Opening Comments

My last note was entitled, Songs Bring Back Memories and I had a lot of emails from readers about memories from some of my songs and others. It is amazing how music brings people together. The two most opened links were Post Malone’s cover of Better Man and the horrific video of the Israeli tragedy as outlined by IDF soldiers.

I went down to Miami on Wednesday night for dinner with my good friends Michael, John, and Jason at Contessa. I was treated to an amazing night with friends and delicious food and wine despite a 2-hour drive in the torrential rain. Michael knows how to order wine. I really like Contessa and anyone who does not has some serious issues. I was also there for lunch the week prior with my good friend, Ari. Some pics below. The pumpkin ravioli is amazing as is the chicken verde. The Tora di Baci chocolate cake is out of this world and stunningly beautiful.

NO REPORT ON WEDNESDAY given Thanksgiving. Everyone needs a little break from the Rosen Report unless something crazy happens.

Pictures of the Day-Miami Art Discussion/Brightline, Not So Bright

Markets

Subprime Auto Loan Victims

Dalio on Fiscal Irresponsibility

Newsom for President?

Open AI-Altman Fired & Co-Founder Quit

Office Loan Day of Reckoning

Signature Bank Loan Sales/DB Office Sale

Arbor Realty Trust Stock

Miami Inflation Rate is Double National Average

Pictures of the Day-Wynwood, Miami Art Discussion Lead By Eric

I spoke at a 3i Members event in Wynwood, Miami on Thursday night. I interviewed Rebecca Fine from Yieldstreet on various areas of the art market and what to consider when investing in art today. After the talk, I walked through a handful of famous paintings by Johns, Lichtenstein, Basquiat, Banksy, Francis, Warhol and others for 15 minutes to discuss why they were important and tell stories about the history of the pieces and artists. The event received positive feedback and resulted in a lot of questions and a robust discussion. Despite the horrific weather leading up to the event, approximately 35 people were in attendance. The crowd at 3i events is always an interesting mix of successful people.

However, my trip to Miami was not uneventful. I was heading down with my friend and neighbor, Tali. We were taking the Brightline and went via Uber a little early. We arrived at the Boca station and they informed us the train was 1.5 hours late. The app continued to say the train was on time (20 min prior to departure) and no email or text suggested a delay. I want to be clear, unless things change, Brightline is doomed with awful management, terrible schedules, weak customer service, and low ridership. How in 2023 can you not notify a rider of a massive delay? I had to scramble and get an Uber back home and then drive to Miami. Brightline, get new management, systems, and infrastructure and run it properly. You CANNOT count on Brightline. Yes, the trains and stations are clean, but I have had too many issues to rely on Brightline. Good luck getting someone on the phone for customer service. I do not believe it exists.

Rosen Report Jobs

I am working on a new RosenReportJobs website to connect people with both permanent jobs and summer internships. I mentor 50 people/year and am always trying to assist young professionals in their careers. I also have placed many senior people in roles recently. I have spent a fair amount of time developing the site and expect the developers to have something back to me in the next couple of weeks. My goal is to help people. If anyone is an expert here or has strong thoughts, please reach out as I am not sure how to properly structure the site to ensure ease of use. I could use all the help I can get. I would like to have some of the readers help beta test it and will hopefully have people put jobs up on the board. There will be a free intern section as I want to promote mentoring and developing young talent. For high-impact, permanent roles or experienced consulting, there will be a section with a fee (1/2 of the standard rate) paid for by the company hiring. Still in development, but excited to help more people find great professional opportunities and continue to mentor college kids and young professionals at zero cost. The site will be for Rosen Report readers and I do not plan on advertising outside of the report.

My Wife Caused a Biblical Rainstorm

Like all good husbands, I like to blame my wife when I lose something or anything else for that matter. On Tuesday morning, my wife said, “Eric, it is amazing, we had no storms and hurricane season is over. The weather has been great.” I am not lying, within minutes of bragging about the weather, the sky parted and we had TORRENTIAL rain for 3 days and wind gusts of over 50MPH. Schools closed in some areas due to heavy flooding. We lost power multiple times. My friend in Miami lost power for 48 hours. One area of Fort Lauderdale received 10” of rain in 24 hours. Clearly, Jill jinxed South Florida.

I drove to Miami Wednesday to see a property I may bid on to develop. At points, I was doing 5mph on I-95 given the rain was so heavy. It took me almost 2 hours to get down to an area it should take 45-50 minutes. After visiting my friends, Johnny (most interesting man alive) and Kim (an incredibly accomplished entrepreneur), and playing with their adorable kids and dog, I headed to Contessa (discussed previously).

As I was leaving the restaurant, the rain was beyond heavy and the streets were flooded. I was doing my best Usain Bolt and Carl Lewis impression to run to my car while hurdling over massive puddles and my phone fell out of my back pocket and into an 18” deep puddle. Given my lightning speed and pouring rain, I did not realize it until I almost reached the garage. When I frantically felt for my phone, I sprinted back to find it in the puddle. I received some funky error messages below.

When I got home, I put my phone in rice overnight. I woke up at 4am to see how my precious phone was doing and rice was stuck in the charge opening. I got two pieces out and one was stuck not allowing me to charge my phone. Clearly, my wife’s fault again. Had she not bragged about the weather, we would not have had a storm that caused the puddle that my phone fell into. The wet phone required the rice which was then stuck. Eventually, my wife was able to get the rice out and my phone appeared to be back to normal. Jill, next time, please don’t jinx the weather. Look at what you did!

Quick Bites

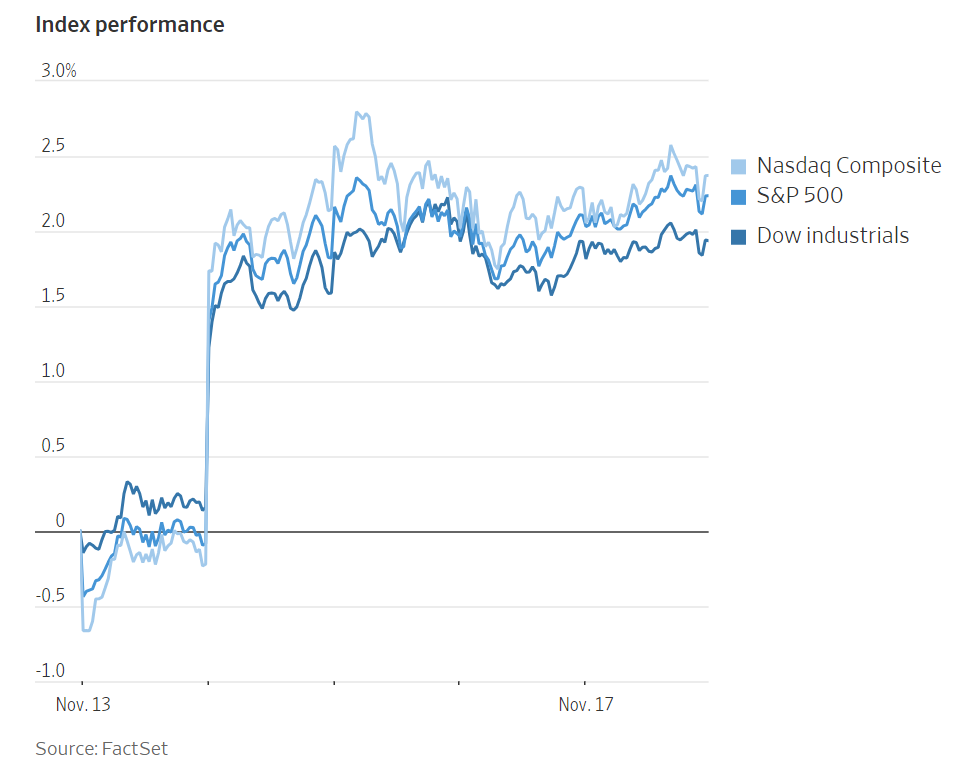

The major averages each notched their third straight positive week. The S&P added 2.2%, while the Nasdaq jumped about 2.4%. The Dow closed the week with a 1.9% advance. This is the first three-week win streak for the Dow and S&P 500 since July, and the first since June for the Nasdaq. Of note, the Russel 2000, is +8.3% since October 27th bringing it to +2.3% YTD. The S&P is +9.6% during that time and is now up 17.6% YTD. The yield on the benchmark U.S. 10-year Treasury hit its lowest level in about two months as investors bet that the U.S. Federal Reserve’s rate-hiking campaign could finally be over. The 10-Year hit 4.38%, but settled at 4.44%. After hitting a 4-month low, oil rallied 3% on Friday to hit $75/barrel.

Good Bloomberg article entitled, “How Wall Street Makes Millions Selling Car Loans Customers Can’t Repay.” The article outlines people getting loans they have no chance to repay. The regulators (CFPB) are cracking down to resolve abusive lending allegations. Still, 30% or more of subprime auto loans typically default, according to LexisNexis and Moody’s Corp. That’s approaching the highest default rate for subprime mortgages 17 years ago, near the peak of the foreclosure disaster. One example suggested the couple who took an auto loan struggled with the monthly payments immediately. An analyst mentioned CarMax Auto and a spike in auto delinquencies. Deliquesces 31 days or more are at 4.75%, the highest of 2023. According to Edmunds, 17.5% of buyers who financed a car in the third quarter had a monthly loan payment of $1,000 or more. The average payment was $736, a record high.

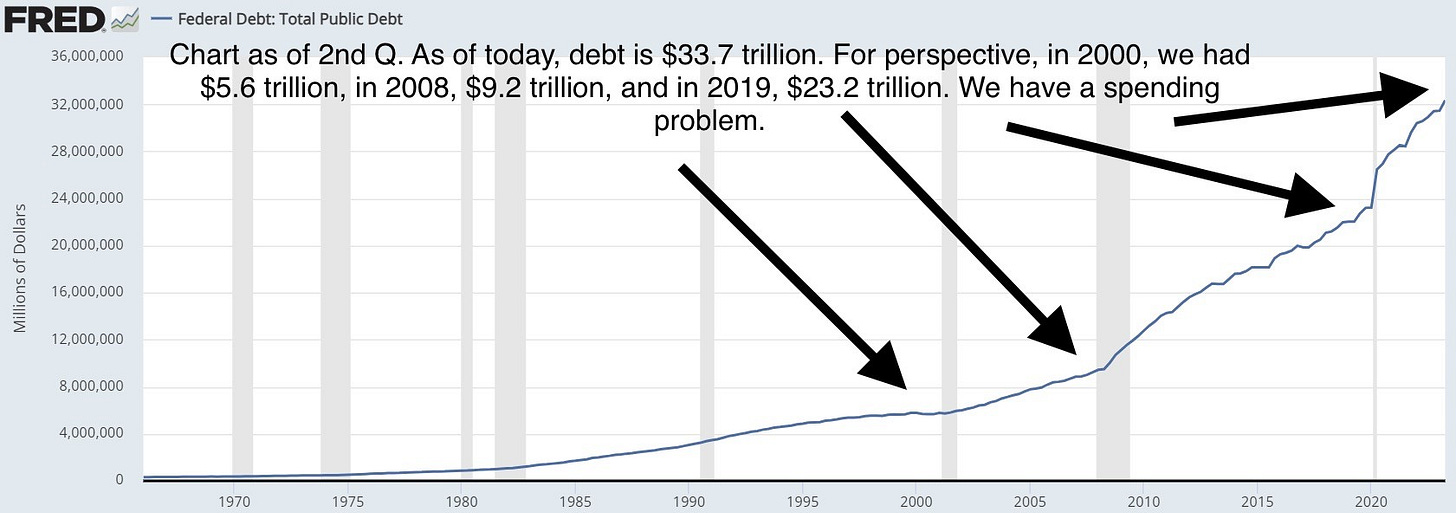

I have been writing about government spending, deficits, fiscal irresponsibility, lack of balanced budgets, and entitlements… for ages. Now, Ray Dalio (Bridgewater) has chimed in on CNBC: Soaring U.S. government debt is reaching a point where it will begin creating larger problems, Bridgewater Associates founder Ray Dalio said Friday. The hedge fund titan warned during a CNBC appearance that the need to borrow more and more to cover deficits will exacerbate the political and social problems the country is facing. “Economically strong means financially strong,” Dalio said on “Squawk Box.” “Financially strong means: do you earn more than you spend? Do you have a good income statement as a country? And do we have a good balance sheet?” The U.S. is $33.7 trillion in debt, a total that exploded by 45% since the Covid pandemic in early 2020, according to Treasury Department data. Last year, the government rang up a $1.7 trillion deficit as it sought to keep up the pace of spending. “You want to keep spending at the same level, there is the need to get more and more into debt. The way that works, it accelerates,” Dalio said. “We are at the point of that acceleration, which creates the supply-demand problem. It’s made worse by the other issues that we’re talking about, the internal political issue, the internal social conflict issue.” The math does not work. We need to curtail spending, have a real immigration policy, not give money away to every country that asks, and have politicians who care about the future- not just about getting re-elected. Good video in the link where Dalio does a nice job of explaining the mess. Druckenmiller has also been sounding the alarm.

I have been vocal that I feel America should demand better than the candidates leading their respective parties. I also recently suggested that Newsom is more likely to be the Democratic candidate. Our inept President said this: "I want to talk about Governor Newsom. I want to thank him. He’s been one hell of a governor, man," Biden said Wednesday during a welcome reception for Asia-Pacific Economic Cooperation (APEC) leaders in San Francisco. "Matter of fact, he could be anything he wants. He could have the job I’m looking for." Sorry President Biden, Newsom has not been “one hell of a governor. I want you to consider the state of California under Newsom. California has the highest gas and natural gas prices in the country, highest taxes, worst homelessness, bad crime, offensive COVID mandates, losing wealthy individuals and many companies to better states, horrible power grid, bad traffic, poor education scores, high cost of living, massive budget deficits, sanctuary cities... CA has the highest poverty rate than any other state when the cost of living is factored into the equation. The soft-on-crime views have let hardened criminals free and men go to women’s prisons. Look at major cities such as LA and San Fran and the carnage with respect to the office and retail markets and flight of wealth out of area. San Fran has the highest vacancy rate of any major city in the US (almost double NYC). The droughts have left CA in a bad way and Newsom has done little to improve the water shortages. The LA port backups during the pandemic added to inflation and supply chain issues for far too long. Remember, Newsom mandated lockdowns and masks while partying with his rich friends at the French Laundry. Yes, I believe there is a good chance that Biden does not run in 2024, and Newsom is the guy. Sadly, I am not convinced either is qualified to be our next President. Newsom went to China to meet Xi. He looks the part, but sadly his track record does not. There is a debate on Fox News on 11/30 between DeSantis and Newsom which will be must-watch TV.

Open AI has taken the world by storm and given us ChatGPT. Sam Altman was the ever-present CEO and he was abruptly fired after the board determined he “was not consistently candid in his communications,” and the “board no longer has confidence in his ability to lead.” On the heels of the firing, co-founder, Greg Brockman (chairman of the board) also quit. Chief technology officer Mira Murati will be the interim CEO, effective immediately. The company will be conducting a search for a permanent CEO successor. I believe the last funding round was at $80bn making Open AI the 3rd most valuable private company in the world behind ByteDance (TikTok) and SpaceX. If you just invested at $80bn in the past two months and the CEO and Co-Founder are gone, what are you thinking about that investment? Microsoft invested $13bn in OpenAI and was informed of Altman’s firing minutes prior to the public announcement. According to this article, Altman is planning to launch a new venture and it is expected that Greg Brockman will join him. This WSJ article suggests existing Open AI investors are petitioning to get Sam back as CEO. Plot Thickens. I look forward to hearing the take from the “All In Podcast” this week.

Israel

Early Sunday, some positive headlines hit the tape. From WaPo, “U.S. close to deal with Israel and Hamas to pause conflict, free some hostages.” Given the edict from Hamas to erase Israel and all Jews, it is hard for me to fathom that any pause would last very long.

Pentagon Confirms Almost 60 Troops Injured By Iran-Proxy Forces in Iraq and Syria

Why Iran Keeps Attacking Americans — At an Astounding Ratio of 17 to One

California Jew's killing 'not a hate crime,' Ventura County DA claims

I do not understand how this is possible based on the news I read.

Pro-Palestinian group shares ‘reprehensible’ antisemitic map of NYC targets on social media

Meet the American millionaire Marxists funding anti-Israel rallies

Why would a Jew ever give a dollar to this school again?

Biden tells two different stories about the Israel-Hamas war in letters to Americans

Other Headlines

Amazon to sell Hyundai vehicles online starting in 2024

Bezos started with books in 1995 and started expanding beyond in 1998. He is now off to cars. Bezos is brilliant and the service is destroying traditional retail. I literally order things and they come to my house in a few hours. It is almost like he is anticipating it. A mandolin in 3 hours? How is that possible? AMZN went public in 1997 with a market cap of $300mm and it is now $1.5 trillion.

The article outlines all the subsidies on what the true cost is of an EV.

Orange juice prices just hit another all time high and are now up 240% in 2 years.

All Is Quiet in Oil Markets—for Now

Interesting opinion piece from WSJ on oil. US production is far higher than the last oil crisis which helps, but the author, Yergin, notes that tensions are high in the Middle East. He also discussed the Strategic Petroleum Reserve.

This link has a longer list including IBM, Disney, Paramount, Sony, Warner Brothers, Sky, and NBC Universal. I saw a recent article suggesting Twitter ad sales were -50% and it appears it will be even lower now. Musk lashed out at large advertisers and Media Matters (watchdog group following the pause on advertising by major companies.

Jim Chanos, the short seller who called Enron’s fall, is converting hedge fund to a family office

He was shorting TSLA for a while which had to hurt.

Charlie Munger says there isn’t the slightest chance Buffett traded own account to enrich himself

Thanksgiving dinner will be less expensive this year

A Thanksgiving meal of twelve classic items for 10 people will cost $61.17 on average – a 4.5% drop from last year’s record high average of $64.05

2024 Republican Presidential Nomination from Real Clear Politics

The numbers seem insurmountable absent Trump being unable to run for legal reasons. Below is the Republican nomination polling.

Trump pledges to expel immigrants who support Hamas, ban Muslims from the U.S.

New resolution filed to expel GOP Rep. George Santos from Congress

There are so many embarrassments in politics, but this guy really takes the cake.

New Marquette Law School National Survey Finds Biden Trailing Three GOP Opponents

Haley is beating Biden by 10 points (55 to 45) according to the poll.

Bronx judge frees men charged with beating up NYPD officer — despite DA’s request for $10K bail

The judge released them without bail. Welcome to NYC and the backward world where beating up police officers is ok.

First US state to decriminalize hard drugs may be set for swift U-turn

The authorities are leading demands for Oregon to recriminalize heroin and fentanyl after addicts took over the streets of major cities. Wait, making hard drugs legal is a bad idea? I wrote about this when it passed and questioned the decision.

No way, Mr. Mayor: Huge NYPD budget cuts mean disaster AND betrayal of your voters

I have been consistent with my view that NYC will face austerity measures and increased taxes. Adams (former Police Officer) wants to cancel the next FIVE Police Academy classes to bring the ranks of the NYPD down to 29,000 by 2025. In 2000, there were 40,285 officers, and in early 2023, 34,000. What does this mean for crime? Safety? Do not look at NYC with rose-colored glasses. What it once was is not what it has become. I loved my time there 20 years ago, but see it for what it is today.

U.S Army Begs Unvaxxed Troops to Return

We let in countless illegal immigrants and did not require vaccinations, but demanded little kids, troops, workers, and government employees.. get them. There is a copy of a letter from the government asking troops to return in the link.

Star Canadian singer's Indigenous heritage disputed in bombshell report

Here we go again. Just like Liz Warren/Pocahontas.

The big regret was not what I expected.

Real Estate

Good Bloomberg article entitled, “Banks Aren't Ready for the Office-Loan Reckoning.” Few banks want to lend to the commercial real estate market right now. Rising interest rates and surging vacancies, particularly for offices, have dramatically increased risks. In the first nine months of this year, banks’ commercial real estate originations dropped by 67% over the same period last year. And in a recent Federal Reserve survey of loan officers, a net two-thirds said that they’re further tightening lending standards. The metrics reflect a reluctance to lend not seen outside the global financial crisis or the start of the pandemic. For banks, the reckoning may come next year. Many of them have a much larger slice of loans coming due in 2024 than this year. In Bank of America Corp.’s case, 36% of office loans are due to mature next year, up from 22% in the final three quarters of 2023. Check out this story about a Deutsche Bank-owned building that cost $500mm and is likely to be sold between $150-200mm. The 780,000 ft building is 31% occupied after Bank of America left and WeWork is likely to follow.

Real Deal article on Signature Bank’s commercial R/E loan sale. Bidding closed last Thursday. The article suggests the $15bn of loans on NY’s deteriorating rent-stabilized housing may not sell this round. Well, who is to blame for the disaster? Awful politicians made horrific rent laws in 2019 where landlords cannot raise rent even if they put a ton of money into the units. The laws were meant to protect tenants, but instead, the opposite happened. Valuations of rent-stabilized apartment buildings are down 50% from prior to the 2019 rent laws. What does that mean for all the lenders? Let’s not forget about the new laws pertaining to the environment and record keeping adding to landlord costs, while making it impossible to evict tenants. Also, valuations have been crushed, but commercial R/E taxes have not followed suit anywhere near the same amount of value destruction. What could possibly go wrong? This article from Bisnow is entitled, ”A Bloodbath': Reckoning For Rent-Stabilized Apartment Owners Starting To Set In.”

Arbor Realty Trust’s share price plunged 8.7% on Thursday after a short-seller of the stock slammed the firm’s loan book and underwriting. The swing wiped out the year-to-date gain in Arbor’s stock. In its nearly 30-page report, Viceroy Research, which stands to profit from a drop in Arbor’s stock price, criticized the company’s reliance on making “high-risk” multifamily bridge loans — short-term, floating-rate debt. Because Arbor gave out the majority of these loans in 2021, when interest rates were historically low, many of its borrowers have struggled to repay them as rates have soared. Valuations for these properties have simultaneously plummeted, in many cases to levels less than the debt tied to them. The comprehensive report is attached above. I am surprised the stock is not down more based on the findings.

This Bloomberg article is entitled, “Miami’s Inflation Ranks Highest in the US,” and shows Miami at 7.4%,” more than double the US average. Miami’s annual inflation rate of 7.4% in October was the highest of the US metro areas tracked by the Bureau of Labor Statistics, and more than double the national average. Tampa stood at 6.7% in September. By comparison, Phoenix and Atlanta, two other inflation hot spots last year, have seen their rates drop to roughly 3%. Much of the stickiness of inflation in Florida appears to be driven by people and businesses relocating to the region, boosting spending and demand for homes and energy, said William Luther, an associate professor of economics at Florida Atlantic University. “People want to live here, and that looks very promising for Florida’s future,” Luther said. “The trade-off, of course, is that that adjustment takes some time, and so you get an increase in prices here in areas like housing.”

Rosen Report™ #632 ©Copyright 2023 Written By Eric Rosen