Opening Comments

My last note was about a fun night in NYC despite a bad meal. The most opened links were the All-In Podcast interview of Donald Trump and the armed robbers stealing a $100k Rolex outside of Carbone in NYC.

Yes, I was in the Bahamas for a few days, and I caught a lot of fish. Sadly, there was no epic catch. Our target species were yellowfin tuna, and despite finding lots of birds feeding on bait, we were unable to hook into any big yellowfin. Just a lot of small to mid-sized fish (snapper, kingfish, tuna, mackerel, shark…). We had a great time despite challenging weather. I am now back around NYC and the area for a while, bouncing between the city, Hamptons, near Cape Cod, Pennsylvania and Nantucket.

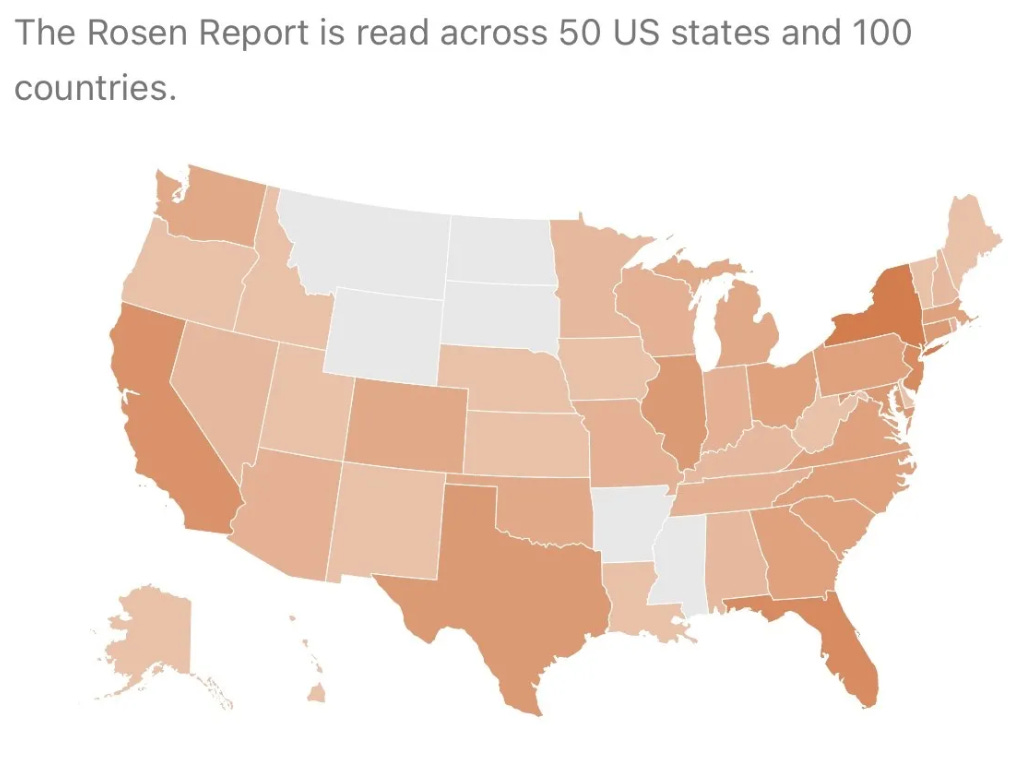

The Rosen Report keeps growing thanks to your help. It is now read in all 50 states, and we just hit 100 countries. Thank you for spreading the word, as the growth has been 100% word of mouth after I started this newsletter by inviting 18 people to read it in February of 2020. I am humbled by what the RR has turned into with your help and support. Also, so many readers send me story ideas to help me come up with topics for the report. Thank you.

Markets

Nvidia

Deficits

Jane Frazer at Citi

NYC Retail Rent Update

Canadian Pension R/E Losses

NYC Commercial R/E Examples (Office/Apartment)

Picture of the Day

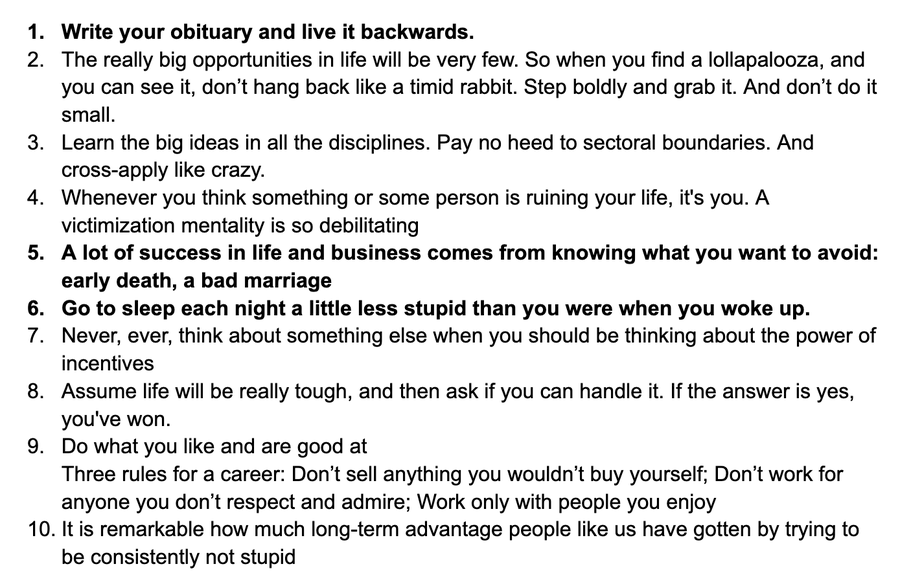

A reader, Beau, sent me this Tweet about Charlie Munger. Hard to argue these points. Learn from a brilliant businessman by reading the 10 thoughts. The bold sections were done by the original creator, Adriane Schwager.

Sorry Tom, There is a New GOAT In Town

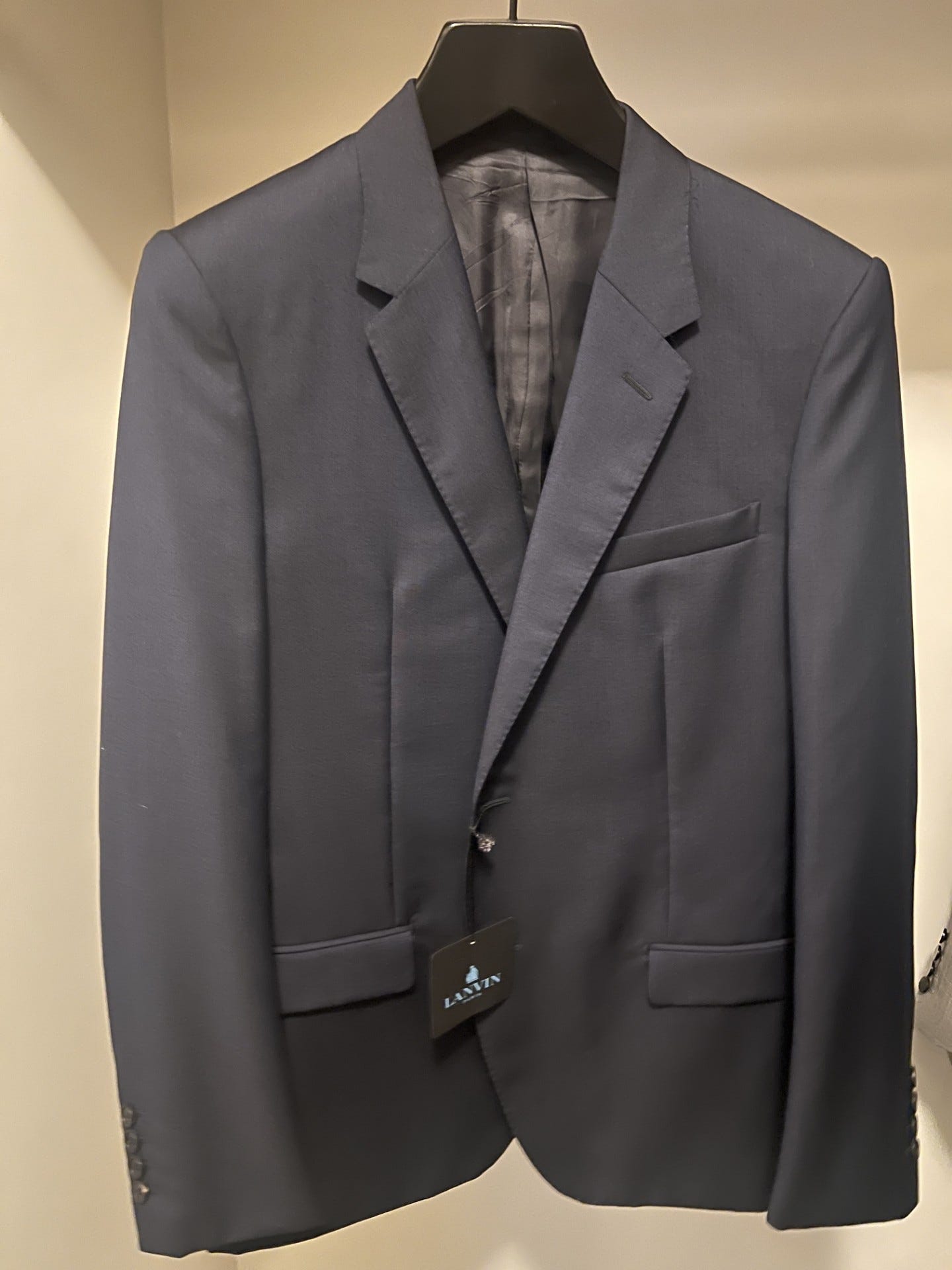

I am often called the Tom Brady of sale shopping and have written about this topic too many times to count (“You Had Me At Clearance Sale,” “Legend at the Clearance Rack,” etc.). But after this week, I no longer believe comparison is fair. Not to Brady, but to me. He is the GOAT of football and quaterbacks for sure. But a recent incident in NYC may have elevated me beyond GOAT status. Yes, just when I thought my sale shopping dominance could not get any greater, I was able to achieve yet another level.

I had a great lunch at JPM a couple weeks ago with my friend, Shira, and as I walking back to the 3i Members offices in Midtown, I saw a sign about designer fashions at closeout prices from a store named “Mad Under.” My heart started pounding, as I know that meant I needed to get my game face on, as I briskly walked towards the store (briskly walking toward a sale for me is akin to Usain Bolt running a 100-meter race in the Olympics.)

I had been to the store on 44th just East of Madison once before and it was not great, but inventory changes. I went to the men’s section and there were a lot of hangers that said “Lanvin” on them. It is a very expensive French brand of clothes. I asked a salesman to show me every blazer in my size from Lanvin. One minute later, he came out with eight blazers. A few were just not my coloring, but I quickly picked out three that fit me perfectly.

Just to recap, I had been in the store less than 5 minutes and already found $13,000 worth of clothes that I would be buying for $1,600. Yes, you saw that right. I am that good. Mortals get a decent blazer for $500, but the best sale shopper ever always gets the best of the best for that price. As a result, I proclaimed to the salesperson, “I am the greatest sale shopper of all time; Brady has nothing on me.” Well, a woman nearby had the audacity to try to compete with greatness. She said, “No chance you are better than me,” which was akin to waiving a red flag in front of a bull. You just don’t question Eric Rosen when he is clearance sale shopping. You don’t trash-talk Michael Jordan on the basketball court, either.

I said, “Let me be clear, I have not been here 5 minutes and have $13,000 locked up for 85% off. I negotiated one blazer that was on sale for $900 from $6,500 down to $550. Yes, champions have no limits to their greatness. She left sulking.

I then found a pair of Isaia suede sneakers from Italy that are generally about $1,000. I got them for $200. The suede is like butter, and they are very comfortable shoes.

In short order, I had my three Lanvin Blazers that fit me like a glove and a great new pair of kicks for a total price of $1,900 including tax. It would have been unfair to others for me to stay longer, so I left.

Going forward, I will be offended when I am compared to Brady with respect to my shopping skills. Yes, he is great and the GOAT in football for all the obvious reasons, but it is official now. I am at another level. My shopping skills are equivalent to 10 Super Bowls where I won the MVP for all of them. Sorry, Tom, there is a new GOAT in town, and he also knows better than agreeing to be roasted.

Quick Bites

All non-bolded text below is excerpted from the cited articles. Bold are my thoughts.

Stocks have been inching higher. The S&P is now +15% and the Nasdaq is +19%. Fedex stock jumped 14% after announcing massive cost-cutting measures. Levis announced after the bell and disappointed pushing the stock -10%. Amazon hit $2 trillion in market cap of the first time and has joined Nvidia, Apple, Alphabet and Microsoft of stocks worth $2 trillion or more. Bitcoin is approximately $62k, but still down from the recent $72k levels.

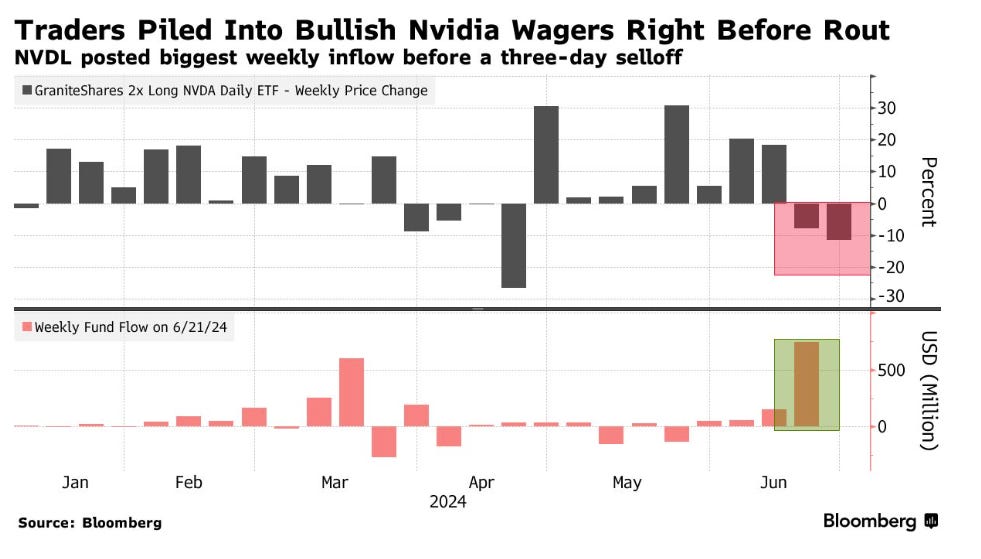

I have written about performance chasers and concentrated bets and discussed it during my Bloomberg interview. This Bloomberg article is entitled, “Wrong-Way Leveraged Nvidia Bet Lured $743 Million Before Rout.” The GraniteShares 2x Long NVDA Daily ETF (ticker NVDL), which delivers double the daily return of the Jensen Huang-run company, saw a record $743 million inflow last week as investors sought to amplify gains in what has been dubbed the world’s “most important stock.” The timing has proven inopportune, as the fund has tumbled about 22% since Tuesday’s close. It’s still up around 340% in 2024. These levered ETFs look brilliant when they work….until they don’t. Be careful. No need for ultra leverage. Slow and steady wins the race on investments. Nvidia slides 13% in three days after briefly becoming most valuable company. . This does not mean that Nvidia is a bad company. Nvidia is an amazing company with massive margins that is changing the world. This is a comment on concentractions and taking levered bets on situations. As an aside, Nvidia has rallied nicely since the sell-off. Jensen Huang (Nvidia CEO) spoke about rising competition at the shareholder meeting.

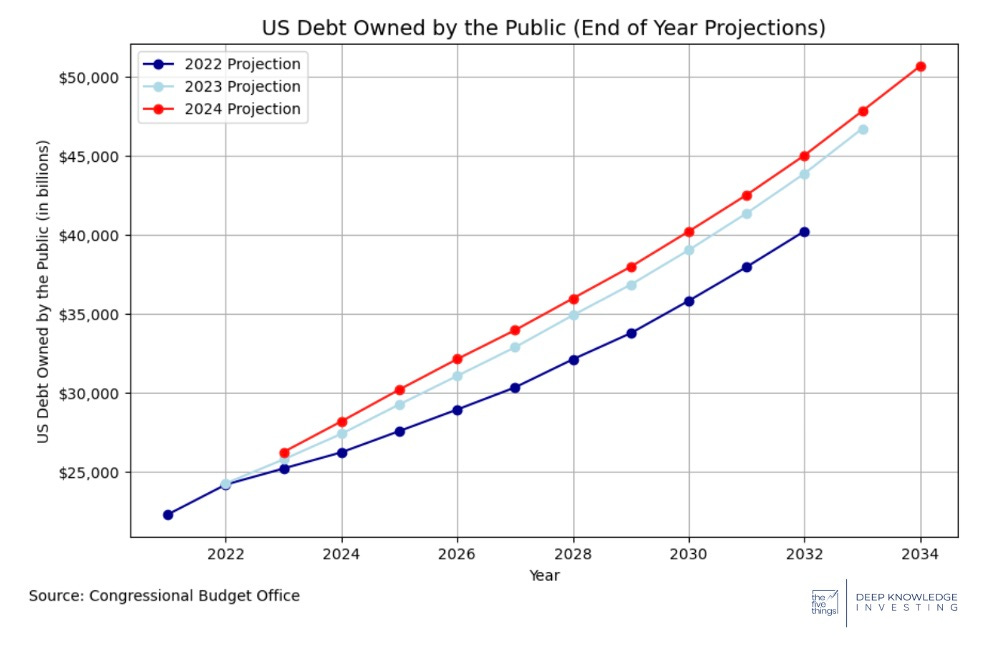

Has anyone written more about deficits, fiscal irresponsibility, and entitlements than I have over the past few years? I have questioned the Congressional Budget Office (CBO) and their ability to forecast, suggesting their deficit projections would be far higher than anticipated. The CBO has dramatically revised its deficit projections, and now expects a surge from $1.5 trillion to $1.9 trillion for this year. New legislation, foreign aid, massive stimulus spending, and skyrocketing interest expense are all contributing to consistently higher debt and deficit expectations. Congress has elected to fund this spending with debt that leads to increased future inflation in order to deflect blame from their desire to throw money at anything that could win them a few more votes in November. The Federal government has a spending problem. Free money, handouts to every country that asks, bad policies, massive cost overruns on projects, horrible bills filled with pork, entitlement spending… the list is endless. When stock markets are elevated, housing prices are at highs, and unemployment is at lows, we should be running a surplus. Nope. Instead we run $2 trillion in deficits. What happens during the next recession if we run 5-6% deficits as a percent of GDP when things are going well? Another consistent theme is that the CBO seems to upwardly revise the deficit numbers with regularity.

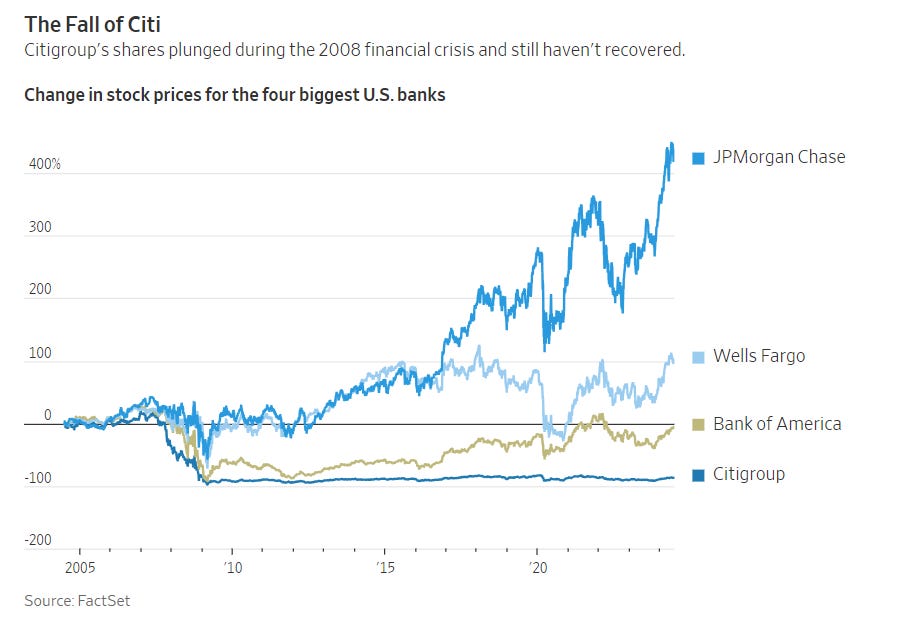

This WSJ article is entitled, “The Clock Is Ticking on Jane Fraser’s Citigroup Turnaround.’ Having worked in the banking industry from 1992-2012 before launching a hedge fund, I feel I have some knowledge on the topic. In the early 90s, Citi was the giant and viewed positively as a global powerhouse. A series of major misteps, five CEOs is about 25 years, susbstantial turnover in senior talent, regulatory issues, and bad leadership have caused the stock to be a massive under performer. The chart tells you all you need to know. I have heard incredibly comical stories about the hiring of senior talent at Citi that would never happen anywhere else. I do not believe Fraser is the answer to the laundry list of problems facing Citi. Compare that to JPM under Dimon, which is the best bank on the planet, run by the best CEO. Consistent leadership, holds people accountable, a clear culture, a fortress balance sheet, and a consistent vision for the direction of the company. Let’s just say Citi cannot check those boxes.

Israel/Middle East

‘Intense’ stage of Gaza fighting is close to end, Israel’s Netanyahu says

Tyler Cherry, the recently promoted Associate Communications Director at the White House, deleted nearly 2,500 Tweets in recent days where he made anti-Israel and anti-police remarks. Read these article about this guy. He would never be in my administration with his history of Tweets.

School Apologizes For Teaching Children That ISIS Is A Terrorist Group After Muslims Complain

Chilling new video captures suspected Saudi spy filming US Capitol, National Monument before 9/11

Anti-Israel protester Anas Saleh who told ‘Zionists’ to ID themselves on subway turns himself in

Bragg, let’s make an example here to deter others.

Other Headlines

Bitcoin Extends Drop After One of Crypto’s Worst Weeks of 2024

Although BTC is +40% YTD, it hit $71k+ in May and is now $61k.

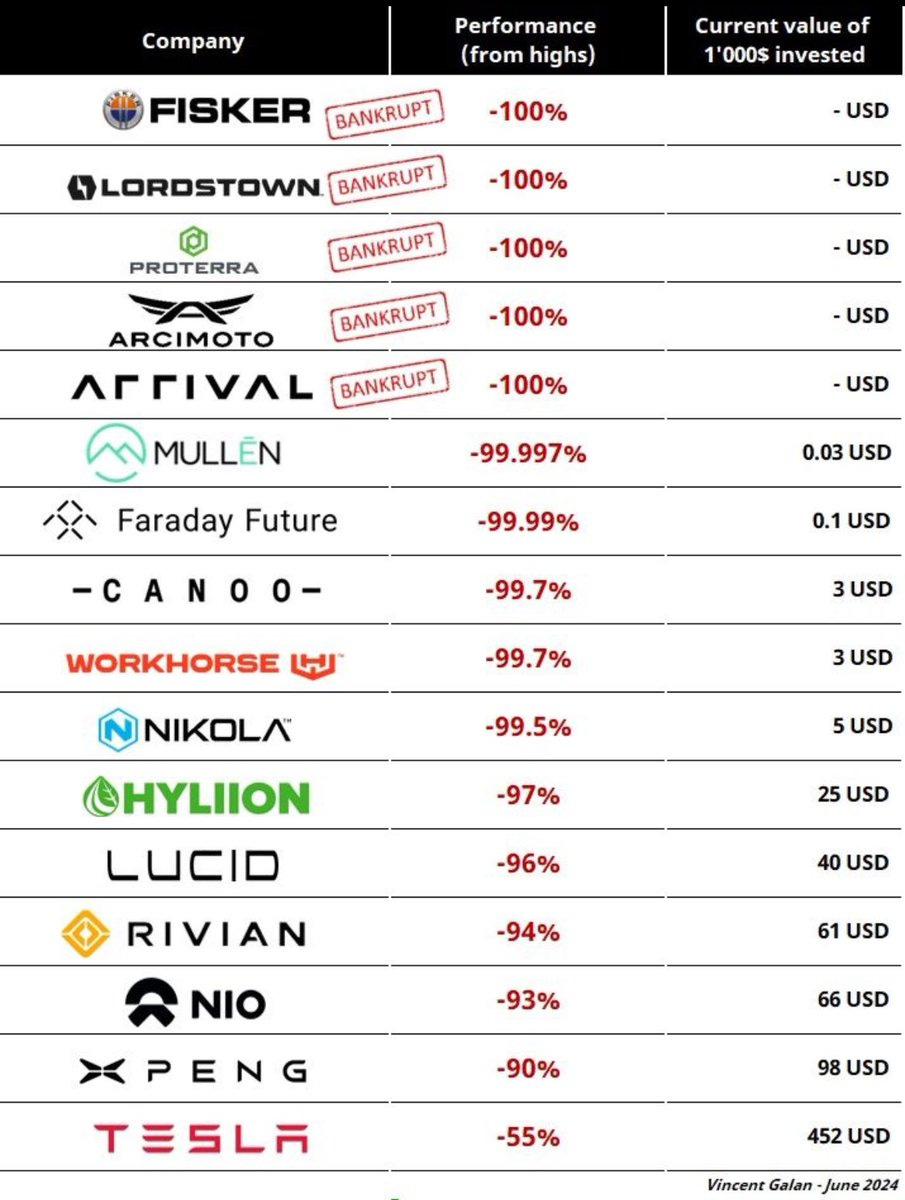

I was an early EV adopter with a TSLA for almost 7 years. However, there are so many limitations, including purchase price, cost to own, charging and range, that adoption is stalling. Of note, Rivian stock is up since this article after Volkswagen announced up to a $5bn investment into the EV maker, but remains -90%+ from the all-time high of $172 in November 2021.

Ransomware group threatens Federal Reserve—claims it hacked America’s ‘banking secrets’

The cybercrime group claims it grabbed ’33 terabytes’ of data from the Fed.

Queen's catalog sells to Sony Music for over $1 billion in record-breaking deal

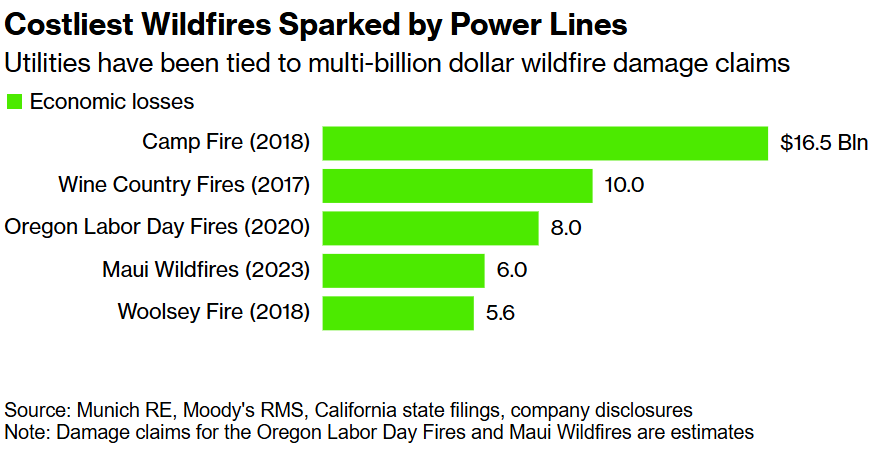

Wildfire Threats Make Utilities Uninsurable in US West

Look at the damages below. Some utilities cannot get fire insurance. What could possibly go wrong? Remember, when it comes to your personal property and casualty insurance needs, reach out to Kevin Lang who has helped dozens of readers get coverage in all 50 states (homes, cars, boats, art, umbrella policies.). Call Kevin at 866-964-4434.

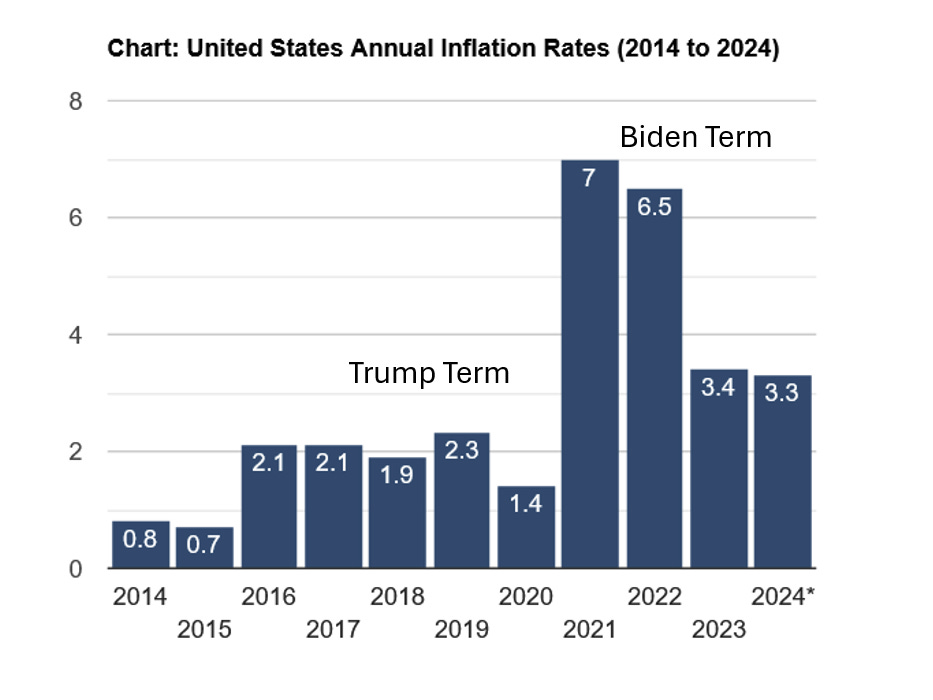

Sixteen Nobel Prize-winning economists warn a second Trump term would ‘reignite’ inflation

I find it comical that they find Biden’s policies are not inflationary but Trump’s are. This is quite partisan as was the 51 CIA personnel who signed a document that Hunter’s laptop was Russian Disinformation prior to the election. I am not suggesting all of Trump’s policies are sound and I agree that tariffs would be inflationary. Biden gives away money when it is not warranted, cancels student debt, Build Back Better would have been inflationary if passed, massive regulations under Biden are inflationary, The Inflation Reduction Act (dumb name) was inflationary, and his energy policy is inflationary as he canceled the Keystone Pipeline on day one and has vilified the industry at every turn. I am all for sound policy, but to suggest Biden’s policies are not inflationary is a joke. Look at prices under Biden of almost everything. Cumulative inflation under Trump was 7.7% and Biden is 20.2% and would have been worse if Build Back Better Passed in its original form.

Trump Media stock soars 30%, breaking weekslong decline in DJT share price

Valuation makes zero sense based on the performance of this company.

Everyone should watch the debate on Thursday at 9pm for 90 minutes. There has been a lot written about the Bias of CNN and the debate moderators. They have clearly been anti-Trump. This takes it to another level. CNN moderator, Dana Bash, has another conflict. Her husband was one of 51 CIA staff that signed the infamous letter claiming Hunter’s laptop was Russian disinformation. What are the chances CNN leaked some questions to Biden as they did for Hillary?

Rep. Jamaal Bowman, a vocal Israel critic and 'squad' member, loses primary

Good news. Bowman has been anti-Israel and Jews. The other candidate cannot be worse.

Why France’s nationalist revolution could be coming for Britain too

I wrote extensively on this topic recently. There are major ramifications of the move against the Left in Europe.

Macron warns of ‘civil war’ if far left or far right wins

Perfect-weeks before the Olympics in Paris.

New Polls Show French National Rally Forging Ahead of Macron

Gassy cows and pigs to be hit by carbon tax in Denmark in world first

Great. We should crush the food supply so people starve. Even less carbon. Watch out Ozempic, if these people have their way, there will be no food supply and you will be out of business.

Julian Assange has reached a plea deal with the U.S., allowing him to go free

A country without a border is chaos. This administration has failed America due to the idiotic border policies. Read what these animals did to a 12-year-old before killing her. Death penalty please. How many illegal immigrants have raped and killed innocent Americans? Too many.

Feds ID 400 migrants smuggled into US by ISIS-affiliated network —with the whereabouts of 50 unknown

38-year-old man killed, 2 others injured in broad-daylight stabbing on ‘out-of-control’ NYC street

Sicko tries to rape Central Park sunbather in broad daylight before her screams send creep running

NYC opening homeless shelter 5 feet from a grade school, outraging parents

Elections matter. Policies matter. Even well-meaning policies have consequences.

NYC Has the World’s Worst Traffic Congestion, Costing $9 Billion

Motorists driving through NYC lost 101 hours last year

Traffic congestion in the US cost $70.4 billion in 2023

The one trait shared by extremely successful people — and it’s a ‘muscle’ you can build

Although I do think having the ability to adapt and be flexible is very important, I am not sure it should be the #1 trait. I gave my Career Advice in a recent piece and will definitely be adding it to the list.

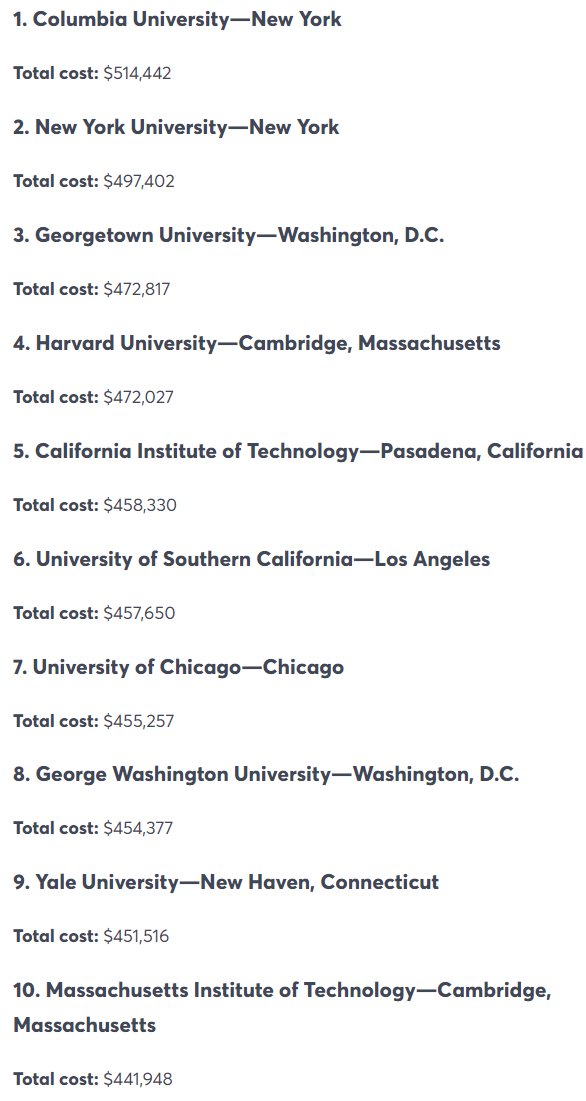

Sorry, in a lot of cases, I believe if you invested the money meant for college and gave it to kids at age 18 upon graduating high school, they would be far better off than if they were going to college. I do not see the benefit of $500k college programs for a majority of youth today. If many kids went to trade school and were given $500k, I think the ultimate outcome of career earnings and savings would surprise you.

I lost 42 pounds on Ozempic — this is the one risk I didn’t see coming

Report warns of dangers of social media bubbles, false relationships

Interesting thoughts in this article. I agree that social media is damaging for a lot of reasons.

Top-secret US aquatic drone weapon ‘Manta Ray’ spotted on Google Maps for all to see

World breaks 1,400 temperature records in a week as heat waves sweep globe

I am adamantly opposed to biological men competing against women. It is bad policy and, in some sports, dangerous.

Katie Ledecky makes history with 800m freestyle victory at US Olympic trials

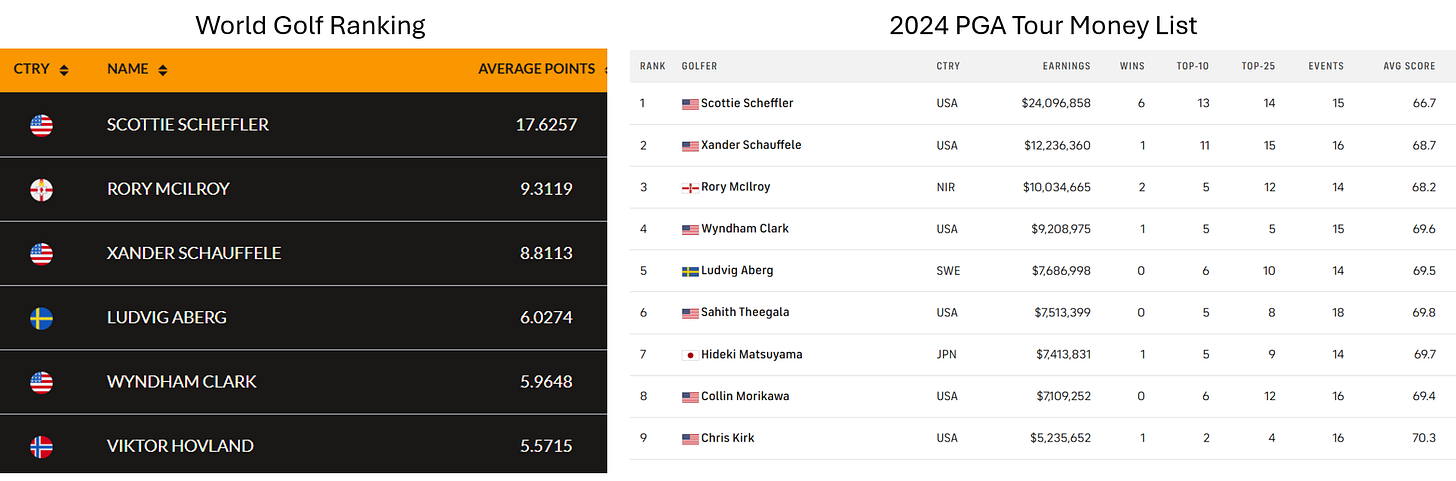

Scottie Scheffler wins Travelers Championship in a playoff as climate protesters storm 18th green

Scheffler is now the first player in PGA Tour history to grab six wins in a single season before July since Arnold Palmer did so in 1962. This is an incredible run by Scottie, including a solid showing despite getting arrested in a major. He is on pace to have one of the more memorable years in golfing history. Look at his dominance over the best in the world.

Real Estate

One of the amazing benefits of writing the Rosen Report is the access to incredibly talented and successful readers that I have befriended over the years. For this section, I called my friend, Ben Birnbaum, a Vice-Chairman at Newmark Retail Services since 2007. He is a knowledgeable on all things retail in NYC. My walks around NYC got me thinking about the state of retail, so I reached out to him with questions. His answers surprised me about some markets being stronger than I anticipated. I saw so many “For Rent” signs that I presumed things were awfu,l but learned they vary considerably by market.

A+ space in demand, except Times Square and parts of Fifth Avenue. Pricing on 5TH is still not sustainable for retailers. Supply outpaces demand even for the best space. Limited apparel demand in times square.

Madison Avenue peak was 2015 at $2,000/ft. Maxing out today at $1,200/ft with few exceptions. Prime 57th-65th Street. Coming out of Covid, rents were going for $700/ft. Covid had seen 40% availability and is now sub 10%.

Soho. Prince and Spring today $1,100/ft key intersections. High as ever. Comparable to 2015 peak. Covid lows saw $400/ft. Soho rebounded sharply. Ferrari leased Nespresso space at Prince and Mercer for over $1,200/ft. Ferrari outbid Tiffany for the space. Luxury groups killed it during Covid and are investing in iconic locations.

Fifth Avenue north of Rock Center (Coach, RL, Gucci, Victoria Secret, Nike) spent $3,000/ft from 2014-17 for annual rents of up to $30mm. Tenants are not willing to pay more than $6-7mm in annual rents today. Limited transactions completion on 5th Avenue North of Rock Center. The average rent of the limited transactions is $1,700/ft, far below peak pricing.

Fifth Avenue south of Rock Center was up to $1,000 in 2015-16, and now $350-450

Upper East and Upper West rents down 30-40% from 2015 highs.

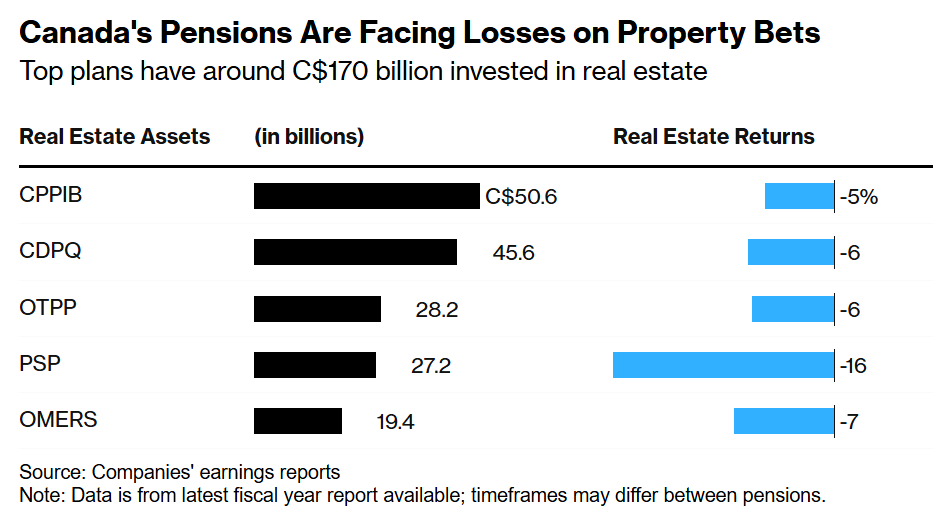

Concerning Bloomberg article outlining losses of Canadian Pension Funds due to R/E exposure. Almost no major Canadian pension manager has been spared.

The largest fund, Canada Pension Plan Investment Board, lost 5% on its property portfolio in its last fiscal year as the commercial real estate slump deepened. For the Public Sector Pension Investment Board, the pain amounted to a staggering 16% loss on those bets, the worst fiscal year performance for those investments since the global financial crisis. With the property market upended by higher borrowing costs, Canadian pensions — known for their massive real estate businesses that were the envy of the investing world for years — are feeling the sting. And it’s leading at least four major funds to now drastically retool their operations. “What’s worked famously well for the last 35 years may not work so well for the next five to 10,” Jo Taylor, chief executive officer of the C$248 billion ($181 billion) Ontario Teachers’ Pension Plan, said in an interview at Bloomberg’s Toronto office. There are a lot more losses to take in coming years, as debt maturities will lead to additional pain for real estate investors.

Here are some additional stories about NYC commercial R/E prices. The appraised value of Shorenstein Properties’ 1407 Broadway dropped from $510 million in 2019 to $136.1 million this year. The decline amounts to $334 per square foot, according to an analysis by Morningstar. It’s the latest blow for the office tower, which sits between West 38th and West 39th streets in the slow-to-evolve Garment District. In March, the special servicer on the building’s $350 million CMBS loan filed to foreclose on the debt, months after Shorenstein stopped paying interest on it.

The Swiss bank UBS and its brokers at JLL have listed the 920,000-square-foot building at 135 West 50th Street for sale on the platform. UBS owns the property through a long-term leasehold, and Safehold owns the ground underneath the building. The starting bid is $7.5 million and it’s unclear what the reserve price is. The 1960s-era Class A building is 35 percent occupied and recently underwent a $76 million renovation, according to the listing. UBS sold the property a block west of Rockefeller Center to Safehold in 2019 for $285 million.

Hal Fetner quietly scooped up an Upper East Side apartment building from the investment giant BlackRock. Fetner bought the 15-story, 174-unit luxury rental building at 85 East End Avenue for $75 million. A spokesperson for Fetner Properties declined to provide details on the deal. BlackRock, which purchased the building in 2005 from Rudin Management for nearly the same price, $75.2 million, declined to comment. So, in 20 years, the property value is unchanged. Given inflation, money spent on the building and opportunity cost, this is a bad outcome for an apartment building. If you invested $1 in the S&P in 2005, you would have $6.41 today for a 541% return or you could have bought this building and broken even. This does not consider how much might have been taken out in refinancings during the ownership of the building or the amount of money invested in it.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #693 ©Copyright 2024 Written By Eric Rosen.