Opening Comments

My last note was about the JPM Partners Dining Room and it received a lot more feedback than I would have thought. Quite a few people asked me about Ace Greenberg and I found a picture of him at my wedding in his signature bow tie. The most opened links were about 15 surprising foods nutritionists say you should never touch and the No. 1 thing that destroys kids’ confidence.

Please be sure to read the bullet and attached link in Quick Bites about the contract between Qatar and Texas A&M. You should be concerned.

I have new readers and want to be sure you know that many email systems truncate the Rosen Report. Reminder to hit “View Entire Message.” Also you can follow me on LinkedIn or download the Substack App to be sure you don’t miss any reports.

Markets

Labor Market

Qatar’s SCARY Contract with Texas A&M

Jeffrey Epstein List

Victor Wembanyama-On His Way to $1bn?

NYC Chelsea Barney’s Sells @ Big Discount

Example of the Issues in R/E Today (NYC Office/Retail)

Current NYC Office Market Compared with 2019

NYers Paying Cash for Homes

Video of the Day-Interview with Greg Waldorf

With my partnership with 3i Members, I have been fortunate to interview some amazing people and every couple weeks, I will be releasing the video or excerpts. This week, I am showing my interview of Greg Waldorf, an incredible investor, businessman and person. Greg seeded eHarmony, became the CEO of Match.com and has an amazing story after starting his first company with his Bar-Mitzvah money. Given Greg teaches the #1 class at Stanford Business School, “Startup Garage,” his presentation is amazing. I learned a lot from Greg in the 30-minute interview and believe you will as well. I am lucky to call him a friend and an avid Rosen Report reader only solidifies his brilliance. Greg, thank you.

Social Media - I am Becoming My Teenage Daughter

My social media game is virtually non-existent. Yes, I use LinkedIn a bit, but when it comes to Twitter, Instagram, Snapchat, TikTok… I am awful. My daughter, Julia, takes a lot of selfies and TikTok videos and I must say, it is a bit irritating. I am the designated photographer and snap hundreds of pics of my daughter in various poses that I find a waste of time. She has 25k followers and seems to post every 30 seconds.

My readers send me a lot of videos from various social media platforms and I always watch them. Given the brilliant algorithms written into these apps, YouTube and Instagram now know what I like and feed me amazing videos.

The other night, I could not sleep and grabbed my phone at 2 am with my earphones. Embarrassingly, I watched two hours of Reels on Instagram and I never requested anything after the first two videos. The system was feeding me exactly what I wanted. It was exhilarating and scary at the same time; Surfing, fishing, basketball and music videos. Sadly, I am becoming addicted, and with the big storm in California, the surfing videos were non-stop perfection.

Yes, social media is a problem for kids and I am not a fan of the impact it has on teens. Now I am growing concerned about the impact on me at 54 years old. No wonder why advertisers have ditched TV, magazines, and newspapers (chart below) for social media. I find myself on it for an uncomfortably long time. I think I need an intervention. My wife likes to yell at me and when she sees me watching my “Reels” she seems to get extra angry. I cannot stop! The first step in overcoming addiction is admitting you have a problem. Houston, I think I have a problem. I imagine that in the past three years, social media only went up (chart ends in 2020).

If I start posting selfies with pouty lips like my 16-year-old daughter, put a straightjacket on me and place me in an institution. Now that I think of it, there are about 83 reasons to have me committed. I will try not to give you the 84th.

Quick Bites

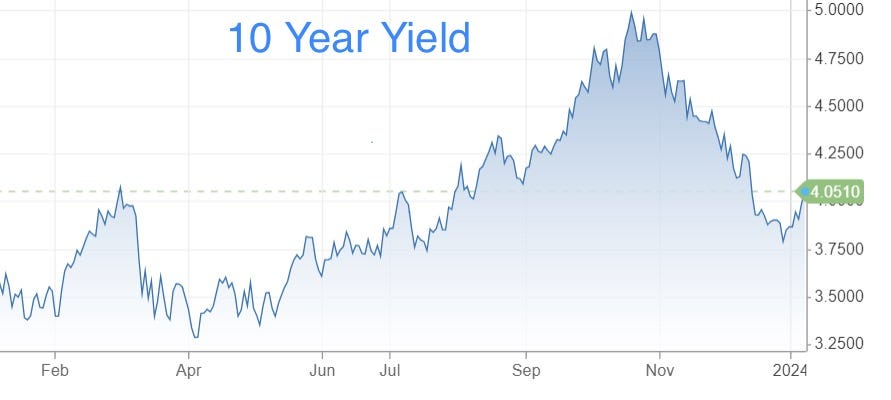

The S&P 500 ended Friday modestly higher, but all three of the major averages snapped a nine-week winning streak following a stronger-than-expected jobs report. The three major averages notched their first negative week in 10, with the Nasdaq suffering the biggest decline at 3.25% — its worst weekly performance since September. The S&P 500 and Dow dropped 1.52% and 0.59%, respectively. However, stocks have been on a tear, so I am not reading too much into the weakness over the past few days just yet. Check out the 1st chart sent to me by Robert, one of my biggest contributors. The Global Forecast Series graph shows 150 years of S&P returns bucketed into 11 categories by return. The hot jobs report sent the 10-year yield higher and touched 4.10% before settling 5bps lower at 4.05%. On 12/28, the yield was 3.78% for perspective. Oil prices rallied 4% on the week to finish at $74/barrel on Middle East tensions.

Yet the job gains were slower than the same period a year ago, with the three-month average gain dropping to 165,000 a month compared to an average of 284,000 in December 2022. Friday’s report showed average hourly earnings increased 4.1% from December 2022. Check out the 2nd chart which shows downward revisions to the jobs number. Don’t get me wrong, the jobs # was hot. I just question how hot give all the recent revisions.

I have written extensively about foreign money, namely from the Middle East being donated to US colleges and Universities. In one November note, I outlined the BILLIONS given by country and to which universities (charts below). This article is entitled, “How Texas A&M’s Deal with Qatar ‘Puts American Security at Risk,’ and is something you need to read. In short, Texas A&M is a powerhouse in nuclear engineering. Under the terms of the “Gift” from Qatar, “The Qatar Foundation shall own the entire right, title, and interest in all Technology and Intellectual Property developed at (Texas A&M University Qatar) or under the auspices of its Research Program, other than those developed by non-TAMUQ employees and without financial support from the Qatar Foundation or any of its affiliates,” says the contract, dated May 25, 2021. Remember, Hamas leadership has been hiding in Qatar. What could go wrong? The charts below are from my November note on the subject of “Follow the Money.” Now, the Texas A&M contract exposes what the money is buying these foreign entities for their “gifts.” This article suggests Texas A&M received $485mm from Qatar between 2013-2018. The school shows $69mm in gifts from Qatar, but the Texas Public Information Act showed the truth.

A highly anticipated trove of secret court files related to Jeffrey Epstein was unsealed on Wednesday, shedding more light on the sex trafficker’s victims and famous colleagues. Clinton is shown receiving a massage from an Epstein accuser in what appears to be an airport. There is an accusation that “Clinton likes them young.” Just because your name shows up on the list does not make you guilty of a crime. Here is another article as well. Bill Clinton allegedly stormed into Vanity Fair newsroom, ‘threatened’ outlet to not run sex trafficking stories against ‘good friend’ Jeffrey Epstein. Overall, the data dump is not incredibly informative.

I thought this was an interesting Bloomberg article on NBA rookie, Victor Wembanyama, the Parisian basketball phenom on the San Antonio Spurs. He is 7’4” and 20 years old. Through the first 34 games of the season, he is averaging 19.2 points 10.1 rebounds, and 3.2 blocks per game. The article suggests he may be the 1st player to earn $1bn in on-the-court earnings alone if he continues to shine. The salaries in the NBA have EXPLODED. I want you to think about this for a minute. Michael Jordan earned a total of $93mm over 16 seasons for an average of $5.8mm/year. Today, the max contract gives a player approximately $47.6mm/year. This means, in two years, the max contract a player earns what MJ did in 16 seasons. The suggestion is Victor could earn $91mm/year at 28 years old.

Israel

Hezbollah, Israel trade heavy cross-border fire as Blinken seeks to prevent regional escalation

Top Israeli Official 'Optimistic' About Hostage Deal Talks Despite Hamas Leader's Assassination

Rutgers law student faces expulsion after ‘doxxing’ Hamas supporters

Not sure I understand how people who post hate are ok, but the person who exposes it is not.

Jewish family faces 'horrific' antisemitic harassment at NJ mall over teen's IDF jacket

Bill Ackman’s Office Picketed by Civil Rights Leader Sharpton in Clash Over Harvard, DEI

Bill Ackman’s wife is accused of plagiarizing part of her dissertation

Neri Oxman, an academic and wife of billionaire investor Bill Ackman, plagiarized parts of her doctoral dissertation at MIT, according to a report from Business Insider. Ackman is checking the MIT staff for plagiarism according to MIT standards.

NY girls HS basketball game canceled after antisemitic slurs hurled at players

“I support Hamas, you f–king Jew,” a Roosevelt player snarled at a Leffell opponent.

Other Headlines

Short sellers lost $195 billion in 2023 bets against US, Canadian stocks

Market forecaster Jim Bianco sees the 10-year Treasury yield surging to 5.5% – a multi-decade high

Gas prices are back down to $3 a gallon

I paid $2.84 the other day.

Apple’s Reign as World’s Top Stock at Risk From Bumpy 2024 Start

Lost $177bn in market cap in 2024.

DOJ close to filing massive antitrust suit against Apple over iPhone dominance

AG wants Trump banned from New York real estate business for life, fined $370 million in fraud case

If the fined passed, I would love to see how Trump would pay for it.

US supreme court to hear appeal of Colorado ruling removing Trump from state ballot

Trump received millions of dollars from foreign governments while president, House Democrats allege

Trump’s businesses, according to the report, received at least $7.8 million from corrupt and authoritarian governments including China, Saudi Arabia and Qatar. The suggestion is that while Trump was President, foreign entities spent money at his hotels. I don’t understand why this is a story. The Democrats don’t seem to care that Biden’s family received tens of millions of dollars from Ukraine, China, Russia and other countries while Biden was VP.

CNN’s inaugural Road to 270 shows Trump in a position to win the White House

Is DeSantis going to drop out of the race on Jan. 15?

A year ago, I thought it was DeSantis who would be the Republican candidate. He blew himself up on abortion and Disney. Sounds like he is out next week.

Broadway takes massive hit as NYC suburbanites steer clear over ‘safety concerns’

The Great White Way sold 12.3 million tickets for the 2022-2023 season — a 17% drop versus 2018-2019, the last complete season before Broadway shut down because of the pandemic. NY metro suburbanites accounted for a mere 14% or 1.7 million of the overall tickets last season — the lowest number on record in the 23 years the Broadway League has tracked such data. Half of suburbanites who have not returned to Broadway cited “concerns about safety” as a primary reason why they see fewer shows. Bad policies have consequences. The businesses in Times Square earn less money, pay less taxes, and can pay lower rents with fewer patrons. The multiplier effect is real.

This is akin to bragging that you received a “D” grade on a test because someone else got an “F.”

Melee breaks out after someone cuts line outside East Village migrant center

New York governor promises a floating pool in city waterways, reviving a long-stalled urban venture

Based on budget deficits, crime, illegal immigrants, cuts in the police force, filth, and poor schools, I have a funny feeling the money can be better spent elsewhere. The total spend would be $90mm on pools for underserved communities.

The disastrous border policy is dangerous and costly on many levels. In fiscal year 2023, which ended in September, (ICE) arrested 170,590 illegal immigrants inside the country, almost half of them with criminal records. The criminal aliens had an average of four charges and convictions each, including more than 33,209 charges or convictions for assault, 7,520 for weapons offenses, 1,713 for homicide-related crimes and 1,615 for kidnapping.

Record-breaking 378 officers shot in the line of duty in 2023, FOP says in annual report

The suggestion is the Defund the Police Movement has contributed.

I went 7 for 9.

Alaska Airlines grounds Boeing 737-9 fleet after emergency landing in Portland

Check out the pics. Unbelievable.

Shocking when you look at the tiny tear. I had no idea.

Setting aside $20 a day could help you save $1 million for retirement—if you start early

I was an amazing saver living well beneath my earnings. However, I was so conservative on investing given I grew up with limited means that my money did not compound as it could have. Save and invest your money in quality stocks bonds and income-producing R/E.

The WiFi of the Future Has Arrived—Just in Time

WiFi 7 offers a substantial jump in performance and speed, unlocking a new world of possibilities.

Now's your chance to be the new Smashing Pumpkins guitarist

I asked my son to apply. How cool would that be? I loved the band in the 1990s and they have some great songs.

Secret UFO meeting prompts speculation over what the government is hiding

No chance we are alone. I want some proof already. Why is this so secretive?

Here’s How the Russian and Ukrainian War Efforts Compare, in 10 Charts

Real Estate

The debt fund that foreclosed on Ben Ashkenazy’s Chelsea retail space – once home to the original Barneys department store – has sold the property for a fraction of its once-lofty price. Douglas Tiesi’s Argentic Investment Management sold the property at 115 7th Avenue for $22 million to Flushing architect and developer Raymond Chan, a source familiar with the sale told The Real Deal. That’s less than half the $57 million Ashkenazy paid for the 40,000-square-foot building in 2014. What about the massive space on 61th and Madison where the main Barney’s was for years? The 475,000 ft building has been vacant for three years. In September, when I was in NYC, the windows of the former Barney’s store were broken and there was a burnt-out car in front of it.

A reader who is an R/E investor and I had dinner recently. He walked me through a NYC R/E investment he made, that on the surface worked out very well, but became a foreclosure due to the large rate increase and the pullback in lending. This is a small NYC office building with 1st-floor retail. New build.

@ 2019 Loan $40M

Proforma expected Net Operating Income $3M. At a 4.85% cap rate it resulted in a value of $62M, LTV=65%. The assumption was a takeout loan upon stabilization at 4+% with a Debt Service Coverage Ratio of 1.3x = about $50M, no problem to refinance the original $40mm loan. Well, rates moved and lenders pulled back. See how it unfolded below.

@ 2023 NOI $3.1M (exceeded expectations) at 5.85% cap rate, value $52M, LTV =77%. The take-out loan at 7% (not 4%) with a Debt Service Coverage Ratio of 1.3x = about $30M new loan, can’t get the $40M original loan taken out! The result was the loan foreclosed on the building that met its originally stated projections. This will happen countless times in 2024/2025 when lenders take back the keys as the equity will refuse to pony up fresh capital. Think about all the deals in retail and office where the pro forma numbers were not met due to higher vacancies and lower rents.

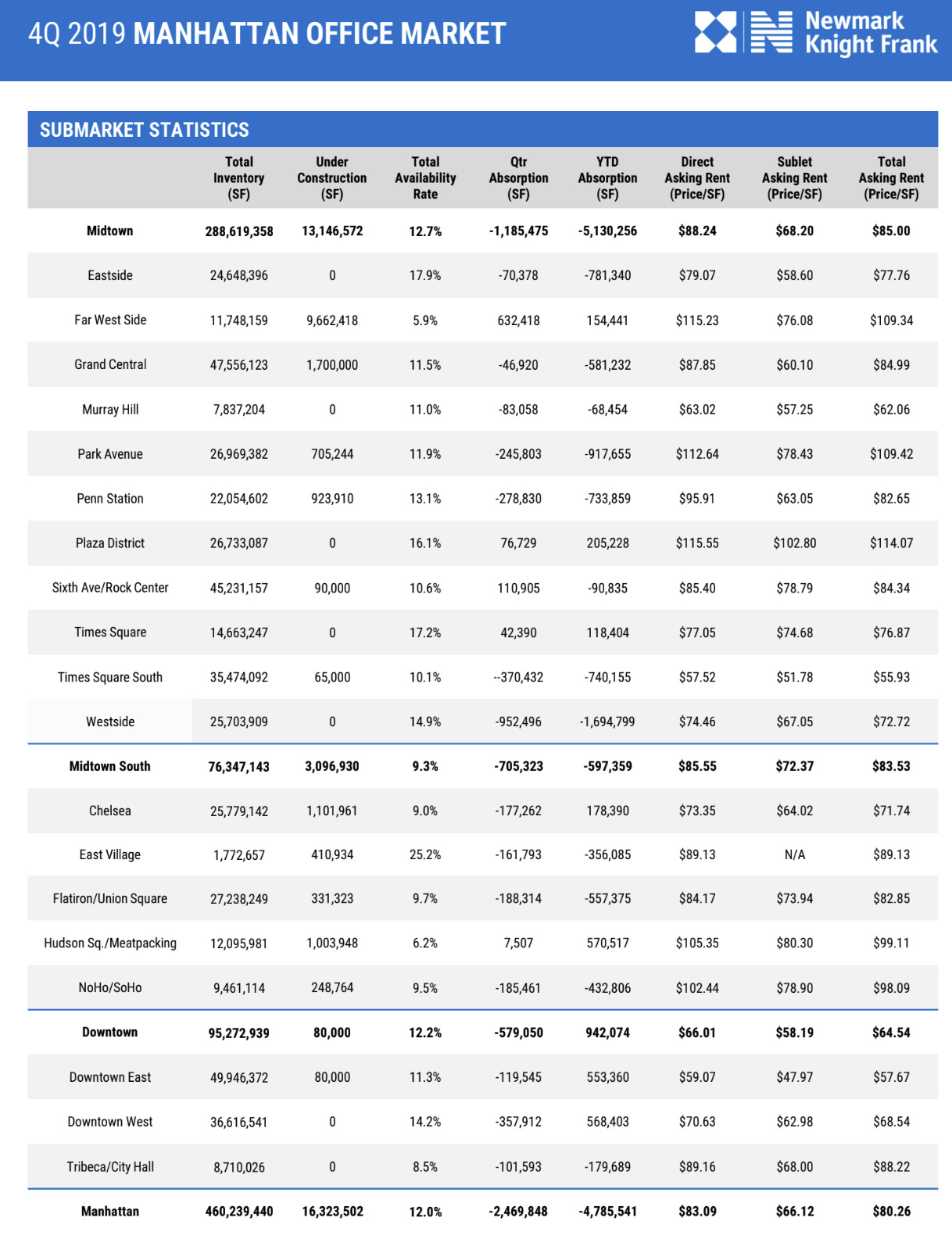

Below, I compare the most recent NYC office data to the 4th Q of 2019. The form is different, but you get the drift. The overall availability rate today is 18.6% relative to 12% at the end of 2019. Although the average stated “Asking” rent went from $80.26 to $75.04/ft, it does not factor in the substantial concessions today relative to pre-pandemic. Landlords are throwing a lot of concessions at the tenants (1-2 years free rent and $100-150/ft build-out provisions) to preserve “Face Rents.” Concessions remain at very high levels which are pushing down Net Effective Rents. Don’t forget the amount of money spent redoing lobbies and updating amenities in buildings as well. The good news is very big deals are happening in NYC and stated rents can be at high levels. The issue is the Net Effective Rents are decently lower than the stated levels once you factor in free rent and build-out payments from landlord to tenant. However, the higher rents in Class A buildings are giving $150 in build-out expenses (upfront) and 1+years of free rent with rents of well over $100/ft. However, the Class B buildings with rents in the $60s/ft are giving $100+ in build-out expenses and 1-2 years of free rent on a 15-year lease. This will put increasing pressure on owners of Class B & C product. As mortgages mature in 2024/5, this will be front and center as banks will be taking over more buildings.

A record number of New Yorkers are dishing out cash to nab a home in Manhattan, where the average digs run for $2 million. Cash sales in the Big Apple made up a staggering 67.9% of transactions in the fourth quarter of 2023, according to the latest quarterly survey of Manhattan sales from appraisers Miller Samuel and brokerage giant Douglas Elliman.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #645 ©Copyright 2024 Written By Eric Rosen