Opening Comments

My last note was about the importance of being passionate about what you do for a living. I believe all young people should be reading the theme piece and watching the short videos in it. There are important career lessons to be learned. The most opened links were the NYC abandoned mall due to crime and the video of the day of the pro footballer asking his son if he is a loser or a winner. I love the message and the delivery of the footballer.

My clearance sale shopping is beyond legendary and I have written multiple pieces including February’s “Legend at the Clearance Rack,” and 2021’s “You Had Me At Clearance Sale.” You know you have made it when your face is on the sale rack not once, but twice in 5 weeks. My face made it again for the Spring Sale this weekend after being the face of the Valentine’s Day Sale. Tom Brady has 7 Super Bowl rings. I feel having your face on a sale is equivalent to an NBA, MLB or NFL ring, so I am quickly catching up to you, Tom. By the time I retire from clearance sale shopping, I may have the equivalent of 30 Super Bowl rings. If there is a Clearance Sale Hall of Fame, surely I should be in it. Yes, that was my mullet at age 16. Trust me, it was a good look back then.

I have been to Le Colonial in Chicago and NYC but only went to the Delray, Florida location for the first time last week. The French-Vietnamese fusion is packed with flavor, snappy service, and a beautifully done restaurant with both indoor and outdoor seating. The crowd was noticeably older with an average age nearing Methuselah. The irony is the menu-type font size required a magnifying glass. I do not require reading glasses and found myself squinting to read the 2-point type and had no idea how the elderly patrons could read the menu. The decor was great. The food was solid and the presentation was impressive. Would I go back? 100%. The restaurant is fully priced and not a weekly or monthly destination despite solid flavors, good service, and a nice ambiance even with an older crowd. I did enjoy my halibut and felt the Brussels sprouts were fantastic. They also offer a lot of peanut sauce which I enjoyed dipping my appetizers into. I was not blown away by the Shaking Beef my daughter ordered. For some reason, I cannot bring myself to eat this kind of food with regularity, but would go twice per year. The kids wanted Whit’s Frozen Custard for dessert instead of ordering from the restaurant menu.

I am doing more restaurant reviews and in upcoming reports, I will review Imoto (Palm Beach), Marygold’s (Miami) and Night Owl Cookies (multiple locations). I have requests to do restaurant reviews in an easily searchable form by city, type, and rating. If anyone has any ideas on how to post, I would be grateful. I will be back in NYC quite a bit in the coming months and have 20 places on my list to try.

Markets

Gas Prices Up

Larry Fink on U.S. Debt Levels

YouTube Worth $400bn?

Truth Social/Twitter/Reddit Valuation Comparison

GQ’s 20 Most Creative Companies in the World

South Florida Remains Hot

Monthly Payment to Buy a Home Up Sharply

Barry Sternlicht Office Losses & Other Concerning R/E Stories

Video of the Day-My Podcast with Alicia Levine

Through my partnership with 3i Members, I get to interview some amazing thought leaders and I have developed some fantastic friendships. Alicia Levine is the Head of Investment Strategy and Equity Advisory Solutions at BNY Mellon and is on Bloomberg and CNBC constantly. Her background is impressive (PhD) and she is a fountain of knowledge. You can watch the 20-minute podcast here.

Funny Misunderstanding

I was fishing and doing quite well on Jan 26th and my phone email was blowing up with what appeared to be unsubscribes from the Rosen Report. When I first started seeing the emails, I was disappointed and could not figure out what was driving the hate. It was two days after my prior posting and was confused. If I get an unsubscribe, it tends to be within a couple of hours of posting and I see “unsubscribed” from Substack. In this case, I had emails from a couple dozen people requesting to be unsubscribed and they were getting nasty.

“I did not sign up for this and there is no opt-out. Stop. I am begging you.”

“Please stop contacting me. I have asked you many times.”

“Respect other people’s time. Delete my email from your email database or mailing list.”

“How many times do I have to ask you to STOP?”

“What is wrong with you? Please stop the madness.”

“I don’t want to be on this dumb distribution.”

Although I was having a blast fishing, my heart sank. I felt awful. In a matter of a few minutes, I had a couple dozen nasty grams asking to be off what I thought was my world-renowned Rosen Report.

I got home and went to my computer to delete all these people off my list and NONE OF THEM WERE ON MY mailing list. I then spent the time to go through the entire chain of emails and somehow, I got onto someone’s email list along with a bunch of other people. The unsubscribes were not for the Rosen Report, but for these stupid emails we were all getting from a list called, “DNClist@idr.co.” I have no idea what that is or why I would be on it.

I then went to my spam and another two dozen angry emails were sent to some guy named Ibrahim, and I was just on the list.

I am just happy all the hate was not directed at me after what was one of the better fishing days I have had in a while. I can now laugh about it, but for a few hours, I felt sick about what I thought were so many people hating on my newsletter.

As a funny aside, I went to Miami for the iConnections conference and attended a few events a couple of days after this incident. So many readers of the RosenReport were coming up to me with supportive comments and telling me their favorite reports. It was a nice offset to just a few days prior when I thought I was being canceled en masse. Then a few weeks later, I went to the JPM Leveraged Finance Conference and was blown away by the support of loyal readers who love the RR and work at major firms in the US and Europe. It sure beats thinking I had a bunch of haters. I guess the lesson is don’t jump to conclusions.

Quick Bites

Stocks finished higher on Thursday to close out a strong quarter. For the quarter, the S&P 500 added 10.2% for its best first-quarter gain since 2019. The Dow advanced 5.6% during the period. The Nasdaq ended the quarter with a 9.1% pop. The Russel is lagging at +4.8% for the quarter. Driving the gains this quarter and month has been Nvidia, last year’s market leader, as the artificial intelligence craze shows no signs of slowing. The stock soared 82.5% for the quarter and gained 14.2% in March alone. Treasury yields rose as investors mulled future Fed rate cut actions, as Fed Governor Waller said there was “no rush” to cut rates. The 2-year was +6bps to 4.63% and the 10-year was +1bps to 4.2%. For perspective, the 2-year began 2024 at 4.25% and the 10-year was at 3.86% at the beginning of 2024. So despite the belief that the Fed is cutting, rates are decently higher than 3 months prior. Oil is back over $83/barrel on the belief OPEC is going to continue with its production cuts. Bitcoin is over $70k and up 59% YTD. I am now down 15% on all my crypto trades after being down almost 80%. The first chart outlines select YTD performance and the 2nd shows the best-performing stocks of the past 5, 10, 15 & 20 years.

I have seen sharp gas price increases in Florida in recent months. I paid $2.84 not long ago and am up to $3.64 now. Prices at the pump typically rise in the first half of the year as more Americans get back on the road and refiners transition to less-polluting summer blends. But costs in 2024 have ramped up faster than normal, thanks largely to severe weather at home and geopolitical disruptions abroad. Unleaded gasoline ran $3.54 a gallon on average across the U.S. on Wednesday, according to AAA, up 3% from a year ago and about 14% higher than at the start of 2024.

I am not convinced anyone else has been earlier or written more regularly about concerns about the debt levels, spending, entitlements, budget deficits… than I have. I am now joined by far more accomplished folks echoing my comments and these two links showcase the issue: 1) Larry Fink joins Jamie Dimon and Jerome Powell is sounding the alarm on ‘snowballing’ national debt: ‘The situation is more urgent than I can ever remember.’ 2) BlackRock CEO says Social Security's retirement age 'a bit crazy' as crisis looms. “The situation is more urgent than I can ever remember,” Fink wrote in his annual letter to investors on Tuesday. “There’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded GDP and led to periods of austerity and stagnation.” “A high-debt America would also be one where it’s much harder to fight inflation, since monetary policymakers could not raise rates without dramatically adding to an already unsustainable debt-servicing bill,” he added. “When I talk about this statistic, I get frightened,” Fink told Bloomberg TV on Tuesday. “The cost of financing our deficits is going to erode more and more of our disposable income as a country.” To be clear, nothing Fink said in these links is new if you have read my commentary in recent years, but given he has a louder voice, I thought I would share it. We need Congress to cut spending, balance budgets, and force Entitlement Reform. In 2023, the Government Accountability Office (GAO) estimated $236bn of IMPROPER government payments and believes the number is low as many federal agencies provided information. Does anyone else have a problem with what could be $300bn in improper payments in a year?

The rich get richer. Google bought YouTube for $1.6bn in 2006. YouTube is the world's largest video platform. It's the world's second-largest search engine. It plays a massive role in culture. Analyst Michael Nathanson has a new note estimating that YouTube could be worth as much as $400 billion as a stand-alone company. He thinks that in 2023, YouTube generated operating profits of $5.5 billion on revenues of $45 billion; he also thinks its future growth will be spurred by subscription services like YouTube TV, as its advertising growth slows. What an amazing story of Google making 250 times the money invested not including all the cash flow along the way which is billions more. This assumes the $400bn estimate is accurate.

I wrote about my view that Trump Social was massively overvalued in my last note. Here is more fodder to support my thesis. Fidelity just reduced its value of its Twitter/X holdings which are now down 73% from the original $44bn valuation. This implies an $11.9bn valuation. Truth Social has also said that it may never disclose key performance data, such as sign-ups, ad impressions and average revenue per user — metrics critical for advertisers to assess potential market opportunity. RED FLAG. Truth Social monthly active users fell 51% in February year over year, yet is valued today at 1,700 times revenues. Also, Reddit went public and I compared the valuation with Truth. Something does not add up and Truth has a higher valuation with a fraction of the users or revenue. Impossible to see the Truth Social valuation last but it is also nearly impossible to short. There is a small float and a challenging borrow. This could rally, but it is worth a fraction of the current value based on fundamentals.

(1) This article from November 2023 showed 556mm Twitter users

(2) Active user data on Twitter is an estimate from this article. There is a range as high as 400mm+ active users for Twitter. I went conservative.

(3) I used the estimated 2023 revenue from this article for Twitter. A Bloomberg article suggested 2023 Twitter Revenues of $2.5bn and history suggests ads are 75% of revenue.

(4) The valuation of Twitter is based on Fidelity marking down its holdings. Remember, Musk bought Twitter for $44bn in 2022.

GQ came out with the most creative companies in the world and I had not heard of all of them. When I think of creativity, the NYT does not come to mind.

Israel

Israel admits it may not be able to destroy Hamas now US has turned its back

'Devil took over me': IDF reveals Islamic Jihad terrorist's October 7 rape confession

Surprise! Hamas has thousands more fighters than Israel initially thought - analysis

Harvard applications drop after antisemitism scandal, affirmative action ruling

Photo of Israeli Being Taken Hostage by Hamas Wins Renowned Award, Drawing Criticism

Other Headlines

US Consumer Sentiment Jumps to Highest Level Since July 2021

Key Fed inflation gauge rose 2.8% annually in February, as expected

Warren Buffett’s favorite market indicator is flashing red

Widely known as the “Buffett Indicator,” it measures the size of the US stock market against the size of the economy by taking the total value of all publicly traded companies (measured using the Wilshire 5000 index) and dividing that by the last quarterly estimate for gross domestic product. The indicator is currently sitting near a two-year high, at nearly 190%. The last time the indicator was this high was in 2022, when it hit 211% and the S&P 500 dropped by 19% over the next year.

Reddit shares plunge almost 25% in two days, finish the week below first day close

Xiaomi releases electric car $4K cheaper than Tesla’s Model 3-price wars heat up

These cars are not sold in the US but are available in 50 countries.

‘Shortcuts Everywhere’: How Boeing Favored Speed Over Quality

Not exactly what you want to see in a plane manufacturer.

Private Credit Firms Awash in Cash Boost Hiring

Surging demand for nonbank lending has private credit providers elevating pay rates as they contend for talent. I can tell you that I have multiple searches in Private-Credit and the demand for talent is real. It is far and away my most requested search and quality candidates are going for more money than I envisioned just a couple of months prior.

Baltimore disaster may be the largest-ever marine insurance payout, Lloyd’s boss says

The article suggests $2-4bn in insurance losses. Just what the insurance market needed, another big claim. There are numerous conspiracy theory reports on the bridge accident suggesting it was intentional. I am not there at this time but want to hear more about the incident.

In a Bumper Year for CEO Pay, One Chief’s $161 Million Award Swells to $1.3bn

FTX founder Sam Bankman-Fried sentenced to 25 years for crypto fraud, pay $11 billion in forfeiture

Amazing story here. Silicon Valley venture funds were so enamored with SBF yet he created a massive fraud. Stuff of movies.

Amid more deadly disorder in New York City, young women are being randomly punched in the face. Another NYC woman sucker-punched on street in attack that left her with broken jaw. The alleged attacker has been arrested for other attacks including on a law enforcement officer. Of course, he was set free despite breaking a woman’s jaw last week on video. If you are wondering why the wealthy are fleeing, take a look at your crime policy.

Suspect who killed NYPD Officer Jonathan Diller has 21 prior arrests

In what alternate universe is someone with 21 arrests (9 felonies) allowed to walk the streets to murder a young cop?

I am so glad I don’t live in NYC anymore.

Illegal immigrant charged with raping ‘mentally incapacitated’ 14-year-old girl in Alabama

Robotic police dog shot and credited with averting bloodshed

Bud Light Backlash Will Cost Brand Up to 15% of Shelf Space

Shelf space is critical to success. The decision to hire Dylan Mulvaney was a clear case of not knowing your customer and proved to be costly.

39-year-old money coach who makes $23,000 a month: My No. 1 tip for starting a side hustle

Church Attendance Has Declined in Most U.S. Religious Groups

3 in 10 U.S. adults attend religious services regularly, led by Mormons at 67%

Cold therapy techniques come under hot scrutiny by researchers: 'Overall benefits remain uncertain'

Venting won’t help, new study shows—this is the No. 1 way to manage your anger

Don’t use these phrases in a job interview, they are ‘major red flags,’ says ex-Google recruiter

Nigerian woman faces seven years in prison for writing a damning online review of tomato puree

I write a lot of critical things about politicians from both sides, restaurants, airlines, hotels, and just about everything else. Despite all the idiocy in the USA, we are the best country in the world. Last I checked, we don’t go to jail for writing a critical review.

Polish PM warns ‘we are in pre-war era’ as Putin’s missiles fire close to border

Real Estate

I am shocked at the strength of the high-end South Florida housing market. It seemed as though the market was taking a pause and in the past 45 days, it has caught fire. In the past 45 days, 7 properties over $12mm sold in my community, Royal Palm in Boca Raton. In all of 2023, only 5 properties sold over $12mm. Countless properties from Miami to Palm Beach have sold more than $20mm in short order. One Palm Beach developer of $50mm homes told me, “Things were slow for a period and all of the sudden all the stale listings of good homes sold in a hurry.” Of note, people need to realize that a lot of high-end homes are transacting and are never formally listed. I spoke with a broker in the Hamptons who told me 50% of his listings are off-market. It is not that high by me but 30% for sure. I know of numerous unlisted opportunities in South Florida and the Hamptons at the high end.

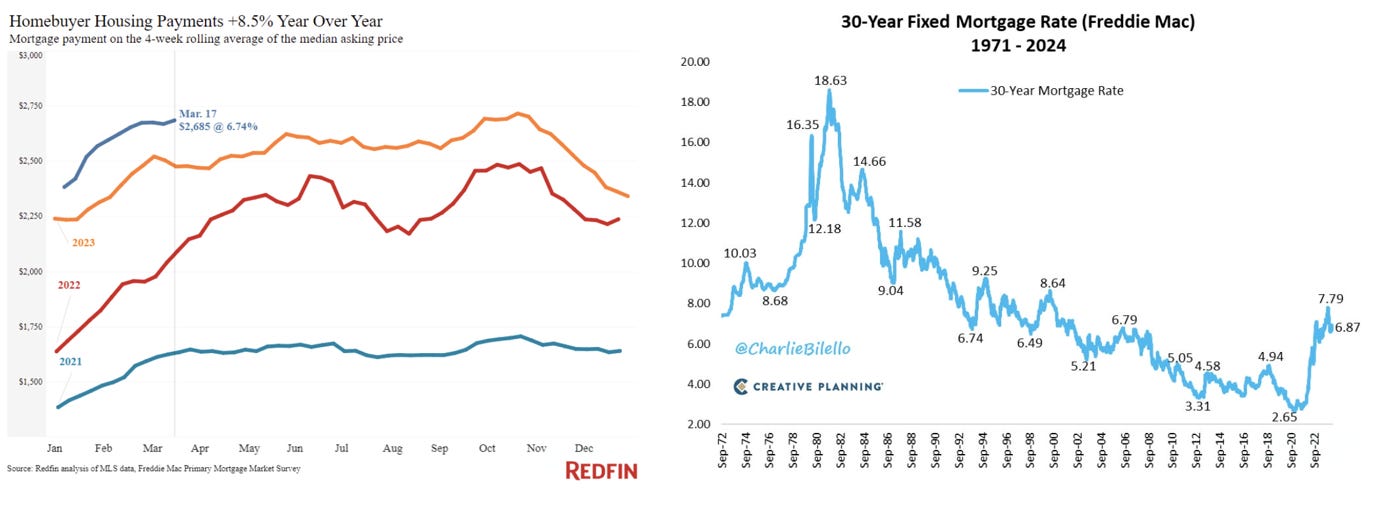

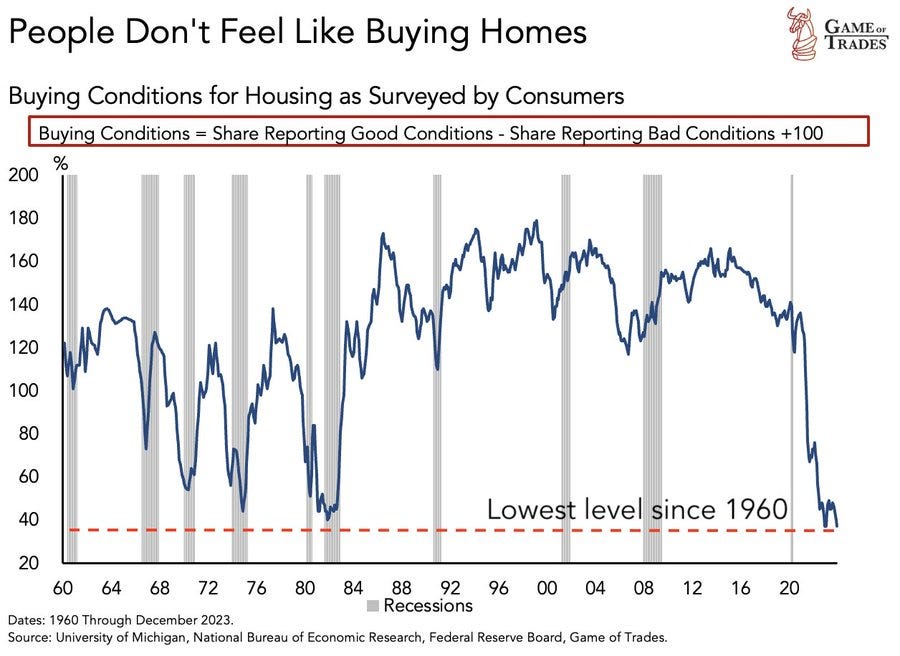

The monthly mortgage payment needed to buy the median-priced home in the US has increased 80% over the last 4 years, moving from $1,500 per month to $2,700. A combination of substantial home price appreciation since the pandemic coupled with sharply higher rates explains the increase in monthly payments. Inventory of homes plummeted from a recent peak in 2020 (3rd chart) and are on the rise again. The last chart shows the sharp decline in buying conditions for homes as outlined by consumers outlining the lowest levels since 1960.

I believe Barry Sternlicht is among the best real estate investors of our time. I have met him multiple times and he is very impressive. Five years ago, Starwood Capital Group paid nearly $500 million for three office buildings in Downtown Oakland. Now it has lost them to its lender after defaulting on a $364.5 million loan. The Miami Beach-based investor led by billionaire Barry Sternlicht has surrendered the three office towers at 1901 Harrison, 2100 Franklin and 2101 Webster streets, the San Francisco Chronicle reported. Starwood had bought the trio of office buildings in 2019 in two deals for a combined $494.3 million, according to the San Jose Mercury News. The foreclosures are the latest trouble for Downtown Oakland, once a destination for companies and residents priced out of high-cost markets like San Francisco. That gap is closing because of plummeting office values in San Francisco. Many older offices “will be stranded because they simply don’t have long-term cash flow growth potential,” Lauren Hochfelder, co-chief executive officer of Morgan Stanley Real Estate Investing, said in a Bloomberg Television interview Thursday. “Those assets just don’t meet modern tenant demand, they don’t meet them from a standpoint of quality or amenitization.” In yet another concerning story on multi-family properties, Nitya Capital is in forbearance with the servicer on a $346mm loan across 2,746 apartments with 89% occupancy. The debt service was not the problem; the loan could not be refinanced. What are the ramifications of cash-flowing properties with 89% occupancy running into trouble? What does it say for all the office buildings with far less occupancy? Here is yet another one. Developer Michael Stern has defaulted on his mezzanine loan at 9 DeKalb, Brooklyn’s tallest tower, and is now facing foreclosure. Larry Silverstein’s Silverstein Capital Partners, which issued a $240 million mezzanine loan in 2019 to help finance the 93-story skyscraper at 9 DeKalb Avenue, has scheduled a UCC foreclosure auction for June 10, according to marketing materials from JLL.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #669 ©Copyright 2024 Written By Eric Rosen.