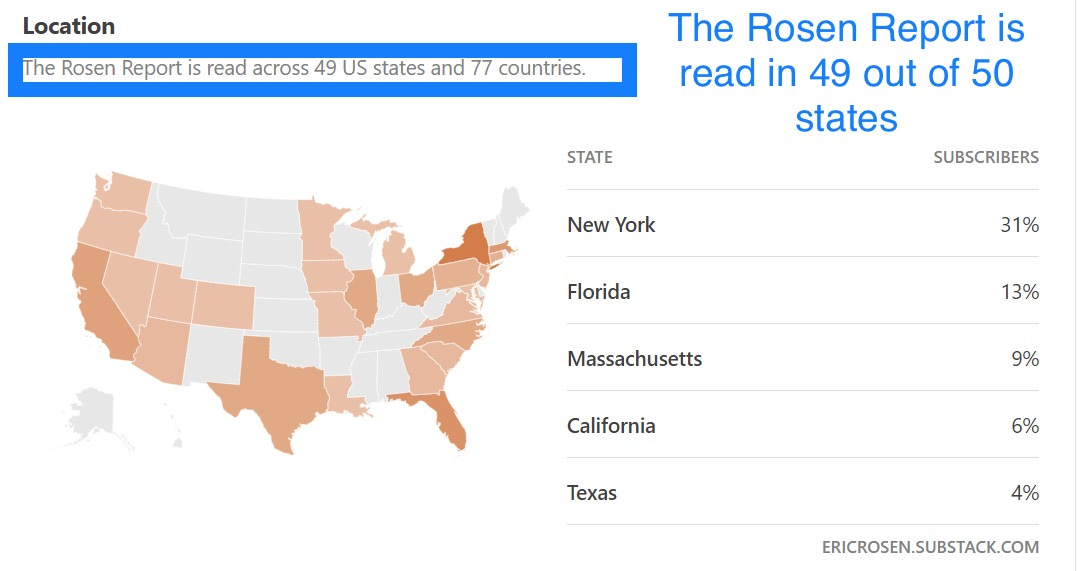

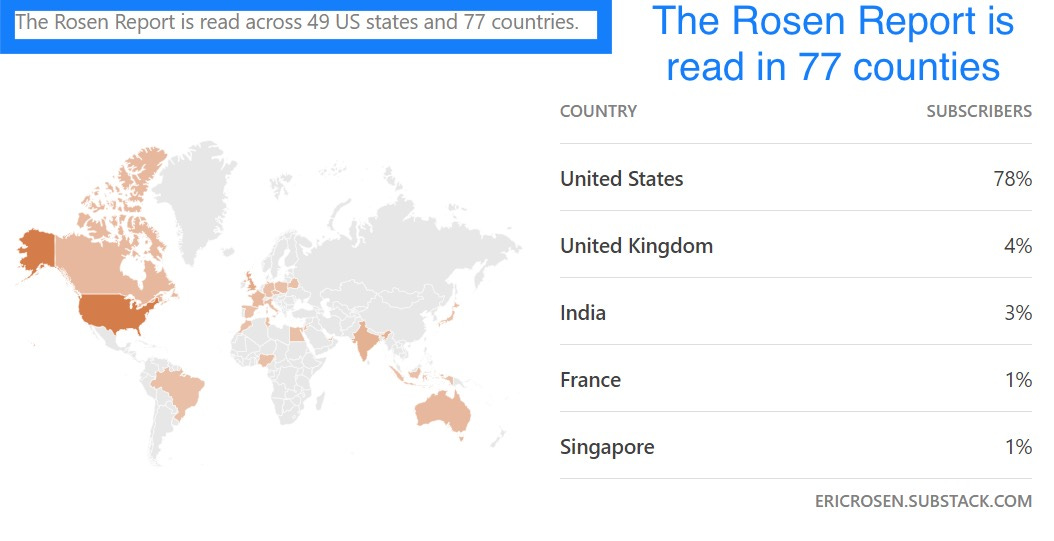

I just found out how to find out where my readers are located and I was excited to see that in the past 30 days, my newsletter was opened in 49 states and 77 countries. Can someone in Alaska please open the Rosen Report so I can get all 50 states? Together, NY and FL represent 44% of my readership. I am underrepresented in Asia and Africa, so let’s get the word out. I am surprised that India is #3 on countries reached behind the US & UK, but love to see it. I would have thought it would have been a Latin American or European country.

“It's Not the End of the World, But You Can See It From There”

With all the doom and gloom in the world, I thought this was a fun story about something that happened to me 30 years ago. I started my career at Continental Bank in 1992 in Chicago. I began trading loans in 1994 and back then, banks were just getting the ability to trade securities through a Section 20 subsidiary. Although loans are not securities, I was part of the securities division which required me to pass the Series 7 and Series 63 exams. As an aside, Continental was bought by Bank of America in 1994.

Given I was the junior person on the desk and joined an existing trading team, all the people on the floor had already passed their required exams. I started studying and felt I would pass, but was worried about the embarrassment if I did not get a passing grade. I went to my then-boss, Peter Vaky, and asked him a question. “What happens if I don’t pass the test on the first try?”

Pete looked me in the eye, put his arm on my shoulder, and said, “Son, it is not the end of the world, but you can see it from there.” I almost crapped my pants and then he laughed. I learned a great deal about how I wanted to manage people from having Pete as a boss. He was a good man who treated his employees well. I have a list of things I do as a manager from Pete Vaky.

Every time I hear the REM song, “It’s the End of the World as We Know it,” I think of Pete. I went back to studying and I passed the exams with flying colors. Pete’s “motivational speech” made me over-prepare and all that matters is a passing grade. Over the years, I also received my Series 55 and Series 25 accreditation, but it had been 25 years since I took any of those tests, or any test for that matter including at the University of Chicago business school.

Fast forward 30 years and I decided to take my Florida Real Estate Sales Associate License exam, given all the free help I give every day. I am constantly assisting Rosen Report readers to relocate to Florida from all over the country. My readers tend to be buyers and sellers of high-end homes. I have readers today looking to spend $5mm-50mm+ and one just listed their home for $45mm.

I bought an online course that I felt was awful (Van Ed), and I was doing poorly on the practice exams and getting frustrated. I recalled what my one-time boss and mentor said to me so many years prior and put my head down and studied in between Rosen Reports, podcasts, travel, cooking, kid duty, board meetings, advisory work and trading.

I made the same mistake as I did all those years prior. I over-studied and took the 100-question test in 27 minutes (3-hour time limit). I finished so fast, I re-read every question to be sure I was not sloppy. Although they do not give you the official score other than “Pass,” I can tell you that I would be shocked if I received less than 94% and 75% passed.

I will write about it in an upcoming report, but I will hang my shingle this week and now can officially represent all those loyal Rosen Report readers who want to do R/E transactions. I have helped almost 100 readers relocate, schools, golf, housing, network… I can also refer you to brokers in markets I don’t focus on anywhere in the country. More to come… I ran a $70bn balance sheet at JPM, Fixed Income at UBS, founded a hedge fund, write a world-renown newsletter, and now can find you a house or sell you one.

Quick Bites

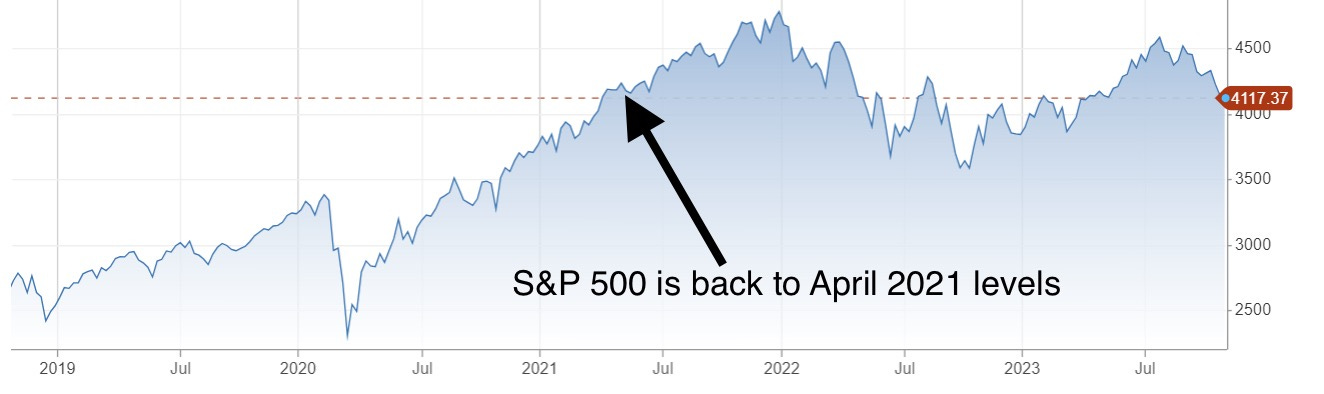

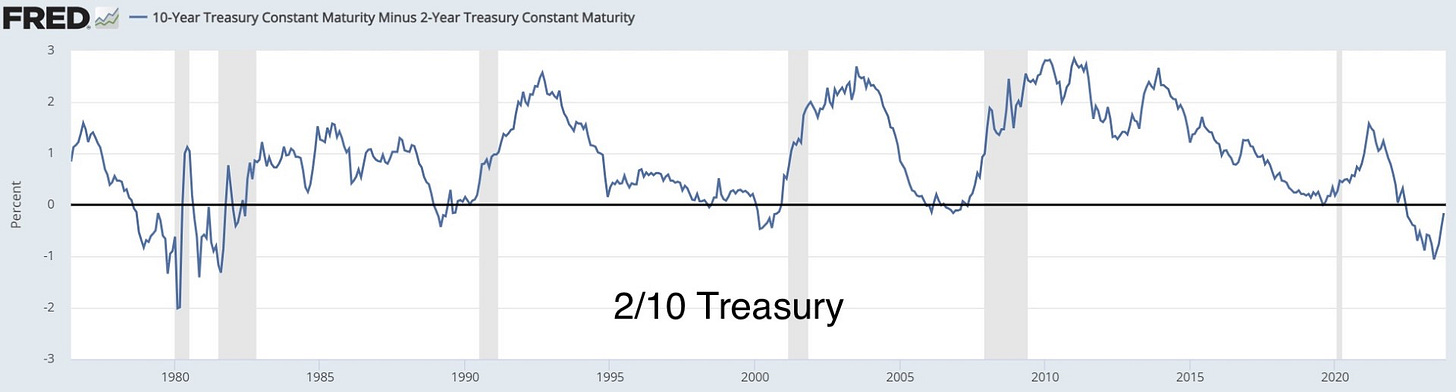

All three major averages registered steep weekly losses. The Dow and S&P 500 are down 2.1% and 2.5%, respectively, for the week. The Nasdaq has fallen 2.6% in that time, dragged down by sharp weekly declines in Meta Platforms and Google-parent company Alphabet. Disappointing earnings have pressured the market this week. Ford dropped 14% week to date after the company missed third-quarter expectations and pulled its guidance for the year, citing the UAW strike. Chevron shares were down 13% on the week after the energy giant reported earnings. The S&P is +8% YTD and -11% from its July high level, while the Nasdaq is +17% YTD and -12% from its July peak. US GDP grew at 4.9% annual pace in the third quarter, better than expected which sent stocks down and treasury yields down. This WSJ article suggests that consumer spending may not last. Amazon reported better-than-expected results as revenue jumped 13% and the stock popped 5%. The Treasury market remained choppy. The 2-year is at 5.02%, the 10-year at 4.85% and the 30-year is at 5.02%. I have written about the 2/10s curve which was inverted by 108 bps recently. It is now down to 16bps of inversion. Note in the 3rd chart, the recessions (gray vertical bars) consistently have a sharp inversion followed by a flattening (less inversion), as we do today. Gold is up to $2,015/oz and is now +15% over the past year. Oil is at $85/barrel and was up 2% on concerns over Israel’s new offensive. The VIX is +67% in 6 weeks and is trading at 21.3 today.

I was very vocal that I wanted Musk to buy Twitter given the bias, but felt he overpaid by $29bn on a $44bn purchase (check my pieces at the time of the announcement). I was given a look at the deal and wrote a long note on why I was passing. There is a WSJ article entitled, “One Year On, Twitter Continues to Burn a Hole Through Bank Balance Sheets.” The banks that underwrote the loan are stuck with it and the article suggests they will try to sell. I have not found any offering prices yet, but we know it will be at a hefty discount. Another WSJ article, “X’s Tumultuous First Year Under Elon Musk, in Charts,” has some amazing pictures to tell the story. Various equity investors in “X” have the investment marked between -26% to -61% of the purchase price. The company is struggling on a number of metrics, according to third-party data, including attracting users. It is trying to rebuild its advertising business after that revenue plummeted post-takeover, and the platform also has been navigating content-moderation challenges after Musk loosened such rules. Musk is one smart guy, but as I said before, he is spread way too thin (Twitter, SpaceX, Tesla, Neuralink, Boring, xAI….).

Great article about Facebook and the $46.5bn in losses associated with the Metaverse. The market capitalization of NXP Semiconductors is $46bn and Apollo Global is $45bn for perspective. Don’t feel bad for the awful mistake by Zuck, his net worth is +$59bn this year to $105bn. How come when I make a bad mistake (investing in crypto), I lose money, and when Zuckerberg drops $46.5n on a bad idea he makes money? Life is clearly not fair.

I have written extensively on my views around oil, the importance of energy independence (national security issue), the travesty of Biden’s draining of the Strategic Petroleum Reserve (1st chart), my love for Tesla cars and the fact that EV’s will not overtake the world near term. The cost is too high, the power grids lack the ability to handle it, rare earth limitations, and we are finding that more producers are unable to make cars cheaply enough even with government subsidies. Additionally, higher interest rates are making buying a new car even more expensive. Honda Motor and General Motors are dropping their plan to jointly develop lower-priced electric vehicles (EVs). The two had agreed in April last year to develop a series of lower-priced EVs based on a new joint platform, producing potentially millions of cars from 2027. This WSJ article is entitled, “Toyota Chairman Says People Are Finally Seeing the Reality About EVs.” The chairman of Toyota was frustrated with the EV mess and cited higher rates and manufacturing challenges for the electric vehicle market. Then, we saw Mercedes shares fall nearly 6% and the CFO discussed “brutal” EV pricing. Ford delayed the $12bn EV investments as the company is struggling with demand on EVs due to price relative to gas vehicles. Yes, I love my Tesla. No, it is not a practical car for distances and given hurricanes here, you need to have a traditional internal combustion engine car to get out of harm’s way. Fossil fuels account for 60.4% of the energy sources that power the US electric grid, with Natural gas at 39.9% and coal at 19.7%. The 2nd picture is from a Bloomberg article entitled, “Tesla’s Cybertruck Will Test America’s Great Political Divide,” which outlines EV demand by state/political affiliation.

A gunman has killed at least 18 people and 13 injured in the town of Lewiston, Maine, after bursting into a bowling alley and a bar and opening fire with an AR 15-style rifle. The town was on lockdown as police hunted for suspect Robert Card, a 40-year-old US Army reserve firearms instructor who was hospitalized this summer for two weeks with mental health issues. Card, from Bowdoin, Maine, had previously reported hearing voices and had threatened to shoot up his National Guard base in Saco, Maine, according to the Maine Information and Analysis Center - a division of the Maine state police. Card was found dead of a self-inflicted wound. This is yet another avoidable horrific act of violence. The man threatened to shoot up a National Guard Base and was only hospitalized for two weeks? The system is broken. We need to do more in America to prevent these tragedies and the thousands of inner-city murders as well.

Israel Headlines

Look at the incidents at the top schools in the country as outlined in the headlines below. Incredibly concerning what is happening in Israel and the rest of the world. There is too much hate. With respect to the Nobel Prize, it turns out that Jews make up .2% of the global population and have won 22% of the awards. They have won 110 times their representation in the population. This article outlines what has driven Jews to succeed. If Jewish DNA has anything to answer for, it’s not natural IQ but diligence in working hard to succeed. I had written about United Hatzalah, a volunteer first responder organization in Israel where I have been donating money. This video is an interview of the founder, Eli Beer, and is amazing. Not for the faint of heart. Blackstone, Salesforce, UBS, Jeffries, Penny Jar, and many sports teams (Hornets, Dolphins, Vikings, Falcons, Yankees, Bulls, White Sox…) have donated to United Hatzalah along with 3i Members who have donated 8 figures to the cause.

Erdogan threatens to declare war on Israel and send military to Gaza in chilling warning

Too many countries close to entering this war. Scary.

Israel conducts airstrikes in West Bank, Syria overnight, kills Hamas commander

Hamas Armed Wing Says 'Almost 50' Israeli Hostages Killed In Raids

Iran’s foreign minister threatens US, accuses Israel of 'genocide' in UN speech

Gaza residents break into U.N. warehouse for supplies as Israeli barrage continues

Before and after satellite images show destruction in Gaza

Amazing pictures from CNN. Check them out. Destruction.

Israel tech workers consider leaving for US following Hamas attacks

Miami was mentioned as a top destination.

Man Breaks into Jewish home in LA and threatens to kill family

The family had four kids and feared for their lives. He is clearly deranged.

‘F–k Israel’ graffiti scrawled across Cornell University campus sidewalks

Cooper Union barricades Jewish students inside library as pro-Palestinian protesters bang on doors

Jews are fearing for their safety all over the world. They are being vilified and attacked everywhere. Remember, 15mm Jews in the world for over 8bn people.

Columbia University lesbian group disinvites ‘Zionists’ from movie night

Read her note. How in the hell are we allowing this crap to continue?

Hedge fund billionaire vows to stop donating to Columbia University amid students’ Israel protests

UPenn Fights Back Against Billionaire Ultimatum as Divisions Rise

California city the first in US to condemn Israel, accuse Jewish state of ‘ethnic cleansing’ in Gaza

Massive exodus out of CA. Is it the taxes, cost of living, homelessness, crime, bad schools, woke policies, COVID restrictions, traffic, earthquakes, fires, floods, droughts, weak power grid, high natural gas costs, high gasoline prices, hate crimes or hate of Israel? I just can’t figure it out.

“I will kill you, Jew.” 9-year-old boy threatened with knife in Brooklyn playground.

What are the consequences? Why not mandatory 5 years in jail? In NYC, the DA will give the guy a cupcake and a hundred dollar bill to do it again.

Anti-Israel protestor demands everyone boycott Nike for doing business in Israel

The low IQ speaker was WEARING NIKE SHOES while calling for a boycott of the company.

Videos-Two great videos

Amazing short video about the lack of knowledge about Palestinians and Israel

Not enough people watched this video last time. MUST SEE.

Other Headlines

Meta Earnings Crushed Targets. Why Is The Stock Falling Anyway?

Despite a strong beat, Meta stock fell 3% post-earnings.

Intel stock rises on earnings beat and strong revenue guidance

Why Align Technology Stock Is Crashing (orthodontic devices)

The stock fell 25% on Thursday post earnings and weak guidance. More signs of consumer stress?

Hasbro, Mattel shares plunge as toymakers forecast a lackluster holiday season

Mattel and Hasbro were -7% & 11% respectively.

IBM bets on generative AI to escape economic headwinds

IBM stock has massively underperformed since 2000 with an average return of 3.5% vs the S&P of 6.7% with reinvested dividends.

Google paid $26 billion in 2021 to become the default search engine on browsers and phones

How do we interpret such a huge #? Information is worth more than platinum is the answer. Your personal and private information is massively valuable and Google is paying tens of billions for it.

Morgan Stanley says Ted Pick will succeed James Gorman as CEO on Jan. 1

Ford, UAW reach tentative deal to end labor strikes

The tentative deal includes 25% pay increases over the terms of the agreement and will cumulatively raise the top wage to more than $40 an hour, including an increase of 68% for starting wages to over $28 an hour. CNBC reported that it will cost $1bn more per year initially and going to $2bn.

Comments from Stephen Schwarzman, CEO of Blackstone.

Retail Credit Card APR Hits Record 28.93% Average

No one has written more about the consumer than I have and these card interest rates will crush consumers. The overall average card rate was between 23-24% last I checked. The savings rate is 50% of the January 2020 (pre-pandemic) rate.

New speaker of the House Mike Johnson once wrote in support of the criminalization of gay sex

Charged with a misdemeanor and fined with an apology and got a clean record in 3 months. Nothing to see here folks.

Recent Harvard CAPS Harris Poll has surprising results for 2024

Great charts in the piece. 58% have doubts about Biden’s mental fitness and 67% feel he is too old to be President. Trump is at 60% of the Republican votes for the Primary with DeSantis at 11%. If Biden is out, polls suggest Harris with 25% of the vote and then Newsom at 10%. I believe it will be Newsom. 63% don’t feel Biden should run and 54% don’t feel Trump should run. How in the hell are these clowns leading their respective parties? Head to head, Trump has 46%, Biden 41%, and 14% undecided.

'A head scratcher': Dems baffled by Dean Phillips' quixotic bid against Biden

The next debate needs to be Trump, DeSantis, Haley and Ramaswamy.

‘Divorce is not an option’ for US and China, Newsom says after Xi meeting

Seems to me Newsom is putting his hat in the ring. China is the worst partner ever. We need to be far less reliant on the bad actors in China.

California lost 817K residents in 2022, many fled to red states Texas, Florida

Brooklyn parents warn playgrounds overrun with drug vials: ‘Finding them all over’

Tyson Foods Begins Massive Investment Into Bug and Insect Proteins

The two companies have agreed to build a giant facility to produce insects and bugs en masse for the American market in order to “reduce the burden on the planet”.

Kanye West drew swastika in Adidas meeting, told Jewish manager to kiss Hitler portrait every day

They ran a man off the road and robbed him. Welcome to LA.

There is real hate in the world. It is disgusting.

Breast cancer breakthrough: AI predicts a third of cases prior to diagnosis in mammography study

A Vanguard study found those between 55 and 64 held an average of roughly $207,854. But this includes high income earners; breaking the figures down, it shrinks to a median of about $71,168.

Before-and-afters show devastation from Category 5 Hurricane Otis in Mexico

Given the idiocy and absurdity of the “Florida Man,” this contest might be the 1st Rosen Report-sanctioned event. I may need to see this one for myself.

Real Estate

Good WSJ article about a community near Austin, TX and the price of entry is high. The story is entitled, “In This Texas Enclave, Homes Cheaper Than $1 Million Are Few and Far Between.” With a median house listing price of $2.65 million in September, Westlake has the second priciest residential real estate in Texas, according to data from Realtor.com. It is outpaced only by Dallas’s Highland Park, whose median listing price was $3.7 million. Known for its natural beauty—rolling hills, trees, lakes and trails—Westlake encompasses the city of West Lake Hills and a handful of other neighborhoods that feed into the coveted Eanes Independent School District.

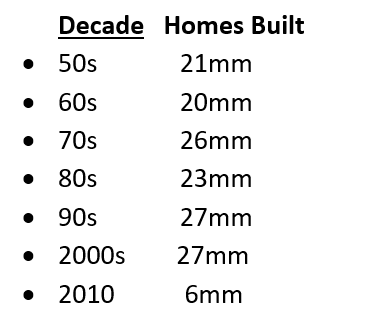

More than a million additional homes need to enter the U.S. housing market to better meet demand and pull back the upward pressure on housing prices, according to an industry economist. National Association of Realtors Chief Economist Lawrence Yun believes that the current inventory of existing homes sits at 1.1 million, down from the 1.8 million reported during the same month in pre-COVID 2019. However, with the population growth of 8 million since 2019, "the market could easily handle a doubling of the current inventory," Yun said. In other words, "an inventory of 2.2 million would help better satisfy demand," Yun said. It could make homeownership attainable for consumers whose incomes aren't keeping pace with housing costs. This chart is from a speech I heard from Barry Sternlicht (R/E titan) and shows the Global Financial Crisis decade crushed new housing builds.

Homebuyer traffic falls ~40% since the start of 2023 to near 2020 lows, according to Reventure Consulting. Here's where it gets interesting. New home sales just surged by 12.3% in September while a decline was expected and as mortgage rates hit 8%. There have only been 3 other times with homebuyer traffic this low:

1. 2020 Lockdowns

2. 2008 Financial Crisis

3. 1980s Housing Crash

Scott Rechler’s RXR negotiated a modification on the largest loan in its portfolio — a deal that could serve as a model for borrowers struggling to refinance office properties. RXR modified the $1.2 billion loan on 1285 Sixth Avenue, a 1.8-million-square-foot tower across from Rockefeller Center, with lenders Morgan Stanley and AIG, company president Michael Maturo told The Real Deal. As part of the deal, RXR put in $220 million of equity to provide for reserves and pay down the loan’s balance to $980 million. The senior loan’s original interest rate of about 4 percent increased to 6 percent, and the debt’s maturity was extended for five years. Rechler had set alarms off across the industry earlier this year when he said that RXR would walk away from struggling office properties that couldn’t be refinanced. But he also said the company would continue to invest in well-performing buildings. Maturo said 1285 Sixth Avenue, which is 100 percent leased, is an example of the kinds of buildings that RXR and its lenders are willing to sustain. In a funny coincidence, when I ran Fixed Income at UBS, they were located in Stanford, CT. I told them for me to consider the job, they had to move the entire division to NYC and I moved them into the building discussed today. I want you to think about this for a second. Rechler had to put in $220mm and increase his interest rate by 50% in a 100% leased, Class A building. What about all those buildings that are leased at 80% or less and don’t have tens or hundreds of millions to pay down debt? I spoke with a large owner of NYC office space and he was telling me the build-out costs and concessions required to attract tenants now has an 8-year or more payback period. He said this is the worst he has ever seen the office market in NYC in his lifetime.

Rosen Report™ #626 ©Copyright 2023 Written By Eric Rosen