Opening Comments

My last note was entitled, Travel, Tariffs and Turmoil and also included an amazing restaurant review of the Sunset Tower Hotel. The most opened links were the four worst drinks for heart health and the mental hack to live a long and happy life.

Today’s note likely missed stories, as I was traveling again to the Masters Golf Tournament in Augusta, Georgia. Originally, I bought tickets to Atlanta and found out ZERO rental cars were available. I then changed flights to Charlotte to again find no cars and had to call in favors to procure a car in Charlotte.

Also of note, the market is so volatile, I am sure I forgot to change something in my piece. I have so much going on now that I may have missed an update. Apologies if that was the case. The moves are so massive, I just cannot keep up!

Markets

Recession Odds Increasing

Recession/Defaults

Health

Real Estate

Happiest City in America

Lionel Messi Buying Spree in Miami

Praxis Futuristic City

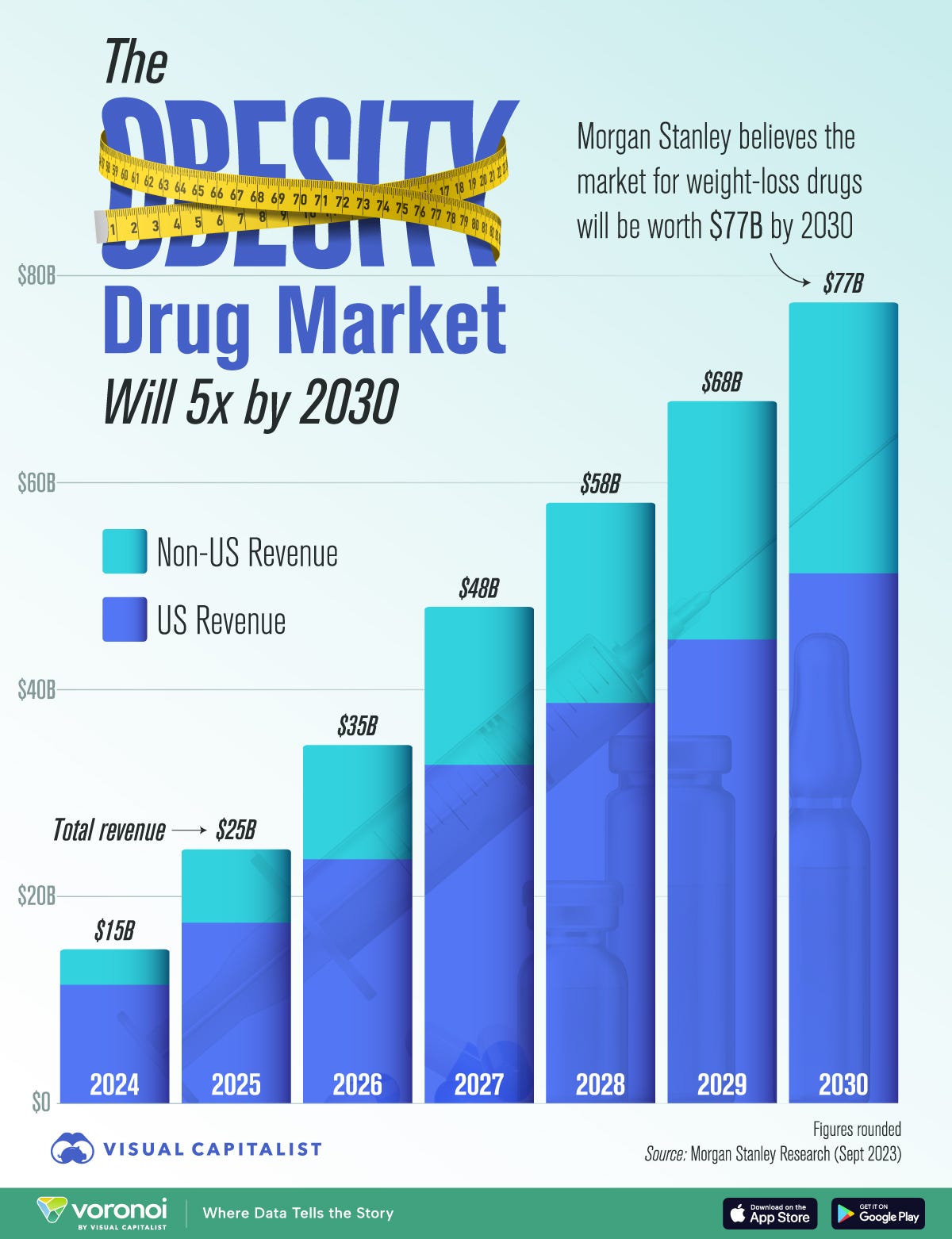

Picture of the Day-Weight Loss Drugs

The Visual Capitalist makes amazing charts and I thought this was a good one. More people I know are on these drugs and have seen weight loss of up to 100 pounds. One man lost 14 inches on his waist in nine months.

Palisades Devastation & Insurance Woes

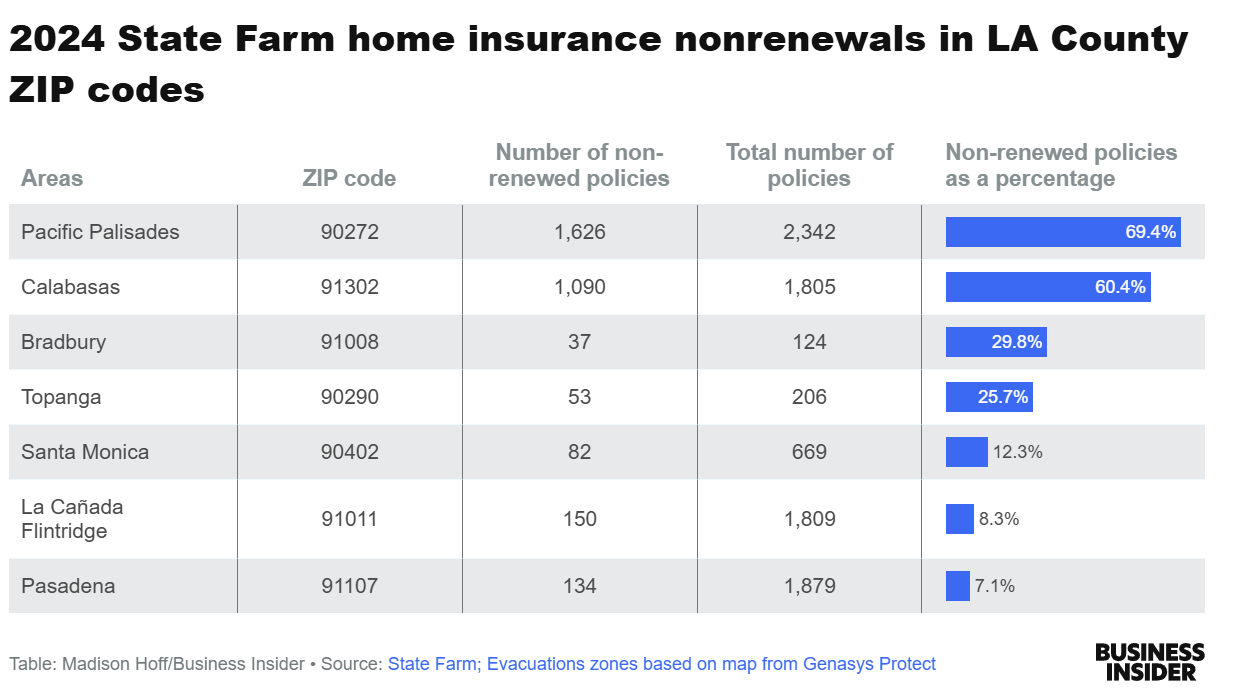

Concerning major US disasters, sadly, I have seen too many. I grew up in South Florida, and lived through countless hurricanes and saw the devastation of Hurricane Andrew shortly after landfall. I was in NYC during the tragic events of 9/11 as well. With the help of the reach of the Rosen Report, last week, I was able to have a private tour of the wreckage in the Pacific Palisades fires. You need to be a contractor or homeowner to gain access. The area is heavily fortified with police activity, and the lines to gain entry can be hours-long. In short, the town of Pacific Palisades has been decimated, and the devastation is so broad and wide, it is hard to explain.

To give you a sense of the scope of the destruction, please watch this one-minute video of various areas in the Palisades that I recorded last week. My voice is a little muffled as I was wearing a mask due to the contaminants in the air. Many of the workers digging were in hazmat suits.

On a crisp and sunny Thursday, I witnessed blocks of homes with complete devastation. A few homes had only brick chimneys remaining. There were cars that were so badly burned you could even tell they were automobiles. The scope of the carnage is massive. Charred remains as far as the eye can see, while the sun shone and just a short distance away, the beautiful Pacific Ocean shimmered with its brilliance. The juxtaposition of destruction and serenity was notable.

I have spoken with multiple victims of the California wildfires, and some consistent themes mimic articles I am referencing in my note. The homeowners who used cheaper alternative insurers have been extremely disappointed with the response.

One Pacific Palisades homeowner owns a lot overlooking a cliff that has a wide view of the Pacific Ocean. The home was about 4,000 feet, and the lot is amazing (sunset pictures above were from her front yard). State Farm offered them 50% of the replacement cost coverage rather than the stated coverage of their policy, and it appears this is not a one-off situation. My reader is no pushover and has hired an independent adjustor to fight the insurance company’s offer. Of note, State Farm is the largest insurer in the state of California and has been cancelling coverage for many residents.

This CNN video confirms 50% offers of the replacement cost, but only 30% of the contents for many State Farm clients. However, better quality insurers such as AIG and Chubb are giving 100% of policy coverage or higher in many cases. When my wife’s car was totaled (not her fault), Chubb wrote us a check for $57k for a car that cost us $42k and was worth less. Going with the best carrier makes all the difference when you need it most.

This NBC story outlines some of the issues that fire victims are facing today. Families devastated by the Palisades Fire are facing a new challenge—this time, with their insurance providers. Many homeowners say they’re only receiving a fraction of what their policies promised, compounding the pain of losing their homes. NBC’s Nick Watt spoke with victims like the Spivaks, who say State Farm—California’s largest insurer—has only paid out half of what they were insured for. “They’ll only give us 30% of personal property and 50% of the dwelling,” the couple shared. While the payout limits are technically legal, fire survivors describe the experience as emotionally and financially draining.

Think of the disaster here. Not only have people lost their homes and lives been disrupted and uprooted, but they have mortgages and must continue to pay on the mortgage for a home they cannot live in.

Remember, for many individuals, your home is your biggest asset. Why would you ever own property in the state of California that is uninsurable? One devastated Pacific Palisades resident told me, “I do not want to rebuild a house in a city and state that cannot provide me the coverage to protect my biggest asset. I want to sell the land, repay the mortgage, and move out of California. Many of my friends and neighbors feel the same way. We have been failed by the system.”

I am saddened by what I witnessed in Pacific Palisades. It will take 7-10 years to rebuild. I am also told that limited building permits have been issued, which will only make the rebuild take longer.

If you know someone who is being taken advantage of by their carriers, be sure they get an independent adjuster to help them navigate these complicated matters. I just want the people who have lost so much to be treated fairly. The rebuild will be brutal and these families need all the capital and help they can get. It will take years just to clear all the debris from the thousands of homes that were destroyed. One reader told me his contractors can spend two hours just to get to the site, given the long lines and security.

The only buildings still standing seem to be the ones saved by citizens taking executive action. Both those with the means to bring in private firefighters and those who filled buckets from swimming pools and stayed awake all night wetting down the property. Check out this video that shows his property relative to the homes torched directly across the street. Most of the town is burned, and few people can live there given the air quality, lack of schools, conveniences, impossible access due to security, and the fact that a majority of the homes are gone.

My insurance broker, Kevin Lang (866-964-4434), has helped nearly 100 of my readers with their property and casualty needs in all 50 states. He will only use the top carriers and has built an incredible business over 35 years. If you have questions about coverage or want a quote from top insurers, give him a call.

Quick Bites

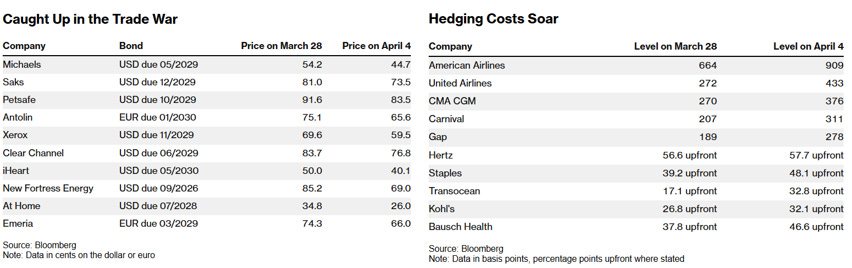

Markets remained volatile on Monday with the VIX hitting 54 intraday. Remember, it was at 21 on Wednesday. On Monday, Hang Seng (Hong Kong) index -13.2% and Nikkei -7.83%. The tariff war escalated this week with Trump announcing an additional 50% tariff on China (now 104%) and China raised its tariffs on the US to 84%. Stocks sold off early Wednesday but rebounded and turned green by mid-morning. Then, Trump announced a 90-day tariff pause on some countries and raised the tariff yet again on China to 125%. Markets went flying with the Nasdaq+12% and S&P+9.5%, while the VIX crashed from 50 to 33 in minutes. It was the biggest Nasdaq rally since 2001. The Dow was +3,000 points! The volatility is out of control in both directions. The hardest hit stocks rebounded sharply on Wednesday, with some names +20% or on the day. Apple was +15%, and RH was +28% and United Air +26% on the day. Yes, the tariffs are concerning, as is the wealth destruction in stocks. However, we must pay attention to the bond market. The Treasury market has been volatile, with the 10-year trading as low as 3.88% last week and hitting 4.51% on Wednesday, as global government bonds sold off. Is China dumping Treasuries? It feels to me that we saw some capitulation likely from levered funds. Remember, generally, as stocks get slammed, investors go to the Treasury market for a safe haven, pushing those yields lower. Wednesday morning, we saw stocks get hit and bonds fall sharply in price, moving yields higher. The 10-Year recovered some of its losses, and is now +8bps to 4.34%. Trump has pushed the Fed to lower rates, and the market is taking Treasury yields higher due to inflation fears. Futures suggested five cuts as of Tuesday, and it dropped to four cuts in 2025 due to Wednesday’s move. Mortgage rates spiked with the 30-year fixed +40bps in three days to 7%. Oil fell below $56 for the first time in five years after hitting $80 in January before rallying back to $62. I had made the call that I could see oil hit $50 in 2025 in my 2024 year in review piece. However, I did not see it falling this fast due to recession fears. The volatility in equities, oil, and bond markets due to bad tariff policies will surely have unintended consequences that will play out over the coming weeks. Yes, Trump should be replenishing the Strategic Petroleum Reserve at these levels.

Recession odds were climbing due to a combination of a slowing consumer, waning business confidence, and the impact of the tariff mess. However, Polymarket betting odds now have a chance of a recession at 50% after being 23% in February and 65% this morning. Many of the major economists and investors increased recession odds to 40-60% in recent days and now are backtracking due to the tariff repeal today. GS rescinded the recession call this afternoon. Markets dislike uncertainty. I believed there was a 75% chance of a recession this am, and it was just cut in half due to Trump’s backtracking.

On a note related to recessions and economic slowdowns, this Bloomberg article outlines the coming corporate default wave, in part, due to tariffs. Donald Trump’s global trade war is already priming financial markets for the next wave of corporate defaults. A Bloomberg News measure of distressed debt worldwide swelled the most in at least 15 months this week, sending more than $43 billion of bonds and loans to levels that make it challenging to refinance. In a telling sign, the pile of distressed debt in the Americas region has now surpassed that in Asia Pacific for the first time since August. “Retailers are getting smacked,” said Robert Schwartz, a portfolio manager at AllianceBernstein. “If you’re a retailer, you tried to diversify into Vietnam or the Philippines. Those tariffs weren’t priced in until this week.” This Moody’s article has some great charts from one month ago showing historic default rates and forecasts. Obviously, if tariffs stick, it defaults may be decently higher than these charts. This is a good couple minute video of the All-In Podcast discussing corporate debt. The latest CNBC survey has one-third of CEOs expecting job cuts this year due to tariffs. Obviously, the announcement today changes things a bit.

Tariffs

A reader and someone I respect greatly sent me this link by Shay Boloor. I have no idea who he is, but his outline of tariffs and the flawed policy was very well done and something you should read. Also of note, my investing hero, Stan Druckenmiller said, “I do not support tariffs exceeding 10%.” Again, I feel there has been an unfair playing field concerning trade, and leveling the playing field is something which needs to happen. I do not agree with the Trump playbook on tariffs, but I also think the status quo was untenable as well.

Trump’s 180 degree turn changed the market sentiment in a hurry and helped to put some of the toothpaste back in the tube. We might have set the lows, but I am not convinced we are in the clear and expect more volatility off of headlines. I should have listened more to my gut. I suggested these tariffs would not last and only dipped my toe in the markets Monday near the lows. Did not buy enough to matter.

Bob Diamond (former Barclay’s CEO) had some good stats on tariffs and data on imports in this short interview. Diamond claims this is as profound of an act of economic self-harm he has seen in his career. 11% of the US economy is imports and 40% of those are not finished goods, but parts. This impacts supply chains. His take is this has a huge impact on the economy. He made comparisons to Smoot-Hawley in the 1930s which contributed to the economic downturn during the Great Depression. Diamond believes if this is rectified quickly, the economic damage could be undone.

Mike Cembalest from JPM always has good thoughts, and I snagged a few charts from his presentation. One key point that Cembalest made was that buying the market after a sharp sell-off ended up with positive returns. Historically, equity markets bottom before other asset classes. He was right. The market ripped just days after his comments.

GOP megadonor Ken Langone is latest billionaire to blast Trump’s tariffs

Now, he said, “recession is a ‘likely outcome” This was before today’s news.

In a factory that makes baseball caps, Trump's tariffs bring chaos and price hikes

I ordered my first Rosen Report hats from a factory in Ohio and they cost $13 with limited embroidery, and the quality was mediocre. I then ordered my 2nd batch from China and received much higher quality caps with far more embroidery. I had them flown in costing an additional $1/hat and my cost was under $5. Even if there are 104% tariffs on hats today, I am still better off ordering higher quality hats at what will be 30% cheaper.

Toy prices could jump 50% following Trump’s tariffs on China, Vietnam

Hanukkah Harry and Santa Claus may be a little light with gifts for kids this year if toy prices are +50%. However, with GLP-1s, Santa should not be getting stuck in any chimneys. Maybe after today’s news, we will get a break.

Politics

U.S. Senate Republicans pass measure to move forward on Trump’s tax cuts

If the sell off persists, we are going to see tax collections crash in 2025 and deficits continue to escalate. We cannot have plans that lower revenues without offsets. $2 trillion deficits in perpetuity make no sense. I am fine being taxed IF the government is not wasting all my money. DOGE is making a dent. Next up entitlements?

AOC's Chances of Beating Chuck Schumer in New York—New Poll

55% AOC and 36% Schumer in the poll of likely NY Democratic primary voters.

Supreme Court allows Trump to deport Venezuelans under wartime law, but only after judges’ review

Judge says White House can’t ban AP from Oval Office, Air Force One

Middle East

IDF responds after Hamas hits Israeli cities with rockets: 'Must pay a heavy price'

Video footage appears to contradict Israeli account of Gaza medic killings

U.S. moves Patriot missile batteries from South Korea to Middle East

Microsoft workers say they’ve been fired after 50th anniversary protest over Israel contract

Other Headlines

CEOs think the U.S. is ‘probably in a recession right now,’ says BlackRock’s Fink

How much do stocks have to drop before trading is halted? The details on market ‘circuit breakers’

Airlines expected to cut 2025 outlooks as travel demand falters

Shopify CEO says staffers need to prove jobs can’t be done by AI before asking for more headcount

Marjorie Taylor Greene makes huge stock market play just days before tariffs announced

Wait. A politician may have traded on inside information with no consequence. Who would have thought that possible? Yes, I am being sarcastic.

As a Candidate, He Wanted to Ban Congressional Stock Trading. In Office, He Trades Freely.

Representative Rob Bresnahan Jr., who campaigned on prohibiting stock trading by members of Congress, has emerged as one of the most active stock traders in the freshman class. A politician who campaigned on one policy yet did a 180? Again, who would have thought a slimy politician would lie to get elected? No major politicians or Fed officials should be allowed to trade.

Woman stabbed in neck with broken bottle, clinging to life after heinous NYC assault

Why we can’t let go of our childhood friends, even when we don’t have anything in common anymore

I think this lesson is true for both men and women.

Alexander Ovechkin passes Wayne Gretzky: Why it’s not your average record being broken

This is a big deal. I spoke with an NHL goalie who is a reader, and he said, “It is insane. You cannot put words into what Ovie did in this era of hockey. For Ovie to do this when goalies are so big and athletic, with larger pads is absurd.”

Health

Texas AG says he’s investigating Kellogg’s over ‘healthy’ cereal claims

Healthcare’s New Partisan Battleground: The Doctor’s Office

The article suggests Americans are now choosing physicians based on politics. I am personally concerned about Jew-hating doctors misdiagnosing me. I am doing research before I see a new physician.

‘Amazing’ reduction in Alzheimer’s risk verified by blood markers, study says

Real Estate

On the whole, happiness in the U.S. is on the decline. The country fell down a spot from the year prior to No. 24 in the 2025 World Happiness Report. But there is still plenty of joy to be found across the 50 states — including in Plano, Texas, which ranked No. 1 in a recent SmartAsset report identifying the happiest cities in America. SmartAsset ranked cities on 11 metrics across three categories: personal finance, wellbeing and quality of life. Individual metrics include the share of households living below the poverty line, share of residents who report being inactive and traffic volume on major roads.

A single buyer is in contract to purchase four units at the Cipriani Residences Miami condominium, including one slated to sell for around $7.5 million. Soccer superstar Lionel Messi is the purchaser of all four units, according to people familiar with the deal. The Argentina native joined Inter Miami in 2023. He already owns several homes in South Florida, including a $10.75 million waterfront home in Fort Lauderdale and multiple condos in Miami, including at the Porsche Design Tower condominium, according to property records. The wealthy athletes and business people are buying up South Florida real estate. I lost count on the number of properties Ken Griffin bought between Miami to Palm Beach, but it must be a dozen or more.

Praxis has raised $500M to build a cybercity operating independently of any country — but where will it be located? Schools would be moot. Education, in Hammond’s vision of Praxis, would be done by AI and food preparation would also be handled by robots. “You could have a 3D printer printing out food,” Hammond said. “You get to adopt and integrate new technologies before anyone else in the world.” The wage-slaves on Praxis, as per Brown, will also not necessarily be human: “Maybe in the future, people don’t work anymore and AI does all the work. We want the city to be designed for a post-work future; we want the city to be able to absorb a new kind of social dynamic. Like, we’re going to find the most talented artists in the world and give them grants and bring them to Praxis.” Although $500 million – plus $20m raised from venture capital funds in 2021– sounds like a lot of money, in terms of establishing a whole city for 1,000 residents it doesn’t necessarily go a long way. Brown acknowledges this and knows that for the initial founders things will start off tough. Sounds like a dumb idea and $500mm is not close to enough money to build a city. Good luck.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #776 ©Copyright 2025 Written By Eric Rosen.

next time you need a rental use Turo. Its super easy and they can leave the car at the airport. No check in lines. Super Simple.