Opening Comments

Really strong feedback on my last report, ”Are We Over-Scheduling Our Kids?”

After 3 months in the shop, I got my 1971 Olds 442 back. Driving with the top down on a nice day is fun, and people stop me far more with this one than when I had my convertible Porsche.

I moderated the podcast last Thursday for Prometheus Alts and it received solid feedback. I will be inserting excerpts in the next few reports. In the China related bullet in Quick Bites, I have a 3 minute clip with Kyle Bass discussing some concerning developments about land purchases in Texas from a Chinese General. You must listen in light of what is going on today.

Early send so people can focus on the big game tonight. I am excited that the two best teams with two young and impressive QBs are in it. Given the Philly defense and potential injury to Mahomes, I would think Philly has a slight edge, but hope it is close.

Markets

Fed, Deficits, CBO Projections

Chinese General Bought Land in Texas-Remarkable

Visit Florida for the Sun, the Surf and... the Food?

Steve Ross on South Florida

NYC Rents Stay Elevated

Royal Palm Update-Big Sale

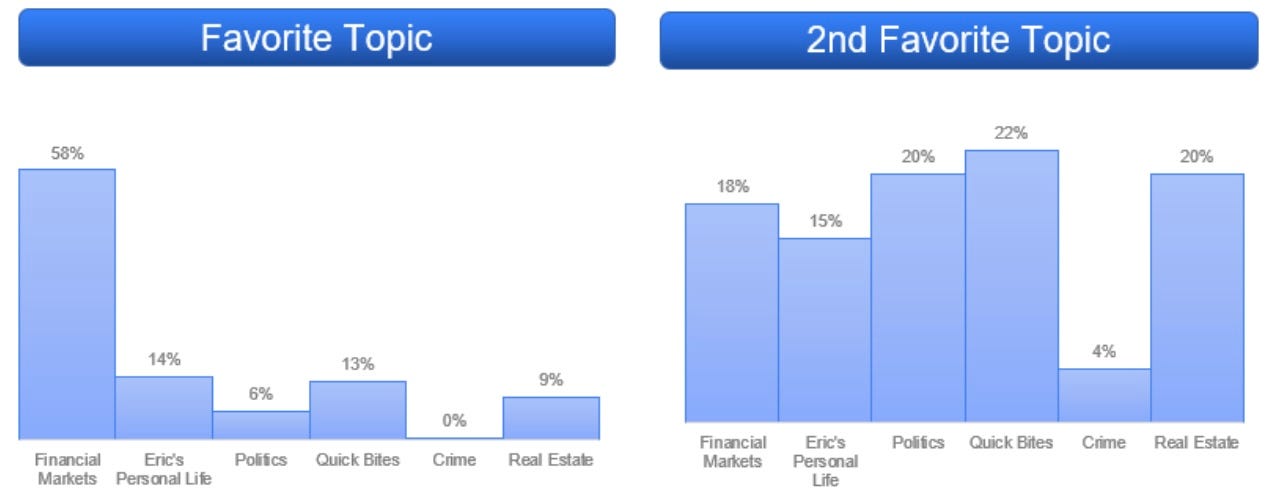

Rosen Report Survey Results

Thanks to all who participated in the survey which had a solid participation rate. My readers tend to be well educated with 94% having a college degree and 47% with an advanced degree. A majority of readers are senior professionals with 56% in the Executive/C-Suite and another 17% in middle management. I know that a good number of the Advisor/Consultants are quite successful as well with many RIAs and retired Wall Street folks who now do board work. I find from my interactions, I largely have two main reader types, senior/wealthy/successful professionals and smaller amount of younger professionals/college students who are hoping to find additional success and aspire to grow into bigger roles. We purposely did not ask income/wealth questions, but can tell you that the cumulative net worth of my readers is in the many tens of billions of dollars. I was a bit surprised that only 7% of those who responded were women. Based on my interactions with readers, I would have guessed 20%. Due to the feedback, I am taking out Crime Headlines and will add a few of those stories to the Other Headlines. The favorite topics were financial markets, my personal life, quick bites and real estate. My hope is to continue to improve and grow the Rosen Report. Ideas are always welcome. The relationships I have developed with my readers are the reason I continue to write the Rosen Report. I spend 40+ hours a week to read, write, edit and respond to readers. I am also spending a good deal of money on consultants, news feeds, and advisors to help improve the report.

A Trade to Remember

It was the late 1990s and I was responsible for Par and Distressed Loan Trading at Chase (prior to JPM merger). My team was growing, and we were building a solid business together. We were the dominant player in the market at the time with Credit Suisse. Chase underwrote a large loan AND bond deal for Iridium, a Motorola sponsored company led by Ed Staiano, formerly the most senior Motorola exec next to CEO Chris Galvin. It was the 1st time Chase/Jimmy Lee was “Lead Left” on a loan and bond, having won the lead underwriting position for the bonds in a fiercely fought battle with then high yield powerhouse, Merrill Lynch. It was a big deal for the firm to begin to aggressively encroach on the investment bank bond underwriting business and became the prototype for JP Morgan Chase’s later dominance in the new issue credit markets in the years that followed. In fact, between bank loans and bonds, nearly $5bn in Iridium debt was underwritten.

It was clear at the time of the financings that Iridium was not ready for prime time—the technology had serious glitches. When CEO Staiano met with investors to demo the product, half the demo calls couldn’t be completed and latency issues with the early voice encoder garbled conversations.

For proper use, you needed line-of-sight between the brick phone’s monstrous antenna and the unseen overhead satellite constellation. It was best used in the desert or mountains in the middle of nowhere and for the military. The company claimed to have a constellation consisting of 66 active satellites in orbit, required for global coverage. These satellites provided coverage for voice and data globally and offered coverage where there was no cell service due to the low-orbit satellites.

Shortly after Chase sold the loans and bonds, investors got nervous and wanted to sell. Given Chase was the underwriter, the investors come back to us when they wanted out of the loans/bonds we sold them. I did not want to go very long Iridium bank debt because I was worried about the fundamentals of the company.

My boss came to me and said, “Eric, we have a buyer of $35mm bonds, but we need to buy $15mm of his bank debt to get the trade.” This meant, my desk had to buy the $15mm bank debt! My boss’ High Yield bond desk was choking on bonds and losing a lot of money. Moving $35mm bonds was important for the firm.

My trading desk was pressured to buy the $15mm at 97, but our HY desk sold $35mm bonds, so my boss was happy, and I was scared. I told the team, “We need to find buyers of these loans as I fear we are going to lose a lot of money.” At the time, my business was doing tens of millions in revenues, so a big loss on $15mm in loans would have been meaningful. In coming years, that business got to many hundreds of millions. Then, in 2004, I was promoted to run Credit Trading which included the bond, derivative business, commercial paper, preferred stock and many others.

The biggest loan buyer in the last 1990s was Van Kampen Merit (VKM), and Jeff Maillet was the CIO of the billions in loans under management. He was the most important investor in the loan market at the time. Knowing he was always hungry for loan product, we put together a $250mm portfolio of loans for him. Some I had in my portfolio, and others were shorted (sold without owning). In the portfolio was $20mm of Iridium at a price of 94 cents. I told him it was an “All or None” portfolio. This meant he had to buy the entire portfolio or none of it.

Jeff bought the entire portfolio and took the desk out of my biggest concern only generating a loss of $450k (3 cents on $15mm). I shorted him $5mm of the loan, and within weeks the loans and bonds crashed allowing me to cover my $5mm short in the 50s generating a “net” profit between the losses on the $15mm and the gains on the $5mm.

The Iridium deal was a big black eye for Chase, given the speed the deal crashed and burned. All the other satellite bank/bond deals underwritten by other banks at the time like Globalstar and ICO Global met quickly with the same fate. Luckily, my team was not crushed by it. Although in my career I had some amazing trades including investing $500k to make $50mm in a week (story for another time), the Iridium trade stands out, as it was earlier in my career and such a big loss could have really set back the trajectory of the growth of my business. Sometimes, selling something at a loss turns out to be the right call.

Like many of the communications technology companies that did failed financings in the ‘90s, Iridium post-restructuring optimized the technology and later became an industry leader in MSS (mobile satellite service). The company today has a $7.2 billion market cap and is the principal MSS provider for the US government.

Quick Bites

The S&P 500 eked out a narrow gain in Friday’s session but still had the worst week in nearly two months. Despite the Dow’s Friday gain, it still ended the week down 0.17%. The S&P 500 and Nasdaq Composite lost 1.11% and 2.41%, respectively, in what was their worst week since December. The rally in equities YTD has been impressive with the Dow the laggard at +2.2%, S&P+6.5% and Nasdaq+12.8%. However, this Bloomberg article, “Credit Markets Are Poised for a Gut Check After 10% Rally,” suggests the mood is beginning to shift in credit market. CPI for January and Wednesday, retail sales which could be market moving data. The estimates for annualized CPI are 6.2% down from 6.5% the prior month and come out Tuesday. The Treasury market sold off again with yields rising to 3.73% on the 10-Year and 4.5% on the 2-Year, as consumer sentiment improved and speculation of future Fed moves. Larry Summers is suggesting the Fed may need to be higher for longer. I had pretty solid calls on inflation and rates. My base case was a cut in 2023 and although I think that could happen, it is moving away from my base case given the strong labor market and inflation which has been a bit stubborn in spots. The futures market is now suggesting Fed Funds in the 5-5.25% range and no cuts in 2023. Oil prices rose 2% after Russia cut output 500k barrels/day due to sanctions.

I have been consistently critical of the Federal Reserve and policy in recent years which contributed mightily to the inflation problem which has proven to be anything but “transitory.” This WSJ article, “U.S. Government Borrowing Costs Rise as Debt Ceiling Fuels Partisan Clash,” outlines the issues we face as debt has exploded, and now rates are materially higher. In my opinion, we must significantly alter spending and be more fiscally responsible. In the 1st four months of this fiscal year, the Treasury is spending $198bn on interest (+41%) from the prior year. As a percent of GDP, interest costs went from 1.2% in 2015 to 1.9% in 2022 and will continue to climb to 3.3% in 2032 according to the CBO. Check out the last chart. The CBO is awful and making projects and the chart uses their past error rate to predict the future which is quite bleak. The growth in borrowing in recent years has been massive between the financial crisis, COVID and careless government spending, we are going down a bad path.

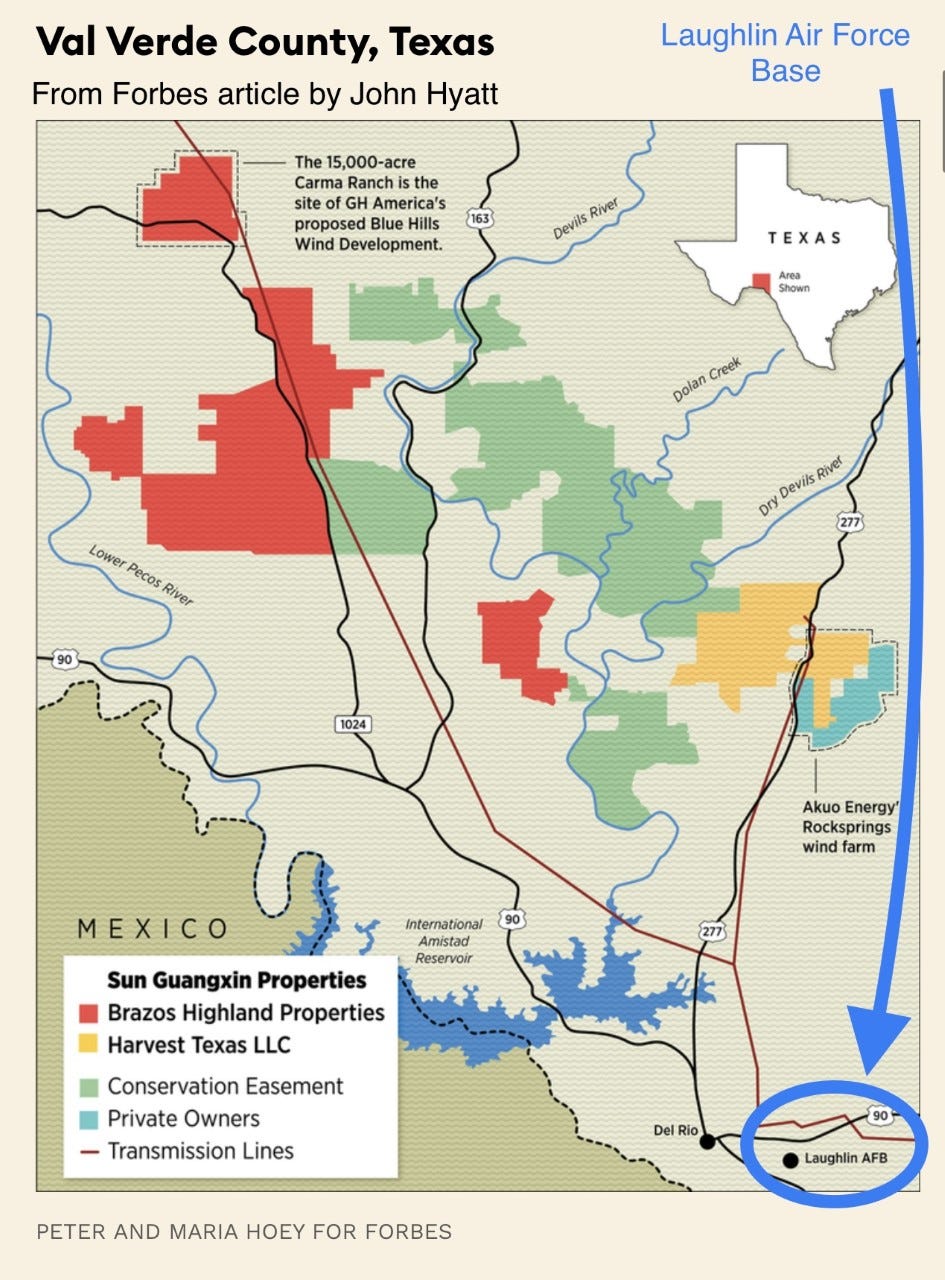

The United States is violating the principles of market economy and international trade rules in considering a ban on Chinese citizens buying property in the United States, the Chinese foreign ministry said on Friday. "Generalizing the concept of national security and politicizing economic, trade and investment issues violate the rules of market economy and international trade rules," spokesperson Mao Ning said at a regular press briefing. Remember, there are serious limitations regarding foreigners purchasing land and companies in China. The Chinese government continues to commit bad acts: COVID, lies, copyright infringement, spying, human rights violations, silencing anyone who speaks against the government… the list is endless. I moderated a panel on Thursday, and Kyle Bass has a fantastic example of a billionaire PLA Chinese general (Sun Guangxin) accumulating over 100 square miles in Texas of land next to an Air Force base and his plans for the land are quite concerning. Listen here to the 3 minute Kyle Bass excerpt from the Prometheus Alts sponsored panel which I moderated. I even wore a blazer. There is a great Forbes article by John Hyatt entitled, “Why A Secretive Chinese Billionaire Bought 140,000 Acres Of Land In Texas.”

The “civilian” balloon according to the Chinese officials, was anything but. The State Department commented the balloon “was capable of conducting signals intelligence collection operations” and was part of a fleet that had flown over “more than 40 countries across five continents.” It appears the balloon was designed to listen to American’s communications. Separately, another smaller object was shot down Friday over Alaska. The object entered US airspace before it was detected. A THIRD object was shot down over Canada on Saturday as well. What the hell is going on? Is China behind all of these?

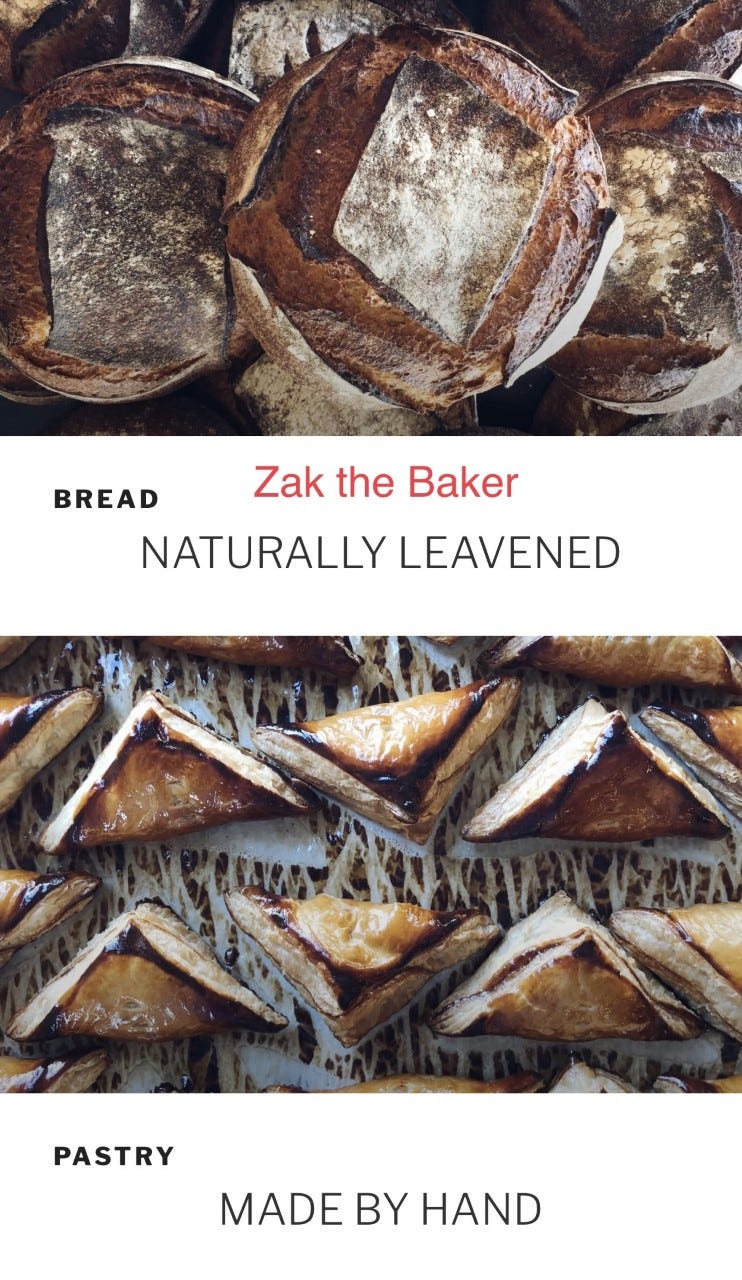

One of the things people asked for more of in the survey was cooking/restaurants. This WSJ article is entitled, “Visit Florida for the Sun, the Surf and... the Food?” I can tell you that in recent years, Florida has come a long way on the restaurant front. There are now 11 Michelin Star restaurants in Miami and more NYC eateries are opening in South Florida from Miami to Palm Beach. No, it is not NYC, Chicago or LA, but I have seen promising improvements. In June of 2022, the Michelin Guide launched its inaugural foray into Florida. The esteemed red guide’s expansion into Florida marks the fifth U.S. destination that Michelin has recognized, after New York, Washington, D.C., Chicago and California. Twenty-nine Florida restaurants in Florida received a Bib Gourmand, a high distinction from Michelin for offering exceptional quality for value. Some listed restaurants include: Zak The Baker, a kosher bakery in Wynwood; Chug’s Diner, a Cuban-American diner in Coconut Grove; Hometown BBQ in Allapattah; and Z-Asian in Orlando. This is the full Florida list for Stars or Bib Gourmand from Michelin. There are good interactive links for restaurants and many good pictures. I have a half dozen I need to try including LPM, Hiden, Stubborn Seed, Boia De, Cote and Over Under to name a few. South Florida is now far less of a culinary wasteland than it was five years ago. Funny, how the wealth migration has impacted the high-end food scene.

Other Headlines

Yahoo to lay off 20% of staff by year-end, beginning this week

Adidas shares tank after it issues warning over unsold Yeezy stock

CNBC article suggests substantial losses over Yeezy inventory issues.

Google shares lose $100 billion after company’s AI chatbot makes an error during demo

China’s biggest chipmaker SMIC posts record 2022 revenue but warns of a tough year ahead

Tiger Global defends its valuation of privately held tech companies

I have not seen many specifics, but Byte Dance, for example, would be tough to sell today at a high valuation given the regulatory issues and potential to be banned. I believe it should be banned in the US. We are learning everyday just how bad the Chinese government is on spying and many other topics outlined. Just curious where Tiger thinks they could sell these large, private stakes today.

DeSantis beats Trump in 2024 GOP primary — if Nikki Haley stays out

DeSantis wins 45% to 41% over Trump head-to-head, but if Haley enters, Trump 38%, DeSantis 35% and Haley 11%. I can see a DeSantis/Haley ticket.

Trump team turns over items marked as classified

Raise your hand if you have classified info? Wow, this is out of control.

Citi Dropped from Texas $3.4 Billion Muni Deal on Gun Policy

State AG said the bank ‘discriminates’ against gun industry

These Millionaires Tried Turning a Yacht Into a Tax Break. The IRS Sank Their Plan.

The Ridingers donated Utopia II to charity and ended up paying $3.5 million in taxes and penalties

A Waitlist of 60,000: Why Women Are Flocking to This Members-Only Club

Some 20,000 senior leaders in the private network help elevate and support women in the workforce.

An 85-year Harvard study found the No. 1 thing that makes us happy in life: It helps us 'live longer

I enjoyed this article which outlines, “Social Fitness” as the key to a happy life with a detailed list.

A neuroscientist says these 4 'highly coveted' skills make introverts more successful than others

Mom fuming as daughter, 13, gets chest binder at school — and is urged not to tell parents

Crazy story about a school and the interaction between a parent and school after a the 13-year-old was given a gender-transitioning device known as a “chest binder.” The girl was told to keep it from her parents.

Jeffrey Epstein docs with names of associates to be made public

I am dying to see the people involved. There are some powerful names associated. I am shocked Ghislaine has not gone public. Someone has all the tapes, as Epstein had every room in the house recorded. Where are they?

Tyre Nichols' deadly encounter in Memphis comes at a critical time in American policing

The article discusses the challenges of finding policies officers and the fact that they are offering bonuses, loosening hiring standards and reducing training to attract more cops. What could possibly go wrong? Retirements and resignations are exploding and police forces have been diminished.

Man shot and killed in Times Square in drug-related shooting

Thieves grab $52K in merch from NYC Givenchy store

The non-stop shoplifting and thefts are crushing retail and making prices higher for law-abiding citizens.

New Jersey girl, 14, takes her own life after latest attack

Horrible story of a bullying situation.

National Pizza Day 2023: Slice into some absurd facts

I don’t love pizza, but if you do, there is a lot of info here. Shockingly, NYC and Chicago did not make the top pizza list. Portand, OR won! In Phoenix there was a 4.5 hour wait at Pizzeria Bianco given the golf tournament and Super Bowl.

Here’s how much Americans plan to spend on the Super Bowl this year

The average is $115 or +31%.

Look of the Week: With these big red boots, fashion is entering its silly era

The stupidity of consumers never ceases to amaze me. Who would wear these boots? Crazy pictures of “models” in the link.

Moment debris falls onto rescuers in Turkey's Hatay

Awful video of rescue team digging only to have massive debris fall onto them. Scary.

Real Estate

Stephen Ross (Related) is actively looking to build projects located outside of West Palm Beach and Miami, where he's already established several projects, Ross told Bloomberg. "People are looking from the Northeast and relocating for jobs — not retirement — and companies are looking" for offices, he said, adding "It’s tax issues, and there’s the security issues. There’s just the ease of living." "New York will continue to grow, but it has its challenges, and a lot of people who don’t have to be there are looking not to be there," said Ross. "It’s changing, it’s getting younger, the older people are moving out, the wealthier people are moving out." This Zero Hedge link outlines numerous firms including Citadel, Apollo, Goldman, Point72 and others who have opened offices in South Florida.

This CNN article, “Rent for a Manhattan apartment remains mind-bogglingly high,” outlines crazy rent prices. The median Manhattan apartment was $4,097/month, up 15.4% from a year ago and +1.2% from December. However, vacancy rates are slipping. Other data and good commentary from Jonathan Miller, CEO of Miller Samuel.

Good WSJ article, “For Remote Workers, These U.S. Cities Are Great Places to Live.” The Springfield, MO metropolitan area, with a population of about 480,000 people, topped The Wall Street Journal’s list of great places to work remotely. Other cities in the top 10 include Conway, Ark., Kansas City, Kan., and Lafayette, Ind., a metro area of about 225,000 people that was recently named the top-ranked emerging housing market, according to The Wall Street Journal/Realtor.com Emerging Housing Market Index. Sorry, I could not live in the places listed. I feel I could live in Nashville, Charlotte, Austin, or South Florida. For an amazing opportunity, obviously NYC would be in the mix.

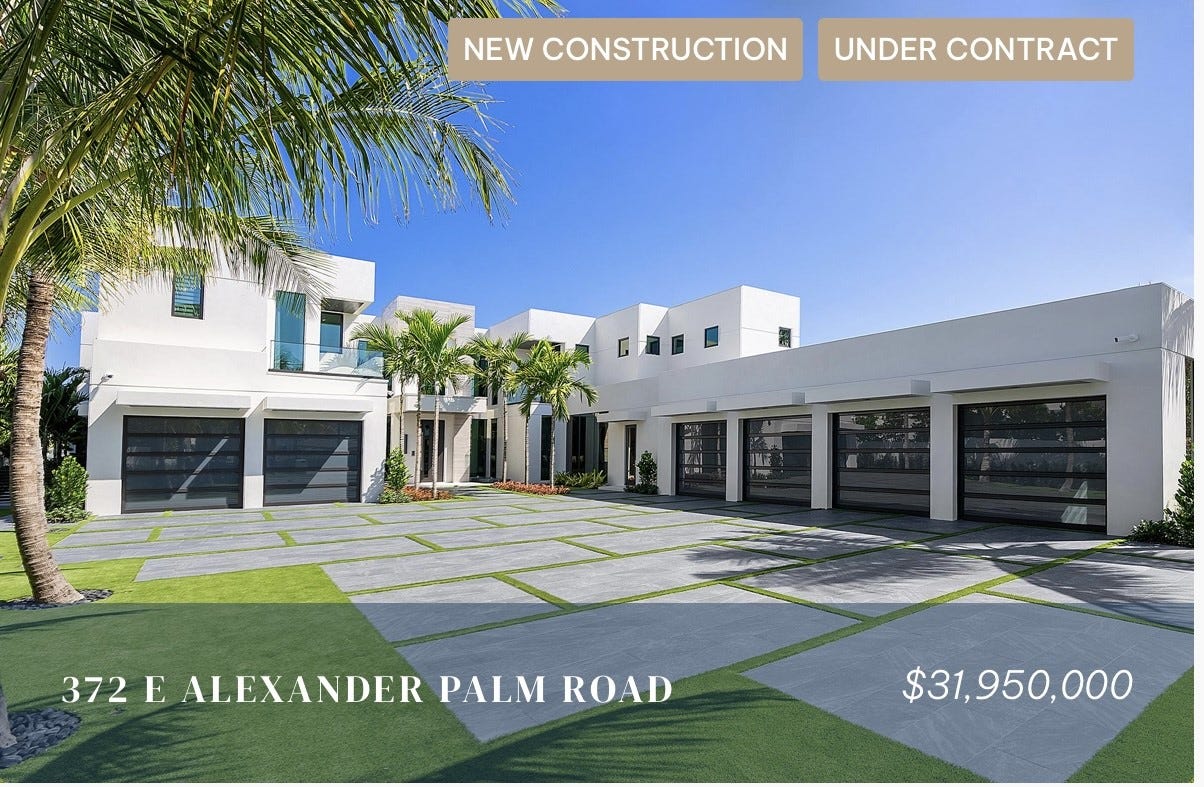

My neighborhood in Boca is called Royal Palm, and higher-end housing has cooled decently. Homes have stayed on the market longer and inventory has gone from 4 homes in December of 2021 to 32 today. There were 71 on the market when I bought in may of 2017. The higher-end inventory (over $15mm is growing sharply) is now at 17 properties, the most ever. When I moved in 2017, ZERO properties were over $15mm, as the record sale was $12mm, I believe. However, a waterfront home listed for $31.9mm is now under contract. The house looks amazing. The SRD (high-end builder) home is 10,660 ft a lot of almost 15,000 ft. Not my favorite location, but a substantial price. After closing the price will become public.

Other R/E Headlines

Here’s what’s happening with home prices as mortgage rates fall

CNBC article which outlines recent price changes and trends.

Steepest Home-Price Declines in Fourth Quarter Were in the West

Mentions Bay Area is 15-20% from peak.

A Greenwich Estate With Ties to Bridgewater’s Ray Dalio Hits Market for $150 Million

Virus/Vaccine

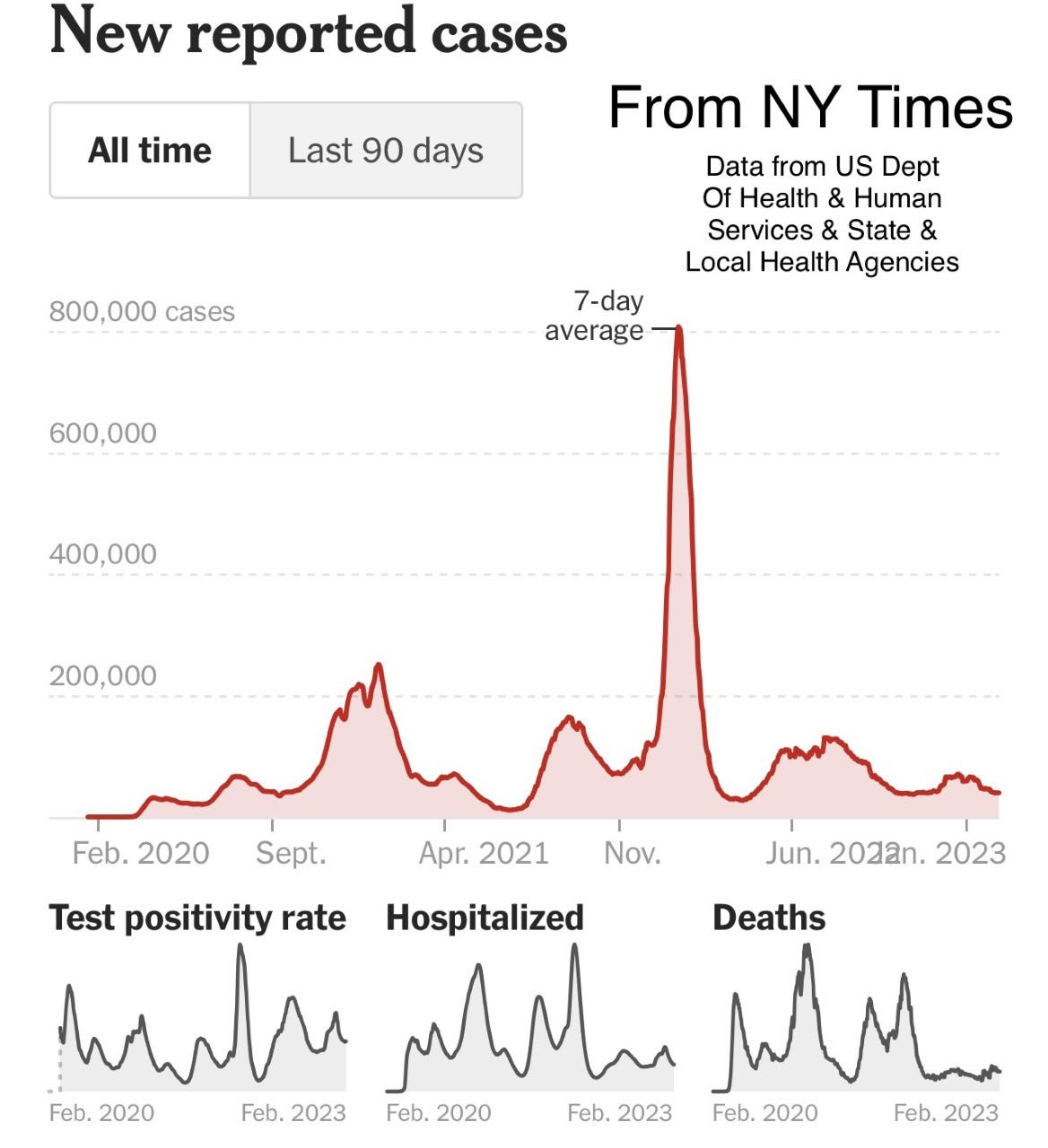

Mixed data with most things going in the right direction, btu case positivity up slightly.

Thank you.

another solid edition of the RR!