Opening Comments

My last note was about valuable investment lessons I learned. The most opened links were advice from a colorectal doctor and the short video of what happened when a boarding school banned phones. On a related note, this is a concerning article about a professor’s concerns about social media and its impact on children.

I will give details in an upcoming piece, but the Rosen family went on a 7-day college tour journey across the Southeast. After flying to New Orleans, I drove over 23 hours (1,500 miles) to 7 schools. It was exciting, overwhelming, and scary to think my son, Jack, would be leaving the house soon. Some of these schools were incredibly impressive. I can tell you that if I was graduating high school today with my transcript from 36 years ago, I would not get into college. Thank you to all my readers who sent me over 750 news stories during the week to help me put together the report.

Picture of the Day-Top 10 Richest Cities in America/Income Disparity

Markets

Private Credit Default Recovery

$1.2 Trillion Spending Bill

Republicans Dropping Like Flies

Democratic Wealth Tax Proposal

High-End South Florida

Florida Residential Inventory Build

Wynwood Office Foreclosure

Commercial R/E Hangover

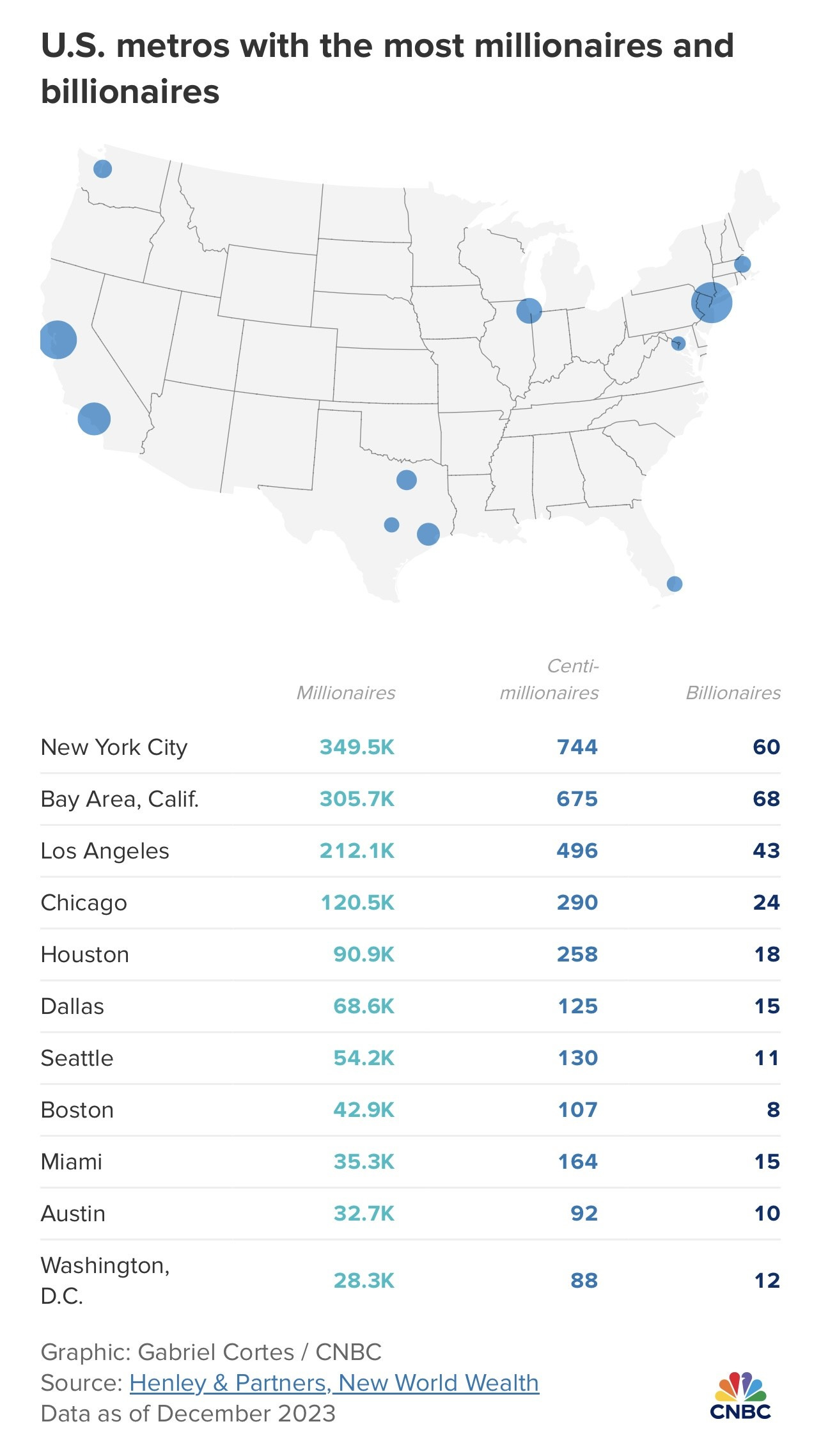

Picture of the Day-Top 10 Richest Cities in America

Interesting CNBC article showing NYC topping the list of wealth in the US with 350k millionaires and 60 billionaires. The San Francisco Bay Area ranks as the second richest city in America, despite topping New York for billionaires, with more than 305,000 millionaires and 68 billionaires. The fastest-growing U.S. city for the ultra wealthy among the top 10 is Austin, Texas, which has more than doubled its millionaire population over the past decade to nearly 33,000. Miami is up there too, with 87% growth in millionaires over the past decade — but with one-tenth the New York City total. This article outlines the cities with the wealthiest retirees. The 2nd chart shows The wealth disparity of 132k households relative to 66mm households. It shows the total net worth of the top .1% is 5 times the bottom 50%.

Eating My Way Through New Orleans

I have been to the Big Easy at least a dozen times. Truth be told, I am not a huge fan of New Orleans as a city, but the food is amazing, and I went all out in 48 hours to prove it.

Cochon Butcher is a casual place for meats, sandwiches, and sausages. You order at the counter and are seated once you pay. The place is a machine with a cool and hip vibe. The food is VERY good and the atmosphere is casual. It was JAM PACKED and it was the single best smoked turkey sandwich I can recall. Everything from the meat to the bread made for a memorable sandwich. The tomatoes were bursting with flavor, while the avocado made the perfect addition. There is a 100% chance I go back to Cochon Butcher and look forward to trying a bunch of new dishes there. Cochon is owned by the Link Restaurant Group that also owns my favorite place in New Orleans, Herbsaint.

On Saturday night, we went to Luvi-homestyle Shanghai cooking melded with modern, Japanese dishes. The Asian fusion bursts with flavor and the menu is full of fresh takes. Is it the best quality sushi I ever ate? No, it is not. However, I am reminded of my first time at Nobu 30 years ago and thinking about how creative the dishes were at the time. At Luvi, the combinations were fantastic and unexpected with a beautiful presentation. I tried the Monkey Snack Salmon with crusted banana and sweet and spicy sauce. Sounds awful, but the flavor combinations resulted in a positive surprise. The Snap Crackle Pop was salmon with Chinese chili crisps and popcorn sunflower seeds was great and the textures added a lot to the dish. The Golden Nugget was a fried Louisiana Shrimp ball with a crunchy crouton crust and the textures made the dish. The Tuna Rangoon with cream cheese and sriracha aioli resulted in a burst of flavor and was another solid selection. The only thing that did not blow my mind was the Pan-fried Vegan Lover Dumplings. You lost me at vegan! I will give the chef a lot of credit for creativity and the overall experience was very positive. If they had higher quality sushi, it could be Michelin Star Quality. It is very casual, as some patrons were wearing Mardi Gras beads.

For lunch Sunday, we went to the Middle Eastern restaurant, Shaya, as it was recommended by many including my friend, Tom. The chef is from Lebanon and he combines Israeli staples with Southern flavors and modern techniques. The Moussaka of chickpeas, tomato, eggplant, and onion was top-notch. I loved the fried chicken hummus, and the steaming hot pita bread was at another level. I think they brought us out 7 different pitas and I appreciated the fact that they just kept coming although I never asked for more. The Tzatziki was the best I ever had. It was not on the menu and had chunks of cucumber and was rich and creamy. We ordered 10 dishes and the only things that underwhelmed were the Falafel and the Crispy Halloumi with Louisiana strawberries and apricot (liked the sauce more than the cheese). The Gulf Shrimp Kabob was fresh and cooked to perfection over Moroccan Couscous and lemon chimichurri. The combination of the sappy service, amazing flavors, and fantastic presentation made for a memorable lunch. 100% chance I return.

For dinner, we went to La Petite Grocery with James Beard award-winning Chef Justin Devillier at the helm. We started with a Yellowfin Tuna Crudo with Grapefruit and it was so fresh. They catch the Tuna in the Gulf close to New Orleans as seen by my trip there last summer below. I make Tuna Crudo myself, but there is now a 100% chance I add Grapefruit to it. I never order steak tartare and tried it for the first time in years. It was the only item on the menu that underwhelmed me, as I did not think there was anything special about it. For my entree, I was living on the edge and ordered the Alligator Bolognese with a fried soft-boiled egg. It was my first time trying alligator and it was not what I expected. It was similar to pork from a texture perspective and made for a memorable dish that I would love to try again. Jack loved his Redfish but it had Red Pepper that did not allow me to try it given my allergy. Julia’s cheeseburger was great too but not special enough to order at a restaurant of this caliber. The presentation of all the dishes was as fantastic and the Apple Tarte Tatin and Chocolate Financier with hazelnut were both remarkable desserts. My one complaint was that the portion control police were in full swing. When I go to amazing restaurants, why is it that they want to give me small portions? The food is good; I want more. I almost needed to have a second meal after eating but what I had was DELICIOUS.

Quick Bites

Although stocks sold off Friday, all three major averages notched healthy gains this week, with the S&P 500 rising about 2.3%. The Dow was up just shy of 2% for its best week since December. The Nasdaq was the outperformer of the three, jumping nearly 2.9%. It has been four years since the market had the “Covid Low” and the S&P is running at +25%/year since. The Federal Reserve meeting suggested that rates will come down later in the year even though they were unchanged in March. The Treasury market was volatile on the week with the 2-year yield hitting 4.74% on Monday before settling at 4.59% on Friday as the market digested the Fed commentary. Oil finished at $81/barrel and was slightly weaker Friday on more peace talks in the Middle East, but remains +12.5% on the year. Bitcoin fell 8% on the week after an amazing run and volatility spiked.

Concerning Bloomberg article entitled, “Private Credit’s Default Recovery Rates Are Worse Than Its Biggest Rival.” The dangers of private credit firms overvaluing their assets has become one of the booming $1.7 trillion industry’s most contentious topics in recent weeks. New data on how much money they expect to get back from defaulting borrowers will only add fuel to that fire. As the private credit industry has battled with investment bankers over the lucrative business of lending companies money, one of its biggest selling points has been that its tougher loan protections and one-to-one relations with borrowers would give it extra protection when those companies hit trouble. A new analysis by KBRA Direct Lending Deals casts doubt on those assumptions. Looking at loans to companies that defaulted over the past year, the data shows that those made by private credit firms were valued at an average of 48 cents in the aftermath of the default, showing how much they’d expect to recover on each dollar lent. That’s worse than loans by bank-led syndicates, where the average value was 55 cents a month after default. So much money has been raised in the Private Credit space in such a short time. I can’t help but think this will lead to poor outcomes given the competition to win deals.

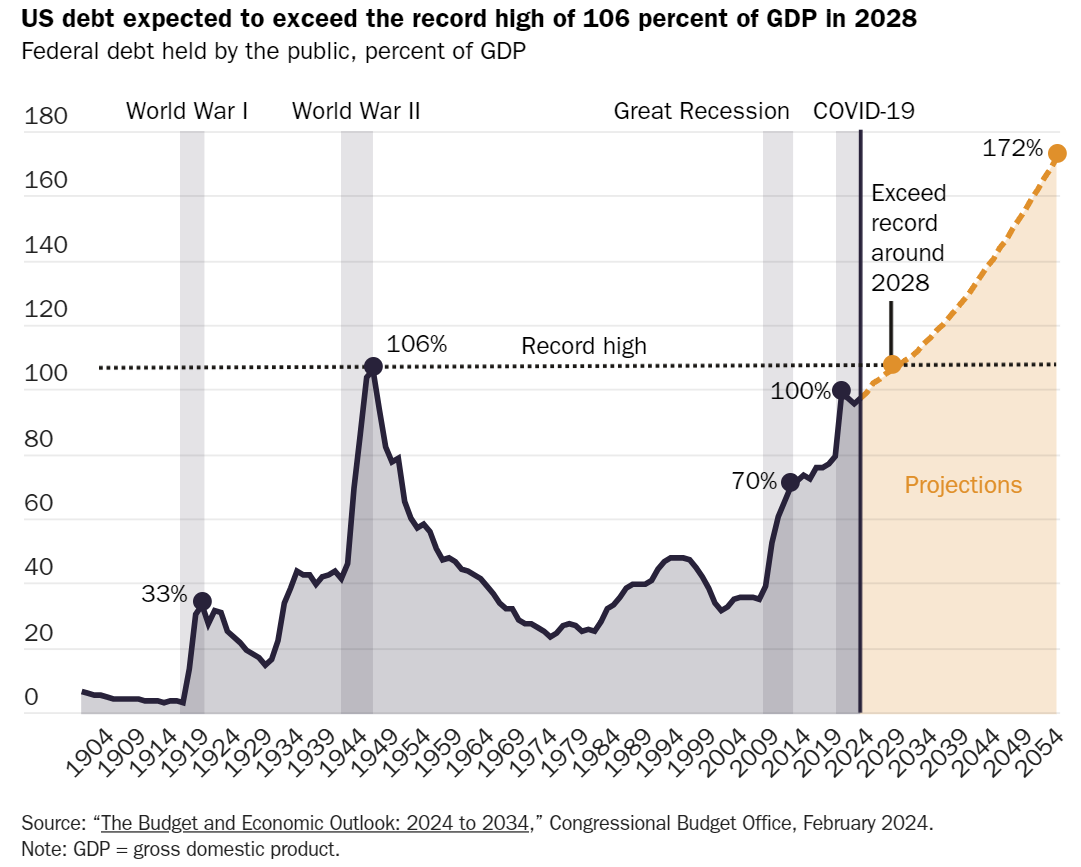

The House on Friday overcame bipartisan objections and passed a $1.2 trillion spending bill to keep most of the federal government funded just hours before a shutdown deadline — but Speaker Mike Johnson's job is being threatened as a result. The Senate passed the bill and Biden signed it. The 1,000-plus-page package of bills includes funding for the State, Education, Defense, Labor, Homeland Security, and Health and Human Services departments in fiscal year 2024 as well as for “general government and foreign operations” and the Internal Revenue Service, The Hill reported. This link shows some of the insane pork including $15mm for Egyptian college tuition…in EGYPT. I am ADAMANTLY opposed to the process for these omnibus bills that give members of Congress hours to read 1,000+ pages and include all kinds of waste. No one seems to care about $34.6 trillion of debt growing by approximately$1 trillion every quarter. The U.S. is looking at another $20 trillion in deficits over the next 10 years according to CBO estimates. The plans and budgets are unsustainable and all Congress does is spend. We need a balanced budget process and Entitlement Reform now. A growing number of Republicans are calling for Entitlement Reform even though it is not popular.

Many Republicans are furious about the passage of the $1.2 trillion spending bill and are calling out Speaker Johnson as a result. This is Forbes list of the major items outlined in the bill. This Nebraska Examiner link gives even more details. There are plenty of funds going to woke projects as you would expect but the bill eliminates the US House Office of DEI. Worst of all, the measure does nothing to address the abuse of taxpayer dollars used for funding and processing illegal immigration. Republicans in Congress are dropping like flies and it means Johnson is down to a margin of one vote with Washington Rep, Gallagher stepping down prior to the end of his fourth term. Ken Buck (R-CO) stepped down on Friday. Bill Johnson (R-OH) resigned in January. Kevin McCarthy (R-CA) resigned at the end of 2023. George Santos (R-NY) was expelled. Cathy McMorris Rodgers (R-WA), Patrick McHenry (R-NC) and Kay Granger (R-TX) have all announced they will retire at the end of the year.

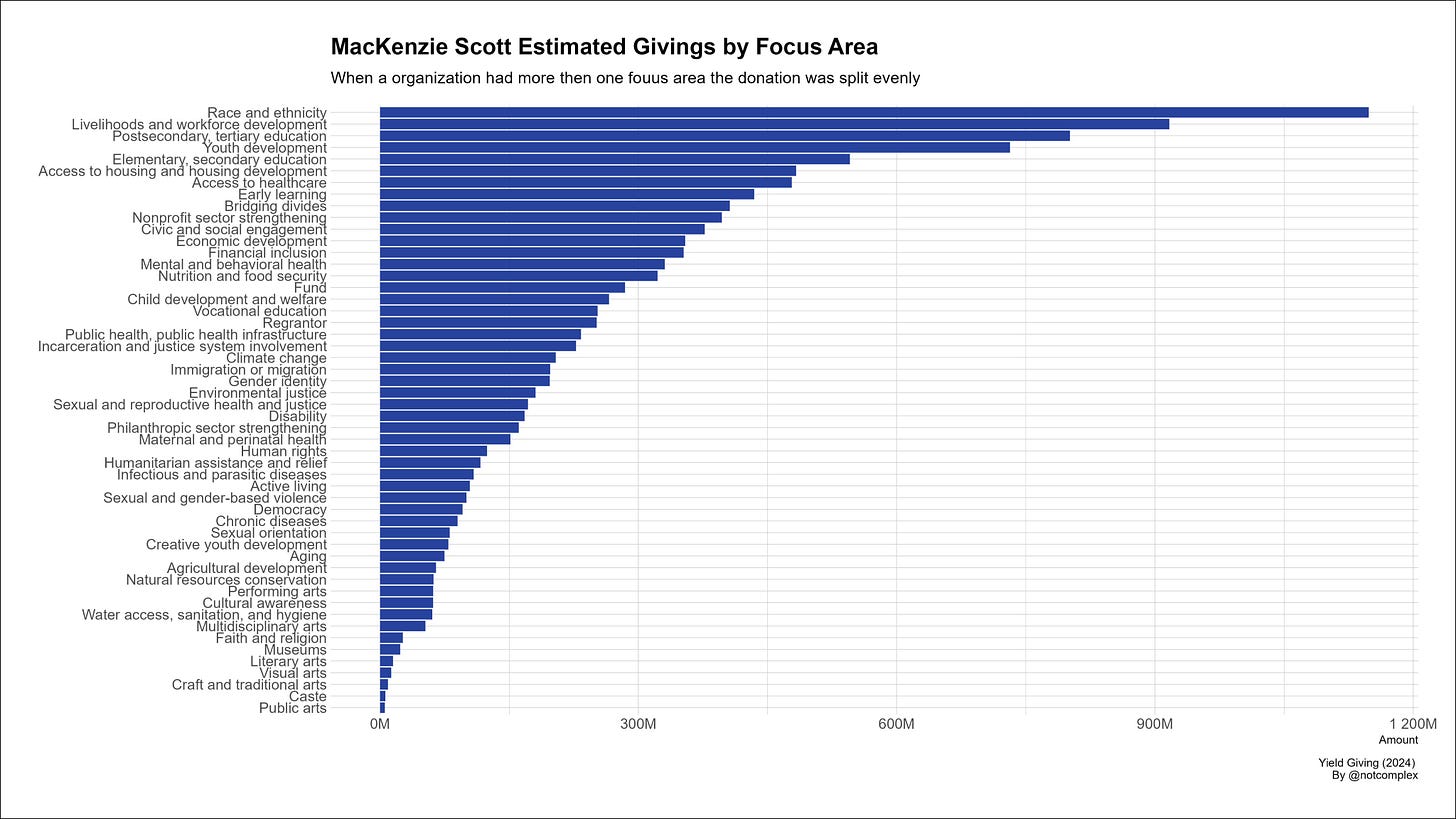

The Democrats have been vilifying the wealthy for years and this article outlines the details from the Right and this one from the Left. Sen. Elizabeth Warren reintroduced the Ultra-Millionaire Tax Act, which would slap a 2% tax on households worth $50 million to $1 billion and a 3% tax on households worth more than $1 billion. Reps. Pramila Jayapal, D-Wash., and Brendan Boyle, D-Pa., have introduced a companion bill in the House. According to Warren, the tax bill would affect the wealthiest 100,000 households in the U.S., about 0.05% of the population, USA Today first reported. The new version of the bill contains additional rules to crack down on tax avoidance for wealth held in trusts. It would also give the IRS an additional $100 billion to fund auditing and enforcement efforts. Additionally, Warren's proposal includes a 40% "exit tax" on people worth more than $50 million who attempt to renounce their U.S. citizenship to avoid paying the tax. The top 1% pay over 42% of the taxes today and the top 5% pay a total of over 62% of taxes. Although I do not believe that we can tax our way to prosperity, I do believe there are too many loopholes. I support a flat tax or a far-simplified tax system. The current code is 6,871 pages and I would like it to be 5 pages or less. My biggest issue is spending, and pork-filled bills that waste my hard-earned money. I have zero faith in Congress to get to the right answer.

Israel

Houthi Cruise Missile Hits Israel in Ominous First

This Houthi situation is getting embarrassing.

IDF claims it killed 170 Hamas terrorists, captures 800 in Al-Shifa Hospital raid

'Will Send Netanyahu To Allah': Erdogan's Words Spark Outrage In Israel

Are you kidding me? The Jew hate is everywhere.

There are many great academic institutions I would never consider sending my children. We just went to 7 schools last week and if there was any indication of Jew hate, I would NOT send my kids and spend basically $100k/year by the time you are done.

I do not believe Fetterman is qualified for the Senate given his cognitive issues. However, I do thank him for his support of Israel.

The global Jew hate has emboldened anti-Semites.

Other Headlines

Top U.S. asset manager Vanguard doesn’t believe the Fed will cut interest rates this year

Definitely out of consensus view that the market is not pricing in especially after this week’s Fed commentary.

Reddit pops 48% in NYSE debut after selling shares at top of range

Nike shares slide on lackluster outlook, slowing China sales

Lululemon shares plunge 16% on weak guidance, slowing North America growth

Target doubles bonuses for salaried employees as profits recover

DOJ sues Apple over iPhone monopoly in landmark antitrust case (stock-4%)

This week’s “All-In Podcast went into details on the antitrust case. Apple is -7% YTD vs the S&P +10% and Nasdaq +11%.

The salary a single person needs to live comfortably in 25 major U.S. cities

The article suggests for a single person to live comfortably, you need to make $138.6k in NYC. Sadly, I am not convinced that is enough based off of rent, food prices, Uber costs and the overall cost of living and taxes.

In 2023, 7.6% of new vehicles sold in the US were EVs. I do not see how it is humanly possible to have 66% in 2032. EV sales are slowing because they are too expensive, short-range, not enough charging, and power grids are unable to handle the extra demands in many major markets. I am an early EV owner and may have bought my last EV for a while due to the issues.

Republicans Call for Retirement Age Hike in Clash With Biden

I am fully sportive of Entitlement Reform including raising the age and means testing. There is no other way to make the math work. Under the current conditions, we have over $100 trillion of underfunding. Aging population, healthcare inflation, fewer younger workers, young adults not having kids, life expectancy growing….Why is this even up for debate?

Trump claims he has $500 million in cash, undercutting lawyers' claims on bond money

Trump social media company will go public as DWAC shareholders approve merger. I question the valuation here.

Illegal immigrants storm border in El Paso, group pushed back to Mexico

Parents of boy bank robbers dubbed as 'little rascals' turned them in, HCSO says

11, 12 and 16 year old boys.

New York’s $4.4B shoplifting shadow economy revealed — fueled by eBay and Facebook Marketplace

Family of girl charged in brutal Kaylee Gain beating claims she’s the real victim, starts fundraiser

A reader pointed out that the girl who was savagely beaten had a bad reputation and may have been the instigator. We do not know enough about this story yet. I am not condoning what happened in any way, but not convinced all the facts are out.

I would like the mother to starve to death.

Countless horror stories of squatters taking over homes. Why do squatters have any rights? Why won’t the police throw them in jail? Too many things in the US have gone the way of absurdity. No consequences for bad acts.

This Queens woman was arrested for trying to keep squatters out of her home by changing the locks

How is this humanly possible? Squatters changed the front door and locks and the OWNER was arrested after the squatters called the police. There is no universe this is Kosher in the U.S. Welcome to NYC.

Florida Gov. Ron DeSantis Stands With Floridian Property Owners Over Squatters

“The Florida Legislature unanimously passed a bill that would allow police to immediately remove squatters — a departure from the lengthy court cases required in most states.” Love him or hate him, he got this right.

$1.8B Sony movie studio backed by Mark Wahlberg approved for Summerlin

More bad news for Hollywood. More people will leave the high crime, high tax, high homeless, bad power grid, expensive gas and high cost of living state for Nevada.

Tennessee becomes first US state with law protecting musicians from AI

Kate Middleton Reveals Cancer Diagnosis

I did not see this one coming.

Neuralink shares video of patient playing chess using signals from brain implant

I’ve spent 20 years studying longevity in Blue Zones: My daily habits for a long, healthy life

Hard for me to follow all of his suggestions.

Florida High-Speed Rail Cuts 2024 Ridership Forecast Again

I love the Brightline, when it works. I do not see a path to profit here.

Elite Avenues school drops plan for campus to Miami with US$48,500 tuition

My kids went to Avenues in NYC. Brilliant idea with awful execution. Way too much turnover in senior staff and I question the execution of the original plan. Not opening Miami is idiotic. Ken Griffin. Buy the location and build a school. I will help you.

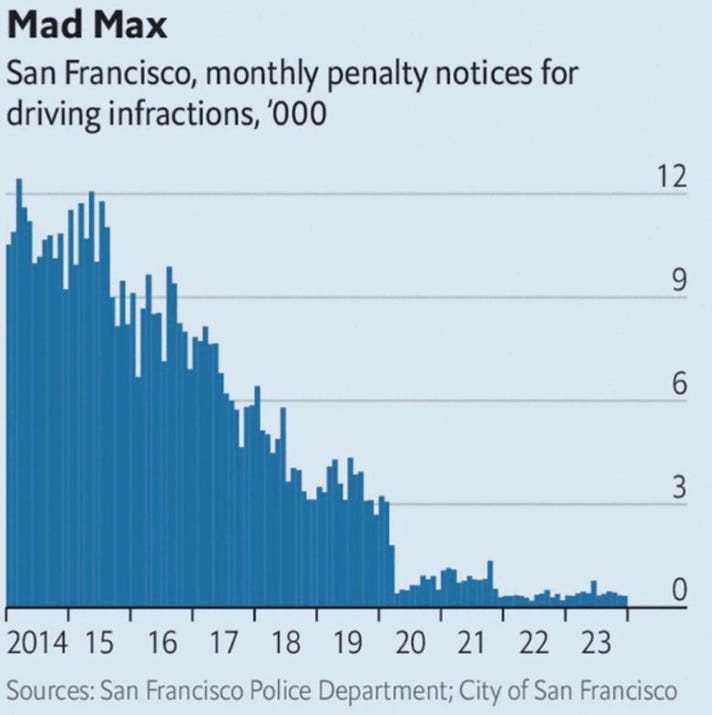

Did drivers in San Fran become a lot more responsible or have they given up policing? Given the incredible crime, cops are too busy solving murders, robberies, rapes, and assaults and hate crimes to pull people over.

Global fertility rate to keep plummeting, major study warns

I have written on this topic extensively and the studies are very concerning. At the end of the century 97 percent -- or 198 out of 204 countries and territories, will be shrinking the researchers projected.

World on the brink as Taiwan admits US troops are now stationed on Chinese border

Russia detains suspects in an attack that left at least 115 dead in a Moscow concert hall

Real Estate

At the high end, Miami to Jupiter remains hot in South Florida. Finally, Tarpon Island sold. It was originally asking $210mm. Although the sale price was not disclosed, I was told it may have sold at a healthy discount to the last asking price. I know multiple people who saw the house and they did not have positive things to say about it, suggesting it should have sold for far less. I never saw it myself. Separately, I am also told that a major billionaire is bidding on homes on Palm Beach Island and has made multiple “aggressive” 9-figure offers and has been regularly turned down.

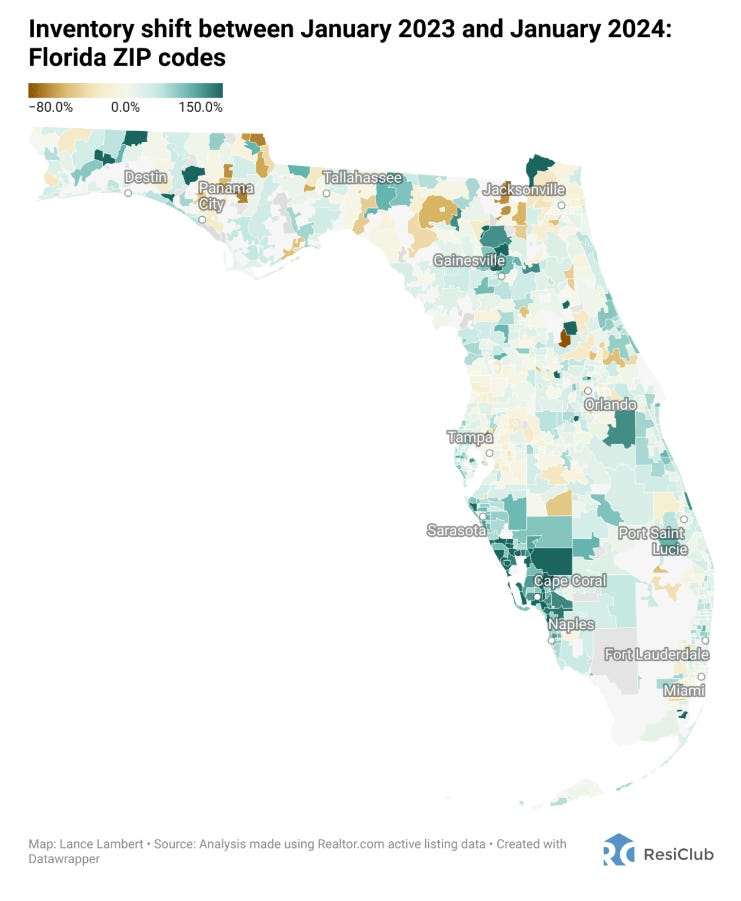

An interesting article entitled, “Is trouble brewing in Florida’s housing market? Here’s what the data says.” Housing inventory levels in Florida are up the most in the nation on a year-over-year basis (34%), but the bulk of the increase is concentrated in sections of Southwest Florida. In particular, in markets like Cape Coral and Fort Myers, which were hard-hit by Hurricane Ian in September 2022.

Hurricane Ian left behind thousands of damaged homes, and the subsequent need for renovations has resulted in a surge of available housing inventory. Hurricane Ian caused an estimated $112.9 billion worth of total damage, making Ian the third-costliest U.S. hurricane on record. In addition to residential property damage, the hurricane coincided with spiked home insurance costs. This combination of increased housing supply for sale—the damaged homes, combined with strained demand, the resulting spiked home prices, spiked mortgage rates, higher insurance premiums, and higher HOAs—has translated into market softening across much of Southwest Florida.

The surprising story of a new Miami office building in trouble caught me off guard. Wilmington Trust, acting on behalf of a commercial mortgage-backed security (CMBS) trust, is suing the owner, R&B Realty Group, in Miami-Dade Court to recoup $101.7 million and seize the 14-story office property. Just over a year ago, A10 Capital provided $113 million to refinance the 418,337-square-foot building, which features 195,000 square feet of office space, about 25,000 square feet of retail, and 512 parking spots. The A10 Capital loan was later collateralized into a CMBS deal. The New York-based R&B Realty completed the complex in 2021, touting its Wynwood location to new-to-market tenants arriving in South Florida in the wake of the COVID pandemic. The company had bought the 1.1-acre site at 2916 N Miami Avenue for $11.5 million in 2016 and landed a $76 million construction loan from 3650 REIT in 2020, before the pandemic hit.

Great FT article entitled, “It’s time to be honest about America’s commercial real estate hangover.” The article outlines how Canadian insurance company, Manulife outlined that it had written down its US office investments by 40% relative to pre-pandemic. The CFO said, “I like to think out property portfolio sis of reasonably high quality and quite resilient. But the structural forces of higher interest rates and trends around return-to-office make it a difficult market.” Since Covid, CRE values have fallen by 33% on average and as much as 60% in some places, primarily for office buildings according to Goldman. What are the ramifications for all the regional banks with too much office exposure? I just don’t think the market is fully digesting the pain coming in the space in the next two years. Two San Francisco office buildings bought for $949M in 2019, have been marked down to zero Market Center and 111 Sutter were acquired by Paramount Group for $722M and $227M, respectively.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #667 ©Copyright 2024 Written By Eric Rosen.