Opening Comments

My last note was about my love for Padel which is the world’s fastest growing sport. So many readers let me know about their love for Padel. The most opened links were Druckenmiller’s top AI stocks, and the best way to lower blood pressure.

The Rosen family is on the road checking out colleges. We started at Tulane on Saturday and will drive a total of 22 hours across the Southeast checking out all kinds of schools for the kids. As a result, I had far less time to write this piece. I am sure I missed some stories but appreciate all those readers who sent me extra ideas this week. The next piece will likely be about the amazing food we ate in New Orleans. I am sending this note early today from Covington, GA. If you knew how hard it was to find Wi-Fi, you would not believe me. Note to self, I won’t be moving to this town any time soon. I am leaving in 10 minutes for a 5 hour drive to NC to tour more schools. 23 hours of driving by the time the week is done.

I cannot believe it has been a year since my surf trip to the Kelly Slater Wave Co. I will be going back in mid-April with the boys for an extraordinary experience. If it is anything like the 1st adventure, I will leave smiling. Below are photos of me me from last year (had not surfed in 5 years). I also have not been in the water once since last year.

Markets

Grocery Price Inflation

Worst Paying College Degrees

Trump Can’t Raise the Money

Sky Rocketing Insurance Premiums

Boarding School Banned Smartphones

US Housing Inventory Building

Building Fire Sales Have Not Barely Started

San Fran Four Seasons Missed Interest Payment

CRE CLO Delinquencies

New Thomas Keller Restaurant in Palm Beach

Aushttps://ericrosen.substack.com/i/142428239/israeltin Ressie Losing Steam

Another NYC Office Default

Video of The Day-Karmapreneur Craig Weiss

Through my partnership with 3i Members, I get to interview some amazing business and thought leaders. I recently interviewed businessman and venture fund manager, Craig Weiss of Flagstaff Ventures. Half of the founders he invested into in his first fund were women. His positivity is infectious, and we talked about the term he coined, “Karmapreneur-doing good is good business.” I go out of my way to help people through my free mentoring programs as well as constantly connecting people using my expansive network. One way to improve your network is consider joining 3i Members that is now has 400 people who are business leaders, thought leaders, professional athletes and philanthropists.

Valuable Investment Lessons

I think we have all been guilty of investment mistakes; I know I sure have. Despite having run a hedge fund and been responsible for very large balance sheets at major banks, now and again I get sloppy. As I replay the “Crypto Craze” in my head, I want to go over the lessons I learned.

If you recall, I suggested putting 1-2% of your Net Worth into the space. Many of the best investors (Druckenmiller, Sternlicht, Thiel, Dorsey, Andreessen…) I put in about 1% of my net worth for perspective. I had bought the Greyscale Bitcoin Trust on my own at a sharp discount (worked out well). Then, a reader called me up in late 2021 telling me all the incredible things he was doing in Crypto. I was mesmerized by the money he was making. My response should have been, “Interesting, that sounds incredible.” I should have written about it and moved on. Instead, I decided to be a hero and was in OVER MY HEAD. I am not lying; these transactions were impossible to execute. There is a ZERO percent chance I could have done them alone. I cannot even find my crypto without his assistance. Trying to get your cost basis on old trades takes forever. Also, FOMO-Fear Of Missing Out got the best of me.

I put on various positions in the following names (Bitcoin, Ether, Ribbon, Solana, Looks, Wmemo, Ibeur, Kp3r, Luna, Dot & AXS). At one point, I was +30% and then, I was -80% on my trades at the depths of the market. I am now -30% given the rally. My first mistake was jumping into something I didn’t understand. My 2nd mistake was going for a GRAND SLAM by playing in the crappy alt-coins rather than just buying Bitcoin, Ether and Solana. Had I just bought those, I would be up sharply, but my impulsivity got the best of me.

The same can be true of stocks. If you focused on the more established names vs the smaller stocks you would have massively outperformed. The lessons are clear. Go with what you know, don’t have FOMO and when investing, pick high-caliber companies and don’t waste time chasing the ghosts.

My last point is on venture and PE and trying to do it directly by yourself. I have done 30 deals in such a manner. Sadly, my first one was a home run and I thought I was Kleiner Perkins or Sequoia. I took my massive gains and redeployed them. Most of my early-stage stuff has become a disaster. Yes, I had a handful of home runs, but I don’t even know how to calculate my total IRR in private instruments anymore. Not to mention the problems of K-1s and the cost of doing my taxes. If I had to do it all over again, I would have been better off just investing in the S&P or NASDAQ over the past 20 years. Learn from my mistakes.

Quick Bites

The Fed announced holding rates steady but penciled in 3 cuts later this year. I don’t think this should have been a surprise, but equities rallied on the news. The last time I had checked a few days prior, the market was pricing in 2.7 cuts on the year. As of 10 minutes post the Fed, stocks were up slightly after being flat to down. Crypto market sheds $400 billion of value as bitcoin sell-off intensifies after all-time high and is down about 12% from the high levels from last week. BTC remains +45% YTD and 130% for the past 12 months and a reprieve from the amazing run was due. Oil fell slightly and is off multi-month highs after hitting $83.37 and now settled at $82.

This Bloomberg article is entitled, “Grocery Prices Have Soared. That’s Spoiling Biden’s Economic Pitch.” President Joe Biden is regularly promoting signs of a strengthening economy and easing inflation, but when it comes to the indicator closest to home, it’s a tough sell. The surge in grocery prices since just before the Covid lockdown has been stunning: up more than 25%, a full 5 percentage points more than consumer prices overall. Americans’ regular trips to the grocery store — three times a week for the average US household — are a powerful driver of economic discontent, constantly reminding consumers of the higher cost of feeding a family. Despite the signs of economic strength Biden touts — such as low unemployment and wage growth that is outpacing overall inflation — Americans are wary of the prices in grocery aisles. Shoppers are shifting to less expensive private label brands. They’re buying more longer-lasting “shelf-stable” products such as pasta and rice. I believe a combination of bad Fed Policies and Biden Administration policies are largely to blame for inflation. During peak Covid, clearly, supply chain issues were contributing, but those have long subsided. This WaPo article is entitled, “In Wisconsin, a vote for Biden or Trump could come down to grocery prices.”

I have often written about the economics of a college degree and have questioned it for many majors and kids. I believe a growing number of students would be better served attending a vocational school rather than a traditional four-year degree. This CNBC article outlines the worst paying majors five years after graduation. These kids went to college, and many went into debt to make $40k after five years. Do you know what that is called? A horrible return on investment. You could attend a vocational school, have no debt and make over $100k in five years. My point is there are alternatives.

Donald Trump's efforts to secure a bond to cover a $454 million judgment in a New York civil fraud case has been rejected by 30 surety companies, his lawyers said on Monday, inching him closer to the possibility of having his properties seized. This means that Trump's New York properties could be seized if he cannot pay a financial penalty linked to his New York civil fraud trial.

The warning comes from New York Attorney General Letitia James, who presented the case against Trump. She is ready to seize property if Trump cannot produce the money. If Trump fails to pay up, the state "could levy and sell his assets, lien his real property, and garnish anyone who owes him money," according to Syracuse University law professor Gregory Germain. Attorney General Letitia James accused the defendants of illegally overstating the value of Trump's properties in order to inflate his net worth and obtain better loan and insurance terms. Judge Engoron also banned Trump for three years from serving in a top role at any New York company or seeking loans from banks registered in the state. I have been a lender for 30 years and disagree with the judge’s ruling on this matter. No banks lost money, and as a lender I do not rely on the borrower’s valuations when making a loan. Just last month, a borrower came to me looking for $35mm on a property he felt was worth $65mm. I told him I value the property at $50-55mm and I am unwilling to go higher than $25mm. What happened? I did not make the loan. The legal drama places Trump’s finances and his image as a successful business tycoon in peril less than eight months before voters will decide whether to elect him for a return trip to the White House. However, Mark Cuban (not a Trump fan), came to his support about not being able to secure financing.

I keep writing about insurance issues, especially in Florida and California as premiums are skyrocketing and carriers are canceling policies. Marsh Mclennan came out with an interesting insurance study: It has never been more important for individuals and families in the private client space to work with a trusted personal insurance broker. In the current hard market, more homeowners are facing non-renewals, less carrier capacity, and carriers pulling out of states most at risk. This leaves homeowners with fewer, more expensive options or worse, no insurance options at all. The report suggests nearly 70% of Mass Affluent Families are overpaying to be underinsured. The report suggests that you can do the following:

This article is entitled, “California's home insurer of last resort sees enrollment surge, raising concerns over its finances.” There is a major problem on the insurance issue and I fear it will boil over soon. My new sponsor, Lang Insurance (1.866.964.4434|), has helped dozens of RR readers save money and get coverage they otherwise were unable to obtain. I switched and saved immediately.

Very compelling 3 minute video outlining a boarding school that banned cell phones. Students are interviewed and discuss how much more social they became after the rule went into effect. Most students have adjusted to the change and feel better but not all went according to plan. Watch the short video. I am all for less screen time and more face to face interactions. I get frustrated with my kids reliance on social media.

Israel

Joe Lieberman slams Schumer for anti-Netanyahu speech: ‘Can’t ever remember anything like it’

Netanyahu snaps back against growing US criticism after being accused of losing his way on Gaza

So many blame the Jews for the atrocities of October 7th. Finally some rationality.

I am literally travelling the country looking for schools for my children. I want them to be happy and feel safe. Why would I send them where they are not wanted and pay $70-90k/year to do it? If I believe my kids will not be comfortable, I refuse to send them.

MIT Refused To Host Dennis Ross. It Invited a Hamas Apologist Instead.

The Jew hate is everywhere, yet the support of Hamas remains strong.

Other Headlines

Bond Traders Surrender to Higher-for-Longer Reality From the Fed

Tech Stocks Left Out of Rally Ease Fears a Bubble Is Building

Banks are in limbo without a crucial lifeline. Here’s where cracks may appear next

Klaros Group analyzed about 4,000 institutions and found 282 with both high levels of commercial real estate exposure and large unrealized losses from the rate surge.

What is shrinkflation? Here’s why consumers may be getting less for their money

Nvidia CEO Jensen Huang announces new AI chips: ‘We need bigger GPUs’

Obviously, you need to consider the source, but if you recall, I have written extensively on my view that we will be reliant on oil for the foreseeable future. and this administration’s vilification of the oil industry is unjustified.

US Warns of Cyberattacks Against Water Systems Throughout Nation

Selena Gomez Weighs Sale of Cosmetics Brand Valued at $2 Billion

The power of a massive social media presence is legit. 430mm on Insta.

Bernie Sanders wants the US to adopt a 32-hour workweek. Could workers and companies benefit?

Employers would not be allowed to cut pay or benefits and overtime would be required after 32 hours. Studies suggest increased worker productivity. I question those results.

Biden’s Proposed 15-Fold Price Hike to Drill on Federal Land Threatens US Energy Dominance

Google's Gmail censorship cost GOP candidates $2B since 2019, Republicans say, citing new study

Study found that Gmail flagged most GOP fundraising emails as spam, while allowing through most Dem emails. I have complained about the bias in the media and social media. If Google did the same thing to Democrats, it would be equally as wrong. Is it surprising that 88% of Google political donations are Left?

Shocking given how porous the border has become that we stopped someone. How many “terrorists” have made it through in recent years?

DHS calls Haitian migrant’s alleged rape of disabled teen ‘heinous’

Illegal immigrants can possess guns under Second Amendment, federal judge rules

Twin teenage girls stabbed, one fatally, at NYC bodega after rejecting attacker’s advances

"It's Like The Wild West": Crime And Violence On NYC Transit Underreported According To NYPD Source

I have called out ridiculous crime and bail polices and been cancelled for it. The call to decriminalize criminal activity has backfired massively. The official number of arrests made in the city’s subway system rose by 45 percent this year, with more than 3,000 arrests made underground in the first two months of the year, many of them of repeat offenders, according to figures released by the NYPD Transit Bureau. However, the publicly released data only scratch the surface of the amount of crime in the nation’s largest transit system, a law enforcement has stated.

I called out the actions at the time and was cancelled for it.

Why do stories like this generally take place in NYC, LA, San Fran, Chicago, Philly, DC….?

Large language models, explained with a minimum of math and jargon

I have heard mixed reviews on JSX and this Post article brings in some questions.

Covid Lessons Learned, Four Years Later

Mandatory lockdowns had almost no benefit—but did significant economic and health-related damage. The chart is telling. Sweden did not close schools or shut down the country.

I’ve studied 100-year-olds and longevity habits for 20 years: What I eat every day

I'm A Colorectal Cancer Doctor. Here Are 5 Things I'd Never Do.

Hard to argue these thoughts.

Brooke Burke warns Ozempic can be 'dangerous,' shares benefits of biohacking: There's no 'quick fix'

I’m a fitness trainer — try these 5 exercises to target belly fat

The Keys to a Long Life Are Sleep and a Better Diet—and Money

Creditors demand Rudy Giuliani sell his $3.5 million Florida condo to pay debts

I appreciate his time as Mayor of NYC and what he did during 9/11. However, as I wrote multiple times, he turned into a clown show.

Bill Maher Fires CAA After Oscar Party Snub

After over two decades, Maher pulled the plug due to not being invited to a party.

Jeff Bezos Gives $50M Each To Eva Longoria And Admiral Bill McRaven

Mr. Bezos, I am doing amazing things through my mentoring program trying to have an impact on college kids and young professionals. If you want to donate $50mm to the mentor program, you can reach me at rosenreport@gmail.com and 100% will go towards helping kids.

Spring Break’s hottest shot: Bartender serves drink along with a slap to the face, makes $6K nightly

Must read to believe.

The state of women’s sports: Top executives weigh in on parity, media share and NIL regulations

Great stats in the article about the growth of women’s sports.

U.S. hits new low in World Happiness Report

The U.S. hit an all-time low ranking in the annual World Happiness Report, tumbling eight spots to 23rd. Finland is #1 and there is a full list in the link.

The world’s 100 worst polluted cities are in Asia — and 83 of them are in just one country

Real Estate

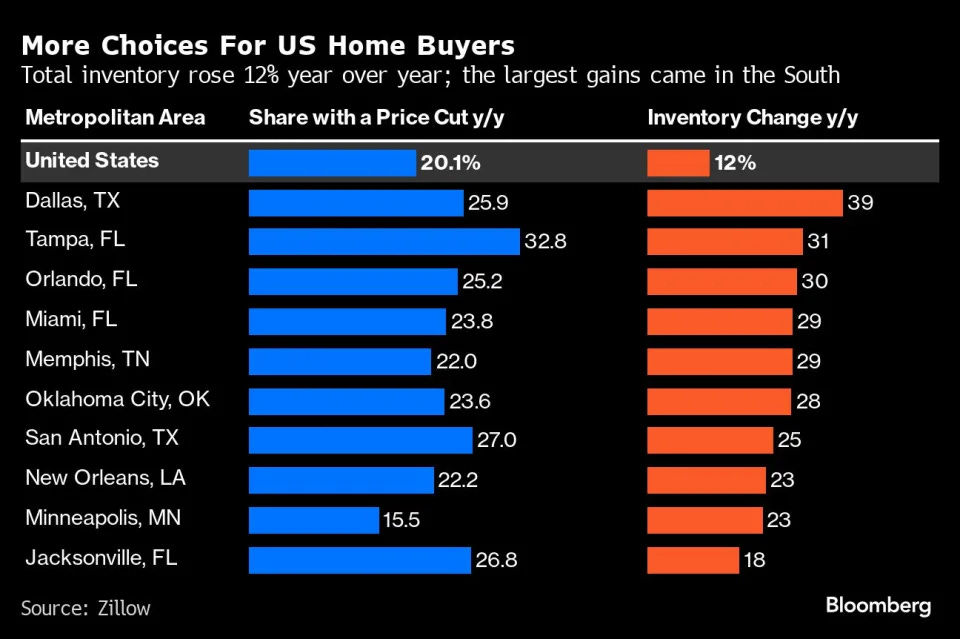

This Bloomberg article found on Yahoo is entitled, “A 39% Gain in Dallas Home Listings Signals Inventory Thaw in Parts of US,” and shows growing inventory in a bunch of states according to Zillow data. Additional inventory is coming to the US housing market, especially in the South, and an increasing number of sellers are lowering their asking prices. Listings of existing homes rose 12% in February compared with a year earlier, and one in five of them are seeing price cuts.

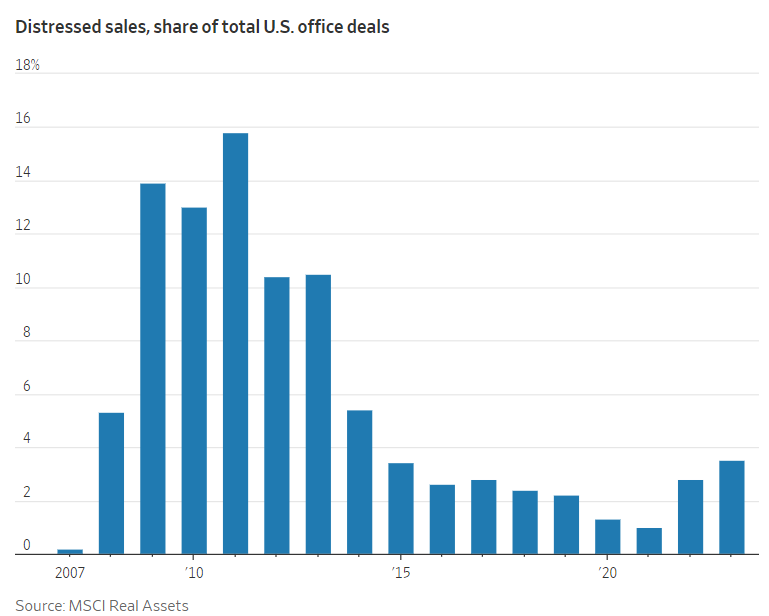

Concerning WSJ article entitled, “America’s Office Fire Sale Has Barely Begun.” Only 3.5% of offices sold last year came from a distressed seller, thanks to optimism and forgiving lenders. Office-building owners have been under pressure since the Covid-19 pandemic hollowed out their buildings in early 2020. According to data from real-estate consulting firm Colliers, the U.S. vacancy rate has risen from 11% in late 2019 to 17% today, higher than at any point in the 2008 global financial crisis. But forced sales are still surprisingly rare. In 2023, only 3.5% of all office deals in the U.S. involved a distressed seller, based on analysis by MSCI Real Assets. The most recent numbers available show the share slipping to 2.7% in January. Distressed sales ramped up much faster in the GFC. Distressed-debt investors might slow the pace of forced sales in a handful of cases, but the office sector’s need for finance will soon massively outstrip supply. Many landlords are counting on a sharp reduction in interest rates over the next year. Due to hotter than anticipated inflation, the number of likely cuts is dwindling. This is a related story suggesting half of downtown Pittsburgh could be empty in four years.

Westbrook Partners, which acquired the San Francisco Four Seasons luxury hotel building, has been served a notice of default, as the developer has failed to make its monthly loan payment since December, and is currently behind by more than $3 million, the San Francisco Business Times reports. The 155-room Four Seasons San Francisco at Embarcadero currently occupies the top 11 floors of the iconic skyscraper. After slow renovations, the hotel officially reopened in the summer of 2021.

An obscure investment product used to finance risky projects is facing unprecedented stress as borrowers struggle to repay loans tied to commercial property ventures. Known as commercial real estate collateralized loan obligations (CRE CLO), they bundle debt that would usually be seen as too speculative for conventional mortgage-backed securities. In just the last seven months, the share of troubled assets held by these niche products surged four-fold—rising by one measure to more than 7.4%. For the hardest hit, delinquency rates are in the double digits.

South Florida continues to grow its wealth base as people leave Blue States for South Florida, Tennessee, Texas and other places. The restaurant scene is BOOMING and there is a growing number of Michelin Star and Bib Gourmand eateries in South Florida. It is far less of a culinary wasteland than it once was and this Wine Spectator article is entitled, “Thomas Keller Plans to Revive an Iconic South Florida Restaurant.” The world-renowned chef and restaurateur behind Napa’s French Laundry is returning to his roots to revive Ta-boo in Palm Beach. Given how weak the Palm Beach food scene is, I cannot wait for this to open. I just hope it is not $500/head. This article is entitled, “Half of all New Yorkers will flee city in next 5 years as quality of life plummets post-pandemic.” Maybe politicians in NYC can do a better job of serving their constituents.

Interesting WSJ article entitled, “Once America’s Hottest Housing Market, Austin Is Running in Reverse-Home prices have fallen more than anywhere in the U.S.” Austin’s recent downswing is a sign that migration patterns that were turbocharged by the pandemic continue to fade. Housing markets in other Sunbelt cities, including Phoenix and Nashville, Tenn., that swelled with new residents in recent years, have also softened from overbuilding, slowing population growth and a lack of affordability. Austin was at the forefront of the U.S. housing boom, when rock-bottom borrowing costs near the start of the pandemic fueled robust sales and sent home prices to new highs. Austin prices soared more than 60% from 2020 to the spring of 2022.

A pre-foreclosure action has been filed against Shorenstein Properties’ Garment District office building at 1407 Broadway after the firm defaulted on a $350M loan. After extending the maturity date on the loan twice until Nov. 9, San Francisco-based Shorenstein failed to make interest payments or pay off the debt when it came due, according to records filed in New York Supreme Court Friday.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #666 ©Copyright 2024 Written By Eric Rosen.