Opening Comments

My last note was about my surf trip and included videos and pictures. The title was “Bigger is Not Always Better.” The most opened links were Mike Cembalest’s latest research note on tariffs and the article about the Tudor trader who lost $140mm on Treasury bonds during April. Those who watched my surf video had some positive comments and I musk bask in my glory given the limited number of times I will surf again in my life.

I get 1,000 emails a week from readers with story ideas, words of encouragement, advice, feedback, critical reviews, hate mail, business ideas… A reader sent me this note the other day, which I appreciated:

I found today's RR one of the most informative items I have ever read on the web...and I read a lot!

Markets

Dalio Concerns

Unintended Consequences

MLB Team Valuations

Florida Housing Inventory Rising

Buyer Pull Back Due to Market Volatility

Inheriting NYC R/E More Common/Trusts

Picture of the Day-Real ID

I wanted to highlight the upcoming deadline for the Real ID. Travelers take note: The federal government says it will start enforcing Real ID requirements at U.S. airports starting May 7 — for real this time. That means travelers will need a Real ID-compliant license or other accepted form of identification like a passport to get through security before a domestic U.S. flight. I just found out that my driver’s license is compliant, and it is from 2017. If it has a star on the upper right, you should be all set.

Augusta National-The Best Run Machine on the Planet

I have worked for amazing companies and feel I have significant exposure to the best of the best businesses and managers. Now that I have attended my 10th Masters Golf Tournament at Augusta, I am here to tell you that Harvard should do a Business School study on it. It could be the best-run entity in the world.

As an aside, all these pictures were taken with my Meta glasses, as NO PHONES are allowed on the grounds. Being away from my phone during massive volatility had me in a panic. No, it was not liberating. However, the pro golfers felt the patrons were more engaged without phones. Although I missed my phone, I was very engaged.

For those who live under a rock, Augusta National is one of the most exclusive golf clubs in the world. Gaining admission is no easy task, and you do not ask to be a member; they ask you! The Masters Golf Tournament is one of four majors on the PGA Tour, and the winner receives the coveted Green Jacket. The traditions at the club are remarkable. When you win, you are given a Green Jacket and can keep it for one year, and then must return it to the club. You are allowed to wear it while on the grounds. The winner has the honor of selecting the menu at the following year’s Champions Dinner. They have a fun par 3 event on Wednesday for players and families.

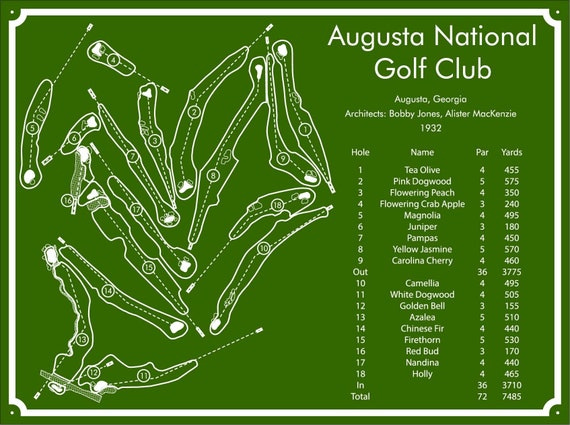

Augusta National was built by Bobby Jones and Clifford Roberts and was designed by famed designer Alister MacKenzie. It opened for play in 1932 and is among the most secretive entities on the planet. They do not disclose much to the public about membership, income or ticket/merchandising sales. The tournament is not only rooted in golf history, but the experience is “unlike any other.” As a patron, the guidebooks provided during the tournament are a highly overlooked resource for the best viewing/tournament experience. Though amended over the years, the pages still include many original notes and expectations of Jones and Roberts as it relates to tournament viewing. The forethought that these gentlemen had was second to none.

Everything at Augusta runs according to plan. I do not know how many employees and contractors were on the property on Tuesday, but if you told me thousands, I would not have argued. Parking attendants, security, concession sales, maintenance staff, gallery guards, bathroom attendants, and more. At every turn, an Augusta employee was waiting to help you have the best experience possible. The staff was incredibly knowledgeable, well-trained, and happy to be there, and it showed.

Efficiency is EVERYWHERE. From patron-facing staff at every touch point, to behind-the-scenes “efficiency engineers,” every little aspect of the tournament is meticulously thought through. A peak behind the curtain would show you the number of tournament staff that’s sole responsibility is to track data as products and services move through the chain to continuously improve the patron experience.

Monday saw two inches of rain, and I feared the course would be in shambles on Tuesday. Guess again. The staff had green sandy rocks dumped by the tons along the walking paths to ensure patrons did not slip on the undulating terrain. I thought my shoes would be trashed. NOPE. Spotless. The Augusta machine is well organized and on top of it.

This amazing story from Phil Mickelson is worth one minute. It was about the speed with which the maintenance crew fixed a massive fallen Georgia Pine Tree and the efficiency with which the staff fixed the issue and re-sodded the grass. Augusta National is run like a machine. Nothing is missed. The golf course also is constantly improving the course and spends a fortune on upgrades and re-sodding each year.

When you pull into the parking facilities (free parking) there are dozens of attendants to guide you to your spot. At 7:15 am, we were forced to park in the back lot, as everything else was taken. Check out the lot despite the early time. Augusta bought all the homes except one in order to create a new parking lot. The holdout is 92 years old, and it is explained here. $40mm was spent to create the parking lot.

The line at the entrance was filled with thousands by 7:30 am, and the numerous staff at the entrance had everything flowing smoothly. Despite the gates opening at 7:00 am, there was a long line at 6:30 am.

We tried to go to the merchandise facility immediately, but they closed the line (too long), so we walked around the stunning and immaculate grounds. It sure does not look as though a storm hit just hours prior. The maintenance staff is world-class. Note how perfect the grounds are and the bunker edges are so tight.

Augusta has SubAir under the greens to take out moisture to control the speed of the greens and even some tee boxes. Additionally, this link suggests they have SubAir on crosswalks to protect patrons from slipping. It would make sense given how dry the crosswalks were after the rain. The link also shows how they can grow grass in challenging areas. Augusta is just another level.

Augusta has an elite driving range used for 12 days per year. I believe they spent $140mm on the 18-acre facility, including the purchase of homes to build it. The bunkers on the range mimic the actual course, and the short game facility is another level. The Masters App allows you to track practice shots hit by each player.

Augusta has spent hundreds of millions acquiring land to expand the facilities and even spent multiples more than the appraised value to ensure the best facility in the world stays that way. This article suggests that since 1999, Augusta has spent $200mm buying over 100 properties covering 270 acres.

We made our way to the merchandise center, and there was a line that said the wait was 75 minutes. They were wrong. It took us 72 minutes to get into the store. We shopped for 30 minutes and spent $1,250. We shipped the goods in a very efficient UPS location next to the store, and in two days, we received our package. Prices were reasonable (T-shirts $32, Hats-$30-35, Pullovers- $90-125, Golf Shirts-$90) and all had the Masters logo. I do not know the total sales during the masters, but could approach $100mm. I believe the average spend is about $1,000. Check out the haul below. You can’t go to Augusta without a stop in the shop. I am told one man spent over $30k on clothes.

The concession stands run like clockwork. Lines move swiftly, and the food is shockingly inexpensive. In our two stops for breakfast and lunch, we spent $20 or $40 in total and could not finish all we purchased. I am not a big fan of pimento cheese, but felt the need to split one with Jack, given it is a specialty.

The bathroom line runs smoothly, given the ample staff. People were directing you to open urinals and stalls. There was someone keeping the sink areas clean by wiping down the water after each patron. Let’s just say it is a slightly different experience than Madison Square Garden.

The Masters App is arguably the best in the business, as it gives the user the ability to follow each and every golfer and watch every single shot of the tournament. Augusta spent a lot of money to make it the best of the best. You can follow every shot from every player.

One former worker told me that his time there was remarkable. “It is a team-oriented environment. Management communicates well and encourages feedback to improve the customer experience.” Every time I bought something Tuesday, the salesperson asked about my day and how it could be improved. I was blown away.

Regular ticket sales are $100 for the practice round and $140 for the tournament, but the secondary market can go over $3,000. Augusta also sells special access tickets, which give you preferred food and access to areas regular patrons are not allowed. Tickets to Berckmans Place (elevated access and food) cost thousands of dollars. It includes bars, restaurants, and another merchandise shop that sells exclusive products and three replica greens for you to experience Augusta. Needless to say, the club makes tens of millions on ticket sales despite the reasonable prices for most of the tickets. There is a lottery to gain access.

The prices of everything are reasonable at Augusta, and despite that, I am sure the week generates nine figures in revenues. This article suggests Augusta National leaves hundreds of millions on the table in pursuit of perfection.

I saw these “data collection” people on every hole. I asked what they were doing. All said the same thing: “collecting data.” They were not allowed to say more. I believe it is data on the golfers and their shots. Fairway, rough, bunkers, greens….The eyes at Augusta have large drones overhead watching everything. They have more data than any club in America, I am sure.

There is a tax law (IRS 280A) named the “Augusta Rule” which allows tax-free rental income for your primary or vacation home for up to two weeks. Augusta, GA has limited hotel choices and many homeowners rent out their primary residence during the Masters and get the money tax free. To be clear, this is a national rule, but it is called the “Augusta Rule,” as it was created to protect residents of Augusta, GA due to the Masters. What other course or tournament has a federal tax rule? Again, Augusta stands alone.

In the ultimate flex, Augusta does not get paid for TV rights in order to have complete control. They have CBS remit the costs for the week, and the handful of sponsors split the costs in return for 4 minutes an hour of ads that the sponsors split. For perspective, the US Open got $93mm for its domestic TV rights, and the Masters would get more if they went that route. They make so much money, they don’t need it.

Augusta National is a special place, and if you are a golf fan or interested in great business, you should experience it once in your life. Senior managers in corporate America could learn a lot by watching what the team at Augusta does each year to put on the Masters. Despite the tight-lipped employees who are sworn to secrecy, you can feel how great the facility is run. It is a tournament and a place like no other. If we could get corporate America and the Federal and State governments to run as efficiently, we would not be running $2 trillion deficits, and the world would be a better place.

My son, Jack, cannot stop talking about his experience for good reason. It was a special day, and we were fortunate for the opportunity. Yes, my son is 4” taller, but he is standing on a hill. He is not 6’5 and I am not 4’7”. No, I am not pregnant. I have stuff in my jacket. Until next time, I can dream of playing Augusta.

This year’s Masters was the most exciting and frustrating I can recall. Congrats to Rory for the win and career grand slam. He sure made it harder than it needed to be. Despite being from Northern Ireland, Rory said, “This is by far the greatest golf tournament in the world,” and I don’t disagree.

Check out the prize money over the years at the Masters for the winner.

Quick Bites

The markets were a bit more subdued on Monday and Tuesday after a crazy bout of volatility. However, Tuesday night, Nvidia announced a $5.5bn charge related to exporting its H20 graphics processing units to China and other nations. The stock dropped 11% on the news and sent broader markets lower. Also of note, chip stocks fell after warnings of higher costs from China export controls. Nvidia stock is now at $101 after a recent high of $153 and low of $87/share. Wednesday had the S&P -2.2% and Nasdaq-3.1%+. The VIX popped again and is up to 33, but was over 50 last week. On a positive note, we did see the 10-Year rally pushing yields -5bps to 4.28% after being as high as 4.58% last week. The US Dollar remains under pressure trading in the 99.5 range against the basket (DXY) after being 110 in January.

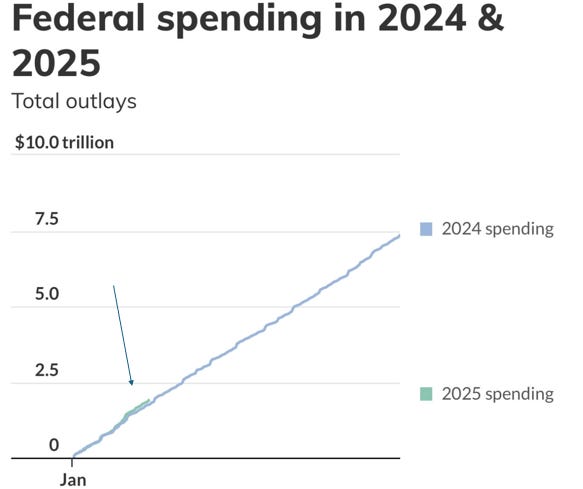

Dalio has been quite vocal lately and this weekend he said, “I’m worried about something worse than a recession.” Bridgewater founder Ray Dalio said on Sunday that he is worried that the turmoil resulting from President Donald Trump’s tariff and economic policies will threaten the global economy. The hedge fund billionaire said he’s more concerned about trade disruptions, mounting U.S. debt and emerging world powers bringing down the international economic and geopolitical structure that has been in place since the end of World War II. “We are going from multilateralism, which is largely an American world order type of thing, to a unilateral world order in which there’s great conflict,” he said. Dalio on “Meet the Press” said on Sunday that Congress should reduce the federal deficit to 3% of gross domestic product. “If they don’t, we’re going to have a supply-demand problem for debt at the same time as we have these other problems, and the results of that will be worse than a normal recession,” Dalio said. I am not sure anyone has written more about deficits, debt, and entitlement reform than I have over the past few years. I am in complete agreement that we need to run smaller deficits and cut spending. I just do not see how it is possible without major entitlement reform.

Although I do not always agree with Dalio, I do feel there are “Unintended consequences” for the incredibly poorly planned tariffs. Look at the crashing US dollar, volatility in the US Treasury market, volatility in equities, increased likelihood of recession, crashing consumer confidence, falling CEO confidence, inflation expectations rising and the list goes on. I do not claim to know all that may unravel over the coming months due to the damage done in recent weeks, but I fear something will pop up that we have not considered. Moves in relatively steady asset classes like the US Dollar and 10-year Treasury are concerning and must be watched.

CNBC came out with the official valuations of the 30 MLB teams. Professional teams have skyrocketed in value to absurd levels, yet there does not seem to be an end in sight. Although the full list is in the link, the range is from $1.2bn for the Miami Marlins to $8.0bn for the NY Yankees. Remember, Steinbrenner paid $10m for the Yankees in 1973. There are lots of billionaires looking for bragging rights and only so many teams across MLB, NFL, NBA, NHL and major soccer teams globally.

Tariffs

I have been supportive of fair trade and true reciprocal tariff policy. However, the clown show of the rollout of the Trump Administration’s tariff policy has been a disaster. Furthermore, the inconsistency of messaging from top officials is concerning and confusing. The on-again-off-again nature of tariffs does not breed confidence. I thought Monday would see a substantial rally given the news on Friday with the end of tariffs on many tech items. Trump then posted “NOBODY is getting ‘off the hook’ for the unfair Trade Balances, and Non Monetary Tariff Barriers, that other Countries have used against us, especially not China which, by far, treats us the worst!” Trump wrote in a social media post. Also, Lutnick came out Sunday to suggest the tariffs on electronic products are coming soon. I honestly do not know who is making these decisions, but that person needs to be fired. Conflicting messages and poor policies are inflicting damage onto the system on a global basis. China suspended rare earth exports critical for EVs, cell phones, defense components and travel. This CNBC article suggests America’s inability to quickly replace rare earths supply from China is a threat to national defense.

Markets do not like uncertainty. Senior management wants to understand the ground rules to figure out how to grow their respective companies. How can you make a decision when the rules change every few days? As a manager, you don’t know if you should hire or fire. Should you relocate factories and suppliers only to find the tariffs from last week are no longer valid? How do you plan when the tariff policy changes more frequently than Trump’s spray tan? I spoke with an importer of stone from Europe. He is eating the tariffs for clients who ordered and are not yet delivered and will pass on the costs to all new clients. The problem is you don’t. This CNBC headline says it all: United Airlines gives two 2025 profit outlooks, calling economy ‘impossible’ to predict.

Trump tariffs won’t lead supply chains back to U.S. but companies will go low-tariff globe-hopping

Nearly three-quarters of those surveyed (74%) said cost was the top reason for saying they would not be reshoring production, followed by the challenge of finding skilled labor (21%). I agree with these conclusions and have written extensively about how uncompetitive costs are in the US absent facilities that are completely robotic/AI driven. It will take decades to build facilities and the US is not prepared to on-shore any significant manufacturing today.

China exports skyrocket over 12% in March as trade war drives businesses to frontload shipments

China orders airlines to suspend Boeing jet deliveries amid trade war

In latest salvo against tariffs, China assails ‘peasants in the U.S.’

U.S. vehicle supply is falling amid tariff fear-buying

New vehicle supply fell to 70 days from 91 days.

Trump aide Hassett says U.S. got ‘amazing’ tariff deal offers, recession ’100% not’ happening

This guy sounds like an idiot.

Auto stocks rise as Trump says he wants to ‘help’ some car companies

How a trade war could impact the price of clothing: ‘Ultimately no one wins,’

Forget tariffs — Beijing is already choking off US exports on the sly

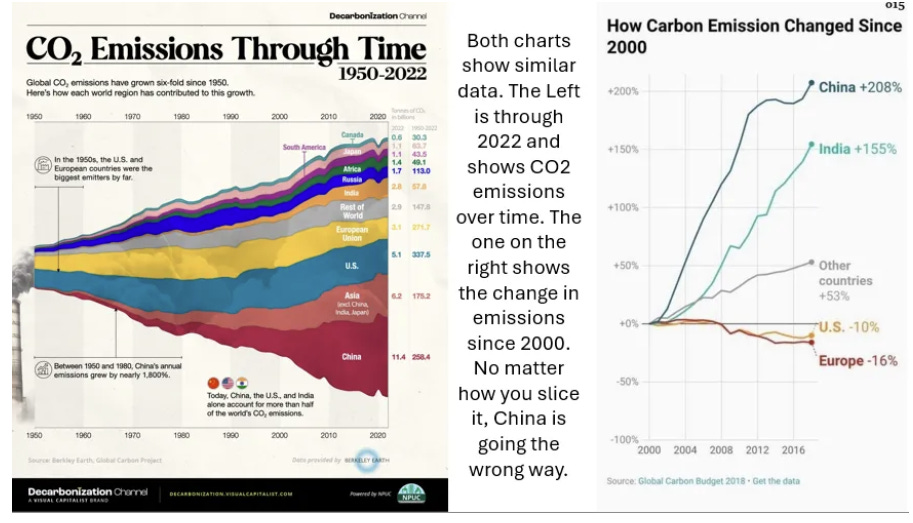

Not only is China cheaper due to labor costs, but they do not have the same environmental protection costs as the US, and the emissions data can be seen below.

Politics

Bessent Says ‘Everything’s On the Table’ for Taxes on Wealthiest

Treasury Secretary Scott Bessent said Republicans are looking at all options to help pay for President Donald Trump’s campaign promises on tax cuts, including increasing levies on the wealthiest Americans.

Musk claims otherwise, but the Trump administration’s spending is on track to surpass Biden’s

Deficits are a major concern, and spending is the problem. The Trump Administration needs to cut spending, not increase it.

Results of President Trump's physical released, here's what they say

The residence is destroyed. Scary pictures.

Wisconsin Teen Murdered Parents in ‘Extremist’ Plot to Fund Assassination of President Trump

20,000 IRS employees interested in deferred resignation offer as tax deadline looms

Middle East

US freezes $2 billion in federal funding for Harvard after it rejects Trump's demands

Iran ‘must stop and eliminate’ nuclear enrichment, says US envoy Witkoff

Paradise Lost: Maldives Officially Bans Israelis From Visiting

I went with Dan Loeb on a surf trip to the Maldives in 2010. It was an amazing time. Sadly, the country does not love Jews. Not sure I ever return.

Other Headlines

Goldman Sachs tops estimates on boom in equities trading revenue

Similar trading commentary to other banks. The volatility has helped the equity traders make more money, while Fixed Income trading came in a little light. Bank of America beat on trading as well.

China Limits Stock Sales To Maintain Impression Of Stability

Nvidia to mass produce AI supercomputers in Texas-part of $500 billion U.S. push

Many Coachella Attendees Are Buying Tickets Through BNPL

Think about this for a second: 60% of general admission ticket buyers at Coachella this year opted to use a payment plan. Tickets start at $499.

LVMH plunge puts spot as world’s top luxury stock at risk after sales miss

Delta Force veteran forced to fend off brick-wielding maniac in unprovoked NYC attack

What happens if this was a child or a woman being attacked? There must be consequences for crime or you have chaos.

Hungary passes constitutional amendment to ban LGBTQ+ public events, seen as a major blow to rights

Salmon are swimming faster due to painkillers dumped into rivers

Want to move to Middle-earth? New Zealand just made it easier for rich Americans to stay

For some reason, I fantasize about living in New Zealand. I have never been. It is a stunning country with great surfing, fishing, skiing, and much more. Before I pack my bags to move, I suppose I should go for a visit first.

Viral CIA file about aliens attacking soldiers takes off with UFO intrigue

A Soviet-era document published on the CIA's website describes an alleged alien UFO encounter by military forces. This is a crazy story from 1990. As much as I believe we are not alone, I am not sure I can buy this story.

Health

Man’s seemingly harmless mistake after a night of drinking led to acute heart failure

Beware this ‘cruel mystery’ disease that can permanently damage organs

Real Estate

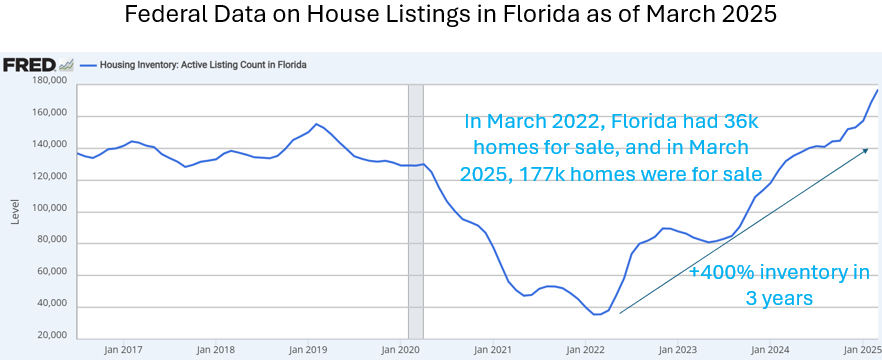

Housing inventory in Florida is rising due to a host of factors. Affordability plays a role as prices have skyrocketed, along with higher rates and insurance costs, making it far more challenging to afford. The great migration has far more developers doing large-scale housing and condo projects across the state. Older condos have new regulations requiring expensive work be done to be in compliance. The result is more people are selling, as many cannot afford the assessments. January ended with 172,209 homes for sale, the highest number of any month in records dating to 2012, according to real estate brokerage firm Redfin. That’s up 22.7% from a year earlier. “With so many options for buyers to choose from, a lot of homes for sale are sitting on the market for months at a time, causing stale inventory to pile up,” Redfin said. “Listings are also piling up because homebuyer demand has been cooling; pending home sales in Florida fell 9.3% year over year in January.” According to Redfin, there were 19,440 active listings in Fort Lauderdale in January, which is a 27.2% increase from the same time last year. In West Palm Beach, there were 17,344 listings, a 19.5% increase. In Orlando, there were 17,770 listings, a 24.5% increase. Data shows homes in Broward County sat on the market for an average of 65 days last year, but it’s 91 days now. In Palm Beach County, homes were on the market an average of 70 days last year, compared to an average of 88 days now. I cannot imagine the spike in volatility causing losses in risky assets and the higher mortgage rates will help matters. We are also coming to the end of the selling season, which tends to see a healthy slowdown in activity. I will say that demand for the highest-end waterfront properties in Miami and Palm Beach remain in high-demand.

Wealthy buyers are backing out of substantial home deals according to this WSJ article. The market volatility has been remarkable and it seems quite a few people lost a fair amount of money over the past month or two. One example was a $10.2mm Lenox Hill (Manhattan) co-op that was going under contract only to be cancelled due to large losses in the market. I don’t see this happening on a large scale at this point, but if we are talking about tariffs in 90 days and markets are sharply lower, I believe more real estate deals will fall apart.

In New York, real estate is increasingly something you inherit — not buy.

The share of Manhattan home sales involving a trust — a preferred tool for passing on wealth — surged to 28% last year in a sharp rise from 17% three years ago, data from real estate analytics firm Attom show. Behind the trend is a combination of factors — including sky-high prices, shifting tax and transparency laws, and the first waves of a $100 trillion wealth transfer. Of course, not all trust beneficiaries are children, but brokers and wealth advisers all say it’s primarily parents who are using trusts to foot the bill on homes for their children — whether it’s a modest one-bedroom apartment in Murray Hill or a trophy

penthouse on Billionaires’ Row.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #778 ©Copyright 2025 Written By Eric Rosen.