Opening Comments

Happy Mother’s Day to all the moms out there. I hope you enjoy your day with family and friends. Thank you for all you do.

My last note was about the absurdity of service animals. The most opened links were Steve Jobs on the challenges of turning an idea into a consumer product and the AI bot that gained 331% in a week trading stocks.

Inflation Example

I am getting work done on my boat engines and the cost is +67% in 3 years. The last time was peak pandemic where I had to scramble to find parts myself, as they were nowhere to be found. The price of the service including parts went from $3,700 to $6,200 in 3 years. I would suggest that is material and today there are no supply chain issues.

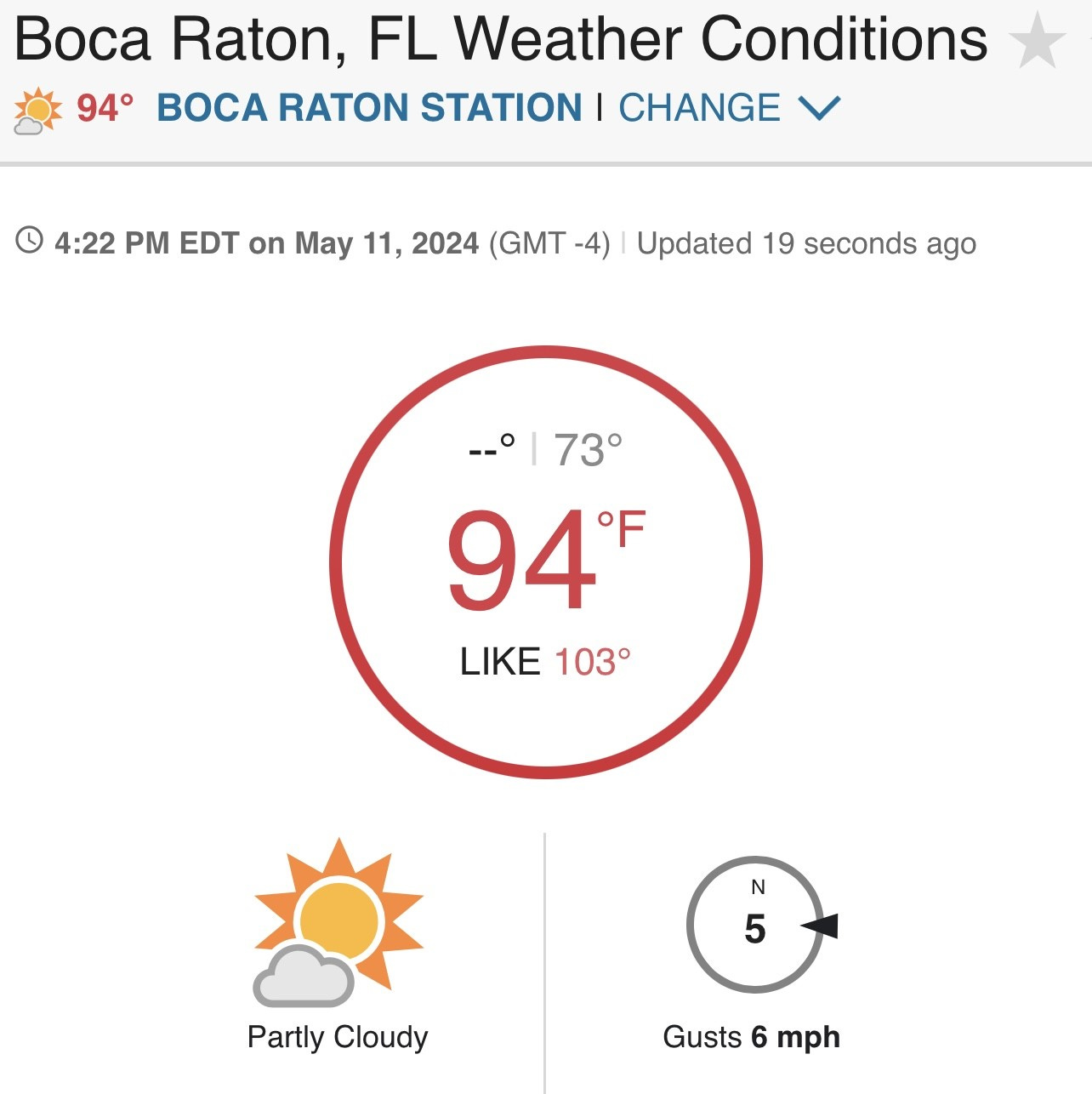

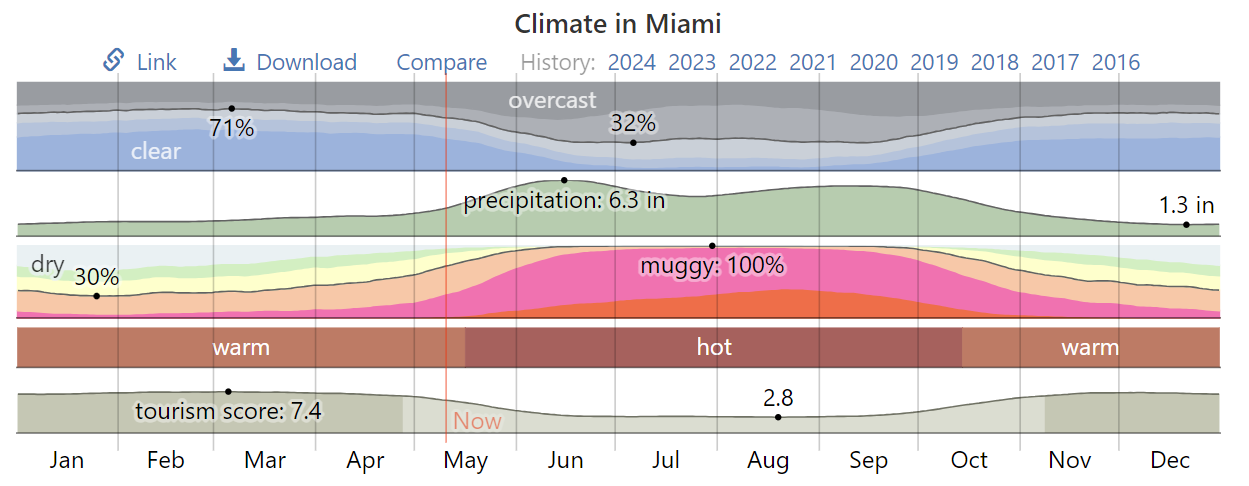

Heat Has Arrived Early

In my experience, South Florida is to be avoided at all costs from July-Mid October. August and September are the worst months from a heat, humidity, rain, and storm perspective. However, the heat is getting bad early this year. The high Friday was 96 degrees (without the heat index) and Saturday had a heat index of 103. From November to May, there is generally amazing weather in South Florida.

Upcoming Restaurant Reviews

Motek-Amazing. Mediterranean with Middle East influences. Coral Gables.

Taki Omakase Lunch-Fantastic fresh sushi. Boca Raton.

Di Farina-Homemade pasta. Not impressed. Pompano Beach.

Flamingo Grill-Boca Resort-Major Food Group is losing its luster.

Today’s theme is a fun one. A reader asked me what my goal was with the Rosen Report. I feel the world is filled with bad news, crime, death and divisiveness. I want my readers to have a little fun and I am willing to share things that are embarrassing to help folks crack a smile before we go into all that is going on in the world. Yes, I want to entertain, educate, inform and stay connected to my readers, too. As always, feedback is appreciated.

Markets

Buy Now Pay Later/Consumer

Private Equity Scrambling to Monetize with Limited IPO Market

Best States

Barry Sternlicht on What is Holding Miami Back

Housing Slowing

Multi-Family Troubles

More Office Stress with NYC Example

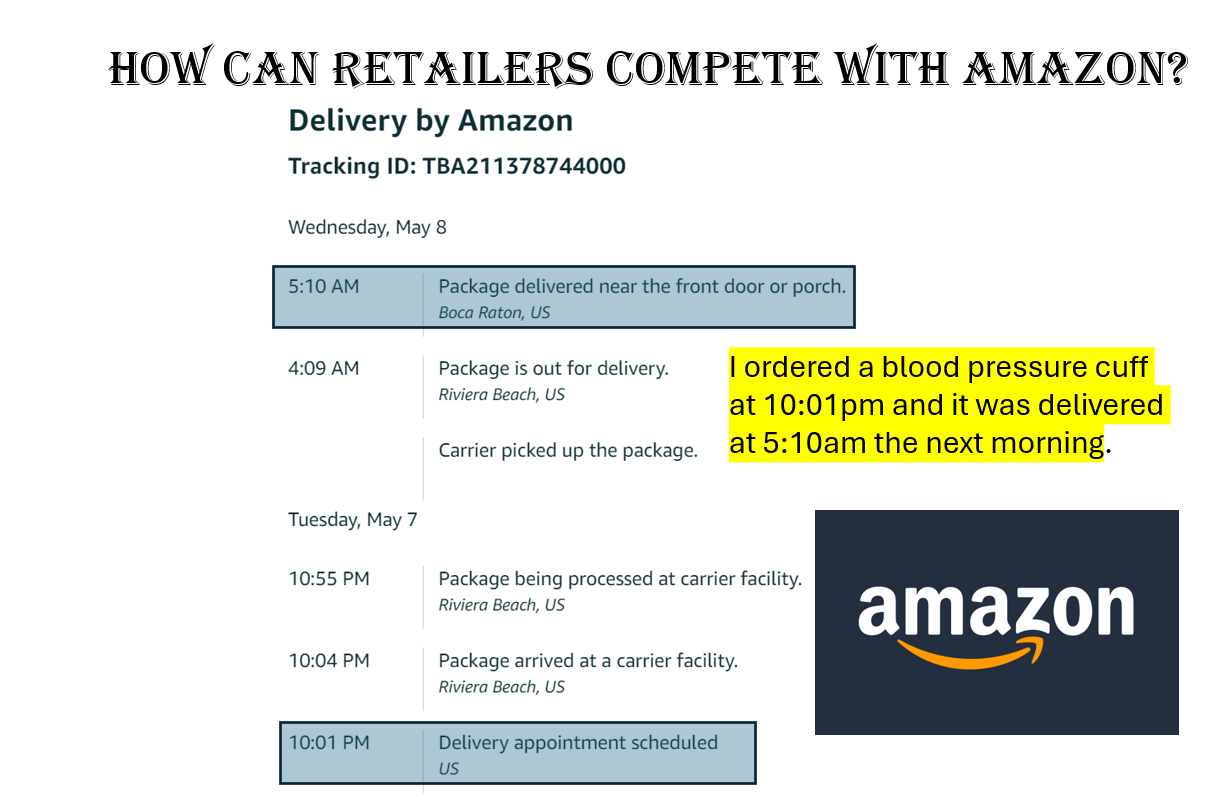

Picture of the Day-Amazon Dominates

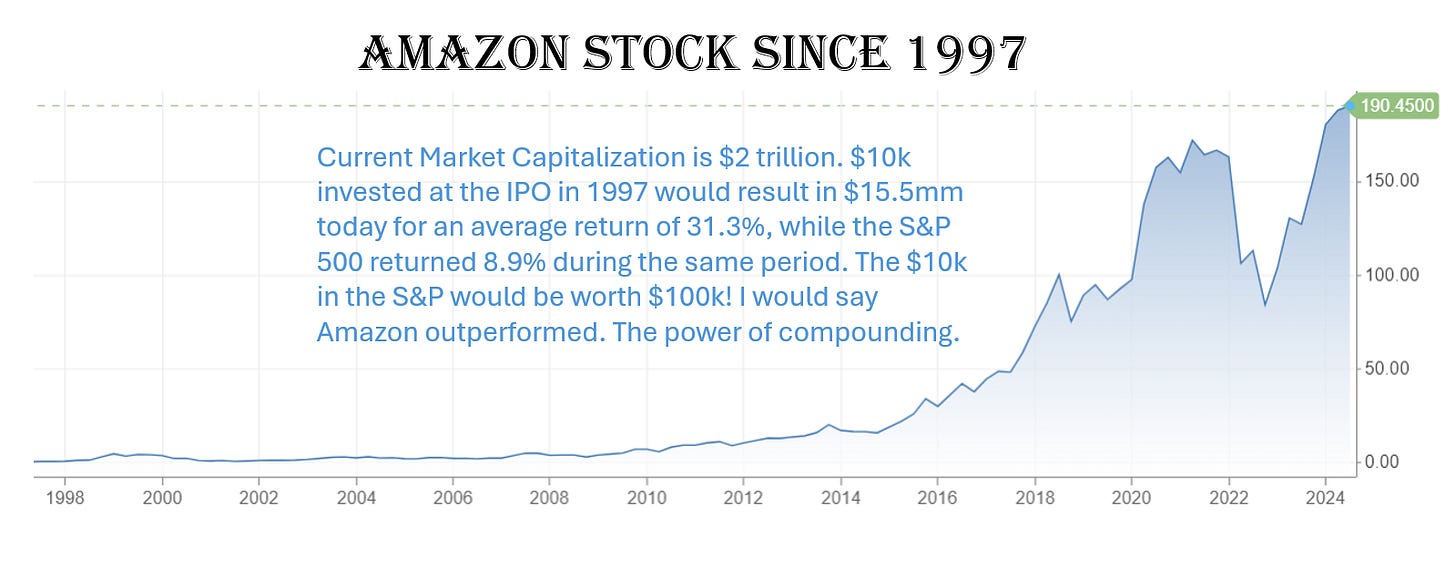

In a shocker, my blood pressure has gone up in recent months despite being in excellent shape. I ordered a new blood pressure cuff at 10:01 pm on a Tuesday and it arrived at my home at 5:10 am the next day. Amazon is the most disruptive company of all time in my opinion. Yes, TSLA, Apple, Google, MSFT, Walmart and OpenAi get a special mention. How can a retailer compete with Amazon? The price was cheaper than a store and it came in hours without me having to leave the house. I can return it for free with no questions asked. $10k invested in AMZN in 1997 is worth $15.6mm today, while $10k invested in the S&P 500 is worth $100k. The power of compounding.

My 1990 Line Dance In College

My Instagram Reels addiction has me watching some of the crazy dance moves kids do today and it got me thinking about my fraternity line dance from 35 years ago. I tracked down a fraternity brother, Chris, who had an old DVD copy of the embarrassing dance. Remember, it was shot on old video technology, so the quality is hardly 8k, but you get the idea. The contest was held at a nightclub called, “The Moon.”

The event was a Pi Beta Phi Fraternity Review Line Dance, and as a Theta Chi fraternity member, I was one of the 8 dancers. In a funny situation, I was also on the fraternity basketball team and there was a playoff game the night before the dance competition. The choreographer of dance had a mandatory practice and I showed up late due to the basketball conflict. As the team’s point guard, I could not miss the game. Hardly NCAA Final Four material, but fun none the less.

The “dance captain” was upset at my late practice arrival and moved me from the front to the back the night before the show. Given it is blurry, I was the 2nd from left on the screen and yes, I had a pony tail. You cannot make this up. I think my shirt would have fit Shaq, but that was the look at the time. I edited the full video down to 2:30 so it is watchable. Watch it if you can handle it. I found it shockingly painful but had a few fun moves for the world to see.

We came in 2nd place but recall having a good time and can laugh about it now. I hope you enjoy the short video and I guess I had a couple moves back in the day. I cannot believe I ever thought my hair was a good look, but clearly times and trends change. This was a photo of a Halloween party the year of the dance. It was taken in my apartment prior to a Chippendale’s themed Halloween party. YES, that is my hair all the way down my back. The ultimate mullet. Mike, were you supposed to be a matador?

Quick Bites

Weekly jobless claims increased to 231k or +22k from the prior week in what could be a sign of a slowing economy. The weaker data helped fuel a stock rally as hopes of rate cuts were back on the table. Treasury yields fell 1-3bps on the news as well. Consumer sentiment from the University of Michigan fell to 67.4 from 77.2 the prior month with concerns around inflation, unemployment changes and interest rates. Fed representatives Logan and Bowman both suggested they do not support rate cuts in 2024 while Kashkari wants to hold rates steady for an “extended period.” Treasury yields were higher Friday with the 2-year +6bs to 4.87% and the 10 year +5bps to 4.50%. On the week, the Dow gained 2.1% (up for 8 straight days). The S&P 500 and the Nasdaq were higher by 1.8% and 1%, respectively. Oil fell back to $78/barrel on the higher for longer fears on rates. The VIX has dropped down to 12.5 from 19.5 a few weeks ago.

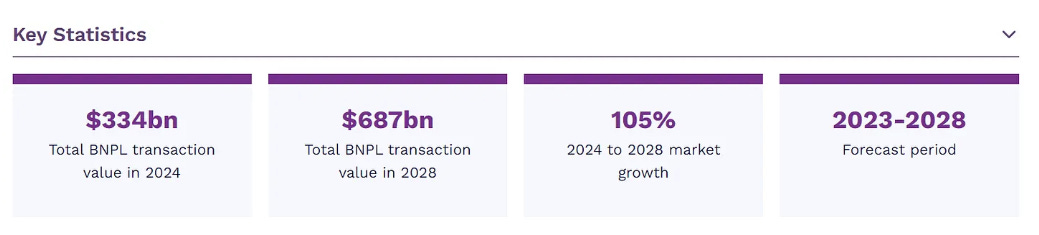

I have been very critical of the consumer and the lack of fiscal responsibility. I have written extensively about crashing savings rates (below pre-crisis levels), growing debt levels and my hate of Buy Now Pay Later (BNPL) programs driving the instant gratification society. "A recent survey conducted by Bloomberg News by Harris Poll found that 43% of those who owe money to BNPL services said they were behind on payments, while 28% said they were delinquent on other debt because of spending on the platforms." "More than half of respondents who use BNPL said it allowed them to purchase more than they could afford, while nearly a quarter agreed with the statement that their BNPL spending was 'out of control.' Harris also found that 23% of users said they couldn't afford the majority of what they bought without splitting payments, while more than a third turned to the services after maxing out credit cards. Finally, of note, "About 42% of those with household income of more than $100,000 report being behind or delinquent on BNPL payments," So it’s now impacting middle income consumers. BNPL lenders apparently do not provide data to the credit bureaus which hides the true credit condition of many consumers. In other words, not only do we not know just how big the BNPL problem is, it is actively masked by credit agencies which can't accurately calculate the FICO score of tens of millions of Americans, and as a result their credit capacity is artificially boosted with far more debt than they can handle... and that's why the US consumer has been so "strong" in recent years, defying all conventional credit metrics. Wealth is created by saving money and investing it wisely, allowing the power of compounding to grow your investments. Buying frivolous crap will not help you to generate wealth. I drive a $50k Kia for goodness sakes.

I thought this Bloomberg article entitled, “Private Equity Scrambles to Find an Alternative to IPOs to Unlock $3 Trillion,” had good data. As the market for initial public offerings bounces back after two lifeless years, investors who’ve been impatiently waiting for their payoff are finally getting some returns. But the revival hasn’t come fast enough: Behind the scenes, the private equity shops are saddled with bulging portfolios — and the banks and exchanges that make millions helping companies go public — are still scrambling to come up with alternative exit strategies. The reasons: A return to true health in the IPO pipeline could take until next year, and a record $3.2 trillion was tied up in aging, closely held companies at the end of 2023, Preqin data found. That’s a problem for private equity, which relies on the cycle of raising money to make acquisitions, exiting via a sale or IPO and then returning money to investors — before ultimately asking for more funds to do it all again.

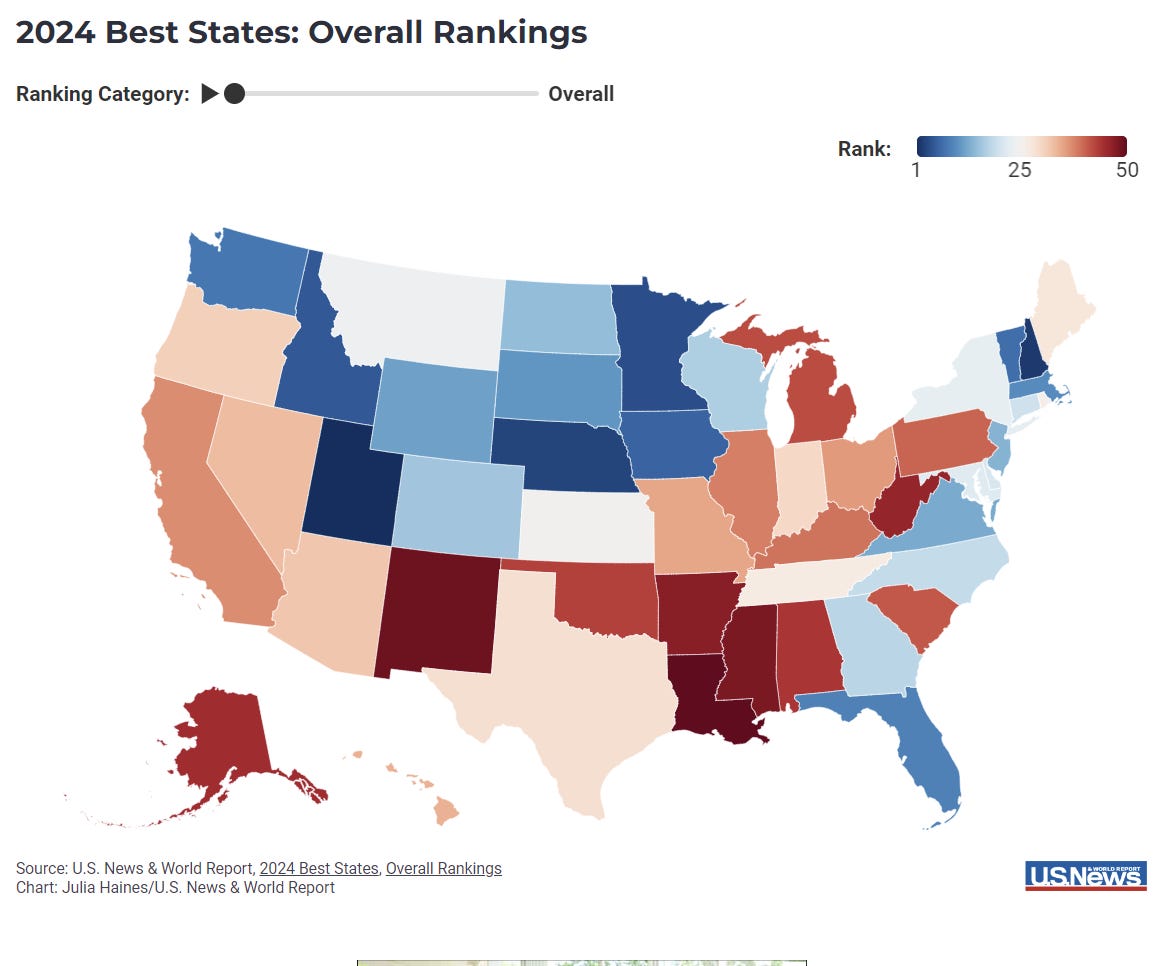

Great US News article which ranks the best states. First launched in 2017, the Best States project ranks states based on their performance in the areas of health care, education, natural environment, opportunity, economy, crime and corrections, infrastructure and fiscal stability. The analysis encompasses thousands of data points across 71 metrics in eight categories to capture how the 50 states serve their residents. As was the case in 2023, Utah’s consistency helped make it king: The state landed in the top 10 in five categories measured by U.S. News, peaking at second in education followed by No. 3 finishes in both economy and infrastructure. A common factor among the highest-ranking states was a relatively strong performance in categories containing various types of economic indicators. More than half of the top 10 states were among the top 20 performers in each of the economy, opportunity and fiscal stability categories. Overall, NY is 23 and CA is 37, IL is 38 while FL is 9. There is an interactive link in the article to show the states that rank best for each category.

Israel/Middle East

The news out of the Biden administration not to supply weapons for Israel’s offensive on Rafah makes it crystal clear to me that he does not stand with Israel or Jews. He is more concerned about the Muslim vote in swing states. Again, please listen to Scott Galloway and the double standard for Israel. The allied forces killed millions of Japanese and German citizens in WWII when the world population was 1/3rd the size of today. Biden is fine giving aid to Ukraine despite Russian civilian deaths and an incredibly corrupt government. Think of the messaging the Biden Administration is giving Hamas and Iran by not supporting Israel. The “Squad” members are hailing Biden’s Israel weapons pause and say, “Protest is working.” Also of note, more than two dozen House Democrats blasted Biden on Israel. Biden, is this really the message you want to send? Remember, in this 30 second video in 2016, Biden said, “we will never ever ever abandon Israel,” and in 2023 he repeated a similar comment. Biden voted for the US to go to war in Iraq and Afghanistan where over 350k civilians were killed. Now, he claims he was opposed to both despite his voting record saying otherwise. I thought this headline was interesting from Senator Cotton (Harvard/Harvard Law), “Senator Calls for Impeachment of Biden for Withholding Israel Aid ‘Based on the Trump-Ukraine Precedent.’ Any civilian death is a tragedy, but sadly, I do not believe Hamas has given Israel a choice. Death is the cost of war. Great piece by Victor Hanson entitled, “Try a Little Honesty About Israel,” that I am in agreement with.

Biden donors rage over his pledge to pause weapon shipments to Israel: 'Bad, bad, bad decision'

Palantir CEO: College protests are 'full-on regression from below our Constitution'

Jewish Businessman Gunned Down In Egypt In Suspected Terror Killing

Hamas has unleashed global hate on Jews. It is amazing that so much anger was brewing beneath the surface and Hamas unlocked it.

Other Headlines

Bad-Loans Hit Record-High As Used-Car Prices Suffer Worst Bear-Market Ever

Also cited in the article is sharply higher auto insurance costs and higher borrowing costs.

China’s Factory Glut Alarms the World But There’s No Quick Fix

Airbnb beats earnings expectations for first quarter but offers weaker-than-expected guidance

Stock -9% after hours.

Jim Simons, billionaire quantitative investing pioneer who generated eye-popping returns, dies at 86

The Medallion Fund had annual returns of 66% from 1988 to 2018 which is the best of all time. Simons was a genius and a quant pioneer after going to MIT. He was not a fundamental investor. “I have no opinion on any stocks. ... The computer has its opinions and we slavishly follow them,” Simons said in a CNBC interview in 2016. I believe Stan Druckenmiller was the best investor but Simons had the best performing fund. My friend, Ted Merz, wrote a great piece on Simons, “Guided by Beauty.”

Chip designer Arm’s shares drop after lackluster revenue guidance

Roblox shares drop 22% as company cuts annual bookings forecast on muted player spending

Robinhood climbs after reporting record earnings for first quarter

Hollywood bracing for its worst summer at the box office since 2000 as experts predict $1B falloff

Fitness startup that Peloton once tried to buy is growing as workout trends shift

Wall Street banker’s death at 35 ignites firestorm over alleged grueling 100-hour workweeks

Horrible story and the suggestion was the long hours led to “acute coronary artery thrombus” killing the former Green Beret, Leo Lukenas III.

Boeing is an unmitigated disaster. The stock is down almost 50% over 5 years, while the S&P is +91%.

As Senator Menendez’s Corruption Trial Set To Begin, Speculation Swirls Around Independent Bid

A reader pointed out that I have published more on Santos (R) than Menendez (D). I did not have time to check about how many times each were mentioned, but I want to be clear. Both are scumbags who should not hold office. Menendez should be in jail.

Denver migrants refuse to leave encampment, send mayor list of demands

So, you have broken the law by entering the US illegally and now continue to break the law. You are also making demands that will require U.S. taxpayers to lose services.

Raging Harlem mob surrounds suspect in attack on 11-year-old, woman – as NYPD cops protect him

NYC is failing law-abiding citizens with soft-on-crime policies.

WNBA Franchise Announces 'Unprecedented' Tickets Move For Caitlin Clark

According to Sports Pro Media, ticket sales have skyrocketed 93% from last season on StubHub. Average ticket prices have jumped 80% for Fever games. Teams have also shifted venues to accommodate high demand when Clark plays. The LA Sparks recently announced a move to Crypto.com Arena, home of the Lakers, for their May 24 home game against Indiana. WOW!

Just 4% of current retirees say they are ‘living the dream,’ survey finds. Here’s why

Comfortable-44%, Not Great-34%, 15%-Struggling, 4% Living the Nightmare. We have a serious issue with rising costs, fixed incomes, people living longer without adequate nest eggs.

Home insurance premiums soar 55% – here's how you can mitigate rising costs

I strongly recommend you reach out to my sponsor, Lang Insurance (866.964.4434) to help you with the property and casualty needs in all 50 states. He saved me money and dozens of readers have signed up with him.

Hospitals Are Refusing to Do Surgeries Unless You Pay In Full First

Here are the ultra processed foods you most need to avoid (30-year study)

Neuralink’s first in-human brain implant has experienced a problem

Dementia cases are on the rise — avoid these 12 risks to keep your brain healthy

Zuckerberg is a Climate Change activist, yet owns a new 287-foot mega yacht

If you want to yell at me about the climate, then practice what you preach. Leo DiCaprio flies privately to accept an award on climate initiatives. It is just disingenuous. Do you understand the carbon footprint of a private plane or 3,00ft yacht? Video of the new yacht. Bezos’ yacht contributes 7,000 tons of carbon annually, but it is a bit larger than Zuck’s ship.

Paul McCartney Hilariously Responds to Fan 60 Years After She Tells Him She ‘Loves’ Him

Your vacation was ruined, and the company apologized — with a heartfelt note written by ChatGPT

AstraZeneca withdraws Covid vaccine worldwide after admitting it can cause rare blood clots

Not a ton of press on this touchy subject.

Miss Teen USA resigns days after Miss USA steps down. What's going on with the pageants?

Serious accusations against the organization responsible for the Miss USA pageants. What they put these young women through was ridiculous.

Photos from across the globe show spectacular displays of the aurora borealis

Video of aliens spotted in Vegas is totally ‘authentic,’ expert says

Sadly, I have never seen a UFO or alien. I remain convinced it is impossible that we are alone. This link has a video of the kid who called in the incident and the cops claim they saw something falling from the sky. There is a perfect circle in the backyard of the house in question. Aliens, I want to be abducted so I can write about it. In FL for 3 weeks, then NYC and Hamptons. Follow the Rosen Report and you will know exactly where I am at all times to safely abduct me and show me your leader.

Real Estate

Great Bloomberg article entitled, “Barry Sternlicht Says Miami Is Hamstrung by ‘Impossible’ School Access,” and addresses a topic I have discussed many times. The two major issues in South Florida today are affordable housing and access to private schools. “There are a lot of companies that would move down if they could get their employees’ kids into schools, which is impossible,” Sternlicht, the chairman and chief executive officer of Starwood Capital Group, said in an interview with Bloomberg Television’s David Westin. “I don’t think Miami has peaked. I think Miami and Florida have cycles because they get overbuilt, but they’re ever-higher cycles. You just have to have stamina to stay with it.” Sternlicht also suggested that Citadel has the power to make Miami a financial capital. Barry lives in Miami on N Bay Road right near his office. He is among the best R/E investors of our time and interesting and outspoken. He has an amazing new building going up in Miami Beach called the Perigon with some units going for $3.5-4k/foot with one PH as high as over $7k/ft. The building will be delivered in late 2026. This is a 20 minute interview of Sternlicht giving his take on R/E today.

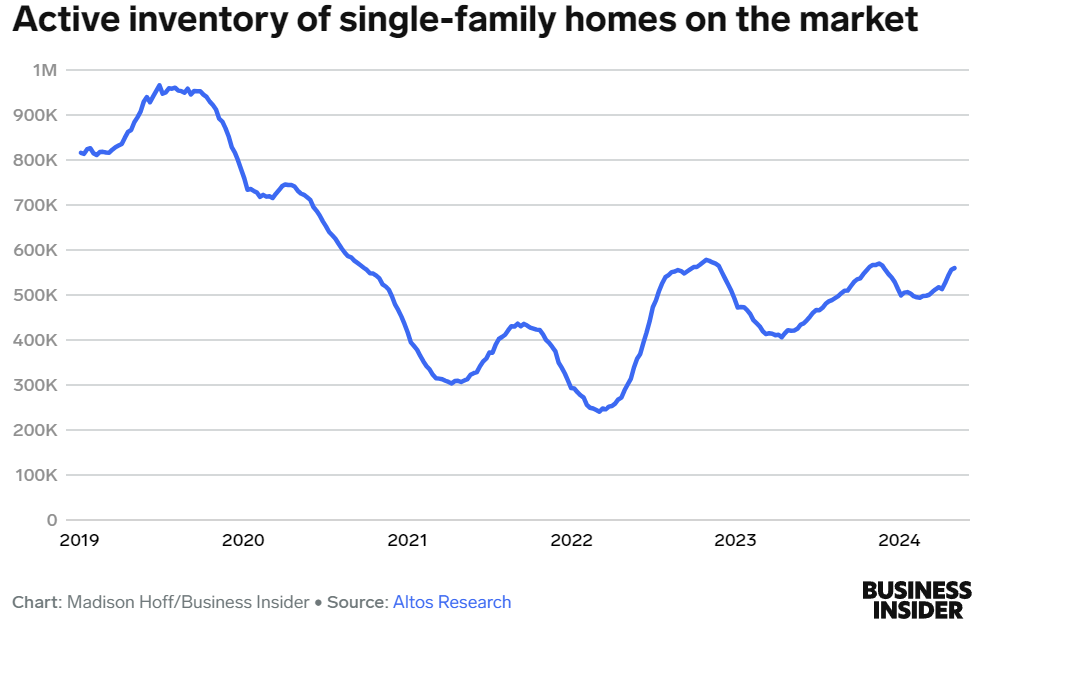

Good Business Insider article entitled, “Home Sellers Are Facing A Summer From Hell.” The past few years were very good to people who decided to sell their homes. The massive relocation shuffle meant most homes hitting the market were the subject of bidding wars. Rich baby boomers jumped in with all-cash offers, and sellers scored huge windfalls as weary buyers pushed prices to new heights. There was no question who had the upper hand. Now, sellers' fortunes are changing. Home prices are still rising at a modest pace around most of the country, but gone are the days of throwing up a for-sale sign and waiting for the feeding frenzy to begin. As buyers' options slowly increase, sellers may have to slash asking prices or wait longer for a viable offer to come along. Today's home shoppers aren't so willing to pass on inspections or give up other contingency rights to expedite a sale, either. Unlike their predecessors at the height of the pandemic, buyers can now afford to kick the tires before jumping into a deal. Most painfully, mortgage rates have spiked to 7% from their record lows of less than 3% in 2021, which has not only deterred prospective buyers but also changed the calculus for many sellers. Since most people have to turn around and buy another property to live in, even the ones who profit handsomely off a sale are finding it hard to upgrade their digs, given the increased borrowing costs. It's shaping up to be a cruel summer for sellers who aren't ready to come to terms with this new reality.

This is another concerning Real Deal article about the mutli-family space. Remember, rents have sky rocketed. However, floating rate debt, coupled with higher insurance and labor costs have hurt landlords. Arbor Realty Trust, a prominent multifamily lender, is working to put out fires across its loan books as its borrowers struggle to survive higher interest rates. The New York-based real estate investment trust modified almost $1.9 billion in loans in the first quarter to help borrowers facing “financial difficulties,” according to a quarterly report filed with the Securities and Exchange Commission. Arbor modified 39 multifamily bridge loans by extending maturity dates and giving borrowers temporary rate relief. In exchange, some borrowers agreed to pay down principal, buy new rate caps and deposit more cash into reserves for renovations or interest rate jumps. On about $1.1 billion in loans, borrowers put more cash into the deals — but only about 4 percent of what they owed. At the end of March, Arbor had about $465 million in non-performing loans, meaning at least 60 days past due. That’s up about 70 percent from the end of 2023, according to financial filings.

Bloomberg article entitled, “One New York Office Building Shows the Stress in the $20 Trillion Commercial Real Estate Market,” paints a challenging picture. The serious delinquency rate for office loans reached 7% in April, its highest level since early 2017, according to data from JPMorgan Chase & Co. That jump was driven in part by the $400 million loan backing 1440 Broadway, and which was bundled into a commercial mortgage-backed security (CMBS) known as JPMCC 2021-1440. Below outlines 1440 Broadway at underwriting and then today. Note it went from 93% occupied to 58%.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #681 ©Copyright 2024 Written By Eric Rosen.

100% cant believe it was almost 35 years ago. I remember it like yesterday. The first day we moved into the apt and our moms left us. We were so scared!

Ha! So funny - that line dance was epic! I can't believe we left the house looking like that, lol. Theta Chi shenanigans. Good stuff!