Opening Comments

My last note was about my night out in Miami, largely at Carbone. The NYT reviewed all the Carbone restaurants and came to my same conclusion-that it underwhelms on the food front. The most opened links in my last note were the Ivy League psychologist sharing a mistake she made raising kids and the video of food guru, Jason Karp, talking about his Senate hearing and issues with the US food supply (must watch). A lot of people emailed me about the app, Yuka, as well.

Protect Your Data/SSNs

Due to dozens of K-1s from my private investments, I always file in October for the prior year’s taxes. I filed last week electronically and the IRS refused to accept my return, as another party had already claimed one or both of my children as dependents on their returns for 2023. This forced me to scramble to send in my return via the mail and try to figure out how someone has taken my kids’ SSN #s and claimed them as their own children. I mentioned the massive data breach in a recent report and must tell you that your data and security are at risk. Be very careful.

Markets

Largest Market Cap Companies Since 1980

Shipping Rates Normalizing

Boeing Does it Again

Vocational Jobs vs College

GS-AI Report

Uber vs Taxi Cost in NYC

Fisher Island Mansions

$33mm Brickell (Miami) Condo

Mansion Taxes

Top 5 Relatively Affordable Cities

Older Condos Continue to Face Issues (Palm Beach)

Video of the Day-Professor Billionaire-David Cheriton

What an amazing story about the Stanford computer science professor worth a reported $15bn+. David Cheriton invested the FIRST $100k into a tiny tech company called Google, as Brin and Paige were his students. The track record of the professor is remarkable. He has invested over $50mm into 17 tech start-ups. Despite his immense wealth, he has lived in the same house for decades, drives a 2012 Honda Odyssey and cuts his own hair. I had never heard of Professor Cheriton before watching this video. What a remarkable guy. His frugal ways make me look like a spender and that is hard to do.

Apple Product Thoughts-iPhone 16

I vividly remember various Apple product launches and the remarkable impact they had on me at the time. The first generation iPod came out in 2001 and was a great tool to listen to music while I was working out and going for runs. I loved it and could not imagine anything better, despite what now is technologically irrelevant today. Then I got the iPod mini in 2004 and again was in awe. This link shows all the Apple products since the first computer in 1976. Some amazing photos.

I bought my first iPad in 2011 to run my new apartment. I swear, I thought I was in the Jetsons cartoon. I could not imagine a more cutting-edge device. To be clear, I have not used an iPad for 7 years. No need, in my opinion, as the phones have gotten bigger and offer similar functionality.

I was a diehard Blackberry user and loved the raised keys, so it took me a while to get the iPhone, as I was wrongly convinced that Blackberry would be the winner. I did not get an iPhone until the iPhone 6 in 2014 and was again in shock at the user-friendly device. I will say that each successive device does not have nearly the impact that the initial units have had. Sure, the camera quality is better and there are small features, but I am never blown away by the upgrade.

I generally take three years between getting new phones, given I don’t find each successive offering. My phone had been acting up lately (version 13 Pro Max) and I decided to trade it in for the newest model, the 16 Pro Max. This is a full review of the new iPhone 16.

The iPhone 16 pro max is 6.9” compared to the 13, which is 6.7.” As a result, you need a new case and a new charger. The constant buying of new cases, charger cords and power cubes is incredibly frustrating. The new case was $50. It is a piece of plastic. I called my friend, Nick, who manufactures anything and everything in China and he told me the cost is less than $1 to make. For the new iPhones, they no longer give you a power cube. The bad news is, I have a dozen cords for my iPhone 13 that are now useless and the new cubes do not take USB, only USB-C.

In an incredibly frustrating situation, I dropped my phone 12 hours after purchasing it and cracked the screen.

Do I think the 16 is better than the 13? I do. The battery life is far better; and the screen is brighter and clearer. The new model also charges significantly faster than my 13. Although the claim is for faster processing power, I have not noticed the difference, but I do not play video games. The new and improved camera is an additional benefit, with far higher resolution than previous versions for both photos and video. The slightly larger screen is not a huge difference, but something I appreciate as I age.

Steve Jobs was a pioneer of epic proportions who changed our lives in so many ways. He was brilliant at so many things. Sadly, we have all become too reliant on his products. I want to hate Apple because they keep making me buy new phones, chargers, power cubes, and cases, however, the functionality of Apple products is too good to ignore. I will bite my tongue and continue to buy a new phone…every three years.

One major frustration: Given my tech idiocy, I always have AT&T do my transfer from the old to the new phone. EVERY time, I end up missing contacts and it happened yet again. I left my phone at AT&T for 3 hours so I could be sure to get all my information on my new device.

Quick Bites

Both the S&P 500 and Dow snapped a six-week winning streak. The former was off nearly 1% on the week, while the latter ended the period lower by 2.7%. The Nasdaq notched its seventh weekly gain, advancing nearly 0.2%. Treasury yields were sharply higher on the week, driving stocks lower. The 2-year finished at 4.11% (+13bps on week) and the 10-year closed at 4.24% (+17bps on week). Think about what the move in Treasury yields is doing to Federal interest expense.

I thought this was an interesting chart from Charlie Biello that outlines the largest market cap companies globally since 1990. I updated it for 2024. Note how few of the companies are consistent. Some of the biggest companies from 1990, including Eastman Kodak, GE, Atlantic Richfield and IBM, are no where near the top of the list today. Note all the Japanese names on the list in 1990. Eight out of the top 10 were Japanese companies (mostly banks). The largest Japanese bank today, Mitsubishi UFJ, is ranked 133 on the global list. In 2010, there were only 2 tech companies on the list and in 2024, 80% are tech. My point? You need to adapt and change and not be complacent. Management must constantly evolve and change paths to ensure continued prosperity.

Peter Boockvar does amazing things as a CIO and writes a great newsletter, The Boock Report. This is an interesting excerpt from Friday’s newsletter on shipping rates. Container shipping rates continue to drop ahead of the holidays and with port workers back to work. The Shanghai to NY route saw prices fall by $343 w/o/w to $5,266. That's well off its high this summer of $9,612 but still almost double where they started the year at $3,074.

Shocker. Boeing did it again. If there is a banana peel, Boeing steps on it. Earnings were reported this week and the quarterly loss was $6bn+. They also cannot come to terms with over 32k striking machinists, as the workers rejected the latest contract offer (2/3rds voted against). The new CEO, Kelly Orthberg, is “reviewing its various businesses.” The Starliner project lost another $250mm, bringing total losses for the project to almost $1.9bn. Earlier in the week, a Boeing-made satellite exploded in space after experiencing an “anomaly.” Let me be clear, with Boeing, these events are not longer anomalies, but have come to be expected. This link lists Boeing scandals from January through March of 2024; there are too many to name and things have only deteriorated. The company went woke instead of focusing on safety, and the stock has been pounded. We must not forget the company plead guilty to fraud when two 737 Max 8 jets crashed killed 346 people in 2018/19. Boeing stock is -55% over 5 years, while the S&P 500 is +92% for the same period. The peak market cap in 2018 was $183bn and today it is $95bn.

I have written frequently about my concerns with 4 year degrees. I do not think many students should be going that route. There are too many opportunities in vocational jobs and the economics of traditional college make less sense today in many cases. “We’re dealing with alarming math … For every five tradespeople who retire this year, two will replace them.” The link has a short video from Mike Rowe that outlines the concerns of the lack of trades people in the market. This WSJ article, “Applications to M.B.A. Programs Soar,” suggests many kids cannot get jobs and are going to additional school. Applications to M.B.A. programs increased 12% in 2024, according to a new survey of schools by the Graduate Management Admission Council, a nonprofit that tracks application trends. Renewed enthusiasm for the M.B.A. reflects limited prospects for recent college graduates despite a still-strong labor market overall. Despite having an MBA from the University of Chicago, I would recommend maybe 20% of the people considering an MBA should do it. I rarely hired MBAs in my senior roles on Wall Street.

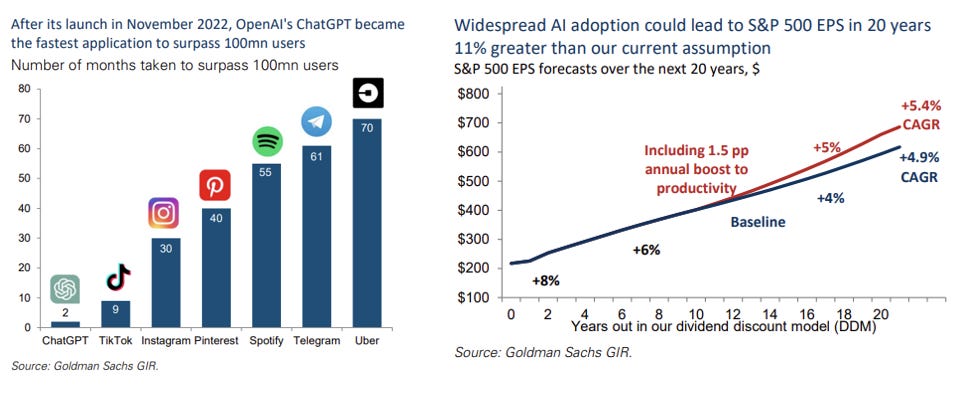

There is a good Goldman report, “Generative AI: Hype or Truly Transformative,” that was sent to me by a reader and included a lot of good data for those who want to learn more. The article has interviews with thought leaders and is worth a quick look. There are many good charts in the article. I am of the belief that AI will lead to a massive improvement in productivity over the next 5-10 years that will make companies incredibly profitable. My concern is around the displacement of a lot of workers (factory, drivers, analysts, data entry, customer service, warehouse workers and more). The new robots will replace many humans in coming years.

I have written about the insane price increases over the past 15 years for Ubers. When I lived on the Upper East Side, I could get to LaGuardia Airport for $17. Today, it would be $80. I have taken 1-mile rides in NYC for $26. My friend, Rich, sent me the pictures below. He was in NYC and Uber wanted $53 for a 3-mile ride. He took a Yellow Cab instead for $14. The CEO of Uber was stunned when he took a 2.9 mile ride for $52.

2024 Election

There are 340mm people in the United States. Approximately 125mm are 35-74 years old. In the USA, approximately 15% of the people are foreign-born. This leaves us with 107mm candidates for President of the United States. Are you telling me that the two best candidates are the clown shows of Trump and Harris? We must be able to do better than these people. It is embarrassing that the best nation in the world puts up two weak candidates.

Bill Ackman was interviewed for 30 minutes on CNBC. Yes, he is backing Trump and explains why, but he complained about the quality of both candidates near the end of the segment. My personal view based on polling data, betting markets, trends, exit polls, and recent endorsement news is that Trump will win. I did not think that was the case a few weeks ago. I feel the Harris campaign made critical mistakes by not allowing Harris to be interviewed for two months, picking Walz and supporting an open border for too long (even though she is recently suggesting a harder stance), her record as prosecutor and her flip-flopping have hurt her chances in my opinion. I think it is 70/30 in terms of Trump’s chances to win at this point. Bezos killed WaPo endorsement of Harris, and the LA Times refused to endorse Harris as well. Also, top CEO’s have cooled on Harris.

Famed polling guru Nate Silver’s ‘gut says Donald Trump’ will win 2024 presidential election

French trader bet over $28 million on Trump election win using 4 Polymarket accounts

In key swing states, the lines at food banks are growing longer

Pennsylvania officials investigating fraudulent voter registration applications in Lancaster County

Biden-appointed judge orders Virginia to reinstate noncitizen voters, GOP gov vows to fight back

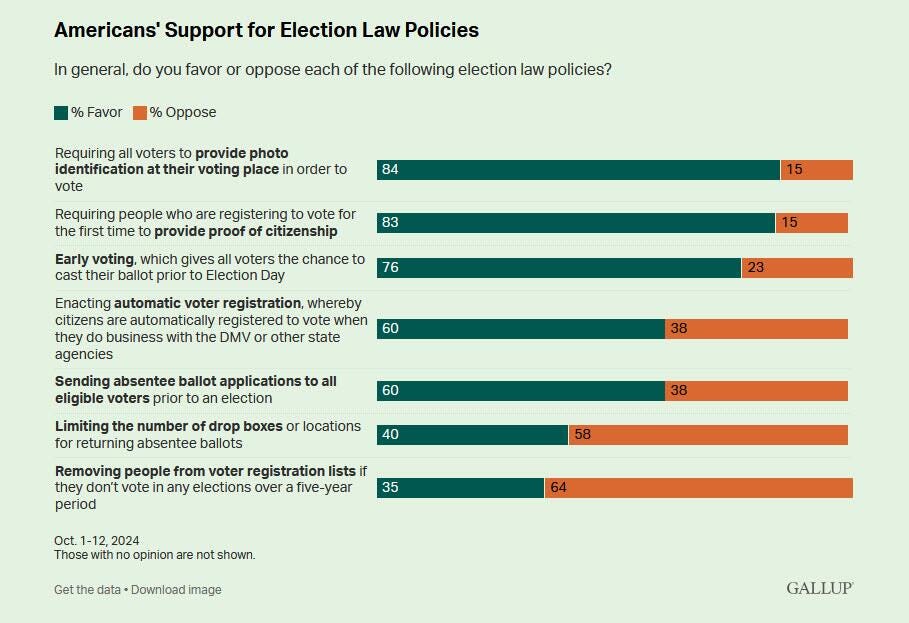

Over 80% Of Americans Are In Favor Of Requiring Photo ID, Proof Of Citizenship To Vote

I do not understand the other side of the argument. You need an ID to drive, get a beer, check into a hotel, open a bank account, apply for food stamps, welfare, Medicaid, social security, and unemployment, buy a house, rent a car, purchase a gun, donate blood, pick up a prescription and so much more. I feel strongly that we should require an ID to vote.

40,171,103 mail-in and early in-person votes cast nationally

Anyone and everyone involved in the election in Maricopa County needs to be fired. In 2024, it takes 2 weeks to count a little over 700k votes?

Former model Stacey Williams accuses Donald Trump of groping her

Israel/Middle East

I like the article by Niall Ferguson: Israel’s Iran Strike—and America’s Strategic Weakness. Interesting viewpoints and I agree with many of them. It is a quick read and worth the time.

Looks like Israel's attack was a “preparation”

Outlines what Israel went after in Iran. Love it.

Dozens of casualties after 'truck-ramming' at bus stop near Tel Aviv

Children among 17 reported killed in strike on school in Gaza refugee camp

Hussein Ali Hazimeh, Head of Hezbollah Intelligence, was eliminated

You don’t want to be a senior official in Hezbollah or Hamas. Your life expectancy is days.

Sens. Rick Scott & Marco Rubio Introduce Bill to Punish Colleges that Allow Antisemitism

Other Headlines

The index has now declined in 30 out of the last 31 months, the longest streak since the 2008 Financial Crisis.

Putin welcomes Iran, India, China to BRICS Summit to discuss 'new world order' to challenge the West

By reducing reliance on the dollar, the alliance hopes to evade sanctions.

Tesla shares jump on profit beat and at least 20% ‘vehicle growth’ next year

Tesla stock soars 20%, heads for best day in over a decade on Musk’s 2025 growth projection

This Bloomberg article suggests Musk’s net worth increased b $33.5bn on Thursday alone. On the Forbes list, Phil Knight (founder of Nike) has a net worth of $35.5bn that took 86 years to build, while Musk did it in a day.

Peloton stock-11%+ after David Einhorn says stock is significantly undervalued

The border issue never ends. Worst policy mistake from this administration. Out of the $150bn in costs, FEMA paid $67bn and the rest was paid for by the states. These states that welcome illegal immigrants have already lost many wealthy residents. Budgets in many cases are imploding.

‘Stunning security failure’: U.S. agents miss Venezuelan gang tattoos in scan for refugee approvals

Flip through this study showing trends in colleges in America. Students were surveyed about the Constitution, free speech, classroom intimidation, ability to befriend someone from another political party, hate speech and much more. The results are a bit troubling.

A 14-year-old boy fell in love with a flirty AI chatbot. He shot himself so they could die together

American Airlines' message to boarding group cheats: Wait your turn.

New stroke prevention guidelines released by American Stroke Association

I’m a doctor — here are 5 signs your body needs more nutrients

Here’s why Banza’s chickpea pasta is all the rage (and why to try it)

Full disclosure, I am an early investor in Banza (10 years ago). The leadership is amazing and the company is doing well. We eat the Banza chickpea pasta all the time. Serena Williams and Tom Brady swear by Banza.

WNBA's $40m projected losses have NBA owners 'frustrated'

Although better than the originally thought $50mm loss, it still has WNBA owners livid.

The swarm of UFOs caught on video near US Air Force base by dozens of stunned onlookers

Real Estate

Duggan is buying a $33 million two-story penthouse, he said in an interview. The roughly 11,000-square-foot (1,022-square-meter) property has five bedrooms and an indoor pool. The deal underscores how high-end properties have surged in value across Miami. Luxury condo sales have soared in Miami in recent years. Since 2021, 86 condo sales in Miami-Dade County topped $15 million, compared to only 19 between 2017 and 2020, according to data from a multiple listing service. The over $15mm data does not include the dozens of apartments sold that have yet to close (new buildings). I am personally not spending $33mm to buy anything in the Brickell neighborhood. I just don’t think it is worth it, but when you are worth $15bn, maybe you don’t care.

I have written about mansion taxes, most notably, the tax in LA County which has crushed high end R/E volumes. This article, What Are ‘Mansion Taxes’ and Why Do Real-Estate Pros Hate Them So Much, does a good job of outlining the issues. Mansion taxes—shorthand for taxes on high-end real-estate sales, usually in the form of a one-time payment at closing—are becoming more common as cash-strapped local governments look for new funding sources. In New York, buyers typically pay the mansion tax; in other markets, like Los Angeles and San Francisco, sellers are usually on the hook to pay such fees. I know that sales in LA have slowed at the high end, with one friend struggling to sell his Beverly Hills home for well over a year. The article suggests that sales will start to normalize again over time and things have picked up slightly in LA, despite the massive new tax (4% on any property over $5mm and 5.5% on any property over $10mm).

Florida's condo crisis: In 3 Palm Beach County communities, big issues = high assessments. It would be very hard for me to recommend buying into an old condo building. There is too much inventory for sale relative to new product that meets the more stringent building codes. The article outlines three Palm Beach buildings with issues, but there are a ton from Miami to Palm beach. Proceed with caution.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #729 ©Copyright 2024 Written By Eric Rosen.

Thank you for the kind comments. Best to discuss. Send me an email with your contact info at rosenreport@gmail.com.

Eric, you continue to do a really great job and getting even better.. I'm Rick Sherman, Fritz Anderson's friend and neighbor in Duck Key. A few comments:

1. Thank you for your stand against anti-semitism. Most Jewish people including me don't say anything. I don't belong to a synagogue because I don't like left wing lectures and gender neutral prayers from the pulpit.

2. I think the USA is in the greatest period of internal chaos in my 80 years. I'm personally a social moderate and a fiscal conservative and agree with your comments on the limited choices we have. In these challenging times, one subject I find very perplexing is where to invest for protection, income and asset growth. I think this is a more macro subject than having an investment advisor guide you in structuring a portfolio. I'm going to share a few things I do but I hate the uncertainty of guessing how to economically protect myself and my family. I'd love a smarter person's thoughts.

3. I started collecting coins at age 8 and gold and silver bullion over 40 years.ago I buy a little bullion at a time to average prices. It's not a get rich quick investment. I started buying gold around 1980 at $800 per ounce. Nineteen years later, it was selling at $300 per ounce. However, you buy it to keep it, not to sell it. I mentally divide purchases into two categories. The first is for an Armageddon event. If one occurs and you're buying food and other essentials, it might be hard to get change for an ounce of gold or even a tenth of an ounce gold coin, so, this category needs some silver which trades at just over 80 ounces of silver per ounce of gold. I prefer uncirculated coins. Less variance in determining value. You can start with a very small investment of about $40 and grow it over time. The second bullion category is a part of your alternative investment funds. This is more gold weighted. I rarely buy gold or silver other than sovereign gold from the US, Canada, Britain, South Africa, and Australia. I think it's safer and more fungible than bars. The premium on US gold versus the other countries isn't great but there is a big difference on US silver dollars(Eagles) versus similar one ounce silver coins. I think the spread is too high and am buying other sovereign silver.

4. Where to store is a big issue. I primarily use bank safety deposit boxes. However, with the stroke of an "Executive Order" pen, all of our boxes could be frozen. There's some recent precedent a few years ago at a California depositary where the FBI under the guise of catching a money launderer seized the contents of 1400 boxes comprised of hundreds of owners who were honest everyday people like us and kept assets worth over $5000. Getting the assets back was very difficult. The government could also call in gold as Roosevelt did in 1933 when citizens were ordered to turn in their gold bullion. Exceptions were for jewelry and numismatic gold. Gold American Eagles have previously and may still be classified as numismatic. There are several other storage options and plenty of experts out there with recommendations.

5. In addition to bullion, my son and I bought a farm with row crop and timber land. Bullion produces no income and we make 2-3% annually on the land. Its not an exciting return but, like bullion, it's appreciated nicely but not like south Florida real estate. For a recently retired guy like me, I still need assets that produce higher levels of income.

6. A related issue is the acceleration of de-dollarization internally and also with respect to BRICs+ and the growth of digital currencies around the world. I read today about the asset freeze going on in Kuwait for people who haven't submitted their biometric data to the government.

7. I haven't commented on stocks, bonds or other securities. I'm not sure what to own now. and for the future if, for example, the country comes apart and becomes 2-4 separate countries.

Eric, thank you again for the outstanding job you do for your readers.