Opening Comments

My last note was about me eating my way through New Orleans. The most opened links were the Jewish boy who was ordered off his hospital bed by Antisemites and the drone footage of the illegal migrant camp in Brooklyn.

Crazy day today and I know I missed a few stories. Early send.

Markets

Facebook 2006 Sell Decision-Peter Thiel’s Perspective

US Liquor Consumption-The “Hangover”

Pawn Shop Inventory Growth

EV Mandates and Power Grid Limitations

DJT Stock Valuation Is Stupid

High-End Miami Condos

Adam Neumann Buying Back WeWork?

Real Estate Commission Update

Another LA Office Disaster

Video of the Day-Are You a Loser or a Winner-Take Control

Robin Van Persie is regarded as one of the best strikers of his generation and is now a Dutch football coach. His son’s team played in the under-14 tournament finals and the boy did not get off the bench. On the ride home, his son complained about the players and coach and made a lot of excuses. Van Persie said, “You sound like a loser. Winners take control, blame themselves and look at how to improve. Complaining sounds like a loser. If you want to be a winner take control of your life and stop complaining about others.” I felt this short video supports my theme piece about being passionate about your career and is great advice about being in control of your destiny. Push yourself to be better and don’t blame others for your failures. I learn from failure, but it is how you respond that defines you. Just ask Michael Jordan. After all, he did not make the varsity basketball team in high school. I think we know how that story ended.

Be Passionate About Your Career

I do public speaking engagements at schools across the country and I try to emphasize the importance of loving what you do. We don’t all have that luxury. If you think about working in finance or consulting, law, or medicine… your hours are long. You can work 12-14 hours or more a day and being miserable for the money is not worth it. Life is short.

When I was graduating college 100 years ago in the early 1990s, jobs were hard to come by on the heels of the recession and banks were stingy with offers. I got a job at Continental Bank in Chicago and entered the credit training program. You complete four months or so of training and then are “placed” into a division. My training manager did not think very highly of me and I was sent to hell, I mean “Large Corporates.” It was akin to “Equities in Dallas” for all those Liar’s Poker lovers. My boss, treated me horribly. I was doing menial jobs that were beneath me and truth be told, If I had been paid 5 times the money, I still would have been miserable. It got to the point that I would tear up getting in the elevator going to work thinking about wasting my time in a boring job. I was not learning, growing, or developing my talents. However, when you start, you must realize you will not always be doing your ideal job day one and have to put up with some frustration regardless.

I don’t have time to go into the story, but I transferred to the Loan Trading Group in late 1994 and my life changed. The people I worked with were smart and intellectually curious, wanted me to succeed, and treated me with respect. I LOVED MY JOB. I would have done it for free. I enjoyed the people and was growing and improving every day. It gave me so much confidence and showed that I was good at trading and building client relationships. I worked long hours and went to the University of Chicago for my MBA at night. It was a hard three years for me but my love of the job kept me going.

For me, it was clear trading was my passion and when I left for Continental Bank for Chase/JPM and became a desk head; it only solidified this view. I enjoyed the people I worked with and constantly learned and grew while I was developing talent along the way. I learned from my bosses and mentors at Continental Bank about how to treat people and manage a team. It proved to be valuable insight. Do not underestimate the importance of loving what you do. I went from an hour feeling like a week to a week feeling like an hour once I was in the right job.

I was fortunate that I found my calling and was given opportunities to succeed by people like Pete Vaky, Walt Bloomenthal, Jon Kitei, Peter Schmidtfellner, John Steinhardt, Don McCree, Patrik Edsparr, Steve Black, Bill Winters, Jamie Dimon and others. Special mention to Jimmy Lee for being my mentor and always making time for me when I had an issue. He was a great man that I sorely miss.

My mentorship program is taking off. I am speaking to up to 7 kids in a single day (free of charge) to help guide them through the process of getting a job or internship. Far too often kids tell me they are doing it for the money and want to be rich. That is not the way it works. If you are not happy working 14 hours a day, you won’t be very good at it, and the big money won’t materialize.

My advice. Be intellectually honest about your passions and where you can thrive and shine. Don’t chase money; it will come if you do a good job in most industries. Sorry, hard to make a financial killing as a nursery school teacher, though it is an important job.

I interviewed Craig Weiss and we talked about passion and loving what you do. This short exchange outlines our discussion. I found his description of being a lawyer comical; it was not his passion. The inflection of his voice said it all.

This is a great short video about the importance of being passionate about your career. The man was an accountant but his love was magic and his boss told him he was in the wrong career and he should quit or be fired. The boss’ story was a powerful one and worth a listen.

This CNBC article about two friends who turned a passion for beef jerky into a $250mm business. It sure sounds as though they are having a blast. They started with $6,500 and turned a profit in the first month. Trader Joe’s initial order was 400 stores and now are sold at Target and Walmart as well. Loving what you do gives you a much better chance of success and means you will never work a day in your life.

Quick Bites

Wednesday, markets rallied snapping a 3-day losing streak and YTD the S&P and Nasdaq are both up approximately 9%. This WSJ article outlines the YTD rise in the 10-year treasury (3.86% to 4.20%) despite the Fed’s suggestion on rate cuts. Bitcoin was down 1.5% on Wednesday after hitting $71k again and settled at $68.7k. Oil is back down to $81 due to rising US stockpiles but it is +14% YTD.

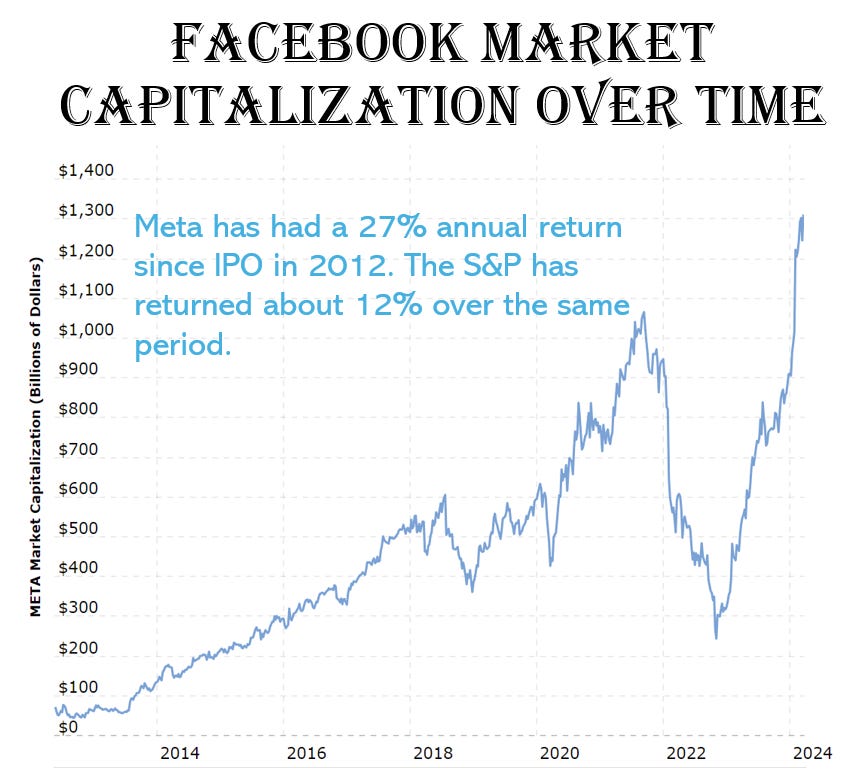

I found this short video of Peter Theil of his story about Facebook in the summer of 2006 facing a $1bn offer from Yahoo. There was a board meeting to discuss the offer and Zuckerberg talked board members out of it. He was 23 years old and would have made $250mm on the sale. Note the Forbes chart below showing Zuckerberg’s net worth at over $176bn today. I think he made the right call by not selling. Theil called the decision not to sell to Yahoo the single most important decision For Facebook. I am not the biggest Zuckerberg fan, but do appreciate what he has created and his passion and vision for Facebook. Remember, Facebook was not the first social media platform. Friendster, My Space, Second Life, Live Journal, Dix Degrees, and other pre-dated FB, yet Zuckerberg dominated.

During the pandemic, people stopped going to bars and restaurants and liquor stores were booming. Alcohol consumption was high and this WSJ article outlines what happened next, “Jack Daniel’s Flowed During the Pandemic. Now Comes the Hangover. Demand has been sliding for Jack Daniel’s Old No. 7 for months and the company behind it, is forecasting a sluggish U.S. whiskey business for at least the next year. Drinkers guzzled whiskey and other spirits during the pandemic, driving banner sales growth for Brown-Forman and other distillers, but the party has ended. Whiskey makers’ revenue in the U.S. fell 2.2% in 2023 to $12.3 billion, according to the Distilled Spirits Council of the United States, while revenue was flat overall for makers of spirits. “The phenomenal sales growth we saw during the pandemic was unprecedented and unpredictable but also unsustainable, and now, the spirits market is recalibrating,” Chris Swonger, the group’s president, said last month. Consumers are under pressure from rising prices and interest rates hovering near their highest level in years. People have returned to their prepandemic activities and are spending less time at the home bars they stocked during Covid-19 lockdowns. Many people are cutting back on their alcohol consumption for health reasons—or choosing marijuana instead.

I have often written about the demise of the U.S. consumer and have been proven wrong. The resiliency and stupidity of the consumer never cease to amaze me. However, we are seeing more concerning data points in the “instant gratification” social media society and this article outlining exploding pawn shop inventories is concerning. When the economy is not doing well, pawn shop inventories tend to go up because people are pawning lots of stuff for fast cash and there aren’t as many buyers as there were during the good times.

So what are we seeing during the early stages of 2024? One pawn shop owner that was recently interviewed by USA Today admitted that he has “a glut of inventory” right now. Also concerning is credit card debt levels/delinquencies surged more than 50% according to the NY Fed, the growing reliance on Buy Now Pay Later, rising auto delinquencies and consumers getting squeezed by inflation. Quotes from the article from pawn shops:

The only thing he’s short on is space. “Right now we have a glut of inventory,” Baron said, “which tells me that our clientele doesn’t necessarily have money.”

EZCORP Inc. also owns 530 pawnshops in the U.S. and reported an 8% increase in inventory at U.S. stores in the company’s latest earnings report. The “challenging macro-economic backdrop” continued to fuel demand for short-term cash loans, the company said.

FirstCash Holdings Inc. operates nearly 1,200 pawnshops in 29 states and the District of Columbia. The company reported “record pawn receivables” in its most recent year-end earnings report and a 10% increase in inventory at its U.S. stores.

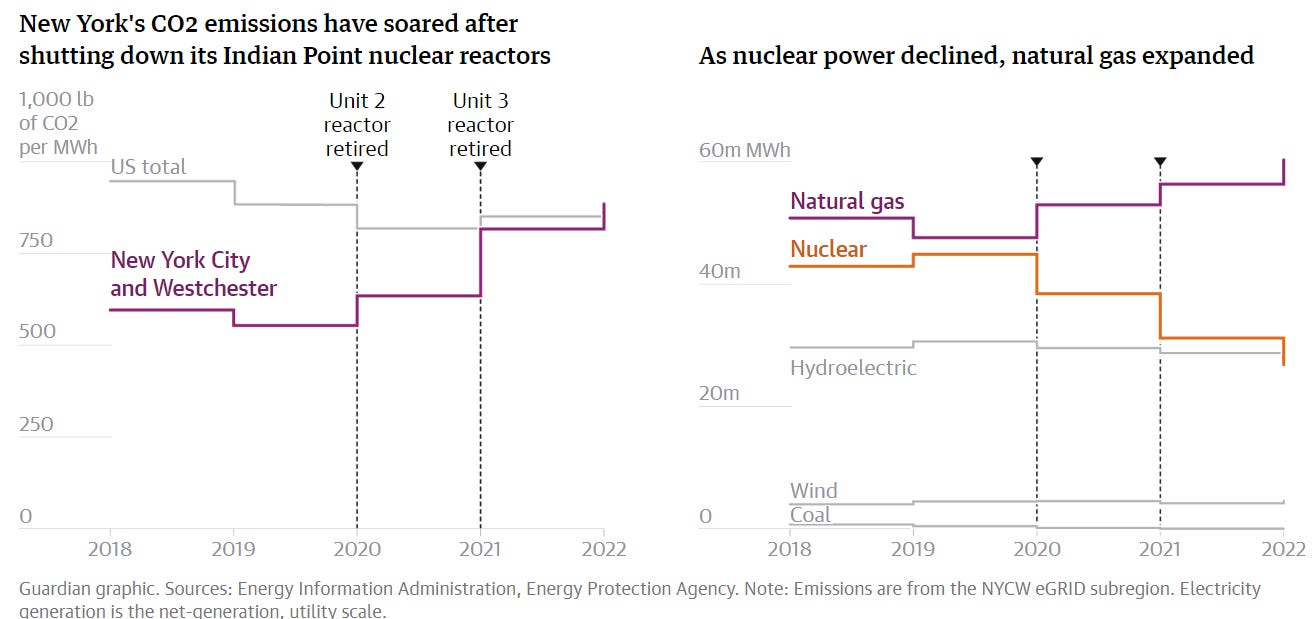

I have questioned EV mandates in states like CA and the U.S. government’s demands for EV use. Remember, I have owned a TSLA for 7 years. Issues of price, range, limited charging stations, and limitations on the power grid all are concerning relative to the mandates. More major US car manufacturers have significantly reduced EV plans as a result and EV sales growth is slowing. Add to it Big Tech’s power demands as outlined by this WSJ article, and you can understand my skepticism. Bill Vass, vice president of engineering at Amazon Web Services, said the world adds a new data center every three days. Microsoft co-founder Bill Gates told the conference that electricity is the key input for deciding whether a data center will be profitable and that the amount of power AI will consume is staggering. Former U.S. Energy Secretary Ernest Moniz said the size of new and proposed data centers to power AI has some utilities stumped as to how they are going to bring enough generation capacity online at a time when wind and solar farms are becoming more challenging to build. Now let’s factor in awful power grids in CA (most aggressive EV mandates), TX and other states. How are we going to power AI and EV growth when we vilify Nuclear Power Plants. Wind, solar, wave… are not realistic to account for the needed growth. This article is entitled, “California’s regionally isolated power grid leaves state vulnerable to failure,” outlines the limitations of the grid. This article is entitled, “How hard will it be to develop California’s electric grid of the future? Like repairing a car while it’s still moving.”

Trump Media stock jumped more than 50% after DJT ticker debut but closed +16%. Trump supporters are creating a ridiculous valuation for a company that had approximately $5mm of revenues in 2023 and lost money. There are 494,000 active monthly users, a DECLINE of 51% from a year ago. The market capitalization is almost $10bn as of Wednesday at 2pm. Trump’s shares as of Tuesday’s close are valued at $5.4bn (owns 58% of shares) but subject to a lock-up agreement preventing him from selling. Based on these numbers, my newsletter should be worth a lot of money as I am cash flow positive and growing (+90% year over year subscriber growth)! Trump’s company is trading at 1,600 times revenues. What could go wrong? Sorry Trump, your buddies can only prop up this company for so long. Yes, idiots can keep the value of this company high for a while, but we all know how this ends, and it is not at 2,000 times revenues. The company also admitted that it “expects to incur operating losses for the foreseeable future” while building out its business, a recent SEC filing. “It’s untethered from fundamentals. It’s a PR gambit,” said David Kaufman, an IPO expert and partner at Thompson Coburn. Let’s go back and look at the Reddit stock craze and Gamestop shares. They went from $5/share to $86 in a few months. Guess where they are today? $13/share. The valuation of DJT makes no sense but I applaud his supporters for the effort. This NYU Stern link shows revenue multiples by sector (2 months old). The HIGHEST multiples are around 10 times (Semiconductors and Software) with the market average being 2.3 times. This is slightly less than DJT’s 2,000 times revenues. In this article, a Finance professor makes analogies to the Reddit craze and suggests Truth Social is worth less than $2/share, slightly less than the current price of $68/share. For perspective, Twitter/X has 550mm active users and was last valued at approximately $20bn. Barron’s article is entitled, “Trump Media Stock Drives Meme Mania 2.0.” The borrow to short is very expensive as is vol making it hard to short.

Israel

Kamala Harris doesn’t rule out consequences for Israel if it goes with Rafah op

Israel cancels Washington visit after US allows UN Gaza ceasefire resolution to pass

Israel said willing to free almost 800 Palestinian security prisoners for 40 hostages

How US Jewish liberalism metastasized into hatred of Israel

Driven by the 'oppressor vs oppressed' dichotomy, some American Jews have come to identify Palestinians as the underdog and therefore worthy of consideration and concern.

Other Headlines

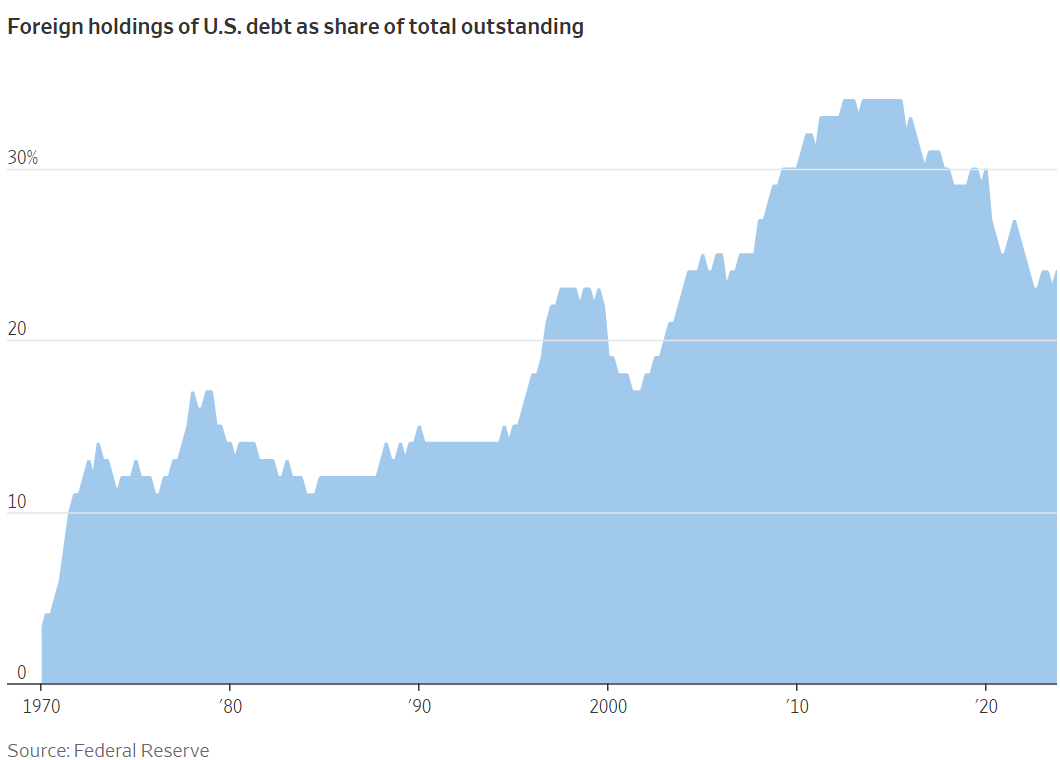

The $27 Trillion Treasury Market Is Only Getting Bigger

More debt, different buyers and increased regulation pose challenges.

FTX's victims may get all their money back. The judge sentencing Sam Bankman-Fried might not care.

Amazon spends $2.75 billion on AI startup Anthropic in its largest venture investment yet

Boeing CEO to step down in broad management shake-up as 737 Max crisis weighs on aerospace giant

What a poorly run company. He should step down.

Viking Therapeutics jumps more than 25% on promising weight loss pill data

Harassment and Drugs Plagued a Citigroup Division for Years

Shocking allegations against the equity division. I understand what took place decades ago, but a bit surprised by the more recent stories.

I am glad they lowered the bond to a more reasonable level even if I do not care for Trump. There is also a pause on the ban for Trump and his children from running companies in NY or applying for loans in the state.

Two Texas boys, ages 7 and 12, taken into custody in connection with woman stabbed

Scary story of young boys stabbing a woman in Texas.

Junior’s Restaurant owner is cheesed off about quality of life in New York: ‘We want our city back’

Although he shares my last name, we are not related. “You need to change the narrative. You need to change reality. We need the city to deliver a better product.” He’s also got beef with New York pols’ seemingly permissive attitudes toward crime. “When did it become OK to shoplift a pharmacy? In what society is that OK? “Enough! There are no consequences. That’s part of the problem.”

SHOCKING video. An amazing mother who saved her daughter’s life.

Both of the alleged criminals had records.

Attacks in NYC transit jump a massive 50% as subway murders surge

What is it that keeps driving the wealthy and educated professionals out of NYC? Crime, safety, taxes, taxes, high cost of living, homelessness, immigration, weather…? I don’t love NYC subways anymore.

Baltimore is now facing apocalyptic levels of policing shortages.

Last week, THREE police officers patrolled a district of 61,000 residents.

Utah coach says team was shaken after experiencing racial hate at hotel during NCAA Tournament

Awful story about racism that forced a team to move hotels.

Major bridge in Baltimore collapses after being struck by ship, people in water Crazy video and pictures-20 people missing. The ship lost power/control.

State Farm discontinuing 72,000 home policies in California in latest blow to state insurance market

I just had my homeowners policies renewed and was very worried about being canceled. They went up by 7%, a very fair # in my mind. If you have insurance questions on property & casualty coverage, call Kevin Lang (1.866.964.4434), my sponsor and insurance broker. Dozens of RR subscribers have converted to Lang for their insurance needs and he works in all 50 states.

Welcome to Florida where criminals face the consequences of crime.

The best- and worst-paying college majors, 5 years after graduation

A nuclear plant’s closure was hailed as a green win. Then emissions went up

I’m a neuroscientist — make these 5 lifestyle tweaks to improve your memory

Loneliness Worse For Health Than Obesity, Alcoholism, Even Smoking 15 Cigarettes Daily?

How to ‘switch on’ your anti-aging genes – and live longer

25% of how long we live is heredity and 75% is the environment. This link gives some advice to live past 100.

Florida Gov. Ron DeSantis signs bill that bans children under 14 from having social media accounts

Social media is damaging, especially to young children.

The American teenage figure skating phenomenon making history

He landed a quadruple axel in competition.

Bizjet Inventories Up 26% from Last Year

Used inventory is still below the five-year average of 5.1% of the total fleet.

Martin Greenfield, tailor for US presidents and survivor of the Holocaust, dies at 95

He was in Auschwitz and was doing Nazi soldier’s laundry as a young boy. He accidentally ripped a uniform and was beaten. “Strangely enough, two ripped Nazi shirts helped this Jew build America’s most famous and successful custom-suit company,” Greenfield continued in his memoir. “God has a wonderful sense of humor.”

Real Estate

Good Real Deal article entitled, “What’s driving billionaire buyers to Miami’s most expensive penthouses.” A mystery buyer plans to spend over $120 million for the penthouse at the Shore Club, an Auberge-branded luxury condo development on the ocean in Miami Beach. The deal will likely set a record for the most expensive condo sale ever in Florida and the most expensive price per square foot sale (more than $11,000 per square foot). The buyers are in finance or tech, or are billionaire entrepreneurs, developers and brokers say. Billionaires are in some cases pushing out the millionaires. The population of millionaires has grown 75 percent over the past decade in Miami, Forbes reported, citing a wealth report from Henley & Partners. More millionaires, centimillionaires (those worth $100 million or more) and billionaires live in Miami than anywhere else in the U.S. High-end South Florida quality product is in high demand. The number of buyers looking to spend $20mm+ for new homes or condos in A+ locations is astounding. I cannot believe the amount of deals in South Florida in the past 60 days from $10-50mm+.

My dislike for Adam Neumann is well-documented. How he handled WeWork and the massive conflicts of interest were disgusting. His “Flow” company is already having issues as well. Now, he is bidding to buy back bankrupt WeWork for over $500mm. I would never invest a dollar with this man.

Good article from Yahoo Finance entitled, “Realtor commission change delivers a boon to homebuilders, a blow to real estate platforms.” A change to the real estate commission structure is shaking the industry — and homebuilders and consumers appear to be the winners. Experts say the NAR settlement — which essentially decouples buyer and seller agent fees — is a win for consumers because it will create transparency around how commissions are set and paid and ultimately lower costs. Increased transparency will make it easier for buyers to negotiate fees or bypass the use of agents entirely. Buyer agent usage in most countries is uncommon, averaging 33% compared to the US’s rate of nearly 90%.

For buyers who decide to use an agent, advocates say fee costs are likely to substantially decline. Right now, US commission rates are among the highest in the world. Commissions on a $500,000 home sold in the US would be about $25,000 to $30,000 — compared to roughly $6,500 in the UK.

Brookfield Properties is selling 777 South Figueroa Tower, formerly one of its trophy office towers in Downtown Los Angeles, for about half of the outstanding debt on the property. South Korea-based investment firm Consus Asset Management is in a deal to buy the 1 million-square-foot tower for about $145 million, according to reports from Bloomberg and Real Estate Alert, which cited unidentified sources. Brookfield did not immediately respond to a request for comment. Brookfield defaulted on $319 million in loans tied to the 52-story tower last year, after rising interest rates squeezed profits from the building. The firm put the property up for sale in the fall. The building is 52% leased. How many more times will we see an office building sell for less than the debt?

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #668©Copyright 2024 Written By Eric Rosen.