Opening Comments

The last note, “GFC-The Long and Short of It,” received some positive feedback and clearly brought back some memories from a disastrous period in markets. Upcoming reports will be of other related stories.

I am very consistent in posting on Sunday and Wednesday. If you do not get a report, you can find me on LinkedIn, where I always post them. Also, if you search the Rosen Report on Substack, to find my newsletters dating back a couple years.

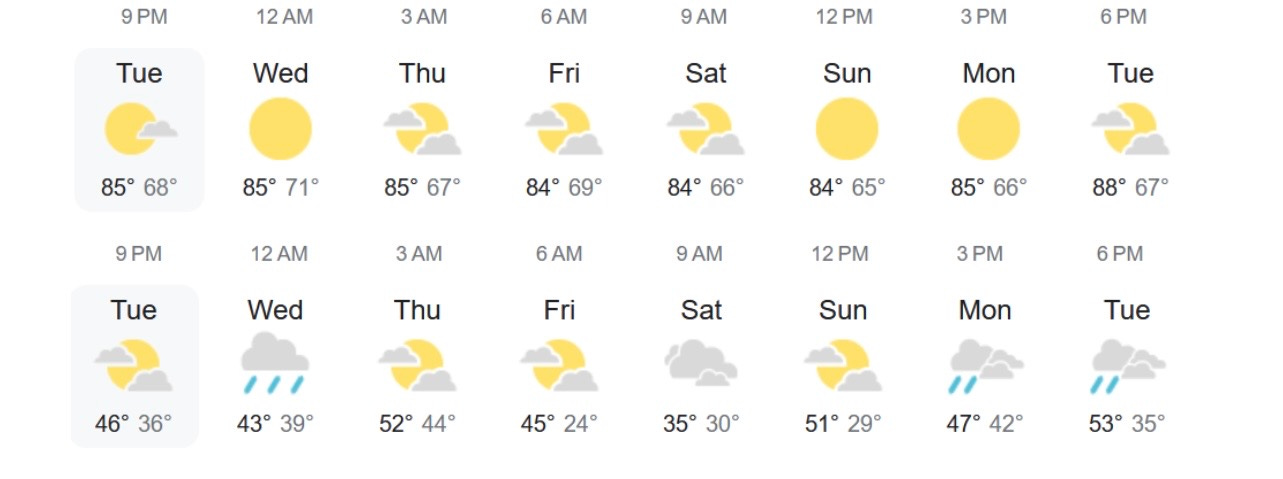

Weather in South Florida has been stunning. I see a storm heading to the Northeast with NYC in the 20s by Friday, while it is 80s and sunny down here. The pace of calls from the Northeast, Midwest and California to relocate to South Florida is picking up again. The themes are the same, and the wealth of those looking to relocate are consistently high. I just cannot fathom how this works out well for the cities who are seeing wealthy individuals and corporations leave. A new story suggests the CA budget deficits may be materially larger than originally feared. The strain on infrastructure in South Florida is no joke when it comes to schools, roads, traffic, doctors…

Pictures of the Day-Brightline Train-Cleanest Train and Stations in the World

Markets

Productivity Gains in Corporate America

Section 230 Update

History of Jews in Florida-Shocking

High-End Boca Update-$28mm Sale

Landlord Defaults Escalating

Institutional Investor Growth in Single Family

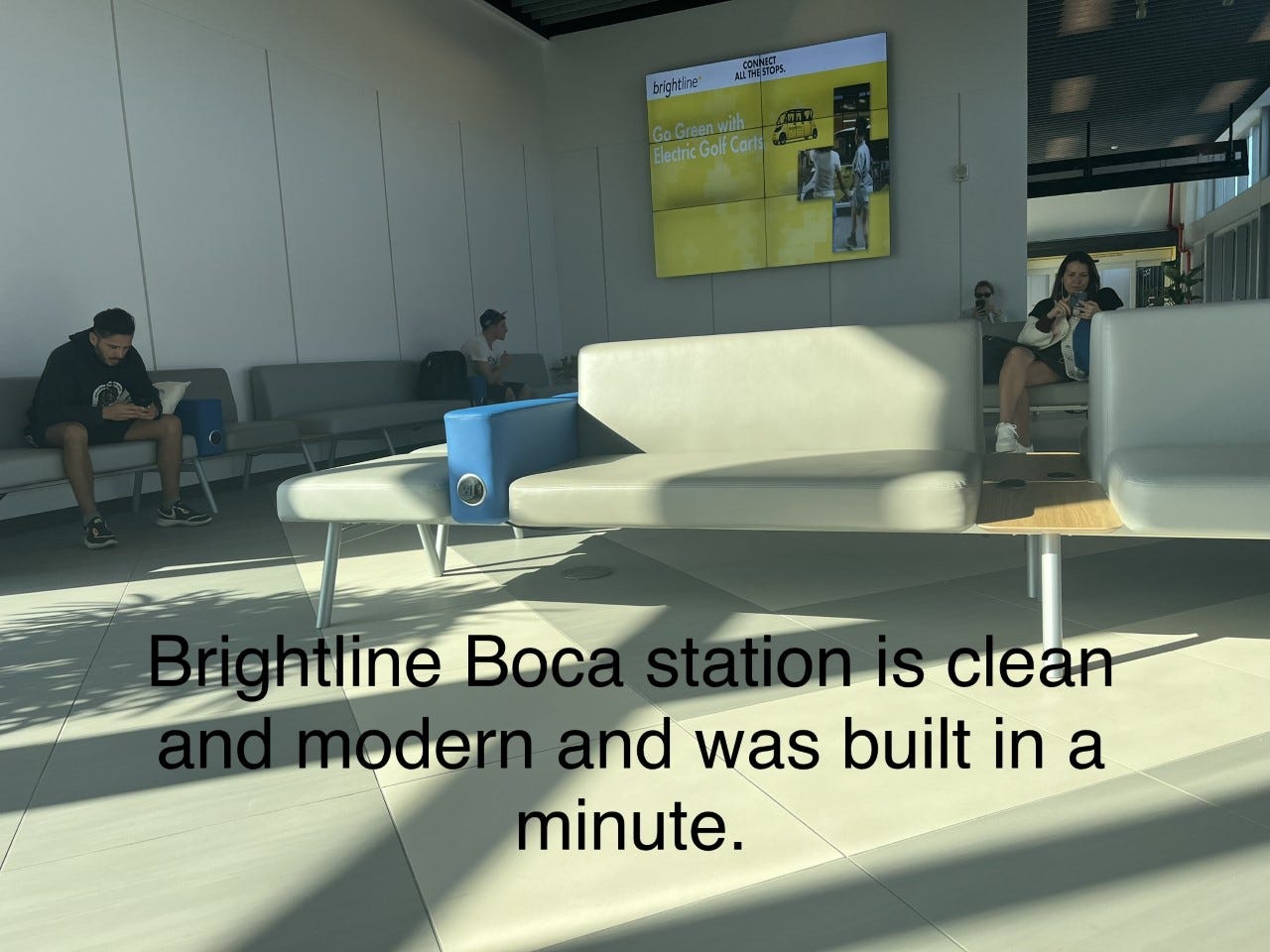

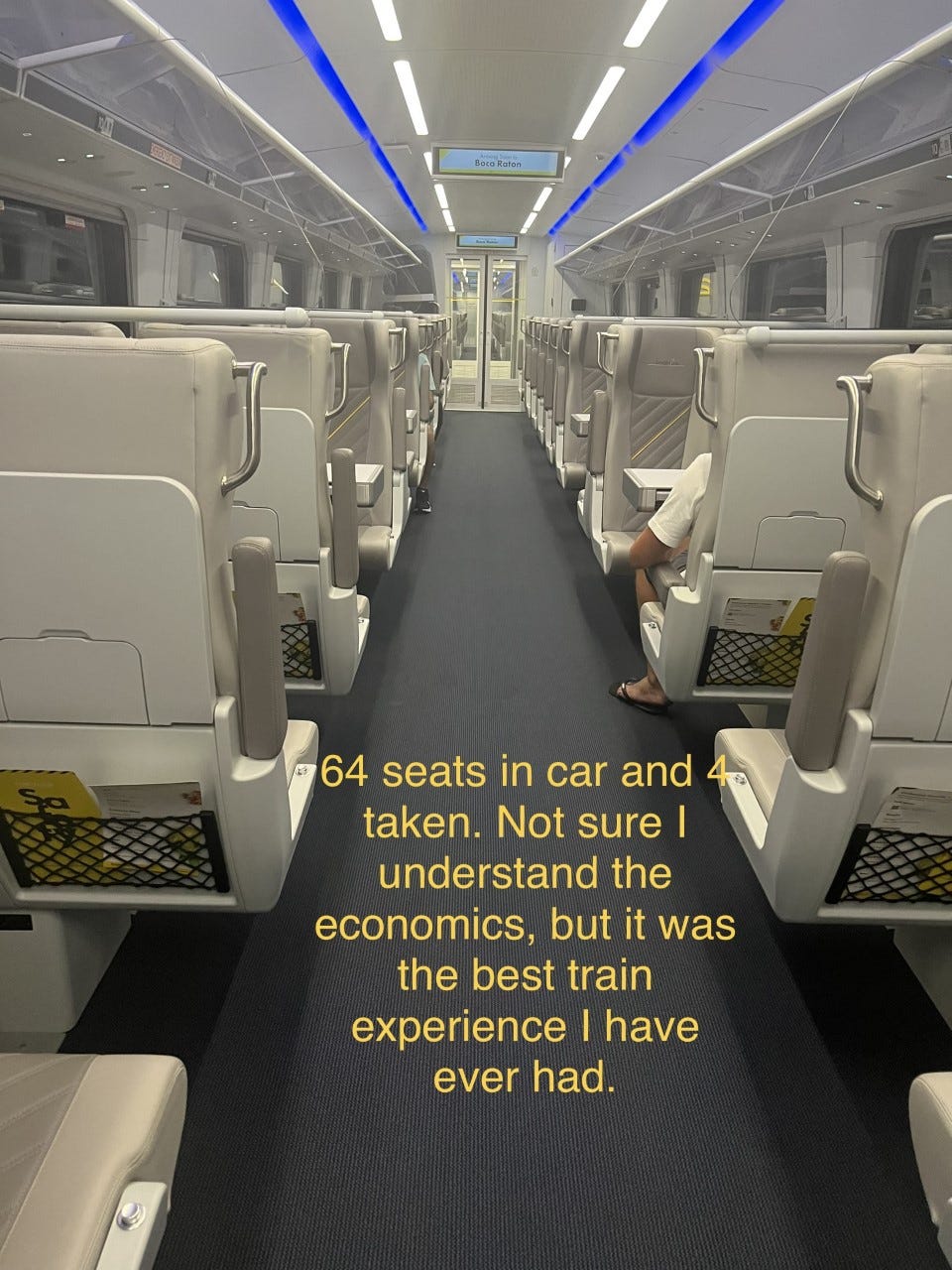

Pictures of the Day-Brightline Train-Cleanest Train and Stations in the World

I have been on trains all over the world. In my life, I have never had a better train experience than the Brightline. The stations are all brand new, and you can literally eat off the floors at Miami, Boca and Palm Beach stations. The trains themselves are amazing with beautiful cabins and roomy seats. I took the coach seat for $24 to Miami and $19 back to Boca. I can’t imagine paying the extra $30 or so each way for upgrades, but they do drive you and pick you up and take you within 5 miles for the higher price. I also believe they serve you some snacks and drinks for the upgraded ticket. My biggest issue is scheduling. Lots of morning trains to Miami, but in the afternoon, it was a 4:07pm or 10:07pm which is not ideal for dinner, so I met “The Most Interesting Man In the World” for a drink at Michael’s Genuine prior to my dinner at Contessa. My other concern about the Brightline is economic viability given the lack of patrons. My trains were empty; four people in a car which seats 64 is not exactly a money maker. There is a 100% chance I use it again. One reader pointed out that the Brightline in Palm Beach, Broward and Miami are all in the top 10 counties with the most railway crossing casualties. Obviously, this would have made a smooth, on-time trip anything but pleasurable.

Eye on the Market-Michael Cembalest-”Winter Heating”

Anyone who reads the Rosen Report knows I am a big fan of Cembalest’s work and cite it anytime he publishes. Winter Heating discusses the warmer winter, interest rates, the equity market rally, and Large Language Models (LLM). Great charts as usual. Cembalest thinks these LLM models will be disruptive and result in productivity benefits over time, but believe there are shortcomings today.

Binge Watching

I was on a flight to Memphis in September and watched a show called, “Bel Air,” which was a new version of the Will Smith show, “The Fresh Prince of Bel Air,” which aired from 1990-1996. It was before Will Smith was the Chris Rock slapping lunatic. The new version is quite dark, and far more aggressive in terms of language and content. I am a bit ashamed I got into the show on the plane, and on my flight to Austin, weeks later, watched the next couple episodes. I then realized I do not have access to the show to see the conclusion, as you need to subscribe to Peacock.

I broke down and paid the $4.99/month for Peacock access to watch episodes of this Bel Air series, despite the fact that it is beyond stupid. My subscription requires adds, but for another $5/month, I could have watched ad free. My notoriously frugal ways have me suffering through frustrating ads. I got through approximately 10 episodes (Season 1) and it turns out season 2 is not yet available and will not be until some time in 2023. I am not much of a “binge watcher” unless I am sick in bed, but it was great to watch 10 episodes of Bel Air in two days and be done.

I am going to make a shocking statement. I NEVER watched one episode of the Game of Thrones. During the chaos, people in the office were going crazy about it. Now that I understand how to binge watch, it seems I may need to tackle that task soon. Others I am yet to watch include Ted Lasso, Breaking Bad, the Wire, Orange is the New Black, Ray Donovan, Squid Game, Stranger Things, White Lotus or countless others. I fear I may become addicted to binge watching. If I disappear for a while, it is probably because I watched 50 episodes of something in 3 days. I spend so much time on the Rosen Report, I don’t seem to have a ton of it to binge watch lately.

I have some friends who are dying to speak with me about White Lotus, so at some point, I need to watch it.

In a related note, my children forced me to watch the most unrealistic show of all time called, “Outer Banks,” which has a new season breaking Thursday at midnight. It was the hottest show inthe summer of 2020 getting twice the viewership as the #2 show. I will be forced to binge watch to see the single most unrealistic story of all time. Don’t tell my kids, but I love the show despite the fact that using the suspension of disbelief is not nearly enough to buy off on the absurd story lines. On the absurdity scale of 1-100, Outer Banks is 150. High school kids take a small boat into the hurricane of the century and live in one episode. Also, the stars are cast to be in high-school, and they are all 24-30 years old. I have a funny feeling we will have watched all 8 episodes by Saturday and I am going to love every minute of it.

Quick Bites

Markets sold off sharply Thursday as Treasuries sold off driving up rates. The 10-Year Treasury sold off 13bps and the 2-Year Treasury sold off 7 bps to yield 4.73%, a level not seen since 2007. On Tuesday, the Dow dropped 697 points, or 2.1%, to close at 33,130. The S&P 500 slid 2.0% to close 3,997. All sectors ended lower, with consumer discretionary stocks seeing the largest decline of 3.3%. The Nasdaq dropped 2.5%. Wednesday stocks fell slightly as Fed officials noted that inflation remained “well above” the 2% target and the labor market is “very tight. Home Depot fell 7% Tuesday after posting worse than expected revenue for the 4th Q. Walmart also had a cautious outlook despite beating expectations, as it gave weaker than expected guidance for 2023. I am not convinced anyone has written more about concerns over than consumer in recent month. Also of note, TJX beat on estimates, but cut its full-year forecast saying inflation has impacted the spending habits of consumers are caused margin erosion. I have had charts and comments on this subject for months. I have been adamant that the consumer is struggling and confused by the recent retail data (last report). I have discussed card balances, auto delinquencies, higher mortgage rates, crashing savings, inflation….all driving the consumer issues. HD and WMT comments are definitely something to watch as both cited consumers that are spending more carefully. However,on a positive note, US PMI (business activity) rose to an 8 month high in February. St. Louis Fed President Bullard is pushing for faster rate hikes and thinks “we have a good shot at beating inflation in 2023.” My question is at what cost.

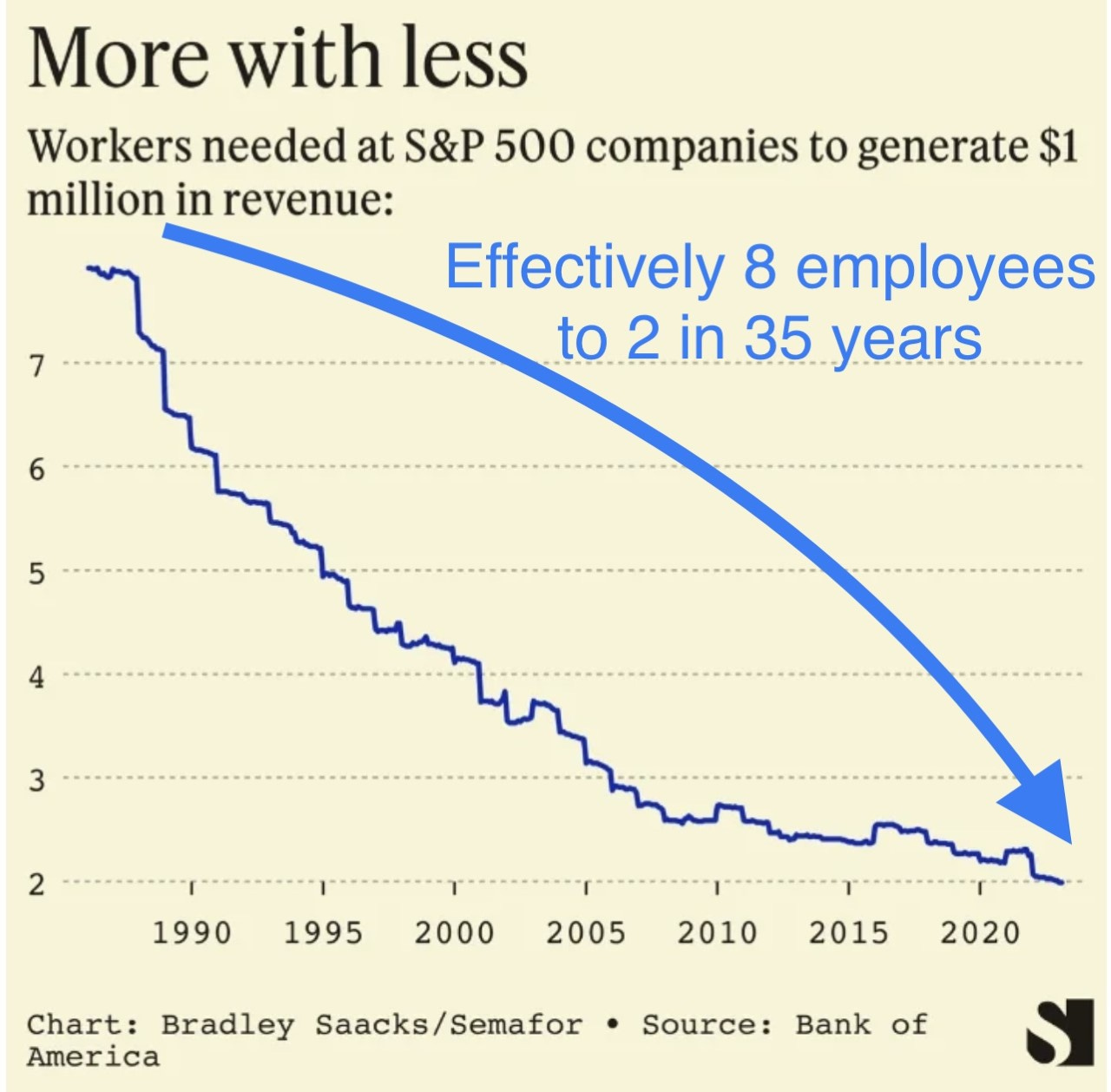

Technology gains in the past 30 years have been remarkable around computers, smart phones, cell phones, video meetings, GPS, streaming, 3-D printing … the list is endless. I am stunned by the chart below sent to me by a reader. When I think about what is coming over the next 10-20 years self-driving cars, AI, continued improvements of automation and robotics in factories and warehouses…I wonder where the chart will go on productivity and the impact for employment. There are millions of Americans who drive for a living (trucks, Ubers, Taxis, Amazon, corporate delivery, food delivery, busses, mail….). How many of those jobs will exist in 20-years time? As the population is aging, health care costs exploding, Federal Debt levels growing, I am concerned about the future available jobs. I suppose new ones will come available much like after the industrial revolution. A friend’s wife needed to write something up for work on an HR matter. As a joke, he typed in the question into ChatGPT and it wrote a beautifully worded program which she used as a base for her work. Saved her hours of time. There is cutting edge productivity for you.

Section 230 of the Communications Decency Act, which was passed in 1996, says an “interactive computer service” can’t be treated as the publisher or speaker of third-party content. This protects websites from lawsuits if a user posts something illegal, although there are exceptions for copyright violations, sex work-related material, and violations of federal criminal law. The Supreme Court is hearing Gonzalez v.Google regarding algorithms used by sites like YouTube that go further than simply allowing users to post content but arrange and promote the content to users in a certain way. The current case was brought by the family of an American killed in a 2015 terrorist attack in Paris. The petitioners argue that Google, through its subsidiary YouTube, violated the Anti-Terrorism Act by aiding and abetting ISIS, as it promoted the group’s videos through its recommendation algorithm. The results of the case will have far reaching consequences for Meta, Google, YouTube and many other platforms. If Section 230 is over-turned (unlikely), it would question the viability of platforms which publish 3rd party content. Informative video in the All-In Podcast on this topic. Interestingly, check out this CNN article which suggests the justices were confused by arguments during the case. Justice Elena Kagan even suggested that Congress step in. “I mean, we’re a court. We really don’t know about these things. You know, these are not like the nine greatest experts on the internet,” she said to laughter.

A reader sent me this link to a story entitled, “The Jews of Florida: A History,” and I am in shock. Too much to summarize, but Jews were not welcome in many parts of South Florida until shockingly recently. More concerning and interesting, parts of Miami did not allow Jews to own land or stay in hotels as recently as 1949. By the 1930s, advertisements for some of Miami Beach's oceanfront hotels said, "Always a view, never a Jew." It was common to see signs in Miami and Miami Beach that read “Gentiles Only” or “No Jews or Dogs.” Wealthy and influential developers, including Highway builder and Entrepreneur Carl G. Fisher’s refused to serve Jewish customers and Oil and Railroad Mogul Henry Flagler (1830-1913) prohibited land sales and hotel lodgings to Jewish clients. In the 1930s, restrictive barriers to Jewish ownership of land began to be removed. As a result, large numbers of Jews purchased properties from debt-ridden owners desperate to sell them. The Miami Beach Art Deco buildings of the 1930s and 1940s – many designed, built, and operated by Jews – are architectural treasures. In 1949 a law was passed by Florida’s Legislature that ended discrimination in real estate and hotels and development of the Jewish community bloomed. By the 1970s, almost 80 percent of the population of Miami Beach was Jewish! There are now 650k Jews in South Florida, the third largest in the US. I was surprised by the details in the article, and the fact that Jews were only allowed in SoFi (South of Fifth) recently in Miami. Now, Miami is basically Little Israel and ranks 2nd behind NYC for Jewishness (Jewish population, synagogues and kosher restaurants). We have seen a sharp increase in antisemitism and Kanye and Kyrie have not helped matters.

Other Headlines

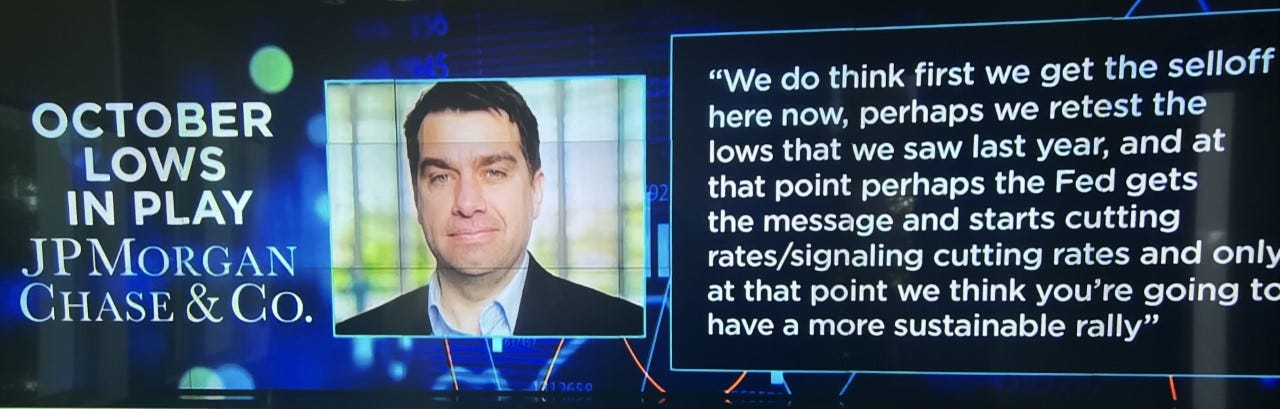

JPMorgan Strategists Say Stock Rally Will Fade

JPM, MS and Citi strategists all believe we are at the top of the range and due for a pullback according to the Bloomberg article. Picture below of CNBC on TV.

Cramer says six things must happen before the market sell-off can end

Elon Musk promised a lot with the Tesla Semi. Here’s how it stacks up now that it’s finally here

This tells me consumers are not ok.

Air Raid Sirens Blared For Dramatic Effect During Biden's Visit To Kiev

Like a movie production for Biden’s visit. The US called the Russians to tell them that Biden would be in Kyiv and no bombs should be going off during his visit. Despite this, air sirens were blaring and according to a CNN reporter, Alex Marquard, “I’ve been here for the past five days. I have not heard any explosions. I have not heard any air sirens, until about half an hour ago, right when President Biden was in the center of Kyiv.” The video in the link is pretty funny with Biden in his aviator glasses. This Politico article suggests Biden may be waffling on 2024.

Grand Jury In Trump Georgia Probe Recommends Multiple Indictments — ‘It Is Not a Short List’

I was surprised that the forewoman would be able to speak as she did. Turns out Trump’s lawyers may argue to quash the indictment based on the forewoman tainting the investigation. Despite the polls, I am hoping that Trump or Biden are not on the ticket in 2024. It’s America, surely we can do better.

George Santos cancels interview with Don Lemon over sexist remarks

You know you have reached a new low when the single biggest liar in the history of US politics cancels an interview with you. Not sure what it takes to get fired at CNN, but there are now quite a few concerning incidents with Lemon around his behavior and his ratings are awful.

We live in scary times where schools are over-stepping boundaries on children. If this happened to me, I would spend my net worth bankrupting the school district.

Albany County DA David Soares: The bail laws takedown Albany refused to hear

Please read the speech from an African American Democrat DA about the failed justice reforms in NY. What he said.

Biden signs 'racial equity' order requiring federal agencies to build 'equity action plan'

Washington property owner says squatters returned after SWAT raid

In my life, this is one of the craziest stories ever. Band of criminals squat in a house and get arrested. Get out and go back to the house and change the locks and live there again while running a car theft ring and WILL NOT LEAVE. Lieutenant David Hayes of the Snohomish County Sheriff’s Office told Fox New Digital that it was “largely on the property owner” to prevent the suspects from returning.

Crazy story. The family only has a toddler. Not like it was high school kids who knew the parents.

3% of people in the world have aphantasia—here's what to know

Aphantasia the inability to have a visual experience when we are thinking about things in their absence.

Why aren't teenagers driving anymore?

I started writing a piece on this topic. Neither of my kids seem to care about driving. Jack is 17 and still has his permit. No interest. The day I turned 16, I had a license.

The new way rich parents are paying to get their kids into the Ivy League

More colleges set to close even as top schools experience application boom

Smaller, less selective schools have been the hardest hit while the country’s most elite colleges and universities continue to thrive.

Iran Nuclear Inspectors Find Uranium Enriched to 84% Purity

IAEA probes accumulation of material just shy of bomb-grade. This is not something I know a great deal about, but the Iranian government hates America and Jews and fund terrorists. I cannot see how this is a good thing.

How Iran used a network of secret torture centers to crush an uprising

Crazy story of torture used to crush the protests. Those Iranian government officials sure are bad people. Serious content in the link.

Putin raises tension on Ukraine, suspends START nuclear pact

Real Estate

The highest price home in the history of my neighborhood in Boca (Royal Palm) closed last week at $28mm. When I moved in 2017, there were 71 homes for sale for an average price of $4.9mm. In 2017, only 1 home sold over $10mm, and it went for $12.4mm. In the past 14 months, 14 homes have sold for over $10mm. Today, there are 32 homes for sale with an average price of $17.1mm. There are 11 homes asking over $20mm and 8 homes asking $15-19.9mm. The cheapest home is a $3.2mm knockdown on .28 acres. When I moved down, you could have bought that house for $1-1.2mm. Homes are staying on the market longer, and I am seeing more price reductions. But as prices have come up so much in the past few years, we are not going to be retesting pre-pandemic levels anytime soon. Picture below from Royal Palm Properties.

Interesting WSJ article entitled, “Office Landlord Defaults Are Escalating as Lenders Brace for More Distress,” which goes into details on the topic I have written about extensively. The number of big office landlords defaulting on their loans is on the rise, fresh evidence that more developers believe that remote and hybrid work habits have permanently impaired the office market. The giant investment manager Brookfield Asset Management recently defaulted on a total of over $750 million in debt for a pair of 52-story towers in Los Angeles, according to a February securities filing. Real-estate firm RXR is in talks with creditors to restructure debt on 61 Broadway, a 34-story tower in Manhattan’s financial district, according to people familiar with the matter. Handing over the building to the lender is among the options under consideration, these people said. In another sign of distress, a venture of an investment manager affiliated with Related Cos. and BentallGreenOak is in similar debt-restructuring talks over a $150 million warehouse-to-office conversion project in Long Island City, N.Y., that hasn’t filled up as much space as expected, according to people familiar with the matter.

Sounds like some politicians are getting concerned about the power of institutional investors within the single family home market in the US. Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management. And a group of Washington, D.C., lawmakers believe that Wall Street needs to back away from the market. The prices in their Sun Belt markets have outpaced national figures for rent inflation, according to research compiled by Zumper for CNBC. Between January 2020 and January 2023, rents for a two-bed detached home increased about 44% in Tampa, Florida, 43% in Phoenix, and 35% near Atlanta. That’s compared to a 24% increase nationwide.

Other R/E Headlines

I think this chart is interesting on Existing Home Sales which fell 37% year-over-year.

Here are the US cities where home prices are actually falling

Most discussed were in CA and the price gainers were largely in FL, TX and Carolina.

Florida homeowners upset by Hurricane Ian insurance payouts

Insurance companies are cancelling policies and SIGNIFICANTLY raising prices down here. This is a big issue. My friend’s premium went from $18k to $55k in a year with zero claims on his home in Boca.

U.S. home sales post 12th straight monthly decline; house price inflation cools

A trailer in a Hamptons billionaires’ bunker sells for a record $3.75M

The most expensive home in the Caribbean just listed for $200 million – take a look inside

17 acres, 9 structures and on the island of Mustique near St. Vincent and the Grenadines. The interior square footage of the entire estate tops 38,000. It climbs to almost 53,000 square feet when you add all of its covered outdoor areas.

must watch White Lotus!!