Opening Comments

My last note was on the power of networking. I cannot stress the importance of making connections, nurturing them, and helping others and strongly suggest you read the theme piece. I received a ton of great comments from readers and over LinkedIn on the networking post. Interestingly, some of my most successful readers were the ones who were so adamantly in agreement about the importance of networking. I also made a dozen new connections as readers reached out to me after reading the piece. The most opened links were the video link of the Albert Einstein story and Marc Rowan’s war with Penn keeps getting hotter. My video entitled, “Exceeding Potential,” of me at a recent conference received a lot of positive feedback and is worth two minutes of your time.

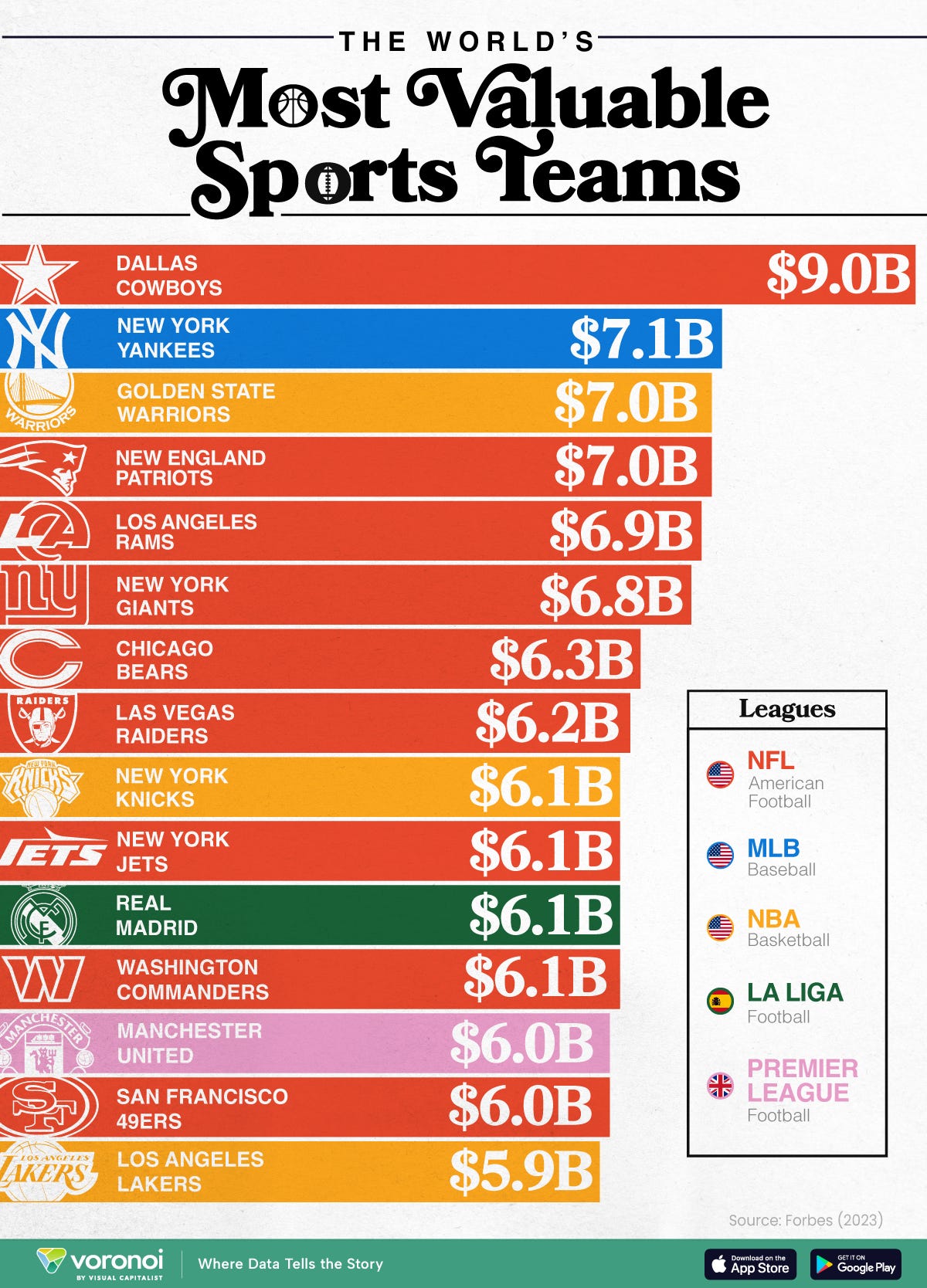

I just thought this was a cool chart from Forbes sent by a reader. Just think about what these teams were worth 30 or 40 years ago. Jerry Jones bought the Cowboys for $140mm in 1989. This is almost double the S&P NOT including all the dividends he took along the way.

The Rosen family is on the road checking out colleges. For Wednesday’s piece, I could use help from readers sending me story ideas given I will be driving over 20 hours this week. Send any ideas to rosenreport@gmail.com. THANKS.

Markets

Hot Inflation Report

EV/Fisker/TSLA

College Still Worth It?

Gen Z Disillusioned-Harm of Social Media/Smart Phones

Concerning US Farming Trends

Royal Palm Boca On FIRE

$12bn Proposed NYC Casino

Commercial R/E Doom Loop

Highest Office Delinquency Rates

6% R/E Commission Gone

Two Great Charts

Pictures of the Day-Nice Afternoon of Fishing With Friends

I was in Miami last week and called my friend, Tom, to grab lunch. Over lunch, He asked me when I could take him fishing and decided we would do it the following afternoon. We went out of the Hillsboro Inlet and fished and it was a little slow until things heated up. We caught about a half dozen small mahi (dolphin), a huge sailfish, a 200 lb shark on a tiny reel and a small shark. Tom’s forearm was burning after fighting so many fish. Here are some pics to prove it. On my boat, I refuse to keep sails or marlin and always revive them in the water to be sure they are safe.

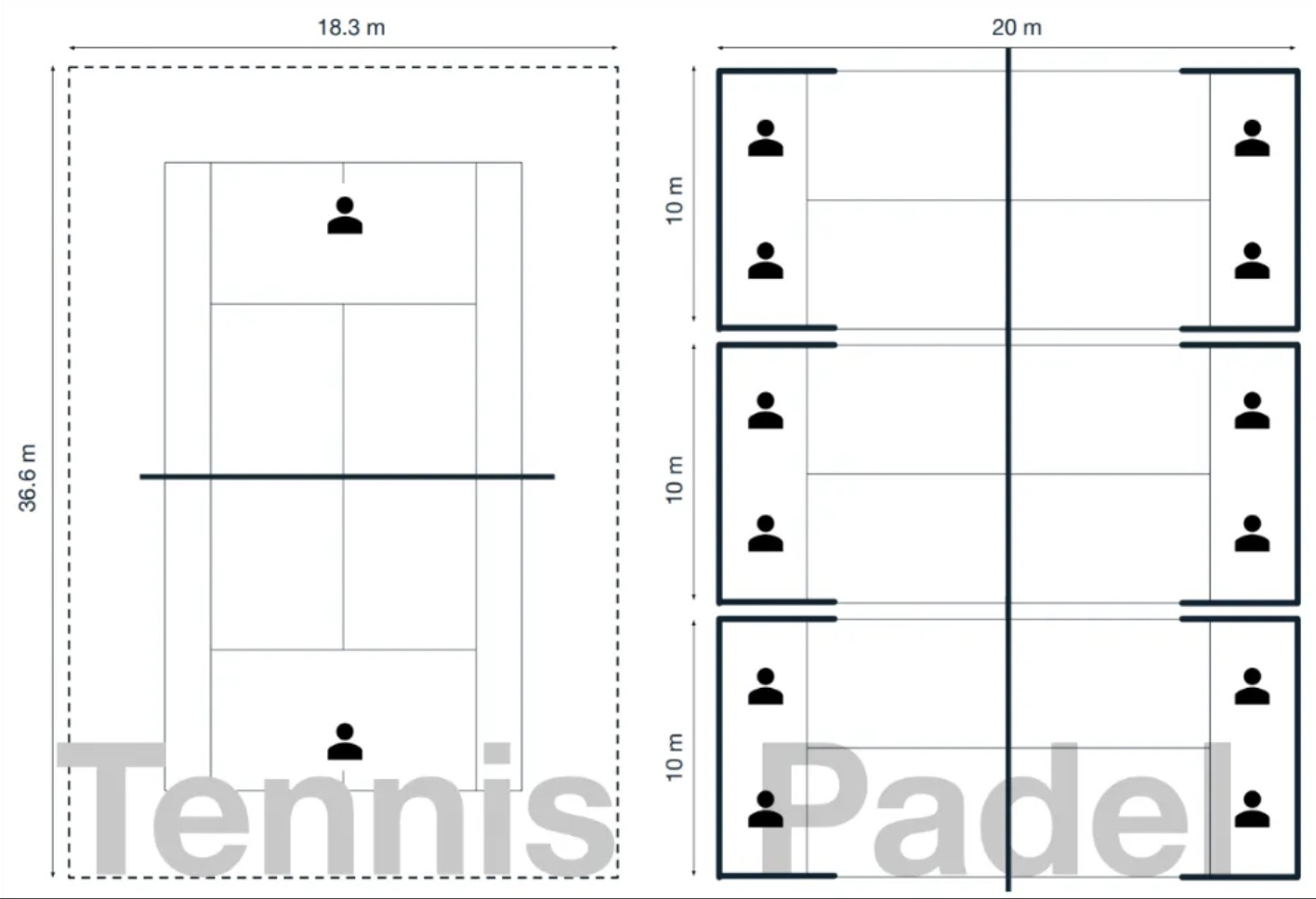

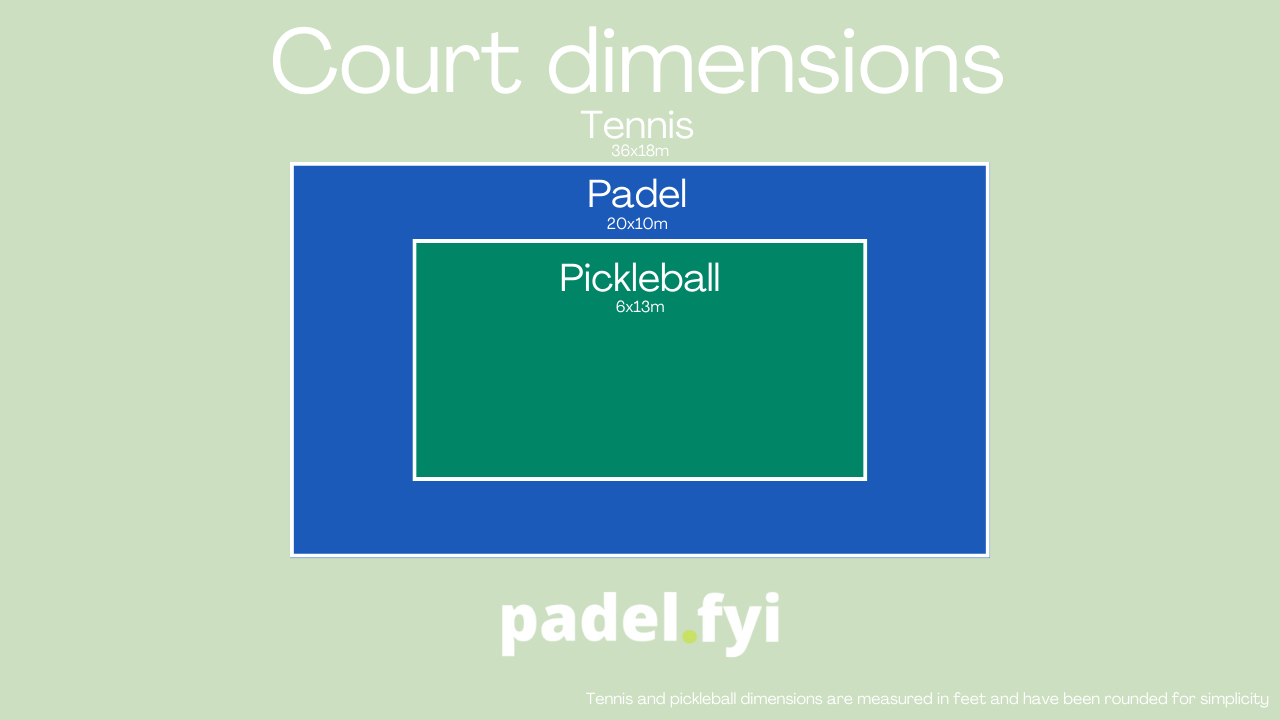

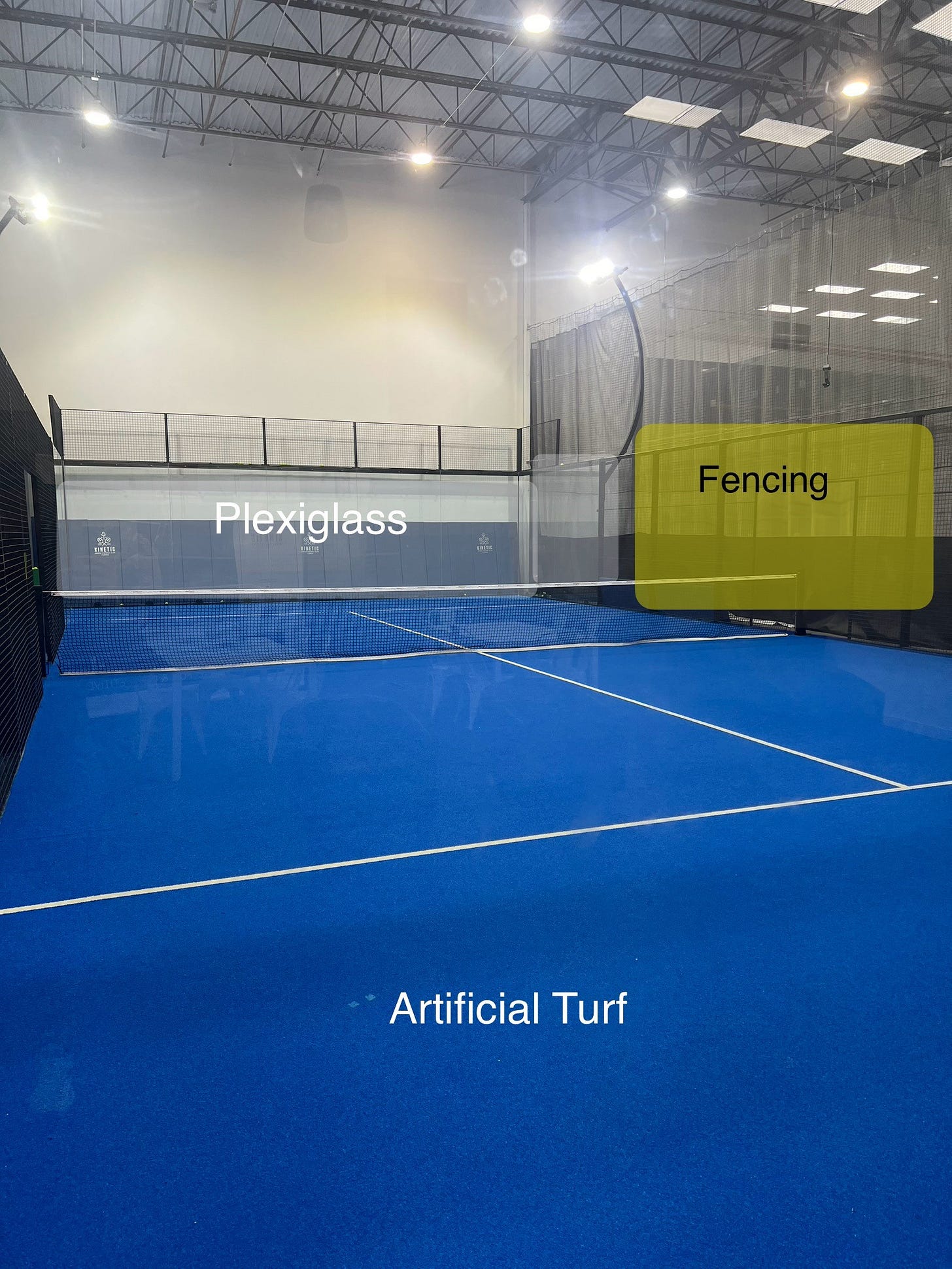

My New Favorite Sport

I try to play tennis a couple of times per week with a group of friends. Ross in the group kept talking about Padel, a mix between tennis and squash. This link has the history of the sport for those interested. We went who weeks ago and I had so much fun that I would rather play Padel than tennis. The game is generally played in doubles. This link outlines the game. The paddle racket is smaller than a tennis racket and is made from carbon and foam. It is thicker as well. These are the best Padel points in tournaments from 2022. Crazy stuff. They run out of the fenced court to hit shots.

You cannot serve overhead, and you must bounce the ball to serve it. Faults and scoring work just like tennis as do the service boxes. After the serve, you can hit the ball back and it must bounce before it touches a wall. If it touches a wall before it bounces, the point is lost by the hitter. When you return, you can hit off the wall to send it back over the net. Part of the wall is fencing and part is plexiglass. When it bounces off of the fencing, you have no idea where it will go. Unlike tennis, you don’t use a lot of over-spin and if anything, you play more cuts, so the stroke is a bit different. If you cut the shot, if it bounces off the wall, the ball goes low making it harder for the opponent to hit.

The floor is artificial turf which is softer than a har-tru tennis court. I dove for a couple like an idiot and got scraped up pretty good. There is a lot of strategy given the tennis ball they use does not bounce well. You need to hit up on the low shots and determine if you are going to use the walls. I had a great time playing doubles and the pro was my partner. At the end, Doug and I played against Diego, the pro, and it was ugly. He destroyed us. I thought I played pretty well for a first-timer and cannot wait to go back. We played for 1:15 minutes and I was dripping with sweat when done. Learning the proper strategy and form will take some time, but I look forward to my next Padel session.

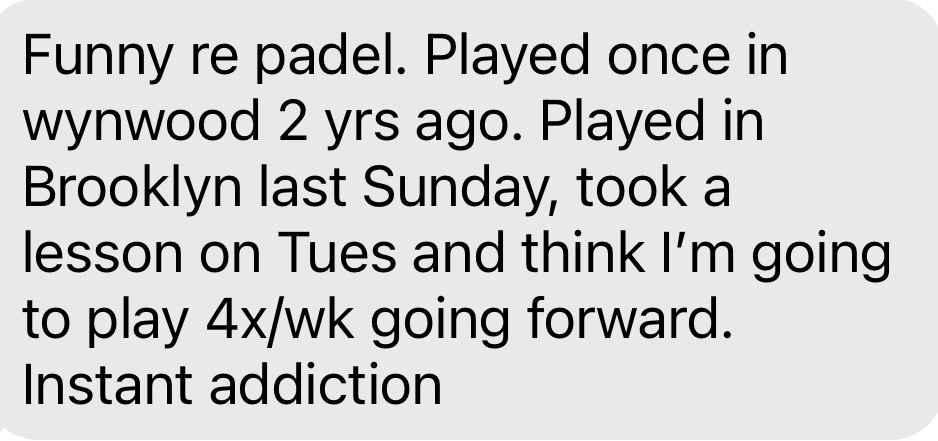

Padel is the fastest-growing sport globally sport and that is for good reason. Currently, there are 25mm players in over 110 countries with Spain being the country where it is most popular. There are 40,000 courts globally and this will grow to over 85,000 by 2026. I am not alone in my love for Padel. A good friend and former hedge fund manager who plays tennis sent me this:

Quick Bites

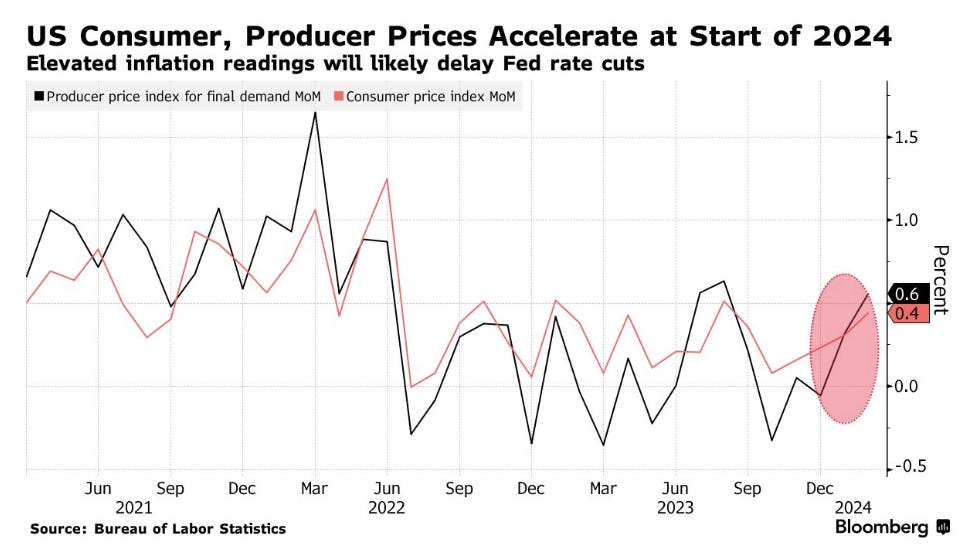

Wholesale inflation came in at .6%, double expectations. Two-thirds of the rise in headline PPI came from a 1.2% surge in goods prices, the biggest increase since August 2023, thanks to a 4.4% jump in energy. Stocks were down slightly on the week: The S&P 500 shed 0.13% this week. The 30-stock Dow inched lower by 0.02% on the week, and the Nasdaq slipped 0.7%. The inflation data pushed stocks down and bond yields higher with the 2-Year and 10-Year Treasury yields rising by 7 and 9 bps respectively post the news. The 2-year is now 4.73% and and t10 year is 4.31%. Oil prices continued to rise and were $81/barrel post the Ukraine attacks on Russian oil refineries pushing oil +3.5% on the week. Bitcoin fell almost 10% in short order on no major news and is back to $66k. This short note outlines how leverage is playing a part in the volatility of BTC.

Fresh data on inflation and unemployment filings gave Federal Reserve officials more reasons to hold off on cutting interest rates, even as retail sales suggested a slowdown in consumer spending. Just a few months ago, the market was anticipating 6 cuts in 2024, and now post data, we are down to 2.7cuts. All those borrowers with debt coming due with hopes of a much lower cost refinancing are in for a negative surprise if this trend continues.

This WSJ article, “Electric-Vehicle Startup Fisker Prepares for Possible Bankruptcy Filing, reminded me of an interesting story. The company has struggled with growing its sales amid stagnant EV demand in the U.S. Electric-vehicle startup has hired restructuring advisers to assist with a possible bankruptcy filing, according to people familiar with the matter. Fisker, which recently warned that it risked running out of cash this year, hired financial adviser FTI Consulting and the law firm Davis Polk to work on a potential filing. The car company reported last month that it had $273 million in sales last year and more than $1 billion in debt. I don’t remember the date, but maybe 15 years ago a wealthy friend was considering investing in TSLA or Fisker. He sent me both books and asked, “Which one do I invest in today in your opinion? After spending time and doing some research I told him, “I believe in the space, but just not sure who wins. You should split the investment in half and do both.” He invested $7mm into Fisker instead and it became a ZERO in 2013. At the time, TSLA was valued well below $1bn, but I cannot recall the exact price. If he had invested $3.5mm in TSLA at $500mm valuation (assuming 50% dilution due to 38 funding rounds) he would have $1.9bn today and more than double at peak valuation. This is about diversification and not putting all your eggs in one basket, especially in an early-stage company. To be clear, I had no clue that TSLA would be huge. I just felt diversifying your bets made sense.

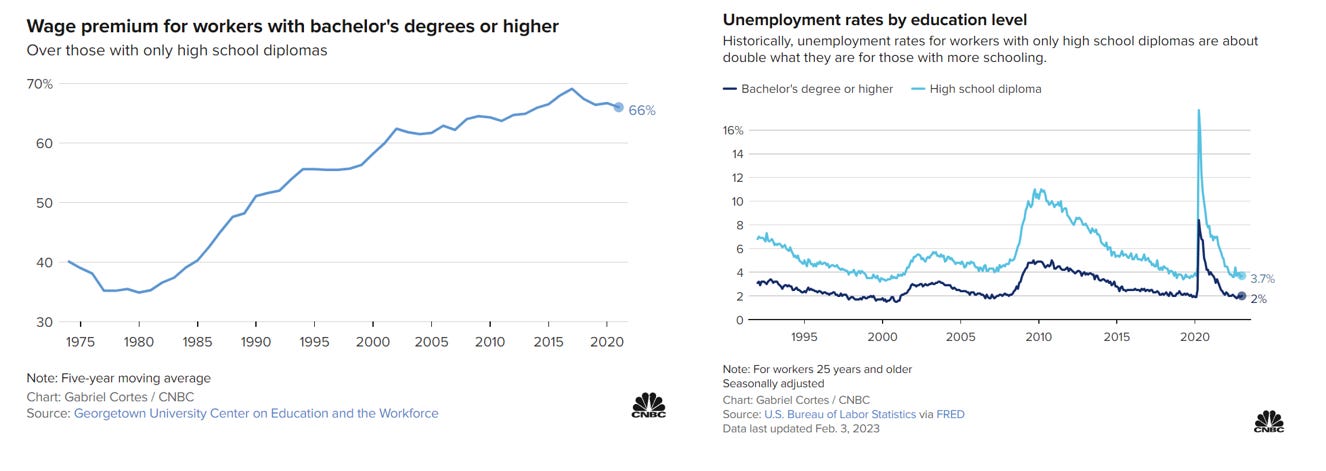

Interesting CNBC article entitled, “College is still worth it, research finds — although these majors have the lowest rate of return.” Between the sky-high cost and student loan burden, more students are taking a closer look at college’s return on investment. I still do not believe traditional college is for everyone. I am a strong proponent of vocational school for many kids today. However, the study showed that engineering and computer science were the highest-earning majors followed by business, health, and math. Education and psychology were the lowest-earning majors.

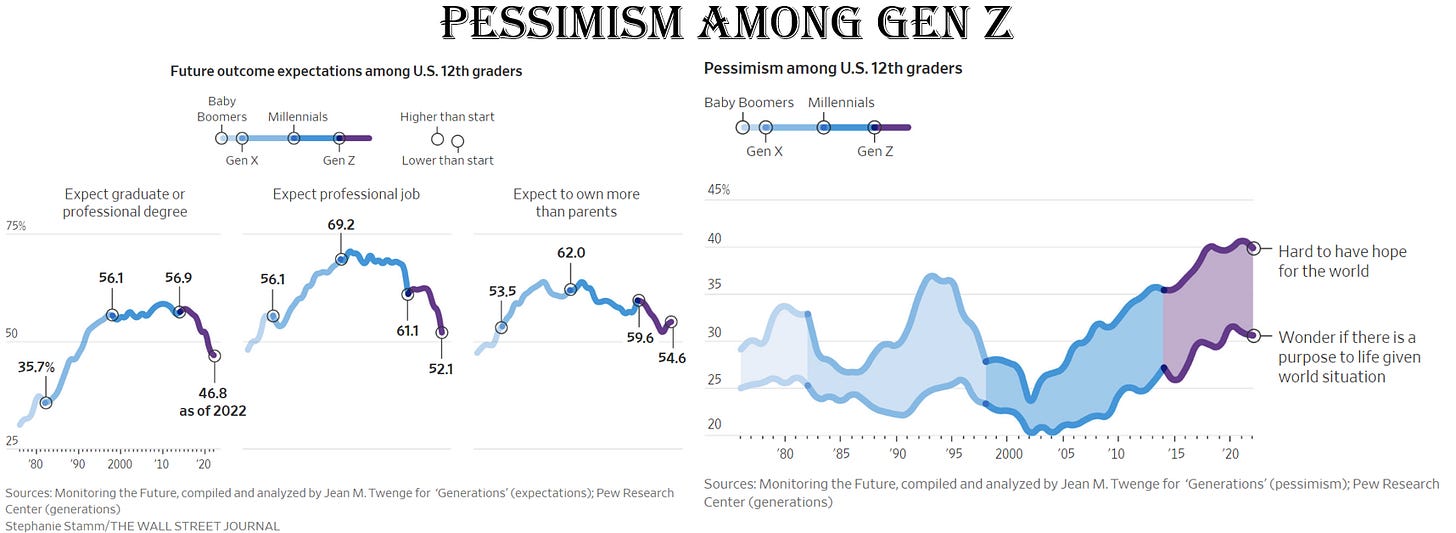

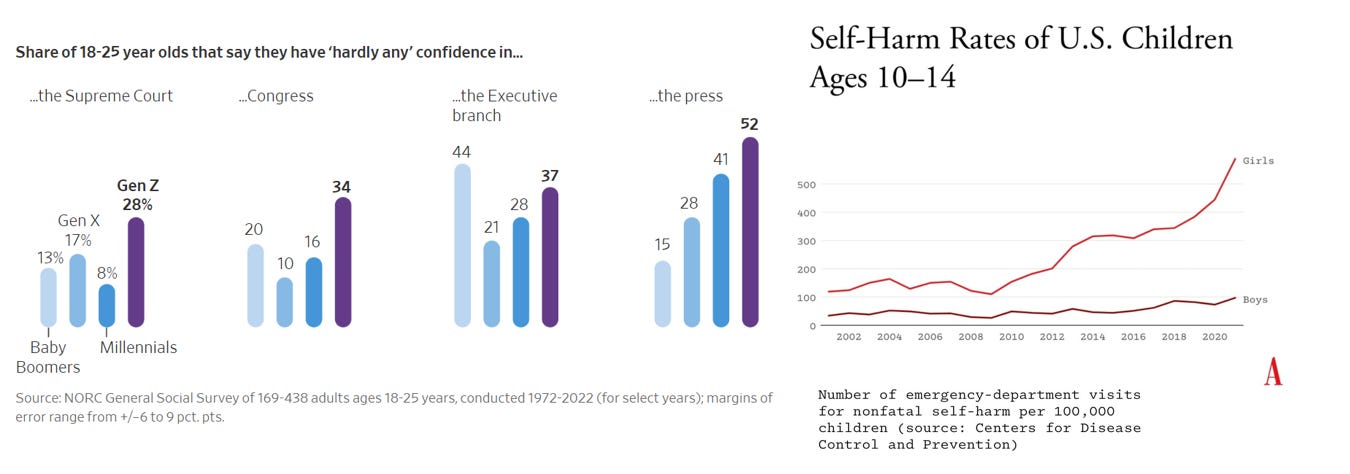

This WSJ article is entitled, “The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters,” and outlines a concerning picture for America’s youth. Young adults in Generation Z—those born in 1997 or after—have emerged from the pandemic feeling more disillusioned than any living generation before them, according to long-running surveys and interviews with dozens of young people around the country. They worry they’ll never make enough money to attain the security previous generations have achieved, citing their delayed launch into adulthood, an impenetrable housing market and loads of student debt. The pessimistic mood contrasts with what in many ways are relatively healthy economic circumstances. Many millennials—those born between 1981 and 1996—started careers around the 2007-09 recession. Gen Z workers are entering the labor market during a historically strong stretch. Jean Twenge, a professor at San Diego State University who researches generational differences, said Gen Z Americans stand out for their pessimism and comparatively low expectations for their lives. Millennials, in contrast, were significantly more optimistic about their futures when they were young. A study showed that Gen Z aged 18-25 reported lower levels of happiness and were less inclined to trust people. The article discussed the potential banning of TikTok as concerning to Gen Z. This Atlantic article, “End The Phone-Based Childhood Now, paints a bleak picture of the impact of smartphones and social media. Rates of depression and anxiety in the United States—fairly stable in the 2000s—rose by more than 50 percent in many studies from 2010 to 2019. The suicide rate rose 48 percent for adolescents ages 10 to 19. For girls ages 10 to 14, it rose 131 percent. By a variety of measures and in a variety of countries, the members of Gen Z (born after 1996) are suffering from anxiety, depression, self-harm, and related disorder at levels higher than any other generation for which we have data.

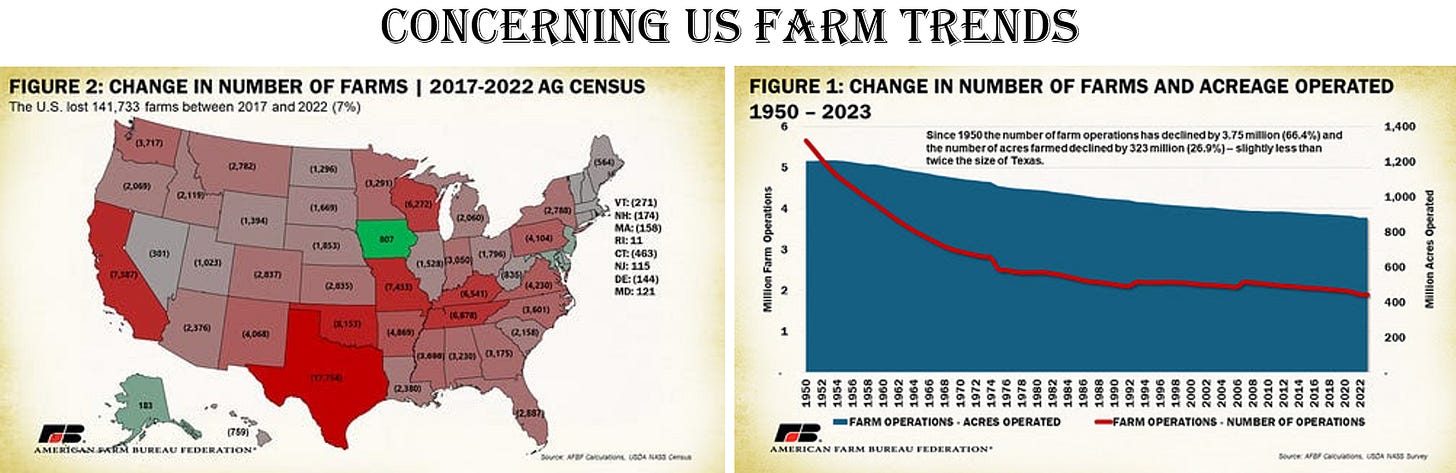

A reader sent me this concerning article entitled, “America's Farms are Getting Wiped Out.” A few days ago the USDA reported that the number of farms in America plunged by 140,000 in the last 5 years -- that's roughly 2,500 farms going bust every month. They're mostly small farms, so farms earning below $50,000 dropped by almost 10%, while large farms -- those earning over a million -- actually grew by 36%. So what's driving the great extinction? Simple: rising costs, falling revenue, and green mandates. Together, according to the USDA, these are expected to crash farm income this year by another 25%. Bringing income for the roughly 2 million farms in America to just over $110 billions -- that's $55,000 per farm. Not per farmer, per farm. For perspective, that's about one-fifth of revenue at Amazon.com. For all the farms in America. To give a flavor of the destructive power of mandates, the FDA admits that a single proposed rule on sustainability -- the so-called "Produce Rule" -- will cost a typical small farm $13,000 per year -- that's a fifth what they're making now. For a single rule. Too much to go over here, but please click the link to the article to educate yourself on concerning trends in US Farming.

Israel

Top Democrat Schumer calls for new elections in Israel, saying Netanyahu is an obstacle to peace

Palantir CEO says his outspoken pro-Israel views have caused employees to leave company

Jew hate is everywhere.

The academic environment is a breeding ground for the most disgusting and outrageous anti-Semitism

Other Headlines

Druckenmiller is my investing hero. The three stocks are Nvidia, MSFT and Coupang.

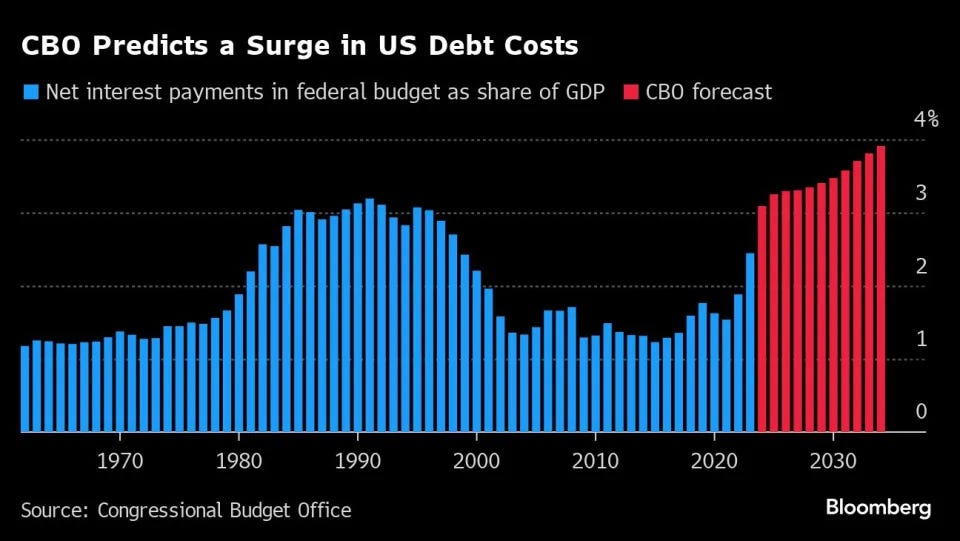

Rogoff Says Biden, Trump Favor ‘Blowing Up’ US Debt

Massive deficits, higher rates, aging population, underfunded entitlements…how can this end well. I agree with Rogoff completely on the dangers of fiscal irresponsibility.

Laid-off techies face ‘sense of impending doom’ with job cuts at highest since dot-com crash

Dick’s Sporting Goods soars past holiday quarter estimates, raises dividend 10%

MicroStrategy shares up 180% this year after debt sale to buy more bitcoin spurs latest rally

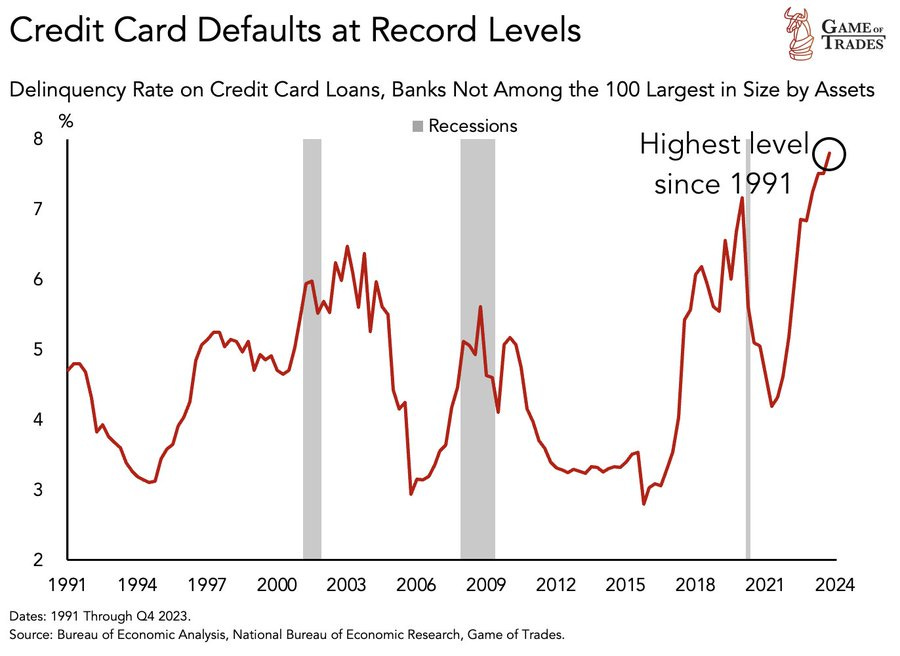

Credit card default rate for small lenders have just hit a new record of 7.8%

On a positive note, the top 10 car balances account for 81.4% of the market share meaning the smaller lenders represent a small part of the market.

"I Can't Even Save": Americans Are Getting Absolutely Crushed Under Enormous Debt Load

Ex-banker challenging Ocasio-Cortez in Democratic primary

He went to Harvard Business School, worked on Wall Street and appears to have some form of sanity. He is overqualified for the job. I would love to see AOC out and a more moderate Dem in but the finances don’t look good. AOC has $5.7mm and Dolan has $58k.

Trump floats billionaire Paulson as potential Treasury chief, Bloomberg reports

Trump vows he 'will never do anything' to Social Security after Biden seized on 'cutting' comment

That was quick. Idiot politicians refuse to make the tough decisions that are needed. I have written about Entitlement Reform extensively. The aging population, rising healthcare costs, longer lifespans, and fewer workers supporting those retired spell disaster. We need politicians willing to make the right call even when it is unpopular.

What to know about judge’s ruling allowing Fani Willis to stay on Trump’s Georgia election case

Trump says there will be ‘bloodbath’ if he doesn’t get elected

WaPo Editorial Calls On Kamala Harris To Step Down ‘For The Country’s Sake’

WaPo which is LEFT is saying this about the VP.

Biden admin under pressure to stop billions of dollars in sanctions relief to Iran

Iran is the biggest funder of terrorism in the world and this administration is not doing enough to stop it.

Hunter Biden declines GOP invitation to testify publicly before House committee

Hunter asked for a public hearing and is now declining it.

He is the President and his team does not want his constant mistakes shown.

RFK Jr. to name wealthy attorney Nicole Shanahan as running mate in prez run

Florida Deploys Officers, Fleet to Halt Potential Haitian Influx

I do not agree with all of DeSantis’ policies, but do feel a strong border is imperative and wish we had one nationally.

Please watch the short video that outlines the Orwellian development about tracking your medication and when you take it.

West Point military academy drops ‘Duty, Honor, Country’ from mission statement

NYC straphanger shoots ‘aggressive’ rider in head after wrestling gun away from him during fight

The agitator with a gun and knife threatened the man who ended up shooting him. Welcome to hell formerly known as NYC. This is a a scary video of the incident. Many innocent passengers were on the train and could have been injured or killed. Sorry Bragg, your awful first-day order policies have only made matters in the city worse.

Meet the two vagrant firebugs helping turn NYC subways into a nightmare for straphangers

I have read a many articles on this topic. I am not convinced it was suicide. This article outlined that Barnett made a grim prediction before his death, “It’s not suicide.”

Illegal Immigrants Leave US Hospitals With Billions in Unpaid Bills

Don Lemon demanded Tesla Cybertruck, $5M advance, equity in X before Elon Musk canned him

Lyft and Uber say they will leave Minneapolis after city council forces them to pay drivers more

America’s 100 most obese cities revealed — and the top 10 have something in common

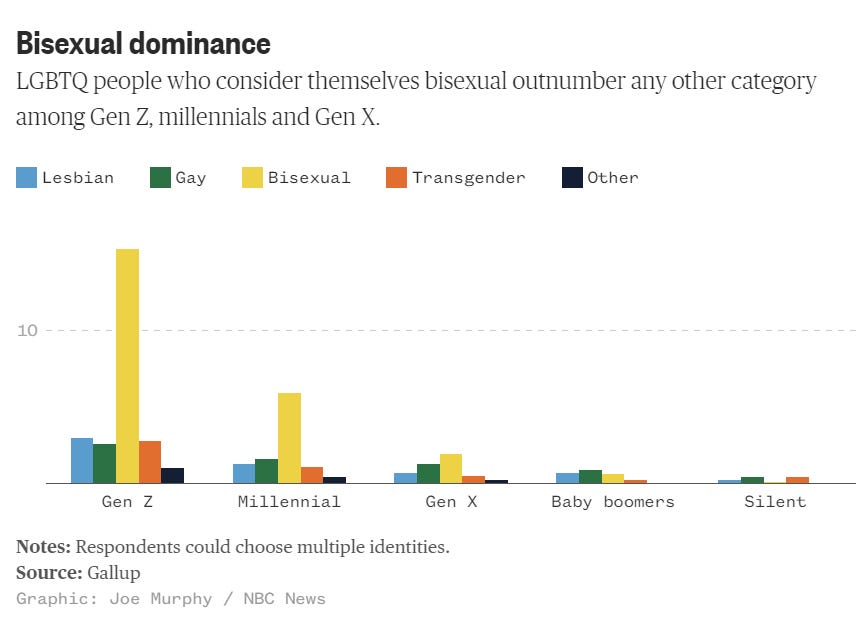

Nearly 30% of Gen Z women identify as LGBTQ, Gallup survey finds

Women ages 18 to 26 were more than twice as likely to identify as LGBTQ than their millennial counterparts, the survey found.

Monster gator lurking in golf-course pond bites off fisherman’s hand

This could have been me!

For $700/person, and having two Michelin Stars, this is shocking.

A look inside the Chinese cyber threat at the biggest ports in US

Wait, the Chinese government is trying to harm the US? Who would have thought it? They are such good, honest, law-abiding, above-board partners.

Real Estate

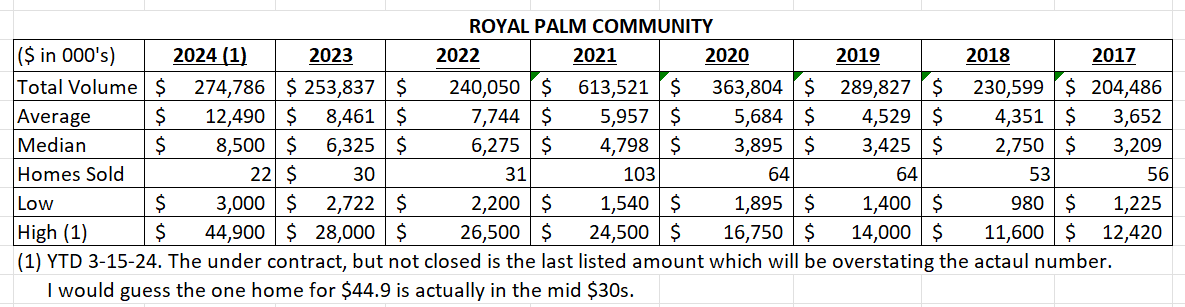

My community of Royal Palm in Boca is on FIRE in recent weeks as the buying season is nearing an end. I updated the chart below to reflect YTD transactions with the disclaimer that there are approximately 10 homes under contract, and I used the last asking price as the final sales price is not public. One house I believe is overstated at $44.9mm and likely sold substantially less, but even with that the volume is impressive. Come on down and I can help buy or sell a home you given my Douglass Elliman license. My big mistake when I bought 8 years ago was not buying 5 homes. Since I moved down, the average price is up 3.4 times and the median is up 2.7 times. The year I moved down, one house sold for over $10mm. Today, that could be a teardown and YTD, 5 have sold over $15mm and 3 over $28mm. In less than 3 months, 10 homes sold for $12mm or more relative to 1 house in 2017 for the full year.

There are numerous articles discussing the proposed $12bn NYC casino in a project by Wynn and Related. The positive news is the project would create jobs, drive tourism and generate taxes. For me, I find Vegas and Atlantic City pretty disgusting and not a place I would want to live. I am ready to leave Vegas after two nights. Just what NYC needs more filth, drugs, prostitutes and shady characters. Sounds as though the plans are for it to be around Hudson Yards on the Hudson River and would include three towers.

This NYT article is entitled, “Cities Face Cutbacks as Commercial Real Estate Prices Tumble-Lost tax revenue fuels concerns over an urban ‘doom loop.’’ It outlines countless examples of buildings selling for a fraction of the prior levels. The losses are hitting more than just commercial real estate investors. Cities are also starting to bear the brunt, as municipal budgets that rely on taxes associated with valuable commercial property are now facing shortfalls and contemplating cutbacks as lower assessments of property values reduce tax bills. Cutbacks could lead to what Arpit Gupta, a professor at the New York University Stern School of Business, has described as an “urban doom loop” across the United States. In a research paper that was updated late last year, Mr. Gupta and his colleagues estimated that the national office market lost $664.1 billion in value from 2019 to 2022. To fill the budget holes created by the lost tax revenue, they posited that cities could cut services or raise other kinds of taxes. Add to this the wealth that has left major cities with companies and individuals leaving while many cities face a massive migrant crisis and I do not see how the budgets can be stabilized. San Francisco, which is experiencing a surge in tax assessment appeals for commercial buildings, has had to defer maintenance on city facilities to save money.

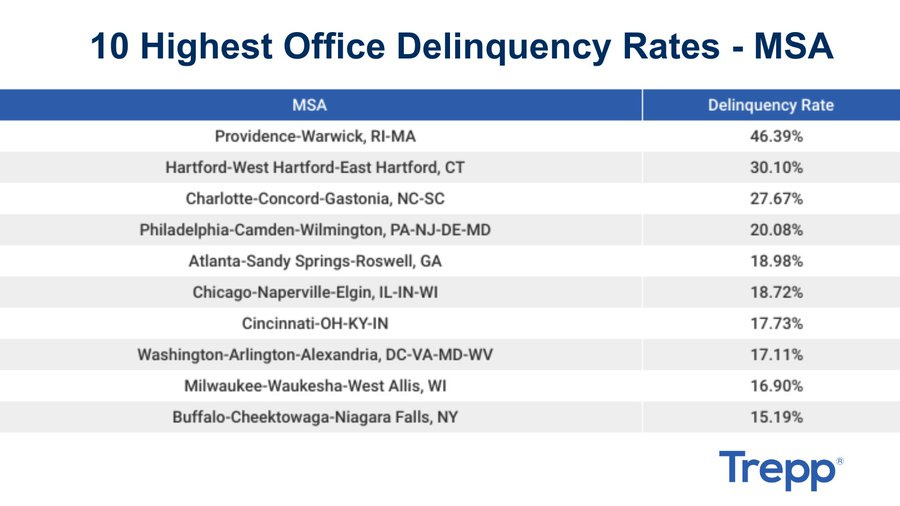

A reader sent me this Trepp office report. Last month, the National #CMBS #office delinquency rate rose 33 bps to 6.63%. Since February 2023, the rate has jumped 400 bps. High rates in areas like Providence-Warwick suggest distress isn't limited to major metros.

The 6% commission on buying or selling a home is gone after Realtors association agrees to seismic settlement In a sweeping move expected to dramatically reduce the cost of buying and selling a home, the National Association of Realtors announced Friday a settlement with groups of home sellers, agreeing to end landmark antitrust lawsuits by paying $418 million in damages and eliminating rules on commissions. Shares of real estate firms Zillow and Compass both fell by more than 13% Friday as investors feared that lower commission rates for agents could lead to less business for real estate platforms. By some estimates, real estate commissions are expected to fall 25% to 50%, according to TD Cowen Insights. Shares of real estate brokerage Redfin also fell nearly 5%. Meanwhile, homebuilder stocks rose on the news: Lennar shares gained 2.4%, PulteGroup shares added 1.1% and Toll Brothers shares added 1.8%.

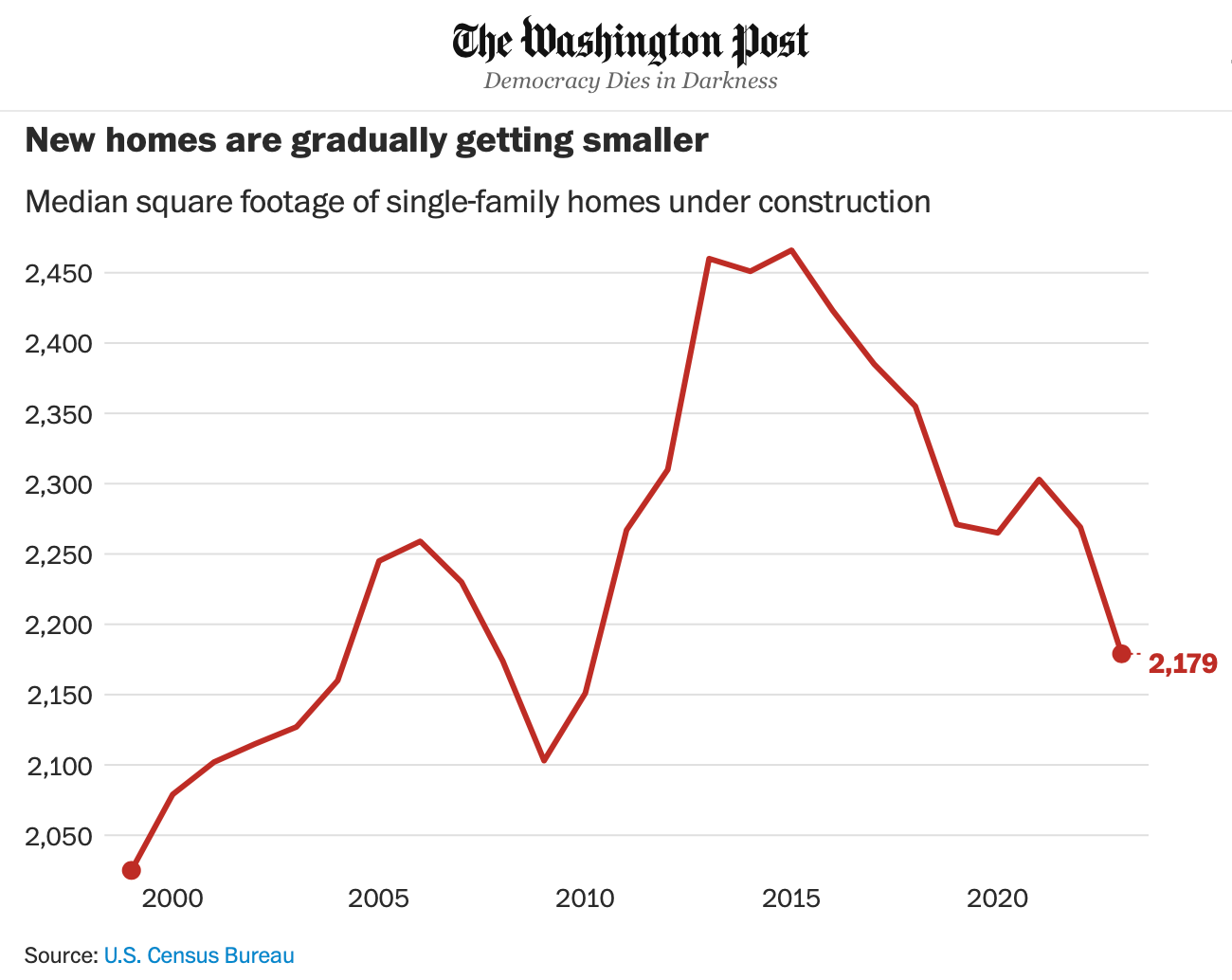

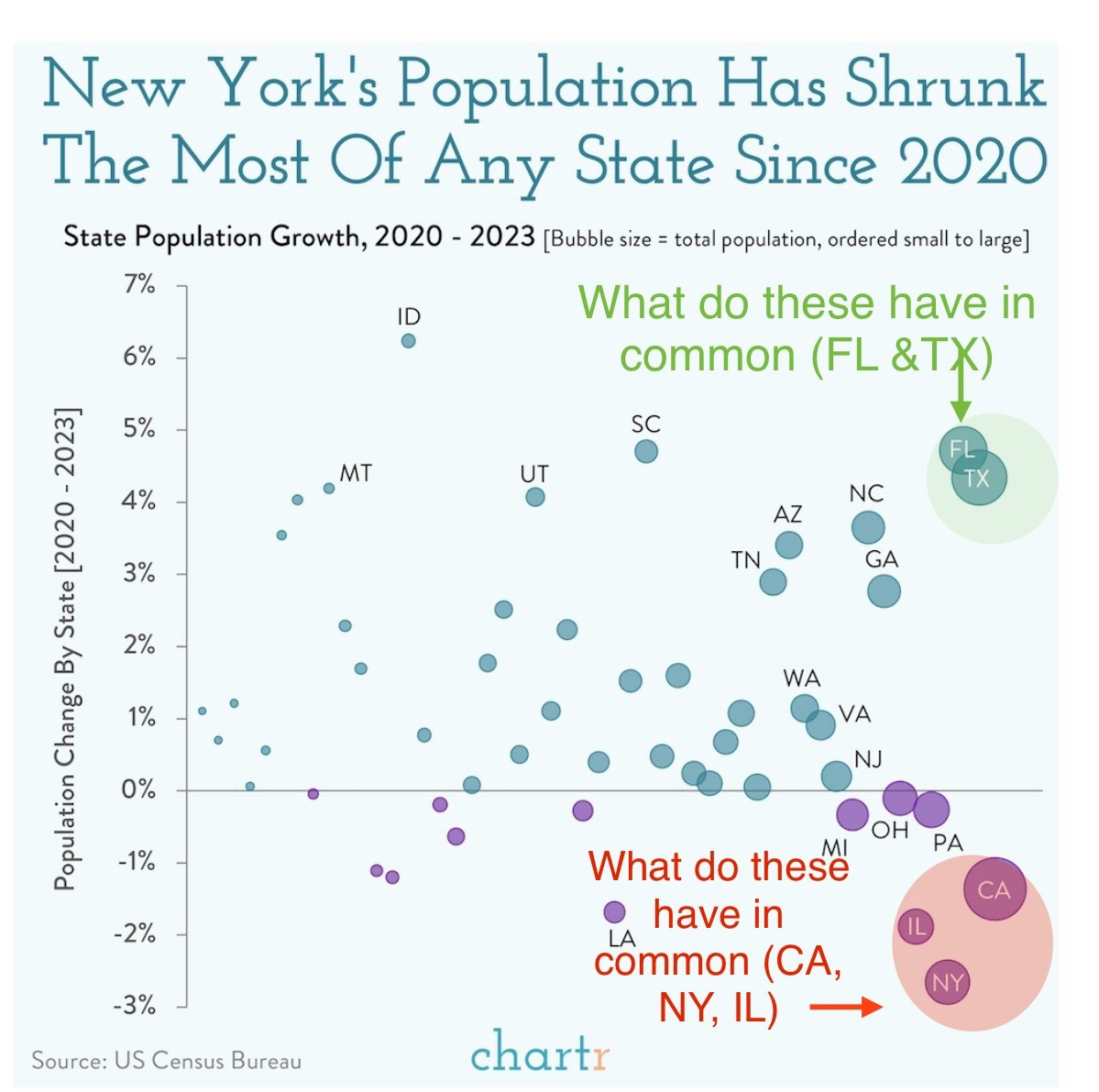

I thought the first chart was interesting on new homes getting smaller from the WaPo. The 2nd chart tells you everything you need to know about shrinking and growing state populations with my comments in colors.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #665 ©Copyright 2024 Written By Eric Rosen.