Opening Comments

My last note was a review of the high-end omakase restaurant, Noz 17. The most opened links were Trump’s swollen hand and the simple fitness test that will determine how long you will live.

Travelling means my sleep gets materially worse as I go from hotel to hotel and bed to bed. I long for my Eight Sleep pod, which I have grown to rely on to get me my best sleep in terms of length and depth. Without my Eight Sleep, I am yet to sleep through the night one time. When I am in my own bed, the Eight Sleep pod regulates the temperature and helps me sleep longer. Countless readers have called to thank me for suggesting the Eight Sleep pod, which has improved their sleep patterns. One told me, “I never woke up after 5 am prior to using the product and now, I don’t want to get out of bed until after 7 am.” A new sleep study showed one in three Americans admit to waking up exhausted. Remember to use the code: ROSEN when ordering your pod to save at checkout.

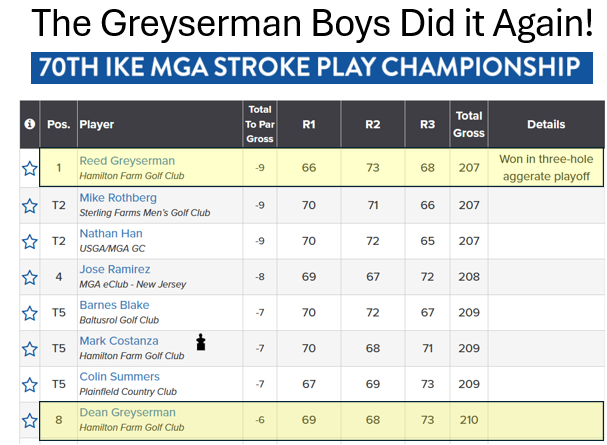

The Greyserman boys know how to golf and continue to compete at the highest levels. Reed won the Ike this week, which is a prestigious amateur tournament held in the NY metropolitan area. The 54 hole stroke play event was held in 100 degree temperatures and despite a playoff, Reed came out on top. Congrats. Dean came in 8th.

Markets

Young Professionals Drained by Long Work Days

Casino Layoffs-Traffic Down and Electronification

US Housing Market Slowing

DOGE Selling Off Unused Office Space

Cities in the USA That Will Pay You to Move There

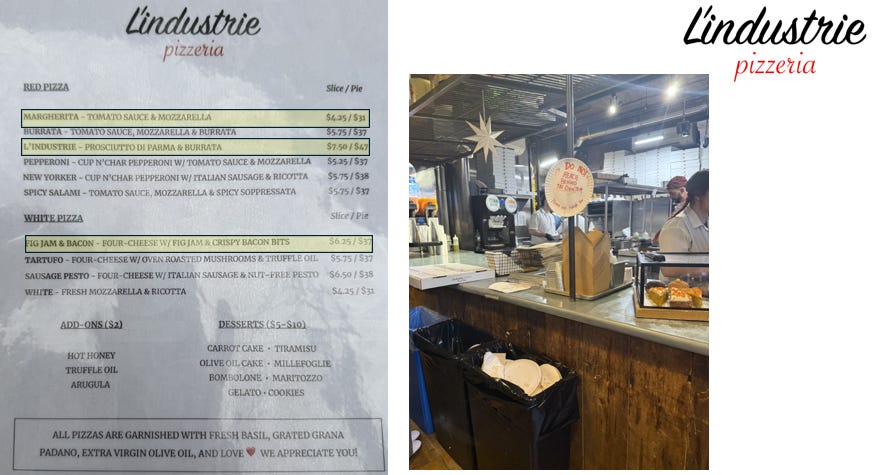

Picture of the Day-L’Industrie Pizza

I am not a huge pizza guy. I am more of a gourmet food eater who likes the fine dining. However, I felt the need to try what is consistently a top-rated pizza establishment in NYC. I am yet to see a top 10 pizza list that does not include L’industrie. We went to the West Village location (another is in Williamsburg) last Monday as our first meal prior to Noz 17 ($195/head omakase). My son Jack and I waited in line for 20 minutes at this tiny pizza joint brimming with young hipsters that disproportionately wore Adidas sneakers. You can get your pie or slice and stand up at a few of the counters and eat or take it to go. They have a few drink choices including beer and a few dessert options. The menu is small, and you can order slices or pies at a very reasonable price. The pizza is a thin crust and light on tomato sauce with a great texture. We tried the margherita, fig jam and bacon, and the L’industrie with prosciutto and burrata. All were delicious, but I felt the fig jam and bacon stole the show. The ingredients are imported from Italy, and it shows as this is one of the best pizzas I have ever tasted. L’industrie owners, I will 100% invest in bringing this concept to Florida. It is that good and you know how to reach me. Places like L’industrie are what makes the NYC food scene amazing.

Food-8.9

Ambiance-7.2 (casual-good for what it is)

Cost-Inexpensive

Overweight Position, Underweight Outcome

Back in the olden days when trading desks were truly fun, a lot of crazy things took place. One of the many was rampant betting on stupid outcomes. There were so many food bets like the one in Cool Hand Luke where Paul Newman ate 50 hard-boiled eggs in an hour. There were push up and pull up bets, ice cream eating contests, and even a famous swimming bet. We had an Olympic champion swimmer who had to race one handed with a delayed start against a trader. That was a fun one.

I believe the year was 2006 and there was a weight bet where a junior analyst was making markets on how much weight a bond trader would lose in three and a half months. The young man making markets was in over his skis and he was about to learn a valuable lesson. To protect the identities, I will call the young analyst James and the bond trader Neil.

January 1st was the official weigh in, but the bet discussions began over a month prior. Neil decided to go into the weigh in +12 pounds from his already overweight frame and got up to 192 to make it easier to lose weight. James had no idea of what was coming, especially given the extra weight.

Once the bet started, young Neil was working out with me at 5 am at Equinox, and I knew he was serious about his weight loss. I worked with him on his diet and exercise program. I had told Neil that I was backing him, meaning I would bet on him losing the weight and he better not come in heavy. I was the boss!

James sent out a message “Neil Weight Loss 13 @ 15 pounds over a three and a half months.” If you thought Neil would lose more than 15 pounds, you would “lift” the offer of 15 and if you thought he would lose less than 13 pounds, you would “hit” the 13 bid.

Bets started at $10/pound. So, if you lifted the 15-pound offer and Neil lost 40 pounds, you would make $250 ((40-15) x $10). However, if you hit the 13-pound bid and Neil only lost 5 pounds, you would lose $80 ((13-5) x $10). I made it clear that Neil was my guy and I lifted the offers constantly, which meant I felt he would lose more weight than the market suggested. Others started betting and market were growing to $30/lb. If the market was 20 @ 22 and you lifted the 22s at $30/pound, there was money to be made or lost. If he lost 40 pounds, you would make $540 ((40-22) x $30) for each bet, and I had too many bets to count. Markets were growing and a bunch of people were backing Neil to fail in his weight loss journey.

People would bring in cookies, donuts, cakes, and other crap to try to entice Neil into eating bad food. He was an animal and stood firm in the face of temptation. I think I was scaring the crap out of him as well. He knew he could not fail. To game the system, we would speak loudly giving bad info about how he was not losing weight fast enough. I would act upset with him on the trading desk and the information would move across the floor like wildfire. It would allow us to make more bets backing Neil. Brilliant. He would wear baggy clothes to make it look as though he was not losing weight. The deception paid off.

I had the inside scoop. I was meeting with Neil daily about die and exercise putting the fear of God in him if he lost. I knew there was no way I was going to lose the bet. I kept on lifting the offers knowing the weight was being shed at a rapid clip. Young James was getting torched. What started as 13 pounds @ 15 pounds, got into the 20s and 30s eventually and I kept buying given I knew Neil would lose a ton of weight.

At the final weigh in, Neil lost over 50 lbs. I won’t tell you how much money was made, but it was not insignificant. James and those who bet against Neil were crushed. I never lost a moment of sleep during the bet as there was no way Neil was ever going to fall short on the bet given I was backing him. Having inside information with daily weigh ins only made the betting easier. It was literally like stealing candy from a baby.

No wonder these politicians make so much money trading with inside information. It is simple when you have material info that the rest of the market lacks.

James eventually became a solid trader, and I have a funny felling this expensive lesson helped improve his trading skills. There is no one who can take credit for other people’s accomplishments better than I can!

These fun and stupid events that are not allowed anymore but actually create an amazing culture and great bonding opportunity across the trading desk. We all had a lot of fun with these silly bets and created a camaraderie that made the job more enjoyable.

Quick Bites

Although stock futures were down slightly Sunday night, they were unchanged by the open on Monday and +1% by the close of trading. Oil opened +3.2% ($76/barrel) on Sunday night after the US dropped bombs on Iran. However, by Monday’s afternoon, oil was -7% as the likelihood of escalation is low. Then, Monday evening, Trump announced a ceasefire, and oil fell further down another 5% to $64/barrel, while stocks continued to rally. YTD, the S&P is now +3.6% and the Nasdaq +3.1% and both indices are less than 1.5% from all-time highs. The Nasdaq is now +35% from the April lows. Nvidia shares hit a record today ($155). The chart below suggests the S&P is trading 35% above historic valuations. Despite Powell’s comments that he was in no hurry to push for rate cuts until the impact of tariffs played out, rates remain largely unchanged. Powell emphasized the Fed’s obligation to prevent the “ongoing inflation problem.” The 10-year Treasury is at 4.28% and 30-year at 4.83%.

A reader sent me this article on young professionals feeling drained by long workdays. Microsoft’s 2025 work trend index report found that many workers are increasingly grappling with “infinite workdays”, which start before sunrise and stretch late into the night. Many young professionals are struggling with this new reality. “There’s usually this unspoken pressure not to work from home, even if it’s allowed, but I do it anyway because I have so much work, [so] commuting feels like a waste of time, and I am just exhausted.” This traditional work culture is disillusioning gen Z as 94% of the generation are prioritizing work-life balance over climbing the corporate ladder, according to research by Deloitte. Sal, a New York-based compensation specialist who declined to provide his full name for privacy reasons, believes his generation is facing new hurdles in the workplace such as rising mental health concerns, and stagnant wage increases in the face of inflating living costs. You must have a plan and goals. Working 15-20 hours a day is NOT for everyone. I spoke with one young analyst at a major bank who said the best analyst quit after one year because he could not handle the long hours. I have no problem with hard work and long hours if you are growing and developing and moving toward a goal. However, more young professionals seem less interested in putting in the time and more focused on work-life-balance. I hear a lot of complaints from CEOs about the lack of work ethic in many young people today.

Las Vegas’s famed casino floors are getting quieter as table game dealers find themselves among the first to feel the squeeze of technological change and a downturn in tourism. Major resorts on the famous Las Vegas Strip, including Fontainebleau and Resorts World, have started laying off workers — many of which are dealers — as foot traffic dwindles on the gaming floor. New data from the Las Vegas Convention and Visitors Authority shows the city’s visitor volume dipped 7.8% year-over-year in March 2025, marking the third straight month that tourism dropped in Sin City. With fewer guests coming into town, gaming revenue on the Strip fell 4.8% over that same period, while hotel occupancy slid to 82.9%, down from 85.3% in March 2024. Tourism throughout the country appears to be in steep decline, as International arrivals are down sharply amid evolving U.S. travel and tariff policies. According to Travel Weekly, advance summer bookings for flights between Canada and the U.S. have plunged by more than 70 percent compared to the summer of 2024. Electronic game tables are also taking a bite out of personnel needs. According to Travel and Tour World, casinos have introduced electronic table games that handle bets and payouts without human intervention, another factor that has encouraged casinos to cut labour costs. Enrollment in dealer training programs has also fallen as fewer people view Las Vegas as a stable option for employment.

Tariffs

Politics

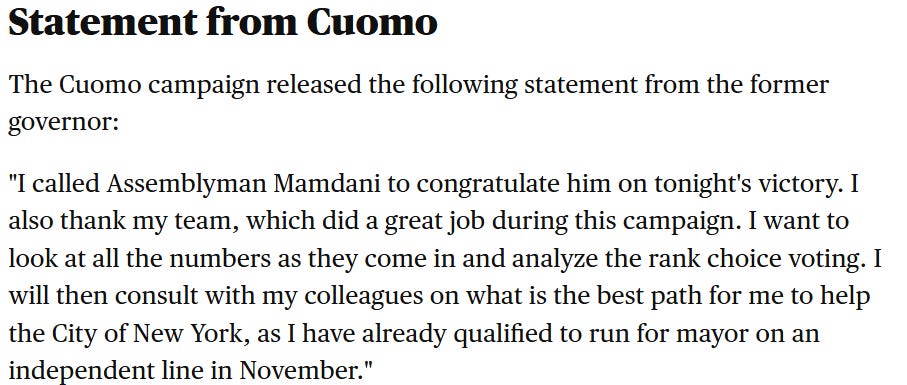

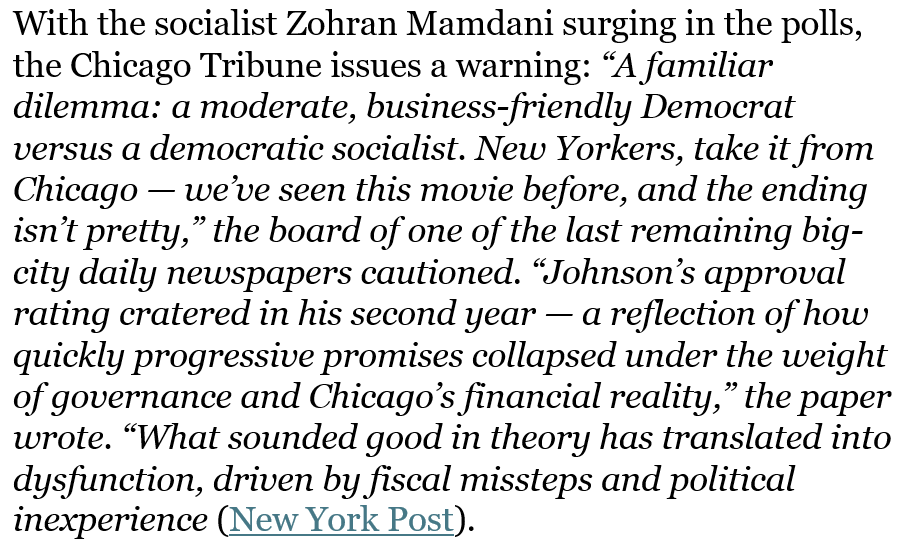

Given the importance of the NYC mayoral elections, I am shocked by the low turnout. In 2021, 23% of eligible voters participated. It appears for the Democratic primary, 1.07mm of the 3.3mm registered Democrats in NYC voted. Socialist, Zohran Mamdani has won the Democratic primary on the first round and Cuomo conceded the race. It appears that Mamdani will be the Democratic candidate in November after ranked voting is done. Cuomo ran an awful campaign and came across entitled. I do think Cuomo runs as an Independent and when the wealthy realize the awful politics of Mamdani, the November race will be tighter than expected. The ramifications for NYC if Mandani is the mayor are not good.

I agree with Ron DeSantis and Dan Loeb on their take for South Florida R/E:

If Mamdani was the next mayor, I know many wealthy Jews who would flee to Florida. My desire to go to NYC would fall dramatically, and I am not sure I would spend much time there if the mayor of the city hates me. You know he is an awful candidate when both Sanders and AOC support him.

Here are some of Zohran’s policies:

His mayoral campaign is based on lowering the cost of living. His signature promises are a rent freeze on stabilized units, free city buses and child care, creating city-owned grocery stores and building 200,000 affordable units of housing. He also wants to raise taxes on the wealthy and have the Department of Community Safety take on some responsibility for the NYPD. The tax policy is another 2% surcharge on those earning over $1mm and raising the corporate tax to 11.5%. Let’s not forget government run grocery stores. If you thought the clown, DeBlasio, was bad, you have no idea when it comes to Zohran. He would be a complete disaster.

Mamdani laments criticism following his ‘globalize the intifada’ comments

US Holocaust Museum accuses Mamdani of ‘exploiting’ Warsaw Ghetto Uprising

New York City mayoral contender didn’t back measures condemning Holocaust, supporting Israel

Is the Financial Capital of the World About to Elect a Socialist Mayor?

Supreme Court allows Trump to resume deporting migrants to third countries

Great article comparing NY and Florida budgets and how money is spent. NY state budget is $252bn for 2025/6, while Florida budget is $115bn for next year. Florida has 20% more people than NY. The article goes into detail on spend. For example, Pre-K through 12th education spend is $31bn for Florida and $37.4bn for NY despite the fact that Florida has 21% more students. Of note, Florida is ranked far higher in education than NY according to US News and World Reports. The link goes into details showing differences in NY and Florida budgets. My point is simple: NY spends over 2 times what Florida spends with 20% fewer people. Further, NY is ranked far lower than Florida in most categories as seen below despite the extra spending.

11 illegal immigrants were taken into custody and many had criminal records. One had ties to Hezbollah. Biden’s open border policy created great havoc that will last many years. Under the Biden administration, more than 700 Iranian migrants who crossed the border illegally were released into the US.

Although I pick on Pelosi, this is a bi-partisan issue, and the law needs to change. Politicians should NOT be allowed to trade at all on individual names and should not be able to buy or sell indices when they have material information.

Middle East

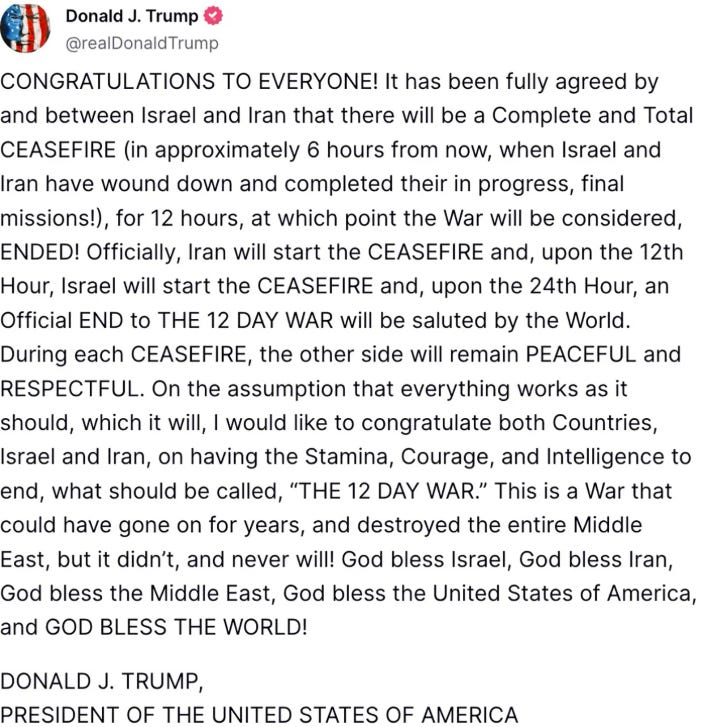

The US bombing Iran’s nuclear sites has become headline news, and I will repeat my thoughts from the prior note that I support Trump in his actions. Trump announced that Iran gave the US advanced notice of the attack in Qatar, suggesting to me that this was a way for Iran to save face and had no intention of escalating. The President also mentioned Iran’s response was very weak and led to no injuries. Israel attacked Fordow again after the US bombing as well. Then Trump announced an Israel-Iran ceasefire on Monday evening. I just don’t think that would have been possible without the help of the Trump Administration and the bombing on the nuclear sites. Iran has been humiliated between Israel and the US bombing campaigns. However, it appears that Iran violated the cease-fire. Trump lost it and dropped the F-Bomb on Iran for breaking the cease-fire, but it appears the cease-fire is back on again

There are conflicting reports regarding the damage to the nuclear facilities. The NYTimes is suggesting minimal damage and just the doors are blocked. However, the NYPost suggested more damage than first believed and there is possible contamination. The Times of Israel suggested the program was set back several years, but not destroyed.

Iran ordered the closure of the Strait of Hormuz, the shipping channel through which around 20% of the world’s daily oil flows. I assume it will not be closed now that the cease-fire is in place, but do not see anything in the news.

Iran delivers strong warning after ceasefire

The ridiculous rhetoric out of Iran reminds me of “Bagdad Bob,” when the US attacked Iraq. The link has some funny videos of Bagdad Bob claiming Iraq will defeat the US with “shock and awe.” The US crushed Iraq in six weeks. Iran’s silly talk is laughable. Those old enough to remember should watch the video of the Iraqi “disinformation minister.”

Frontrunners emerge as Iranian officials discuss possible successors to Khamenei

U.S. intel found Iran did not move nuclear material from Fordo ahead of attack, Sen. Mullin says

In leaked call, Israeli operative tells Iranian general: ‘You have 12 hours to escape’

Hegseth claims Iran’s nuclear ambitions ‘obliterated’ after U.S. strikes

Tom Homan reveals the 'biggest national security vulnerability' after US strikes Iran

Tom Homan warns of two million 'gotaways,' creating unprecedented national security threat amid heightening tensions between US, Iran

Israel has ‘interesting intel’ on whereabouts of Iran’s 60% enriched uranium

Major US cities on high alert following airstrikes on Iranian nuclear facilities

Another Holocaust survivor, 95, was killed by Iranian missile

Dramatic footage shows Israel striking Iran’s most notorious prison, blowing doors off hinges

So many professors are indoctrinating our children today. This was a Georgetown professor, and it is revolting what these moron professors support.

Other Headlines

FedEx beats earnings estimates, forecasts $1 billion cost savings in the next fiscal year

145 people pricked with syringes at France street music festival

The suggestion was the needles may have had date rape drugs in them.

China Strikes Hard: Chinese Satellite Pulverizes Starlink With a 2-Watt Laser 36,000 KM From Earth

It seems this technology can send data materially faster than Starlink.

Tesla stock pops 8% as Musk touts ‘successful’ robotaxi Austin launch

Power Blackout Hits Parts Of Queens, NYC: Con Edison Urges Energy Conservation As Temps Spike

Health

Microplastics shed by food packaging are contaminating our food and drink, study finds

Robotic surgery performed remotely from the U.S. on a patient in Africa

I sure hope you have a good internet connection!

Grandfather's simple changes reversed pre-diabetes diagnosis that left him 'petrified'

Changing what and how he eats brought dance teacher's blood sugar to a healthy range

Alzheimer's could start 20 years before memory fades, study warns

Real Estate

Interesting CNBC article about the US housing market which is showing signs of slowing. Rising supply and slowing demand in the housing market are finally causing prices to cool off, and the weakness is accelerating. Home prices nationally rose just 2.7% in April compared with the previous year, according to the S&P CoreLogic Case-Shiller Index released Tuesday. That is down from a 3.4% annual increase in March and is the smallest gain in nearly two years. S&P Case-Shiller found the deceleration in prices was taking hold across the 10- and 20-city composites its index measures. Both are now substantially below their recent peaks. In addition, much of the annual increase in the April reading occurred in just the past six months, meaning prices got a boost from the spring market rather than showing up throughout the year. Prices in those previously hot markets are now falling. Both Tampa, Florida, and Dallas turned negative, down 2.2% and 0.2%, respectively. San Francisco prices were basically flat, and both Phoenix and Miami eked out gains of just over 1%. Sales of new homes fell 13.7% in May pushing supply up to a three year high.

The Senate’s DOGE leader is hoping to give the U.S. Treasury another boost in cutting the $37 trillion national debt, this time by selling off some major real estate in Washington, D.C., currently home to several prominent cabinet agencies. The headquarters of the Departments of Energy, Housing & Urban Development, along with ancillary buildings home to other top agencies, would be sold off but without attrition or layoffs, as the employees therein would be relocated elsewhere, according to Sen. Joni Ernst, R-Iowa, the caucus' chairwoman. The "For Sale Act" would put the James Forrestal Federal Building on the market, one of six properties identified by the Senate DOGE Caucus as ripe for removal from the federal government’s portfolio. The Federal government spends about $7bn to lease and maintain office space, and many of those buildings have high vacancy rates. I view selling unused buildings a great idea. Sadly, DOGE has not had the savings Musk suggested, but I correctly outlined why those lofty ambitions would not be met.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #796 ©Copyright 2025 Written By Eric Rosen.