Opening Comments

My last note was about my WhatsApp issues of being over-run by messages. The most opened links were the video of the surgeon outlining a scary situation of United Healthcare refusing coverage and Pam Bondi telling Epstein secrets to bogus “nanny.”

Markets

Countries By Passing the US Dollar

People Working Until They are Older

Boca’s High-End in a Chart

Weakness in the Vacation Home Market

Weak Spring Home Selling Season

Video of the Day-Bezos on the Four Core Principles of his Companies

I am a big fan of Bezos as a leader and business builder. Amazon is one of the most disruptive companies in history. This is a short video of Bezos outlining his core principles, and I agree 100% with all of them. There are many reasons that Bezos has been successful at building a world class business that has an equity market cap of $2 trillion.

Customer obsession rather than competitor obsession

Willingness to think long term

Eagerness to invent, which goes hand-in-hand with failure

Taking professional pride in operational excellence

Idiocy

There have been times in my life when I’ve pulled off some pretty impressive things, and it’s made me realize that my ability to juggle multiple priorities and follow through sets me apart. People say, “How do you do that?” Most of the time, it is said positively. However, I had one hell of a day on Wednesday, May 7th. Anyone who witnessed my stupidity that day would have said, “How did you do that?” However, it would have been anything but complimentary.

I went fishing Wednesday morning and loaded up my car with rods and tackle the night before. I placed water, Gatorade, and food in the cooler and had it ready to go with ice packs. I got to my boat, unloaded my equipment, and took off to fish. My boat has been acting up, and I was frustrated with how it was behaving, setting me off in a negative mood. I get out to the open ocean, and 30 minutes later, I received a text from my wife:

I cannot share my response given the language, but you get the idea. Being in the ocean with no fresh water is dangerous. If you have mechanical issues and are stuck on the boat for some time, it can be life-threatening. Just last week, fishermen were stranded for 55 days at sea before being found. Thanks to the technology on my boat, this could not happen to me. But you can see how not having anything to drink is not ideal in 85-degree heat.

It was the FIRST time I ever left my cooler at home when fishing. And of course, I didn’t feel thirsty until I realized I had nothing to drink. After that, it’s all I could think about. As a result, I had to cut fishing short. How could I be such an idiot?

Even before that, I was a mess. I’m usually quick with lines, but not that day. Everything tangled. I was off. What usually takes three minutes took twenty, with a healthy dose of swearing mixed in.

I hooked a huge sailfish-80lbs (short video of it). It was tearing my line off my reel at a rapid clip. I tightened the drag just a bit too much and broke it off. Then, I hooked another sailfish and got spooled. This means the fish took off all my line and broke off. I went ZERO for two in my first hour of fishing. How could I be such an idiot?

And just when I thought I was done embarrassing myself, I made one more run to the marina that night to grab extra ice for the next morning’s trip. I took the fish bucket from the boat, filled it, and put it on the passenger seat of my car. On the drive back, it tipped over and dumped hundreds of ice cubes all over the interior. Dashboard. Seats. Floor. Under the seats. Into the console. And because it’s a fish bucket, the ice wasn’t exactly clean. I spent the next hour scrubbing my car.

I like to think I’m efficient. Productive. Capable. Most days, I am. But May 7th was not one of those days. That was a day for the highlight reel of idiocy.

Quick Bites

The big news Sunday and early Monday was U.S. and China agreed to slash tariffs for 90 days, setting major stock indices flying 3-4%+. The deal will reduce Chinese import tariffs to 30% (10% in addition to a 20% fentanyl tariff). As of Wednesday’s close, stocks have been positive since “Liberation Day.” Who would have thought it possible? Nvidia rallied almost 6% on Tuesday after the company announced it would send 18,000 of its AI chips to Saudi Arabia, pushing the stock to $135/share (recent low of $87). Treasury yields were +7bps on the tariff news and climbed further Tuesday back to 4.53% after being as low as 4.13% two weeks ago. Gold dropped sharply, down 3% after the China tariff news – and is now back at $3,180. Still, it’s up 19% year-to-date. On Tuesday, April inflation data was released and was lower than expected at 2.3% on an annual basis, with core CPI at 2.8%. Oil bounced back to $63 post the China tariff deal after hitting $55/barrel just 10 days ago. The US dollar is back to 101 relative to the basket (DXY). It was as low as 98 a couple weeks ago and a recent high of 110.

Interesting Bloomberg article, “Global Shift to Bypass the Dollar Is Gaining Momentum in Asia.” Banks and brokers are seeing rising demand for currency derivatives that bypass the dollar, as trade tensions add a sense of urgency to a years-long shift away from the greenback. The attempt to find alternatives is another sign that companies and investors are turning their backs on the world’s reserve currency, which was hit with a wave of selling this week amid shifting bets on trade deals. Stephen Jen, a high-profile strategist known for his work on the “dollar smile” theory, has warned of a potential $2.5 trillion “avalanche” of dollar selling that could derail the currency’s long-term appeal. I have written extensively on the topic of the US dollar as a reserve currency. The US dollar accounted for 85% of global currency reserves in 1975 and is down to 58% today. I suspect it will continue to decline, but I do not see any other currency that could replace it. The Euro is #2 at 20% but peaked at 28% in 2009.

I thought these articles on people working longer were interesting and concerning. ‘I’m 94 and still work 7 days a week’: Number of seniors delaying retirement explodes — and could surge further amid economic uncertainty

Tariffs

The biggest news was the China 90-day tariff reprieve, cutting the rate to 30%. Is it enough to save the holidays? It’s clearly a step in the right direction, but the fallout from a poorly executed policy isn’t behind us yet. A 30% tariff will be hard for retailers to overcome, and it will be interesting to see how much is “absorbed” by China. A lot of production has already shifted to Southeast Asia. In Trump’s press conference, he suggested a “total reset.” We will know more in coming weeks, but at least this announcement is a step in the right direction. Markets rallied sharply on the news.

Bessent sees tariff agreement as progress in ‘strategic’ decoupling with China

Trump China trade deal: Tariff pause means new surge in freight shipments, and higher prices

Lutnick says 10% baseline tariff will stick around for “foreseeable future”

Toy stocks rally after Chinese tariffs slashed to 30%

I am a little surprised, as a 30% tariff is still high.

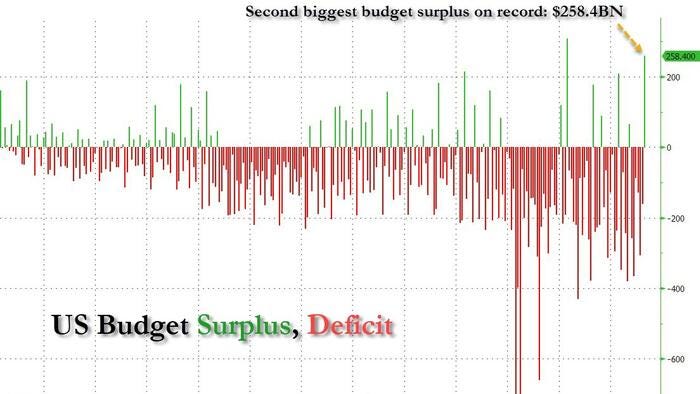

Tariff receipts topped $16 billion in April, a record that helped cut the deficit

Bessent says China ‘ignored their obligations’ on trade under Biden

Goldman cautions overall U.S. tariff rate still much higher than expected even after China reduction

These household items have gotten pricier since Trump’s tariffs announcement, new report finds

Politics

Trump to sign order to cut some U.S. drug prices to match those abroad

I am not sure this is the best method to get the desired outcome. This long Truth Social post outlines Trump’s view on the matter. I am all for lowering drug prices. However, we have to recognize that pharma companies spend billions developing drugs, and many never make it to approval. The Executive Order will introduce a "most favored nations" policy, which locks the price of prescriptions in the U.S. to the lowest negotiated price anywhere in the world. Americans shouldn’t be paying more for the same drugs than people in other countries. This article shows a study that the US pays 278% more for drugs than other countries.

Global pharma shares drop as Trump aims to lower US drug prices

White House announces $600 billion Saudi investment in U.S. during Trump visit

Trump administration poised to accept 'palace in the sky' as a gift for Trump from Qatar

This does not seem Kosher. This article calls it a “flying palace” costing $400mm. The plane is for the President’s use, as it will be gifted to the Pentagon and then will be given to the Trump Library, according to the article. I felt the ABC reporter’s question on the topic was fair, but Trump eviscerated her for it. In 2018, Qatar gifted a luxury 747 to Turkey according to this article. I feel the Republicans will get absolutely eviscerated for this kind of “gift” during the mid-terms. From 2001 to 2021, Qatar donated $4.7bn to US universities, which bought significant influence. Now, the donations from foreign countries are going to benefit the President. Follow the money. $400mm gifts always come with strings attached. If they don’t, you too can send me $400mm. I prefer Zelle. This article suggests this plane would be a security and upgrade disaster.

Zelensky offers first meeting of war with Putin after Russia ignores ceasefire demand

NYC Warns of 17% Drop in Foreign Tourists Due to Trump Policies

Wisconsin Judge Indicted on Charges That She Helped Immigrant Evade Agents

Americans were lied to by Biden, his family, the administration, the media and his friends. So many cover-ups. I called it early and was vilified for suggesting it years ago. This article suggests Biden forgot the name of longtime aids halfway through his term. Nothing to see here folks. The President of the United States was diminished and there was a massive cover up.

AOC Isn’t Ruling Anything Out, Including the White House

For the Democrats to succeed, they need to move to the center, not further left.

JP Morgan CEO Jamie Dimon slams Democrats for LA wildfire reconstruction delays, ‘more regulations’

I was there last month and wrote about it with pictures and videos. Many homeowners are complaining about permits and regulations. I think it will take 10 years to rebuild.

Susan Collins takes steps toward 2026 run as big-name Democrats weigh potential challenge

Pentagon spent at least $21 million on flights to Guantanamo, which currently holds 32 migrants

DOGE needs to look into this one.

Middle East

Edan Alexander, the last living American held hostage by Hamas, freed from captivity

Poll: 59% of Palestinians in West Bank Say October 7 Massacre Was ‘Correct Decision’

Nearly 80% of Palestinians oppose dismantling of Hamas as a terrorist fighting force. According to the poll, nearly 80 percent of Palestinians blamed Israel, or even the U.S., for their current plight in Gaza.

I have been critical of Trump’s Houthi deal and how it leaves Israel exposed. I know Bolton is a Trump-hater, but his take here is similar to mine.

Disagreements on Iran, Gaza straining Trump-Netanyahu relationship

Iran and the US conclude a 4th round of negotiations over Tehran’s nuclear program in Oman

I was Hitler’s neighbor: ‘If he’d known we were Jewish, we’d have been sent to Dachau’

Other Headlines

Goldman changes tack again, raises 2025 S&P 500 target to account for easier tariffs

Goldman Sachs’ David Kostin hiked his 2025 S&P 500 target back to 6,100 from 5,900. The revised target implies upside of 4% from Monday’s close. Trump’s tariff pivot gave markets a boost, but the economy and business confidence already took a hit from the poor rollout.

Powell may have a hard time avoiding Trump’s ‘Too Late’ label even as Fed chief does the right thing

The inventory-to-sales ratio for retailers was 1.5 before the pandemic, and now it is 1.3, see chart below:

I thought this chart from BofA was interesting on lower capex guidance

China's AI-powered humanoid robots aim to transform manufacturing

The age of incredibly powerful 'manager nerds' is upon us

The article outlines growth of AI and fleets of bots that will be running companies and doing much of the work.

GM unveils new ‘groundbreaking’ EV battery tech, aims to be first to market

McDonald’s announces plans to hire 375,000 workers with Trump Labor secretary

Clearly not all roles are ready to be taken over by AI just yet.

Chegg to lay off 22% of workforce as AI tools shake up education tech industry

Why Warren Buffett Doesn’t Think You Need a Fancy Degree to Be Successful

Reddit CEO says some 'very basic human stuff' makes a good leader at any level

To interrupt someone who won’t stop talking, do 3 simple things: ‘Others will appreciate you’

Why U.S. air traffic control is stretched so thin — and the fight to fix it

Feds’ Sean “Diddy” Combs Case In Danger As Key Witness Remains AWOL On Eve Of NYC Trial Start

New hypercar Czinger 21C-first 3-D printed and goes 0-60 in under two seconds

Spain, Austria and Italy named the safest countries for women to visit solo

‘Resort fees’ in the U.S. must now be disclosed. But some aren’t celebrating yet

Jesus' tomb 'discovered' by archaeologists in 'unbelievable' find

Man stumbles across hoard of priceless coins while out for nature walk: ‘Face to face with history’

Guy went for a walk in the forest in Romania with a metal detector and found hundreds of coins over 2,000 years old.

Archaeologists discover tomb of Egyptian royalty behind false door: 'Unveils new secrets'

'Massive false door' made of pink granite dates back to about 2400 B.C.

Health

I study happiness for a living—my 4 best parenting lessons for raising happy, successful kids

Good advice and #4 is as true as they come.

The ‘particularly alarming’ ways that obesity affects teenage brains revealed

Top 10 'allergy capitals' of the US, plus 4 tips to manage symptoms

I’m a longevity researcher — this cheap, tasty snack can help you live to 100

I did not see this one coming.

Real Estate

In my community in Boca Raton, Florida, Royal Palm, housing prices have escalated dramatically since I moved down in 2017. The chart below outlines the price changes, and I would focus on the median home price, which has gone from $3.2mm to $8.2mm during the past eight years. There are approximately 750 homes in the community, and when we moved down in 2017, there were 71 for sale. In December 2021 (peak COVID migration), we got down to four homes for sale as inventory evaporated. We are back up to 38 listings, as sales are slowing down. When I moved in 2017, the most expensive home sold for $12.4mm (only one sold over $10mm that year), and now, 21 of the 38 homes for sale are asking $15mm or more. In 2024, 21 homes sold for $10mm+ and five sold for over $20mm. There is a house under construction on the Intracoastal that is rumored to be asking $80mm, but is yet to be formally listed (video of it from my boat).

Interesting article on the weakness in the vacation home market with various cities outlined. Vacation homes are being dumped at a rapid rate as fresh fears of a housing market crash — and a shrinking pool of renters — rattle sellers. The number of people buying second homes has plunged to its lowest level since records began, and is under a third of what it was during the pandemic boom. A toxic mix of sky-high mortgage rates, soaring maintenance costs, and a widespread return-to-office push is fueling the trend. In 2024, just 86,604 mortgages were issued for second homes across the United States. That's a 5 percent drop from the year before and down dramatically from the 258,289 in 2021. At the height of the pandemic, remote workers who could afford it were fleeing big cities in droves and buying up homes in sunny spots like Florida and California. 'Most people aren't buying vacation homes at all because mortgage rates and insurance costs — especially for waterfront properties — have skyrocketed,' said Lindsay Garcia, a Redfin Premier agent in Fort Lauderdale.

This WSJ article about the weak spring home-selling season has a lot of good information. The troubled housing market can’t seem to get back on track. Inventory of homes for sale is steadily rising, but demand is still tepid. Home prices in parts of the country are falling. But with prices not much below record highs, many would-be buyers are still squeezed out. Mortgage rates are hovering around 6.75%, more than double the level of only a few years ago. The crucial spring selling season is shaping up as a dud, crushing hopes that a housing market that has been anemic for more than two years can gain significant momentum this year. Even in markets where there is a glut of inventory and sellers are offering concessions, it isn’t enough to get the market moving nationally. Sales rose in February, but activity the next month suffered its slowest sales pace for any March since 2009. Then in early April, President Trump rolled out his tariff policy, causing fresh economic anxiety and the stock market to sell off. That gave buyers another reason to stay away.

One in three distressed borrowers handing back buildings, experts say

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #785 ©Copyright 2025 Written By Eric Rosen.